Squalene Market by Source (Animal Source (Shark Liver Oil), Vegetable Source (Olive Oil, Palm Oil, Amaranth Oil), Biosynthetic (GM Yeast]), End-use Industry (Cosmetics, Food, and Pharmaceuticals), and Region - Global Forecast to 2028

Updated on : November 11, 2025

Squalene Market

Squalene Market Size, Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

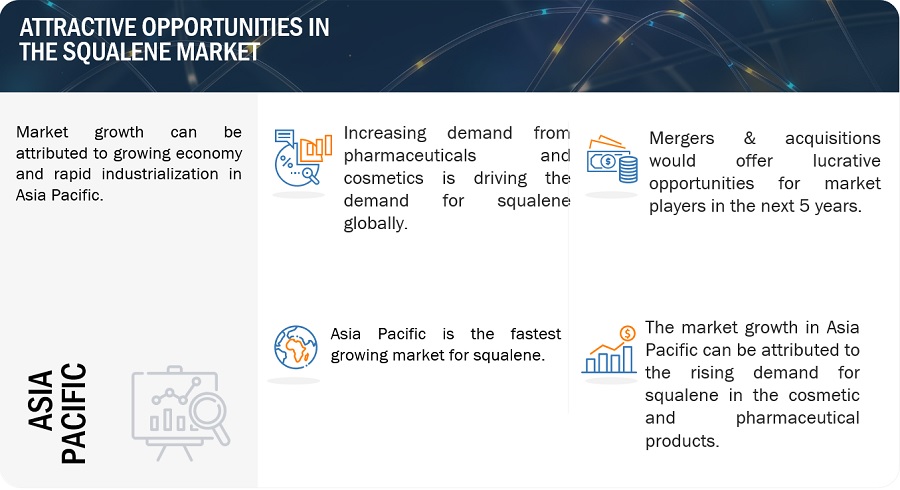

Attractive Opportunities in the Squalene Market

Squalene Market Dynamics

Driver: Growing demand for cosmetic products

The cosmetics industry has been evolving to be more inclusive and diverse. Brands are expanding their shade ranges for makeup products to cater to a wider range of skin tones, reflecting the demand for products that cater to all ethnicities. The convenience of online shopping has led to a significant increase in cosmetic sales through e-commerce platforms. Consumers can easily browse and purchase products online, which has expanded market access. Personalized and customizable cosmetics are also gaining popularity. Consumers appreciate the ability to tailor products to their specific needs and preferences. All these factor drive the market for squalene used in cosmetic products.

Restraints: Consumer skepticism about animal-sourced products and limitations on shark killing

The traditional source of squalene, shark liver oil, has faced restrictions due to concerns about overfishing and the conservation of shark populations. Some regions have imposed bans or limitations on the extraction of squalene from shark liver oil. Several regulatory bodies such as the General Fisheries Commission of the Mediterranean, Northeast Atlantic Fisheries Commission (NEAFC), Commission for Conservation of Antarctic Marine Living Resources, and North Atlantic Fisheries Organization (NAFO) have imposed restrictions such as fixed quotas for shark fishing, which, in turn, has resulted in supply shortage of shark liver and, thereby squalene. This is expected to restrict the market for animal sourced squalene during the forecast period.

Opportunities: New renewable sources for production

With the restrictions and concern about shark liver oil sourced from sharks and low concentration of squalene in vegetable oils, the supply is volatile, and the prices are fluctuating. Due to various regulations imposed on shark killing the supply of squalene is majorly affected across various regions. The squalene content vegetable oils is very low, and therefore, tons of olives and amaranth are required to produce a small quantity of squalene. This has led to high squalene retail prices. This creates new opportunity for the players to come up with new technologies to develop squalene from alternative sources. Sugarcane and other sugar-containing biomaterials are identified as the sources of producing squalane (hydrogenated squalene).

Challenges: Fluctuating costs of raw materials

With the increasing regulations introduced by various governing bodies, there has been a decline in the shark fishing activities in various regions over the past years. This has resulted in the decline of the supply of shark livers and shark fins over the years. Due to this scenario, companies are trying to shift to vegetable-sourced squalene. Europe leads the market for squalene which is sourced from vegetable oils. For the past few years, there has been an irregular supply of olives in Europe. All these factors are affecting the raw material availability for squalene production, thereby resulting in fluctuation of prices. The raw materials are subject to continuously varying prices, which affect the overall squalene market. This volatility is expected to harm the industry growth, thereby leading to the development of alternative products and challenging the squalene market.

