Sputter Coater Market by Substrate Type (Metal, Glass, Semiconductor), Target Type (Metal, Compound), End-Use Industry (Automotive, Electronics & Semiconductor, Institutes), and Region (North America, EU, APAC, South America, MEA) - Global Forecast to 2022

[129 Pages Report] sputter coater market was valued at USD 563.1 Million in 2016 and is projected to reach USD 804.2 Million by 2022, at a CAGR of 6.2% during the forecast period. The base year considered for the study is 2016, while the forecast period is from 2017 to 2022.

Objectives of the report are as follows:

- To define, describe, and forecast the market size of sputter coater in terms of value

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To define, describe, and forecast the market size of sputter coater on the basis of substrate type, target type, end-use industry, and region

- To forecast the market size, in terms of value, with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa

- To analyze the opportunities in the market for stakeholders and details of a competitive landscape for the market leaders

- To analyze competitive developments, such as expansions, new product developments, partnerships, agreements, and research & developments (R&D) in the market

- To strategically profile key players in the sputter coater market

Research Methodology

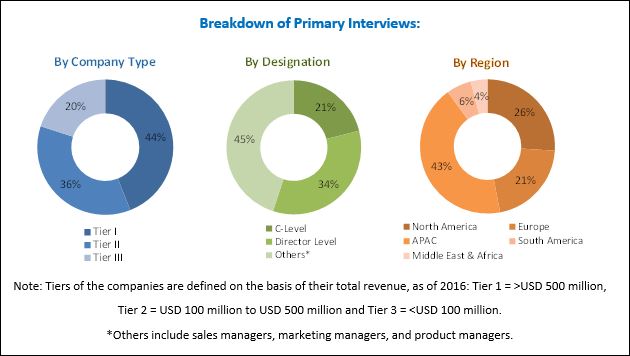

Top-down and bottom-up approaches have been used to estimate and validate the size of the sputter coater market and to estimate the sizes of various other dependent submarkets in the overall sputter coater market. The research study involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for this technical, market-oriented, and commercial study of the sputter coater market.

To know about the assumptions considered for the study, download the pdf brochure

The supply chain of the sputter coater market starts with sourcing raw materials, followed by manufacturing of sputter coaters, and supplying of finished sputter coater products and ends with the use of sputter coaters in various end-use applications. Major players in the sputter coater market are ULVAC (Japan), Quorum Technologies (UK), Buhler (Switzerland), Cressington Scientific Instruments (UK), Hitachi High-Technologies Corporation (Japan), Oxford Instruments (UK), Semicore Equipment (US), PLASSYS Bestek (France), PVD Products (US), and Denton Vacuum (US).

Key Target Audience:

- Sputter Coater Manufacturing Companies

- Target Manufacturing Companies

- Traders and Distributors

- Commercial R&D Institutes

- Research Institute, Trade Association, and Government Agencies

- End-use Industries

Scope of the report:

This research report categorizes the sputter coater market on the basis of substrate type, target type, end-use industry, and region.

Sputter Coater Market On the Basis of Substrate Type:

- Metal

- Glass

- Semiconductor

- Others (Biological and Plastics)

Sputter Coater Market On the Basis of Target Type:

- Metal

- Compound

- Others (Alloys and Ceramics)

Sputter Coater Market On the Basis of End-Use Industry:

- Automotive

- Electronics & Semiconductor

- Institutes

- Others (Hardware, FMCG, Construction, and Medical)

Sputter Coater Market On the Basis of Region:

- North America

- South America

- Europe

- Asia Pacific

- Middle East & Africa

The market has been further analyzed for key countries in each of these regions.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix that gives a detailed comparison of product portfolio of each company

Regional Analysis:

- Further breakdown of a region with respect to a particular country

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

The sputter coater market is projected to grow from USD 595.8 Million in 2017 to USD 804.2 Million by 2022, at a CAGR of 6.2% between 2017 and 2022. The growth of the sputter coater market can be attributed to the growth of the electronics & semiconductor industry. The rising use of sputter coaters in electronics & semiconductor and medical applications is expected to drive the market during the forecast period.

