Agricultural Textiles Market by Fiber Material (Nylon, Polyester, PE, PP, Natural Fiber), Fabric Formation Technology (Woven, Knitted, Nonwoven), Product type (Shade Nets, Mulch Mats), Application and Region - Global Forecast to 2028

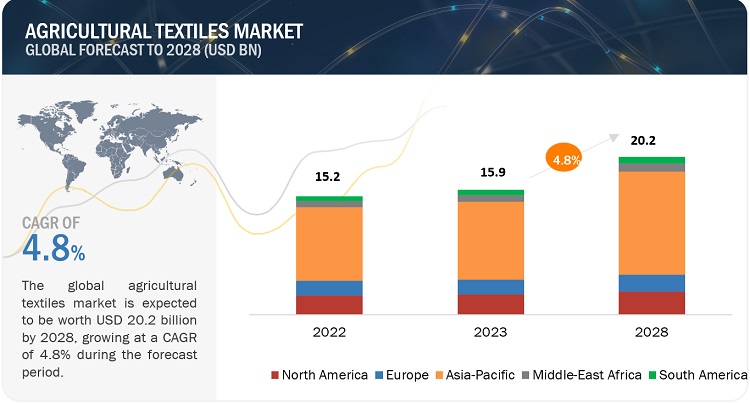

Agricultural textiles market is projected to grow from USD 15.9 billion in 2023 and is projected to reach USD 20.2 billion by 2028, at a CAGR of 4.8%, between 2023 and 2028 period. The demand and use of agricultural textiles is rapidly increasing due to the growth in industries such as outdoor and controlled-environment agriculture especially in the Asia Pacific region.

Attractive Opportunities in the Agricultural Textiles Market

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Agricultural Textiles Market Dynamics

Drivers: Global focus on increasing agricultural output

The world population is estimated to reach approximately 8.5 billion by 2030. The demand for food is expected to increase, especially in Eastern Europe, Central Asia, Latin America, and Asia, owing to the rapid population increase in these regions. The rising population leads to increased demand for food, which exerts pressure on agricultural productivity. This sharp rise in demand for agricultural products can be achieved by controlled agriculture, adopting technologies, such as greenhouses. Agricultural textiles help in improving crop quality and agricultural productivity by minimizing soil erosion, providing nutrients, increasing soil temperature, suppressing the growth of weeds, and others. Therefore, the need to increase agricultural production plays an important role in driving the demand for agricultural textiles.

Restraints: Volatility in raw material prices

Higher costs of raw materials moderately hamper the growth of the agricultural textile market. The market is facing challenges owing to an increase in raw material prices. It is influenced by shifts in the consumers’ needs, high oil prices, and global trade patterns. Most of the agricultural textile producers face challenges in earning sustained profit margins amid the volatility in raw material prices that continues to impact their financial performance. Oil prices in the Middle Eastern countries play a dominant role in the price dynamics of polypropylene as the region controls the production of crude oil. Excess supply of crude oil pulls down its prices, thereby making the market unstable to the extent that several producers try to curtail their production to maintain the price of the raw material—naphtha.

Opportunities: Opportunities in horticulture

Sustainability in the food supply is under immense pressure because of the growth in population, climate change, and limited resources. New uncertainties rose due to disruption in the food supply chain that made a significant increase in prices. Because of the uncertainty in these times, opportunities in horticulture have emerged. Trends toward green energy and sustainability have been increasing more in recent years across the world. “Urban horticulture,” which is one of the upcoming trends, brings several opportunities with it. Urban horticulture is a feasible concept to provide sufficient fresh and safe food to cities to achieve a sustainable food supply and food security. This trend is focused on the cultivation of vegetables, fruits, herbs, mushrooms, and aromatic and ornamental plants that can grow easily in the surroundings of a city.

Challenges: Crop protection and weed management

The global population is expected to reach over 9 billion by 2050. According to The Food and Agriculture Organization, to feed this amount of population, global food production needs to be increased by 70-100%. In addition to socioeconomic and crop management related issues, there are many biotic and abiotic constraints to crop production. The most important biotic constraint to agricultural production is weed in both developed and developing countries. In general, weeds present the highest potential yield loss to crops along with pathogens like fungi, bacteria, etc. and animal pests like rodents, insects, nematodes, birds, mites, etc. which are of less concern. Weeds compete with crops for water, sunlight, nutrients, and space. Additionally, they harbor pathogens and insects, which attack crop plants. Moreover, they destroy native habitats, threatening native plants.

