3D Printing Medical Devices Market Size by Component (3D Printer, 3D Bioprinter, Material, Software, Service), Technology (EBM, DMLS, SLS, SLA, DLP, Polyjet), Application (Surgical Guides, Prosthetics, Implants), End User & Region - Global Forecast to 2028

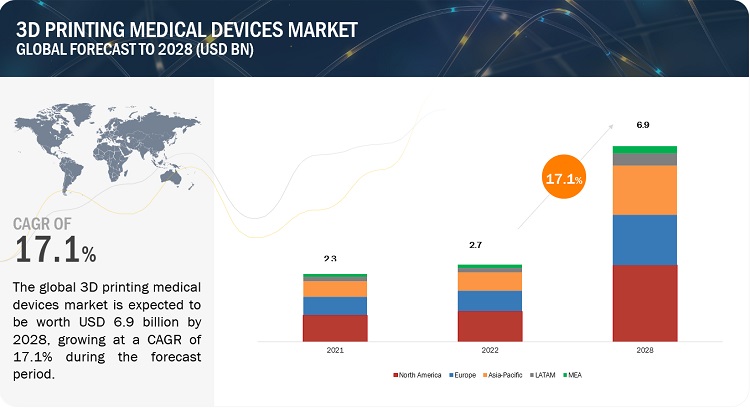

The global 3D printing medical devices market, valued at US$2.3 billion in 2021, stood at US$2.7 billion in 2022 and is projected to advance at a resilient CAGR of 17.1% from 2022 to 2028, culminating in a forecasted valuation of US$6.9 billion by the end of the period. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Continuous technological advancements in 3D printing have significantly improved the quality, speed, and efficiency of the devices. Innovations in materials, printing processes, and software have expanded the range of applications and made 3D printing more accessible to various industries.

To know about the assumptions considered for the study, Request for Free Sample Report

3D Printing Medical Devices Market Dynamics

Driver: Easy development of customized medical products using 3D printing

3D printing facilitates the development of customized medical products at a low cost. It directly creates 3D products based on specific CAD images of the systems in a layer-wise manner and eases the building of complex custom products with unimaginable accuracy in a small production run as compared to traditional manufacturing approaches.

In the medical field, 3D printing leads to the development of patient-specific products such as implants, hearing aids, bone scaffolds, and surgical equipment directly from patient CAD images. These custom products result in a faster recovery of patients, increased success rate of surgeries, and lower costs. Standard implants do not often suit patient requirements, especially in neurosurgery, where every human skull has an irregular and different shape, making it difficult for cranial implants. A 3D-printed patient-specific model enables physicians to plan elective surgical procedures, especially those which are complex to perform. These models optimize procedural time and improve the quality of the patient’s treatment and care. Hence, 3D printing technology is being widely used to make complex and customized prosthetic limbs, surgical implants, and brain designs.

3D Systems Corporation (US), Materialise NV (Belgium), and EOS GmbH (Germany) are some of the key players involved in providing technologies for creating patient-specific customized products. For instance, in March 2017, Johnson & Johnson (US) developed 3D-printed patient-specific surgical tools for surgeons across the US. This will enable doctors to 3D print patient-specific tools during surgical procedures, with the aim to reduce the use of multiple instruments of different sizes in operating rooms. The company’s 3D Printing Center of Excellence has partnered with DePuy Synthes (US) and Ethicon (US) for the development of prototypes for bioprinted knee meniscus tissue implantation as well as titanium alloys for cancer patients suffering from bone degradation.

The need for biocompatible and drug contact materials has increased the production of 3D-printed medical devices perfectly suited for particular individuals. Customized 3D printing allows the simultaneous production of devices along with improved manufacturing efficiency. Dental laboratories and hearing aid manufacturers are involved in the mass production of customized products. For instance, the hearing aid industry is known for the highest installations of customized consumer devices produced by 3D printing. EnvisionTEC’s E-Shell is a biocompatible material that offers over 15 shades of colors and has perspiration- and water-resistant capabilities, which is used for making custom patient solutions for hearing aid devices.

The growing demand for personalized medical products and increasing efforts by market players to develop 3D printing solutions for customized medical devices are positively impacting the growth of the global healthcare 3D printing industry.

Restraint: Stringent regulatory process for the approval of 3D-printed medical devices

Stringent regulatory guidelines (especially in the US) are a major factor restraining the growth of the 3D printing medical devices market. In the US, it takes around 3 to 7 years to prove the medical safety of any new device. As per law, even a new size of a previously approved device needs to go through the entire process before commercialization. If a customized product/device is manufactured, the company has to go through a long process in which every single part of the device has to be tested and approved individually. Simple 3D-printed devices receive FDA approval, but complex devices that need to comply with a large number of FDA requirements are a hurdle for the availability of 3D-printed products on a large scale. Moreover, state legal requirements and manufacturing regulations become an obstacle for dispensing 3D-printed medicines.

In 2016, the US FDA issued draft guidance on the Technical Considerations for Additive Manufactured Devices, with the aim to advise manufacturers engaged in developing devices using the 3D printing technique. The draft is an initial publication to obtain public feedback, and the FDA is still working on its finalization process. The FDA is also evaluating the submissions for 3D-printed medical devices with the aim to determine their safety and effectiveness. As per these requirements, the safety and effectiveness of any medical product would be determined through traditional FDA submission and preview procedures. However, to establish product safety, the device produced using the additive manufacturing technology may need additional or different testing standards compared to products manufactured through traditional (or subtractive) techniques. Furthermore, the FDA intends to provide clarity on the requirements of design controls and systems for the complaint handling of 3D printing manufacturing settings. It also aims to provide clarification on several other quality control issues, such as material qualifications and sterility.

The FDA usually evaluates all medical devices for safety and effectiveness and conducts appropriate benefit and risk assessments. However, in some cases, the FDA may require manufacturers to provide additional data, depending on the complexity of the device. At present, the FDA regulates 3D-printed medical devices in the same manner as traditionally manufactured medical products. However, 3D printing requires software and material specifications, which are stricter as compared to the typical specifications of a traditionally produced device.

