Space Power Electronics Market by Device Type (Power Discrete, Power Module, Power IC), Application (Satellites, Spacecraft & Launch Vehicles, Space Stations, Rovers), Platform, Voltage, Current, Material and Region - Global Forecast to 2026

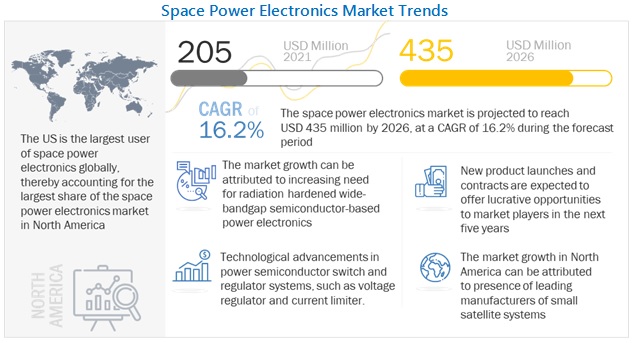

The Space Power Electronics Market size is projected to grow from USD 205 million in 2021 to USD 435 million by 2026, at a CAGR of 16.2%.

Space power electronics is the application of electronics on satellites, spacecraft, launch vehicles, space stations and rovers to control and convert electric power from one form to other. It deals with the processing of high voltages and currents to deliver power that supports a variety of needs. According to the National Aeronautics and Space Administration, a power electronic system can comprise a modular power electronic subsystem (PESS) connected to a source and load at its input and output power ports, respectively. Semiconductor devices such as metal-oxide semiconductor field effect transistors (MOSFET), insulated gate bipolar transistors (IGBT), mos-controlled thyristor (MCT), and gate-turn-off thyristors (GTO) represent the cornerstone of modem power electronic converters.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Space Power Electronics Market

The COVID-19 pandemic has caused significant damage to the economic activities of countries across the world. The manufacturing of space power electronics, subsystems, and components has also been impacted. Although satellite systems are critically important, disruptions in the supply chain have halted their manufacturing processes for the time being. Resuming manufacturing activities depends on the level of COVID-19 exposure, the level at which manufacturing operations are running, and import-export regulations, among other factors. While companies may still be taking in orders, delivery schedules may not be fixed.

Space Power Electronics Market Dynamics

Driver: Increasing demand for wide bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN)

The semiconductor material used to make space power cables has made significant strides in the last few decades. Wide bandgap semiconductor materials are of specific interest, which has provided significant improvements in performance over the current standard, silicon, due to which there is an increase in demand for materials such as silicon carbide (SiC) and gallium nitride (GaN). These wide bandgap materials can operate at higher temperatures of up to 200°C as long as the package can tolerate this, while silicon is limited to 150°C. A wide bandgap semiconductor can handle nearly 10 times more voltage as compared to silicon and the switching speed/ switching frequency of SiC and GaN are also nearly 10 times higher than the silicon. GaN and SiC power semiconductors are expected to make significant strides in the power industry within the next decade and will have a consolidated share of 13% in the power semiconductor market by 2024.

Restrains: Complex design and integration process

Many space agencies and private entities are trying to improve the technologies used in space power electronics to improve their reliability by improving the output with reduction in power losses. At the same time, they are trying to reduce the cost of space power electronics. They are innovating in radiation-hardened power electronics to enable them to tolerate harsher radiation environments with better precision for longer operational periods. The players operating in the power electronics industry are focusing on integrating multiple functionalities in a single chip, which results in a complex design.

Furthermore, the designing and integrating complex devices require special skillsets, robust methodology, and a particular toolset, which increase the overall cost of the devices. Consequently, the high cost of the devices is expected to hamper the switching process toward advanced technological devices. Subsequently, evolving technologies generate demand for more functionalities to be integrated into system-on-chips (SoCs), making devices smaller and more efficient. All these changes in space power electronics are making their design more complex and increasing the difficulty in the integration process.

Opportunities: Miniaturization of space DC-DC converters

In the current scenario, satellite manufacturers are demanding compact-sized power converters. The compactness of converters benefits designers who need galvanically isolated output power or noise reduction in an analog circuit. The miniaturized version of DC-DC converters will offer very low output noise with an extended operating temperature, which will result in high switching frequencies. As a result, the converters will deliver high efficiency. Therefore, market players have the opportunity to reduce the device size to make DC-DC converters more effective.

Challenges: Hazards due to harsh space conditions

The first challenge for space power electronics is the vibration imposed by the launch vehicle. When the spacecraft leaves the Earth’s atmosphere there are many environment changes such as change in temperature and pressure which need to be handled by electronics.

