Structural Adhesive Tapes Market by Resin Type (Acrylic, Rubber, Silicone), Backing Material, End-Use Industry (Automotive, Healthcare, Electronics & Electrical, Renewable Energy, E-Mobility, Building & Construction), & Region - Global Forecast to 2028

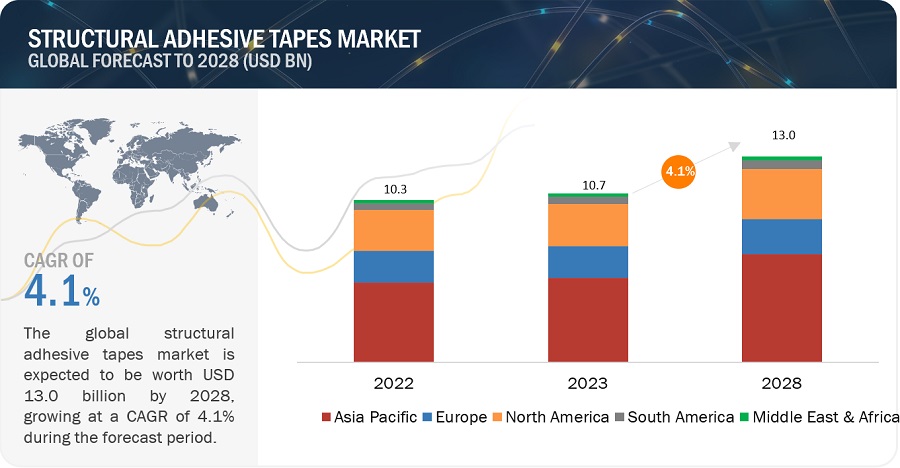

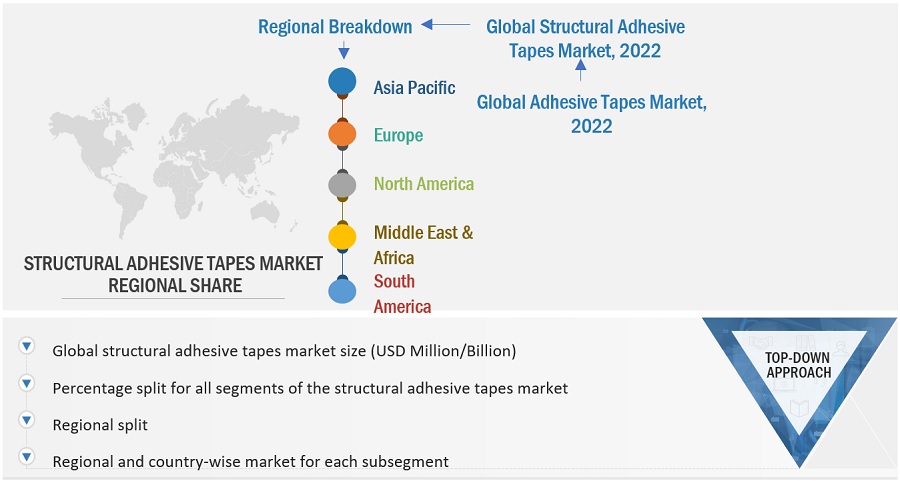

The structural adhesive tapes market is projected to grow from USD 10.3 billion in 2022 to USD 13.0 billion by 2028, at a CAGR of 4.1% between 2023 and 2028. Asia Pacific has been a highly promising structural adhesive tapes market against the backdrop of an overall slowdown in global economic development. This region encompasses a diverse range of economies with different levels of economic development and a large variety of industries. The important industries in this region include manufacturing, mining, semiconductors, electronics, oil & natural gas, textile, automobile, financial services, pharmaceutical, and telecommunication.