Polyethylene type accounted for the largest share of the agricultural textiles market

Polyethylene is a thermoplastic polymer with a changeable crystalline structure and, depending on the kind, a wide range of applications. With tens of millions of tonnes produced each year, it is one of the most frequently used polymers on the planet. PE is one of the most commonly used material for agro textile and it is slightly more expensive as compared to polypropylene. HDPE Fabrics are used in agriculture products at farms and protect them from bad weather as well as from harmful UV rays. HDPE Yarns are the suitable starting material for weaving, braiding, and twisting applications. Their technical characteristics resist acids and alkalis. This fabric is used as weaving material for agrotextiles such as shade nets, filters, industrial textiles, and furnishing fabrics.

To know about the assumptions considered for the study, download the pdf brochure

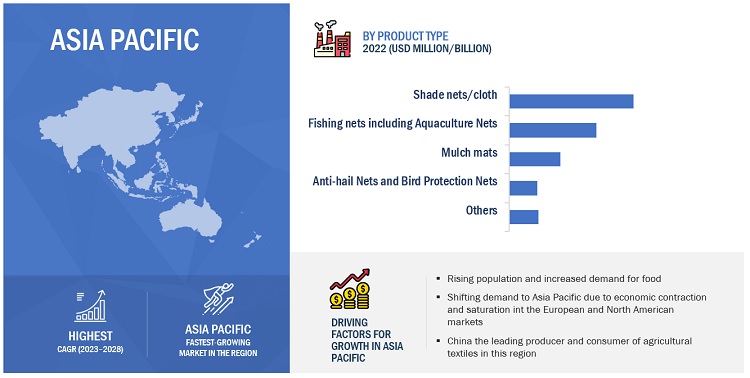

Asia Pacific is the fastest-growing agricultural textiles market.

Asia Pacific has emerged as one of the leading producers as well as consumers of agricultural textiles. In India, low-cost labor, government initiatives, such as Make in India, and the proposed scheme on entrepreneurship development may open up opportunities in the industrial and infrastructure segments. Asia Pacific region due to economic contraction and saturation in the European and North American markets. Agricultural textiles manufacturers are targeting this region, as it is currently the strongest regional market.

Key Market Players

Beaulieu Technical Textiles (Belgium), Belton industries (US), Hy-Tex (UK) Limited, Diatex SAS (France), and Garware Technical Fibres Limited (India) are the key players in the global agricultural textiles market.

Scope of the report

|

Report Metric |

Details |

|

Years Considered for the study |

2019-2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments |

By Fiber Material |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

Beaulieu Technical Textiles (Belgium), Belton industries (US), Hy-Tex (UK) Limited, Diatex SAS (France), and Garware Technical Fibres Limited (India). A total of 20 players have been covered. |

This research report categorizes the agricultural textiles market based on Fiber Material, Fabric Formation Technology, Product Type, Application, and Region.

By Fiber Material:

- Nylon

- Polyethylene

- Polypropylene

- Polyester

- Natural Fibers

- Biodegradable Synthetic Fibers

- Others

By Fabric formation technology:

- Woven

- Knitted

- Nonwoven

- Others

By Product type:

- Shade nets/cloths

- Mulch mats

- Anti-hail Nets and Bird Protection Nets

- Fishing Nets

- Others

By Application:

- Outdoor agriculture

- Controlled-environment agriculture

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In July 2020, Beaulieu Technical Textiles launched Agrolys WH FR which was the very first halogen-free, flame-retardant reflective woven groundcover.

Frequently Asked Questions (FAQ):

What is the current size of the global Agricultural textiles market?

Agricultural textiles market is projected to grow from USD 15.9 billion in 2023 and is projected to reach USD 20.2 billion by 2028, at a CAGR of 4.8%, between 2023 and 2028 period.

Which segment has the potential to register the highest market share for Agricultural textiles market?

Outdoor agriculture is the largest application segment, in terms of both value and volume, in 2022.

Who are the major manufacturers?

Beaulieu Technical Textiles (Belgium), Belton Industries (US), Hy-Tex (UK) Limited, Diatex SAS (France), and Garware Technical Fibres Limited (India), are some of the leading players operating in the global agricultural textiles market.

What are the reasons behind agricultural textiles gaining market share?

Agricultural textiles are gaining market share due to increase in world population which leads to increasing food demand.

Which is the fastest-growing region in the market?