Opportunity: Increasing adoption of CAD/CAM technology and desktop printers

3D printing in healthcare has evolved as per the requirements and size of healthcare facilities. Industrial-grade high-throughput 3D printers offer good capacity and quality for large healthcare facilities that need to produce large volumes of appliances on a daily basis. Desktop printers, on the other hand, offer great print quality and are smaller and versatile, with lower throughput. Affordability and the increasing adaptability and versatility of 3D printers for different types of practices have resulted in their rising adoption in dental clinics and hospitals. This has boosted the overall market growth for 3D printers for the medical and dental sector.

Computer-aided design (CAD)/computer-aided manufacturing (CAM) is increasingly being embraced by the medical and dental industry due to its high precision in dental restoration and surgical planning. This technology is used for not only designing and manufacturing milled crowns and bridges & anatomical models but also designing fabricated abutments used in dental & surgical procedures. CAD/CAM is highly useful in customizing dental (dental crowns made of zirconium) and orthopedic prosthetics. The use of CAD/CAM also reduces the need to wear temporary bridges/crowns or revision surgeries during the course of the treatment and the number of doctor visits, thereby reducing the cost of dental restoration or medical treatment procedures.

Customized CAD-based products offer superior surgical outcomes along with a significant reduction in operation time, lower risk of post-surgical complications, and improved mechanical protection to surrounding tissues or organs. According to the American Academy of Cosmetic Dentistry, in 2022, 30% of surveyed practices in the US reported using chairside CAD/CAM, up from 28% in 2019. Among practices without a chairside CAD/CAM, 32% are considering a future purchase.

Challenge: Socio-ethical concerns related to the use of 3D-printed products

3D printing is used for the development of products for a wide range of medical applications. It is used on a large scale in developing tissues and organs, with the aim to cater to the growing demand for organ transplantation across the globe. Living cells and biomaterials are used in the 3D printing process for the development of human organs. However, the use of 3D-printed products (developed using living cells) inside the human body leads to biosafety concerns. This aspect also raises ethical issues, as several religions across the world are against the use of living cells, such as stem cells, in medicine.

To monitor the activities related to the use of human embryos, strict regulations have been formulated by authorities, such as the Human Tissue Authority (HTA), Human Fertilization and Embryology Authority (HFEA), Medicines and Healthcare Products Regulatory Agency (MHRA), and the Central Ethics Committee for Stem Cell Research. The source of biomaterials used for developing 3D-printed products and concerns related to waste elimination are two other major factors hindering the adoption of 3D printing in the medical device industry.

By component, the services & software segment accounted for the largest share of the 3d printing medical devices market during the forecast period.

This segment is projected to reach USD 3.2 billion by 2028 from USD 1.4 billion in 2023, at a CAGR of 17.0% during the forecast period. Based on component, the 3D printing medical devices market is segmented into equipment, materials, and software & services. The software & services segment accounted for the largest share of the 3D printing medical devices market. However, the materials segment is estimated to grow at the highest CAGR of 17.1% during the forecast period.

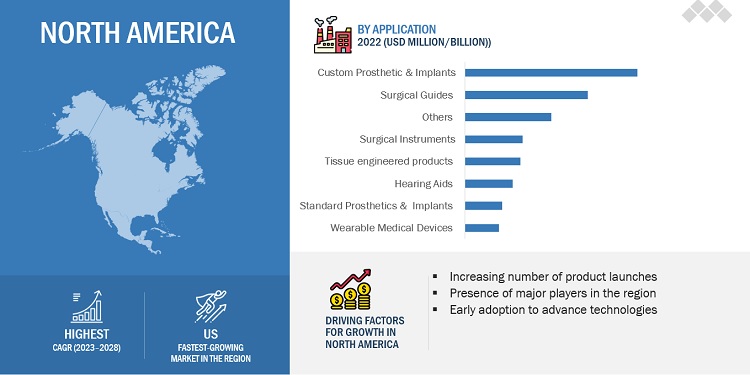

By Application, Custom Prosthetic & Implants segment holds the largest share of the global 3d printing medical devices market.

This segment is projected to reach USD 1.9 billion by 2028 from USD 0.88 billion in 2023, at a CAGR of 17.1% during the forecast period. Custom or patient-specific implants have several benefits over standard implants—they make surgeries easier, save time and cost, and reduce the margin for errors. According to industry experts, the opportunities presented by this sector—the 3D printing of custom implants—are attracting many small companies and new investors to this market.

By Technology, the laser beam melting segment accounted for the largest share of the global 3d printing medical devices market during the forecast period.

This segment is projected to reach USD 2.0 billion by 2028 from USD 0.8 bllion in 2023, at a CAGR of 18.0% during the forecast period. On the basis of technology, the 3D printing medical devices market is divided into six segments, namely, electron beam melting (EBM), laser beam melting (LBM), photopolymerization, droplet deposition or extrusion-based technologies, three-dimensional printing (3DP) or adhesion bonding, and other technologies. The laser beam melting segment is estimated to grow at the highest CAGR during the forecast period owing to the increasing application of this technology in the dental industry and for manufacturing parts for minimally invasive surgery.

By End User, the Hospitals & Surgical centers segment of the global 3d printing medical devices market is expected to grow at the fastest rate during the forecast period.

This segment is projected to reach USD 2.3 billion by 2028 from USD 1.0 billion in 2023, at a CAGR of 17.2% during the forecast period.The large share of this end-user segment can be attributed to the increasing number of 3D printing laboratories, the expansion of existing 3D printing laboratories, the outsourcing of certain manufacturing functions to 3D printing vendors, and the increasing demand for customized/fabricated solutions.