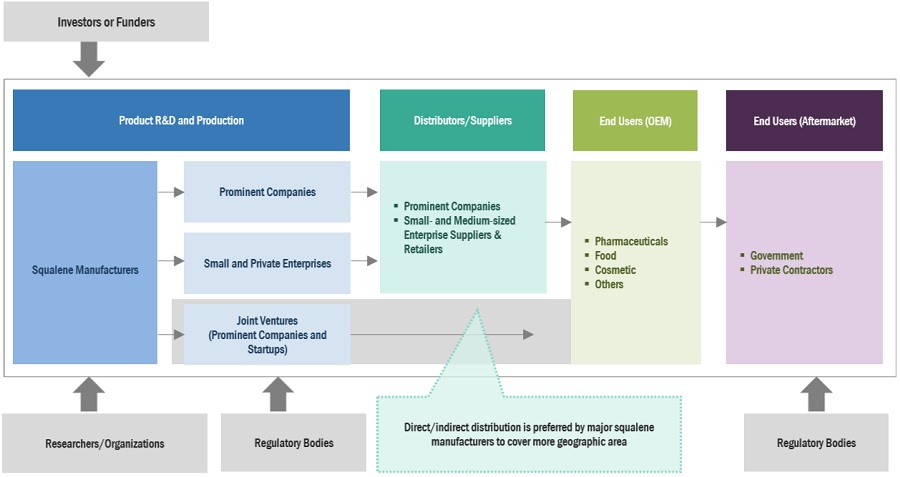

Squalene Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of squalene. These companies have been in business for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. Prominent companies in this market include Amyris, Inc (US), SOPHIM (France), Merck KGaA (Germany), Kishimoto Special Liver Oil Co., Ltd. (Japan), Empresa Figueirense De Pesca (Portugal), Arbee (India), Cibus (US), Otto Chemie Pvt. Ltd. (India), Arista Industries (US), and Oleicfat s.l. (Spain).

Based on source, biosynthetic is projected to register highest CAGR, in terms of value, during the forecast period.

Biosynthetic production allows for better control over the quality and purity of squalene. Manufacturers can ensure that the product meets specific quality standards, making it attractive to industries like cosmetics and pharmaceuticals. Biosynthetic squalene is highly stable and pure, which makes it suitable for use in various industries, including cosmetics, skincare, and pharmaceuticals. The growth of biosynthetic squalene is expected to continue, especially as more industries recognize the benefits of sustainable and high-quality squalene sourced through biotechnological methods.

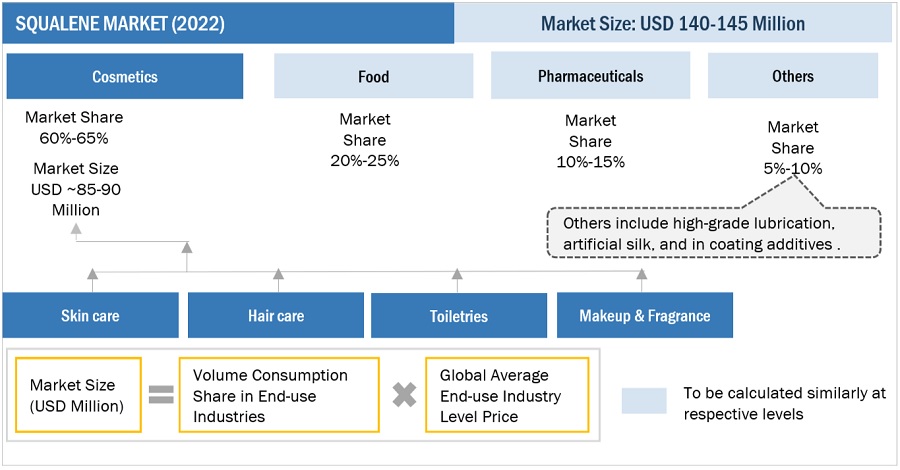

Based on end-use industry, cosmetics was the largest segment for squalene market, in terms of value, in 2022.

Cosmetics end-use industry dominated the squalene market, in terms of both value and volume, in 2022. Antioxidant properties of squalene can aid in shielding the skin from oxidative stress and free radical harm. This makes it a valuable ingredient in anti-aging skincare products, as it can help reduce the appearance of fine lines and wrinkles. Squalene is adaptable and can be blended with other substances in skincare products to increase its potency. It can be found in skincare products that address particular skin issues including hydration, brightness, or acne avoidance. Increasing demand for cosmetic products drives the market for squalene.

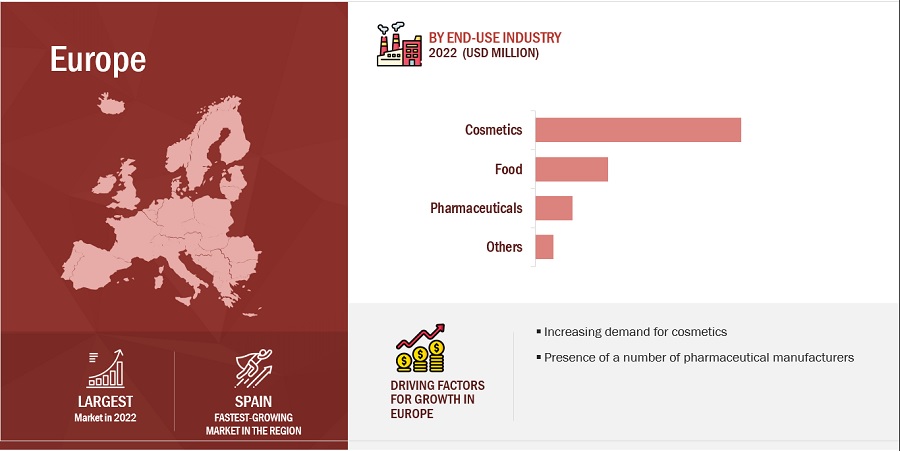

“Europe accounted for the largest market share for squalene market, in terms of value, in 2022”