Asia Pacific is projected to be the fastest-growing market for Agricultural textiles market during the forecast period. Easy availability of raw materials at competitive prices and cheap labor force have made Asia Pacific the biggest market for agricultural textiles. Global manufacturers are increasingly setting up their production plants in the region in a bid to ramp up production and increase sales. The major end-use industries of Agricultural textiles are outdoor and controlled-environment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 VALUE CHAIN ANALYSIS

-

5.3 MARKET DYNAMICSDRIVERS- Global focus on increasing agricultural output- Importance of controlled agriculture in greenhouses- Increased demand for greenhouse-cultivated cropsRESTRAINTS- Volatility in raw material pricesOPPORTUNITIES- Advancements in technology- Opportunities in horticultureCHALLENGES- Crop protection and weed management

-

5.4 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.5 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.6 MACROECONOMIC INDICATORS AND KEY TRENDSINTRODUCTIONTRENDS AND FORECAST OF GDPTRENDS IN GLOBAL AGRICULTURAL INDUSTRY- Decreasing arable land- Growing production of high-value cropsTRENDS AND FORECAST FOR GLOBAL FISHERIES AND AQUACULTURE INDUSTRY

- 5.7 REGULATORY LANDSCAPE

- 5.8 PRICING ANALYSIS

-

5.9 ECOSYSTEM/MARKET MAP

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

-

5.11 TRADE DATA STATISTICS: KEY EXPORTING AND IMPORTING COUNTRIESAGRICULTURAL TEXTILES TRADE SCENARIO 2020–2022

- 5.12 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTH

-

5.13 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSLEGAL STATUS OF PATENTSTOP JURISDICTIONTOP APPLICANTS

- 5.14 CASE STUDY ANALYSIS

- 5.15 TECHNOLOGY ANALYSIS

- 5.16 KEY CONFERENCES & EVENTS IN 2023–2024

- 5.17 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 NYLONFISH NET AND SHADE NET MANUFACTURING

-

6.3 POLYESTERSUPERIOR HEAT AND WATER RESISTANCE AND HIGH STRENGTH

-

6.4 POLYETHYLENEPOLYETHYLENE ACCOUNTS FOR LARGEST MARKET SHARE

-

6.5 POLYPROPYLENEHIGH THERMAL CONDUCTIVITY AND HEAT RETENTION FOR LONGER DURATIONS

-

6.6 NATURAL FIBERSGROWING CONCERN FOR CLIMATE CHANGE TO DRIVE DEMAND

-

6.7 BIODEGRADABLE SYNTHETIC FIBERSBIODEGRADABLE SYNTHETIC FIBERS TO BE FASTEST-GROWING FIBER MATERIAL

- 6.8 OTHERS

- 7.1 INTRODUCTION

-

7.2 WOVENOLDEST METHOD OF FABRIC CREATION

-

7.3 NONWOVENIMPROVED PROPERTIES AND COST-EFFECTIVENESS

-

7.4 KNITTEDFLEXIBILITY OF KNITTED FABRIC INCREASING ITS POPULARITY

- 7.5 OTHERS

- 8.1 INTRODUCTION

-

8.2 SHADE NETS/CLOTHSPREVENT UV RAYS FROM BURNING SAPLINGS AND HARMING SOIL

-

8.3 MULCH MATSBLOCK WEED, RETAIN MOISTURE, PREVENT SOIL EROSION, AND REGULATE SOIL TEMPERATURE

-

8.4 ANTI-HAIL NETS AND BIRD PROTECTION NETSPROTECT FROM INSECTS AND PESTS

-

8.5 FISHING NETSBIODEGRADABLE FISHING NETS TO DRIVE MARKET

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 OUTDOOR AGRICULTUREOUTDOOR AGRICULTURE ACCOUNTS FOR LARGE MARKET SHARE

-

9.3 CONTROLLED-ENVIRONMENT AGRICULTUREINSECT PROTECTION NETS KEEP PESTS AWAY FROM GREENHOUSE

-

10.1 INTRODUCTIONGLOBAL RECESSION OVERVIEW

-

10.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Largest consumer of agricultural textiles globallyINDIA- Increase in food demand to drive marketJAPAN- Use of advanced technologies to produce cropsINDONESIA- Largest economy in Southeast AsiaREST OF ASIA PACIFIC

-

10.3 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Rise in demand from emerging nationsCANADA- Aquaculture practiced widelyMEXICO- Emerging market for agricultural textiles

-

10.4 EUROPERECESSION IMPACT ON EUROPEGERMANY- Sustainability, innovations, and know-how of greenhouse farmingFRANCE- Major global exporter of agricultural commoditiesUK- Manufacture of agricultural textiles compliant with environmental standardsRUSSIA- Agriculture most consistently growing sectorROMANIA- Increase in import & export of foodsTURKEY- Seventh-largest agricultural producer globallySPAIN- Extensive use of agricultural textiles to protect greenhouses from direct exposure to sunlightREST OF EUROPE

