Sonar Systems Market by Application, Platform (Commercial vessels, Defence vessels, Unmanned Underwater Vehicles, Aircrafts, and Ports), Type, Material, and Region (North America, Europe, APAC, Middle East, & RoW) (2021-2026 )

Update: 14/01/2026

Sonar Systems Market Size & Growth

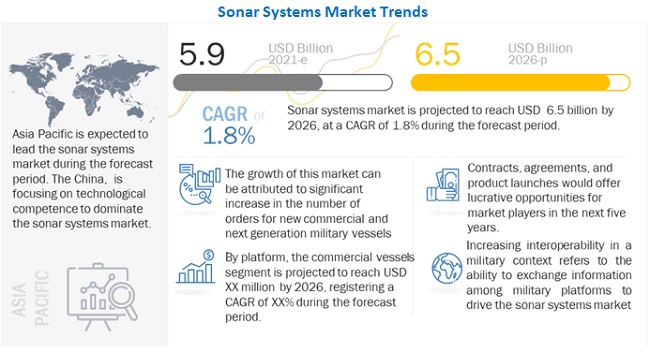

The Global Sonar System Market Size was valued at USD 5.9 Billion in 2021 and is estimated to reach USD 6.5 Billion by 2026, growing at a CAGR of 1.8% during the forecast period.

The Sonar System Industry is driven by factors such as adoption of sonar systems by naval forces to enhance anti-submarine warfare capabilities, the growing use of sonobuoy in tactical defense program and rising demand for high resolution imaging for seabed mapping.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Sonar systems market

The COVID-19 has led to several challenges for many industries. Maritime industry is no exception to that. Because of COVID-19 outbreak, the budget allotted to the defense sector has been reduced by several countries. This puts most of the research projects on hold. Also, the export of military and commercial vessels to the several countries in Middle east, Africa and Latin America has also been reduced. All these scenarios affect the development of sonar system.

Sonar Systems Market Dynamics

Driver : Stable Growth in the Deliveries of Military Vessels

The stable growth in the deliveries of military vessel will drive the market for sonar systems. Military vessels use few of the most advanced sonar systems for achieving the precision of the highest level. In military vessels, Sonar systems are used for several applications like mine detection, seabed terrain investigation, anti-submarine warfare, diver detection, port security etc. Different type of ships uses different sonar for different applications for example, submarines use passive sonar for moving in the enemy waters undetected, whereas vessels like frigates, corvettes use multi-static sonar for enemy detection. The growth in the deliveries of such military ships will provide the favorable conditions for the sonar systems market to grow in coming years.

Opportunity : Increasing Adoption rate of Unmanned Underwater Vehicles (UUVs)

Unmanned Underwater Vehicles (UUVs) are the remote operable devices that are used in marine environment for several tasks like mine detection, seabed terrain investigation, fish behavioral observation, etc. These UUVs are evolving rapidly as more and more militaries and other organizations are showing interest in them. Because of the compact size of UUVs, a sonar system used in them is also very compact in size and the sonar system must be the advanced one which can efficiently operate on remote control. This provides the opportunity for sonar systems market to evolve and grow at the same time.

Challenges : Shift from 2D sonar processing to 3D sonar processing for seabed imaging and charting

Anti-submarine warfare involves the use of various sensors and weapon technologies. Thorough training is required for personnel using these technologies to attain the required technical expertise. A typical ASW technique involves detecting, followed by classifying, locating, and tracking the target submarine, for which end users undergo a rigorous and complex training to fully comprehend the functioning of these systems.

Sonar Systems Market Segments

Sonar for commercial platform to lead the sonar system market during the forecast period

Naval sonars are capable of operating in active and passive operations. In the passive operating mode, sonars act as listening sonars, and they do not transmit their signals. This enables naval vessels to maintain stealth and secrecy. This operating mode can detect enemy ships and animals in the ocean. In comparison to active operations, passive operations cannot provide the range of the sound source.

The commercial vessels segment of the sonar system market is projected to grow from USD 2686.5 million in 2021 to USD 2939.0 million by 2026, at a CAGR of 1.8% from 2021 to 2026. The defence vessels segment is projected to grow from USD 1495.2 million in 2021 to USD 1650.2 million by 2026, at a CAGR of 2% during the forecast period.

Deployable Sonar to command the sonar systems market by installation during the forecast period

“Sonar buoys(sonobuoys)” are made to drop from the aircraft into the water or dip. It uses transducer and radio transmitter to detect, record and convey underwater echoes. The use of sonobuoys for wide-ranging area zone multi static surveillance transforms the field of aerial SONAR, providing a substantial surge in capability. Aircraft can drop sonobuoys from the altitude of 30,000 feet.

“Dipping SONARS” are made to lowered to sea surface from a hovering helicopter. The helicopter cannot move while using dipping SONAR, so it must check one spot, raising the SONAR, fly somewhere else, lowering the SONAR again and so on. Variant of dipping SONAR tech consist of side scan systems mounted on towed sled. Its operations are supported by bathythermographs for recovering water depth and temperature and determining layer depth and acoustic characteristics.

Hull-mounted sonar to command the sonar systems market by platform during the forecast period

Hull-mounted sonar is one of the most used type of sonar. Hull-mounted sonar are attached at the bottom of the vessel. Hull-mounted sonar are used for performing various tasks like seabed monitoring, fish finding, anti-submarine warfare, diver detection etc. Hull-mounted sonar are further classified as Forward-looking sonar, Omnidirectional sonar and Echosounders.

Active Sonar to command the sonar systems market by technology during the forecast period

Active SONAR employs an acoustic energy pulse that is projected from the array and reflects from the target. The transducers that transmit the pulse normally receive the echoes, but other arrays can be used to sense the return signal. If the same transducer is used as transmitter and receiver, the required aperture space is reduced, and few cables are required. Active transducers are far more expensive than receiving hydrophones and their size makes them difficult to isolate from self-noise in the receive mode. The distance to the object is measured by how long it takes for the ping to travel to the object and back to the transducer. Active SONAR can detect marine mammals in shipping lanes or in high sound pressure zone.

Market for Sonar systems used for anti-submarine warfare is projected to witness highest CAGR during the forecast period

In defense, sonar systems are mainly used on warships, submarines, and search & rescue boats for anti-submarine warfare, mine detection & countermeasure, port security, diver detection, and search & rescue to increase homeland security.

The sonar system market for anti-submarine warfare is expected to grow from USD 1194.3 million in 2021 to USD 1308.4 million by 2026, at a CAGR of 1.8% during the forecast period.

