Soil Monitoring Market by Offering (Hardware, Software, Services), System Type (Sensing & Imagery, Ground-based Sensing, Robotic & Telematics), Application (Agricultural, Non-agricultural) and Region - Global Forecast to 2027

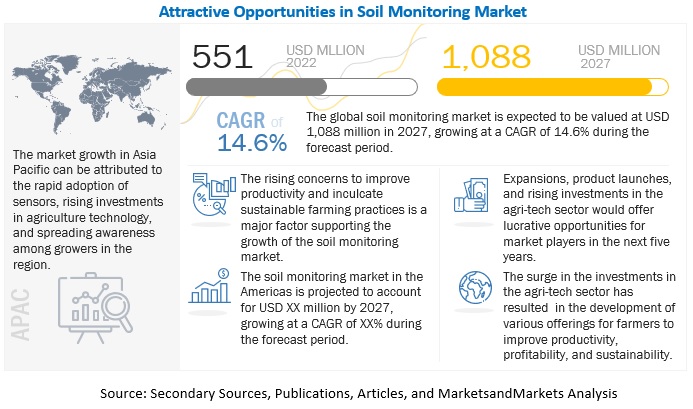

The soil monitoring market is estimated to be worth USD 551 million in 2022 and is projected to reach USD 1,088 million by 2027, at a CAGR of 14.6%. Efforts of governments and companies to promote sustainable agriculture practices, the pressing need to preserve soil quality, stringent government regulations pertaining to ecological stability, and the growing need for improving farm productivity to feed the rising population are some of the driving factors for the soil monitoring market.

To know about the assumptions considered for the study, Request for Free Sample Report

Soil Monitoring Market Dynamics

Driver: Growing need for improving farm productivity to feed the rising population

Progressive farmers in the US, Canada, the Netherlands, Israel, Denmark, and Australia have shown interest in soil monitoring. Soil monitoring is widely accepted among farmers in irrigation practices as it can help to achieve optimum crop quality and maximum yields. Over-irrigation of fields results in the development of a shallow root pattern, which affects the nutrients, which get washed off the soil and affect the crop quality. Soil monitoring has become significantly important as the world population is increasing considerably, which might lead to food shortages. To tackle the threat of food security over the future generation, the farming community is under excessive pressure to boost its agricultural output. The technology helps to improve crop output per hectare as inputs need to be precisely monitored to ensure proper crop development. Good irrigation or water management techniques with the use of soil moisture sensors help in increasing yields and improving crop quality. Sensors enable to make farming more profitable through water and energy conservation as well as significant cost savings.

Restraint: Difficulties in monitoring due to spatial variability of the soil

Soil monitoring devices, systems, and equipment are used in several different fields for different purposes, including researchers and farm consultants. While researchers use them for monitoring the surface run-off or movement of dissolved solutes, nutrient content, the temperature of the soil, etc., farm consultants use it to determine the amount and time of irrigation required for crops. However, due to the spatial variability of soil, it is not viable to monitor every single parameter to represent large areas such as farms or grounds. It limits the reliability of the soil measurement information taken at certain points, as the information depends on the extent to which the measurement locations represent the rest of the ground. In case of high spatial variability in soil, farmers need to take precautions while taking measurements and avoid relying on comparatively insufficient measurements.

Opportunity: Huge government spending on agriculture R&D

Soil monitoring can help farmers to economize the use of resources to avoid expenditure on water bills, fertilizers, pesticides, and other inputs. However, the cost of reliable soil monitoring sensors is high, or else growers need to compromise on reliability with the price. Farmers need to invest a huge amount of capital to buy soil monitoring systems. While large commercial farmers can afford the high cost of soil monitoring sensors and devices to avail benefits, small landholders find it difficult to purchase owing to the high upfront costs involved. Government incentives and subsidies or aids from any donor community can help marginal farmers to adopt advanced technologies for soil monitoring purposes. Public sector investments in agricultural R&D have made the agricultural industry in the US one of the largest contributors to state-of-the-art technologies. In the US, the Senate Appropriations Committee’s fiscal year 2020 agriculture appropriations bill would provide USD 23.1 billion in discretionary funding, with USD 3.172 billion specifically for agriculture research.

Challenge: Lack of awareness and technical skills pertaining to soil monitoring

The low awareness among people regarding soil monitoring is a major challenge to the market’s growth. Many end users from agriculture, residential, landscaping, and sports turf, are unaware of the benefits of soil monitoring. Currently, only a few farms are equipped with soil monitoring sensors, mainly due to the dominance of other alternative approaches like manual inspection and visual judgment. The availability of limited options for supporting the use of soil monitoring sensors, equipment, devices, and solutions challenges the market growth as these sensors are costly and unaffordable by smallholders.

Ground-based monitoring systems were the most extensively used technology in the global soil monitoring market in 2021

Ground-based monitoring systems accounted for the largest share in the soil monitoring market in 2021. The level of adoption of sensors and other soil monitoring devices has been on the rise among progressive farmers across the globe. This is due to the several benefits provided by these sensors, which enable growers to provide site-specific inputs to the crops. Ground-based monitoring systems are expected to get a further boost during the forecast period. The market for sensing & imagery systems is expected to grow at the highest rate during 2022-2027. The satellite-based soil monitoring segment held the largest share in the soil monitoring market for sensing and imagery systems in 2021 and is expected to grow at a significant rate during 2022–2027.