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICANIGERIA- Agriculture sector facing numerous obstaclesSOUTH AFRICA- Increased demand from end usersEGYPT- Food & dairy industry propelling market growthISRAEL- Leading agri-tech countrySAUDI ARABIA- Imports most agricultural productsREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICABRAZIL- Leading producer of coffee, dry beans, soybean, and cornARGENTINA- Emerging agricultural textiles marketREST OF SOUTH AMERICA

- 11.1 OVERVIEW

-

11.2 COMPANY EVALUATION QUADRANT MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.3 STRENGTH OF PRODUCT PORTFOLIO

-

11.4 SMALL & MEDIUM-SIZED ENTERPRISES EVALUATION QUADRANT MATRIX, 2022RESPONSIVE COMPANIESPROGRESSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 11.5 COMPETITIVE BENCHMARKING

-

11.6 COMPETITIVE SCENARIOMARKET EVALUATION MATRIX

- 11.7 MARKET SHARE ANALYSIS

- 11.8 MARKET RANKING ANALYSIS

-

11.9 REVENUE ANALYSISBEAULIEU TECHNICAL TEXTILESBELTON INDUSTRIES, INC.HY-TEX (UK) LTD.DIATEX SASGARWARE TECHNICAL FIBRES LIMITED

-

11.10 STRATEGIC DEVELOPMENTSPRODUCT LAUNCHES

-

12.1 KEY COMPANIESBEAULIEU TECHNICAL TEXTILES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBELTON INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- MnM viewHY-TEX (UK) LTD.- Business overview- Products/Solutions/Services offered- MnM viewDIATEX SAS- Business overview- Products/Solutions/Services offered- MnM viewGARWARE TECHNICAL FIBRES LTD.- Business overview- Products/Solutions/Services offered- MnM viewB & V AGRO IRRIGATION CO.- Business overview- Products/Solutions/Services offeredMEYABOND INDUSTRY & TRADING (BEIJING) CO., LTD.- Business overview- Products/Solutions/Services offeredNEO CORP INTERNATIONAL LTD.- Business overview- Products/Solutions/Services offeredADUNO SRL- Business overview- Products/Solutions/Services offered- Recent developmentsLUDVIG SVENSSON- Business overview- Products/Solutions/Services offered

-

12.2 OTHER COMPANIESPHORMIUM- Business overview- Products/Solutions/Services offered- Recent developmentsDRAPE NET PTY LTD- Business overview- Products/Solutions/Services offeredHELIOS GROUP S.R.L.- Business overview- Products/Solutions/Services offeredMILLER NET COMPANY, INC.- Business overview- Products/Solutions/Services offeredSIANG MAY PTE LTD.- Business overview- Products/Solutions/Services offeredMEMPHIS NET & TWINE CO., INC.- Business overview- Products/Solutions/Services offeredNAGAURA NET CO., INC.- Business overview- Products/Solutions/Services offeredNITTO SEIMO CO., LTD.- Business overview- Products/Solutions/Services offeredBADINOTTI GROUP S.P.A.- Business overview- Products/Solutions/Services offeredHUNAN XINHAI CO., LTD.- Business overview- Products/Solutions/Services offered

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 TECHNICAL TEXTILE MARKETMARKET DEFINITIONMARKET OVERVIEWTECHNICAL TEXTILE MARKET ANALYSIS, BY MATERIAL- Natural Fiber- Synthetic Polymer- Mineral- Metal- OthersTECHNICAL TEXTILE MARKET, BY PROCESSTECHNICAL TEXTILE MARKET, BY APPLICATIONTECHNICAL TEXTILE MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 AGRICULTURAL TEXTILES MARKET SNAPSHOT (2023 VS. 2028)

- TABLE 2 SUPPLY CHAIN ECOSYSTEM

- TABLE 3 PORTER’S FIVE FORCES ANALYSIS: AGRICULTURAL TEXTILES MARKET

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR AGRICULTURAL TEXTILES

- TABLE 6 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE OF KEY COUNTRIES, 2019–2028

- TABLE 7 EXISTING STANDARDS

- TABLE 8 COUNTRY-WISE EXPORT DATA, 2020–2022 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE IMPORT DATA, 2020–2022 (USD THOUSAND)

- TABLE 10 PATENT PUBLICATION TRENDS: DOCUMENT COUNT

- TABLE 11 TOP 10 PATENT OWNERS DURING LAST FEW YEARS

- TABLE 12 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 DIFFERENT TYPES OF AGRO-TEXTILE PRODUCTS WITH CONSTITUENT FIBER

- TABLE 17 AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 18 AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 19 AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (KILOTON)

- TABLE 20 AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (KILOTON)

