Cargo Handling Equipment Market by Application (Air, Land, & Marine), Equipment (Conveyors, Forklift Truck, Aviation Dolly, Pallet Jack, AGV, Crane, RTG, Loader, Stacker, Straddle Carrier, Terminal Tractor), Propulsion, and Region - Global Forecast to 2025

[177 Pages Report] The global cargo handling equipment market size was valued at USD 21.08 billion in 2017 and is expected to reach USD 8.02 billion by 2025, at a CAGR of 3.61% during the forecast period 2017-2025. The base year considered for the study is 2017 and the forecast period is 2018–2025. As per the United Nations Conference on Trade And Development (UNCTAD), the global seaborne trade volume touched 10.2 billion tons in 2016. Additinally, the IATA has estimated the growth in global aircargo movement at the CAGR of 4.5% till 2035. The constantly increasing seaborne trade, industrial production, and air cargo is driving the demand for cargo handling equipment globally. Equipment with higher fuel efficiency and lower or zero emissions are in demand to meet the stringent emission norms, which would drive the electric market during the forecast period.

Objectives of the Study

- To estimate and forecast the cargo handling equipment market, by propulsion type, application type, and region

- To segment the market and forecast the market size, by value, for marine cargo, on the basis of equipment type at the regional level.

- To segment the market and forecast the market size, by value, for land cargo, on the basis of equipment type at the regional level

- To segment the market and forecast the market size, by value, for air cargo, on the basis of equipment type at the regional level

Top-down approach has been used to estimate the size of the cargo handling equipment market. The total global cargo handling market is derived and validated through primary sources. Then the global market was segmented at the application level market by using the data in MNM repository and further validated through primary respondents. Application-wise market is further segmented at the regional level. Regional penetration for each application is derived from the macroeconomic factors such as land size, GDP, International trade, and cargo handling capacity. Market size for country is derived from the overall cargo carrying capacity. The regional level applications are further segmented into equipment based on their usage in respective applications.

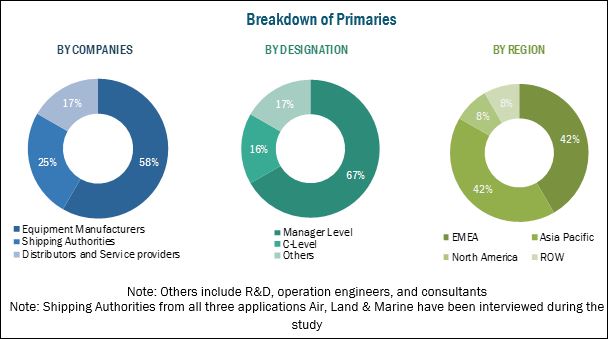

The research methodology involved various secondary sources such as the Warehousing Education and research council (WERC), International Air Transport Association (IATA), World Cargo Alliance (WCA), Port Equipment Manufacturers’ Association (PEMA), Container Handling Equipment Manufacturers' Association (CHEM), Container Owners Association (COA), Container Dealers Association (CDA), Container Traders and Innovators Association, United Nations Conference on Trade and Development (UNCTAD), World Shipping Council, corporate filings (such as annual reports, investor presentations, and financial statements), business and industry magazines, and paid databases. The figure below illustrates the break-up of the profiles of the industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The cargo handling equipment market is dominated by a few globally established players such as Kalmar (Finland), Konecranes (Finland), Liebherr (Switzerland), Hyster (US), Sany (China), ZPMC (China), Lonking (China), Anhui Heli (China), CVS Ferrari (Italy), and Hoist Liftruck (US).

