Stacker Crane Market by Type (Single-Column, Double-Column), Operation Type, End-Use Industry (Automotive, Consumer Goods, E-Commerce/Retail & Wholesale, Pharmaceuticals), Robotic Stacker Crane Market & Region - Forecast to 2027

The stacker crane market size is projected to reach USD 1,442 million by 2027 from an estimated USD 976 million in 2021, at a CAGR of 6.7% from during the forecast period. The growth of this market is influenced by increasing demand of automated storage and retrieval systems as well as increasing demand fo automated warehouses and automated material handling equipments.. Therefore, the stacker crane market is expected to witness significant growth in the future.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Stacker Crane Market

The spread of COVID-19 is expected to increase the demand for shopping from e-commerce platforms, prompting retailers to invest in automation solutions to cater to the burgeoning demand. Companies endeavoring to protect themselves from supply chain disruptions in the future are also likely to deploy automation solutions. Consequently, the growth of this market is driven by the increased demand for automated storage and retrieval solutions from the e-commerce, retail, healthcare, and food & beverages industries. However, the imposition of lockdowns in different countries has led to severe cash flow issues for market players. The semiconductor & electronics manufacturing curve has flattened as well but is stable. In addition, the size of the machinery industry is contracting but is expected to stabilize in the coming years. Furthermore, halting or slowing down production in manufacturing-based industries such as automotive, metals and heavy machinery, aviation, and semiconductor & electronics industries globally resulted in a decline in demand for stacker cranes in 2020. However, the market is expected to gain momentum due to the growing e-commerce and retail industries after 2020.

Market Dynamics

Driver: Increased demand for automated storage and retrieval systems (ASRS)

Stacker cranes are an important component of ASRS.ASRS eliminates the need for human intervention in basic operations, such as precise storage of an item at a predefined location, retrieval of an item, and transferring goods to specific processing or interface points. Thus, ASRS implementation reduces costs incurred on laborers and improves space utilization. The growing warehouse rents and reducing availability of warehouses are expected to drive the adaptation of ASRS systems.

Restraint: High integration and switching costs

The initial cost of the installation of a stacker crane is high. Setting up this system must be accurate and thus requires skilled labor. Companies often experience high ongoing costs for maintaining and updating various subsystems. Making such huge investments is difficult for small and medium-sized enterprises. The starting costs of an automated storage and retrieval system are quite high, which includes stacker cranes, storage units, and racks.

Opportunity: Industrial growth in emerging economies

Globalization has resulted in the industrial growth of emerging economies like India, Brazil, Mexico, and China. This has attracted global manufacturers to locate their manufacturing units in these countries. Various industries such as food & beverages, pharmaceuticals, retail, and automotive are focusing on expansion in emerging economies due to various economic advantages.

The rising demand for products of these industries is straining their distribution and logistics network. Thus the demand for automated warehouses is increasing across these industries which are leading to the increased demand for stacker cranes. Hence, increasing industrial growth would increase the adoption of efficient and automated manufacturing and distribution processes. This has created a requirement for advanced and sophisticated warehousing facilities to integrate and manage supply chains. The surge in investments toward enhancing the capability of supply chains in emerging economies has opened new growth opportunities for stacker crane or ASRS providers.

Challenge: Technical challenges related to sensing elements

A Stacker crane operates in synchronization with several sensors, motors, and equipment guided by programming software. Any technical issue related to the sensing element in the stacker crane may halt an entire operational process, which leads to additional time and cost to the company. Any fault in the software programming can also lead to improper functioning of the stacker crane, thereby delaying the entire production process and increasing downtime that can range from a few minutes to several days. Therefore, system failures adversely affect the process and result in diminishing profits. A stacker crane would not contribute to profitability unless it is properly maintained. This poses a challenge for the players operating in the stacker crane market.

Consumer Goods segment to hold largest market share during the forecast period

The adaptation of stacker cranes has been rising in consumer goods end use industries as stacker cranes are usually used for storing finished and semi-finished goods. Furthermore, raw material handling and efficient buffer storage are driving the stacker crane market for consumer goods. Whereas increased adaptation of advanced manufacturing techniques and processes has improved the throughput of consumer good manufacturing factories. Hence, the need for efficient material handling solutions such as stacker cranes is also growing in consumer goods industry.

Single column segment to hold largest market share during the forecast period

Single column stacker cranes can be integrated with existing storage infrastructure with less capital requirement than double column stacker cranes. These stacker cranes are preferred in the pharmaceutical, food & beverage, retail, and logistics industries. These industries need a standard pallet size and a vertical height of the stacker crane less than or equal to 20 meters. Single column cranes reduce the overall cost of the project. The system moves faster with greater ease, consumes less energy, and saves money which is driving the growth of the single column stacker crane market.

