EDS, WDS, EBSD, Micro-XRF Instruments Market by Product, by Application (Energy, Defense, Metals, Medical, Research, Agriculture, Nanotechnology, Electronics, Biotechnology, Automotive, Pharmaceutical, Oil and Gas) - Global Forecasts to 2019

The global spectroscopy instruments market is segmented on the basis of products, applications, and regions. Based on products, the market is categorized into EDS, WDS, EBSD, and Micro-XRF. The EDS segment accounted for a major share of the spectroscopy Instruments market, by product, in 2014.

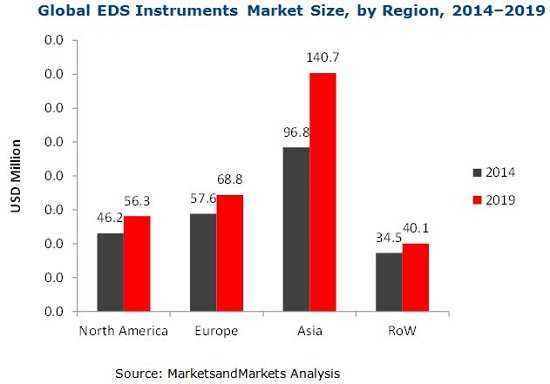

On the basis of region, the spectroscopy Instruments market is divided into North America, Europe, Asia, and the Rest of the World (consisting of Latin America, the Pacific countries, the Middle East, and Africa).

The key factors that are expected to spur the growth of spectroscopy Instruments market are the growing semiconductors industry, increasing demand for nanotechnology, demand for automobiles, and technological advancements. On the other hand, the high cost of instruments, sluggish economy (especially in the European countries and the U.S.), and lack of trained professionals are restricting the growth of this market to a certain extent.

Some of the major players in the spectroscopy Instruments market include Oxford Instruments plc (U.K.), AMETEK, Inc. (U.S.), Bruker Corporation (U.S.), Thermo Fisher Scientific, Inc. (U.S.), JEOL Ltd. (Japan), FEI Company (U.S.), Shimadzu Corporation (Japan), Rigaku Corporation (Japan), and IXRF Systems, Inc. (U.S.), among others.

Spectroscopy Instruments Market : Scope of the Report

This research report categorizes the EDS, WDS, EBSD, Micro-XRF Instruments market into the following segments and subsegments:

Spectroscopy Instruments Market, by Product

- Energy Dispersive Spectroscopy (EDS)

- Wavelength Dispersive Spectroscopy (WDS)

- Electron Backscatter Diffraction (EBSD)

- Micro X-Ray Fluorescence (Micro-XRF)

Energy Dispersive Spectroscopy Instruments Market, by Application

- Semiconductors

- Nanotechnology

- Oil and Gas

- Defense

- Automotive/Aerospace

- Medical Health

- Pharmaceuticals

- Paint and Coatings

- Agriculture

- Mineralogy/Mining

- Energy (Alternate Energy)

- Forensics

- Research

- Metals

Wavelength Dispersive Spectroscopy Instruments Market, by Application

- Semiconductors

- Oil and Gas

- Pharmaceuticals

- Research

Micro X-Ray Fluorescence Spectroscopy Instruments Market, by Application

- Semiconductors

- Oil and Gas

- Pharmaceuticals and Biotechnology

- Manufacturing

- Others (Clinical, Agrochemicals, and Forensics)

Electron Backscatter Diffraction Spectroscopy Instruments Market, by Application

- Environmental Sciences

- Life Sciences

- Manufacturing

Spectroscopy Instruments Market, by Region

- North America

- Europe

- Asia

- Rest of the World (RoW)

The global spectroscopy Instruments market is dominated majorly by four players, namely, Oxford Instruments plc, AMETEK, Inc., Bruker Corporation, and Thermo Fisher Scientific, Inc.

Based on products, the spectroscopy Instruments market is categorized into EDS, WDS, EBSD, and micro-XRF. The EDS segment accounted for a major share of the market, by product, in 2014.

The semiconductors application accounted for a major share of the EDS market, by application, in 2014; whereas, the oil and gas dominated the WDS market, by application, in 2014. The manufacturing application accounted for the largest share of the micro-XRF market, by application, in 2014.

The EDS, WDS, EBSD, and micro-XRF instruments market has registered constant growth over the years. Factors such as the growing semiconductors industry, increasing demand for nanotechnology, demand for automobiles, and technological advancements are propelling the growth of spectroscopy Instruments market. On the other hand, the high cost of instruments, sluggish economy (especially in the European countries and the U.S.), and lack of trained professionals are limiting the growth of this market.

On the basis of region, this market is classified into North America, Europe, Asia, and the Rest of the World (RoW).

The global spectroscopy Instruments market is expected to reach USD 529.6 Million by 2019 from USD 403.6 Million in 2014, at a CAGR of 5.6% during the forecast period.