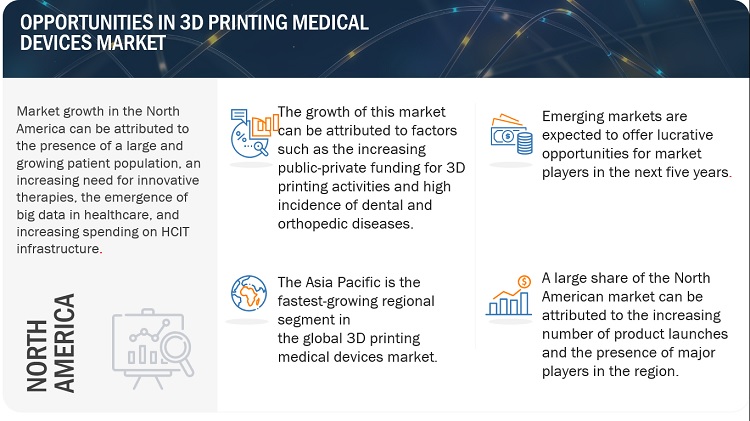

North America region of the 3d printing medical devices market is expected to be the largest market during the forecast period.

North America accounted for the largest share of 45.0% of the global 3D Printing medical devices market. The large share of the North American market is attributed to the high adoption of advanced diagnostic technologies and technological advancements. Europe accounted for the second-largest share of 29.5% of the global 3D Printing medical devices market in 2021.The Asia Pacific market is estimated to grow at the highest CAGR of 7.5% during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

As of 2022, prominent players in the market include are Stratasys Ltd. (Israel), EnvisionTEC (US), 3D Systems, Inc. (US), EOS (US), Renishaw plc (UK),GE additive(US),Desktop Metal,Inc(US), CELLINK(Sweden), Formalabs(US), Materialise (Belgium), 3T Additive Manufacturing Ltd. (US), GENERAL ELECTRIC COMPANY (US), Carbon, Inc. (US), Prodways Group (France), SLM Solutions (Germany), Organovo Holdings Inc. (US), FIT AG (Germany), Wacker Chemie AG (Germany), Denstply Sirona(USA), DWS Systems SRL (Italy), Roland DG(Japan), HP,Inc(USA), regenHU(Switzerland), Fluicell (Sweden), Proto Labs(US), GESIM (Germany), Triastek(China), Inventia(Australia), FabRx(UK) and Apprecia Pharmaceuticals(US).

3D Printing Medical Devices Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$2.7 billion |

|

Projected Revenue by 2028 |

$6.9 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 17.1% |

|

Market Driver |

Easy development of customized medical products using 3D printing |

|

Market Opportunity |

Increasing adoption of CAD/CAM technology and desktop printers |

This report categorizes the global 3D Printing Medical Devices Market to forecast revenue and analyze trends in each of the following submarkets:

By Component

-

Equipment

- 3D Printers

- 3D Bioprinters

-

Materials

-

Plastics

- Thermoplastics

- Photopolymers

- Metals and Metal Alloys

- Biomaterials

- Ceramics

- Paper

- Wax

- Other Materials

-

Plastics

- Services & Software

By Application

-

Surgical Guides

- Dental Guides

- Craniomaxillofacial Guides

- Orthopedic Guides

- Spinal Guides

-

Surgical Instruments

- Surgical Fasteners

- Scalpels

- Retractors

- Standard Prosthetics & Implants

-

Custom Prosthetics & Implants

- Orthopedic Implants

- Dental Prosthetics & Implants

- Craniomaxillofacial Implants

-

Tissue-engineered Products

- Bone & Cartilage Scaffolds

- Ligament & Tendon Scaffolds

- Hearing Aids

- Wearable Medical Devices

- Other Applications

By Technology

-

Laser Beam Melting

- Direct Metal Laser Sintering

- Selective Laser Sintering

- Selective Laser Melting

- LaserCUSING

-

Photopolymerization

- Digital Light Processing

- Stereolithography

- Two-photon Polymerization

- PolyJet 3D Printing

-

Droplet Deposition/Extrusion-based Technologies

- Fused Deposition Modeling

- Multiphase Jet Solidification

- Low-temperature Deposition Manufacturing

- Microextrusion Bioprinting

- Electron Beam Melting

- Three-dimensional Printing/Adhesion Bonding/Binder Jetting

- Other Technologies

By End User

- Hospitals & Surgical Centers

- Dental & Orthopedic Clinics

- Academic Institutions & Research Laboratories

- Pharma-Biotech & Medical Device Companies

- Clinical Research Organizations

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments

- In Feb 2023 Stratasys Ltd launched TrueDent resin, which is used in labs for the application in dental structure shades.

- In May 2023 CELLINK launched Lumen X a new benchtop DLP bioprinter.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the 3D printing medical devices market?

The 3D printing medical devices market boasts a total revenue value of $6.9 billion by 2028.

What is the estimated growth rate (CAGR) of the 3D printing medical devices market?

The global 3D printing medical devices market has an estimated compound annual growth rate (CAGR) of 17.1% and a revenue size in the region of $2.7 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing public-private funding for 3D printing- High incidence of orthopedic and dental diseases- Easy development of customized medical products using 3D printing- Growing applications of 3D printing in healthcare industry- Availability of advanced 3D printing materials for dental and medical applications- Increasing demand for 3D-printed products in cosmetology and pharmaceutical industryRESTRAINTS- Shortage of skilled workforce due to limited specialized training in additive manufacturing- Stringent regulatory process for approval of 3D-printed medical devicesOPPORTUNITIES- Direct digital manufacturing- Increasing adoption of CAD/CAM technology and desktop printers- Consolidation of dental laboratories and hospitals- Growing demand for organ transplants- Expiry of key patents in 3D printing industryCHALLENGES- High capital investment and operating costs- Rising number of large medical practices- Socio-ethical concerns related to use of 3D-printed products

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

-

5.4 REGULATORY ANALYSISUSCANADAEUROPEASIA PACIFIC- Japan- China- India

-

5.5 AUSTRALIATGA DEVICE CLASSIFICATION

-

5.6 ECOSYSTEM ANALYSIS: 3D PRINTING MEDICAL DEVICES

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL & MEDIUM-SIZED ENTERPRISES

