Smart Water Management Market by Water Meter (AMR, AMI), Solution (Enterprise Asset Management, Network Management, Smart Irrigation), Service (Professional, Managed), End User (Residential, Commercial, Industrial) and Region - Global Forecast to 2028

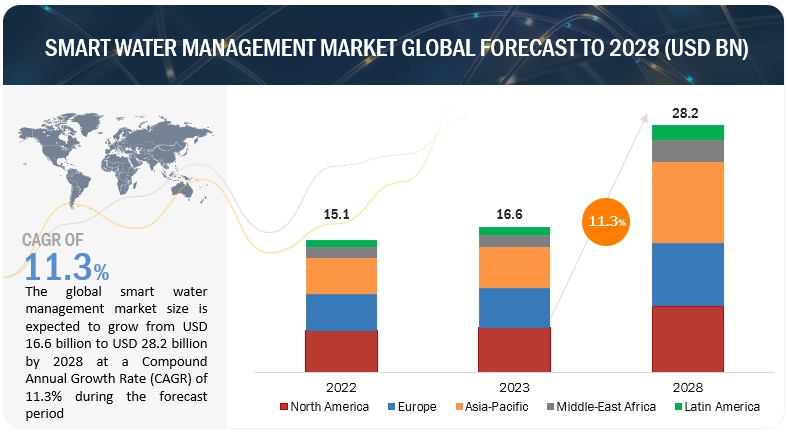

The global smart water management market size was estimated at USD 16.6 billion in 2023 and is projected to reach USD 28.2 billion by 2028, growing at a CAGR of 11.3% from 2023 to 2028. The rising challenge of water scarcity and a growing need for effective water resource management will drive the smart water management market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Smart Water Management Market Dynamics

Driver: Growing rapid urbanization

Rapid urbanization is leading to a significant increase in the water demand. This is putting a strain on existing water resources and infrastructure. Smart water management solutions can help utilities to meet the growing demand for water by improving water efficiency, reducing water loss, and optimizing water distribution. Urbanization is also leading to a decline in water quality. This is due to factors such as pollution and wastewater runoff. Smart water management solutions can help utilities to improve water quality by monitoring water quality in real-time and identifying and addressing potential problems early on.

Restraint: Integration of water systems with modern smart solutions

Legacy water systems may be incompatible with modern smart water management solutions. This can be due to differences in hardware, software, or communication protocols. Itegrating legacy water systems with modern solutions can be expensive, especially if the legacy systems are in poor condition or need to be significantly upgraded. Integrating legacy water systems with modern smart solutions can indeed be a complex and costly process due to several factors. Legacy water systems often rely on older hardware and software that may not easily integrate with newer, smart technology. These legacy systems may use proprietary communication protocols and data formats that are incompatible with modern smart devices and platforms. As a result, significant engineering and customization are required to establish communication and data exchange between the old and new systems. Smart water management relies on the collection and analysis of data from various sources, such as sensors, meters, and remote monitoring devices. Legacy systems may not adhere to modern data standards, making it necessary to standardize and format data for seamless integration. This process can be time-consuming and resource-intensive. The integration of modern technologies with legacy systems is a multifaceted process. It demands careful planning, substantial investments, and technical expertise to overcome compatibility issues, data standardization, and infrastructure upgrades.