Some of the major players in the Spectroscopy Instruments Market include Oxford Instruments plc (U.K.), AMETEK, Inc. (U.S.), Bruker Corporation (U.S.), and Thermo Fisher Scientific, Inc. (U.S.), JEOL Ltd. (Japan), FEI Company (U.S.), Shimadzu Corporation (Japan), Rigaku Corporation (Japan), and IXRF Systems, Inc. (U.S.).

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.1.1 Years Considered for the Study

1.1.2 Assumptions

2 Research Methodology (Page No. - 13)

2.1 Secondary and Primary Research Methodology

2.1.1 Secondary Research

2.1.2 Primary Research

2.2 Spectroscopy Instruments Market Size Estimation Methodology

2.3 Spectroscopy Instruments Market Size Estimation Methodology for Micro-XRF Instruments Market

2.4 Spectroscopy Instruments Market Forecast Methodology

2.5 Spectroscopy Instruments Market Data Validation and Data Triangulation

3 Executive Summary (Page No. - 20)

4 Market Overview (Page No. - 24)

4.1 Market Dynamics

4.1.1 Drivers

4.1.1.1 Growing Semiconductors Industry Generating Demand for Spectroscopy and Diffraction Instruments

4.1.1.2 Automobile and Aerospace Industry Driving the Spectroscopy Instruments Market

4.1.1.3 Growing Popularity of Nanotechnology

4.1.1.4 Technological Advancements

4.1.2 Restraints

4.1.2.1 High Initial Investment Restricts Its Penetration in Academic Institutions and Smaller Companies

4.1.2.2 Sluggish Economy Retarding Demand for Many Analytical Instruments

4.1.2.3 Lack of Skilled Professionals

4.2 Market Share Analysis

4.2.1 Oxford Instruments PLC

4.2.2 Ametek, Inc.

4.2.3 Bruker Corporation

4.2.4 Thermo Fisher Scientific, Inc.

5 Spectroscopy Instrumentation Market, By Product (Page No. - 33)

5.1 Introduction

5.1.1 Energy Dispersive Spectroscopy

5.1.2 Wavelength Dispersive Spectroscopy

5.1.3 Electron Backscatter Diffraction

5.1.4 Micro X-Ray Flourescence

6 Spectroscopy Instrumentation Market, By Application (Page No. - 43)

6.1 Energy Dispersive Spectroscopy

6.1.1 Semiconductors

6.1.2 Nanotechnology

6.1.3 Oil and Gas Industry

6.1.4 Defense

6.1.5 Automotive/Aerospace

6.1.6 Medical/Health

6.1.7 Pharmaceuticals

6.1.8 Agriculture

6.1.9 Paints and Coatings

6.1.10 Mineralogy/Mining

6.1.11 Energy (Alternative Energy)

6.1.12 Forensics

6.1.13 Research

6.1.14 Metals

6.2 Wavelength Dispersive Spectroscopy

6.2.1 Pharmaceuticals

6.2.2 Semiconductors

6.2.3 Oil and Gas Industry

6.2.4 Research

6.3 Micro X-Ray Fluorescence

6.3.1 Pharmaceutical and Biotechnology

6.3.2 Oil and Gas Industry

6.3.3 Manufacturing

6.3.4 Semiconductors

6.3.5 Research (Academic Institutes and Qa/Qc Laboratories):

6.3.6 Others (Clinical, Agrochemical, and Forensic Laboratories)

6.4 Electron Backscatter Diffraction

6.4.1 Environmental Sciences

6.4.2 Life Sciences

6.4.3 Manufacturing

7 Global Spectroscopy Instrumentation Market, By Geography (Page No. - 56)

7.1 Introduction

7.2 North America

7.2.1 Government Funding in the U.S.

7.2.2 Spectroscopy Conferences to Create Awareness on Technologies

7.2.3 Increased Funding in Research May Develop New Application Areas for Spectroscopy Instruments

7.3 Europe

7.3.1 Funding in European Countries

7.3.2 Pharmaceutical Industry to Drive the Demand for Spectroscopy Instruments

7.3.3 Nanotechnology Industry in Germany

7.4 Asia

7.4.1 Expanding Footprint of Market Leaders in Asia

7.4.2 Conferences on Spectroscopy Applications in Asia

7.4.3 Growing Semiconductors Market in Asia

7.4.4 Strong Foothold of Asia in the Global Electron Microscopy Market

7.4.5 Free Trade Agreements Between Korea and U.S. Will Provide Opportunities for Asian Companies

7.4.6 Food Security Concerns in Asia to Increase Crop Science Research

7.4.7 Growing Pharmaceutical Industry in India & China

7.5 Rest of the World (RoW)

7.5.1 Flourishing Biotechnology & Pharmaceuticals Markets in Brazil & Mexico

7.5.2 Wide Usage of Spectroscopy Instruments in the Rich African Mining Industry

7.5.3 Strategic Expansions By Key Players in Pacific Countries

8 Competitive Landscape (Page No. - 66)

8.1 Competitive Situation and Trends

8.2 New Product Launches

8.3 Expansion

8.4 Product Enhancement

8.5 Acquisitions

8.6 Other Developments

9 Company Profiles (Page No. - 74)

(Overview, Financials, Products & Services, Strategy, & Developments)*

9.1 Bruker Corporation

9.2 Thermo Fisher Scientific

9.3 Ametek, Inc.

9.4 Oxford Instruments PLC

9.5 Jeol, Limited.

9.6 Horiba, Ltd.

9.7 FEI Company

9.8 Shimadzu Corporation

9.9 IXRF Systems, Inc.

9.10 Rigaku Corporation

*Details on Financials, Product & Services, Strategy, & Developments Might Not Be Captured in Case of Unlisted Companies.