Target Audience

- Cargo handling equipment manufacturers

- Cargo handling equipment traders and distributors

- Air cargo associations

- Air cargo equipment manufacturers

- Global industrial vehicle and cargo handling associations

- Government and regulatory authorities

- Research and consulting associations

Scope of the Report

Cargo Handling Equipment Market, by Equipment Type

- Aviation dollies

- Stacker

- Pallet jack

- Loaders

- Conveyor system

- Automated guided vehicle

- Forklift Trucks

- Cranes

- Rubber-Tired Gantry Cranes

- Straddle Carriers

- Reach Stackers

- Terminal Tractors

Cargo Handling Equipment Market, by Application

- Air Cargo

- Marine Cargo

- Land Cargo

Air Cargo Handling Equipment Market, by Equipment Type

- Aviation dollies

- Stacker

- Loaders

- Conveyor system

- Forklift Trucks

- Terminal Tractors

Land Cargo Handling Equipment Market, by Equipment Type

- Stacker

- Pallet jack

- Conveyor system

- Automated guided vehicle

- Forklift Trucks

Marine Cargo Handling Equipment Market, by Equipment Type

- Forklift Trucks

- Cranes

- Rubber-Tired Gantry Cranes

- Straddle Carriers

- Reach Stackers

- Terminal Tractors

Cargo Handling Equipment Market, by Propulsion Type

- Diesel

- Electric

- Others

Cargo Handling Equipment Market, by Region and Country

-

Asia Pacific

- China

- India

- Japan

- Singapore

-

Europe, the Middle East, and Africa

- Germany

- France

- Spain

- UK

- UAE

- South Africa

-

North America

- Canada

- Mexico

- US

-

RoW

- Argentina

- Brazil

- Russia

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Air Cargo Handling Equipment Market, By equipment (Units)

- Loader

- Aviation dollies

- Conveyor system

- Forklift truck

Marine Cargo Handling Equipment Market, By Equipment (Units)

- Crane

- Forklift

- RTG

- Reach stacker

- Straddle carrier

- Terminal tractor

- Others

Land Cargo Handling Equipment Market, By Equipment (Units)

- Forklift

- Stacker

- Pallet jack

- Conveyor system

- Others

Land Cargo Handling Equipment Market, By Propulsion Type

- Diesel

- Electric

- Others

Air Cargo Handling Equipment Market, By Propulsion Type

- Diesel

- Electric

- Others

Marine Cargo Handling Equipment Market, By Propulsion

- Diesel

- Electric

- Others

Detailed analysis and profiling of additional market players (UP TO 3)

- Business Overview

- Company Snapshot

- Product Portfolio

- Recent developments

The increase in cargo transportation and need for automation to handle increased cargo volumes is expected to drive the market for cargo handling equipment.

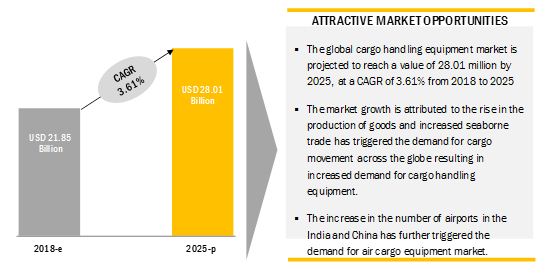

The cargo handling equipment market is projected to grow at a CAGR of 3.61%, during the forecast period, to reach a market size of USD 28.02 billion by 2025 from an estimated USD 21.85 billion in 2018. Increased seaborne trade and increase in trends such as E-commerce are the key drivers for this market. However, the high capital costs of cargo handling equipment and lack of synchronization among different equipment can hinder the growth of the market.

The important factors driving the growth of this market include the demand for passenger cars and commercial vehicles. However, a major restraint for the brake friction products market is the increasing life of brake friction products.

Ongoing new product developments by leading companies for advanced differential systems and components are likely to propel further growth of the automotive differential market during the forecast period.

Market Dynamics

Drivers

-

Increasing Cargo Transportation Around the World

- Increasing Marine Cargo Transportation

- Increase in Demand for Air Cargo Transportation

- Increase in Demand for Land Cargo Transportation

Restraints

- High Capital Costs of Cargo Handling Equipment

Opportunities

- Increasing Stringency in Emission Regulations

- Growing Automation in Cargo Handling Equipment to Open Doors for Technology Suppliers

Challenges

- Accidents Involved While Using Cargo Handling Equipment

- Lack of Synchronization Between Different Port Equipment

Critical Questions:

- Why diesel propelled cargo equipment has the largest market today and will also dominate in future as well?

- How and why marine cargo handling equipment’s are the fastest growing?

- How the industry players will address the challenge of increasing accidents related to cargo handling equipment?

