Greenhouse Film Market by Resin Type (LDPE, LLDPE, EVA), Thickness (80 to 150 Microns, 150 to 200 Microns, More than 200 Microns), Width (4.5M, 5.5 M, 7M, 9M) and Region (APAC, Europe, North America, South America, MEA) - Global Forecast to 2026

Updated on : September 02, 2025

Greenhouse Film Market

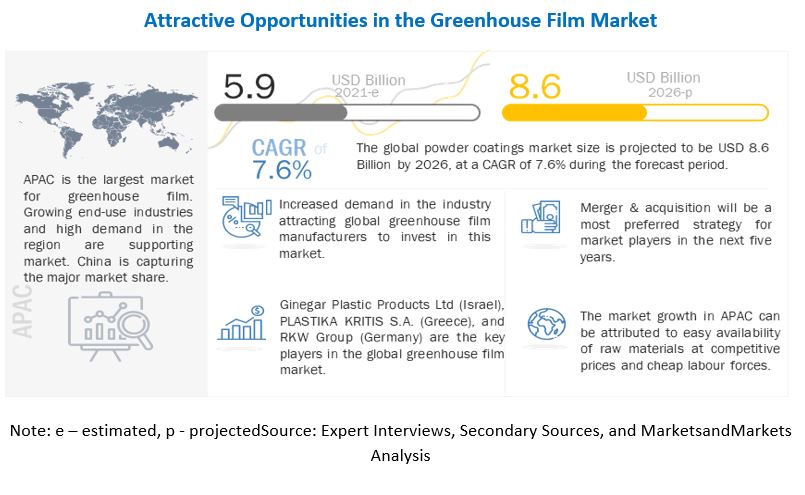

The global greenhouse film market was valued at USD 5.9 billion in 2021 and is projected to reach USD 8.6 billion by 2026, growing at 7.6% cagr from 2021 to 2026. The market is witnessing high growth on account of increased demand for greenhouse-cultivated crops and development in areas for greenhouse-protected cultivation.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Greenhouse film Market

The outbreak of COVID-19 has disrupted the production of raw materials used in agriculture textiles manufacturing. Asian countries such as India, China, Japan, Singapore, and Thailand are the hubs for agriculture textiles manufacturing and are major suppliers of these raw materials. The outbreak of the novel coronavirus in Asia Pacific has affected the supply of these raw materials. For instance, China is one of the major suppliers of resins and exports a million tons of resins in the global market. The break in the supplies of raw materials has reduced the production of greenhouse film product.

Greenhouse Film Market Dynamics

Drivers: Increase in the area for greenhouse-protected cultivation

The world population is estimated to reach approximately 8.5 billion by 2030. The demand for food is expected to increase, especially in Eastern Europe, Central Asia, Latin America, and Asia, owing to the rapid population increase in these regions. The rising population leads to increased demand for food, which exerts pressure on agricultural productivity. This sharp rise in demand for agricultural products can be achieved by controlled agriculture, adopting technologies, such as greenhouses. Greenhouse films help improve crop quality and agricultural productivity by minimizing soil erosion, providing nutrients, increasing soil temperature, suppressing the growth of weeds, and others. Therefore, the need to increase agricultural production plays an essential role in driving the demand for greenhouse films.

Restraints: High cost of installation

Greenhouses are commonly used to cultivate horticulture crops during seasons when the climatic conditions are unfavorable for plant growth. The high cost of installation of greenhouse films is restricting their use, primarily in developing countries. For instance, glass is among the traditional greenhouse covering materials, which requires expensive and durable structural systems. Although the market for greenhouse films has significant potential in developing countries, the high cost of greenhouse films lowers their affordability. Therefore, high investment in greenhouses is a restraining factor for market growth, especially in developing countries.

Opportunities: Advancements in technology

As the area under protected cultivation increases, the focus is now shifted to R&D activities to produce different types of greenhouse films by adding different properties, such as UV ray protection, NIR blocking, fluorescent, and ultra-thermic. UV-blocking films protect plants from diseases and pests. These films block the transmission of UV rays in the interior of the greenhouse, reducing the growth of pests and diseases. NIR blocking films block radiation and stimulate plant growth. Fluorescent films allow only the spectrum radiation of 300 nm–700 nm to enter inside the greenhouse. Thus, advancements in technologies, such as soil fumigation, drip farming, and providing ventilation to crops, are expected to bring potential opportunities for the market.