The sputter coater market has been segmented on the basis of substrate type into metal, glass, semiconductor, and others. The others segment includes biologicals and plastics. The semiconductor substrate type sputter coaters accounted for the largest share of the sputter coater market in 2016, in terms of value. The increasing demand for semiconductors for several applications, such as communication devices, automotive devices, consumer electronics, and industrial electronics is driving the use of sputter coaters in semiconductor fabrication. APAC and North America are the major semiconductors producing regions. Hence, these regions witness a high demand for sputter coaters from semiconductor manufacturers. Based on target type, the sputter coater market has been divided into metal, compound, and others. The others segment includes alloys and ceramics. The metal target type segment accounted for a major share of the sputter coater market in 2016 due to its high purity and demand from several end-use industries, such as electronics & semiconductors, and research and development institutes. The sputter coater market has been segmented on the basis of end-use industry into electronics & semiconductor, automotive, institutes, and others. The others segment includes hardware, FMCG, construction, and medical industries. Electronics & semiconductor is the largest end-use industry segment of the sputter coater market due to the extensive use of these coaters in the manufacturing of semiconductors, consumer electronics, and industrial electronics. The increased growth of the electronics & semiconductor industry and continuous technological advancements are expected to drive the sputter coater market.

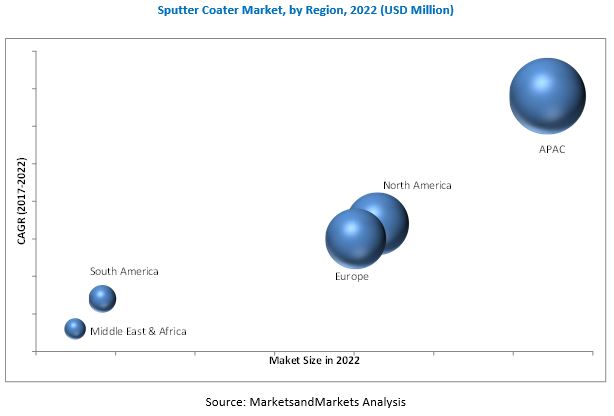

Asia Pacific led the sputter coater market in 2016. The sputter coater market in Asia Pacific is projected to grow at the highest CAGR during the forecast period due to the presence of numerous electronics manufacturers in the region. China accounted for the largest share of the Asia Pacific sputter coater market in 2016. Major producers of sputter coaters such as ULVAC (Japan) and Hitachi High-Technologies Corporation (Japan) are located in the region. North America accounted for the second-largest share of the global sputter coater market in 2016. Some of the major producers of sputter coaters in the North American region are Semicore Equipment (US), PVD Products (US), and Denton Vacuum (US).

The price of sputter coaters is directly proportional to the cost involved in their technology development, complex manufacturing process, and targets used in the machine/equipment/sputter coater systems. Key players in the industry have developed high-cost technologies to produce sputter coaters to meet the customer demands. These technologies are patented and are difficult to be developed by small companies. This increases the cost of production and leads to price rise of sputter coater. This high price may restrict the use of sputter coaters in different price-sensitive applications.

Companies are majorly adopting the strategies of new product development and agreements to increase their geographical presence and cater to the increasing demand for sputter coaters in end-use industries, such as electronics & semiconductor, automotive, and medical. For example, ULVAC launched the industrys first low-temperature PZT sputtering technology in mass production scale used for the production of piezoelectric MEMS device integrated on the complementary metal oxide semiconductor (CMOS). This technology will serve as a growth driver for the next generation MEMS devices.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Sputter Coater Market

4.2 Sputter Coater Market in APAC, By Target Typeand Country

4.3 Sputter Coater Market, By Country

4.4 Sputter Coater Market, By Target Type

4.5 Sputter Coater Market, By End-Use Industry

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Electronics & Semiconductor Industry