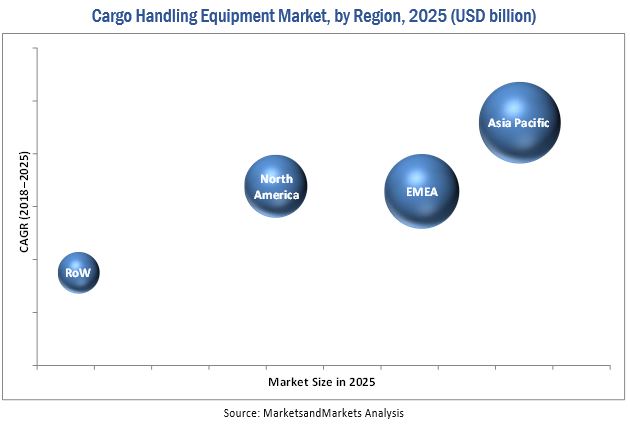

The cargo handling equipment market is projected to reach USD 28.02 billion by 2025 from an estimated USD 21.85 billion in 2018, at a CAGR of 3.61% during the forecast period. The efforts toward cargo equipment automation, rising demand for electric and hybrid equipment to achieve lower emissions and fuel consumption, and increased demand in the Asia Pacific region are expected to drive the market for cargo handling equipment during the forecast period.

The diesel propelled cargo handling equipment segment is expected to hold the largest market share in 2018 due to the efficient power delivery, low fuel costs, and inadequate/insufficient electric infrastructure at small and medium terminals. Also, the stringent emission regulations for NOx, PM, and CO2 by the US EPA and European Union have prompted equipment manufacturers to offer fuel-efficient equipment with lower emissions. Hence, equipment manufacturers are focusing on the development and sale of electric and hybrid equipment.

Increasing seaborne trade and import/export have increased the demand for movement of cargo in the marine ports. Furthermore, the number of small and medium marine ports is increasing in countries such as India, Malaysia and Thailand, which has driven the demand and boosted the growth of marine cargo equipment handling market in Asia Pacific at the highest CAGR during forecast period.

Forklift trucks are estimated to hold the largest market share. Forklift trucks are used in all types of cargo handling, such as air cargo, marine cargo, and land cargo. Forklift trucks are available in multiple propulsion types, such as diesel, electric, hybrid, and propane. Furthermore, forklift trucks are available in a wide range of capacity. All these factors and the ability to transfer cargo at high speed at marine ports, airports, and industrial warehouses boost the demand for forklift trucks in cargo handling market. Hence, forklift trucks segment is estimated to account for the largest market by equipment type.

Asia Pacific is expected to be the largest and fastest growing market during forecast period. Highest growth can be attributed to the increasing seaborne trade, increasing industrial production and increase in air cargo movement in the region. As per IATA, Asia Pacific accounts for the 37.4% of worldwide cargo movement. additionally, growing trend such as E-commerce is also fuelling the demand for market in Asia pacific.

The high capital cost of cargo handling equipment is one of the key restraints for the growth of the cargo handling equipment market. Also, the lack of synchronization among different equipment types acts as a challenge for this market. These factors may affect the growth of this market in the near future.

Some of the key cargo handling equipment manufacturers and suppliers include Kalmar (Finland), Konecranes (Finland), Liebherr (Switzerland), JBT corporation (US), Mitsubishi (Japan), Toyota Industries (Japan), Hyster (US), Sany (China), Kion Group (Germany), Anhui Heli (China), Terex corporation (US), and Macgregor (Finland). Major players such as Kalmar and Konecranes are adopting strategies such as new product development to gain traction in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 CARGO HANDLING EQUIPMENT MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 CARGO HANDLING EQUIPMENT MARKET SIZE ESTIMATION

2.4.1 TOP DOWN APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 CARGO HANDLING EQUIPMENT: GLOBAL MARKET SIZING & FORECAST

4.2 CARGO HANDLING EQUIPMENT MARKET, BY REGION

4.3 MARKET, BY APPLICATION

4.4 MARKET, BY PROPULSION

4.5 MARKET, BY AIR CARGO EQUIPMENT

4.6 MARKET, BY LAND CARGO EQUIPMENT

4.7 MARKET, BY MARINE CARGO EQUIPMENT TYPE

5 CARGO HANDLING EQUIPMENT MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing cargo transportation around the world