The pharmaceutical industry in Europe may use squalene in the production of vaccines, immunotherapies, and pharmaceutical formulations. The demand for squalene can increase if there is a focus on vaccine development, immunotherapy research, or the use of squalene as an adjuvant in vaccines.The European Union (EU) is home to several pharmaceutical companies and vaccine manufacturers. The development and production of vaccines, especially in response to emerging infectious diseases, can lead to a higher demand for squalene-based adjuvants. Also, the consumers are often well-informed and health-conscious. They may seek products that include squalene for its potential health and skincare benefits, further driving demand in cosmetics end-use industry. All these factors are driving the market for squalene in Europe region majorly in cosmetics and pharmaceutical end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

Squalene Market Players

The key players profiled in the report include Amyris, Inc (US), SOPHIM (France), Merck KGaA (Germany), Kishimoto Special Liver Oil Co., Ltd. (Japan), Empresa Figueirense De Pesca (Portugal), Arbee (India), Cibus (US), Otto Chemie Pvt. Ltd. (India), Arista Industries (US), and Oleicfat s.l. (Spain).among others, these are the key manufacturers that secured major market share in the last few years.

Squalene Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Ton) and Value (USD Thousand/Million) |

|

Segments covered |

Source, End-use Industry, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

The key players profiled in the report include Amyris, Inc (US), SOPHIM (France), Merck KGaA (Germany), Kishimoto Special Liver Oil Co., Ltd. (Japan), Empresa Figueirense De Pesca (Portugal), Arbee (India), Cibus (US), Otto Chemie Pvt. Ltd. (India), Arista Industries (US), and Oleicfat s.l. (Spain) among others. |

This report categorizes the global squalene market based on type, application, and region.

On the basis of source, the squalene market has been segmented as follows:

- Vegetable

- Animal

- Biosynthetic

On the basis of end-use industry, the squalene market has been segmented as follows:

- Cosmetics

- Food

- Pharmaceuticals

- Others

On the basis of region, the squalene market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In August 2021, Amyris, Inc. launched Rose Inc., a clean color cosmetics brand. The products’ non-comedogenic formulas are developed with proprietary bioengineered and sustainably-sourced ingredients, including squalene and hemisqualane.

- In April 2020, Amyris, Inc. launched the squalene-based hand sanitizer named Pipette under its No Compromise Pipette baby care branded products. The hand sanitizer contains 65% USP plant-based ethyl alcohol, glycerin, and Amyris, Inc.’s sugarcane-derived squalene (for moisturizing benefit).

- In May 2023, Amyris, Inc. signed an exclusive license agreement with British specialty chemicals company Croda International Plc, ("Croda") for the supply of sustainable squalene.

- In July 2023, SOPHIM launched a moisturizing and soothing massage oil. It helps in restoring the skin’s lipidic film, creating a protective barrier that preserves your epidermis from external aggression.

- In June 2023, SOPHIM launched a moisturizing foot mask. The ingredients in this formulation restores the lipid barrier for long-lasting protection against external aggressors and dryness.

Frequently Asked Questions (FAQ):

Which are the major players in squalene market?

The key players profiled in the report include Amyris, Inc (US), SOPHIM (France), Merck KGaA (Germany), Kishimoto Special Liver Oil Co., Ltd. (Japan), Empresa Figueirense De Pesca (Portugal), Arbee (India), Cibus (US), Otto Chemie Pvt. Ltd. (India), Arista Industries (US), and Oleicfat s.l. (Spain).

What are the drivers and opportunities for the squalene market?

The increasing demand from cosmetic and pharmaceutical industries are the major drives for squalene market. Also, new renewable sources for production is expected to create new opportunities for the market.

What are the various strategies key players are focusing within squalene market?

New product launches, expansion and partnership are some of the strategies atoped by key players to expand their global presence.