Hardware offerings to hold the largest market share during the forecast period

The hardware offering is expected to hold the largest share in the global soil monitoring market. This is attributed to the increasing penetration of soil sensors, soil scanners, weather stations, and other devices for soil monitoring among farmers. Progressive farmers globally have benefitted from soil monitoring, which has increased the adoption of soil monitoring sensors and devices.

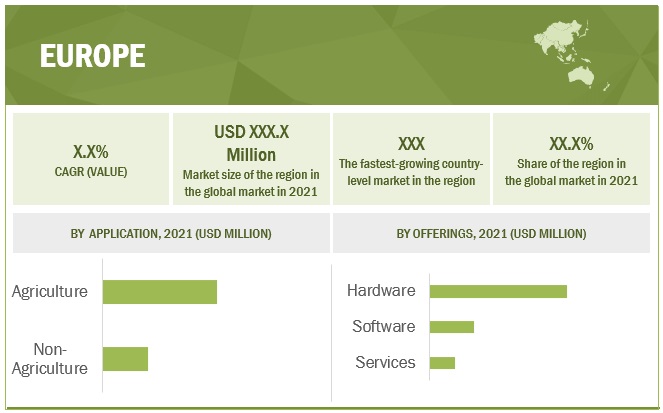

Europe was the second-largest market for soil monitoring in 2021

To know about the assumptions considered for the study, download the pdf brochure

The European region held the second-largest share in the soil monitoring market in 2021 after the Americas and is expected to maintain its position during the forecast period. The use of digital farming techniques has become more prominent in Europe owing to advancements in the field of sensors, robotics and automation, and remote sensing technology. Soil monitoring helps farmers to utilize the technology to improve farm productivity; additionally, sensors are useful in saving water resources in other applications such as sports turf, residential irrigation, and landscaping and ground care. EU countries have signed a Declaration of Cooperation on a smart and sustainable digital agriculture future and take action to support the digitalization of agriculture. However, the APAC region is expected to witness fast growth during the forecast period owing to the high degree of agriculture technology adoption in Australia, New Zealand, and Japan, with emerging countries like India and China investing a huge amount in the digitalization of the agriculture sector.

Key Market Players

The major players in the soil monitoring market are Stevens Water Monitoring Systems (US), SGS Group (Switzerland), METER Group (US), Element Materials Technology (UK), The Toro Company (US), Campbell Scientific (US), Sentek Technologies (Australia), Spectrum Technologies (US), Irrometer (US), and CropX Technologies (Israel).

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD) |

|

Segments covered |

Offering, System Type, Application, and Region |

|

Regions covered |

Americas (North America, South America), Europe, Asia Pacific, and the Rest of the World |

|

Companies studied |

|

Target Audience:

- Agriculture technology companies

- Government and research organizations

- Soil monitoring system distributors

- Crop growers and farmers

- Marketing directors

- Key executives from various key companies and organizations in the soil monitoring market

Report Scope:

This research report categorizes the soil monitoring market based on offering, system type, application, and region

By Offering

- Hardware

- Software

- Services

- By System Type

- Sensing & Imagery

- Ground-based Sensing

- Robotic & Telematics

By Application

- Agricultural

- Non-agricultural

Recent Developments

- Stevens Water acquired Structure Monitoring (US) in January 2019, a provider of intelligent IoT solutions, to enhance Steven Water’s platform—Stevens-Connect.

- In October 2021, SGS launched the GLP soil characterization service to help determine the chemical, physical, and biological properties that affect soil fertility.

- SGS partnered with Mammoet (Netherlands) in November 2019, a global leader in lifting and transporting heavy objects, for sustainable soil stabilization in Nigeria.

- In July 2020, METER Group launched 2 new data loggers—ZL6 Basic and ZL6 Pro—to its Zentra series of data loggers and will provide more options to customers to connect with their data.

- Element Materials Technology Group Limited acquired FOSTA Group in July 2022, a leading geotechnical instrumentation and soil investigation specialist based in Singapore. This acquisition significantly strengthens Element’s services within the fast-growing infrastructure and environmental markets and complements its existing capabilities in Southeast Asia.

- In January 2020, The Toro Company acquired Venture Products (US), a manufacturer of Ventrac products. This acquisition will support the company’s strategy to grow in the professional market with an expanded product line to cater to customers in landscape, turf, and snow and ice maintenance categories.

- CropX Technologies, Ltd. announced the commercial launch of a new capability for its farm management system in August 2022. The new capability can continuously track the movement of nitrogen and salts in the soil. The CropX solution is easier, less time-consuming, and can supply continuous monitoring of nitrogen leaching events than traditional lab testing methods.

Frequently Asked Questions (FAQ):

What is the current size of the global soil monitoring market?

The global soil monitoring market is estimated to be USD 551 million in 2022 and projected to reach USD 1,088 million by 2027, at a CAGR of 14.6%. Major factors driving the growth of the soil monitoring market include efforts of governments and companies to promote sustainable agriculture practices, the pressing need to preserve soil quality, stringent government regulations pertaining to ecological stability, and the growing need for improving farm productivity to feed the rising population.

Who are the winners in the global soil monitoring market?

Companies such as Stevens Water Monitoring Systems (US), SGS Group (Switzerland), METER Group (US), Element Material Technology (UK), and The Toro Company (US) fall under the winners category. Companies cater to the requirements of their customers by providing soil monitoring sensors, devices, software, and integrated solutions with a presence in most countries.

I am interested in the Asia Pacific market for various systems of soil monitoring. Is customization available for the same? What information would be included in the same?