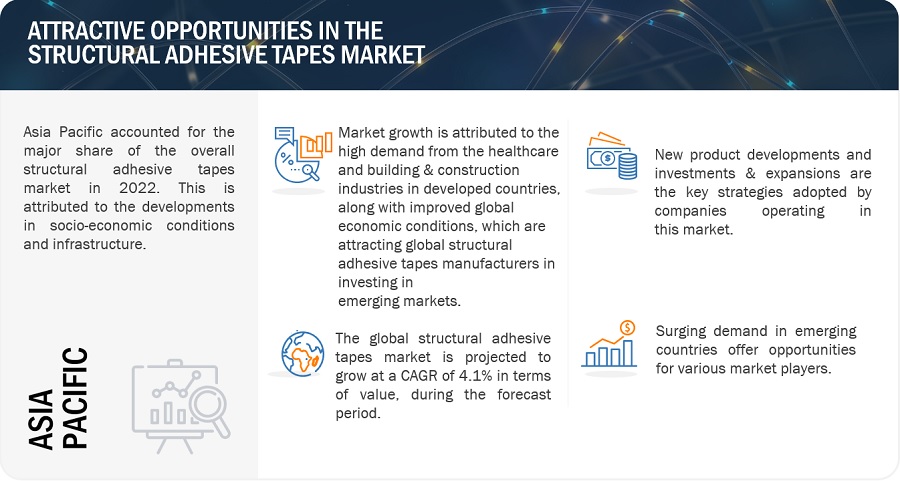

Attractive Opportunities in the Structural Adhesive Tapes Market

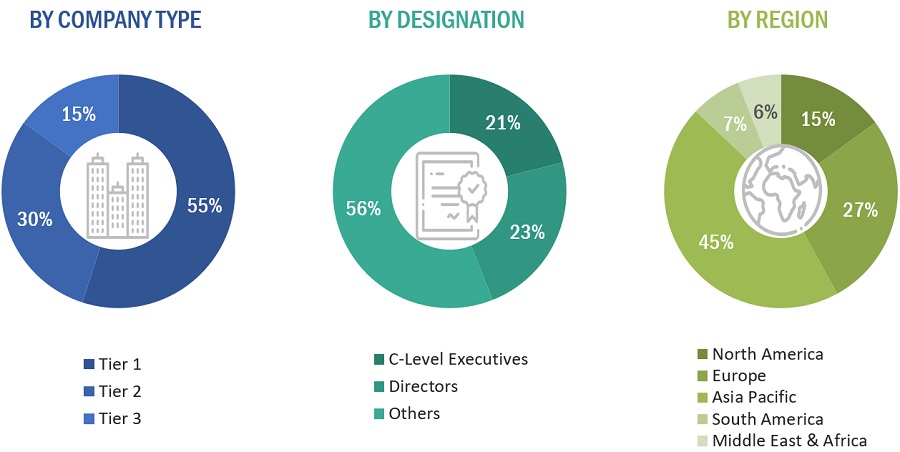

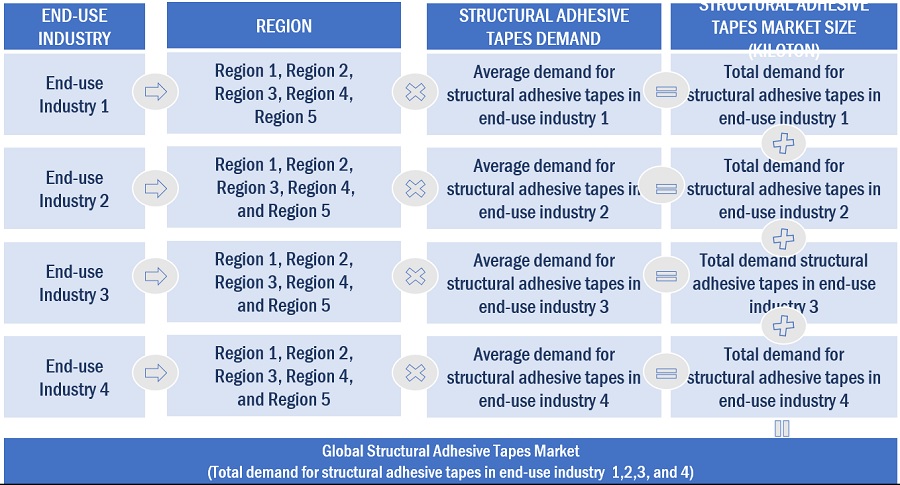

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Structural Adhesive Tapes Market Dynamics

Drivers: Growing use of structural adhesive tapes in diverse end-use industries

Structural adhesive tapes find applications across various end-use sectors, including electrical and electronics, healthcare, automotive, e-mobility, renewable energy, building and construction, among others. The growing utilization of structural adhesive tapes is anticipated to fuel market growth.

The ongoing adoption of flatter and micro-electronic devices is perpetuating the expansion of adhesive tape applications within the electrical and electronics sector. Forecasts indicate that the adhesive tape market within the healthcare and hygiene domain is poised to exhibit the most substantial compound annual growth rate (CAGR). This surge can be attributed to the increasing elderly population and the rising incidence of chronic ailments. Furthermore, the global healthcare industry is witnessing heightened demand for in vitro diagnostics, hydrophilic films, transdermal drug delivery patches, and oral dissolvable films, all of which are stimulating adhesive tape market growth. The building and construction industry, especially in regions like the Asia Pacific, South America, and the Middle East, is also emerging as a burgeoning consumer of adhesive tapes. These tapes are deployed for various purposes such as HVAC, glazing, abatement, and insulation, thus fueling market expansion in the building and construction sector.