Challenges: Lack of awareness about the benefits of greenhouses

The demand for greenhouse farming in most regions is very less as people lack awareness about its benefits. Increasing awareness among farmers should be initiated by government institutions and other related authorities to utilize the benefits of greenhouse farming.

LDPE resin segment accounted for the largest share of the greenhouse film market in 2020.

LDPE resin-based greenhouse films are used extensively across all regions. The vital features of LDPE that make it suitable for use in greenhouse films are low cost, high thickness, optical properties, and high resistance to sunlight and the external environment. The LDPE type offers advantages, such as high clarity and ease of use, making it suitable for agricultural applications. Its low cost drives its demand in emerging markets. However, despite the low-cost advantage of LDPE, it can get easily damaged in extreme climatic conditions, decreasing the lifetime of greenhouse films.

150 to 200 Microns thickness segment is forecasted to be the fastest-growing segment during the forecast period.

150 to 200 microns is projected to be the fastest-growing segment during the forecast period. 150 to 200 microns thick greenhouse films are preferred in the European countries. They have benefits, such as UV stability for resistance to solar aging, excellent light transmission, excellent mechanical properties for harsh weather conditions, and additives to ensure good light transfusion.

APAC is the fastest-growing greenhouse film market.

The rising population in the APAC region is the key factor driving the market for greenhouse films. It has increased the demand for food, thereby exerting pressure on agricultural yield. China is the leading producer and consumer of greenhouse films in the region. India is an agriculture-based economy. In Japan, the demand for vegetables and flowers is being meet by crops cultivated in the greenhouse.

The spread of the coronavirus started in China in early January 2020. Within a small period, the spread in other Asian countries such as Japan, South Korea, and Thailand, resulted in the pandemic situation, with rapid positive cases and death. This situation led national governments across Asia Pacific to announce lockdowns, leading to a decrease in traffic, construction & mining activities, manufacturing industries, and so on. Since China is a manufacturing hub globally, the impact of COVID-19 is anticipated to be much higher in the country. Considering the above factors, the greenhouse film market is expected to decline in Asia Pacific in 2020.

To know about the assumptions considered for the study, download the pdf brochure

Greenhouse Film Market Players

Ginegar Plastic Products Ltd (Israel), PLASTIKA KRITIS S.A. (Greece), RKW Group (Germany), Berry Global, Inc (US), and Grupo Armando Alvarez (Spain) are the major players in the greenhouse film market.

Greenhouse Film Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 5.9 billion |

|

Revenue Forecast in 2026 |

USD 8.6 billion |

|

CAGR |

7.6% |

|

Years considered for the study |

2017-2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Resin Type |

|

Regions covered |

Asia Pacific, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players are Ginegar Plastic Products Ltd (Israel), PLASTIKA KRITIS S.A. (Greece), RKW Group (Germany), Berry Global, Inc (US), and Grupo Armando Alvarez (Spain) (Total 20 companies) |

This research report categorizes the greenhouse film market based on resin type, width, thickness, and region.

Greenhouse Film Market by Type:

- LDPE

- LLDPE

- EVA

- Others (PVC and EBA)

Greenhouse Film Market by Width:

- 4.5

- 5.5

- 7

- 9

- Others (9 to 20-meter)

Greenhouse Film Market by Thickness:

- 80 to 150 Micron

- 150 to 200 Micron

- more than 200 Micron

Greenhouse Film Market by Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In June 2017, Ginegar Plastic Products Ltd, produce of PE sheets and nets for a variety of applications in the agriculture sector, announced the acquisition of Flextech, a plastic films manufacturer for agriculture, wind energy, automotive, manufacturing plants, ship-building, and packaging industries, for USD 7.8 million.