Yes, the customization for the Asia Pacific market for various segments can be provided on various aspects, including the market size, forecast, market dynamics, company profiles, and competitive landscape. Exclusive insights on the below-mentioned Asia Pacific countries will be provided:

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- Singapore

- Vietnam

- Malaysia

- Thailand

- Indonesia

- Rest of Asia Pacific

Also, you can let us know if there are any other countries of your interest.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide an explanation on the same?

Yes, a detailed explanation of the research methodology can be provided over a scheduled call; it will also enable us to explain all your queries in detail. For a brief overview and knowledge, multiple approaches have been adopted to understand the holistic view of this market, including:

- Bottom-up approach

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of the below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate the analyst’s view on the company. Some of the key players in the market include Stevens Water Monitoring Systems (US), SGS Group (Switzerland), METER Group (US), Element Materials Technology (UK), The Toro Company (US), Campbell Scientific (US), Sentek Technologies (Australia), Spectrum Technologies (US), Irrometer (US), and CropX Technologies (Israel). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.1.1 Inclusions and exclusions, by offering segment

1.2.1.2 Inclusions and exclusions, by application, system type, and geography segment

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.1.2 List of major secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 PRIMARY AND SECONDARY RESEARCH

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis (demand side)

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: DEMAND-SIDE APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 ASSUMPTIONS

FIGURE 7 SOIL MONITORING MARKET FORECAST AND GROWTH ASSUMPTION

TABLE 1 GLOBAL ECONOMY AND GROWTH OUTLOOK ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 8 SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 9 SENSORS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

FIGURE 10 SENSING & IMAGERY SYSTEMS TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 11 AGRICULTURAL APPLICATION TO HOLD LARGER MARKET SHARE IN 2022

FIGURE 12 AMERICAS HELD LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SOIL MONITORING MARKET

FIGURE 13 SURGING DEMAND FOR AGRICULTURAL PRODUCTS DUE TO INCREASING GLOBAL POPULATION

4.2 SOIL MONITORING MARKET IN ASIA PACIFIC, BY SYSTEM TYPE AND COUNTRY

FIGURE 14 AUSTRALIA & GROUND-BASED MONITORING SYSTEMS HELD LARGEST SHARE OF SOIL MONITORING MARKET IN ASIA PACIFIC IN 2021

4.3 SOIL MONITORING MARKET, BY OFFERING

FIGURE 15 HARDWARE SEGMENT TO HOLD LARGEST MARKET FROM 2022 TO 2027

4.4 SOIL MONITORING MARKET, BY HARDWARE

FIGURE 16 SENSORS TO HOLD LARGEST MARKET SHARE FROM 2022 TO 2027

4.5 SOIL MONITORING MARKET, BY APPLICATION

FIGURE 17 AGRICULTURAL APPLICATION TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

4.6 GEOGRAPHIC ANALYSIS OF SOIL MONITORING MARKET

FIGURE 18 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 SUSTAINABLE AGRICULTURAL PRACTICES TO DRIVE MARKET GROWTH

5.2.1 DRIVERS

5.2.1.1 Efforts of governments and companies to promote sustainable agriculture practices

TABLE 2 SUSTAINABLE AGRICULTURE SCORE OF MAJOR COUNTRIES (ON A SCALE OF 100)

5.2.1.2 Need to preserve soil quality

5.2.1.3 Stringent government regulations pertaining to ecological stability

5.2.1.4 Growing need to improve farm productivity

FIGURE 20 PROJECTED WORLD POPULATION TILL 2100

FIGURE 21 IMPACT ANALYSIS: DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Difficulties in monitoring due to spatial variability of soil

5.2.2.2 Poor reliability and high costs associated with soil monitoring sensors

FIGURE 22 IMPACT ANALYSIS: RESTRAINTS

5.2.2.3 Low adoption of modern agricultural technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of advanced technologies like IoT and data analytics to promote smart agriculture

5.2.3.2 Huge government spending on agriculture

5.2.3.3 Digitalization of agriculture and adoption of advanced farming techniques post-COVID-19

FIGURE 23 IMPACT ANALYSIS: OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness and technical skills

FIGURE 24 IMPACT ANALYSIS: CHALLENGES

6 INDUSTRY TRENDS (Page No. - 68)

6.1 INTRODUCTION

6.2 MAJOR TRENDS IN SOIL MONITORING MARKET

6.2.1 ADOPTION OF IOT DEVICES AND DEVELOPMENT OF CONNECTED ENVIRONMENT

6.2.2 EVOLVING WIRELESS MONITORING SYSTEMS

6.2.3 DEVELOPMENT OF SMART SENSORS

6.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS AND SYSTEM INTEGRATORS

6.4 TECHNOLOGY ANALYSIS

6.4.1 SOIL SENSOR TECHNOLOGIES

FIGURE 26 ADOPTION OF SOIL SENSOR TECHNOLOGIES IN 2021

6.5 AVERAGE SELLING PRICE (ASP) ANALYSIS

FIGURE 27 VOLUMETRIC SOIL MOISTURE SENSORS (AVERAGE SELLING PRICE)

FIGURE 28 WATER POTENTIAL SOIL MOISTURE SENSORS (AVERAGE SELLING PRICE)

TABLE 3 AVERAGE SELLING PRICE OF SOIL SENSORS FOR MAJOR COMPANIES

6.6 CASE STUDIES: SOIL MONITORING MARKET

6.6.1 CASE STUDY 1: SENTEK TECHNOLOGIES

6.6.2 CASE STUDY 2: CAMPBELL SCIENTIFIC

6.7 ECOSYSTEM MARKET MAP

TABLE 4 SOIL MONITORING MARKET: ECOSYSTEM

6.8 PATENT ANALYSIS

FIGURE 29 PATENTS GRANTED FOR SOIL MONITORING MARKET, 2011-2021

FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED FOR SOIL MONITORING MARKET, 2011-2021