10 Industry Speaks (Page No. - 101)

List of Tables (19 Tables)

Table 1 Spectroscopy Instrumentation Market Size, By Product, 2011–2019 ($Million)

Table 2 EDS Market Size, By Region, 2013-2019 ($Million)

Table 3 WDS Market Size, By Region, 2011–2019 ($Million)

Table 4 EBSD Market Size, By Region, 2011–2019 ($Million)

Table 5 Micro-XRF Market Size, By Region, 2011–2019 ($Million)

Table 6 Micro-XRF Market Volume, By Region, 2011–2019 (Units)

Table 7 Energy Dispersive Spectroscopy Market Size, By Application, 2011–2019 ($Million)

Table 8 Wavelength Dispersive Spectroscopy Market Size, By Application, 2011–2019 ($Million)

Table 9 Micro-XRF Spectroscopy Market Size, By Application, 2011–2019 ($Million)

Table 10 Electron Backscatter Diffraction Market Size, By Application, 2011–2019 ($Million)

Table 11 North America, Spectroscopy Instrumentation Market, By Product 2014–2019 ($Million)

Table 12 Europe Spectroscopy Instrumentation Market, By Product 2014–2019 ($Million)

Table 13 Asia Spectroscopy Instrumentation Market, By Product 2014–2019 ($Million)

Table 14 RoW Spectroscopy Instrumentation Market, By Product 2014–2019 ($Million)

Table 15 New Product Launches, 2012–2014

Table 16 Expansion, 2012–2014

Table 17 Product Enhancement, 2012–2014

Table 18 Acquisitions, 2012–2014

Table 19 Other Developments, 2012–2014

List of Figures (37 Figures)

Figure 1 Global Spectroscopy Instrumentation Market: Research Methodology Steps

Figure 2 Sampling Frame: Primary Research

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Market Forecast Methodology

Figure 8 Data Triangulation Methodology

Figure 9 Micro-XRF Likely to Witness the Highest Growth in Forecast Period (2014-2019)

Figure 10 North America Dominated the EBSD Market in 2014

Figure 11 Asia Set to Be Growth Hub for EDS, WDS, and Micro-XRF Instruments Markets

Figure 12 Micro-XRF Instruments Market Potential, By Geography

Figure 13 Largest and Fastest-Growing Applications, By Spectroscopy Product, 2013

Figure 14 Drivers and Restraints

Figure 15 Oxford Instruments Dominated the EDS Market With 36% Market Share in 2013

Figure 16 Oxford Instruments Dominated the WDS Market With 47% Share in 2013

Figure 17 Oxford Instruments and Ametek are the Leading Players in the EBSD Market

Figure 18 EDS Segment Commanded the Largest Market Share in 2014 and is Expected to Register the Highest CAGR in the Forecast Period

Figure 19 Asia to Be the Fastest Growing EDS Market From 2014 to 2019

Figure 20 Asia to Be the Fastest-Growing WDS Market in the Forecast Period

Figure 21 North America to Be the Fastest Growing EBSD Market in the Forecast Period

Figure 22 Asia to Be the Fastest-Growing Micro-XRF Market

Figure 23 Companies Adopted New Product Launches and Expansion as Key Growth Strategies Over the Last Three Years

Figure 24 Key Growth Strategies in the Global Spectroscopy Instrumentation Market, 2012–2014

Figure 25 Key Players Focusing on New Product Launches, 2012–2014

Figure 26 Key Players Focusing on Expansion, 2012–2014

Figure 27 Key Players Focusing on Product Enhancement, 2012–2014

Figure 28 Key Players Focusing on Acquisitions, 2012–2014

Figure 29 Key Players Focusing on Other Developments, 2012–2014

Figure 30 Bruker Corporation: Company Snapshot

Figure 31 Thermo Fisher Scientific: Company Snapshot

Figure 32 Ametek, Inc.: Company Snapshot

Figure 33 Oxford Instruments PLC: Company Snapshot

Figure 34 Jeol, Limited.: Company Snapshot

Figure 35 Horiba, Ltd.: Company Snapshot

Figure 36 FEI Company: Company Snapshot

Figure 37 Shimadzu Corporation: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EDS, WDS, EBSD, Micro-XRF Instruments Market