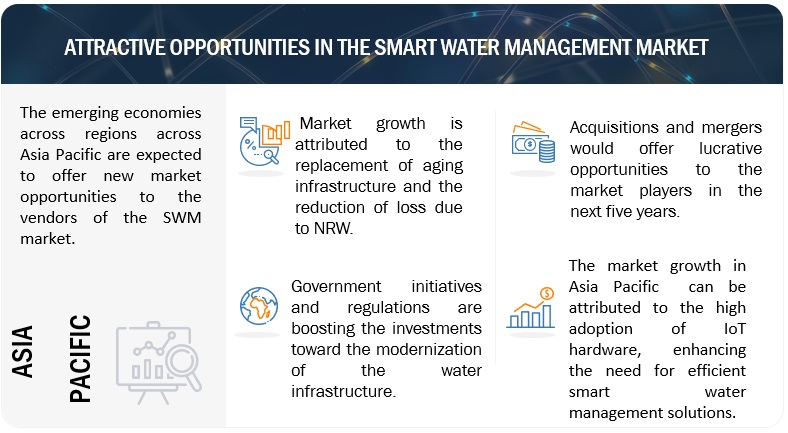

Opportunity: Increasing role of smart water management in smart city revolution

The smart city movement is providing a significant opportunity for the smart water management market. Smart water management solutions can help smart cities to improve water efficiency, reduce water costs, optimize water distribution, and adapt to the challenges of climate change. A number of smart cities around the world are implementing smart water management solutions, such as smart water meters, smart water distribution systems, and smart wastewater management systems. As more and more cities adopt smart water management solutions, the demand for smart water management products and services is expected to grow.

Challenge: High initial investments and lower return

Water utilities is a government-controlled and highly regulated industry where technology implementations take place gradually. The installation of smart water meters requires high capital investments. There is no government aid provided for the installation of smart water meters. This makes it difficult for the utilities and end users to install smart water meters. Further, utilities are incapable of making heavy capital expenditures as they face losses due to nonrevenue water, water theft, and leakages. The smart metering infrastructure requires various components, such as measuring and sensing devices, real-time communication devices, data management systems, and control tools. All these components increase the total cost of smart water metering. With heavy capital spending to implement smart technologies, a significant and promising ROI is expected. Technology deployments are slow, with each project implementation taking up to 5 to 7 years, eventually delaying the ROI. Hence, to develop a faster RoI, the cost management steps taken by water utilities must understand the cost to serve customers, workforce spending, capital costs, cost of outsourcing processes, and cost of implementing programs focused on low emissions.

Market Ecosystem

Residential segment is expected to account for a higher CAGR during the forecast period

The demand for freshwater in residential areas has shown unprecedented growth due to the world’s growing urban population, changing lifestyles, and eating habits leading to higher water consumption. The increase in water consumption is more pronounced in urban settings with high population density with the presence of production industries that contribute toward major water consumption. The rising demand for quality water services is expected to propel the demand for SWM solutions in residential areas.

Industrial segment is expected to hold the highest market share during CAGR during the forecast period.

The industrial segment of the Smart Water Management market includes manufacturing, energy and utilities, agriculture, mining, and other industries. The industrial sector stands at the forefront of the smart water management industry, playing a pivotal role in revolutionizing the way we manage and utilize this precious resource. With a growing awareness of the environmental and economic implications of water scarcity, industries are increasingly turning to smart technologies to optimize their water usage.

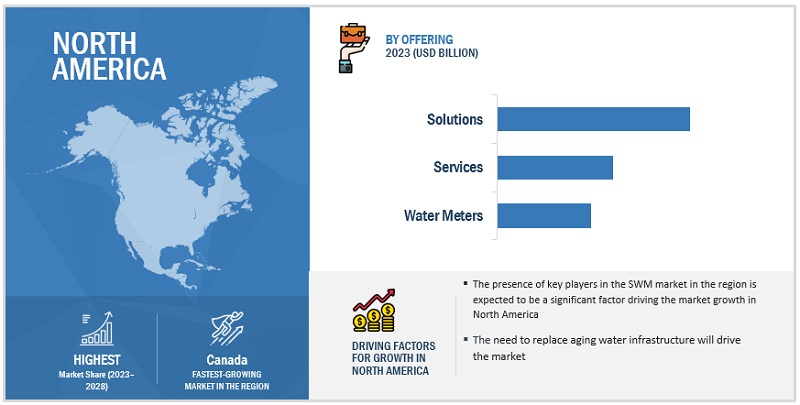

North America to account for the largest market share during the forecast period

North America is estimated to hold the largest share of the overall Smart water management market. Governments in North America are increasingly supporting the adoption of smart water management solutions through initiatives and regulations. Also, much of the water infrastructure in North America is aging and in need of replacement. Smart water management solutions can be used to extend the life of existing infrastructure and improve its performance.