Sonar Systems Market Regions

The Asia Pacific market is projected to contribute the largest share from 2021 to 2026

The sonar system market is projected to grow at a CAGR of 1.8%, Asia Pacific is estimated to account for the largest share of 39.0% of the market in 2021. The market in Europe is projected to reach USD 2602.7 million by 2026, growing at a CAGR 2.7% during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Emerging Industry Trends

Sonar systems are used in defense and marine applications for performing several tasks like surveillance, navigation, tracking, etc. The applications of Sonar in defense as well as commercial domains includes Port security, Anti-submarine Warfare, Fishing, Mine detection, Seabed Terrain observation, etc. Sonar plays an important role in all the above-mentioned applications.

Sonar systems have evolved with the technological advancements in the electronics and communication domains, for e.g. The Sonobuoys which are the deployable sonars that plays a crucial role in the anti-submarine warfare. Further, the development of 3D sonar systems like Echosounder provides the real time 3-Dimensional view of seabed and the fish & other objects present in that area.

Sonar Systems Companies: Top Key Market Players

The Sonar Systems Companies are dominated by globally established players such as:

- Thales Group (France)

- ATLAS ELEKTRONIK GmbH (Germany)

- Raytheon Company (US)

- Lockheed Martin (US)

- L-3 Technologies Inc. (US)

- Ultra Electronics (UK)

Major players in the hydrographic sonar market include Kongsberg Gruppen ASA (Norway), Teledyne Technologies Inc. (US), and Sonardyne (UK). Navigation and fisheries sonars are provided by Furuno Electric Co., Ltd. (Japan), Japan Radio Company (Japan), Navico (Norway), and FLIR Systems (US). The report covers various industry trends and new technological innovations in the sonar system market for the period, 2016-2023.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

$ 5.9 Billion |

|

Projected Market Size |

$ 6.5 Billion |

|

Growth Rate |

1.8% |

|

Market Size Available for Years |

2018–2026 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

By Application, By Platform, By Installation, By End User |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East, and Rest of the World |

|

Companies Covered |

Lockheed Martin (US), L3Harris (US), Thales Group (France), Kongsberg Maritime (Norway), and Northrop Grumman Corporation (US) |

The study categorizes the Sonar systems market based on Application, Platform, Product, Installation, and Region.

By Application

- Anti-submarine Warfare

- Port Security

- Mine Detection & Countermeasure Systems

- Search & Rescue

- Navigation

- Diver Detection

- Seabed Terrain Investigation

- Scientific

- Others

By Platform

- Commercial Vessels

- Defence Vessels

- Unmanned Underwater Vehicles (UUVs)

- Aircrafts

- Ports

By Product

- Hull-mounted Sonar

- Stern-mounted Sonar

- Dipping Sonar

- Sonobuoy

By Installation

- Fixed

- Deployable

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Rest of the World

Recent Developments

- In May 2021, the new Echoscope PIPE Real-Time XYZ series sonar has been developed specifically for OEM and system integrators to allow simple integration of our unique real-time volumetric imaging sonars. The PIPE Real-Time XYZ series sonar generates this XYZ data in real-time as part of the beamforming image process output.

- In October 2020, The WINGHEAD dual-head configuration offers multiple advantages for bathymetric surveys. The user can benefit from 2,048 true soundings, 1024 for each of the NORBIT WINGHEAD multibeam echosounders and use each one differently, either to extend the visible sector or to increase the along-track sounding density

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Sonar systems market?

The Sonar systems market is expected to grow substantially owing to the technological development in designing of the new and compact missiles.

What are the key sustainability strategies adopted by leading players operating in the Sonar systems market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Sonar systems market. The major players Raytheon (UK), Lockheed Martin (US), Thales (France), Kongsberg Gruppen (Norway), Ultra Electronics (UK)., these players have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Sonar systems market?

Some of the major emerging technologies and use cases disrupting the market include Diver detection sonar system, Synthetic aperture sonar, surveillance network sonar, etc.

Who are the key players and innovators in the ecosystem of the Sonar systems market?

The key players in the Sonar systems market include Raytheon (UK), Lockheed Martin (US), Thales (France), Kongsberg Gruppen (Norway), Ultra Electronics (UK).

Which region is expected to hold the highest market share in the Sonar systems market?

Sonar systems market in The Asia Pacific region is estimated to account for the largest share of 60.0% of the market in 2021. Whereas the market in Europe is projected to grow at the highest CAGR of 7.69% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SONAR SYSTEMS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR STUDY

1.4 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY & PRICING

TABLE 1 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

FIGURE 4 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.1.2.2 Breakdown of primaries

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.3 DEMAND-SIDE INDICATORS

2.1.3.1 Increasing adoption rate of unmanned underwater vehicles (UUVs)

2.1.4 SUPPLY-SIDE ANALYSIS

2.1.4.1 Development of dipping sonars & sonobuoys for anti-submarine warfare

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

2.2.1.1 Key industry insights

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.2 SONAR SYSTEMS MARKET ESTIMATION PROCEDURE

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2.1 COVID-19 impact on market analysis

2.3.3 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR RESEARCH STUDY

2.7 LIMITATIONS

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 58)

FIGURE 9 BY PLATFORM, UNMANNED UNDERWATER VEHICLES (UUVS) SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 BY APPLICATION, MINE DETECTION & COUNTERMEASURE SYSTEMS SEGMENT PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 11 BY PRODUCT, HULL-MOUNTED SONAR SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 BY TECHNOLOGY, ACTIVE SEGMENT ESTIMATED TO LEAD SONAR SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC ESTIMATED TO LEAD SONAR SYSTEMS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN SONAR SYSTEMS MARKET

FIGURE 14 CHANGING NATURE OF WARFARE TO DRIVE SONAR SYSTEMS MARKET

4.2 SONAR SYSTEMS MARKET, BY INSTALLATION

FIGURE 15 FIXED SONAR SYSTEMS SEGMENT ESTIMATED TO LEAD MARKET FROM 2018 TO 2026

4.3 SONAR SYSTEMS MARKET, BY END USER

FIGURE 16 RETROFIT SEGMENT TO LEAD MARKET FROM 2018 TO 2026

4.4 SONAR SYSTEMS MARKET, BY FREQUENCY

FIGURE 17 ULTRASONIC FREQUENCY SEGMENT TO LEAD MARKET FROM 2018 TO 2026

4.5 SONAR SYSTEMS MARKET, BY SOLUTION

FIGURE 18 2D SONAR SEGMENT TO LEAD MARKET FROM 2018 TO 2026

4.6 SONAR SYSTEMS MARKET, BY COUNTRY

FIGURE 19 ITALY PROJECTED TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 SONAR SYSTEMS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in deliveries of military vessels