Restraints: Volatility in raw material prices

Adhesive tape manufacturers must carefully assess prices and the accessibility of raw materials when determining the cost frameworks for their products. The production of adhesive tapes relies on a range of raw materials, including rubber, acrylic, silicone, paper, polypropylene (PP), polyvinyl chloride (PVC), adhesives, and release liners. The majority of these raw materials are derived from petroleum, making them susceptible to price fluctuations. The past has witnessed substantial volatility in oil prices, driven by factors such as escalating global demand and unrest in the Middle East. The resulting uncertainty and oscillations in the cost and availability of these essential inputs exert a direct influence on the growth trajectory of the market.

Opportunities: Upcoming expansion of battery gigafactories in key EV manufacturing hubs

Several automakers are investing in their own battery production to secure volume and control costs, while many are partnering with existing suppliers to extend their exposure to new advancements in battery technology and increase flexibility. The batteries used for vehicles differ in many characteristics, such as energy storage efficiency, speed, recharging time, reliability, cost, safety, and consistent performance. Several companies have announced new Gigafactories in Central and Eastern Europe. Thus, with the increase in battery productions, the demand for structural adhesive tapes in insulation, wire harnessing, and other applications is expected to increase in the upcoming years.

Challenges: Implementation of stringent regulatory policies

The European chemical industry is grappling with regulatory hurdles imposed by authorities such as the Control of Substances Hazardous to Health (COSHH), the European Union (EU), and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH). Manufacturers across Europe, spanning countries like Germany, Slovakia, the Czech Republic, Hungary, Poland, Romania, and others, are obligated to adhere to stringent regulations governing the production and utilization of structural adhesive tapes across various applications. These regulations aim to curtail the release of volatile organic compounds (VOCs). Complying with these directives necessitates a transition from solvent-based to water-based technology, a formidable challenge for manufacturers. Solvent-based structural adhesive tapes have historically offered durability and the ability to withstand a broad temperature range, rendering them suitable for a diverse array of applications. Consequently, due to these regulations, the production of solvent-based structural adhesive tapes has seen a decline.

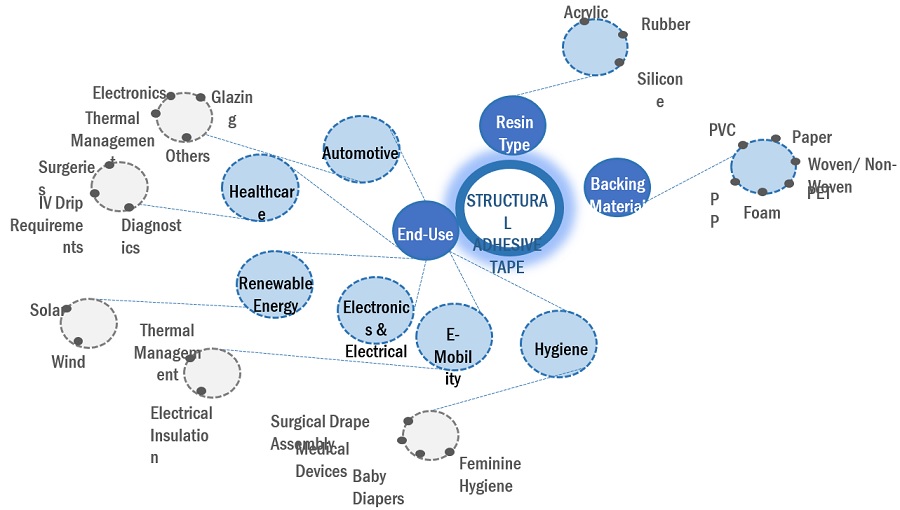

Structural Adhesive Tapes Ecosystem

The diagram below indicates MnM coverage of the structural adhesive tapes ecosystem. Knowledgestore provides strategic insights on each of the nodes in the ecosystem through a cloud based, highly interactive market intellence platform.

Acrylic by resin type accounted for the largest segment of structural adhesive tapes market

The demand for acrylic structural adhesive tapes is increasing worldwide, particularly in the Asia Pacific, because of the region’s growing electrical & electronics, healthcare, and automotive industries. The properties of acrylic structural adhesive tapes make them more favorable, where environmental regulations regarding solvent-based technology are stringent. Also, the price of acrylic structural adhesive tapes is comparatively lower than other types.

Woven/Non-woven is the fastest-growing backing material segment of structural adhesive tapes market

Woven and non-woven structural adhesive tapes are pressure-sensitive adhesive-backed by woven/non-woven fabrics such as polyester and paper. They can either be single-sided or double-sided and coated with acrylic, rubber, or silicone adhesive. Woven/non-woven structural adhesive tapes have relatively low thickness, which helps achieve better wetting and enhanced cohesion. These tapes are widely used in the healthcare industry, where medical-grade acrylic, rubber, or silicone adhesives are used. Woven and non-woven structural adhesive tapes are ideal for device attachment, medical devices, wearables, and wound care. The breathable and conformable material provides a moderate stretch and excellent adhesion to the skin.