To know about the assumptions considered for the study, download the pdf brochure

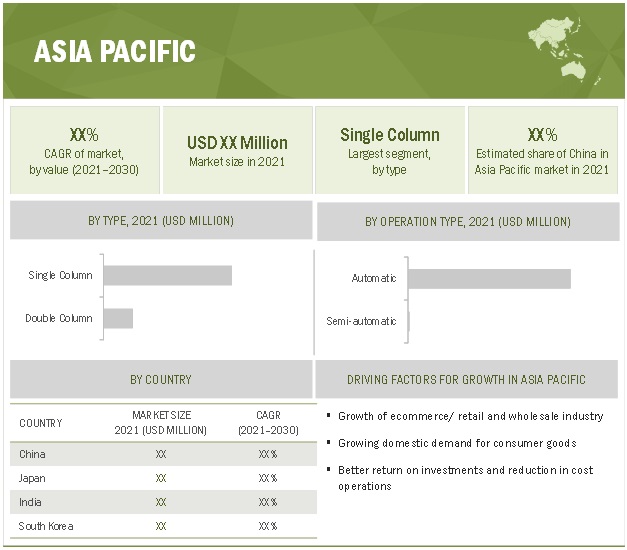

Asia-Pacific is estimated to lead the stacker crane market in 2021.

Currently, Asia-pacific contributes a share of approximately 52% to the overall market. It is the largest market since high population growth and economic development with increasing domestic consumption have intensified the need for efficient logistics and warehousing. China and, India have a strong export-oriented manufacturing industry and growing consumerism, which require them to consider automation to improve efficiency. Japan was the early adopter of stacker cranes, it also host a number of global stacker crane manufacturers. The stacker cranes market in Japan is driven by a shortage of labor and space. South Korea has a growing electronics and e-commerce industry, which has been investing in automated material handling systems. Furthermore, the consumer goods industry is a leading consumer of stacker cranes in the country. The region is expected to hold a dominant share in the market for the forecast period

Key Market Players & Start-ups

The stacker crane market is dominated by players such as Daifuku Co. Ltd (Japan), Kion Group AG (Germany), Murata Machinery Ltd (Japan), SSI Schäfer (Germany) and, Swisslog AG (Switzerland). These companies offer turnkey stacker crane automation services and have strong distribution networks at the global level. These companies have adopted extensive expansion strategies; and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the growing market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2027 |

|

Forecast volume |

Units |

|

Forecast value |

USD Million |

|

Segments covered |

By Type, Operation Type, End-use Industry and, Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and Rest of the World |

|

Companies covered |

Daifuku Co. Ltd (Japan), Kion Group AG (Germany), Murata Machinery Ltd(Japan), SSI Schäfer (Germany), Swisslog AG (Switzerland) (Total of 25 companies) |

The study categorizes the stacker crane market based on type, operation, end-use industry and, region at regional and global levels.

By Type

- Single Column

- Double Column

By Operation Type

- Semi-Automatic

- Automatic

By End-Use Industry

- Consumer Goods

- E-commerce/Retail & Wholesale

- Pharmaceutical

- Automotive

- Others

By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In Feb 2021, AFT industries, a manufacturer and seller of material handling systems to automotive manufacturers, concluded a strategic partnership agreement with Daifuku Industries. Both companies will collaborate on a project-by-project basis by leveraging AFT Industries’ European automotive customer base, technologies, and procurement knowledge, and Daifuku’s extensive global network encompassing sales, production, and service to increase the level of offerings to customers in the global automotive industry.

- In November 2020, Doosan Logistics Solutions signed a strategic deal with Chinese robotic firm Greek+ to sell and provide maintenance services to the autonomous logistics robots in South Korea. Greek+ holds a 16% market share of autonomous mobile robots. The deal is expected to improve its product offerings and hold on to the logistics and automation market.

- In September 2020, Jungheinrich AG acquired stakes in Munich-based robotics startup Magazino and agreed on broad strategic collaboration and intent to combine skill sets in the field of mobile automation.

- In August 2019, Murata Machinery, Ltd. and US material handling system supplier Alert Innovation, Inc. announced a joint venture in manufacturing and supplying automated picking solutions in Japan.