5.2.1.2 Growing Telecommunication Industry

5.2.1.3 Increasing Applications of Glass Coating

5.2.2 Restraints

5.2.2.1 High Price of Sputter Coaters

5.2.2.2 Longevity of Sputter Coaters

5.2.3 Opportunities

5.2.3.1 Increasing Use of Sputter Coater in Medical Industry

5.2.3.2 Increasing Use of Small Chamber Confocal Sputteringequipment in R&D

5.2.4 Challenges

5.2.4.1 Difficulties Faced in Using Sputter Coaters

5.3 Macroeconomic Overview

5.3.1 Introduction

5.3.2 GDP Growth Rate and Forecast of Major Economies

5.3.3 Electronics Industry Analysis

5.3.4 Automotive Industry Analysis

6 Sputter Coater Market, By Substrate Type (Page No. - 37)

6.1 Introduction

6.2 Metal

6.3 Glass

6.4 Semiconductor

6.5 Others

7 Sputter Coater Market, By Target Type (Page No. - 44)

7.1 Introduction

7.2 Metal

7.3 Compound

7.4 Others

8 Sputter Coater Market, By End-Use Industry (Page No. - 50)

8.1 Introduction

8.2 Automotive

8.3 Electronics & Semiconductor

8.4 Institutes

8.5 Others

9 Sputter Coater Market, By Region (Page No. - 56)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 South America

9.3.1 Brazil

9.3.2 Argentina

9.3.3 Rest of South America

9.4 Europe

9.4.1 Germany

9.4.2 France

9.4.3 Italy

9.4.4 Spain

9.4.5 Russia

9.4.6 UK

9.4.7 Rest of Europe

9.5 APAC

9.5.1 China

9.5.2 Japan

9.5.3 India

9.5.4 South Korea

9.5.5 Taiwan

9.5.6 Rest of APAC

9.6 Middle East & Africa

9.6.1 South Africa

9.6.2 UAE

9.6.3 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 96)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 Expansions

10.3.2 New Product Developments

10.3.3 Agreements

10.3.4 Partnerships

11 Company Profiles (Page No. - 100)

11.1 ULVAC

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 SWOT Analysis

11.1.4 Recent Developments

11.1.5 MnM View

11.2 Quorum Technologies

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 SWOT Analysis

11.2.4 MnM View

11.3 Buhler

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Cressington Scientific Instruments

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 MnM View

11.5 Hitachi High-Technologies Corporation

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 SWOT Analysis

11.5.4 MnM View

11.6 Oxford Instruments

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 MnM View

11.7 Semicore Equipment

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 MnM View

11.8 Plassys Bestek

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 MnM View

11.9 PVD Products

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 MnM View

11.10 Denton Vacuum

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 MnM View

11.11 Other Market Players

11.11.1 Veeco Instruments

11.11.2 Kolzer

11.11.3 SPI Supplies

11.11.4 Hind High Vacuum Company (HHV)

11.11.5 KDF Electronic & Vacuum Services

11.11.6 FHR Anlagenbau

11.11.7 Angstrom Engineering

11.11.8 Soleras Advanced Coatings

11.11.9 Milman Thin Film Systems

11.11.10 Plasma Process Group

11.11.11 Mustang Vacuum Systems

11.11.12 Kenosistec

11.11.13 Scientific Vacuum Systems

11.11.14 AJA International

11.11.15 Electron Microscopy Sciences

12 Appendix (Page No. - 122)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (107 Tables)

Table 1 Trends and Forecast of Nominal GDP, By Country, 20152022

Table 2 Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 3 Metal Substrate Type Market Size, By Region, 20152022 (USD Million)

Table 4 Glass Substrate Type Market Size, By Region, 20152022 (USD Million)

Table 5 Semiconductor Substrate Type Market Size, By Region, 20152022 (USD Million)

Table 6 Other Substrate Types Market Size, By Region, 20152022 (USD Million)

Table 7 Sputter Coater Market Size, By Target Type, 20152022 (USD Million)

Table 8 Metal Target Type Market Size, By Region, 20152022 (USD Million)

Table 9 Compound Target Type Market Size, By Region, 20152022 (USD Million)

Table 10 Other Target Types Market Size, By Region, 20152022 (USD Million)

Table 11 Sputter Coater Market Size, By End-Use Industry, 20152022 (USD Million)

Table 12 Sputter Coater Market Size in Automotive End-Use Industry, By Region,20152022 (USD Million)

Table 13 Sputter Coater Market Size in Electronics & Semiconductor End-Use Industry, By Region, 20152022 (USD Million)