FIGURE 21 GLOBAL MILITARY VESSELS DELIVERED FROM 2018 TO 2021

5.2.1.2 Changing nature of warfare

5.2.1.3 Increasing defense expenditure of emerging economies

TABLE 2 DEFENSE BUDGET OF INDIA & CHINA, 2015-2020 (USD BILLION)

5.2.1.4 Growing need for cost-effective sonar systems for anti-submarine warfare

5.2.1.5 Increasing adoption rate of unmanned underwater vehicles (UUVs)

5.2.2 RESTRAINTS

5.2.2.1 Side effects of sonar on marine life

5.2.3 OPPORTUNITIES

5.2.3.1 Support for researchers and manufacturers for developing sonar systems

5.2.4 CHALLENGES

5.2.4.1 Complex training involved in building anti-submarine warfare capability

5.3 COVID-19 IMPACT SCENARIOS

5.4 IMPACT OF COVID-19 ON SONAR SYSTEMS MARKET

FIGURE 22 IMPACT OF COVID-19 ON SONAR SYSTEMS MARKET

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2020 to August 2021

TABLE 3 KEY DEVELOPMENTS IN SONAR SYSTEMS MARKET, 2020-2021

5.4.2 SUPPLY-SIDE IMPACT

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.5.1 SONAR SYSTEMS FOR UNMANNED UNDERWATER VEHICLES (UUV)

5.5.2 DEVELOPMENT OF 3D SONAR SYSTEM BY CODA OCTOPUS

FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 24 SONAR SYSTEMS ECOSYSTEM

TABLE 4 SONAR SYSTEMS MARKET ECOSYSTEM

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICE ANALYSIS OF SONAR SYSTEMS IN 2020

5.8 TARIFF REGULATORY LANDSCAPE FOR MARITIME INDUSTRY

5.9 TRADE DATA

5.9.1 TRADE ANALYSIS

TABLE 5 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 6 COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

5.10 VALUE CHAIN ANALYSIS OF SONAR SYSTEMS MARKET

FIGURE 25 VALUE CHAIN ANALYSIS

5.11 PORTER’S FIVE FORCES MODEL

TABLE 7 KEY SONAR SYSTEMS MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 26 SONAR SYSTEMS MARKET: PORTER'S FIVE FORCE ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 TECHNOLOGY ANALYSIS

5.12.1 DEVELOPMENT OF DIPPING SONAR & SONOBUOYS FOR ANTI-SUBMARINE WARFARE

5.13 USE CASES

5.13.1 INDIAN NAVY FORMALLY INDUCTED FOUR TYPES OF INDIGENOUSLY DEVELOPED SONAR

5.14 OPERATIONAL DATA

TABLE 8 NEW COMMERCIAL SHIP DELIVERIES, BY TYPE, 2017-2020

6 INDUSTRY TRENDS (Page No. - 81)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 27 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

6.3.1 DIVER DETECTION SONAR SYSTEMS

6.3.2 SYNTHETIC APERTURE SONAR

6.3.3 SURVEILLANCE NETWORK SONAR

6.3.4 TWIN INVERTED PULSE SONAR (TWIPS)

6.3.5 TORPEDO COUNTERMEASURE SYSTEM

6.3.6 CHIRP TECHNOLOGY

6.3.7 DUAL-AXIS SONAR (DAS)

6.4 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 9 IMPORTANT INNOVATIONS AND PATENT REGISTRATIONS, 2012-2021

6.5 IMPACT OF MEGATREND

6.5.1 USE OF AI IN DEFENCE

6.5.2 CONSTANT INNOVATION IN DEFENSE SECTOR

7 SONAR SYSTEMS MARKET, BY PLATFORM (Page No. - 85)

7.1 INTRODUCTION

FIGURE 28 UNMANNED UNDERWATER VEHICLES (UUVS) EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 10 SONAR SYSTEMS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 11 SONAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.2 COMMERCIAL VESSELS

FIGURE 29 SONAR SYSTEMS USED IN BULK CARRIERS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 12 SONAR SYSTEMS IN COMMERCIAL VESSELS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 13 SONAR SYSTEMS IN COMMERCIAL VESSELS MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.2.1 BULK CARRIERS

7.2.2 TANKERS

7.2.3 PASSENGER CRUISE

7.2.4 DRY CARGO

7.2.4.1 Containers

7.2.4.2 General cargo ships

7.2.4.3 Dredgers

7.3 DEFENSE VESSELS

FIGURE 30 SONAR SYSTEMS USED IN DESTROYERS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 14 SONAR SYSTEMS IN DEFENSE VESSELS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 15 SONAR SYSTEMS IN DEFENSE VESSELS MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.3.1 AIRCRAFT CARRIERS

7.3.2 AMPHIBIOUS SHIPS

7.3.3 DESTROYERS

7.3.4 FRIGATES

7.3.5 SUBMARINES

7.3.6 CORVETTES

7.3.7 OFFSHORE PATROL VESSELS

7.4 UNMANNED UNDERWATER VEHICLES (UUV)

FIGURE 31 SONAR SYSTEMS USED IN ROVS EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 16 SONAR SYSTEMS IN UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 17 SONAR SYSTEMS IN UNMANNED UNDERWATER VEHICLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.4.1 REMOTELY OPERATED VEHICLES

7.4.2 AUTONOMOUS UNDERWATER VEHICLES

7.5 AIRCRAFT

FIGURE 32 ROTARY WING SEGMENT EXPECTED TO LEAD MARKET FOR SONAR SYSTEMS IN AIRCRAFT FROM 2021 TO 2026

TABLE 18 SONAR SYSTEMS IN AIRCRAFT MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 19 SONAR SYSTEMS IN AIRCRAFT MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.5.1 FIXED-WING AIRCRAFT

7.5.2 ROTARY-WING AIRCRAFT

7.6 PORTS

7.6.1 SIDE SCAN SONAR SYSTEMS INSTALLED ON PORTS USED FOR OBJECT AND DIVER DETECTION

8 SONAR SYSTEMS MARKET, BY APPLICATION (Page No. - 94)

8.1 INTRODUCTION

FIGURE 33 MINE DETECTION & COUNTERMEASURE SYSTEMS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 20 BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 21 BY APPLICATION, 2021–2026 (USD MILLION)