- 5.9 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.11 PATENT ANALYSIS

-

5.12 CASE STUDIES

- 5.13 PRICING ANALYSIS

- 5.14 IMPACT OF RECESSION ON 3D PRINTING MEDICAL DEVICES MARKET

- 6.1 INTRODUCTION

-

6.2 SOFTWARE AND SERVICESADVANCEMENTS IN PRINTING TECHNOLOGY AND MATERIALS TO DRIVE GROWTH

-

6.3 EQUIPMENT3D PRINTERS- Workflow enhancements and benefits of digitization to drive growth3D BIOPRINTERS- Increasing clinical applications of 3D bioprinters to drive growth

-

6.4 MATERIALSPLASTICS- Photopolymers- ThermoplasticsMETALS AND METAL ALLOYS- Superior mechanical strength and surface finish to drive growthBIOMATERIALS- Increasing R&D activities for use of biomaterials in 3D bioprinting to drive growthCERAMICS- Ceramics have wide applications in dental industryPAPER- Cost-effective paper-based 3D-printed anatomical models used for training and education purposesWAX- Increasing number of orthodontic procedures to drive growthOTHER MATERIALS

- 7.1 INTRODUCTION

-

7.2 CUSTOM PROSTHETICS AND IMPLANTSCUSTOM CRANIOMAXILLOFACIAL IMPLANTS- Rising prevalence of head and neck cancer to increase adoption of 3D-printed CMF implantsCUSTOM DENTAL PROSTHETICS AND IMPLANTS- Growing edentulous population to encourage 3D printing of customized prosthodonticsCUSTOM ORTHOPEDIC IMPLANTS- Increasing demand for patient-specific 3D-printed orthopedic implants to drive growth

-

7.3 SURGICAL GUIDESDENTAL GUIDES- Advantages offered by 3D-printed dental guides to drive growthORTHOPEDIC GUIDES- Exponential growth in customized orthopedic guides to drive growthCRANIOMAXILLOFACIAL GUIDES- Strategic initiatives for adoption of 3D-printed CMF medical devices to drive growthSPINAL GUIDES- Adoption of spinal guides increasing for pedicle screw placement

-

7.4 TISSUE-ENGINEERED PRODUCTSBONE AND CARTILAGE SCAFFOLDS- Increasing incidence of musculoskeletal conditions to drive growthLIGAMENT AND TENDON SCAFFOLDS- Advances in tendon and ligament tissue engineering to fuel growth

-

7.5 SURGICAL INSTRUMENTSSURGICAL FASTENERS- Application of surgical fasteners increasing in minimally invasive surgeriesSCALPELS- Demand for advanced scalpels increasing among end usersRETRACTORS- Low development and production costs to drive demand for retractors

-

7.6 HEARING AIDSDEVELOPMENT OF 3D-PRINTED ANTI-BACTERIAL HEARING AIDS TO DRIVE MARKET GROWTH

-

7.7 STANDARD PROSTHETICS AND IMPLANTSRISING NUMBER OF SPORTS AND ACCIDENT-RELATED INJURIES TO DRIVE GROWTH

-

7.8 WEARABLE MEDICAL DEVICESGROWING DEMAND FOR REMOTE MONITORING TO FUEL GROWTH

- 7.9 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 LASER BEAM MELTINGDIRECT METAL LASER SINTERING- DMLS enables economical manufacturing of medical implantsSELECTIVE LASER SINTERING- High productivity of SLS to drive growthSELECTIVE LASER MELTING- Technological advancements in SLM to boost growthLASERCUSING- Emerging applications of LaserCUSING in designing medical instruments to drive growthPHOTOPOLYMERIZATION- Most precise and accurate technique of medical 3D printingSTEREOLITHOGRAPHY- Ease of use and accuracy to drive adoption of stereolithographyDIGITAL LIGHT PROCESSING- Low output quality of DLP printing to hamper growthPOLYJET 3D PRINTING- High precision and wide application areas to drive adoption of PolyJet 3D printingTWO-PHOTON POLYMERIZATION- Advances in 2PP for biomedical applications to drive growth

-

8.3 DROPLET DEPOSITION/EXTRUSION-BASED TECHNOLOGIESFUSED DEPOSITION MODELING- Low cost of FDM technology-based printers to drive growthMICROEXTRUSION BIOPRINTING- Increasing research on microextrusion technology to drive growthMULTIPHASE JET SOLIDIFICATION- Lengthy production run to restrain growthLOW-TEMPERATURE DEPOSITION MANUFACTURING- Applications of LDM in tissue engineering to drive growth

-

8.4 ELECTRON BEAM MELTINGPRINTERS BASED ON EBM TECHNOLOGY PRODUCE HIGH-DENSITY ORTHOPEDIC IMPLANTS

-

8.5 THREE-DIMENSIONAL PRINTING/ADHESION BONDING/ BINDER JETTINGLOW COST OF INKJET TECHNOLOGY TO DRIVE GROWTH

- 8.6 OTHER TECHNOLOGIES

- 9.1 INTRODUCTION

-

9.2 HOSPITALS AND SURGICAL CENTERSRAPID ADOPTION OF 3D PRINTING AS SURGICAL PLANNING TOOL TO DRIVE GROWTH

-

9.3 DENTAL AND ORTHOPEDIC CLINICSGREATER VERSATILITY DRIVING PATIENT VOLUME IN DENTAL AND ORTHOPEDIC CLINICS

-

9.4 PHARMA-BIOTECH AND MEDICAL DEVICE COMPANIESGROWING APPLICATION OF 3D PRINTING IN PRECLINICAL TESTING TO BOOST GROWTH

-

9.5 ACADEMIC INSTITUTIONS AND RESEARCH LABORATORIESGROWING APPLICATION OF 3D PRINTING IN PRECLINICAL EDUCATION TO BOOST GROWTH