Table 14 Sputter Coater Market Size in Institutes, By Region, 20152022 (USD Million)

Table 15 Sputter Coater Market Size in Other End-Use Industries, By Region,20152022 (USD Million)

Table 16 Sputter Coater Market Size, By Region, 20152022 (USD Million)

Table 17 North America: Sputter Coater Market Size, By Country, 20152022 (USD Million)

Table 18 North America: Market Size, By Target Type, 20152022 (USD Million)

Table 19 North America: Market Size, By Substrate Type, 20152022 (USD Million)

Table 20 North America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 21 US: Sputter Coater Market Size, By Target Type, 20152022 (USD Million)

Table 22 US: Market Size, By Substrate Type, 20152022 (USD Million)

Table 23 US: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 24 Canada: Sputter Coater Market Size, By Target Type, 20152022 (USD Million)

Table 25 Canada: Market Size, By Substrate Type, 20152022 (USD Million)

Table 26 Canada: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 27 Mexico: Sputter Coater Market Size, By Target Type, 20152022 (USD Million)

Table 28 Mexico: Market Size, By Substrate Type, 20152022 (USD Million)

Table 29 Mexico: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 30 South America: Sputter Coater Market Size, By Country, 20152022 (USD Million)

Table 31 South America: Market Size, By Substrate Type, 20152022 (USD Million)

Table 32 South America: Market Size, By Target Type, 20152022 (USD Million)

Table 33 South America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 34 Brazil: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 35 Brazil: Market Size, By Target Type, 20152022 (USD Million)

Table 36 Brazil: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 37 Argentina: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 38 Argentina: Market Size, By Target Type, 20152022 (USD Million)

Table 39 Argentina: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 40 Rest of South America: Sputter Coater Market Size, By Substrate Type,20152022 (USD Million)

Table 41 Rest of South America: Market Size, By Target Type,20152022 (USD Million)

Table 42 Rest of South America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 43 Europe: Sputter Coater Market Size, By Country, 20152022 (USD Million)

Table 44 Europe: Market Size, By Substrate Type, 20152022 (USD Million)

Table 45 Europe: Market Size, By Target Type, 20152022 (USD Million)

Table 46 Europe: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 47 Germany: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 48 Germany: Market Size, By Target Type, 20152022 (USD Million)

Table 49 Germany: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 50 France: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 51 France: Market Size, By Target Type, 20152022 (USD Million)

Table 52 France: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 53 Italy: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 54 Italy: Market Size, By Target Type, 20152022 (USD Million)

Table 55 Italy: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 56 Spain: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 57 Spain: Market Size, By Target Type, 20152022 (USD Million)

Table 58 Spain: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 59 Russia: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 60 Russia: Market Size, By Target Type, 20152022 (USD Million)

Table 61 Russia: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 62 UK: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 63 UK: Market Size, By Target Type, 20152022 (USD Million)

Table 64 UK: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 65 Rest of Europe: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 66 Rest of Europe: Market Size, By Target Type, 20152022 (USD Million)

Table 67 Rest of Europe: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 68 APAC: Sputter Coater Market Size, By Country, 20152022 (USD Million)

Table 69 APAC: Market Size, By Substrate Type, 20152022 (USD Million)

Table 70 APAC: Market Size, By Target Type, 20152022 (USD Million)

Table 71 APAC: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 72 China: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 73 China: Market Size, By Target Type, 20152022 (USD Million)

Table 74 China: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 75 Japan: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 76 Japan: Market Size, By Target Type, 20152022 (USD Million)

Table 77 Japan: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 78 India: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 79 India: Market Size, By Target Type, 20152022 (USD Million)

Table 80 India: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 81 South Korea: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 82 South Korea: Market Size, By Target Type, 20152022 (USD Million)

Table 83 South Korea: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 84 Taiwan: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 85 Taiwan: Market Size, By Target Type, 20152022 (USD Million)

Table 86 Taiwan: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 87 Rest of APAC: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 88 Rest of APAC: Market Size, By Target Type, 20152022 (USD Million)

Table 89 Rest of APAC: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 90 Middle East & Africa: Sputter Coater Market Size, By Country, 20152022 (USD Million)