TABLE 5 KEY PATENTS PERTAINING TO SOIL MONITORING MARKET, 2021

6.9 KEY CONFERENCES & EVENTS,2022-2023

TABLE 6 SOIL MONITORING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

7 SOIL MONITORING MARKET, BY SYSTEM TYPE (Page No. - 81)

7.1 INTRODUCTION

TABLE 7 SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

FIGURE 31 SENSING & IMAGERY SYSTEMS SEGMENT TO HOLD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 8 SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

7.2 SENSING & IMAGERY SYSTEMS

TABLE 9 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 10 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 11 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

FIGURE 32 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR

TABLE 12 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 13 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 14 SENSING & IMAGERY SYSTEMS: SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.1 SATELLITE-BASED SOIL MONITORING

7.2.1.1 Satellite-based soil monitoring for agricultural applications

7.2.2 MANNED AIRCRAFT/ AERIAL PHOTOGRAPHY-BASED SOIL MONITORING

7.2.2.1 Utilization of aerial photography by large farms

7.2.3 DRONE-BASED SOIL MONITORING

7.2.3.1 Increasing adoption of drone-based soil monitoring

7.3 GROUND-BASED MONITORING SYSTEMS

7.3.1 DOES NOT REQUIRE STRONG TECHNICAL KNOWLEDGE

TABLE 15 GROUND-BASED MONITORING SYSTEMS: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

FIGURE 33 SOFTWARE SEGMENT EXPECTED TO HOLD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 16 GROUND-BASED MONITORING SYSTEMS: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 17 GROUND-BASED MONITORING SYSTEMS: SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 18 GROUND-BASED MONITORING SYSTEMS: SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 OTHERS (TELEMATICS & ROBOTICS)

TABLE 19 OTHERS: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 20 OTHERS: SOIL MONITORING MARKET, BY OFFERING 2022–2027 (USD MILLION)

TABLE 21 OTHERS: SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

FIGURE 34 ASIA PACIFIC IS EXPECTED TO HOLD HIGHEST CAGR

TABLE 22 OTHERS: SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

8 SOIL MONITORING MARKET, BY OFFERING (Page No. - 93)

8.1 INTRODUCTION

TABLE 23 SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

FIGURE 35 SOFTWARE TO EXHIBIT HIGHEST CAGR

TABLE 24 SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

8.2 HARDWARE

TABLE 25 HARDWARE: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 26 HARDWARE: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 27 HARDWARE: SOIL MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

FIGURE 36 AGRICULTURAL APPLICATIONS TO HOLD LARGER MARKET SHARE IN 2027

TABLE 28 HARDWARE: SOIL MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 29 HARDWARE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 30 HARDWARE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 31 HARDWARE: SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

FIGURE 37 ASIA PACIFIC TO REGISTER HIGHEST CAGR

TABLE 32 HARDWARE: SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2.1 SENSORS

TABLE 33 SENSORS: SOIL MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 34 SENSORS: SOIL MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2.1.1 Volumetric soil moisture sensors

TABLE 35 VOLUMETRIC SOIL MOISTURE SENSORS: SOIL MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

FIGURE 38 TDT SENSORS HELD LARGEST MARKET SIZE IN 2021

TABLE 36 VOLUMETRIC SOIL MOISTURE SENSORS: SOIL MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2.1.1.1 Neutron probes

8.2.1.1.1.1 Neutron probes offer accurate readings when calibrated properly

8.2.1.1.2 Capacitance sensors

8.2.1.1.2.1 Capacitance sensor account for second-largest share

8.2.1.1.3 Time-domain transmissometry sensors

8.2.1.1.3.1 Dominance of time-domain transmissometry sensors

8.2.1.2 Soil water potential sensors

TABLE 37 SOIL WATER POTENTIAL SENSORS: SOIL MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 38 SOIL WATER POTENTIAL SENSORS: SOIL MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2.1.2.1 Tensiometers

8.2.1.2.1.1 Used in measuring soil water content

8.2.1.2.2 Gypsum blocks

8.2.1.2.2.1 Increased demand for gypsum blocks

8.2.1.2.3 Granular matrix sensors

8.2.1.2.3.1 Capability to capture data on soil moisture

8.2.1.3 Others

TABLE 39 OTHER SENSORS: SOIL MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

FIGURE 39 CLIMATE SENSORS TO GROW AT HIGHEST CAGR

TABLE 40 OTHER SENSORS: SOIL MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2.1.3.1 Temperature sensors

8.2.1.3.1.1 Monitoring soil temperature to boost farm productivity

8.2.1.3.2 pH sensors

8.2.1.3.2.1 Enable better nutrient absorption to enhance plant growth

8.2.1.3.3 Nutrient sensors

8.2.1.3.3.1 Nutrient measurement aids in better input management

8.2.1.3.4 Climate sensors

8.2.1.3.4.1 Global climate change prompts growers to deploy climate sensors

8.2.1.3.5 Salinity sensors

8.2.1.3.5.1 Prevent soil erosion and land degradation

8.2.2 SMART IMAGING SYSTEMS

8.2.2.1 Increased demand for hyperspectral camera systems

8.2.3 DATA LOGGERS AND TELEMETRY SYSTEMS

8.2.3.1 Escalated demand for telematics devices

8.2.4 PORTABLE SOIL SCANNERS

8.2.4.1 Flexibility and mobility to use on targeted sites

8.2.5 OTHERS

8.3 SOFTWARE

TABLE 41 SOFTWARE: SOIL MONITORING MARKET, BY DEPLOYMENT TYPE, 2019–2021 (USD MILLION)