High levels of contamination on surfaces can contribute to electrostatic discharge. Satellites are also vulnerable to charging and discharging. Satellite charging is a variation in the electrostatic potential of a satellite, with respect to the surrounding low-density plasma around the satellite. The extent of the charging depends on the design of the satellite and the orbit. The two primary mechanisms responsible for charging are plasma bombardment and photoelectric effects. Discharges as high as 20,000 V have been known to occur on satellites in geosynchronous orbits. The atmosphere in LEO is comprised of about 96% atomic oxygen.

Based on device type, the power IC segment is expected to lead the space power electronics market from 2021 to 2026.

Power ICs are integrated circuits that include multiple power rails and power management functions within a single chip. Power ICs are frequently used to power small, battery-operated devices since the integration of multiple functions into a single chip result in more efficient use of space and system power. Functions commonly integrated into a PMIC include voltage converters and regulators, battery chargers, battery fuel gauges, LED drivers, real-time clocks, power sequencers, and power control. The Power ICs consist of Power Management ICs and Application Specific ICs.

Based on application, the satellite segment is expected to lead the space power electronics market from 2021 to 2026.

Satellites are increasingly being adopted in modern communication technologies. The introduction of wireless satellite internet and development of miniature hardware systems are exploiting numerous opportunities in the field of satellite-enabled communication. Over the past decade, there has been an explosion of activity in the small satellite world, driven by technology breakthroughs, industry commercialization, and private investments. There is a growing demand for space exploration, which enables small satellites to achieve attitude and orbit control, orbital transfers, and end-of-life deorbiting. Miniaturization of power electronic technologies are performing very well for CubeSats. Also, rapid growth in the NewSpace industry has led to the greater use of modular components like miniaturized rad-hard MOSFETs, gate drivers, DC-DC convertors and solid-state relays.

Based on region, North America is expected to lead the space power electronics market from 2021 to 2026.

The US is a lucrative market for space power electronics in the North American region. The US government is increasingly investing in advanced space power electronics technologies to enhance the quality and effectiveness of satellite communication, deep space exploration. The increasing investment on satellite equipment to enhance defense and surveillance capabilities of the armed forces, modernization of existing communication in military platforms, critical infrastructure and law enforcement agencies using satellite systems, are key factors expected to drive the Space Power Electronics Industry in North America. Boeing-manufactured O3b mPOWER satellites are widely using radiation-fault-tolerant DC-DC converter power modules for better power conversion

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Space Power Electronics Companies are dominated by a few globally established players such as Infineon Technologies (Germany), Texas Instrument Incorporated US), STMicroelectronics (Switzerland), Onsemi (US), Renesas Electronics Corporation (Japan), among others.

Contracts were the main strategy adopted by leading players to sustain their position in the space power electronics market, followed by new product developments with advanced technologies. Many companies also collaborated to set up special centers for the research & development of advanced space power electronics equipment.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Value

|

USD 205 Million in 2021 |

| Projected Value | USD 435 Million by 2026 |

| Growth Rate | CAGR of 16.2% |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Device Type, by Application, by Platform Type, by Voltage, by Current, by Material and by Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Infineon Technologies (Germany), Texas Instrument Incorporated US), STMicroelectronics (Switzerland), Onsemi (US), Renesas Electronics Corporation (Japan) are some of the major players of space power electronics market. (25 Companies) |

The study categorizes the space power electronics market based on Device Type, Application, Platform Type, Voltage, Current, Material and Region

By Device Type

- Power Discrete

- Power Module

- Power IC

By Application

- Satellite

- Spacecraft & Launch Vehicle

- Rovers

-

Space stations

By Platform type

- Power

- Command and data handling

- ADCS

- Propulsion

- TT&C

- Structure

- Thermal system

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Current

- Upto 25A

- 25-50A

- Over 50A

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In March 2022, Cobham Advanced Electronic Solutions (CAES) and Trident Systems Incorporated announced a strategic partnership to offer an integrated portfolio of best-in-class advanced mission computing and communications solutions for space, air, sea, and land defense applications.

- In February 2022, Infineon Technologies is strengthening its market leadership in power semiconductors by adding significant manufacturing capacities in the field of wide bandgap (SiC and GaN) semiconductors. The company is investing more than USD 2.3 billion to build a third module at its site in Kulim, Malaysia. Once fully equipped, the new module will generate USD 2.3 billion in additional annual revenue with products based on silicon carbide and gallium nitride.