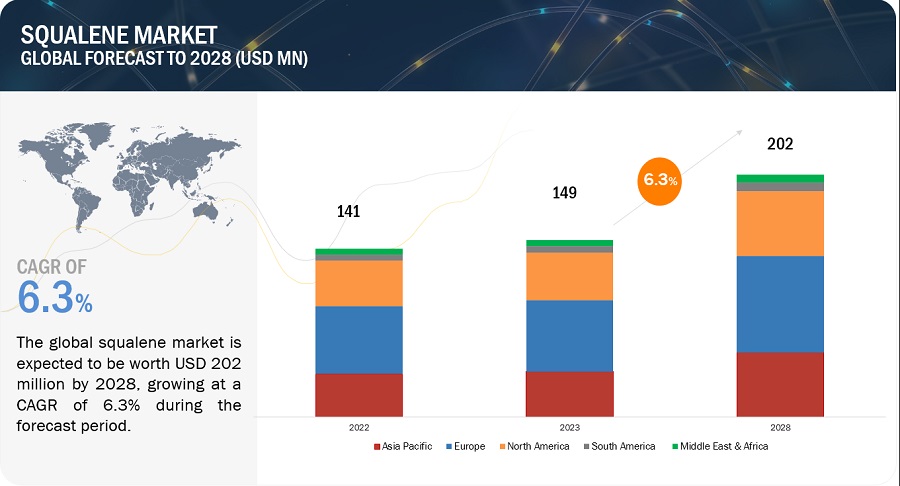

What is the CAGR of the Squalene Market?

The market is projected to grow at a CAGR of 6.34%, in terms of value, during the forecast period.

What are the major factors restraining squalene market growth during the forecast period?

Consumer skepticism about animal-sourced products and limitations on shark fishing is expected to restrict the market demand. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth in R&D activities in pharmaceutical industry- Rising popularity in nutraceuticals- Growing demand for cosmetic products- Beneficial properties for human healthRESTRAINTS- Consumer skepticism about animal-sourced products and limitations on shark fishingOPPORTUNITIES- New renewable sources for squalene productionCHALLENGES- Fluctuating costs of raw materials

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALSMANUFACTURERSDISTRIBUTION NETWORKEND-USE INDUSTRIES

-

6.2 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

-

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFTS & NEW REVENUE POCKETS IN SQUALENE MARKET

-

6.5 SQUALENE MARKET: ECOSYSTEM ANALYSIS

-

6.6 TECHNOLOGY ANALYSISSUPERCRITICAL FLUID EXTRACTION TECHNOLOGY

-

6.7 CASE STUDY ANALYSISCASE STUDY ON AMYRIS, INC.

-

6.8 TRADE DATA STATISTICSIMPORT SCENARIO OF SQUALENEEXPORT SCENARIO OF SQUALENE

-

6.9 TARIFF & REGULATORY LANDSCAPEREGULATIONS ON USE OF SQUALENEREGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

-

6.10 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 ANIMAL SOURCELOWER COST DRIVING DEMAND FOR ANIMAL-SOURCED SQUALENE

-

7.3 VEGETABLE SOURCESTRINGENT REGULATIONS ON ANIMAL-SOURCED SQUALENE TO BOOST MARKET FOR THIS SEGMENT

-

7.4 BIOSYNTHETICGROWING DEMAND FOR RENEWABLE SOURCE FOR SQUALENE PRODUCTION TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 COSMETICSSKINCARE SEGMENT TO BE MAJOR CONSUMER OF SQUALENE IN COSMETICS INDUSTRY

-

8.3 FOODINCREASING DEMAND FOR NUTRACEUTICALS IN EMERGING ECONOMIES TO SUPPORT MARKET GROWTH

-

8.4 PHARMACEUTICALSONCOLOGY SEGMENT TO POSITIVELY INFLUENCE SQUALENE MARKET IN PHARMACEUTICAL SECTOR

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACTASIA PACIFIC SQUALENE MARKET, BY SOURCEASIA PACIFIC MARKET, BY END-USE INDUSTRYASIA PACIFIC MARKET, BY COUNTRY- China- Japan- South Korea

-

9.3 NORTH AMERICARECESSION IMPACTNORTH AMERICA SQUALENE MARKET, BY SOURCENORTH AMERICA MARKET, BY END-USE INDUSTRYNORTH AMERICA MARKET, BY COUNTRY- US- Canada- Mexico

-

9.4 EUROPERECESSION IMPACTEUROPE SQUALENE MARKET, BY SOURCEEUROPE MARKET, BY END-USE INDUSTRYEUROPE MARKET, BY COUNTRY- Germany- France- UK- Italy- Spain

-

9.5 MIDDLE EAST & AFRICARECESSION IMPACTMIDDLE EAST & AFRICA SQUALENE MARKET, BY SOURCEMIDDLE EAST & AFRICA MARKET, BY END-USE INDUSTRYMIDDLE EAST & AFRICA MARKET, BY COUNTRY- Saudi Arabia- UAE- Turkey

-

9.6 SOUTH AMERICARECESSION IMPACTSOUTH AMERICA: SQUALENE MARKET, BY SOURCESOUTH AMERICA: MARKET, BY END-USE INDUSTRYSOUTH AMERICA: MARKET, BY COUNTRY- Brazil- Argentina

- 10.1 INTRODUCTION

- 10.2 KEY PLAYERS STRATEGIES

- 10.3 RANKING OF KEY MARKET PLAYERS, 2022

- 10.4 MARKET SHARE ANALYSIS

- 10.5 REVENUE ANALYSIS OF TOP 3 PLAYERS

-

10.6 COMPANY EVALUATION MATRIX (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.7 START-UPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING- Squalene market: Detailed list of key start-ups/SMEs- Squalene market: Competitive benchmarking of key start-ups/SMEs