- In April 2019, Daifuku Co. ltd acquired Vega, a prominent supplier of conveyors and other material handling equipment in the Indian market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 STACKER CRANE MARKET: MARKET SEGMENTATION

FIGURE 2 MARKET: BY REGION

1.3.1 YEARS CONSIDERED IN THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 3 STACKER CRANE MARKET: RESEARCH DESIGN

FIGURE 4 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

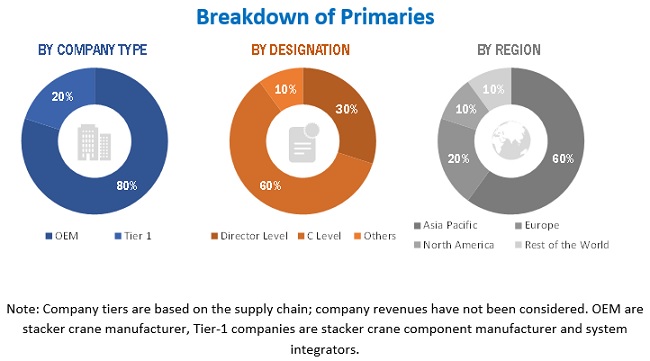

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.1 Sampling techniques & data collection methods

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

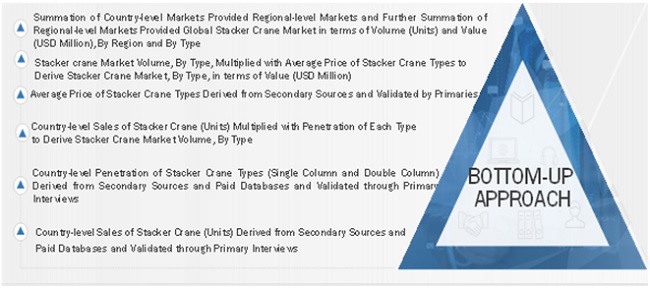

2.3.1 APPROACH 1: BOTTOM-UP APPROACH: STACKER CRANE MARKET

FIGURE 7 BOTTOM-UP APPROACH: MARKET

2.3.2 APPROACH 2: TOP-DOWN APPROACH: MARKET

FIGURE 8 TOP-DOWN APPROACH: MARKET, BY OPERATION TYPE

FIGURE 9 TOP-DOWN APPROACH: MARKET, BY END USE INDUSTRY

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDE

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

3.1 PRE- & POST-COVID-19 SCENARIOS

FIGURE 11 PRE- & POST-COVID-19: STACKER CRANE MARKET, 2019–2027 (USD MILLION)

TABLE 1 MARKET: PRE- VS. POST-COVID-19 SCENARIO, 2019–2027 (USD MILLION)

3.2 REPORT SUMMARY

FIGURE 12 MARKET, BY REGION, 2021 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN STACKER CRANE MARKET

FIGURE 13 RISE IN DEMAND FOR AUTOMATED MATERIAL HANDLING EQUIPMENT EXPECTED TO DRIVE GLOBAL MARKET

4.2 MARKET, BY TYPE

FIGURE 14 SINGLE COLUMN STACKER CRANES ESTIMATED TO ACCOUNT FOR LARGER MARKET SHARE, BY VALUE, IN 2021

4.3 MARKET, BY OPERATION TYPE

FIGURE 15 AUTOMATED STACKER CRANES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

4.4 MARKET, BY END USE INDUSTRY

FIGURE 16 CONSUMER GOODS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2021

4.5 ROBOTIC MARKET, BY REGION

FIGURE 17 ASIA PACIFIC PROJECTED TO HOLD LARGEST SHARE (VALUE) FOR ROBOTIC STACKER CRANES BY 2027

4.6 MARKET, BY REGION

FIGURE 18 ASIA PACIFIC DOMINATED MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 STACKER CRANE MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased demand for automated storage and retrieval systems (ASRS)

FIGURE 20 COMPONENTS OF ASRS

FIGURE 21 GLOBAL ASRS MARKET, BY VALUE (2018-2026)

5.2.1.2 Rising popularity of automated material handling equipment and warehouses

FIGURE 22 GLOBAL WAREHOUSE AUTOMATION MARKET, BY VALUE (2016-2025)

5.2.2 RESTRAINTS

5.2.2.1 High integration and switching costs

5.2.3 OPPORTUNITIES

5.2.3.1 Industrial growth in emerging economies

5.2.3.2 Development of robotic stacker cranes

5.2.3.3 Increasing demand for third-party logistics (3PL)

5.2.4 CHALLENGES

5.2.4.1 Technical challenges related to sensing elements

5.2.4.2 Flexible and scalable stacker crane solutions for industries

5.3 TRENDS/DISRUPTIONS IMPACTING MARKET

FIGURE 23 REVENUE SHIFT FOR MARKET

5.4 MARKET SCENARIO

FIGURE 24 STACKER CRANE MARKET SCENARIO, 2019–2027 (USD MILLION)