FIGURE 40 ON-PREMISES SOFTWARE TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

TABLE 42 SOFTWARE: SOIL MONITORING MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 43 SOFTWARE: SOIL MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 44 SOFTWARE: SOIL MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 45 SOFTWARE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 46 SOFTWARE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 47 SOFTWARE: SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

FIGURE 41 ASIA PACIFIC TO WITNESS TREMENDOUS GROWTH DURING FORECAST PERIOD

TABLE 48 SOFTWARE: SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3.1 ON-PREMISES

8.3.1.1 Allow growers to store data locally securely

8.3.2 CLOUD-BASED

8.3.2.1 Provides remote access to field information

8.3.2.2 Software-as-a-service (SaaS)

8.3.2.3 Platform-as-a-service (PaaS)

8.4 SERVICES

TABLE 49 SERVICES: SOIL MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 50 SERVICES: SOIL MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 51 SERVICES: SOIL MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 52 SERVICES: SOIL MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 53 SERVICES: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

FIGURE 42 GROUND-BASED MONITORING SYSTEMS TO HOLD LARGEST MARKET SHARE IN 2027

TABLE 54 SERVICES: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 55 SERVICES: SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 56 SERVICES: SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4.1 SYSTEM INTEGRATION AND CONSULTING SERVICES

8.4.1.1 System integration and consulting services hold major share in market

8.4.2 MANAGED SERVICES

8.4.2.1 Farm operation services

8.4.2.1.1 Demand for farm operation service in soil monitoring market

8.4.2.2 Data services

8.4.2.2.1 Data-driven farming has created significant demand for data services

8.4.2.3 Analytics services

8.4.2.3.1 Need to interpret data to meet growing demand for analytics services

8.4.3 CONNECTIVITY SERVICES

8.4.3.1 High demand for connected farming tools

8.4.4 ASSISTED PROFESSIONAL SERVICES

8.4.4.1 Supply chain management services

8.4.4.1.1 Concerns to ensure food security to fuel demand

8.4.4.2 Climate information services

8.4.4.2.1 Need for sustainable agriculture to boost demand for climate information services

9 SOIL MONITORING MARKET, BY APPLICATION (Page No. - 121)

9.1 INTRODUCTION

TABLE 57 SOIL MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

FIGURE 43 NON-AGRICULTURAL APPLICATION TO GROW AT HIGHER CAGR

TABLE 58 SOIL MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 AGRICULTURAL

TABLE 59 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY TYPE 2019–2021 (USD MILLION)

TABLE 60 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 61 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 62 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 63 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

FIGURE 44 AMERICAS TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 64 AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2.1 FIELD CROPS (OPEN-FIELD FARMING AND ROW CROPS)

9.2.1.1 High adoption of soil monitoring sensors in field crops

TABLE 65 FIELD CROPS: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 66 FIELD CROPS: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

9.2.2 SMART GREENHOUSE & HORTICULTURE

9.2.2.1 Crucial role of soil sensors in smart greenhouses

TABLE 67 SMART GREENHOUSE & HORTICULTURE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

FIGURE 45 GROUND-BASED MONITORING SYSTEMS TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 68 SMART GREENHOUSE & HORTICULTURE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

9.2.3 VERTICAL FARMS

9.2.3.1 Adoption of advanced smart sensors in vertical farms

9.2.4 OTHERS (FLORICULTURE, ORCHARDS, AND CANNABIS/HEMP)

TABLE 69 OTHER AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 70 OTHER AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

9.3 NON-AGRICULTURAL

TABLE 71 NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

FIGURE 46 SPORTS TURF MANAGEMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 72 NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 73 NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 74 NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3.1 RESIDENTIAL

9.3.1.1 Expanding residential infrastructure has resulted in heightened demand for soil monitoring

9.3.2 LANDSCAPING AND GROUND CARE

9.3.2.1 Landscaping and ground care in sloping terrains generate substantial demand for soil monitoring

9.3.3 SPORTS TURF

9.3.3.1 Soil monitoring in sports turf management help to optimize irrigation of sport turfs

9.3.4 FORESTRY

9.3.4.1 Adoption of soil monitoring to protect forests

9.3.5 CONSTRUCTION AND MINING

9.3.5.1 Demand for construction and mining verticals for soil monitoring during forecast period

9.3.6 WEATHER FORECASTING

9.3.6.1 Implementation of soil monitoring to reduce soil erosion

TABLE 75 WEATHER FORECASTING: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 76 WEATHER FORECASTING: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

9.3.7 OTHERS

TABLE 77 OTHER NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

FIGURE 47 GROUND-BASED MONITORING SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 78 OTHER NON-AGRICULTURAL APPLICATION: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

10 SOIL MONITORING MARKET, BY GEOGRAPHY (Page No. - 138)

10.1 INTRODUCTION

FIGURE 48 GEOGRAPHIC SNAPSHOT: GLOBAL COUNTRY-LEVEL SOIL MONITORING MARKET

TABLE 79 SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 80 SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 AMERICAS

TABLE 81 AMERICAS: SOIL MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 82 AMERICAS: SOIL MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 83 AMERICAS: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 84 AMERICAS: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 85 AMERICAS: SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