- TABLE 21 NYLON: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 NYLON: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 NYLON: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 24 NYLON: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 25 POLYESTER: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 POLYESTER: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 POLYESTER: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 28 POLYESTER: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 29 POLYETHYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 POLYETHYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 POLYETHYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 32 POLYETHYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 33 POLYPROPYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 POLYPROPYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 POLYPROPYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 36 POLYPROPYLENE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 37 NATURAL FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 NATURAL FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 NATURAL FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 40 NATURAL FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 41 BIODEGRADABLE SYNTHETIC FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 BIODEGRADABLE SYNTHETIC FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 BIODEGRADABLE SYNTHETIC FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 44 BIODEGRADABLE SYNTHETIC FIBERS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 45 OTHER FIBER MATERIALS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 OTHER FIBER MATERIALS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 OTHER FIBER MATERIALS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 48 OTHER FIBER MATERIALS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 49 AGRO-TEXTILE PRODUCTS IN DIFFERENT APPLICATIONS

- TABLE 50 AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 51 AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 52 AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 53 AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 54 WOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 WOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 WOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 57 WOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 58 NONWOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 NONWOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 NONWOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 61 NONWOVEN: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 62 KNITTED: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 KNITTED: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 KNITTED: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 65 KNITTED: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 66 OTHER TECHNOLOGIES: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 OTHER TECHNOLOGIES: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 OTHER TECHNOLOGIES: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 69 OTHER TECHNOLOGIES: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 70 AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 71 AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 72 AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 73 AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 74 SHADE NETS/CLOTHS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 SHADE NETS/CLOTHS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 SHADE NETS/CLOTHS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 77 SHADE NETS/CLOTHS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 78 MULCH MATS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 MULCH MATS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 MULCH MATS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 81 MULCH MATS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 82 ANTI-HAIL NETS AND BIRD PROTECTION NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 ANTI-HAIL NETS AND BIRD PROTECTION NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 ANTI-HAIL NETS AND BIRD PROTECTION NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 85 ANTI-HAIL NETS AND BIRD PROTECTION NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 86 FISHING NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 FISHING NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 FISHING NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 89 FISHING NETS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 90 OTHER PRODUCTS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 91 OTHER PRODUCTS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 OTHER PRODUCTS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 93 OTHER PRODUCTS: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 94 AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 95 AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 97 AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 98 OUTDOOR AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 99 OUTDOOR AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 OUTDOOR AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 101 OUTDOOR AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 102 CONTROLLED-ENVIRONMENT AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 103 CONTROLLED-ENVIRONMENT AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 104 CONTROLLED-ENVIRONMENT AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 105 CONTROLLED-ENVIRONMENT AGRICULTURE: AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 106 AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 107 AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 108 AGRICULTURAL TEXTILES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 109 AGRICULTURAL TEXTILES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 110 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 113 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 114 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (KILOTON)

- TABLE 117 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (KILOTON)

- TABLE 118 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 121 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 122 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 125 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 126 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 129 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 130 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 133 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 134 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (KILOTON)

- TABLE 137 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (KILOTON)

- TABLE 138 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 141 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 142 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 145 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 146 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 149 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 150 EUROPE: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 151 EUROPE: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 152 EUROPE: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 153 EUROPE: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 154 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 155 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 156 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (KILOTON)

- TABLE 157 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (KILOTON)

- TABLE 158 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 159 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 160 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 161 EUROPE: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 162 EUROPE: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 163 EUROPE: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 164 EUROPE: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 165 EUROPE: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 166 EUROPE: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 167 EUROPE: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 168 EUROPE: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 169 EUROPE: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 170 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 173 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 174 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (KILOTON)

- TABLE 177 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (KILOTON)

- TABLE 178 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 181 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 182 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 185 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 186 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 189 MIDDLE EAST & AFRICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 190 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 191 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 192 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 193 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 194 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (USD MILLION)

- TABLE 195 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (USD MILLION)

- TABLE 196 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2019–2022 (KILOTON)

- TABLE 197 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL, 2023–2028 (KILOTON)

- TABLE 198 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 199 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 200 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 201 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 202 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 203 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 204 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2019–2022 (KILOTON)

- TABLE 205 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 206 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 207 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 208 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 209 SOUTH AMERICA: AGRICULTURAL TEXTILES MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 210 OVERVIEW OF STRATEGIES ADOPTED BY KEY AGRICULTURAL TEXTILE PLAYERS

- TABLE 211 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 212 COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 213 COMPANY EVALUATION MATRIX

- TABLE 214 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 215 INDUSTRY FOOTPRINT OF COMPANIES

- TABLE 216 REGION FOOTPRINT OF COMPANIES

- TABLE 217 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 218 MOST FOLLOWED STRATEGIES