8.2 ANTI-SUBMARINE WARFARE

8.2.1 ANTI-SUBMARINE WARFARE APPLICATIONS INCLUDE DETECTING, CLASSIFYING, LOCATING, AND TRACKING TARGET SUBMARINES

8.3 PORT SECURITY

8.3.1 USE OF SONAR SYSTEMS IN PORT SECURITY TO CHECK UNLAWFUL ACTIVITIES

8.4 MINE DETECTION & COUNTERMEASURE SYSTEMS

8.4.1 MINE DETECTION & COUNTERMEASURE SYSTEMS EXPECTED TO GROW AT HIGHEST RATE DUE TO PROFOUND IMPACT ON MILITARY OPERATIONS

8.5 SEARCH & RESCUE

8.5.1 SONAR SYSTEMS IN SEARCH & RESCUE OPERATIONS TO SAVE TIME AND ENABLE FUNCTIONING IN POOR VISIBILITY

8.6 NAVIGATION

8.6.1 COLLISION AVOIDANCE APPLICATION TO DRIVE GROWTH OF NAVIGATION SONAR SYSTEMS

8.7 OTHERS

8.7.1 HYDROGRAPHIC SURVEY

8.7.2 FISHING

8.7.3 DIVER DETECTION

8.7.4 SEABED TERRAIN INVESTIGATION

8.7.5 SCIENTIFIC

9 SONAR SYSTEMS MARKET, BY INSTALLATION (Page No. - 100)

9.1 INTRODUCTION

FIGURE 34 MARKET FOR DEPLOYABLE SONAR SYSTEMS PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 22 BY INSTALLATION, 2018–2020 (USD MILLION)

TABLE 23 BY INSTALLATION, 2021–2026 (USD MILLION)

9.2 DEPLOYABLE SONAR

9.2.1 ANTI-SUBMARINE WARFARE APPLICATIONS TO DRIVE SEGMENT

9.3 FIXED SONAR

9.3.1 HULL-MOUNTED SONAR TO LEAD MARKET FOR FIXED SONAR SYSTEMS

10 SONAR SYSTEMS MARKET, BY TECHNOLOGY (Page No. - 103)

10.1 INTRODUCTION

FIGURE 35 MULTISTATIC SONAR SYSTEM EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 24 BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 25 BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.2 ACTIVE SONAR

10.2.1 ACTIVE SONAR MARKET DRIVEN BY LARGE NEED IN MOST SURFACE MARINE VESSELS

10.3 PASSIVE SONAR

10.3.1 MARKET FOR PASSIVE SONAR DRIVEN BY USE IN SUBMARINES

10.4 MULTISTATIC SONAR

10.4.1 CAPABILITY TO WORK WITH HIGH PRECISION DRIVES THIS SEGMENT

11 SONAR SYSTEMS MARKET, BY PRODUCT (Page No. - 106)

11.1 INTRODUCTION

FIGURE 36 HULL-MOUNTED SEGMENT EXPECTED TO GROW AT HIGHEST DURING FORECAST PERIOD

TABLE 26 BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 27 BY PRODUCT, 2021–2026 (USD MILLION)

11.2 HULL-MOUNTED SONAR

11.2.1 RETROFITTING OF SURFACE VESSELS TO DRIVE MARKET FOR HULL-MOUNTED SONAR SYSTEMS

11.2.2 FORWARD-LOOKING SONAR

11.2.3 OMNIDIRECTIONAL SONAR

11.2.4 ECHOSOUNDERS

11.3 STERN-MOUNTED SONAR

11.3.1 APPLICATIONS LIKE DIVER AND MINE DETECTION EXPECTED TO INCREASE DEMAND FOR STERN-MOUNTED SONAR SYSTEMS

11.3.2 VARIABLE DEPTH SONAR

11.3.3 TOWED ARRAY SONAR

11.4 DIPPING SONAR

11.4.1 INCREASING NEED FOR SUBMARINE DETECTION TO DRIVE THIS SEGMENT

11.5 SONOBUOY

11.5.1 DEVELOPMENT IN ANTI-SUBMARINE WARFARE RESPONSIBLE FOR GROWTH OF SONOBUOYS

12 SONAR SYSTEMS MARKET, BY SOLUTION (Page No. - 110)

12.1 INTRODUCTION

FIGURE 37 3D SONAR SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 28 BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 29 BY SOLUTION, 2021–2026 (USD MILLION)

12.2 2D SONAR

12.2.1 REAL-TIME DETECTION OF MOVING TARGETS TO BOOST SEGMENT

12.3 3D SONAR

12.3.1 ABILITY TO WORK IN ZERO VISIBILITY TO INCREASE DEMAND FOR 2D SONAR SYSTEMS

13 SONAR SYSTEMS MARKET, BY FREQUENCY (Page No. - 113)

13.1 INTRODUCTION

FIGURE 38 ULTRASONIC SEGMENT EXPECTED TO LEAD SONAR SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 30 BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 31 BY FREQUENCY, 2021–2026 (USD MILLION)

13.2 ULTRASONIC

13.2.1 LONG RANGE DETECTION OF TARGETS WITH VARIED SURFACE PROPERTIES DRIVE THIS SEGMENT

13.3 INFRASONIC

13.3.1 RETROFITTING AND LINE FITTING OF INFRASONIC SONAR SYSTEMS IN SUBMARINES TO BOOST MARKET

14 SONAR SYSTEMS MARKET, BY END USER (Page No. - 116)

14.1 INTRODUCTION

FIGURE 39 RETROFIT SEGMENT TO LEAD MARKET FOR SONAR SYSTEMS DURING FORECAST PERIOD

TABLE 32 SONAR SYSTEMS MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 33 SONAR SYSTEMS MARKET, BY END USER, 2021–2026 (USD MILLION)

14.2 LINE FIT

14.2.1 INCREASING NUMBER OF DELIVERIES OF NEW MILITARY SHIPS TO AMPLIFY LINE FIT SEGMENT

TABLE 34 DELIVERIES OF NEW MILITARY SHIPS, BY TYPE, 2017-2021

14.3 RETROFIT

14.3.1 UPGRADATION OF EXISTING SONAR SYSTEMS OF MILITARY VESSELS TO UPLIFT DEMAND FOR RETROFIT SEGMENT

TABLE 35 CLASSIFICATION OF ACTIVE MILITARY SHIPS, BY COUNTRY

15 REGIONAL ANALYSIS (Page No. - 120)

15.1 INTRODUCTION

FIGURE 40 ASIA PACIFIC ESTIMATED TO HOLD LARGEST SHARE OF SONAR SYSTEMS MARKET IN 2021

15.2 IMPACT OF COVID-19

FIGURE 41 IMPACT OF COVID-19 ON SONAR SYSTEMS MARKET

TABLE 36 SONAR SYSTEMS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 37 SONAR SYSTEMS MARKET, BY REGION, 2021–2026 (USD MILLION)