- In July 2019, Plastika Kritis developed new EVO AC films. These EVO AC films consist of 8 layers and are based on nanomaterials for the longest-lasting anti-dripping effect. These films are expected to have better performance compared to other films where additives that migrate to their surface and get gradually depleted within 1-2 years.

Frequently Asked Questions (FAQ):

What is the current size of the global greenhouse film market?

The global greenhouse film market is estimated to be USD 5.9 billion in 2021 and is projected to reach USD 8.6 billion by 2026, at a CAGR of 7.6%.

Who are the major players of the greenhouse film market?

Companies such as Ginegar Plastic Products Ltd (Israel), PLASTIKA KRITIS S.A. (Greece), RKW Group (Germany), Berry Global, Inc (US), and Grupo Armando Alvarez (Spain) are the major players in the market.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, and investments & expansions are expected to help the market grow. Several products are being introduced, and investments are made on increasing the production capacity of greenhouse film by manufacturers for different applications. The advancement in technology is expected to increase the penetration of greenhouse film in various end-use industries.

Which resin type has the potential to register the highest market share?

The most frequently used resin type for greenhouse film is LDPE. The vital features of LDPE that make it suitable for use in greenhouse films are low cost, high thickness, optical properties, and high resistance to sunlight and the external environment. The developing economies of India, Brazil, and Russia are expected to be key consumers during the projected period because of the developing consumer goods market in these countries.

What are some of the technological advancements in the market?

Ubiquitous Quantum Dots (UbiQD) Inc., a nanotechnology company based in Los Alamo, has launched a red light emitting window greenhouse film named UbiGro. Researchers have found that greenhouses covered in this film can enhance crop yields by more than 10%. It was observed that late summer sunlight is considered the most potent time of the year for plants because they sense winter coming and grow faster. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 GREENHOUSE FILM MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 GREENHOUSE FILM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Primary data sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 GREENHOUSE FILM MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.4.1 PRICING ASSUMPTIONS

2.5 RISK ANALYSIS ASSESSMENT

2.6 LIMITATIONS

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 1 GREENHOUSE FILM MARKET SNAPSHOT (2021 VS. 2026)

FIGURE 6 LDPE RESIN-BASED GREENHOUSE FILM DOMINATED MARKET IN 2020

FIGURE 7 150 TO 200 MICRONS WAS DOMINATING SEGMENT IN 2020

FIGURE 8 ASIA PACIFIC IS LARGEST AND FASTEST-GROWING MARKET FOR GREENHOUSE FILMS

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN GREENHOUSE FILM MARKET

FIGURE 9 GREENHOUSE FILM MARKET TO WITNESS MODERATE GROWTH BETWEEN 2021 AND 2026

4.2 GREENHOUSE FILM MARKET, BY RESIN TYPE

FIGURE 10 LDPE TO BE LARGEST SEGMENT BETWEEN 2021 AND 2026

4.3 ASIA PACIFIC: GREENHOUSE FILM MARKET, BY RESIN TYPE AND COUNTRY, 2020

FIGURE 11 CHINA AND LDPE SEGMENT ACCOUNTED FOR LARGEST SHARES

4.4 GREENHOUSE FILM MARKET: DEVELOPED VS. EMERGING COUNTRIES

FIGURE 12 GREENHOUSE FILM MARKET TO WITNESS HIGHER GROWTH IN EMERGING COUNTRIES

4.5 GREENHOUSE FILM MARKET: RISING DEMAND FROM ASIA PACIFIC

FIGURE 13 INDIA TO REGISTER HIGHEST CAGR IN ASIA PACIFIC MARKET

4.6 GREENHOUSE FILM MARKET, BY MAJOR COUNTRIES

FIGURE 14 INDIA TO EMERGE AS A LUCRATIVE MARKET BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.1.1 ADVANTAGES AND DISADVANTAGES OF GREENHOUSE FILM