- TABLE 219 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 220 DEGREE OF COMPETITION, 2022

- TABLE 221 AGRICULTURAL TEXTILES MARKET: PRODUCT LAUNCHES

- TABLE 222 BEAULIEU TECHNICAL TEXTILES: COMPANY OVERVIEW

- TABLE 223 BEAULIEU TECHNICAL TEXTILES: PRODUCT OFFERINGS

- TABLE 224 BEAULIEU TECHNICAL TEXTILES: PRODUCT LAUNCHES

- TABLE 225 BELTON INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 226 BELTON INDUSTRIES INC.: PRODUCT OFFERINGS

- TABLE 227 HY-TEX (UK) LTD.: COMPANY OVERVIEW

- TABLE 228 HY-TEX (UK) LTD.: PRODUCT OFFERINGS

- TABLE 229 DIATEX SAS: COMPANY OVERVIEW

- TABLE 230 DIATEX SAS: PRODUCT OFFERINGS

- TABLE 231 GARWARE TECHNICAL FIBRES LTD.: COMPANY OVERVIEW

- TABLE 232 GARWARE TECHNICAL FIBRES LTD.: PRODUCT OFFERINGS

- TABLE 233 B & V AGRO IRRIGATION CO.: COMPANY OVERVIEW

- TABLE 234 B & V AGRO IRRIGATION CO.: PRODUCT OFFERINGS

- TABLE 235 MEYABOND INDUSTRY & TRADING (BEIJING) CO., LTD.: COMPANY OVERVIEW

- TABLE 236 MEYABOND INDUSTRY & TRADING (BEIJING) CO., LTD.: PRODUCT OFFERINGS

- TABLE 237 NEO CORP INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 238 NEO CORP INTERNATIONAL LTD.: PRODUCT OFFERINGS

- TABLE 239 ADUNO SRL: COMPANY OVERVIEW

- TABLE 240 ADUNO SRL: PRODUCT OFFERINGS

- TABLE 241 ADUNO SRL: PRODUCT LAUNCHES

- TABLE 242 LUDVIG SVENSSON: COMPANY OVERVIEW

- TABLE 243 LUDVIG SVENSSON: PRODUCT OFFERINGS

- TABLE 244 PHORMIUM: COMPANY OVERVIEW

- TABLE 245 PHORMIUM: PRODUCT OFFERINGS

- TABLE 246 PHORMIUM: PRODUCT LAUNCHES

- TABLE 247 DRAPE NET PTY LTD: COMPANY OVERVIEW

- TABLE 248 DRAPE NET PTY LTD: PRODUCT OFFERINGS

- TABLE 249 HELIOS GROUP S.R.L.: COMPANY OVERVIEW

- TABLE 250 HELIOS GROUP S.R.L.: PRODUCT OFFERINGS

- TABLE 251 MILLER NET COMPANY, INC.: COMPANY OVERVIEW

- TABLE 252 MILLER NET COMPANY, INC.: PRODUCT OFFERINGS

- TABLE 253 SIANG MAY PTE LTD.: COMPANY OVERVIEW

- TABLE 254 SIANG MAY PTE LTD.: PRODUCT OFFERINGS

- TABLE 255 MEMPHIS NET & TWINE CO., INC.: COMPANY OVERVIEW

- TABLE 256 MEMPHIS NET & TWINE CO., INC.: PRODUCT OFFERINGS

- TABLE 257 NAGAURA NET CO., INC.: COMPANY OVERVIEW

- TABLE 258 NAGAURA NET CO., INC.: PRODUCT OFFERINGS

- TABLE 259 NITTO SEIMO CO., LTD.: COMPANY OVERVIEW

- TABLE 260 NITTO SEIMO CO., LTD.: PRODUCT OFFERINGS

- TABLE 261 BADINOTTI GROUP S.P.A.: COMPANY OVERVIEW

- TABLE 262 BADINOTTI GROUP S.P.A.: PRODUCT OFFERINGS

- TABLE 263 HUNAN XINHAI CO., LTD.: COMPANY OVERVIEW

- TABLE 264 HUNAN XINHAI CO., LTD.: PRODUCT OFFERINGS

- TABLE 265 TECHNICAL TEXTILE MARKET, BY MATERIAL, 2018–2025 (USD BILLION)

- TABLE 266 TECHNICAL TEXTILE MARKET, BY MATERIAL, 2018–2025 (MILLION TON)

- TABLE 267 TECHNICAL TEXTILE MARKET, BY PROCESS, 2018–2025 (USD BILLION)

- TABLE 268 TECHNICAL TEXTILE MARKET, BY PROCESS, 2018–2025 (MILLION TON)