Key Market Players

The Smart water management industry vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Smart water management market Siemens (Germany), IBM (US), ABB (Switzerland), Honeywell Elster (US), Schneider Electric (France), Itron (US), SUEZ ( France), Oracle (US), Landis+Gyr (Switzerland), Trimble Water (US), Xylem (US), Kamstrup (Denmark), HydroPoint (US), i2O (UK), Xenius (India), Neptune Technology (US), TaKaDu (Israel), Badger Meter (US), AquamatiX (UK), Lishtot (Israel), CityTaps ( France), FREDsense (Canada), Fracta (US), Smart Energy Water (US), Ayyeka ((US), Ketos (US).

The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

By offering, end-user, technology and region |

|

Regions covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

Siemens (Germany), IBM (US), ABB (Switzerland), Honeywell Elster (US), Schneider Electric (France), Itron (US), SUEZ ( France), Oracle (US), Landis+Gyr (Switzerland), Trimble Water (US), Xylem (US), Kamstrup (Denmark), HydroPoint (US), i2O (UK), Xenius (India), Neptune Technology (US), TaKaDu (Israel), Badger Meter (US), AquamatiX (UK), Lishtot (Israel), CityTaps ( France), FREDsense (Canada), Fracta (US), Smart Energy Water (US), Ayyeka ((US), Ketos (US). |

This research report categorizes the smart water management market to forecast revenues and analyze trends in each of the following subsegments:

By Offering:

-

Water Meters

- AMR Meters

- AMI Meters

- Solutions

-

Services

-

Professional Services

- Consulting Services

- System Integration and Deployment Services

- Support and Maintenance Services

- Managed Services

-

Professional Services

By Solutions:

-

Enterprise Asset Management

- Asset Condition Monitoring

- Predictive Maintenance

-

Analytics and Data Management

- Meter Data Management

- SCADA

- Security

- Smart Irrigation Management

- Advanced Pressure Management

- Mobile Workforce Management

- Network Management

- CIS and Billing

- Leak Detection

- Other Solutions

By End-User

- Residential

- Commercial

-

Industrial

- Manufacturing

- Energy and Utilities

- Agriculture

- Mining

- Others

By Technology

- IoT

- AI

- Big Data & Analytics

- Cloud Computing

- Others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe*

-

Asia Pacific

- China

- Japan

- South Korea

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2023, SUEZ, a leader in digital and circular solutions in waste and water services, and Schneider Electric, the leader in the digital transformation of energy management and automation, joined forces to accelerate the deployment of digital solutions for energy efficiency, resource conservation, and the control of carbon impact of water cycle management systems.

- In June 2023, SUEZ joined forces with Northumbrian Water Ltd. (NWL) as one of the key partners in the groundbreaking Hydro Powered Concentric Smart Meter Project, the recipient of the Ofwat1 Innovation Fund’s Catalyst Stream prize.

- In November 2022, Siemens became a sustaining partner for The Water Tower. As part of the partnership, the conglomerate corporation will sponsor The Water Tower’s Control Center, a learning and demonstration center for emerging digital technologies in the water and wastewater industries.

- In October 2022, Landis+Gyr Pty Ltd., a subsidiary of Landis+Gyr Group AG (SIX: LAND), partnered with Watercare, New Zealand’s largest water utility, to deploy 22,000 of Landis+Gyr’s W350 smart water meters across Auckland.

- In September 2022, Trimble acquired Bilberry, a startup focused on using artificial intelligence for spot spraying. The acquisition of Bilberry builds out Trimble’s crop protection portfolio by adding green-on-green selective spraying capabilities and supports the development of autonomous solutions..

Frequently Asked Questions (FAQ):

What is Smart water management ?