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GREENHOUSE FILM MARKET

5.2.1 DRIVERS

5.2.1.1 Global focus on increasing agricultural output

5.2.1.2 Increase in the area for greenhouse-protected cultivation

5.2.1.3 Increased demand for greenhouse-cultivated crops

5.2.2 RESTRAINTS

5.2.2.1 High cost of installation

5.2.2.2 Adverse effects of plastics on the environment

5.2.2.3 Less tolerance of greenhouse film for adverse climatic conditions

5.2.2.4 Shorter lifespan of greenhouse film than glasshouse and polycarbonate sheets

5.2.3 OPPORTUNITIES

5.2.3.1 Advancements in technology

5.2.3.2 Small and mid-sized greenhouses

5.2.3.3 Increased use of biodegradable film in developed regions

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about the benefits of greenhouses

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS: GREENHOUSE FILM MARKET

5.3.1 INTENSITY OF COMPETITIVE RIVALRY

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 THREAT OF NEW ENTRANTS

5.4 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECAST OF GDP

TABLE 2 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE OF KEY COUNTRIES, 2019–2026

5.5 TECHNOLOGY ANALYSIS

5.5.1 NEW PRODUCT LAUNCHES:

5.5.2 NEW TECHNOLOGIES:

5.6 CASE STUDY ANALYSIS

5.6.1 CHINA AND ISRAEL PARTNERSHIP

5.7 PATENT ANALYSIS

5.7.1 METHODOLOGY

5.7.2 PUBLICATION TRENDS

FIGURE 17 NUMBER OF PATENTS PUBLISHED, 2015–2021

5.7.3 TOP APPLICANTS

FIGURE 18 PATENTS PUBLISHED BY MAJOR PLAYERS, 2015–2021

5.7.4 JURISDICTION

FIGURE 19 PATENTS PUBLISHED BY JURISDICTION, 2015–2021

TABLE 3 RECENT PATENTS BY OWNERS

5.7.5 TRENDS IN GLOBAL AGRICULTURAL INDUSTRY

5.7.5.1 Decreasing arable land

5.7.5.2 Growing production of high-value crops

5.7.5.3 Trends and forecasts for global fisheries and aquaculture industries

5.8 VALUE CHAIN ANALYSIS

FIGURE 20 GREENHOUSE FILM: VALUE CHAIN ANALYSIS

5.9 AVERAGE SELLING PRICE, 2020

5.10 COVID-19 IMPACT

5.10.1 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

5.11 IMPACT OF COVID-19 ON END-USE INDUSTRIES

FIGURE 22 PRE-COVID-19 IMPACT AND POST-COVID-19 IMPACT MARKET SCENARIOS: GREENHOUSE FILM MARKET

5.12 SHIFT IN AGRICULTURE INDUSTRY

5.12.1 AFFECTED AREAS

5.12.2 FUTURE SCOPE AND REFORMS

5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 23 REVENUE SHIFT IN GREENHOUSE FILM MARKET

6 GREENHOUSE FILM MARKET, BY RESIN TYPE (Page No. - 73)

6.1 INTRODUCTION

FIGURE 24 LDPE TO REGISTER HIGHEST MARKET SHARE IN 2020

TABLE 4 GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 5 GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 6 GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 7 GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

6.2 LDPE

6.2.1 LOW COST OF LDPE FILMS DRIVES THEIR DEMAND IN EMERGING MARKETS

TABLE 8 LDPE GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 9 LDPE GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 10 LDPE GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 11 LDPE GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.3 LLDPE

6.3.1 REPLACING CONVENTIONAL LDPE DUE TO ITS LOW PRODUCTION COST AND SUPERIOR PRODUCT PERFORMANCE

TABLE 12 LLDPE GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 13 LLDPE GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 14 LLDPE GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 15 LLDPE GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.4 EVA

6.4.1 FASTEST-GROWING SEGMENT IN MARKET

TABLE 16 EVA GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 EVA GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 18 EVA GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 19 EVA GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.5 OTHERS

TABLE 20 OTHERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 OTHERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 OTHERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 23 OTHERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7 GREENHOUSE FILM MARKET, BY WIDTH (Page No. - 83)

7.1 INTRODUCTION

FIGURE 25 GREENHOUSE FILM WITH A WIDTH OF 9 M TO ACCOUNTED FOR LARGEST SHARE IN 2020

TABLE 24 GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (USD MILLION)