Healthcare by end-use industry accounted for the largest segment of structural adhesive tapes market

The healthcare segment is the largest segment during the forecast period. Population growth and penetration of products in the healthcare sector in emerging countries, along with growth in disposable income, are driving the market for healthcare specialty adhesive tapes. The aging global population is also a key driver of this segment. Improved healthcare systems and the growth of Western diseases are also expected to drive the market. There is lower hygiene tape production in Asia as against that in North America and Europe; however, this is expected to change as demographic trends favor growth in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

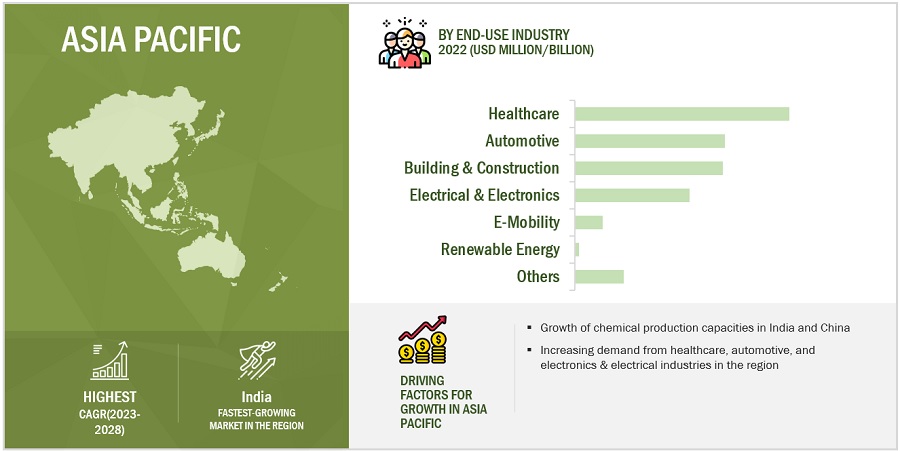

Asia Pacific is the largest growing structural adhesive tapes market.

The Asia Pacific is the largest structural adhesive tapes market, in terms of both, value and volume, and is projected to be the fastest-growing market during the forecast period. Economic development is credited to Asia Pacific, which is followed by major investment in areas such as healthcare, building & construction, and automotive. Asia Pacific is the most promising market and will remain such in the foreseeable future. Furthermore, multinational corporations are relocating production facilities to Asia Pacific to take advantage of reduced labour costs and meet local market demand.

Key Market Players

3M Company (US), Avery Dennison Corporation (US), Nitto Denko Corporation (Japan), tesa SE (Germany), and Lintec Corporation (Japan) are the key players in the global structural adhesive tapes market.

Avery Dennison Corporation manufactures, markets, and sells pressure-sensitive materials, self-adhesive base materials, and self-adhesive consumer & office products. The company operates through two business segments, namely, Materials Group and Solutions Group. The company manufactures and sells adhesive tapes and other bonding solutions for industrial, medical, and retail applications through the Materials Group segment. The company operates in approximately 50 countries across the globe, with 180 manufacturing and distribution facilities.

Scope of the Report

|

Report Metric |

Details |

|

Years Considered for the study |

2019-2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments |

By Resin Type |

|

Regions covered |

Asia Pacific, Europe, North America, South America, Middle East & Africa |

|

Companies profiled |

3M Company (US), Avery Dennison Corporation (US), Nitto Denko Corporation (Japan), tesa SE (Germany), and Lintec Corporation (Japan). A total of 25 players have been covered. |

This research report categorizes the structural adhesive tapes market based on Type, Technology, End-use Industry, and Region.

By Resin Type:

- Acrylic

- Rubber

- Silicone

- Others

By Backing Material:

- PVC

- Paper

- Woven/Non-woven

- PET

- Foam

- PP

- Others

By Product Type:

- Single-sided bonding

- Double-sided bonding

By Technology:

- Solvent-based

- Water-based

- Hot-melt

- Reactive

By End-use Industry:

- Automotive

- Healthcare

- Electrical & Electronics

- Renewable Energy

- E-Mobility

- Building & Construction

- Others

By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In February 2021, Avery Dennison Corporation announced its agreement to buy JDC Solutions, Inc., a Tennessee-based pressure-sensitive Structural adhesive tapes maker headquartered in the US, for around USD 24 million.

- In December 2020, Avery Dennison Corporation paid USD 88 million to acquire ACPO, Ltd. (“ACPO”), an Ohio-based maker of self-wound (linerless) pressure-sensitive overlaminate devices headquartered in the US.

Frequently Asked Questions (FAQ):

What are the growth driving factors of structural adhesive tapes?

Asia Pacific accounted for the major share of the overall market in 2022. This is due to expansion in socio-economic conditions and infrastructure development. Growth in electrical & electronics, automotive, building & construction, and healthcare industries are propelling the development of the global structural adhesive tapes market in Asia Pacific.