Smart water management is an integration of smart meters, smart technology solutions, and services that use Information and Communication Technology (ICT) and real-time data and responses as a vital part of the solution for challenges. It brings transparency and improved control to the whole water supply chain, improves water distribution network efficiency, reduces energy costs in pumping water through the distribution network, streamlines water utility operations, and enhances asset management for water and wastewater utility infrastructure by continuously and remotely monitoring critical water infrastructure. It focuses on prioritizing the flow of data for informed decisions through enterprise asset management, analytics and data management, smart irrigation management, Advanced Pressure Management (APM), and network management

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France in the European region.

Which are the key drivers supporting the growth of the Smart water management market?

The major driver of the Smart water management market is technological advancements, including sensors and data analytics, make it increasingly feasible and cost-effective to implement smart water systems.

Who are the key vendors in the Smart water management market?

The key vendors operating in the Smart water management market include. Siemens (Germany), IBM (US), ABB (Switzerland), Honeywell Elster (US), Schneider Electric (France), Itron (US), SUEZ ( France), Oracle (US), Landis+Gyr (Switzerland), Trimble Water (US), Xylem (US), Kamstrup (Denmark), HydroPoint (US), i2O (UK), Xenius (India), Neptune Technology (US), TaKaDu (Israel), Badger Meter (US), AquamatiX (UK), Lishtot (Israel), CityTaps ( France), FREDsense (Canada), Fracta (US), Smart Energy Water (US), Ayyeka ((US), Ketos (US).

Which region is expected to hold the highest market share In the Smart water management market?

North America is expected to hold the highest market share in the Smart water management market. The presence of key players across the region will drive the growth of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 MARKET OVERVIEW

-

5.2 MARKET DYNAMICSDRIVERS- Rapid urbanization- Rising complexities of managing water usage- Need for regulatory and sustainability mandates concerning environment- Rising need to replace aging water infrastructureRESTRAINTS- Integration of water systems with modern smart solutions- Reduced shelf-life of smart metersOPPORTUNITIES- Increasing role of smart water management in smart city revolution- Strong government initiatives and regulatory implementations to promote smart water management solutionsCHALLENGES- Difficulty in technology implementation over legacy infrastructure- High initial investments and low returns

- 5.3 EVOLUTION OF SMART WATER MANAGEMENT SERVICES

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PATENT ANALYSIS

-

5.7 TRADE ANALYSISEXPORT SCENARIO OF WATER METERSIMPORT SCENARIO OF WATER METERS

-

5.8 CASE STUDIESCASE STUDY 1: SOUTHERN WATER INSTALLED NEW METERS TO HELP CUSTOMERS TAKE CONTROL OF THEIR WATER BILLSCASE STUDY 2: LOS ANGELES DEPARTMENT OF WATER AND POWER INSTALLED TRIMBLE ERESPOND INCIDENT MANAGEMENT SOLUTION TO IMPROVE OVERALL INCIDENT MANAGEMENT AND CUSTOMER RELATIONSUSE CASE 3: LAS VEGAS VALLEY WATER DISTRICT INSTALLED MUELLER WATER PRODUCTS’ ECHOSHORE®-TX PERMANENT LEAK DETECTION PLATFORM TO REDUCE WATER LOSS DUE TO LEAKAGEUSE CASES 4: ILLINOIS WATER DEPARTMENT INSTALLED NEPTUNE MOBILE AMR TO FACILITATE FAST DATA COLLECTIONCASE STUDY 5: K-WATER INTRODUCED SMART WATER MANAGEMENT SOLUTIONS TO ENSURE SUSTAINABLE WATER SUPPLY TO EVERY CITIZEN

-

5.9 PRICING ANALYSISINDICATIVE PRICING ANALYSIS, BY KEY OFFERING

-

5.10 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Artificial Intelligence (AI)- Internet of Things (IoT)- Big Data Analytics- 5G NetworkADJACENT TECHNOLOGIES- Edge Computing- Digital Twin