TABLE 25 GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (USD MILLION)

TABLE 26 GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (KILOTON)

TABLE 27 GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (KILOTON)

7.2 4.5 METERS

7.2.1 THESE FILMS ARE WIDELY USED IN ASIA PACIFIC

TABLE 28 4.5 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 4.5 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 4.5 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 31 4.5 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.3 5.5 METERS

7.3.1 DEMAND FOR THESE FILMS IS HIGH DUE TO EASY INSTALLATION AND MAINTENANCE

TABLE 32 5.5 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 5.5 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 34 5.5 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 35 5.5 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.4 7 METERS

7.4.1 HIGH DEMAND IN EUROPE AND NORTH AMERICA

TABLE 36 7 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 7 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 7 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 39 7 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.5 9 METERS

7.5.1 USED IN BIG STRUCTURES FOR PRODUCTION OF TALL CROPS

TABLE 40 9 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 9 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 9 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 43 9 METERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.6 OTHERS

TABLE 44 OTHERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 OTHERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 OTHERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 47 OTHERS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

8 GREENHOUSE FILM MARKET, BY THICKNESS (Page No. - 93)

8.1 INTRODUCTION

FIGURE 26 GREENHOUSE FILM WITH THICKNESS OF 150 TO 200 MICRONS DOMINATED MARKET IN 2020

TABLE 48 GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (USD MILLION)

TABLE 49 GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (USD MILLION)

TABLE 50 GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (KILOTON)

TABLE 51 GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (KILOTON)

8.2 80 TO 150 MICRONS

8.2.1 BUDGET OPTIONS FOR GREENHOUSE APPLICATIONS

TABLE 52 80 TO 150 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 80 TO 150 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 80 TO 150 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 55 80 TO 150 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

8.3 150 TO 200 MICRONS

8.3.1 MOST PREFERRED IN EUROPE

TABLE 56 150 TO 200 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 150 TO 200 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 58 150 TO 200 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 59 150 TO 200 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

8.4 MORE THAN 200 MICRONS

8.4.1 HAVE VERY FEW APPLICATIONS

TABLE 60 MORE THAN 200 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 MORE THAN 200 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 62 MORE THAN 200 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 63 MORE THAN 200 MICRONS: GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

9 GREENHOUSE FILM MARKET, BY REGION (Page No. - 101)

9.1 INTRODUCTION

TABLE 64 GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 66 GREENHOUSE FILM MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 67 GREENHOUSE FILM MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

9.2 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: GREENHOUSE FILM MARKET SNAPSHOT

TABLE 68 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 69 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 70 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 71 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 72 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 73 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 74 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 75 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

TABLE 76 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (USD MILLION)

TABLE 77 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (USD MILLION)

TABLE 78 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (KILOTON)

TABLE 79 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (KILOTON)

TABLE 80 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (USD MILLION)

TABLE 81 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (USD MILLION)

TABLE 82 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (KILOTON)

TABLE 83 ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (KILOTON)

9.2.1 CHINA

9.2.1.1 Rising population key driver for market

TABLE 84 CHINA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 85 CHINA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 86 CHINA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 87 CHINA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.2.2 INDIA

9.2.2.1 Greenhouse protected farming area is increasing at a high rate

TABLE 88 INDIA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 89 INDIA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 90 INDIA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 91 INDIA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.2.3 JAPAN

9.2.3.1 Growing greenhouse farming due to less arable land to drive the market

TABLE 92 JAPAN: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 93 JAPAN: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 94 JAPAN: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 95 JAPAN: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.2.4 SOUTH KOREA

9.2.4.1 Use of improved technologies driving market

TABLE 96 SOUTH KOREA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 97 SOUTH KOREA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 98 SOUTH KOREA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 99 SOUTH KOREA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.2.5 REST OF ASIA PACIFIC

TABLE 100 REST OF ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 101 REST OF ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 102 REST OF ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 103 REST OF ASIA PACIFIC: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.3 EUROPE

FIGURE 28 EUROPE: GREENHOUSE FILM MARKET SNAPSHOT

TABLE 104 EUROPE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 105 EUROPE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 106 EUROPE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 107 EUROPE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