What are the major end-use for structural adhesive tapes?

The major end-use industries of structural adhesive tapes are automotive, healthcare, electrical & electronics, e-mobility, renewable energy, building & construction, and others.

Who are the major manufacturers?

3M Company (US), Avery Dennison Corporation (US), Nitto Denko Corporation (Japan), tesa SE (Germany), and Lintec Corporation (Japan), are some of the leading players operating in the global structural adhesive tapes market.

What are the reasons behind structural adhesive tapes gaining market share?

Structural adhesive tapes are gaining market share due to their properties, such as the ability to impart strength, durability, inhibit corrosion, and superior bonding, among others.

Which is the largest region in the structural adhesive tapes market?

Asia Pacific is the largest region in structural adhesive tapes market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Improving healthcare systems in emerging countries- Increasing production of electric vehicles- Growing use in diverse end-use industriesRESTRAINTS- Volatility in raw material prices- Strong competition from commodity tapes- Fluctuating price of siliconeOPPORTUNITIES- Innovations in electro-mobility- Upcoming expansion of battery gigafactories in key EV manufacturing hubsCHALLENGES- Implementation of stringent regulatory policies- Intense competition posing challenge to new entrants

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.5 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.6 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS IN CONSUMER ELECTRONICS INDUSTRYTRENDS IN AUTOMOTIVE INDUSTRY- Launch of electric vehicle models, 2025–2028TRENDS AND FORECAST IN BUILDING & CONSTRUCTION INDUSTRY

-

5.7 TARIFF AND REGULATORY LANDSCAPEEUROPEUSCHINAINDIA

- 5.8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE, BY KEY PLAYER

-

5.10 ECOSYSTEM ANALYSIS

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.12 TRADE DATA STATISTICS: KEY EXPORTING AND IMPORTING COUNTRIESMAJOR IMPORTERSMAJOR EXPORTERS

-

5.13 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHCHINA- China’s debt problem- Australia-China trade war- Environmental commitmentsEUROPE- Political instability in Germany- Energy crisis in Europe

-

5.14 PATENT ANALYSISMETHODOLOGYPATENT PUBLICATION TRENDSLEGAL STATUS OF PATENTSTOP JURISDICTIONTOP APPLICANTS

- 5.15 CASE STUDY

-

5.16 TECHNOLOGY ANALYSISWATER-BASEDSOLVENT-BASEDHOT-MELTS

- 5.17 KEY CONFERENCES & EVENTS IN 2023–2024

- 6.1 INTRODUCTION

-

6.2 ACRYLICACRYLIC-BASED TAPES USED FOR BONDING AND ASSEMBLY APPLICATIONS ACROSS INDUSTRIES

-

6.3 RUBBERRUBBER-BASED STRUCTURAL ADHESIVE TAPES MAINTAIN EXCEPTIONAL BONDING AND SEALING PROPERTIES

-

6.4 SILICONEOFFERS FLEXIBILITY, HIGH-TEMPERATURE RESISTANCE, AND EXCELLENT BONDING STRENGTH

- 6.5 OTHERS

- 7.1 INTRODUCTION

-

7.2 POLYVINYL CHLORIDE (PVC)FLAME RETARDANCY AND ELECTRICAL INSULATION PROPERTIES OF PVC DRIVING DEMAND

-

7.3 WOVEN/NON-WOVENLOW THICKNESS AND GOOD ADHESION TO VARIOUS SUBSTRATES TO DRIVE MARKET

-

7.4 PAPERREPULPABLE NATURE OF PAPER TO DRIVE USE OF PAPER BACKING MATERIAL IN STRUCTURAL ADHESIVE TAPES

-

7.5 PETGROWING DEMAND IN CONSUMER ELECTRONICS, AUTOMOTIVE, AND BUILDING & CONSTRUCTION TO DRIVE DEMAND

-

7.6 FOAMINCREASING CONSUMPTION IN INDUSTRIAL APPLICATION TO SUPPORT MARKET GROWTH

-

7.7 POLYPROPYLENE (PP)EXPANSION OF FAST-MOVING CONSUMER ELECTRONICS SECTOR TO DRIVE MARKET

- 7.8 OTHERS

- 8.1 INTRODUCTION

-

8.2 AUTOMOTIVEGROWING FOCUS ON LIGHTWEIGHT HYBRID VEHICLES TO BOOST DEMAND FOR STRUCTURAL ADHESIVE TAPESPASSENGER CARSCOMMERCIAL VEHICLES