- 5.11 KEY CONFERENCES & EVENTS, 2023–2024

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.13 REGULATORY LANDSCAPE

-

5.14 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS ON BUYING PROCESSBUYING CRITERIA

-

5.16 BEST PRACTICES IN SMART WATER MANAGEMENT MARKETCOMPREHENSIVE DATA COLLECTIONADVANCED DATA ANALYTICSLEAK DETECTION AND PREVENTIONREAL-TIME MONITORINGDEMAND FORECASTINGREMOTE CONTROL AND AUTOMATIONSMART METERING AND BILLING

- 5.17 TECHNOLOGY ROADMAP FOR SMART WATER MANAGEMENT MARKET

- 5.18 BUSINESS MODELS OF SMART WATER MANAGEMENT MARKET

-

6.1 INTRODUCTIONOFFERINGS: MARKET DRIVERS

-

6.2 WATER METERSAMR METERS- Need to eliminate issues, such as inaccurate invoicing and poor customer service, to drive popularity of AMR metersAMI METERS- Demand to replace legacy systems in residential, commercial, and industrial setups to propel market

-

6.3 SOLUTIONSENTERPRISE ASSET MANAGEMENT- Growing need for effective management solutions to manage high input costs to drive market- Asset condition monitoring- Predictive maintenanceANALYTICS & DATA MANAGEMENT- Need for processing huge amounts of data into actionable insights to propel market- Meter data management- Supervisory control & data acquisitionSECURITY- Demand to manage water supply networks to boost growthSMART IRRIGATION MANAGEMENT- Rising need for sustainable and responsible irrigation solutions to encourage market expansionADVANCED PRESSURE MANAGEMENT- Increasing water loss due to leakage and rising incidental expenses to drive growthMOBILE WORKFORCE MANAGEMENT- Aging infrastructure and workforce transitions to encourage adoption of MWM solutions among leading playersNETWORK MANAGEMENT- Rising need for smarter infrastructure to drive marketCUSTOMER INFORMATION SYSTEM & BILLING- Growing demand to streamline utility operations and provide quality services to boost growthLEAK DETECTION- Growing need to detect leaks in pipelines and other water network assets to drive marketOTHER SOLUTIONS

-

6.4 SERVICESPROFESSIONAL SERVICES- Increasing complexity of operations to drive demand for professional services- Consulting services- System integration & deployment services- Support & maintenance servicesMANAGED SERVICES- Rising need to improve operations and cut down expenses to spur growth

-

7.1 INTRODUCTIONEND USERS: MARKET DRIVERS

-

7.2 RESIDENTIALDEMAND FOR FRESHWATER IN RESIDENTIAL AREAS TO DRIVE ADOPTION OF SMART WATER SOLUTIONSRESIDENTIAL: SMART WATER MANAGEMENT USE CASES- Leak detection- Irrigation control- Appliances efficiency- Remote monitoring

-

7.3 COMMERCIALNEED TO COMBAT WATER CHALLENGES TO MAINTAIN GOOD WATER QUALITY TO PROPEL MARKETCOMMERCIAL: SMART WATER MANAGEMENT USE CASES- Facility management- Tenant billing- Sustainable practices- Predictive maintenance- Regulatory compliance

-

7.4 INDUSTRIALGROWING AWARENESS AMONG INDUSTRIES REGARDING IMPACT OF WATER WASTAGE TO DRIVE POPULARITY OF SMART WATER MANAGEMENT SOLUTIONSMANUFACTURINGENERGY & UTILITIESAGRICULTUREMININGOTHERSINDUSTRIAL: SMART WATER MANAGEMENT USE CASES- Process optimization- Water quality monitoring- Energy efficiency- Remote operation

-

8.1 INTRODUCTIONTECHNOLOGIES: SMART WATER MANAGEMENT MARKET DRIVERS

-

8.2 IOTNEED TO COLLECT REAL-TIME DATA ON WATER QUALITY TO BOOST ADOPTION OF IOT SOLUTIONS IN SMART WATER MANAGEMENT

-

8.3 ARTIFICIAL INTELLIGENCEADOPTION OF AI SOLUTIONS TO ANALYZE VAST AMOUNTS OF DATA GENERATED BY IOT SENSORS TO BOOST MARKET