- TABLE 269 TECHNICAL TEXTILE MARKET, BY APPLICATION, 2018–2025 (USD BILLION)

- TABLE 270 TECHNICAL TEXTILE MARKET, BY APPLICATION, 2018–2025 (MILLION TON)

- TABLE 271 TECHNICAL TEXTILE MARKET, BY REGION, 2018–2025 (USD BILLION)

- TABLE 272 TECHNICAL TEXTILE MARKET, BY REGION, 2018–2025 (MILLION TON)

- FIGURE 1 AGRICULTURAL TEXTILES MARKET SEGMENTATION

- FIGURE 2 AGRICULTURAL TEXTILES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 AGRICULTURAL TEXTILES MARKET: DATA TRIANGULATION

- FIGURE 6 WOVEN TO BE LARGEST FABRIC FORMATION TECHNOLOGY OF AGRICULTURAL TEXTILES

- FIGURE 7 POLYETHYLENE CAPTURED LARGEST MARKET SHARE IN 2022

- FIGURE 8 SHADE NETS/CLOTHS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 10 AGRICULTURAL TEXTILES MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

- FIGURE 11 POLYETHYLENE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 12 NONWOVEN TO BE FASTEST-GROWING SEGMENT BETWEEN 2023 AND 2028

- FIGURE 13 MULCH MATS TO BE LARGEST SEGMENT BETWEEN 2023 AND 2028

- FIGURE 14 OUTDOOR AGRICULTURE TO BE LARGER SEGMENT BETWEEN 2023 AND 2028

- FIGURE 15 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 16 EMERGING MARKETS TO GROW FASTER THAN DEVELOPED MARKETS

- FIGURE 17 INDIA EMERGING AS LUCRATIVE MARKET FOR AGRICULTURAL TEXTILES

- FIGURE 18 AGRICULTURAL TEXTILES: VALUE CHAIN ANALYSIS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AGRICULTURAL TEXTILES MARKET

- FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: AGRICULTURAL TEXTILES MARKET

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 22 KEY BUYING CRITERIA FOR AGRICULTURAL TEXTILES

- FIGURE 23 AVERAGE PRICE COMPETITIVENESS IN AGRICULTURAL TEXTILES MARKET, BY REGION

- FIGURE 24 AVERAGE PRICE COMPETITIVENESS IN AGRICULTURAL TEXTILES MARKET, BY FIBER MATERIAL

- FIGURE 25 AVERAGE PRICE COMPETITIVENESS IN AGRICULTURAL TEXTILES MARKET, BY FABRIC FORMATION TECHNOLOGY

- FIGURE 26 AVERAGE PRICE COMPETITIVENESS IN AGRICULTURAL TEXTILES MARKET, BY PRODUCT TYPE

- FIGURE 27 AVERAGE PRICE COMPETITIVENESS IN AGRICULTURAL TEXTILES MARKET, BY APPLICATION

- FIGURE 28 AVERAGE PRICING FOR KEY INDUSTRIES, BY MAJOR PLAYER

- FIGURE 29 AGRICULTURAL TEXTILES ECOSYSTEM

- FIGURE 30 REVENUE SHIFT IN AGRICULTURAL TEXTILES MARKET

- FIGURE 31 PATENT PUBLICATION TRENDS: DOCUMENT COUNT

- FIGURE 32 NUMBER OF PATENTS PUBLISHED, 2018–2023

- FIGURE 33 LEGAL STATUS OF PATENTS

- FIGURE 34 NUMBER OF PATENTS PUBLISHED, BY JURISDICTION

- FIGURE 35 PATENTS PUBLISHED BY MAJOR APPLICANTS

- FIGURE 36 POLYETHYLENE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 37 WOVEN TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 38 SHADE NETS/CLOTHS TO BE LARGEST MARKET SEGMENT DURING FORECAST PERIOD

- FIGURE 39 OUTDOOR AGRICULTURE TO BE LARGER MARKET SEGMENT DURING FORECAST PERIOD

- FIGURE 40 AGRICULTURAL TEXTILES MARKET IN ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE

- FIGURE 41 ASIA PACIFIC: AGRICULTURAL TEXTILES MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: AGRICULTURAL TEXTILES MARKET SNAPSHOT

- FIGURE 43 EUROPE: AGRICULTURAL TEXTILES MARKET SNAPSHOT

- FIGURE 44 COMPANY EVALUATION QUADRANT MATRIX, 2022

- FIGURE 45 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN AGRICULTURAL TEXTILES MARKET