Table 91 Middle East & Africa: Market Size, By Substrate Type,20152022 (USD Million)

Table 92 Middle East & Africa: Market Size, By Target Type, 20152022 (USD Million)

Table 93 Middle East & Africa: Market Size, By End-Use Industry,20152022 (USD Million)

Table 94 South Africa: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 95 South Africa: Market Size, By Target Type, 20152022 (USD Million)

Table 96 South Africa: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 97 UAE: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 98 UAE: Market Size, By Target Type, 20152022 (USD Million)

Table 99 UAE: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 100 Rest of Middle East & Africa: Sputter Coater Market Size, By Substrate Type, 20152022 (USD Million)

Table 101 Rest of Middle East & Africa: Market Size, By Target Type, 20152022 (USD Million)

Table 102 Rest of Middle East & Africa: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 103 Ranking of Major Sputter Coater Manufacturers, 2016

Table 104 Expansions, 20152017

Table 105 New Product Developments, 20152017

Table 106 Agreements, 20152017

Table 107 Partnerships, 20152017

List of Figures (42 Figures)

Figure 1 Sputter Coater Market Segmentation

Figure 2 Sputter Coater Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Sputter Coater Market: Data Triangulation

Figure 6 Metal to Be the Largest Target Type of the Sputter Coater Market

Figure 7 Electronics & Semiconductor to Be the Leading End-Use Industry of Sputter Coater

Figure 8 APAC Was the Largest Sputter Coater Market in 2016

Figure 9 Increasing Demand From Various End-Use Industries to Drive the Sputter Coater Market

Figure 10 China LED the APAC Sputter Coater Market in 2016

Figure 11 China to Be the Fastest-Growing Market Between 2017 and 2022

Figure 12 Metal to Be the Fastest-Growing Target Type

Figure 13 Electronics & Semiconductor to Be the Largest End-Use Industry Between 2017 and 2022

Figure 14 Drivers, Restraints, Opportunities, and Challenges in Sputter coater Market

Figure 15 Production of Global Electronics and IT Industries, 20142017

Figure 16 Regional Production of Cars and Commercial Vehicles, 2016

Figure 17 China Was the Largest Producer of Cars and Commercial vehicles in 2016

Figure 18 Semiconductor Substrate Type LED the Sputter Coater Market in 2016

Figure 19 APAC to Be the Largest Market for Metal Substrate Type

Figure 20 APAC to Be the Largest Market for Glass Substrate Type

Figure 21 APAC to Be the Largest Market for Semiconductor Substrate Type

Figure 22 APAC to Be the Largest Market for Other Substrate Types

Figure 23 Metal Target Type Dominated the Sputter Coater Market in 2016

Figure 24 APAC to Be the Largest Market for Metal Target Type

Figure 25 APAC to Be the Largest Market for Compound Target Type

Figure 26 APAC to Be the Largest Market for Other Target Types

Figure 27 Electronics & Semiconductor Dominated Sputter Coatermarket in 2016

Figure 28 APAC to Be the Fastest-Growing Market for Sputter Coater in Automotive Industry

Figure 29 APAC to Be the Largest Sputter Coater Market in Electronics& Semiconductor Industry

Figure 30 APAC to Be the Fastest-Growing Sputter Coater Market in Institutes

Figure 31 APAC to Be the Largest Sputter Coater Market in Otherend-Use Industries

Figure 32 Regional Snapshot: Rapidly Growing Markets are Emerging as New Strategic Locations

Figure 33 North America: Sputter Coater Market Snapshot

Figure 34 US Market Snapshot, 2017 vs 2022

Figure 35 APAC: Sputter Coater Market Snapshot

Figure 36 China Market Snapshot, 2017 vs 2022

Figure 37 Companies Adopted Expansions as the Key Growth Strategy Between 2015 and 2017

Figure 38 ULVAC: Company Snapshot

Figure 39 Quorum Technologies: Company Snapshot

Figure 40 Buhler: Company Snapshot

Figure 41 Hitachi High-Technologies Corporation: Company Snapshot

Figure 42 Oxford Instruments: Company Snapshot

Growth opportunities and latent adjacency in Sputter Coater Market