-

10.8 COMPETITIVE SITUATION & TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSMERCK KGAA- Business overview- Products offered- MnM viewAMYRIS, INC.- Business overview- Products offered- Recent developments- MnM viewSOPHIM- Business overview- Products offered- Recent developments- MnM viewKISHIMOTO SPECIAL LIVER OIL CO., LTD.- Business overview- Products offered- MnM viewEMPRESA FIGUEIRENSE DE PESCA, LDA- Business overview- Products offered- MnM viewARBEE- Business overview- Products offeredARISTA INDUSTRIES- Business overview- Products offeredCIBUS- Business overview- Products offered- Recent developmentsOTTO CHEMIE PVT. LTD.- Business overview- Products offeredOLEICFAT, S.L.- Business overview- Products offered

-

11.2 OTHER KEY MARKET PLAYERSNZ GREEN HEALTH LTD.CAROI’LINE COSMÉTICACARBOMER, INC.BLUELINE FOODS (INDIA) PVT. LTD.COASTAL GROUPISSHO GENKI INTERNATIONAL INC.MAYPROCLARIANT AGEVONIK INDUSTRIES AGTIANJIN WINNING HEALTH PRODUCTS CO., LTD. (WINNING)AASHA BIOCHEMADVONEX INTERNATIONAL CORPORATIONTRIPLENINEMY SQUALENENATURAL LIFE AUSTRALIA

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 PERSONAL CARE INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEWPERSONAL CARE INGREDIENTS MARKET, BY REGION- Europe- Asia Pacific- North America- Middle East & Africa- South America

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 TOP 10 GLOBAL NUTRACEUTICAL COMPANIES (2022)

- TABLE 2 SQUALENE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2020–2028 (USD BILLION)

- TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 6 AVERAGE SELLING PRICE TREND OF SQUALENE, BY REGION (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY (USD/KG)

- TABLE 8 SQUALENE MARKET: ROLE IN ECOSYSTEM

- TABLE 9 BENEFITS OF SUPERCRITICAL FLUID EXTRACTION TECHNOLOGY

- TABLE 10 IMPORT OF SQUALENE, BY REGION, 2013–2022 (USD THOUSAND)

- TABLE 11 EXPORT OF SQUALENE, BY REGION, 2013–2022 (USD THOUSAND)

- TABLE 12 TOTAL NUMBER OF PATENTS (2012–2022)

- TABLE 13 LIST OF PATENTS BY BRISTOL-MYERS SQUIBB

- TABLE 14 LIST OF PATENTS BY NOVARTIS AG

- TABLE 15 TOP 10 PATENT OWNERS IN US, 2012–2022

- TABLE 16 SQUALENE MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 17 MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 18 SQUALENE MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 19 MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 20 ANIMAL-SOURCED SQUALENE MARKET SIZE, BY REGION, 2017–2021 (USD THOUSAND)

- TABLE 21 ANIMAL-SOURCED MARKET SIZE, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 22 ANIMAL-SOURCED SQUALENE MARKET SIZE, BY REGION, 2017–2021 (TON)

- TABLE 23 ANIMAL-SOURCED MARKET SIZE, BY REGION, 2022–2028 (TON)

- TABLE 24 VEGETABLE-SOURCED SQUALENE MARKET SIZE, BY REGION, 2017–2021 (USD THOUSAND)

- TABLE 25 VEGETABLE-SOURCED MARKET SIZE, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 26 VEGETABLE-SOURCED SQUALENE MARKET SIZE, BY REGION, 2017–2021 (TON)

- TABLE 27 VEGETABLE-SOURCED MARKET SIZE, BY REGION, 2022–2028 (TON)

- TABLE 28 BIOSYNTHETIC SQUALENE MARKET SIZE, BY REGION, 2017–2021 (USD THOUSAND)

- TABLE 29 BIOSYNTHETIC MARKET SIZE, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 30 BIOSYNTHETIC SQUALENE MARKET SIZE, BY REGION, 2017–2021 (TON)

- TABLE 31 BIOSYNTHETIC MARKET SIZE, BY REGION, 2022–2028 (TON)

- TABLE 32 SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 33 MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 34 SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 35 MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 36 SQUALENE MARKET SIZE IN COSMETICS, BY REGION, 2017–2021 (USD THOUSAND)

- TABLE 37 MARKET SIZE IN COSMETICS, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 38 SQUALENE MARKET SIZE IN COSMETICS, BY REGION, 2017–2021 (TON)

- TABLE 39 MARKET SIZE IN COSMETICS, BY REGION, 2022–2028 (TON)

- TABLE 40 SQUALENE MARKET SIZE IN FOOD, BY REGION, 2017–2021 (USD THOUSAND)