15.3 NORTH AMERICA

15.3.1 COVID-19 IMPACT ON NORTH AMERICA

15.3.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 42 NORTH AMERICA: SNAPSHOT

TABLE 38 NORTH AMERICA: BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 39 NORTH AMERICA: BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 41 NORTH AMERICA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 43 NORTH AMERICA: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: BY INSTALLATION, 2018–2020 (USD MILLION)

TABLE 45 NORTH AMERICA: BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 47 NORTH AMERICA: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 49 NORTH AMERICA: BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 51 NORTH AMERICA: BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: BY END USER, 2018–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: BY END USER, 2021–2026 (USD MILLION)

15.3.3 US

15.3.3.1 Increased naval shipbuilding to push US market for sonar systems

TABLE 56 US: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 57 US: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 58 US: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 59 US: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 60 US: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 61 US: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 62 US: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 63 US: BY PRODUCT, 2021–2026 (USD MILLION)

15.3.4 CANADA

15.3.4.1 Growth of marine industry to drive market

TABLE 64 CANADA: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 65 CANADA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 66 CANADA: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 67 CANADA: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 68 CANADA: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 69 CANADA: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 70 CANADA: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 71 CANADA: BY PRODUCT, 2021–2026 (USD MILLION)

15.4 EUROPE

15.4.1 COVID-19 IMPACT ON EUROPE

15.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 43 EUROPE SONAR SYSTEMS MARKET SNAPSHOT

TABLE 72 EUROPE: SONAR SYSTEMS MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 73 EUROPE: SONAR SYSTEMS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 74 EUROPE: SONAR SYSTEMS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 75 EUROPE: SONAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 76 EUROPE: SONAR SYSTEMS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 77 EUROPE: SONAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 78 EUROPE: SONAR SYSTEMS MARKET, BY INSTALLATION, 2018–2020 (USD MILLION)

TABLE 79 EUROPE: SONAR SYSTEMS MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 80 EUROPE: SONAR SYSTEMS MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 81 EUROPE: SONAR SYSTEMS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 82 EUROPE: SONAR SYSTEMS MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 83 EUROPE: SONAR SYSTEMS MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 84 EUROPE: SONAR SYSTEMS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 85 EUROPE: SONAR SYSTEMS MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 86 EUROPE: SONAR SYSTEMS MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 87 EUROPE: SONAR SYSTEMS MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 88 EUROPE: SONAR SYSTEMS MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 89 EUROPE: SONAR SYSTEMS MARKET, BY END USER, 2021–2026 (USD MILLION)

15.4.3 GERMANY

15.4.3.1 Upgradation of ship equipment to raise demand for sonar systems in Germany

TABLE 90 GERMANY: SONAR SYSTEMS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 91 GERMANY: SONAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 92 GERMANY: SONAR SYSTEMS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 93 GERMANY: SONAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 94 GERMANY: SONAR SYSTEMS MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 95 GERMANY: SONAR SYSTEMS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 96 GERMANY: SONAR SYSTEMS MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 97 GERMANY: SONAR SYSTEMS MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

15.4.4 FRANCE

15.4.4.1 Shipbuilding and naval vessel sonar replacement industries driving market growth

TABLE 98 FRANCE: SONAR SYSTEMS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 99 FRANCE: SONAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 100 FRANCE: SONAR SYSTEMS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 101 FRANCE: SONAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 102 FRANCE: SONAR SYSTEMS MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 103 FRANCE: SONAR SYSTEMS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 104 FRANCE: SONAR SYSTEMS MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 105 FRANCE: SONAR SYSTEMS MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

15.4.5 ITALY

15.4.5.1 Retrofitting of autonomous ship technologies in vessels to help grow market in Italy

TABLE 106 ITALY: SONAR SYSTEMS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 107 ITALY: SONAR SYSTEMS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 108 ITALY: SONAR SYSTEMS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 109 ITALY: SONAR SYSTEMS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 110 ITALY: SONAR SYSTEMS MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 111 ITALY: SONAR SYSTEMS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 112 ITALY: SONAR SYSTEMS MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 113 ITALY: SONAR SYSTEMS MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

15.4.6 UK

15.4.6.1 Increasing investments to upgrade marine systems expected to drive market in UK

TABLE 114 UK: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 115 UK: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 116 UK: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 117 UK: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 118 UK: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 119 UK: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 120 UK: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 121 UK: BY PRODUCT, 2021–2026 (USD MILLION)

15.4.7 RUSSIA

15.4.7.1 Introduction of advanced threat detection and identification technologies in naval ships to boost demand for sonar systems in Russia

TABLE 122 RUSSIA: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 123 RUSSIA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 124 RUSSIA: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 125 RUSSIA: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 126 RUSSIA: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 127 RUSSIA: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 128 RUSSIA: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 129 RUSSIA: BY PRODUCT, 2021–2026 (USD MILLION)

15.4.8 REST OF EUROPE

15.4.8.1 Increasing investment in maintenance of autonomous ship projects to fuel growth of market in Rest of Europe

TABLE 130 REST OF EUROPE: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 131 REST OF EUROPE: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 132 REST OF EUROPE: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 133 REST OF EUROPE: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 134 REST OF EUROPE: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 135 REST OF EUROPE: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 136 REST OF EUROPE: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 137 REST OF EUROPE: BY PRODUCT, 2021–2026 (USD MILLION)

15.5 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: SNAPSHOT

15.5.1 COVID-19 IMPACT ON ASIA PACIFIC

15.5.2 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 138 ASIA PACIFIC: BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 139 ASIA PACIFIC: BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 140 ASIA PACIFIC: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 141 ASIA PACIFIC: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 142 ASIA PACIFIC: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 143 ASIA PACIFIC: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: BY INSTALLATION, 2018–2020 (USD MILLION)