5.4.1 REALISTIC SCENARIO

TABLE 2 MARKET (REALISTIC SCENARIO), BY REGION, 2019–2027 (USD BILLION)

5.4.2 LOW-IMPACT SCENARIO

TABLE 3 MARKET (LOW-IMPACT SCENARIO), BY REGION, 2019–2027 (USD MILLION)

5.4.3 HIGH-IMPACT SCENARIO

TABLE 4 MARKET (HIGH-IMPACT SCENARIO), BY REGION, 2019–2027 (USD MILLION)

5.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: PRESENCE OF ESTABLISHED GLOBAL PLAYERS INCREASES DEGREE OF COMPETITION

5.5.1 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 PORTER’S FIVE FORCES ANALYSIS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 THREAT OF NEW ENTRANTS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 BARGAINING POWER OF SUPPLIERS

5.5.6 INTENSITY OF COMPETITIVE RIVALRY

5.6 MARKET ECOSYSTEM

FIGURE 26 MARKET ECOSYSTEM

TABLE 6 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 27 SUPPLY CHAIN ANALYSIS: MARKET

5.8 TECHNOLOGY ANALYSIS

5.8.1 INDUSTRY 4.0

5.8.2 5G

5.8.3 MACHINE LEARNING (ML)

5.9 AVERAGE SELLING PRICE TREND

5.9.1 AVERAGE REGIONAL PRICE TREND: STACKER CRANE (USD MILLION/UNIT), 2021

5.10 PATENT ANALYSIS

5.10.1 APPLICATIONS AND PATENTS GRANTED, 2018–2021

5.11 CASE STUDY ANALYSIS

5.11.1 USE CASE 1: R&M MATERIAL HANDLING

5.11.2 USE CASE 2: AUTOMATED SYSTEM FOR RETAIL STORE REPLENISHMENT

5.11.3 USE CASE 3: IMPLEMENTING AS/RS AND AGVS TO REDUCE DELIVERY TIME

5.11.4 USE CASE 4: AUTOMATED MATERIAL HANDLING

5.12 REGULATORY FRAMEWORK

6 STACKER CRANE MARKET, BY TYPE (Page No. - 61)

Note: The market size and forecast of each type is further segmented into regions – Asia Pacific, Europe, North America, and Rest of the World

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 INDUSTRY INSIGHTS

6.1.3 ASSUMPTIONS

FIGURE 28 MARKET, BY TYPE, 2021 VS 2027 (USD MILLION)

TABLE 7 MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 8 MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 9 MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 10 MARKET, BY TYPE, 2021–2027 (USD MILLION)

6.2 SINGLE COLUMN

6.2.1 GROWTH OF GLOBAL E-COMMERCE INDUSTRY TO BOOST DEMAND FOR SINGLE COLUMN SEGMENT

TABLE 11 SINGLE COLUMN STACKER CRANE MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 12 SINGLE-COLUMN MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 13 SINGLE-COLUMN MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 14 SINGLE-COLUMN MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 DOUBLE COLUMN

6.3.1 GROWING AUTOMATION IN AUTOMOTIVE INDUSTRY TO INFLUENCE DEMAND FOR DOUBLE COLUMN STACKER CRANES

TABLE 15 DOUBLE COLUMN STACKER CRANE MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 16 DOUBLE COLUMN MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 17 DOUBLE COLUMN MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 18 DOUBLE COLUMN MARKET, BY REGION, 2021–2027 (USD MILLION)

7 STACKER CRANE MARKET, BY OPERATION TYPE (Page No. - 68)

Note: The market size and forecast of each operation type is further segmented into regions – Asia Pacific, Europe, North America, and Rest of the World

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.1.3 INDUSTRY INSIGHTS

FIGURE 29 MARKET, BY OPERATION TYPE, 2021 VS 2027 (USD MILLION)

TABLE 19 MARKET, BY OPERATION TYPE, 2018–2020 (UNITS)

TABLE 20 MARKET, BY OPERATION TYPE, 2021–2027 (UNITS)

TABLE 21 MARKET, BY OPERATION TYPE, 2018–2020 (USD MILLION)

TABLE 22 MARKET, BY OPERATION TYPE, 2021–2027 (USD MILLION)

7.2 SEMI-AUTOMATIC

7.2.1 GROWING DEMAND FOR MATERIAL HANDLING TECHNOLOGY IN EMERGING ECONOMIES TO BOOST DEMAND FOR SEMI-AUTOMATED STACKER CRANES