TABLE 108 EUROPE: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (USD MILLION)

TABLE 109 EUROPE: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (USD MILLION)

TABLE 110 EUROPE: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (KILOTON)

TABLE 111 EUROPE: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (KILOTON)

TABLE 112 EUROPE: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (USD MILLION)

TABLE 113 EUROPE: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (KILOTON)

TABLE 115 EUROPE: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (KILOTON)

TABLE 116 EUROPE: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 117 EUROPE: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 118 EUROPE: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 119 EUROPE: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

9.3.1 GERMANY

9.3.1.1 Huge opportunities for growth of recyclable and compostable type of greenhouse films

TABLE 120 GERMANY: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 121 GERMANY: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 122 GERMANY: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 123 GERMANY: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.3.2 ITALY

9.3.2.1 Home to world’s first greenhouse structure

TABLE 124 ITALY: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 125 ITALY: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 126 ITALY: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 127 ITALY: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.3.3 FRANCE

9.3.3.1 High installation cost of glasshouse driving market

TABLE 128 FRANCE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 129 FRANCE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 130 FRANCE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 131 FRANCE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.3.4 UK

9.3.4.1 COVID-19 outbreak likely to have a severe impact on agriculture sector

TABLE 132 UK: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 133 UK: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 134 UK: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 135 UK: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.3.5 SPAIN

9.3.5.1 Increased number of dairy cows, reduction of spoilage, and rising demand for high-quality fodder driving market

TABLE 136 SPAIN: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 137 SPAIN: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 138 SPAIN: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 139 SPAIN: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.3.6 REST OF EUROPE

TABLE 140 REST OF EUROPE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 141 REST OF EUROPE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 142 REST OF EUROPE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 143 REST OF EUROPE: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.4 NORTH AMERICA

FIGURE 29 NORTH AMERICA: GREENHOUSE FILM MARKET SNAPSHOT

TABLE 144 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 145 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 146 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 147 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 148 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 149 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 150 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 151 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

TABLE 152 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (USD MILLION)

TABLE 153 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (USD MILLION)

TABLE 154 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (KILOTON)

TABLE 155 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (KILOTON)

TABLE 156 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (USD MILLION)

TABLE 157 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (USD MILLION)

TABLE 158 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (KILOTON)

TABLE 159 NORTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (KILOTON)

9.4.1 US

9.4.1.1 Food and dairy industries boosting market

TABLE 160 US: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 161 US: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 162 US: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 163 US: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.4.2 CANADA

9.4.2.1 Has hi-tech, automated, and hydroponically grown greenhouses

TABLE 164 CANADA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 165 CANADA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 166 CANADA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 167 CANADA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.4.3 MEXICO

9.4.3.1 Accounts for largest share of region’s greenhouse film market

TABLE 168 MEXICO: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 169 MEXICO: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 170 MEXICO: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 171 MEXICO: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.5 MIDDLE EAST & AFRICA

TABLE 172 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 175 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 176 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 179 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

TABLE 180 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (KILOTON)

TABLE 183 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (KILOTON)

TABLE 184 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (KILOTON)

TABLE 187 MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (KILOTON)

9.5.1 SOUTH AFRICA

9.5.1.1 Presence of seven climatic regions drives market

TABLE 188 SOUTH AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 189 SOUTH AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 190 SOUTH AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 191 SOUTH AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.5.2 EGYPT

9.5.2.1 Food industry propelling market growth

TABLE 192 EGYPT: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 193 EGYPT: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 194 EGYPT: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 195 EGYPT: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 196 REST OF MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 197 REST OF MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 198 REST OF MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 199 REST OF MIDDLE EAST & AFRICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.6 SOUTH AMERICA

TABLE 200 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 201 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 202 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 203 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 204 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 205 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 206 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 207 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

TABLE 208 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (USD MILLION)

TABLE 209 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (USD MILLION)

TABLE 210 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2017–2020 (KILOTON)

TABLE 211 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY THICKNESS, 2021–2026 (KILOTON)

TABLE 212 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (USD MILLION)