FIGURE 49 NORTH AMERICA TO HOLD MAJOR SHARE DURING FORECAST PERIOD

TABLE 86 AMERICAS: SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 87 AMERICAS: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 88 AMERICAS: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.2.1 NORTH AMERICA

TABLE 89 NORTH AMERICA: SOIL MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 90 NORTH AMERICA: SOIL MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

FIGURE 50 SENSING & IMAGERY SYSTEMS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 92 NORTH AMERICA: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: SOIL MONITORING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 94 NORTH AMERICA: SOIL MONITORING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.2.1.1 US

10.2.1.1.1 Early adopter of soil monitoring technology

TABLE 97 US: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 98 US: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.2.1.2 Canada

10.2.1.2.1 Availability of large-sized and favorable government policies to propel growth

TABLE 99 CANADA: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 100 CANADA: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.2.1.3 Mexico

10.2.1.3.1 Country to witness growth in soil monitoring technologies

TABLE 101 MEXICO: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 102 MEXICO: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.2.2 SOUTH AMERICA

TABLE 103 SOUTH AMERICA: SOIL MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

FIGURE 51 NON-AGRICULTURAL SEGMENT TO WITNESS HIGHER CAGR

TABLE 104 SOUTH AMERICA: SOIL MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 105 SOUTH AMERICA: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 106 SOUTH AMERICA: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 107 SOUTH AMERICA: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 108 SOUTH AMERICA: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 109 SOUTH AMERICA: SOIL MONITORING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 110 SOUTH AMERICA: SOIL MONITORING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.2.1 Brazil

10.2.2.1.1 Large farm size to surge adoption of soil monitoring technology

TABLE 111 BRAZIL: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 112 BRAZIL: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.2.2.2 Argentina

10.2.2.2.1 Increasing focus toward data-driven farming to boost demand for soil monitoring technology

TABLE 113 ARGENTINA: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 114 ARGENTINA: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.2.2.3 Rest of South America

10.3 EUROPE

FIGURE 52 SNAPSHOT: SOIL MONITORING MARKET IN EUROPE

TABLE 115 EUROPE: SOIL MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

FIGURE 53 AGRICULTURAL APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 116 EUROPE: SOIL MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 117 EUROPE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 118 EUROPE: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 120 EUROPE: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 121 EUROPE: SOIL MONITORING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

FIGURE 54 UK TO EXHIBIT HIGHEST CAGR

TABLE 122 EUROPE: SOIL MONITORING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.1 FRANCE

10.3.1.1 Increasing adoption of modern agriculture techniques to drive market growth

TABLE 123 FRANCE: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 124 FRANCE: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Germany among early adopter of soil monitoring technology

TABLE 125 GERMANY: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 126 GERMANY: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Strong commercial support for adoption of precision farming technology

TABLE 127 UK: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 128 UK: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Surging adoption of advanced digital farming techniques to drive market growth

TABLE 129 ITALY: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 130 ITALY: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Rising concern for water conservation to propel growth

TABLE 131 SPAIN: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 132 SPAIN: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.3.6 POLAND

10.3.6.1 Poland to witness promising growth in eastern European market

TABLE 133 POLAND: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 134 POLAND: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.3.7 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 55 SNAPSHOT: SOIL MONITORING MARKET IN ASIA PACIFIC

TABLE 135 ASIA PACIFIC: SOIL MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

FIGURE 56 AGRICULTURAL APPLICATION TO WITNESS HIGHER CAGR

TABLE 136 ASIA PACIFIC: SOIL MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: SOIL MONITORING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

FIGURE 57 CHINA TO WITNESS HIGHEST CAGR

TABLE 142 ASIA PACIFIC: SOIL MONITORING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Focus on agricultural research projects to create additional demand for soil monitoring technology

TABLE 143 CHINA: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 144 CHINA: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.4.2 AUSTRALIA

10.4.2.1 Support from local government and surging funding activities in agri-tech space to boost market growth

TABLE 145 AUSTRALIA: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 146 AUSTRALIA: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Research projects with focus on soil moisture measurement to drive market growth

TABLE 147 JAPAN: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 148 JAPAN: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Recent government initiatives to spur market growth

TABLE 149 INDIA: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 150 INDIA: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.4.5 SOUTH KOREA

10.4.5.1 Rising interest among growers toward digital farming to propel market growth

TABLE 151 SOUTH KOREA: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 152 SOUTH KOREA: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

10.5 ROW (REST OF THE WORLD)

TABLE 153 ROW: SOIL MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

FIGURE 58 AGRICULTURAL TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 154 ROW: SOIL MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 155 ROW: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2019–2021 (USD MILLION)

TABLE 156 ROW: SOIL MONITORING MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 157 ROW: SOIL MONITORING MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 158 ROW: SOIL MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 159 ROW: SOIL MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

FIGURE 59 MIDDLE EAST TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 160 ROW: SOIL MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST

10.5.1.1 Increasing trend toward indoor farming to drive market growth

10.5.2 AFRICA

10.5.2.1 Rising concern for precision irrigation method to propel market growth

11 COMPETITIVE LANDSCAPE (Page No. - 181)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS – SOIL MONITORING MARKET, 2O21

TABLE 161 SOIL MONITORING MARKET: DEGREE OF COMPETITION

11.3 STRATEGIES ADOPTED BY KEY PLAYERS

11.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

FIGURE 60 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN SOIL MONITORING MARKET, 2019–2021 (USD BILLION)