5.2.1.1.1 Increasing marine cargo transportation

5.2.1.1.2 Increase in demand for air cargo transportation

5.2.1.1.3 Increase in demand for land cargo transportation

5.2.2 RESTRAINTS

5.2.2.1 High capital costs of cargo handling equipment

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing stringency in emission regulations

5.2.3.2 Growing automation in cargo handling equipment to open doors for technology suppliers

5.2.4 CHALLENGES

5.2.4.1 Accidents involved while using cargo handling equipment

5.2.4.2 Lack of synchronization between different port equipment

6 CARGO HANDLING EQUIPMENT MARKET, BY APPLICATION (Page No. - 48)

Note: The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, North America, and RoW

6.1 INTRODUCTION

6.2 MARINE CARGO

6.3 AIR CARGO

6.4 LAND CARGO

7 AIR CARGO HANDLING EQUIPMENT MARKET, BY EQUIPMENT TYPE (Page No. - 54)

Note: The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, North America, and RoW

7.1 INTRODUCTION

7.2 AVIATION DOLLIES

7.3 FORKLIFT TRUCK

7.4 LOADER

7.5 CONVEYOR SYSTEM

7.6 TERMINAL TRACTOR

7.7 OTHER AIR CARGO HANDLING EQUIPMENT

8 LAND CARGO HANDLING EQUIPMENT MARKET, BY EQUIPMENT TYPE (Page No. - 62)

Note: The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, North America, and RoW

8.1 INTRODUCTION

8.2 FORKLIFT TRUCKS

8.3 PALLET JACK

8.4 CONVEYOR SYSTEM

8.5 STACKER

8.6 AUTOMATED GUIDED VEHICLE

8.7 OTHER LAND CARGO HANDLING EQUIPMENT

9 MARINE CARGO HANDLING EQUIPMENT MARKET, BY EQUIPMENT TYPE (Page No. - 70)

Note: The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, North America, and RoW

9.1 INTRODUCTION

9.2 CRANE

9.3 FORKLIFT TRUCK

9.4 REACH STACKER

9.5 RUBBER-TIRED GANTRY (RTG)

9.6 STRADDLE CARRIER

9.7 TERMINAL TRACTOR

9.8 OTHER MARINE CARGO HANDLING EQUIPMENT

10 CARGO HANDLING EQUIPMENT MARKET, BY EQUIPMENT TYPE (Page No. - 79)

Note: The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, North America, and RoW

10.1 INTRODUCTION

10.2 AVIATION DOLLIES

10.3 LOADER

10.4 TERMINAL TRACTOR

10.5 CRANE

10.6 REACH STACKER

10.7 RUBBER-TIRED GANTRY (RTG)

10.8 STRADDLE CARRIER

10.9 FORKLIFT TRUCK

10.1 PALLET JACK

10.11 CONVEYOR SYSTEM

10.12 STACKER

10.13 AUTOMATED GUIDED VEHICLE

10.14 OTHER CARGO HANDLING EQUIPMENT

11 CARGO HANDLING EQUIPMENT MARKET, BY PROPULSION TYPE (Page No. - 96)

Note: The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, North America, and RoW

11.1 INTRODUCTION

11.2 DIESEL

11.3 ELECTRIC

11.4 OTHER PROPULSION TYPES

12 CARGO HANDLING EQUIPMENT MARKET, BY REGION (Page No. - 101)

Note: The Chapter is Further Segmented at Country Level and By Application, Considered Applications Air Cargo, Land Cargo and Marine Cargo