TABLE 145 ASIA PACIFIC: BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 146 ASIA PACIFIC: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 147 ASIA PACIFIC: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 148 ASIA PACIFIC: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 149 ASIA PACIFIC: BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 150 ASIA PACIFIC: BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 151 ASIA PACIFIC: BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 152 ASIA PACIFIC: BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 153 ASIA PACIFIC: BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 154 ASIA PACIFIC: BY END USER, 2018–2020 (USD MILLION)

TABLE 155 ASIA PACIFIC: BY END USER, 2021–2026 (USD MILLION)

15.5.3 CHINA

15.5.3.1 Dredging activities in oil & gas to lead to growth of hydrographic sonar industry in China.

TABLE 156 CHINA: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 157 CHINA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 158 CHINA: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 159 CHINA: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 160 CHINA: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 161 CHINA: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 162 CHINA: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 163 CHINA: BY PRODUCT, 2021–2026 (USD MILLION)

15.5.4 INDIA

15.5.4.1 Investments in naval shipbuilding capacity to help grow sonar system market in India

TABLE 164 INDIA: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 165 INDIA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 166 INDIA: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 167 INDIA: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 168 INDIA: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 169 INDIA: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 170 INDIA: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 171 INDIA: BY PRODUCT, 2021–2026 (USD MILLION)

15.5.5 JAPAN

15.5.5.1 Increasing defense expenditure to boost sonar system market in Japan

TABLE 172 JAPAN: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 173 JAPAN: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 174 JAPAN: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 175 JAPAN: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 176 JAPAN: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 177 JAPAN: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 178 JAPAN: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 179 JAPAN: BY PRODUCT, 2021–2026 (USD MILLION)

15.5.6 SOUTH KOREA

15.5.6.1 Requirement of sonar systems in commercial vessels to drive sonar system market in South Korea

TABLE 180 SOUTH KOREA: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 181 SOUTH KOREA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 182 SOUTH KOREA: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 183 SOUTH KOREA: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 184 SOUTH KOREA: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 185 SOUTH KOREA: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 186 SOUTH KOREA: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 187 SOUTH KOREA: BY PRODUCT, 2021–2026 (USD MILLION)

15.5.7 AUSTRALIA

15.5.7.1 Constant upgradation of sonar systems used by Royal Australian Navy ships expected to drive market

TABLE 188 AUSTRALIA: BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 189 AUSTRALIA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 190 AUSTRALIA: BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 191 AUSTRALIA: BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 192 AUSTRALIA: BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 193 AUSTRALIA: BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 194 AUSTRALIA: BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 195 AUSTRALIA: BY PRODUCT, 2021–2026 (USD MILLION)

15.5.8 REST OF ASIA PACIFIC

15.5.8.1 Retrofitting of sonar systems in naval ships in Taiwan, Pakistan, Malaysia, Philippines to drive market in this region

TABLE 196 REST OF ASIA PACIFIC: SONAR SYSTEM MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 197 REST OF ASIA PACIFIC: SONAR SYSTEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 198 REST OF ASIA PACIFIC: SONAR SYSTEM MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 199 REST OF ASIA PACIFIC: SONAR SYSTEM MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 200 REST OF ASIA PACIFIC: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 201 REST OF ASIA PACIFIC: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 202 REST OF ASIA PACIFIC: SONAR SYSTEM MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 203 REST OF ASIA PACIFIC: SONAR SYSTEM MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

15.6 MIDDLE EAST

15.6.1 COVID-19 IMPACT ON MIDDLE EAST

FIGURE 45 MIDDLE EAST: SONAR SYSTEM MARKET SNAPSHOT

15.6.2 PESTLE ANALYSIS: MIDDLE EAST

TABLE 204 MIDDLE EAST: SONAR SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 205 MIDDLE EAST:SONAR SYSTEM MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 206 MIDDLE EAST: SONAR SYSTEM MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 207 MIDDLE EAST: SONAR SYSTEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 208 MIDDLE EAST: SONAR SYSTEM MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 209 MIDDLE EAST: SONAR SYSTEM MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 210 MIDDLE EAST: SONAR SYSTEM MARKET, BY INSTALLATION, 2018–2020 (USD MILLION)

TABLE 211 MIDDLE EAST: SONAR SYSTEM MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 212 MIDDLE EAST: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 213 MIDDLE EAST: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 214 MIDDLE EAST: SONAR SYSTEM MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 215 MIDDLE EAST: SONAR SYSTEM MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 216 MIDDLE EAST: SONAR SYSTEM MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 217 MIDDLE EAST: SONAR SYSTEM MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 218 MIDDLE EAST: SONAR SYSTEM MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 219 MIDDLE EAST: SONAR SYSTEM MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 220 MIDDLE EAST: SONAR SYSTEM MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 221 MIDDLE EAST: SONAR SYSTEM MARKET, BY END USER, 2021–2026 (USD MILLION)

15.6.3 UAE

15.6.3.1 Instability and insurgence across all border and neighboring countries drive market

TABLE 222 UAE: SONAR SYSTEM MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 223 UAE: SONAR SYSTEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 224 UAE: SONAR SYSTEM MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 225 UAE: SONAR SYSTEM MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 226 UAE: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 227 UAE: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 228 UAE: SONAR SYSTEM MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 229 UAE: SONAR SYSTEM MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

15.6.4 SAUDI ARABIA

15.6.4.1 Ongoing military modernization to fuel market growth

TABLE 230 SAUDI ARABIA: SONAR SYSTEM MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 231 SAUDI ARABIA: SONAR SYSTEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 232 SAUDI ARABIA: SONAR SYSTEM MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 233 SAUDI ARABIA: SONAR SYSTEM MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 234 SAUDI ARABIA: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 235 SAUDI ARABIA: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 236 SAUDI ARABIA: SONAR SYSTEM MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 237 SAUDI ARABIA: SONAR SYSTEM MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

15.6.5 ISRAEL

15.6.5.1 Focus on strengthening security in border areas drive market

TABLE 238 ISRAEL: SONAR SYSTEM MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 239 ISRAEL: SONAR SYSTEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 240 ISRAEL: SONAR SYSTEM MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 241 ISRAEL: SONAR SYSTEM MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 242 ISRAEL: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 243 ISRAEL: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 244 ISRAEL: SONAR SYSTEM MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 245 ISRAEL: SONAR SYSTEM MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