TABLE 213 AMERICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (USD MILLION)

TABLE 214 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2017–2020 (KILOTON)

TABLE 215 SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY WIDTH, 2021–2026 (KILOTON)

9.6.1 BRAZIL

9.6.1.1 Increased emphasis on agricultural output to drive market

TABLE 216 BRAZIL: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 217 BRAZIL: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 218 BRAZIL: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 219 BRAZIL: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.6.2 ARGENTINA

9.6.2.1 Government initiatives to boost market

TABLE 220 ARGENTINA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 221 ARGENTINA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 222 ARGENTINA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 223 ARGENTINA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

9.6.3 REST OF SOUTH AMERICA

TABLE 224 REST OF SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 225 REST OF SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 226 REST OF SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 227 REST OF SOUTH AMERICA: GREENHOUSE FILM MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 170)

10.1 OVERVIEW

10.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY GREENHOUSE FILM PLAYERS

10.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2020

10.2.1 STARS

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE

10.2.4 EMERGING COMPANIES

FIGURE 30 GREENHOUSE FILM MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

10.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 31 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN GREENHOUSE FILM MARKET

10.4 SME MATRIX, 2020

10.4.1 RESPONSIVE COMPANIES

10.4.2 PROGRESSIVE COMPANIES

10.4.3 STARTING BLOCKS

10.4.4 DYNAMIC COMPANIES

FIGURE 32 GREENHOUSE FILM MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2020

10.5 MARKET EVALUATION MATRIX

TABLE 228 PRODUCT FOOTPRINT OF COMPANIES

TABLE 229 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 230 REGION FOOTPRINT OF COMPANIES

10.5.1 COMPETITIVE SCENARIO AND TRENDS

TABLE 231 GREENHOUSE FILM MARKET: PRODUCT LAUNCHES

TABLE 232 GREENHOUSE FILM MARKET: DEALS, 2016-2021

10.6 MARKET SHARE ANALYSIS

FIGURE 33 GLOBAL GREENHOUSE FILM MARKET SHARE, BY KEY PLAYERS (2019)

11 COMPANY PROFILES (Page No. - 179)

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1 GINEGAR PLASTIC PRODUCTS LTD.