- TABLE 41 MARKET SIZE IN FOOD, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 42 SQUALENE MARKET SIZE IN FOOD, BY REGION, 2017–2021 (TON)

- TABLE 43 MARKET SIZE IN FOOD, BY REGION, 2022–2028 (TON)

- TABLE 44 SQUALENE MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2017–2021 (USD THOUSAND)

- TABLE 45 MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 46 SQUALENE MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2017–2021 (TON)

- TABLE 47 MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2022–2028 (TON)

- TABLE 48 SQUALENE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2021 (USD THOUSAND)

- TABLE 49 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 50 SQUALENE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2021 (TON)

- TABLE 51 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2028 (TON)

- TABLE 52 SQUALENE MARKET SIZE, BY REGION, 2017–2021 (USD THOUSAND)

- TABLE 53 MARKET SIZE, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 54 SQUALENE MARKET SIZE, BY REGION, 2017–2021 (TON)

- TABLE 55 MARKET SIZE, BY REGION, 2022–2028 (TON)

- TABLE 56 ASIA PACIFIC: SQUALENE MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 57 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 58 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 59 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 60 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 61 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 62 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 63 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 64 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 65 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 66 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2021 (TON)

- TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2028 (TON)

- TABLE 68 CHINA: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 69 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 70 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 71 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 72 CHINA: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 73 CHINA: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 74 CHINA: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 75 CHINA: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 76 JAPAN: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 77 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 78 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 79 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 80 JAPAN: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 81 JAPAN: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 82 JAPAN: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 83 JAPAN: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 84 SOUTH KOREA: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 85 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 86 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 87 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 88 SOUTH KOREA: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 89 SOUTH KOREA: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 90 SOUTH KOREA: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 91 SOUTH KOREA: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 92 NORTH AMERICA: SQUALENE MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 93 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 94 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 95 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 96 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 97 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 98 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 99 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 100 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 101 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 102 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (TON)

- TABLE 103 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2028 (TON)

- TABLE 104 US: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 105 US: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 106 US: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 107 US: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 108 US: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 109 US: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 110 US: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 111 US: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 112 CANADA: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 113 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 114 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 115 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 116 CANADA: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 117 CANADA: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 118 CANADA: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 119 CANADA: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 120 MEXICO: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 121 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 122 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 123 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 124 MEXICO: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 125 MEXICO: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 126 MEXICO: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 127 MEXICO: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 128 EUROPE: SQUALENE MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 129 EUROPE: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 130 EUROPE: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 131 EUROPE: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 132 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 133 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 134 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 135 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 136 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 137 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 138 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2021 (TON)

- TABLE 139 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2028 (TON)

- TABLE 140 GERMANY: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 141 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 142 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 143 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 144 GERMANY: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 145 GERMANY: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 146 GERMANY: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 147 GERMANY: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 148 FRANCE: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 149 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 150 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 151 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 152 FRANCE: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 153 FRANCE: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 154 FRANCE: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 155 FRANCE: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 156 UK: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 157 UK: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 158 UK: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 159 UK: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 160 UK: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 161 UK: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 162 UK: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 163 UK: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 164 ITALY: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 165 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 166 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 167 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 168 ITALY: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 169 ITALY: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 170 ITALY: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 171 ITALY: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 172 SPAIN: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 173 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 174 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 175 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 176 SPAIN: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 177 SPAIN: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 178 SPAIN: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 179 SPAIN: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 180 MIDDLE EAST & AFRICA: SQUALENE MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 181 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 182 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 183 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 184 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 185 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 186 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 187 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 188 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 189 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 190 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2021 (TON)

- TABLE 191 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2028 (TON)

- TABLE 192 SAUDI ARABIA: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 193 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 194 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 195 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 196 SAUDI ARABIA: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 197 SAUDI ARABIA: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 198 SAUDI ARABIA: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 199 SAUDI ARABIA: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 200 UAE: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 201 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 202 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 203 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 204 UAE: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 205 UAE: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 206 UAE: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 207 UAE: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 208 TURKEY: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 209 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 210 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 211 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 212 TURKEY: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 213 TURKEY: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 214 TURKEY: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 215 TURKEY: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 216 SOUTH AMERICA: SQUALENE MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 217 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 218 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 219 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 220 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 221 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 222 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 223 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 224 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 225 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 226 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (TON)

- TABLE 227 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2028 (TON)

- TABLE 228 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 229 BRAZIL: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 230 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 231 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 232 BRAZIL: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 233 BRAZIL: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 234 BRAZIL: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 235 BRAZIL: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 236 ARGENTINA: SQUALENE MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 237 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 238 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 239 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 240 ARGENTINA: MARKET SIZE, BY SOURCE, 2017–2021 (USD THOUSAND)

- TABLE 241 ARGENTINA: MARKET SIZE, BY SOURCE, 2022–2028 (USD THOUSAND)

- TABLE 242 ARGENTINA: MARKET SIZE, BY SOURCE, 2017–2021 (TON)