15.6.6 REST OF MIDDLE EAST

TABLE 246 REST OF MIDDLE EAST: SONAR SYSTEM MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 247 REST OF MIDDLE EAST: SONAR SYSTEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 248 REST OF MIDDLE EAST: SONAR SYSTEM MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 249 REST OF MIDDLE EAST: SONAR SYSTEM MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 250 REST OF MIDDLE EAST: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 251 REST OF MIDDLE EAST: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 252 REST OF MIDDLE EAST: SONAR SYSTEM MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 253 REST OF MIDDLE EAST: SONAR SYSTEM MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

15.7 REST OF THE WORLD

15.7.1 COVID-19 IMPACT ON REST OF THE WORLD

FIGURE 46 REST OF THE WORLD: SONAR SYSTEM MARKET SNAPSHOT

15.7.2 PESTLE ANALYSIS: REST OF THE WORLD

TABLE 254 REST OF THE WORLD: SONAR SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 255 REST OF THE WORLD: SONAR SYSTEM MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 256 REST OF THE WORLD: SONAR SYSTEM MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 257 REST OF THE WORLD: SONAR SYSTEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 258 REST OF THE WORLD: SONAR SYSTEM MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 259 REST OF THE WORLD: SONAR SYSTEM MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 260 REST OF THE WORLD: SONAR SYSTEM MARKET, BY INSTALLATION, 2018–2020 (USD MILLION)

TABLE 261 REST OF THE WORLD: SONAR SYSTEM MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 262 REST OF THE WORLD: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 263 REST OF THE WORLD: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 264 REST OF THE WORLD: SONAR SYSTEM MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 265 REST OF THE WORLD: SONAR SYSTEM MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 266 REST OF THE WORLD: SONAR SYSTEM MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 267 REST OF THE WORLD: SONAR SYSTEM MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 268 REST OF THE WORLD: SONAR SYSTEM MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 269 REST OF THE WORLD: SONAR SYSTEM MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 270 REST OF THE WORLD: SONAR SYSTEM MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 271 REST OF THE WORLD: SONAR SYSTEM MARKET, BY END USER, 2021–2026 (USD MILLION)

15.7.3 LATIN AMERICA

15.7.3.1 Focus on strengthening combat capabilities to boost market

TABLE 272 LATIN AMERICA: SONAR SYSTEM MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 273 LATIN AMERICA: SONAR SYSTEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 274 LATIN AMERICA: SONAR SYSTEM MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 275 LATIN AMERICA: SONAR SYSTEM MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 276 LATIN AMERICA: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 277 LATIN AMERICA: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 278 LATIN AMERICA: SONAR SYSTEM MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 279 LATIN AMERICA: SONAR SYSTEM MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

15.7.4 AFRICA

15.7.4.1 Focus on securing borders and improving military capabilities to drive market

TABLE 280 AFRICA: SONAR SYSTEM MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 281 AFRICA: SONAR SYSTEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 282 AFRICA: SONAR SYSTEM MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 283 AFRICA: SONAR SYSTEM MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 284 AFRICA: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 285 AFRICA: SONAR SYSTEM MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 286 AFRICA: SONAR SYSTEM MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 287 AFRICA: SONAR SYSTEM MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 208)

16.1 INTRODUCTION

TABLE 288 KEY DEVELOPMENTS IN SONAR SYSTEM MARKET BETWEEN 2018 AND 2021

16.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2020

TABLE 289 DEGREE OF COMPETITION

FIGURE 47 COLLECTIVE REVENUE SHARE OF TOP PLAYERS

16.3 RANK ANALYSIS, 2020

FIGURE 48 REVENUE GENERATED BY MAJOR PLAYERS IN SONAR SYSTEM MARKET

TABLE 290 COMPANY REGION FOOTPRINT

TABLE 291 COMPANY PRODUCT FOOTPRINT

TABLE 292 COMPANY APPLICATION FOOTPRINT

16.4 COMPETITIVE EVALUATION QUADRANT

16.4.1 STAR

16.4.2 PERVASIVE

16.4.3 EMERGING LEADERS

16.4.4 PARTICIPANTS

FIGURE 49 SONAR SYSTEM MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

16.5 STARTUP EVALUATION QUADRANT

16.5.1 PROGRESSIVE COMPANIES

16.5.2 RESPONSIVE COMPANIES

16.5.3 STARTING BLOCKS

16.5.4 DYNAMIC COMPANIES

FIGURE 50 SONAR SYSTEM MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

16.6 COMPETITIVE SCENARIO

16.6.1 NEW PRODUCT LAUNCHES

TABLE 293 NEW PRODUCT LAUNCHES, JANUARY 2018–OCTOBER 2021

16.6.2 DEALS

TABLE 294 DEALS, JANUARY 2018– OCTOBER 2021

17 COMPANY PROFILES (Page No. - 222)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

17.1 INTRODUCTION

17.2 KEY PLAYERS

17.2.1 NORTHROP GRUMMAN CORPORATION

TABLE 295 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 51 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

17.2.2 ASELSAN A.S.

TABLE 296 ASELSAN A.S.: BUSINESS OVERVIEW

FIGURE 52 ASELSAN A.S.: COMPANY SNAPSHOT

17.2.3 FURUNO ELECTRIC CO., LTD

TABLE 297 FURUNO ELECTRIC CO., LTD: BUSINESS OVERVIEW

FIGURE 53 FURUNO ELECTRIC CO., LTD: COMPANY SNAPSHOT

17.2.4 KONGSBERG MARITIME

TABLE 298 KONGSBERG MARITIME: BUSINESS OVERVIEW

FIGURE 54 KONGSBERG MARITIME: COMPANY SNAPSHOT

17.2.5 LOCKHEED MARTIN

TABLE 299 LOCKHEED MARTIN: BUSINESS OVERVIEW

FIGURE 55 LOCKHEED MARTIN: COMPANY SNAPSHOT

17.2.6 JAPAN RADIO COMPANY

TABLE 300 JAPAN RADIO COMPANY: BUSINESS OVERVIEW

FIGURE 56 JAPAN RADIO COMPANY: COMPANY SNAPSHOT

17.2.7 L3HARRIS

TABLE 301 L3HARRIS: BUSINESS OVERVIEW

FIGURE 57 L3HARRIS: COMPANY SNAPSHOT

17.2.8 RAYTHEON TECHNOLOGIES

TABLE 302 RAYTHEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 58 RAYTHEON TECHNOLOGIES: COMPANY SNAPSHOT

17.2.9 TELEDYNE TECHNOLOGIES

TABLE 303 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 59 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