TABLE 23 SEMI-AUTOMATIC STACKER CRANE MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 24 SEMI-AUTOMATIC MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 25 SEMI-AUTOMATIC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 SEMI-AUTOMATIC MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3 AUTOMATIC

7.3.1 GROWING DEMAND FOR AUTOMATED MATERIAL HANDLING EQUIPMENT DRIVES DEMAND FOR AUTOMATIC STACKER CRANES

TABLE 27 AUTOMATIC STACKER CRANE MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 28 AUTOMATIC MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 29 AUTOMATIC MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 30 AUTOMATIC MARKET, BY REGION, 2021–2027 (USD MILLION)

8 STACKER CRANE MARKET, BY END-USE INDUSTRY (Page No. - 75)

Note: The market size and forecast of each end use industry is further segmented into regions – Asia Pacific, Europe, North America, and Rest of the World

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 30 STACKER CRANE MARKET, BY END-USE INDUSTRY, 2021 VS 2027 (USD MILLION)

TABLE 31 MARKET, BY END-USE INDUSTRY, 2018–2020 (UNITS)

TABLE 32 MARKET, BY END-USE INDUSTRY, 2021–2027 (UNITS)

TABLE 33 MARKET, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 34 MARKET, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.2 CONSUMER GOODS

8.2.1 FLUCTUATING DEMAND AND INCREASING ADAPTATION OF MAKE-TO-STOCK MANUFACTURING TECHNIQUES TO DRIVE DEMAND FOR STACKER CRANES

TABLE 35 CONSUMER GOODS: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 36 CONSUMER GOODS: MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 37 CONSUMER GOODS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 38 CONSUMER GOODS: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.3 E-COMMERCE/RETAIL & WHOLESALE

8.3.1 CHANGE IN CONSUMER HABITS DUE TO PANDEMIC LED TO GROWTH OF RETAIL & WHOLESALE SEGMENT

TABLE 39 E-COMMERCE/RETAIL & WHOLESALE: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 40 E-COMMERCE/RETAIL & WHOLESALE: MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 41 E-COMMERCE/RETAIL & WHOLESALE: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 42 E-COMMERCE/RETAIL & WHOLESALE: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.4 PHARMACEUTICAL

8.4.1 INCREASING DEMAND AND NEED FOR SAFE STORING & HANDLING DROVE MARKET

TABLE 43 PHARMACEUTICAL: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 44 PHARMACEUTICAL: MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 45 PHARMACEUTICAL: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 46 PHARMACEUTICAL: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.5 AUTOMOTIVE

8.5.1 TIME-BOUND MANUFACTURING CONTRIBUTES TO DEMAND FOR STACKER CRANES IN AUTOMOTIVE SEGMENT

TABLE 47 AUTOMOTIVE: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 48 AUTOMOTIVE: MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 49 AUTOMOTIVE: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 50 AUTOMOTIVE: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.6 OTHERS

8.6.1 PRICE FLUCTUATIONS AND GLOBALIZATION OF SUPPLIERS IMPROVED MATERIAL HANDLING

TABLE 51 OTHERS: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 52 OTHERS: MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 53 OTHERS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 54 OTHERS: MARKET, BY REGION, 2021–2027 (USD MILLION)

9 ROBOTIC STACKER CRANE MARKET, BY APPLICATION (Page No. - 87)

Note: The market size and forecast of robotic stacker cranes is further segmented into regions – Asia Pacific, Europe, North America, and Rest of the World

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 31 MARKET, BY REGION, 2021 VS 2027 (USD MILLION)

TABLE 55 MARKET, BY REGION, 2020–2027 (UNITS)

TABLE 56 MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 AUTOSTORE

9.3 EARLY BAGGAGE STORAGE (EBS)

9.4 SORTATION SYSTEMS

9.5 ROBOTIZED ORDER PREPARATION

10 STACKER CRANE MARKET, BY REGION (Page No. - 92)

Note: The market size and forecast of each country is further segmented into stacker crane type – Single Column and Double Column

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 INDUSTRY INSIGHTS

10.1.3 ASSUMPTIONS

FIGURE 32 STACKER CRANE MARKET, BY REGION, 2021 VS 2027 (USD MILLION)

TABLE 57 MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 58 MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 59 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 60 MARKET, BY REGION, 2021–2027 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 61 ASIA PACIFIC MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 62 ASIA PACIFIC MARKET, BY COUNTRY, 2021–2027 (UNITS)