-

9.6 CLINICAL RESEARCH ORGANIZATIONSRISING OUTSOURCING OF RESEARCH FUNCTIONS BY MEDICAL OEMS TO BOOST GROWTH

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Presence of prominent market players to drive growthCANADA- Rising healthcare expenditure and favorable public and private funding to drive growth

-

10.3 EUROPEGERMANY- Germany to hold largest share of European marketUK- Large patient base and favorable coverage under NHS to drive growthFRANCE- Favorable government healthcare strategies to fuel growthITALY- Increasing availability of 3D-printed solutions to drive growthSPAIN- High demand for 3D-printed medical devices to drive growthREST OF EUROPE

-

10.4 ASIA PACIFICJAPAN- Japan to dominate APAC 3D printing medical devices marketCHINA- Expansion of target patient population to drive growthINDIA- Growing number of hip and knee surgeries to promote growthAUSTRALIA- Favorable government initiatives to support growthSOUTH KOREA- Increasing research activities to support growthREST OF ASIA PACIFIC

-

10.5 LATIN AMERICABRAZIL- Growing popularity of 3D-printed devices in dental and craniomaxillofacial surgeries to promote growthMEXICO- Government initiatives focused on promoting 3D printing to drive growthREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICARISING PRESENCE OF MARKET PLAYERS TO DRIVE GROWTH

- 11.1 INTRODUCTION

- 11.2 STRATEGIES OF KEY PLAYERS/RIGHT TO WIN

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.4 MARKET SHARE ANALYSIS (2022)

-

11.5 COMPANY EVALUATION MATRIX FOR 25 MAJOR PLAYERS (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSSTRATASYS- Business overview- Products offered- Recent developments- MnM view3D SYSTEMS, INC.- Business overview- Products offered- Recent developments- MnM viewMATERIALISE NV- Business overview- Products offered- Recent developments- MnM viewGE ADDITIVE- Business overview- Products offered- Recent developments- MnM viewRENISHAW PLC.- Business overview- Products offered- Recent developments- MnM viewDESKTOP METAL, INC.- Business overview- Products offered- Recent developmentsPRODWAYS GROUP- Business overview- Products offered- Recent developmentsSLM SOLUTIONS GROUP AG- Business overview- Products offered- Recent developmentsCELLINK- Business overview- Products offered- Recent developmentsORGANOVO HOLDINGS INC.- Business overview- Products offeredEOS GMBH- Business overview- Products offered- Recent developmentsFORMLABS- Business overview- Products offered- Recent developmentsCARBON, INC.- Business overview- Products offered- Recent developments3T ADDITIVE MANUFACTURING LTD.- Business overview- Recent developmentsBIOMEDICAL MODELING, INC.- Business overview- Products & services offered

-

12.2 OTHER PLAYERSDENTSPLY SIRONA, INC.ROLAND DGDWS SYSTEMS SRLREGENHUHP INC.FIT AGPROTO LABSTRIASTEK, INC.FABRXAPRECIA PHARMACEUTICALSFLUICELLGESIMINVENTIA

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 MAJOR INTRAORAL SCANNERS INTEGRATED WITH CAD/CAM LAUNCHED IN RECENT YEARS

- TABLE 3 KEY PATENT EXPIRY DATES IN 3D PRINTING MARKET

- TABLE 4 3D PRINTING MEDICAL DEVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 6 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 7 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 8 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 9 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 10 3D PRINTING MEDICAL DEVICES: LIST OF MAJOR CONFERENCES AND EVENTS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF 3D PRINTING MEDICAL DEVICES

- TABLE 12 KEY BUYING CRITERIA FOR 3D PRINTING MEDICAL DEVICES

- TABLE 13 CASE STUDY 1: USE OF NEW TECHNOLOGIES TO REDUCE MANUAL WORK AND INCREASE PRECISION

- TABLE 14 PRICING ANALYSIS: 3D PRINTERS, 2020 (ASP IN USD)

- TABLE 15 3D PRINTING MEDICAL DEVICES MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 16 3D PRINTING SOFTWARE AND SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 3D PRINTING EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 18 3D PRINTING EQUIPMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 3D PRINTERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 3D BIOPRINTERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 3D PRINTING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 22 3D PRINTING MATERIALS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 3D PRINTING PLASTICS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 24 3D PRINTING PLASTICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 3D PRINTING PHOTOPOLYMERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 3D PRINTING THERMOPLASTICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 3D PRINTING METALS AND METAL ALLOYS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 3D PRINTING BIOMATERIALS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 3D PRINTING CERAMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 3D PRINTING PAPER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 3D PRINTING WAX MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 LIQUID RESINS AVAILABLE IN DENTAL 3D PRINTING MARKET