TABLE 233 GINGER PLASTIC PRODUCTS LTD.: COMPANY OVERVIEW

11.2 PLASTIKA KRITIS S. A.

TABLE 234 PLASTIKA KRITIS S.A.: COMPANY OVERVIEW

FIGURE 34 PLASTIKA KRITIS S.A.: COMPANY SNAPSHOT

11.3 RKW GROUP

TABLE 235 THE RKW GROUP: COMPANY OVERVIEW

11.4 GRUPO ARMANDO ALVAREZ

TABLE 236 GRUPO ARMANDO ALVAREZ: COMPANY OVERVIEW

11.5 BERRY GLOBAL INC.

TABLE 237 BERRY GLOBAL INC.: COMPANY OVERVIEW

FIGURE 35 BERRY GLOBAL INC.: COMPANY SNAPSHOT

11.6 POLIFILM EXTRUSION GMBH

TABLE 238 POLIFILM EXTRUSION GMBH: COMPANY OVERVIEW

11.7 ESSEN MULTIPACK LIMITED

TABLE 239 ESSEN MULTIPACK LIMITED: COMPANY OVERVIEW

11.8 AGRIPLAST

TABLE 240 AGRIPLAST: COMPANY OVERVIEW

11.9 EIFFEL S.P.A.

TABLE 241 EIFFEL S.P.A.: COMPANY OVERVIEW

11.10 A. A. POLITIV LTD.

TABLE 242 A.A. POLITIV LTD.: COMPANY OVERVIEW

11.11 BARBIER GROUP

TABLE 243 BARBIER GROUP: COMPANY OVERVIEW

11.12 FVG FOLIEN-VERTRIEBS GMBH

TABLE 244 FVG FOLIEN-VERTRIEBS GMBH: COMPANY OVERVIEW

11.13 ENGINEERING SERVICES & PRODUCTS COMPANY

TABLE 245 ENGINEERING SERVICES & PRODUCTS COMPANY: COMPANY OVERVIEW

11.14 MITSUBISHI CHEMICAL CORPORATION

TABLE 246 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

11.14.3 BERRY GLOBAL GROUP, INC.: DEALS

11.15 INDUSTRIAL DEVELOPMENT COMPANY S.A.L. (INDEVCO)

TABLE 247 INDUSTRIAL DEVELOPMENT COMPANY S.A.L: COMPANY OVERVIEW

11.16 ACHILLES CORPORATION

TABLE 248 ACHILLES CORPORATION: COMPANY OVERVIEW

11.17 LUMITE INC.

TABLE 249 LUMITE INC.: COMPANY OVERVIEW

11.18 THAI CHAROEN THONG KARNTOR CO., LTD.

TABLE 250 THAI CHAROEN THONG KARNTOR CO., LTD.: COMPANY OVERVIEW

11.19 CENTRAL WORLDWIDE CO., LTD.

11.19.2 CENTRAL WORLDWIDE CO., LTD.: COMPANY OVERVIEW

11.20 COSIO INDUSTRIES LTD.

TABLE 251 COSIO INDUSTRIES LTD.: COMPANY OVERVIEW

11.21 CHARU AGROPLAST PRIVATE LIMITED

TABLE 252 CHARU AGROPLAST PRIVATE LIMITED: COMPANY OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 207)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

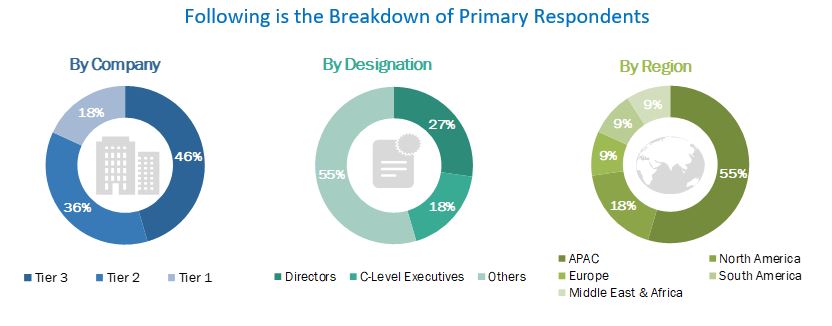

The study involves four major activities in estimating the current greenhouse film market size. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The greenhouse film market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of end-users, such as farmers and farmer unions. Advancements in technology characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

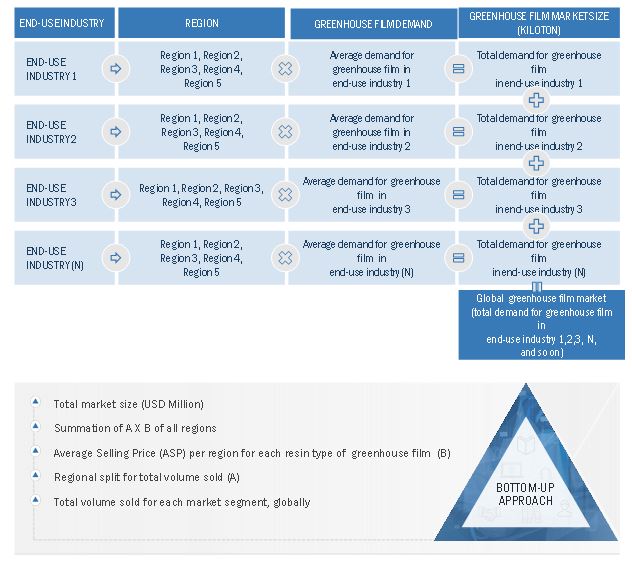

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the greenhouse film market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Greenhouse Film Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment & subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the greenhouse film market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the size of the market based on form, resin type, thickness, and width

- To estimate and forecast the market size based on five regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa, and South America

- To estimate and forecast the greenhouse film market at the country-level in each of the regions

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as new product launch, joint venture & partnership, and merger & acquisition in the market

- To strategically identify and profile the key market players and analyze their core competencies1

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Greenhouse Film Market