TABLE 63 ASIA PACIFIC MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 64 ASIA PACIFIC MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Reduction in cost of material handling equipment expected to drive market

TABLE 65 CHINA: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 66 CHINA: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 67 CHINA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 68 CHINA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.2.2 INDIA

10.2.2.1 Exponential growth of pharmaceutical, retail, and FMCG industries to fuel Indian market

TABLE 69 INDIA: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 70 INDIA: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 71 INDIA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 72 INDIA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.2.3 JAPAN

10.2.3.1 Space constraints, inventory holding cost, and labor shortage influence demand for Japanese market

TABLE 73 JAPAN: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 74 JAPAN: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 75 JAPAN: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 76 JAPAN: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.2.4 SOUTH KOREA

10.2.4.1 Growth of urbanized population and space constraints contributes to growth of stacker cranes in South Korea

TABLE 77 SOUTH KOREA: STACKER CRANE MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 78 SOUTH KOREA: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 79 SOUTH KOREA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 80 SOUTH KOREA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.3 EUROPE

FIGURE 34 EUROPE: MARKET SNAPSHOT

TABLE 81 EUROPE: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 82 EUROPE: MARKET, BY COUNTRY, 2021–2027 (UNITS)

TABLE 83 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Presence of high-volume logistics sector to drive market in Germany

TABLE 85 GERMANY: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 86 GERMANY: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 87 GERMANY: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 88 GERMANY: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Growth in e-commerce/retail & wholesale and food & beverages industry to improve stacker crane demand in France

TABLE 89 FRANCE: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 90 FRANCE: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 91 FRANCE: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 92 FRANCE: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Localized distribution centers and rising space constraints to uplift demand for stacker cranes in UK

TABLE 93 UK: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 94 UK: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 95 UK: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 96 UK: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Efficient mobility infrastructure drives market in Spain

TABLE 97 SPAIN: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 98 SPAIN: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 99 SPAIN: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 100 SPAIN: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Growing exports of retail, fast-fashion, and e-commerce contributes growth in Italian market

TABLE 101 ITALY: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 102 ITALY: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 103 ITALY: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 104 ITALY: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.3.6 RUSSIA

10.3.6.1 Need to improve competitive advantage of Russia consumer goods to boost market

TABLE 105 RUSSIA: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 106 RUSSIA: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 107 RUSSIA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 108 RUSSIA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.4 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET, 2021 VS 2027 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 110 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (UNITS)

TABLE 111 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.4.1 US

10.4.1.1 US market improved global market share during e-commerce boom

TABLE 113 US: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 114 US: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 115 US: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 116 US: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.4.2 CANADA

10.4.2.1 E-commerce boom and rising cost of warehouse operation drove Canadian market

TABLE 117 CANADA: STACKER CRANE MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 118 CANADA: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 119 CANADA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 120 CANADA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.4.3 MEXICO

10.4.3.1 Growth of foreign manufacturing units in Mexico to drive demand for stacker cranes in consumer goods industry

TABLE 121 MEXICO: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 122 MEXICO: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 123 MEXICO: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 124 MEXICO: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.5 REST OF THE WORLD

FIGURE 36 REST OF THE WORLD: MARKET, 2021 VS 2027 (USD MILLION)

TABLE 125 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 126 REST OF THE WORLD: MARKET, BY COUNTRY, 2021–2027 (UNITS)

TABLE 127 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 128 REST OF THE WORLD: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Increase in consumer goods exports and e-to lead market growth in Brazil

TABLE 129 BRAZIL: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 130 BRAZIL: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 131 BRAZIL: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 132 BRAZIL: MARKET, BY TYPE, 2021–2027 (USD MILLION)

10.5.2 SOUTH AFRICA

10.5.2.1 Expansion of AS/RS market to push growth of market in South Africa

TABLE 133 SOUTH AFRICA: MARKET, BY TYPE, 2018–2020 (UNITS)

TABLE 134 SOUTH AFRICA: MARKET, BY TYPE, 2021–2027 (UNITS)

TABLE 135 SOUTH AFRICA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 136 SOUTH AFRICA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 123)