12.1 INTRODUCTION

12.2 ASIA PACIFIC

12.2.1 CHINA

12.2.2 INDIA

12.2.3 JAPAN

12.2.4 SINGAPORE

12.2.5 ASIA PACIFIC OTHERS

12.3 EUROPE, MIDDLE-EAST & AFRICA (EMEA)

12.3.1 GERMANY

12.3.2 FRANCE

12.3.3 SPAIN

12.3.4 UK

12.3.5 UAE

12.3.6 SOUTH AFRICA

12.3.7 EMEA OTHERS

12.4 NORTH AMERICA

12.4.1 CANADA

12.4.2 MEXICO

12.4.3 US

12.5 ROW

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 RUSSIA

12.5.4 ROW OTHERS

13 COMPETITIVE LANDSCAPE (Page No. - 121)

13.1 OVERVIEW

13.2 CARGO HANDLING EQUIPMENT: PRODUCT MATRIX FOR KEY MANUFACTURERS

13.3 CARGO HANDLING EQUIPMENT: MARKET RANKING ANALYSIS

13.4 COMPETITIVE SCENARIO

13.4.1 SUPPLY CONTRACTS & AGREEMENTS

13.4.2 NEW PRODUCT DEVELOPMENTS

13.4.3 MERGERS & ACQUISITIONS

13.4.4 EXPANSIONS

13.4.5 JOINT VENTURE

14 COMPANY PROFILES (Page No. - 131)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis)*

14.1 KALMAR

14.2 KONECRANES

14.3 LIEBHERR

14.4 HYSTER

14.5 KION GROUP

14.6 TOYOTA INDUSTRIES

14.7 MITSUBISHI

14.8 MACGREGOR

14.9 JBT CORPORATION

14.1 TEREX

14.11 SANY

14.12 ANHUI HELI

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Might Not Be Captured in Case of Unlisted Companies.

14.13 ADDITIONAL COMPANY PROFILES

14.13.1 EUROPE

14.13.1.1 Teleflex Lionel-Dupont

14.13.1.2 Tec Containers

14.13.1.3 Mallaghan Engineering

14.13.1.4 Siemens

14.13.1.5 Gantrex

14.13.2 NORTH AMERICA

14.13.2.1 Tug Technologies

14.13.2.2 Emerson Electric

14.13.2.3 Hoist Lifttruck

14.13.3 ASIA PACIFIC

14.13.3.1 Shanghai Zhenhua Heavy Industries Company Limited

14.13.3.2 Lonking Machinery

14.13.3.3 Hangcha Group Co. Ltd Oist Lifttruck

15 APPENDIX (Page No. - 168)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.4.1 AIR CARGO HANDLING EQUIPMENT MARKET, BY EQUIPMENT (UNITS)

15.4.1.1 Loader

15.4.1.2 Aviation dollies

15.4.1.3 Conveyor system

15.4.1.4 Forklift trucks

15.4.2 MARINE CARGO HANDLING EQUIPMENT MARKET, BY EQUIPMENT (UNITS)

15.4.2.1 Crane

15.4.2.2 Forklift trucks

15.4.2.3 RTG

15.4.2.4 Reach stacker

15.4.2.5 Straddle carrier

15.4.2.6 Terminal tractor

15.4.2.7 Others

15.4.3 LAND CARGO HANDLING EQUIPMENT MARKET, BY EQUIPMENT (UNITS)

15.4.3.1 Forklift trucks

15.4.3.2 Stacker

15.4.3.3 Pallet jack

15.4.3.4 Conveyor system

15.4.3.5 Others

15.4.4 LAND CARGO HANDLING EQUIPMENT MARKET, BY PROPULSION TYPE

15.4.4.1 Diesel

15.4.4.2 Electric

15.4.4.3 Others

15.4.5 AIR CARGO HANDLING EQUIPMENT MARKET, BY PROPULSION TYPE

15.4.5.1 Diesel

15.4.5.2 Electric

15.4.5.3 Others

15.4.6 MARINE CARGO HANDLING EQUIPMENT MARKET, BY PROPULSION

15.4.6.1 Diesel

15.4.6.2 Electric

15.4.6.3 Others

15.4.7 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

15.4.7.1 Business Overview

15.4.7.2 Products offerings

15.4.7.3 Recent Developments

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

LIST OF TABLES (91 TABLES)

TABLE 1 CURRENCY EXCHANGE RATES (W.R.T. PER USD)

TABLE 2 AVERAGE COST OF DIFFERENT EQUIPMENT TYPES

TABLE 3 EMISSION NORMS COMPARATIVE ANALYSIS FOR NON-ROAD VEHICLES: US EPA VS. EU EMISSION STANDARDS

TABLE 4 CARGO HANDLING EQUIPMENT MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 5 MARINE CARGO: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 6 AIR CARGO: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 7 LAND CARGO: MARKET, BY REGION, 2015–2025 (USD MILLION)