-

8.3 HEALTHCAREASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR STRUCTURAL ADHESIVE TAPES IN HEALTHCARE SECTOR

-

8.4 ELECTRICAL & ELECTRONICSGROWING PRODUCTION OF ELECTRICAL & ELECTRONIC COMPONENTS TO SUPPORT MARKET GROWTH

-

8.5 RENEWABLE ENERGY (SOLAR & WIND)INCREASING DEMAND FOR SUSTAINABLE ENERGY SOURCES BOOSTING DEMAND FOR STRUCTURAL ADHESIVE TAPES

-

8.6 E-MOBILITY (ELECTRIC VEHICLES & EV-BATTERY)GROWTH OF EVS IN EUROPE & NORTH AMERICA TO BOOST DEMAND FOR EV BATTERIES

-

8.7 BUILDING & CONSTRUCTIONPLANNED INFRASTRUCTURE DEVELOPMENTS TO BOOST GROWTH OF MARKET

- 8.8 OTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Growing healthcare & building & construction sectors to drive marketINDIA- Expansion of automotive and healthcare industries to fuel market growthJAPAN- Growth of healthcare industry and increasing automobile production to drive marketSOUTH KOREA- Automotive and building & construction sectors to support market growthASEAN COUNTRIES- Increasing FDI investments to propel market growthREST OF ASIA PACIFIC

-

9.3 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Growing healthcare expenditure and steady growth of automotive industry to support market growthCANADA- Acrylic-based structural adhesive tapes to dominate market during forecast periodMEXICO- Rapid growth of automotive industry to drive demand for structural adhesive tapes

-

9.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Growth of manufacturing and healthcare industries to drive demandFRANCE- Government initiatives to promote automotive industry to support market growthITALY- Government incentive on purchase of hybrid or electric vehicles to drive marketUK- Healthcare industry to fuel demand for structural adhesive tapesSPAIN- Recovery of construction and automotive industries to drive demandRUSSIA- Market hampered by sharp decline in automobile productionREST OF EUROPE

-

9.5 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Government’s investment and support to medical and automotive industries to drive marketARGENTINA- Increasing passenger car sales to drive structural adhesive tapes marketREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICAIRAN- Construction and automotive industries to drive structural adhesives tapes marketSOUTH AFRICA- New vehicles market to witness slow growthREST OF MIDDLE EAST & AFRICA

- 10.1 INTRODUCTION

-

10.2 COMPANY EVALUATION MATRIX (TIER 1 COMPANIES)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.3 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

-

10.4 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.5 COMPETITIVE BENCHMARKING

- 10.6 COMPANY FOOTPRINT

- 10.7 MARKET SHARE ANALYSIS

- 10.8 MARKET RANKING ANALYSIS

-

10.9 REVENUE ANALYSIS3M COMPANYAVERY DENNISON CORPORATIONNITTO DENKO CORPORATIONLINTEC CORPORATIONTESA SE

- 10.10 COMPETITIVE SCENARIO & TRENDS

-

11.1 LINTEC CORPORATIONBUSINESS OVERVIEWPRODUCTS OFFEREDMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

11.2 AVERY DENNISON CORPORATIONBUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

11.3 NITTO DENKO CORPORATIONBUSINESS OVERVIEWPRODUCTS OFFEREDMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

11.4 3M COMPANYBUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

11.5 TESA SEBUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

11.6 SCAPA GROUP PLC (SCHWEITZER-MAUDUIT INTERNATIONAL, INC.)BUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTS

-

11.7 INTERTAPE POLYMER GROUP, INC. (CLEARLAKE CAPITAL GROUP, L.P.)BUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTS

-

11.8 BERRY GLOBAL INC.BUSINESS OVERVIEWPRODUCTS OFFEREDRECENT DEVELOPMENTS

-

11.9 SAINT-GOBAIN PERFORMANCE PLASTICS CORPORATIONBUSINESS OVERVIEWPRODUCTS OFFERED

-

11.10 LOHMANN GMBH & CO. KGBUSINESS OVERVIEWPRODUCTS OFFERED

-

11.11 OTHER PLAYERSNICHIBAN CO. LTD.- Products offeredADHESIVES RESEARCH, INC.- Products offeredADVANCE TAPES INTERNATIONAL- Products offeredAMERICAN BILTRITE INC.- Products offeredATP ADHESIVE SYSTEMS AG- Products offeredMACTAC, LLC- Products offeredSHURTAPE TECHNOLOGIES, LLC- Products offeredYEM CHIO CO. LTD.- Products offeredGERGONNE INDUSTRIES- Products offeredLEPIKY SRO- Products offeredLOGO TAPE GMBH & CO. KG- Products offeredMDE CONVERTING SRL- Products offeredPARAFIX TAPES & CONVERSIONS LTD.- Products offeredSTOKVIS TAPES GROUP- Products offeredVOLZ SELBSTKLEBETECHNIK GMBH- Products offered