17.2.10 THALES GROUP

TABLE 304 THALES GROUP: BUSINESS OVERVIEW

FIGURE 60 THALES GROUP: COMPANY SNAPSHOT

TABLE 305 THALES GROUP: DEALS

17.2.11 ULTRA ELECTRONICS

TABLE 306 ULTRA ELECTRONICS.: BUSINESS OVERVIEW

FIGURE 61 ULTRA ELECTRONICS.: COMPANY SNAPSHOT

17.2.12 RAYMARINE

TABLE 307 RAYMARINE: BUSINESS OVERVIEW

FIGURE 62 RAYMARINE: COMPANY SNAPSHOT

17.2.13 CODA OCTOPUS PRODUCTS LTD.

TABLE 308 CODA OCTOPUS PRODUCTS LTD.: BUSINESS OVERVIEW

FIGURE 63 CODA OCTOPUS PRODUCTS LTD.: COMPANY SNAPSHOT

17.2.14 HANWHA SYSTEMS

TABLE 309 HANWHA SYSTEMS: BUSINESS OVERVIEW

FIGURE 64 HANWHA SYSTEMS: COMPANY SNAPSHOT

17.2.15 GENERAL DYNAMICS

TABLE 310 GENERAL DYNAMICS: BUSINESS OVERVIEW

FIGURE 65 GENERAL DYNAMICS: COMPANY SNAPSHOT

17.3 OTHER KEY PLAYERS

17.3.1 GEOSPECTRUM TECHNOLOGIES

TABLE 311 GEOSPECTRUM TECHNOLOGIES: BUSINESS OVERVIEW

17.3.2 SONARDYNE

TABLE 312 SONARDYNE.: BUSINESS OVERVIEW

17.3.3 ATLAS ELEKTRONIK

TABLE 313 ATLAS ELEKTRONIK.: BUSINESS OVERVIEW

17.3.4 NAVICO

TABLE 314 NAVICO.: BUSINESS OVERVIEW

17.3.5 DSIT SOLUTIONS LTD.

TABLE 315 DSIT SOLUTIONS LTD.: BUSINESS OVERVIEW

17.3.6 EDGETECH

TABLE 316 EDGETECH: BUSINESS OVERVIEW

17.3.7 TRITECH

TABLE 317 TRITECH: BUSINESS OVERVIEW

17.3.8 NORBIT

TABLE 318 NORBIT: BUSINESS OVERVIEW

17.3.9 DEFENCE RESEARCH & DEVELOPMENT ORGANIZATION

TABLE 319 DEFENCE RESEARCH & DEVELOPMENT ORGANIZATION: BUSINESS OVERVIEW

17.3.10 BHARAT ELECTRONICS LIMITED

TABLE 320 BHARAT ELECTRONICS LIMITED: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

18 APPENDIX (Page No. - 275)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATION

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

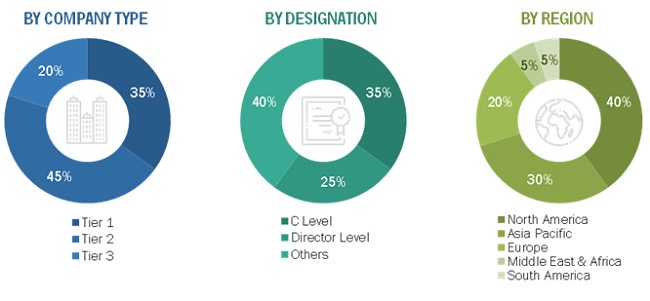

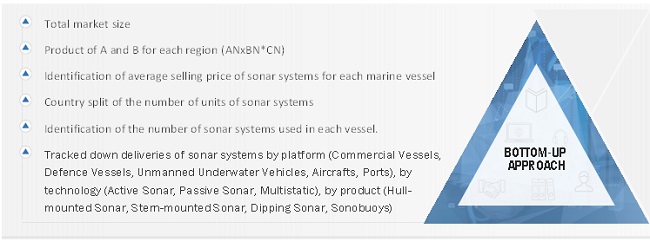

The study involved four major activities in estimating the current size of the Sonar systems market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from fiber optic cables vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using fiber optic cables vendors were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of missile seekers vendors and future outlook of their business which will affect the overall market.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

Sonar Systems OEMs |

Others |

|

Kongsberg Maritime |

Raytheon Technologies |

|

Hanwha Systems |

General Dynamics |

|

Aselsan AS |

Lockheed Martin |

|

Sonardyne |

L3Harris |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Sonar systems market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Sonar systems market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Sonar systems market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the Sonar systems market.

Potential Benefits and Growth Opportunities of Underwater Sensing and Communication Applications in the Sonar Systems Market

Underwater sensing and communication applications like sonar devices, side scan sonar, and sonar radar are essential components of the sonar systems market. Sonar systems are used for underwater sensing and communication and are critical to marine exploration, underwater security and surveillance, underwater communication, and navigation. The increasing demand for underwater sensing and communication applications is expected to drive the growth of the sonar systems market.

The side-scan sonar is one of the most important applications of sonar systems that is used to produce images of the seafloor. The images are created by analyzing the sonar signal reflected from the seafloor. Sonar radar, on the other hand, is used to detect underwater objects, including submarines, ships, and other vessels. The technology works by emitting sound waves and analyzing the echo that is reflected back from underwater objects. These technologies are widely used in various underwater applications, including military and defense, oil and gas exploration, and marine research.

Advancements in technology and the increasing demand for underwater sensing and communication applications have resulted in the development of new and innovative sonar systems. For instance, the integration of artificial intelligence and machine learning technologies in sonar systems has enabled the development of highly efficient and accurate sonar systems. Furthermore, the development of compact and portable sonar systems has enabled underwater communication and navigation in areas where traditional communication methods are not effective. These advancements are expected to drive the growth of the sonar systems market in the future.

Report Objectives

- To define, describe, segment, and forecast the size of the Sonar systems market based on platform, application, installation, end user, solution, dimention, product, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Middle east, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the fiber optic cabl es market for military & aerospace

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets1, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customization

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific requirements. The following customization options are available for the report:

Country-level analysis

- Market sizing and forecasting for other countries of the Rest of the World

- Additional company profiles (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sonar Systems Market

Hello, I would like to know who is the main actor is, in the manufacturing of shallow water sonars for ASW. Kongsberg, for example? Best regards, M.LIHI

Hello, I would like to know who is the main actor is, in the manufacturing of shallow water sonars for ASW. Kongsberg, for example? Best regards, M.LIHI

I am interested in the market analysis of sonar system product by DDS. May I ask the price and terms for that? Thanks. Regards.