- In December 2021, Microchip Technology undertook a significant expansion of its Gallium Nitride (GaN) Radio Frequency (RF) power device portfolio with new MMICs and discrete transistors that cover frequencies up to 20 gigahertz (GHz). The devices combine high power-added efficiency (PAE) and high linearity to deliver new levels of performance in applications ranging from 5G to electronic warfare, satellite communications, commercial & defense radar systems, and test equipment.

- In November 2021, Texas Instruments Incorporated announced plans to begin construction on its new 300-millimeter semiconductor wafer fabrication (fab) plant in Sherman in the second half of 2022. Production from the first new fab is expected as early as 2025.

- In August 2021, STMicroelectronics collaborated with Xilinx, Inc. to build a power solution for the Xilinx Kintex UltraScale XQRKU060 radiation-tolerant FPGA, leveraging QML-V qualified voltage regulators from ST’s space-products portfolio.

- In June 2020, Efficient Power Conversion (EPC) Corporation and VPT, Inc, a subsidiary of HEICO Corporation, announced the establishment of EPC Space LLC, a joint venture focused on designing and manufacturing radiation hardened (Rad Hard) GaN-on-silicon transistors and ICs packaged, tested, and qualified for satellite and high-reliability applications.

Frequently Asked Questions (FAQ):

Which are the major companies in the space power electronics market? What are their major strategies to strengthen their market presence?

The space power electronics market is dominated by a few globally established players such as Infineon Technologies (Germany), Texas Instrument Incorporated US), STMicroelectronics (Switzerland), Onsemi (US), Renesas Electronics Corporation (Japan), among others.

Contracts were the main strategy adopted by leading players to sustain their position in the space power electronics market, followed by new product developments with advanced technologies. Many companies also collaborated to set up special centers for the research & development of advanced space power electronics equipment.What are the drivers and opportunities for the space power electronics market?

The market for space power electronics has grown substantially across the globe, and especially in Asia Pacific, where increase in developing new technologies and procurement of new satellite technologies in such as China, India, and Japan, will offer several opportunities for small satellite systems industry. The rising R&D activities to develop space power electronics are also expected to boost the growth of the market around the world.

Which region is expected to grow at the highest rate in the next five years?

The market in Rest of the World is projected to grow at the highest CAGR of from 2021 to 2026, showcasing strong demand for internet connectivity in the region.

Which type of space power electronics is expected to significantly lead in the coming years?

Others (Gallium-arsenide (GaAs) and Silicon Germanium (SiGe)) segment of the space power electronics market is projected to witness the highest CAGR due to increasing use of high-mobility channel materials i.e., materials that have high flow of electrons in the space power electronics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

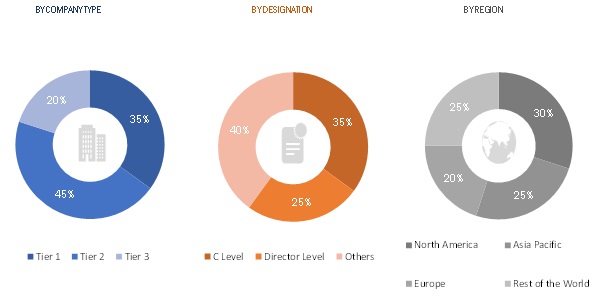

The study involved various activities in estimating the current size of the space power electronics market. Exhaustive secondary research was done to collect information on the space power electronics market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the space power electronics market.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies were rated on the basis of performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to, for this research study include financial statements of companies offering space power electronics and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the space power electronics market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the space power electronics market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market sizing of the market was undertaken from the supply side. The power electronics penetration was applied to the market value of satellites, spacecraft & launch vehicles, and rovers to derive the market size of space power electronics by each of these platforms.

Note: All the launches of satellites, spacecraft & launch vehicles, and rovers over the historical and estimated years were mapped to arrive at the CAGR and understand the market dynamics of all countries in the report.

Space Power Electronics Market Size: Top-Down Approach:

Data Triangulation

After arriving at the overall size of the space power electronics market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and subsegments of the market. The data was triangulated by studying various factors and trends from both, the demand and supply sides. The market size was validated using both, the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the space power electronics market based on device, platform, application, voltage, current, material, and region from 2021 to 2026

- To forecast the size of various segments of the market with respect to four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with major countries in each of them

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify opportunities for stakeholders in the market by studying key market and technology trends

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and R&D activities in the market

- To estimate the procurement of space power electronics by different countries to track technological advancements in the market

- To provide a comprehensive competitive landscape of the market along with an overview of the different strategies adopted by key players to strengthen their position

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the space power electronics market

Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the space power electronics market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Space Power Electronics Market