- FIGURE 46 SMALL & MEDIUM-SIZED ENTERPRISES EVALUATION QUADRANT MATRIX, 2022

- FIGURE 47 MARKET SHARE, BY KEY PLAYER, 2022

- FIGURE 48 MARKET RANKING ANALYSIS, 2022

- FIGURE 49 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2022

- FIGURE 50 GARWARE TECHNICAL FIBRES LTD.: COMPANY SNAPSHOT

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global agricultural textiles market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases & investor presentations of companies, white papers, regulatory bodies, trade directories, certified publications, articles from recognized authors, gold and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain and verify qualitative and quantitative information for this report as well as analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the agricultural textiles market. Primary sources from the demand side include experts and key persons from the application segment. Extensive primary research has been conducted after understanding and analyzing the current scenario of the agricultural textiles market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

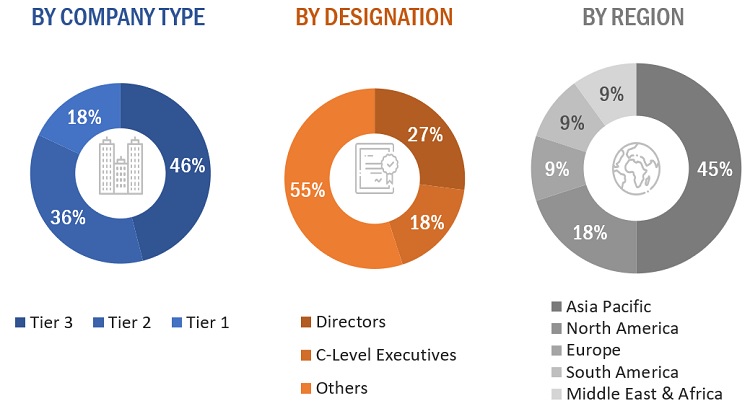

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

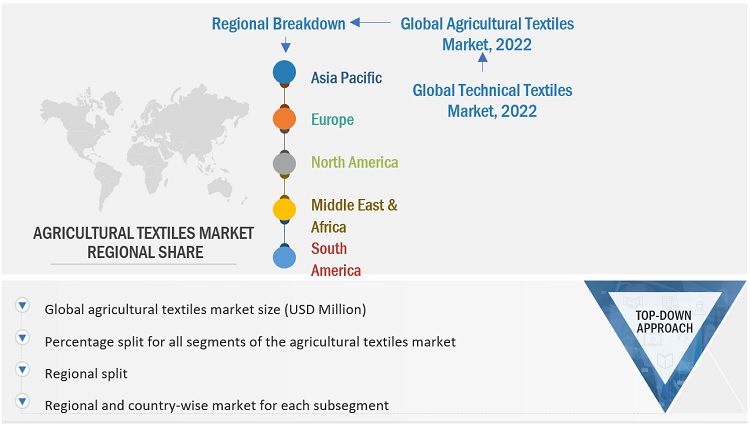

The top-down and bottom-up approaches have been used to estimate and validate the agricultural textiles market size and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market shares in the key regions have been determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top players and extensive interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives, for key insights.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters affecting the markets covered in this study were accounted for, viewed in detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The three figures below represent the overall market size estimation process through the study.

Global Agricultural Textiles Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both, the demand and supply sides. The market has been validated using both, the top-down and bottom-up approaches.

Market Definition.

- Textile is any material made of interlacing fibers, including carpet and geotextiles. Any woven or knitted fabric is a textile.

-

The word "AGROTEXTILE" is now used to classify the woven, nonwoven,

and knitted fabrics applied for agricultural and horticultural uses. - The reduced usage of harmful pesticides and herbicides render a healthy farming culture and is an eco-friendly technique. Agricultural textiles for its excellent environmental resistance, mechanical properties, easy processability, and durability can improve quantity, quality, and safety of agricultural products.

Key Stakeholders

- Raw material suppliers

- Agricultural textile manufacturers

- Manufacturing technology providers

- Industry associations

- Traders, distributors, and suppliers of agricultural textiles

- Non-governmental organizations (NGOs), government and regional agencies and research organizations

Report Objectives

- To define, describe, and forecast the agricultural textiles market in terms of value and volume

- To provide information about drivers, restraints, opportunities, and challenges influencing market growth

- To forecast and analyze the market based on fiber material, fabric formation technology, product type, application, and region

- To analyze and forecast the market size, with respect to five main regions: Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of market leaders

- To strategically profile key players in the market and comprehensively analyze their core competencies2

Note: 1. Micromarkets are defined as the subsegments of the global agricultural textiles market included in the report.

2. Core competencies of companies are determined in terms of the key developments and strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Agricultural textiles market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agricultural Textiles Market