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 61 SOIL MONITORING MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

11.6 PRODUCT FOOTPRINT

TABLE 162 KEY PLYERS: COMPANY PRODUCT FOOTPRINT, BY OFFERING

TABLE 163 KEY PLYERS: COMPANY PRODUCT FOOTPRINT, BY APPLICATION

TABLE 164 KEY PLYERS: COMPANY PRODUCT FOOTPRINT, BY REGIONAL FOOTPRINT

TABLE 165 KEY PLYERS: COMPANY PRODUCT FOOTPRINT: OVERALL FOOTPRINT

11.7 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 62 SOIL MONITORING MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

11.8 PRODUCT FOOTPRINT

TABLE 166 OTHER PLAYERS: COMPANY PRODUCT FOOTPRINT, BY OFFERING

TABLE 167 OTHER PLAYERS: COMPANY PRODUCT FOOTPRINT, BY APPLICATION

TABLE 168 OTHER PLAYERS: COMPANY PRODUCT FOOTPRINT, BY REGIONAL FOOTPRINT

TABLE 169 OTHER PLAYERS: COMPANY PRODUCT FOOTPRINT: OVERALL FOOTPRINT

TABLE 170 OTHER PLAYERS: SOIL MONITORING: COMPETITIVE BENCHMARKING OF KEY START-UPS

11.9 COMPETITIVE SCENARIO

11.9.1 PRODUCT LAUNCHES

TABLE 171 SOIL MONITORING MARKET: NEW PRODUCT LAUNCHES, 2018–2022

11.9.2 DEALS

TABLE 172 SOIL MONITORING MARKET: DEALS, 2018–2022

11.9.3 OTHERS

TABLE 173 SOIL MONITORING MARKET: EXPANSIONS, 2018 - 2022

12 COMPANY PROFILES (Page No. - 196)

12.1 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats)*

12.1.1 STEVENS WATER MONITORING SYSTEMS INC.

TABLE 174 STEVENS WATER MONITORING SYSTEMS INC.: BUSINESS OVERVIEW

TABLE 175 STEVENS WATER MONITORING SYSTEMS INC.: DEALS

12.1.2 SGS GROUP

TABLE 176 SGS GROUP: BUSINESS OVERVIEW

FIGURE 63 SGS GROUP: COMPANY SNAPSHOT

TABLE 177 SGS GROUP: NEW PRODUCT LAUNCHES

TABLE 178 SGS GROUP: DEALS

TABLE 179 SGS GROUP: OTHERS

12.1.3 METER GROUP

TABLE 180 METER GROUP: BUSINESS OVERVIEW

TABLE 181 METER GROUP: NEW PRODUCT LAUNCHES

12.1.4 ELEMENT MATERIALS TECHNOLOGY GROUP LIMITED

TABLE 182 ELEMENT MATERIALS TECHNOLOGY GROUP LIMITED: BUSINESS OVERVIEW

TABLE 183 ELEMENT MATERIALS TECHNOLOGY GROUP LIMITED: DEALS

12.1.5 THE TORO COMPANY

TABLE 184 THE TORO COMPANY: BUSINESS OVERVIEW

FIGURE 64 THE TORO COMPANY: COMPANY SNAPSHOT

TABLE 185 THE TORO COMPANY: DEALS

12.1.6 CAMPBELL SCIENTIFIC

TABLE 186 CAMPBELL SCIENTIFIC: BUSINESS OVERVIEW

TABLE 187 CAMPBELL SCIENTIFIC: DEALS

TABLE 188 CAMPBELL SCIENTIFIC: OTHERS

12.1.7 SENTEK TECHNOLOGIES

TABLE 189 SENTEK TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 190 SENTEK TECHNOLOGIES: NEW PRODUCT LAUNCHES

TABLE 191 SENTEK TECHNOLOGIES: OTHERS

12.1.8 SPECTRUM TECHNOLOGIES, INC.

TABLE 192 SPECTRUM TECHNOLOGIES, INC.: BUSINESS OVERVIEW

TABLE 193 SPECTRUM TECHNOLOGIES, INC.: NEW PRODUCT LAUNCHES

12.1.9 IRROMETER COMPANY, INC.

TABLE 194 IRROMETER COMPANY, INC.: BUSINESS OVERVIEW

12.1.10 CROPX TECHNOLOGIES LTD.

TABLE 195 CROPX TECHNOLOGIES LTD.: BUSINESS OVERVIEW

TABLE 196 CROPX TECHNOLOGIES LTD.: DEALS

TABLE 197 CROPX TECHNOLOGIES LTD.: OTHERS

12.2 SMES/START-UPS

12.2.1 ACCLIMA, INC.

TABLE 198 ACCLIMA, INC.: BUSINESS OVERVIEW

12.2.2 AQUACHECK USA

TABLE 199 AQUACHECK USA: BUSINESS OVERVIEW

12.2.3 HYDROPOINT

TABLE 200 HYDROPOINT: BUSINESS OVERVIEW

TABLE 201 HYDROPOINT: NEW PRODUCT LAUNCHES

12.2.4 DELTA-T DEVICES LTD

TABLE 202 DELTA-T DEVICES LTD: BUSINESS OVERVIEW

TABLE 203 DELTA-T DEVICES LTD: NEW PRODUCT LAUNCHES

12.2.5 IMKO MICROMODULTECHNIK GMBH

TABLE 204 IMKO MICROMODULTECHNIK GMBH: BUSINESS OVERVIEW

12.2.6 E.S.I. ENVIRONMENTAL SENSORS

12.2.7 VEGETRONIX

12.2.8 AQUASPY

12.2.9 SOIL SCOUT OY

12.2.10 CAIPOS GMBH

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 229)