- TABLE 33 3D PRINTING MARKET FOR OTHER MATERIALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 35 CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 36 CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 38 CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 39 CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 40 CUSTOM CRANIOMAXILLOFACIAL IMPLANTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 CUSTOM DENTAL PROSTHETICS AND IMPLANTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 CUSTOM ORTHOPEDIC IMPLANTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 44 SURGICAL GUIDES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 SURGICAL GUIDES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 46 SURGICAL GUIDES MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 47 SURGICAL GUIDES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 48 DENTAL GUIDES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 ORTHOPEDIC GUIDES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 50 CRANIOMAXILLOFACIAL GUIDES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 SPINAL GUIDES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 53 TISSUE-ENGINEERED PRODUCTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 54 TISSUE-ENGINEERED PRODUCTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 55 TISSUE-ENGINEERED PRODUCTS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 56 TISSUE-ENGINEERED PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 57 BONE AND CARTILAGE SCAFFOLDS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 58 LIGAMENT AND TENDON SCAFFOLDS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 59 SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 SURGICAL INSTRUMENTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 61 SURGICAL INSTRUMENTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 62 SURGICAL INSTRUMENTS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 63 SURGICAL INSTRUMENTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 64 SURGICAL FASTENERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 65 SURGICAL SCALPELS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 66 RETRACTORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 67 HEARING AIDS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 68 HEARING AIDS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 69 HEARING AIDS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 70 HEARING AIDS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 STANDARD PROSTHETICS AND IMPLANTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 72 STANDARD PROSTHETICS AND IMPLANTS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 73 STANDARD PROSTHETICS AND IMPLANTS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 74 STANDARD PROSTHETICS AND IMPLANTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 75 WEARABLE MEDICAL DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 76 WEARABLE MEDICAL DEVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 77 WEARABLE MEDICAL DEVICES MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 78 WEARABLE MEDICAL DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 OTHER APPLICATIONS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 80 OTHER APPLICATIONS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 81 OTHER APPLICATIONS MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 82 OTHER APPLICATIONS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 83 3D PRINTING MEDICAL DEVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 84 3D PRINTING MEDICAL DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 85 LASER BEAM MELTING TECHNOLOGIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 86 LASER BEAM MELTING TECHNOLOGIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 87 DIRECT METAL LASER SINTERING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 88 SELECTIVE LASER SINTERING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 89 SELECTIVE LASER MELTING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 90 LASERCUSING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 91 PHOTOPOLYMERIZATION TECHNOLOGIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 92 PHOTOPOLYMERIZATION TECHNOLOGIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 93 STEREOLITHOGRAPHY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 94 DIGITAL LIGHT PROCESSING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 95 POLYJET 3D PRINTING TECHNOLOGY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 96 TWO-PHOTON POLYMERIZATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 97 DROPLET DEPOSITION/EXTRUSION-BASED TECHNOLOGIES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 DROPLET DEPOSITION/EXTRUSION-BASED TECHNOLOGIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 99 FUSED DEPOSITION MODELING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 100 MICROEXTRUSION BIOPRINTING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 101 MULTIPHASE JET SOLIDIFICATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 102 LOW-TEMPERATURE DEPOSITION MANUFACTURING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 103 ELECTRON BEAM MELTING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 104 THREE-DIMENSIONAL PRINTING/ADHESION BONDING/BINDER JETTING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 105 OTHER TECHNOLOGIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 106 3D PRINTING MEDICAL DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 107 3D PRINTING MEDICAL DEVICES MARKET FOR HOSPITALS AND SURGICAL CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 108 3D PRINTING MEDICAL DEVICES MARKET FOR DENTAL AND ORTHOPEDIC CLINICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 109 3D PRINTING MEDICAL DEVICES MARKET FOR PHARMA-BIOTECH AND MEDICAL DEVICE COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 110 TOP 10 NIDCR GRANTS TO US DENTAL INSTITUTIONS

- TABLE 111 3D PRINTING MEDICAL DEVICES MARKET FOR ACADEMIC INSTITUTIONS AND RESEARCH LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 112 3D PRINTING MEDICAL DEVICES MARKET FOR CLINICAL RESEARCH ORGANIZATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 113 3D PRINTING MEDICAL DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 121 NORTH AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 122 NORTH AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 123 US: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 124 US: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 US: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 US: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 127 US: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 CANADA: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 129 CANADA: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 CANADA: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 CANADA: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 CANADA: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 EUROPE: 3D PRINTING MEDICAL DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 134 EUROPE: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 135 EUROPE: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 EUROPE: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 EUROPE: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 EUROPE: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 139 EUROPE: 3D PRINTING MEDICAL DEVICES MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 140 EUROPE: 3D PRINTING MEDICAL DEVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 141 EUROPE: 3D PRINTING MEDICAL DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 142 GERMANY: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 143 GERMANY: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 GERMANY: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 GERMANY: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 GERMANY: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 UK: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 148 UK: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 UK: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 UK: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 151 UK: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 FRANCE: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 153 FRANCE: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 154 FRANCE: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 FRANCE: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 FRANCE: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 ITALY: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 158 ITALY: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 159 ITALY: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 160 ITALY: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 ITALY: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 162 SPAIN: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 163 SPAIN: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 164 SPAIN: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 SPAIN: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 SPAIN: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 REST OF EUROPE: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 168 REST OF EUROPE: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 REST OF EUROPE: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 170 REST OF EUROPE: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 171 REST OF EUROPE: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: 3D PRINTING MEDICAL DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: 3D PRINTING MEDICAL DEVICES MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: 3D PRINTING MEDICAL DEVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: 3D PRINTING MEDICAL DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 181 JAPAN: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 182 JAPAN: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 JAPAN: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 184 JAPAN: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 JAPAN: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 186 CHINA: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 187 CHINA: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 CHINA: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 189 CHINA: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 CHINA: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 191 INDIA: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 192 INDIA: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 193 INDIA: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 194 INDIA: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 195 INDIA: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 196 AUSTRALIA: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 197 AUSTRALIA: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 198 AUSTRALIA: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 199 AUSTRALIA: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 200 AUSTRALIA: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 201 SOUTH KOREA: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 202 SOUTH KOREA: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 203 SOUTH KOREA: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 204 SOUTH KOREA: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 205 SOUTH KOREA: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 211 LATIN AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 212 LATIN AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 213 LATIN AMERICA: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 215 LATIN AMERICA: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 216 LATIN AMERICA: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 217 LATIN AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 219 LATIN AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 220 BRAZIL: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 221 BRAZIL: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 222 BRAZIL: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 223 BRAZIL: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 224 BRAZIL: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 225 MEXICO: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 226 MEXICO: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 227 MEXICO: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 228 MEXICO: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 229 MEXICO: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 230 REST OF LATIN AMERICA: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 231 REST OF LATIN AMERICA: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 232 REST OF LATIN AMERICA: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 233 REST OF LATIN AMERICA: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: CUSTOM PROSTHETICS AND IMPLANTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: SURGICAL GUIDES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: TISSUE-ENGINEERED PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: 3D PRINTING MEDICAL DEVICES MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: 3D PRINTING MEDICAL DEVICES MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: 3D PRINTING MEDICAL DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 242 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN 3D PRINTING MEDICAL DEVICES MARKET