- TABLE 243 ARGENTINA: MARKET SIZE, BY SOURCE, 2022–2028 (TON)

- TABLE 244 OVERVIEW OF STRATEGIES ADOPTED BY KEY SQUALENE MANUFACTURERS

- TABLE 245 SQUALENE MARKET: DEGREE OF COMPETITION

- TABLE 246 MARKET: SOURCE FOOTPRINT

- TABLE 247 SQUALENE MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 248 MARKET: COMPANY REGION FOOTPRINT

- TABLE 249 SQUALENE MARKET: PRODUCT LAUNCHES (2018–2023)

- TABLE 250 MARKET: DEALS (2018–2023)

- TABLE 251 SQUALENE MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2018–2023)

- TABLE 252 MERCK KGAA: COMPANY OVERVIEW

- TABLE 253 AMYRIS, INC.: COMPANY OVERVIEW

- TABLE 254 SOPHIM: COMPANY OVERVIEW

- TABLE 255 KISHIMOTO SPECIAL LIVER OIL CO., LTD.: COMPANY OVERVIEW

- TABLE 256 EMPRESA FIGUEIRENSE DE PESCA, LDA: COMPANY OVERVIEW

- TABLE 257 ARBEE: COMPANY OVERVIEW

- TABLE 258 ARISTA INDUSTRIES: COMPANY OVERVIEW

- TABLE 259 CIBUS: COMPANY OVERVIEW

- TABLE 260 OTTO CHEMIE PVT. LTD.: COMPANY OVERVIEW

- TABLE 261 OLEICFAT, S.L.: COMPANY OVERVIEW

- TABLE 262 NZ GREEN HEALTH LTD.: COMPANY OVERVIEW

- TABLE 263 CAROI’LINE COSMÉTICA: COMPANY OVERVIEW

- TABLE 264 CARBOMER, INC.: COMPANY OVERVIEW

- TABLE 265 BLUELINE FOODS (INDIA) PVT. LTD.: COMPANY OVERVIEW

- TABLE 266 COASTAL GROUP: COMPANY OVERVIEW

- TABLE 267 ISSHO GENKI INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 268 MAYPRO: COMPANY OVERVIEW

- TABLE 269 CLARIANT AG: COMPANY OVERVIEW

- TABLE 270 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 271 TIANJIN WINNING HEALTH PRODUCTS CO., LTD. (WINNING): COMPANY OVERVIEW

- TABLE 272 AASHA BIOCHEM: COMPANY OVERVIEW

- TABLE 273 ADVONEX INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 274 TRIPLENINE: COMPANY OVERVIEW

- TABLE 275 MY SQUALENE: COMPANY OVERVIEW

- TABLE 276 NATURAL LIFE AUSTRALIA: COMPANY OVERVIEW

- TABLE 277 PERSONAL CARE INGREDIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 278 PERSONAL CARE INGREDIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

- TABLE 279 PERSONAL CARE INGREDIENTS MARKET SIZE, BY REGION, 2017–2021 (KILOTON)

- TABLE 280 PERSONAL CARE INGREDIENTS MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

- TABLE 281 EUROPE: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 282 EUROPE: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 283 EUROPE: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 284 EUROPE: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 285 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 286 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 287 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 288 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 289 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 290 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 291 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 292 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 293 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 294 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 296 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 297 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 298 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 299 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 300 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

- FIGURE 1 SQUALENE MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

- FIGURE 4 SQUALENE MARKET: DATA TRIANGULATION

- FIGURE 5 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 6 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- FIGURE 7 BIOSYNTHETIC TO BE FASTEST-GROWING SOURCE DURING FORECAST PERIOD

- FIGURE 8 PHARMACEUTICALS TO BE FASTEST-GROWING END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 9 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 10 GROWING PHARMACEUTICALS INDUSTRY TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 11 EUROPE TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 12 COSMETICS END-USE INDUSTRY ACCOUNTED FOR LARGEST SHARE

- FIGURE 13 VEGETABLE SOURCE LED SQUALENE MARKET IN MOST REGIONS

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SQUALENE MARKET

- FIGURE 16 GLOBAL PHARMACEUTICAL R&D SPENDING, 2012–2021

- FIGURE 17 SQUALENE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 18 SQUALENE MARKET: SUPPLY CHAIN

- FIGURE 19 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- FIGURE 20 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 21 AVERAGE SELLING PRICE TREND OF SQUALENE, BY REGION (USD/KG)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- FIGURE 23 REVENUE SHIFT FOR PLAYERS IN SQUALENE MARKET

- FIGURE 24 SQUALENE MARKET: ECOSYSTEM MAPPING

- FIGURE 25 IMPORT OF SQUALENE, BY KEY COUNTRIES (2013–2022)

- FIGURE 26 EXPORT OF SQUALENE, BY KEY COUNTRIES (2013–2022)