13.1 INTRODUCTION

TABLE 205 ADJACENT MARKETS TO SOIL MONITORING MARKET

13.2 LIMITATIONS

13.3 SOIL AMENDMENTS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 206 SOIL AMENDMENTS MARKET, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 207 SOIL AMENDMENTS MARKET, BY CROP TYPE, 2021–2027 (USD MILLION)

13.4 SOIL CONDITIONERS MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

TABLE 208 SOIL CONDITIONERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

13.5 SOIL TESTING EQUIPMENT MARKET

13.5.1 MARKET DEFINITION

13.5.2 MARKET OVERVIEW

TABLE 209 SOIL TESTING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2017–2025 (USD MILLION)

14 APPENDIX (Page No. - 232)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

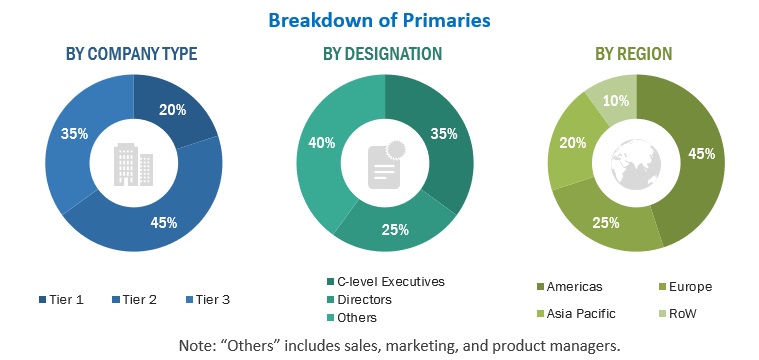

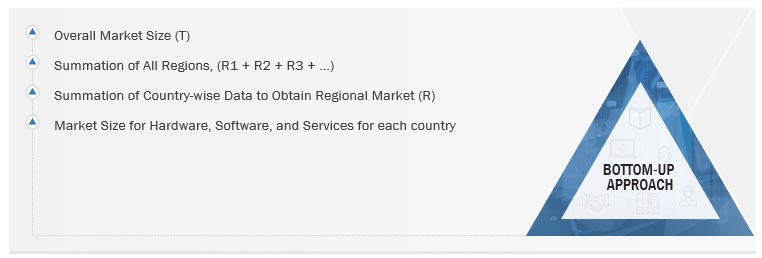

This research study involved four major activities in estimating the size of the soil monitoring market. Exhaustive secondary research has been conducted to collect significant information on the soil monitoring market, peer market, and parent market. The validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. Post this, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred for this research study include the International Society for Precision Agriculture (ISPA) (US), Precision Ag Institute (US), Association for Unmanned Vehicle Systems International (US), National Integrated Drought Information System (US), SPAA Precision Agriculture (Australia), and Agricultural Research Organization (Israel).

In the soil monitoring market report, the top-down and the bottom-up approaches have been used for the estimation and validation of the market size, along with several other dependent submarkets. The major players in the soil monitoring market were identified using extensive secondary research and their presence using primary and secondary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the soil monitoring market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions—the Americas, Europe, Asia Pacific (APAC), and the Rest of the World (Russia, the Middle East, and Africa). Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. This primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the soil monitoring market, as well as that of various other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying the market for soil monitoring-based hardware, software, and services in each country

- Identifying major applications of soil monitoring-related products, along with the types of hardware, software, and services required for various applications

- Estimating the size of the market in each region by adding the size of the country-wise markets

- Tracking the ongoing and upcoming implementation of soil monitoring projects by various companies in each region and forecasting the size of the soil monitoring market based on these developments and other critical parameters

- Arriving at the size of the global market by adding the size of the region-wise markets

Market Size Estimation Methodology - Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall soil monitoring market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the soil monitoring market has been validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To define, describe, and forecast the soil monitoring market, in terms of value and volume, by offering, system type, application, and region

- To forecast the market for various segments with respect to 4 main regions—the Americas, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value and volume

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall soil monitoring market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the soil monitoring market growth

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the soil monitoring market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the soil monitoring market landscape

- To map the competitive intelligence based on company profiles, key player strategies, and key developments

- To strategically profile key players and start-ups and comprehensively analyze their market ranking and core competencies2

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the soil monitoring market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the Asia Pacific soil monitoring market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Soil Monitoring Market

We are interested to learn about soil moisture market in agriculture. Before purchasing the report I wish to learn what part of the potential market you believe is agriculture and how much this report covers this market segment.

I am in need of intelligent probe moisture meters to be used in green house irrigation system. Can you provide the scope of these sensors Africa, specifically in Kenya. Also I would like to know the market coverage for intelligent probe and moisture meters.

What is the scope and verticals which you have considered. Also would like to understand the major applications that are catered to this market. Are there any trending topics that you have considered in the study of this topic?

Have you covered the trends such as smart sensors used in agriculture in the soil moisture sensor report?

I am working in the geotechnical area which involves heat and moisture migration. I am looking for an appropriate Volumetric water content sensors and water potential sensors available in the market and my interest will to modify for better accuracy.

We design first of kind made in India Soil sensor, which is validated by Indian Space Research Organisation( ISRO) and Indian council of agriculture research for its accuracy. Contact neeragriventures@gmail.com for more and check www.neerx.in