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 ADHESIVE TAPES MARKETMARKET DEFINITIONMARKET OVERVIEWADHESIVE TAPES MARKET, BY RESIN TYPE- Acrylic-based adhesive tapes- Rubber-based adhesive tapes- Silicone-based adhesive tapes- Other resin typesADHESIVE TAPES MARKET, BY TECHNOLOGY- Solvent-based- Water-based- Hot-melt-basedADHESIVE TAPES MARKET, BY BACKING MATERIAL- Polypropylene (PP)- Paper- Polyvinyl Chloride (PVC)- OthersADHESIVE TAPES MARKET, BY END-USE INDUSTRY- Commodity adhesive tapes- Specialty adhesive tapesADHESIVE TAPES MARKET, BY REGION- Asia Pacific- Europe- North America- Middle East & Africa- South America

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 STRUCTURAL ADHESIVE TAPES MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 2 STRUCTURAL ADHESIVE TAPES MARKET: ROLE IN ECOSYSTEM

- TABLE 3 STRUCTURAL ADHESIVE TAPES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP END-USE INDUSTRIES (%)

- TABLE 5 KEY BUYING CRITERIA FOR STRUCTURAL ADHESIVE TAPES

- TABLE 6 GDP TRENDS AND FORECAST BY COUNTRY, PERCENTAGE CHANGE

- TABLE 7 AUTOMOTIVE INDUSTRY PRODUCTION (2021–2022)

- TABLE 8 LAUNCH OF ELECTRIC VEHICLE MODELS, 2025–2028

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MAJOR IMPORTERS OF SELF-ADHESIVE TAPES, PLATES, SHEETS, FILMS, FOILS, STRIPS, AND OTHER FLAT SHAPES MADE OF PLASTICS, 2020–2022 (USD THOUSAND)

- TABLE 13 MAJOR EXPORTERS OF SELF-ADHESIVE TAPES, PLATES, SHEETS, FILMS, FOILS, STRIPS, AND OTHER FLAT SHAPES MADE OF PLASTICS, 2020–2022 (USD THOUSAND)

- TABLE 14 NUMBER OF PATENTS PUBLISHED, 2018–2023

- TABLE 15 TOP 10 PATENT OWNERS DURING LAST FEW YEARS

- TABLE 16 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 17 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 18 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 19 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 20 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 21 ACRYLIC STRUCTURAL ADHESIVE TAPES, BY APPLICATION

- TABLE 22 ACRYLIC STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 23 ACRYLIC STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 24 ACRYLIC STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 ACRYLIC STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 RUBBER STRUCTURAL ADHESIVE TAPES, BY APPLICATION

- TABLE 27 RUBBER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 28 RUBBER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 29 RUBBER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 RUBBER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 SILICONE STRUCTURAL ADHESIVE TAPES, BY APPLICATION

- TABLE 32 SILICONE STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 33 SILICONE STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 34 SILICONE STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 SILICONE STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 OTHER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 37 OTHER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 38 OTHER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 OTHER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 41 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 42 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 43 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 44 PVC STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 45 PVC STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 46 PVC STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 PVC STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 WOVEN/NON-WOVEN STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 49 WOVEN/NON-WOVEN STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 50 WOVEN/NON-WOVEN STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 WOVEN/NON-WOVEN STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 PAPER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 53 PAPER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 54 PAPER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 PAPER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 PET STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 57 PET STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 58 PET STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 PET STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 FOAM STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 61 FOAM STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 62 FOAM STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 FOAM STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 POLYPROPYLENE STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 65 POLYPROPYLENE STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 66 POLYPROPYLENE STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 POLYPROPYLENE STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 OTHER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 69 OTHER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 70 OTHER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 OTHER STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 73 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 74 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 75 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 76 MAJOR APPLICATIONS OF TAPES IN AUTOMOTIVE SECTOR

- TABLE 77 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 78 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 79 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN AUTOMOTIVE, BY SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 82 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN AUTOMOTIVE, BY SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 83 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN AUTOMOTIVE, BY SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 84 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN AUTOMOTIVE, BY SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 85 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN PASSENGER CARS, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 86 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN PASSENGER CARS, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 87 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN PASSENGER CARS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN PASSENGER CARS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN COMMERCIAL VEHICLES, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 90 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN COMMERCIAL VEHICLES, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 91 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN COMMERCIAL VEHICLES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN COMMERCIAL VEHICLES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN HEALTHCARE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 94 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN HEALTHCARE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 95 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN HEALTHCARE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN HEALTHCARE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 98 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 99 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 BACKING MATERIALS VS. APPLICATION