TABLE 8 AIR MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 9 AVIATION DOLLIES: AIR MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 10 FORKLIFT TRUCK: AIR MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 11 LOADER: AIR MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 12 CONVEYOR SYSTEM: AIR MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 13 TERMINAL TRACTOR: AIR MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 14 OTHERS: AIR MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 15 LAND MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 16 FORKLIFT TRUCKS: LAND MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 17 PALLET JACK: LANDMARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 18 CONVEYOR SYSTEM: LAND MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 19 STACKER: LAND MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 20 AUTOMATED GUIDED VEHICLE: LAND MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 21 OTHERS: LAND MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 22 MARINE MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 23 CRANES: MARINE MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 24 FORKLIFT TRUCKS: MARINE MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 25 REACH STACKER: MARINE MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 26 RTG: MARINE MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 27 STRADDLE CARRIER: MARINE MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 28 TERMINAL TRACTORS: MARINE MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 29 OTHERS: MARINE MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 30 MARKET, BY EQUIPMENT TYPE, 2016–2025 (UNITS)

TABLE 31 MARKET, BY EQUIPMENT TYPE, 2016–2025 (USD MILLION)

TABLE 32 AVIATION DOLLIES: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 33 AVIATION DOLLIES: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 34 LOADER: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 35 LOADER: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 36 TERMINAL TRACTORS: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 37 TERMINAL TRACTORS: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 38 CRANES: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 39 CRANES: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 40 REACH STACKER: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 41 REACH STACKER: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 42 RTG: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 43 RTG: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 44 STRADDLE CARRIER: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 45 STRADDLE CARRIER: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 46 FORKLIFT TRUCK: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 47 FORKLIFT TRUCK: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 48 PALLET JACK: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 49 PALLET JACKS: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 50 CONVEYOR SYSTEM: MARKET, BY REGION, 2016–2025 (000’ METERS)

TABLE 51 CONVEYOR SYSTEM: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 52 STACKER: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 53 STACKER: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 54 AUTOMATED GUIDED VEHICLE: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 55 AUTOMATED GUIDED VEHICLE: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 56 OTHERS: MARKET, BY REGION, 2016–2025 (UNITS)

TABLE 57 OTHERS: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 58 CARGO HANDLING EQUIPMENT MARKET, BY PROPULSION TYPE, 2016–2025 (USD MILLION)

TABLE 59 DIESEL: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 60 ELECTRIC: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 61 OTHERS: MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 62 MARKET, BY REGION, 2016–2025 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 64 CHINA: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 65 INDIA: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 66 JAPAN: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 67 SINGAPORE: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 68 ASIA PACIFIC OTHERS: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 69 EMEA: MARKET, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 70 GERMANY: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 71 FRANCE: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 72 SPAIN: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 73 UK: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 74 UAE: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 75 SOUTH AFRICA: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 76 EMEA OTHERS: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 78 CANADA: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 79 MEXICO: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 80 US: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 81 ROW: MARKET, BY COUNTRY, 2016–2025 (USD MILLION)

TABLE 82 BRAZIL: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 83 ARGENTINA: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 84 RUSSIA: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 85 ROW OTHERS: MARKET, BY APPLICATION, 2016–2025 (USD MILLION)

TABLE 86 MARKET: MARKET RANKING ANALYSIS, 2017

TABLE 87 SUPPLY CONTRACTS & AGREEMENTS, 2017–2018

TABLE 88 NEW PRODUCT DEVELOPMENTS, 2016–2018

TABLE 89 MERGERS & ACQUISITIONS, 2015–2018

TABLE 90 EXPANSIONS, 2016–2018

TABLE 91 JOINT VENTURE, 2014–2017

LIST OF FIGURES (45 FIGURES)

FIGURE 1 MARKET SEGMENTATION: CARGO HANDLING EQUIPMENT MARKET

FIGURE 2 MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 5 MARKET: TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION

FIGURE 7 MARKET: MARKET OUTLOOK

FIGURE 8 MARKET, BY REGION, 2018 VS. 2025 (USD MILLION)