11.1 OVERVIEW

11.2 STACKER CRANE MARKET SHARE ANALYSIS, 2020

TABLE 137 MARKET SHARE ANALYSIS FOR MARKET, 2020

FIGURE 37 MARKET SHARE, 2021

11.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

11.4 COMPETITIVE EVALUATION QUADRANT

11.4.1 TERMINOLOGY

11.4.2 STAR

11.4.3 EMERGING LEADERS

11.4.4 PERVASIVE

11.4.5 PARTICIPANTS

FIGURE 38 STACKER CRANE MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

TABLE 138 MARKET: COMPANY FOOTPRINT, 2021

TABLE 139 STACKER CRANES MARKET: COMPANY PRODUCTFOOTPRINT, 2021

TABLE 140 STACKER CRANES MARKET: COMPANY REGION FOOTPRINT, 2021

11.5 COMPETITIVE SCENARIO

11.5.1 NEW PRODUCT LAUNCHES

TABLE 141 PRODUCT LAUNCHES

11.5.2 DEALS

TABLE 142 DEALS, 2017–2021

11.5.3 EXPANSIONS, 2018–2021

TABLE 143 EXPANSIONS, 2018–2021

11.6 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018–2021

FIGURE 39 COMPANIES ADOPTED DEALS SUCH AS ACQUISITIONS, AGREEMENTS AND EXPANSION AS KEY GROWTH STRATEGIES, 2017–2021

12 COMPANY PROFILES (Page No. - 136)

Note: The Business Overview, Products Offered, and Recent Developments are covered for Top 13 Stacker Crane Market players.

MnM View is covered for top 5 Market players

Profiles of ‘Additional players’ cover Business Overview, Products Offered and Company’s Regional Presence

12.1 MARKET - KEY PLAYERS

12.1.1 DAIFUKU

TABLE 144 DAIFUKU: BUSINESS OVERVIEW

FIGURE 40 DAIFUKU: COMPANY SNAPSHOT

TABLE 145 DAIFUKU: DEALS

12.1.2 SWISSLOG AG

TABLE 146 SWISSLOG AG: BUSINESS OVERVIEW

FIGURE 41 SWISSLOG AG: COMPANY SNAPSHOT

TABLE 147 SWISSLOG AG: DEALS

12.1.3 KION GROUP AG

TABLE 148 KION GROUP AG: BUSINESS OVERVIEW

FIGURE 42 KION GROUP AG: COMPANY SNAPSHOT

TABLE 149 KION GROUP AG: EXPANSIONS

12.1.4 SSI SCHÄFER

TABLE 150 SSI SCHÄFER GMBH: BUSINESS OVERVIEW

TABLE 151 SSI SCHÄFER GMBH: DEAL

12.1.5 MURATA MACHINERY, LTD.

TABLE 152 MURATA MACHINERY, LTD.: BUSINESS OVERVIEW

FIGURE 43 MURATA MACHINERY LTD. CORPORATION: COMPANY SNAPSHOT

TABLE 153 MURATA MACHINERY, LTD.: DEALS

12.1.6 DOOSAN CORPORATION

TABLE 154 DOOSAN CORPORATION: BUSINESS OVERVIEW

FIGURE 44 DOOSAN CORPORATION: COMPANY SNAPSHOT

TABLE 155 DOOSAN CORPORATION: DEALS

12.1.7 HYSTER-YALE MATERIALS HANDLING

TABLE 156 HYSTER-YALE MATERIALS HANDLING: BUSINESS OVERVIEW

FIGURE 45 HYSTER-YALE MATERIALS HANDLING: COMPANY SNAPSHOT

TABLE 157 HYSTER-YALE MATERIALS HANDLING: PRODUCT LAUNCHES

12.1.8 JUNGHEINRICH AG

TABLE 158 JUNGHEINRICH AG: BUSINESS OVERVIEW

FIGURE 46 JUNGHEINRICH AG: COMPANY SNAPSHOT

TABLE 159 JUNGHEINRICH AG: DEALS

TABLE 160 JUNGHEINRICH AG: EXPANSIONS

12.1.9 MITSUBISHI LOGISNEXT CO., LTD

TABLE 161 MITSUBISHI LOGISNEXT CO., LTD: BUSINESS OVERVIEW

FIGURE 47 MITSUBISHI LOGISNEXT CO., LTD INC.: COMPANY SNAPSHOT

12.1.10 TOYOTA INDUSTRIES CORPORATION

TABLE 162 TOYOTA INDUSTRIES CORPORATION: BUSINESS OVERVIEW

FIGURE 48 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

TABLE 163 TOYOTA INDUSTRIES CORPORATION: DEALS

12.1.11 ATOX SISTEMAS DE ALMACENAJE, S.A

TABLE 164 ATOX SISTEMAS DE ALMACENAJE, S.A: BUSINESS OVERVIEW

12.1.12 MECALUX, INC

TABLE 165 MECALUX, INC: BUSINESS OVERVIEW

TABLE 166 MECALUX, INC: EXPANSIONS

12.1.13 GODREJ KOERBER SUPPLY CHAIN LIMITED

TABLE 167 GODREJ KOERBER SUPPLY CHAIN LIMITED: BUSINESS OVERVIEW

FIGURE 49 GODREJ KOEBER SUPPLY CHAIN LIMITED: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.2 STACKER CRANE MARKET – ADDITIONAL PLAYERS