- TABLE 243 APPLICATION FOOTPRINT ANALYSIS OF TOP PLAYERS IN 3D PRINTING MEDICAL DEVICES MARKET

- TABLE 244 REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN 3D PRINTING MEDICAL DEVICES MARKET

- TABLE 245 3D PRINTING MEDICAL DEVICES MARKET: RECENT PRODUCT LAUNCHES

- TABLE 246 3D PRINTING MEDICAL DEVICES MARKET: RECENT DEALS

- TABLE 247 STRATASYS: COMPANY OVERVIEW

- TABLE 248 3D SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 249 MATERIALISE NV: COMPANY OVERVIEW

- TABLE 250 GE ADDITIVE: COMPANY OVERVIEW

- TABLE 251 RENISHAW PLC.: COMPANY OVERVIEW

- TABLE 252 DESKTOP METAL, INC.: COMPANY OVERVIEW

- TABLE 253 PRODWAYS GROUP: COMPANY OVERVIEW

- TABLE 254 SLM SOLUTIONS GROUP AG: COMPANY OVERVIEW

- TABLE 255 CELLINK: COMPANY OVERVIEW

- TABLE 256 ORGANOVO HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 257 EOS GMBH: COMPANY OVERVIEW

- TABLE 258 FORMLABS: COMPANY OVERVIEW

- TABLE 259 CARBON, INC.: COMPANY OVERVIEW

- TABLE 260 3T ADDITIVE MANUFACTURING LTD.: COMPANY OVERVIEW

- TABLE 261 BIOMEDICAL MODELING, INC.: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN: 3D PRINTING MEDICAL DEVICES MARKET

- FIGURE 2 PRIMARY SOURCES

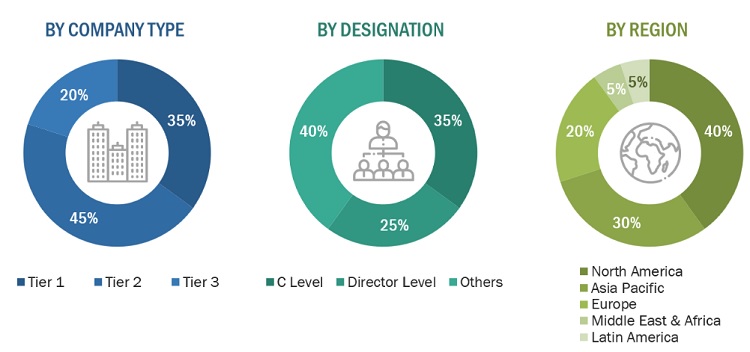

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

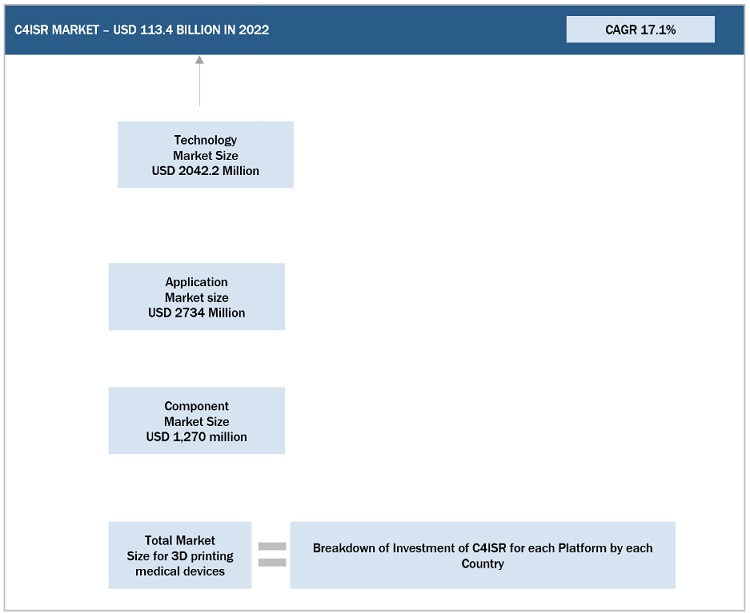

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 3D PRINTING MEDICAL DEVICES MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 3D PRINTING MEDICAL DEVICES MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 3D PRINTING MEDICAL DEVICES MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 GEOGRAPHICAL SNAPSHOT OF 3D PRINTING MEDICAL DEVICES MARKET

- FIGURE 12 HIGH INCIDENCE OF DENTAL AND ORTHOPEDIC DISEASES TO DRIVE GROWTH

- FIGURE 13 JAPAN ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC 3D PRINTING MEDICAL DEVICES MARKET

- FIGURE 14 HOSPITALS AND SURGICAL CENTERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 3D PRINTING MEDICAL DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 WORKFLOW COMPARISON: TRADITIONAL VS. DIGITAL DENTISTRY

- FIGURE 18 US: PERCENTAGE OF DENTISTS IN SOLO PRACTICES (2000 TO 2017)

- FIGURE 19 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 20 EUROPE: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES (MDR)

- FIGURE 21 ECOSYSTEM COVERAGE

- FIGURE 22 3D PRINTING MEDICAL DEVICES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 SUPPLY CHAIN ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF 3D PRINTING MEDICAL DEVICES

- FIGURE 25 KEY BUYING CRITERIA FOR 3D PRINTING MEDICAL DEVICES

- FIGURE 26 TOP 10 PATENT APPLICANTS IN 3D PRINTING MEDICAL DEVICES MARKET

- FIGURE 27 TOP 10 PATENT OWNERS IN 3D PRINTING MEDICAL DEVICES MARKET

- FIGURE 28 NORTH AMERICA: 3D PRINTING MEDICAL DEVICES MARKET SNAPSHOT

- FIGURE 29 ASIA PACIFIC: 3D PRINTING MEDICAL DEVICES MARKET SNAPSHOT

- FIGURE 30 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS OPERATING IN 3D PRINTING MEDICAL DEVICES MARKET

- FIGURE 31 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN 3D PRINTING MEDICAL DEVICES MARKET

- FIGURE 32 STRATASYS HELD LEADING POSITION IN 3D PRINTING MEDICAL DEVICES MARKET IN 2022

- FIGURE 33 3D PRINTING MEDICAL DEVICES MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 34 3D PRINTING MEDICAL DEVICES MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- FIGURE 35 STRATASYS: COMPANY SNAPSHOT (2022)