- FIGURE 27 PATENTS REGISTERED IN SQUALENE MARKET, 2012–2022

- FIGURE 28 PATENT PUBLICATION TRENDS, 2012–2022

- FIGURE 29 LEGAL STATUS OF PATENTS FILED IN SQUALENE MARKET

- FIGURE 30 TOP JURISDICTIONS

- FIGURE 31 BRISTOL MYERS SQUIBB REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2012 AND 2022

- FIGURE 32 VEGETABLE SOURCE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING ANIMAL-SOURCED SQUALENE MARKET

- FIGURE 34 EUROPE TO BE LARGEST VEGETABLE-SOURCED SQUALENE MARKET DURING FORECAST PERIOD

- FIGURE 35 EUROPE TO BE LARGEST BIOSYNTHETIC SQUALENE MARKET DURING FORECAST PERIOD

- FIGURE 36 COSMETICS TO DOMINATE SQUALENE MARKET DURING FORECAST PERIOD

- FIGURE 37 EUROPE TO BE LARGEST MARKET FOR SQUALENE IN COSMETICS INDUSTRY

- FIGURE 38 EUROPE TO BE LARGEST SQUAENE MARKET IN FOOD SEGMENT DURING FORECAST PERIOD

- FIGURE 39 MIDDLE EAST & AFRICA TO BE FASTEST-GROWING SQUALENE MARKET IN PHARMACEUTICALS

- FIGURE 40 ASIA PACIFIC TO BE FAST-GROWING SQUALENE MARKET IN OTHER END-USE INDUSTRIES

- FIGURE 41 ASIA PACIFIC TO BE FASTEST-GROWING SQUALENE MARKET DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC: SQUALENE MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: SQUALENE MARKET SNAPSHOT

- FIGURE 44 EUROPE: SQUALENE MARKET SNAPSHOT

- FIGURE 45 RANKING OF TOP 3 PLAYERS IN SQUALENE MARKET, 2022

- FIGURE 46 KISHIMOTO SPECIAL LIVER OIL CO., LTD. LED SQUALENE MARKET IN 2022

- FIGURE 47 REVENUE ANALYSIS OF KEY COMPANIES (2018–2022)

- FIGURE 48 COMPANY EVALUATION MATRIX FOR SQUALENE MARKET

- FIGURE 49 SQUALENE MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 50 START-UP/SME EVALUATION MATRIX FOR SQUALENE MARKET

- FIGURE 51 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 52 AMYRIS, INC.: COMPANY SNAPSHOT

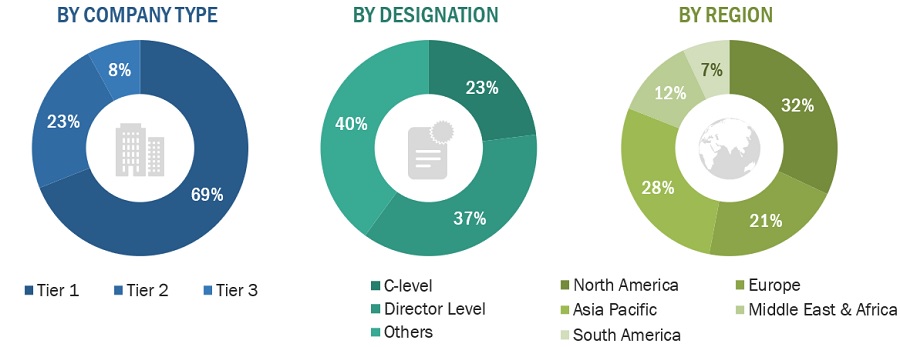

The study involved four major activities in estimating the market size for squalene. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The squalene market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the cosmetics, pharmaceuticals, food and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

|

COMPANY NAME |

DESIGNATION |

|

Amyris, Inc. |

Senior Manager |

|

SOPHIM |

Innovation Manager |

|

Arbee |

Sales Manager |

|

Merck KGaA |

Production Supervisor |

|

Cibus |

Vice-President |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the squalene market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Squalene Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Squalene Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the squalene industry.

Market Definition

Squalene is a natural organic compound in the form of an oil; it helps to hydrate and maintain the barrier of the skin. Squalene has also been found to have an antioxidant effect. Traditional squalene is been sourced from shark liver oil, which is known to contain about 40-60% of squalene. Vegetable is another source for squalene, such as olive oil, rice bran oil, wheat germ oil, and amaranth oil. It is used as an emollient or moisturizer in cosmetic products that are required for softening the skin. Squalene is also used in food and pharmaceutical products (vaccines).

Key Stakeholders

- Squalene manufacturers

- Squalene suppliers

- Raw material suppliers

- Service providers

- End users, such as cosmetics, pharamceuticals, food and other companies

- Government bodies

Report Objectives

- To define, describe, and forecast the Squalene market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by force, end-use industry, and region

- To forecast the size of the market for five main regions: Europe, North America, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To analyze the impact of COVID-19 on the market and end-use industries

- To strategically profile key players and comprehensively analyze their growth strategies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Squalene Market

Historic and current market analysis for squalane

Market data for the global Squalene market

Looking for information on Squalene market

General information on payment method of report