FIGURE 9 SUBSTANTIAL OPPORTUNITIES IN THE MARKET

FIGURE 10 ASIA OCEANIA IS ESTIMATED TO BE THE LARGEST REGION OF THE MARKET IN ASIA PACIFIC, 2018 (USD MILLION)

FIGURE 11 MARINE CARGO SEGMENT IS ANTICIPATED TO GROW AT THE FASTEST RATE WHILE THE LAND CARGO SEGMENT IS ESTIMATED TO BE THE LARGEST MARKET, 2018 VS. 2025 (USD MILLION)

FIGURE 12 DIESEL-PROPELLED EQUIPMENT SEGMENT IS ESTIMATED TO DOMINATE THE MARKET, 2018 VS. 2025 (USD MILLION)

FIGURE 13 TERMINAL TRACTOR SEGMENT TO HAVE THE LARGEST SHARE OF THE AIR MARKET, 2018 VS. 2025 (USD MILLION)

FIGURE 14 FORKLIFT TRUCK SEGMENT TO ACCOUNT FOR THE LARGEST SHARE IN THE LAND MARKET, 2018 VS. 2025 (USD MILLION)

FIGURE 15 CRANES TO BE THE LARGEST AND FASTEST GROWING EQUIPMENT SEGMENT IN THE MARINE MARKET, 2018 VS. 2025 (USD MILLION)

FIGURE 16 MARKET: MARKET DYNAMICS

FIGURE 17 WORLD IMPORT & EXPORT (2005–2016) (USD TRILLION)

FIGURE 18 GLOBAL SEABORNE TRADE, 1996–2016 (MILLION TONS LOADED)

FIGURE 19 MARKET, BY APPLICATION, 2018 VS. 2025 (USD MILLION)

FIGURE 20 AIR CARGO HANDLING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018 VS. 2025 (USD MILLION)

FIGURE 21 LAND CARGO HANDLING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018 VS. 2025 (USD MILLION)

FIGURE 22 MARINE CARGO HANDLING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018 VS. 2025 (USD MILLION)

FIGURE 23 MARKET, BY EQUIPMENT TYPE, 2018 VS. 2025 (USD MILLION)

FIGURE 24 MARKET, BY PROPULSION TYPE, 2018 VS. 2025 (USD MILLION)

FIGURE 25 MARKET, BY REGION, 2018 VS. 2025 (USD MILLION)

FIGURE 26 ASIA PACIFIC: SNAPSHOT

FIGURE 27 EMEA: REGION SNAPSHOT

FIGURE 28 NORTH AMERICA: MARKET, BY COUNTRY, 2018 VS. 2025 (USD MILLION)

FIGURE 29 ROW: CARGO HANDLING EQUIPMENT MARKET, BY COUNTRY, 2018 VS. 2025 (USD MILLION)

FIGURE 30 COMPANIES ADOPTED CONTRACTS & AGREEMENTS AS THE KEY GROWTH STRATEGY, 2014–2018

FIGURE 31 KALMAR: COMPANY SNAPSHOT

FIGURE 32 KALMAR: SWOT ANALYSIS

FIGURE 33 KONECRANES: COMPANY SNAPSHOT

FIGURE 34 KONECRANES: SWOT ANALYSIS

FIGURE 35 LIEBHERR: COMPANY SNAPSHOT

FIGURE 36 SWOT ANALYSIS: LIEBHERR

FIGURE 37 HYSTER: COMPANY SNAPSHOT

FIGURE 38 SWOT ANALYSIS: HYSTER

FIGURE 39 KION GROUP: COMPANY SNAPSHOT

FIGURE 40 KION GROUP: SWOT ANALYSIS

FIGURE 41 TOYOTA INDUSTRIES: COMPANY SNAPSHOT

FIGURE 42 MITSUBISHI: COMPANY SNAPSHOT

FIGURE 43 MACGREGOR: COMPANY SNAPSHOT

FIGURE 44 JBT CORPORATION: COMPANY SNAPSHOT

FIGURE 45 TEREX: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in Cargo Handling Equipment Market

Hi. I am interested to understand if you have United States forklift historical data by class for each state and also at each county level. Thank you.

We are Forklift Truck Arm Manufacturer. We have a factory in USA. We want to find the size of the AFTER Market for Forklift Truck in USA.