- FIGURE 36 3D SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 37 MATERIALISE NV: COMPANY SNAPSHOT (2022)

- FIGURE 38 RENISHAW PLC.: COMPANY SNAPSHOT (2022)

- FIGURE 39 DESKTOP METAL, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 40 PRODWAYS GROUP: COMPANY SNAPSHOT (2022)

- FIGURE 41 SLM SOLUTIONS GROUP AG: COMPANY SNAPSHOT (2022)

- FIGURE 42 CELLINK: COMPANY SNAPSHOT (2022)

- FIGURE 43 ORGANOVO HOLDINGS INC.: COMPANY SNAPSHOT (2022)

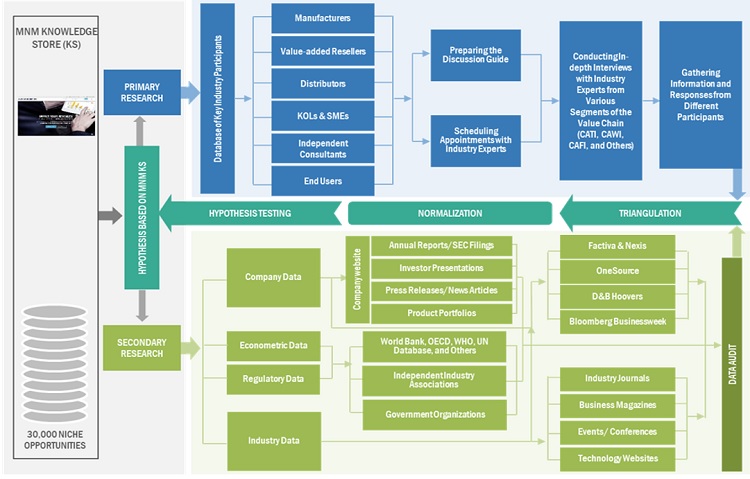

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the 3D printing medical devices market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in 3D printing industry. The primary sources from the demand side include medical OEMs, Oncologists, CDMOs and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

In this report, the 3D printing medical devices market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the 3D printing segment were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the 3D printing devices market.

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover a major share of the global market share, as of 2021.

- Extrapolating the global value of the 3D printing medical devices market.

Approaches: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

- For estimating the size of the 3D Printing medical devices market, the country-level market revenues were obtained from secondary sources and through extensive primary interviews.

- Country-level markets for the US and Canada were added to arrive at the market size for North America. Similarly, country-level markets for other countries were added to arrive at the market size of Europe and Asia Pacific.

- The total market derived through the bottom-up approach was again validated through secondary sources and primary sources.

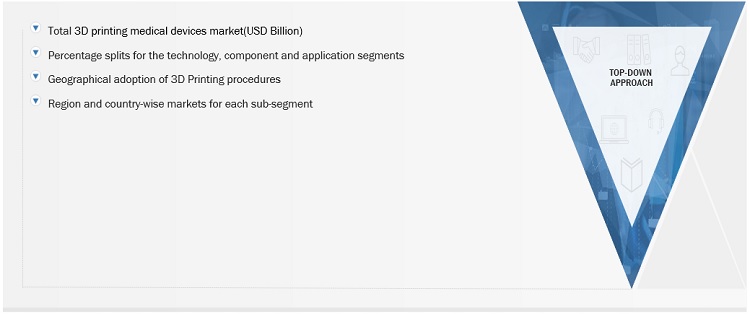

Top-down approach

- The overall market size derived from the bottom-up approach was used in the top-down procedure to estimate the size of the subsegment.

- Percentage splits were applied to the total market size (splits were obtained from secondary and primary research) to obtain the market size for each subsegment.

- The top-down approach was used to reach the regional and country-level market size for these subsegments.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the 3D printing medical devices was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the 3D printing medical devices market was validated using both top-down and bottom-up approaches.

Market definition

3D printing or additive manufacturing is the process of manufacturing three-dimensional solid objects from a digital file. In this technique, the objects are produced by laying down materials in the form of thin-sliced layers. A number of materials, such as plastics, metal & metal alloy powders, bioprinting biomaterials, ceramics, nylon, and paper, are utilized to develop 3D-printed products.

3D printing is adopted for many applications, including the production of physical models for medical devices for preclinical testing and prototyping, anatomy models for clinical training and clinical testing, orthodontics, prosthodontics, surgery, tissue engineering, manufacturing of dental and medical implants, construction of surgical guides and instruments, and the fabrication/customization of frameworks for prosthetics and hearing aids.

Key stakeholders

- 3D printing medical devices manufacturing companies.

- Healthcare service providers (Including hospitals, transplant centers and blood transfusion centers)

- Blood, tissue, and stem cell banks

- Government Organizations

- Independent association and regulatory authorities

- R&D companies

- Independent reference laboratories

- Diagnostic Laboratories

- Clinical Research organizations

Objectives of the Study

- To define, describe, and forecast the 3D printing medical devices market based on Component, Software &Services, Application, End User & Region.

- To provide detailed information regarding the major factors influencing the growth potential of the 3D printing medical devices market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the 3D printing medical devices market.

- To analyze key growth opportunities in the 3D printing medical devices market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Thailand, Indonesia and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the 3D printing medical devices market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the 3D printing medical devices market , such as product launches, agreements, expansions, and mergers & acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present 3D printing medical devices market

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe 3D printing medical devices marketinto Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of the Asia Pacific 3D printing medical devices marketinto Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Latin American 3D printing medical devices marketinto Colombia, Chile, Argentina, and Peru, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 3D Printing Medical Devices Market