- TABLE 102 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN RENEWABLE ENERGY, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 103 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN RENEWABLE ENERGY, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 104 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN RENEWABLE ENERGY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 105 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN RENEWABLE ENERGY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 106 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN E-MOBILITY, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 107 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN E-MOBILITY, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 108 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN E-MOBILITY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 109 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN E-MOBILITY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 110 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 111 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 112 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 115 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 116 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 117 STRUCTURAL ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 118 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 119 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 120 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 121 STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 123 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 124 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 127 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 128 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 131 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 132 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 135 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 136 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 139 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 140 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 142 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 143 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 144 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 145 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 146 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 147 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 148 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 149 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 150 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 151 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 152 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 153 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 154 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 155 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 156 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 157 CHINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 158 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 159 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 160 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 161 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 162 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 163 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 164 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 165 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 166 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 167 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 168 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 169 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 170 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 171 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 172 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 173 INDIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 174 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 175 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 176 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 177 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 178 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 179 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 180 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 181 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 182 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 183 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 184 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 185 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 186 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 187 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 188 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 189 JAPAN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 190 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 191 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 192 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 193 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 194 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 195 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 196 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 197 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 198 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 199 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 200 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 201 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 202 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 203 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 204 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 205 SOUTH KOREA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 206 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 207 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 208 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 209 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 210 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 211 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 212 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 213 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 214 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 215 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 216 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 217 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 218 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 219 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 220 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 221 ASEAN COUNTRIES: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 223 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 224 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 227 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 228 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 229 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 230 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 231 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 232 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 233 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 234 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 235 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 236 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 238 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 239 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 240 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 241 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 242 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 243 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 244 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 245 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 246 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 247 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 248 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 249 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 250 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 251 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 252 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 253 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 254 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 255 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 256 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 257 NORTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 258 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 259 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 260 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 261 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 262 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 263 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 264 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 265 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 266 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 267 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 268 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 269 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 270 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 271 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 272 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 273 US: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 274 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 275 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 276 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 277 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 278 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 279 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 280 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 281 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 282 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 283 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 284 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 285 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 286 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 287 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 288 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 289 CANADA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 290 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 291 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 292 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 293 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 294 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 295 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 296 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 297 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 298 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 299 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 300 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 301 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 302 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 303 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 304 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 305 MEXICO: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 306 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 307 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 308 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 309 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 310 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 311 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 312 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 313 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 314 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 315 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 316 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 317 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 318 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 319 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 320 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 321 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 322 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 323 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 324 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 325 EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 326 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 327 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 328 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 329 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 330 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 331 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 332 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 333 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 334 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 335 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 336 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 337 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 338 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 339 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 340 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 341 GERMANY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 342 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 343 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 344 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 345 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 346 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 347 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 348 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 349 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 350 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 351 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 352 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 353 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 354 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 355 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 356 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 357 FRANCE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 358 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 359 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 360 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 361 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 362 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 363 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 364 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 365 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 366 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 367 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 368 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 369 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 370 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 371 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 372 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 373 ITALY: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 374 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 375 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 376 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 377 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 378 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 379 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 380 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 381 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 382 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 383 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 384 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 385 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 386 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 387 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 388 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 389 UK: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 390 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 391 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 392 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 393 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 394 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 395 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 396 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 397 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 398 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 399 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 400 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 401 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 402 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 403 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 404 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 405 SPAIN: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 406 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 407 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 408 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 409 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 410 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 411 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 412 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 413 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 414 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 415 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 416 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 417 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 418 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 419 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 420 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 421 RUSSIA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 422 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 423 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 424 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 425 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 426 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 427 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 428 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 429 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 430 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 431 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 432 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 433 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 434 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 435 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 436 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 437 REST OF EUROPE: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 438 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 439 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 440 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 441 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 442 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 443 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 444 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 445 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 446 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 447 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 448 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 449 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 450 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 451 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 452 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 453 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 454 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 455 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 456 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 457 SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 458 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 459 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 460 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 461 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 462 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 463 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 464 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 465 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 466 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 467 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 468 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 469 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 470 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 471 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 472 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 473 BRAZIL: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 474 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 475 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 476 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 477 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 478 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 479 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 480 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 481 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 482 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 483 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 484 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 485 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 486 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 487 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 488 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 489 ARGENTINA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 490 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 491 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 492 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 493 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 494 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (MILLION SQUARE METER)

- TABLE 495 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 496 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2019–2022 (USD MILLION)

- TABLE 497 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 498 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 499 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 500 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 501 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 502 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (MILLION SQUARE METER)

- TABLE 503 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (MILLION SQUARE METER)

- TABLE 504 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2019–2022 (USD MILLION)

- TABLE 505 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY AUTOMOTIVE SUB-SEGMENT, 2023–2028 (USD MILLION)

- TABLE 506 MIDDLE EAST & AFRICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 507 MIDDLE EAST & AFRICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 508 MIDDLE EAST & AFRICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 509 MIDDLE EAST & AFRICA: STRUCTURAL ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)