12.2.1 CLARK MATERIAL HANDLING

TABLE 168 CLARK MATERIAL HANDLING: COMPANY OVERVIEW

12.2.2 ELECTROMESH

TABLE 169 ELECTROMESH: COMPANY OVERVIEW

12.2.3 MIAS GROUP

TABLE 170 MIAS GROUP.: COMPANY OVERVIEW

12.2.4 CASSIOLI

TABLE 171 CASSIOLI: COMPANY OVERVIEW

12.2.5 ALSTEF GROUP

TABLE 172 ALSTEF GROUP: COMPANY OVERVIEW

12.2.6 KALMAR GLOBAL

TABLE 173 KALMAR GLOBAL: COMPANY OVERVIEW

12.2.7 LTW INTRALOGISTICS GMBH

TABLE 174 LTW INTRALOGISTICS GMBH: COMPANY OVERVIEW

12.2.8 KNAPP AG

TABLE 175 KNAPP AG: COMPANY OVERVIEW

12.2.9 VANDERLANDE CORPORATION

TABLE 176 VANDERLANDE CORPORATION: COMPANY OVERVIEW

12.2.10 TGW LOGISTICS GROUP

TABLE 177 TGW LOGISTICS GROUP OVERVIEW

12.2.11 BEUMER GROUP

TABLE 178 BEUMER GROUP: COMPANY OVERVIEW

13 RECOMMENDATIONS (Page No. - 171)

13.1 ASIA PACIFIC TO DOMINATE STACKER CRANES MARKET

13.2 E-COMMERCE/RETAIL & WHOLESALE INDUSTRY EXPECTED TO BE KEY FOCUS FOR MANUFACTURERS

13.3 CONCLUSION

14 APPENDIX (Page No. - 172)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.4.1 BY PAYLOAD CAPACITY

14.4.1.1 Unit Load

14.4.1.2 Mini Load

14.4.2 STACKER CRANE SENSOR MARKET, BY REGION

14.4.2.1 Asia Pacific

14.4.2.2 Europe

14.4.2.3 North America

14.4.2.4 Rest of the World

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the stacker crane market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company websites, press releases, industry association publications, Intralogistics magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles were used to identify and collect information useful for an extensive commercial study of the stacker crane market.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs; vice presidents; directors from business development, marketing, and product development/innovation teams; and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as stacker crane market forecast, current technology trends, and upcoming technologies in this market. Data triangulation of all these points was carried out with the information gathered from secondary research. Stakeholders from the supply side were interviewed to understand their views on the points mentioned above.

Primary interviews were conducted with market experts from the supply side (stacker crane manufacturers) across four major regions, namely, North America, Europe, Asia-Pacific, and Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the stacker crane market by type, and region. Whereas, the top-down approach was used to derive market size by operation type and end-use industry. To determine the global market size by type, the country-level estimated value share of stacker cranes for each type was multiplied by the average selling price (single column and double column).

The country-level market sizes were summed up to arrive at the regional market size, which was further added to derive this market size. The market size of the operation type and end-use industry segments was derived based on the share of operation type (semi-automatic and automatic) and share of each end-use industry then multiplied by region-wise market volume and by value.

Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that are expected to affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Report Objectives

- To analyze and forecast the stacker crane market size from 2021 to 2027, in terms of value (USD million)

- To define and describe the market by type, operation, end-use industry and, region.

- By type (single column and double column)

- By operation type (semi-automatic and automatic )

- By end-use industry (consumer goods, e-commerce/retail & wholesale, pharmaceuticals, automotive, and others.)

- By region (Asia Pacific, Europe, North America, and Rest of the World)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the share of key players operating in the market

- To understand the dynamics of competitors and distinguish them into stars, emerging leaders, pervasive players, and emerging companies according to the strength of their product portfolio and business strategies

- To analyze recent developments, such as agreements/partnerships/collaborations, joint ventures/mergers & acquisitions, geographic expansions, and new product launches, of key players in the mobility as a service market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

-

By payload capacity

- Unit Load

- Mini Load

-

Stacker crane sensor market, by region

- Asia Pacific

- Europe

- North America

- Rest of the World

Note: This will be further segmented by region.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Stacker Crane Market