-

8.4 BIG DATA & ANALYTICSUSE OF BIG DATA & ANALYTICS TO ANALYZE HISTORICAL DATA AND IDENTIFY CONSUMPTION PATTERNS TO SPUR GROWTH

-

8.5 CLOUD COMPUTINGRISING DEMAND FOR SCALABLE AND FLEXIBLE PLATFORMS TO STORE AND PROCESS WATER-RELATED DATA TO ENCOURAGE GROWTH

- 8.6 OTHER TECHNOLOGIES

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Dire need to replace aging infrastructure to foster growthCANADA- Increasing investments in industrial development to boost growth

-

9.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Adoption of smart solutions by water agencies to cut down water leakage incidents to drive growthGERMANY- Need to improve water quality and clean up rivers to drive marketFRANCE- High usability of smart water management technologies to drive growthREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Government efforts to develop sustainable water supply strategies to encourage market expansionJAPAN- Strong investments by leading players in new technologies to drive growthSOUTH KOREA- Rising government initiatives to improve water management to boost growthREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Active participation of governments in developing and upgrading infrastructure to drive marketAFRICA- Awareness about benefits of optimum consumption of water to propel market

-

9.6 LATIN AMERICALATIN AMERICA: SMART WATER MANAGEMENT MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Rapid population growth to drive demand for smart water managementMEXICO- Rising government incentives to support use of water-efficient technologies to drive demandREST OF LATIN AMERICA

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- 10.4 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- 10.5 RANKING OF KEY PLAYERS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.8 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

11.1 MAJOR PLAYERSSIEMENS- Business overview- Products offered- Recent developments- MnM viewIBM- Business overview- Products offered- Recent developments- MnM viewABB- Business overview- Products offered- Recent developments- MnM viewHONEYWELL ELSTER- Business overview- Products offered- Recent developments- MnM viewSCHNEIDER ELECTRIC- Business overview- Products offered- Recent developments- MnM viewITRON- Business overview- Products offered- Recent developmentsSUEZ- Business overview- Products offered- Recent developmentsORACLE- Business overview- Products offered- Recent developmentsLANDIS+GYR- Business overview- Products offered- Recent developmentsTRIMBLE WATER- Business overview- Products offered- Recent developmentsXYLEMKAMSTRUP

-

11.2 OTHER PLAYERSHYDROPOINTI20XENIUSNEPTUNE TECHNOLOGYTAKADUBADGER METERAQUAMATIXLISHTOTCITYTAPSFREDSENSEFRACTASMART ENERGY WATERAYYEKAKETOS

- 12.1 INTRODUCTION

-

12.2 IOT IN SMART CITIES MARKETMARKET DEFINITIONMARKET OVERVIEW- IoT in smart cities market, by offering- IoT in smart cities market, by solution- IoT in smart cities market, by service- IoT in smart cities market, by application- IoT in smart cities market, by region

-

12.3 SMART BUILDINGS MARKETMARKET DEFINITIONMARKET OVERVIEW- Smart buildings market, by component- Smart buildings market, by solution- Smart buildings market, by service- Smart buildings market, by building type- Smart buildings market, by region

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 SMART WATER MANAGEMENT MARKET: PRIMARY RESPONDENTS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 ECOSYSTEM ANALYSIS

- TABLE 5 TOP 20 PATENT OWNERS (US)

- TABLE 6 INDICATIVE PRICING ANALYSIS, BY KEY OFFERING

- TABLE 7 SMART WATER MANAGEMENT MARKET: LIST OF KEY CONFERENCES & EVENTS

- TABLE 8 SMART WATER MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- TABLE 10 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 11 TECHNOLOGY ROADMAP FOR SMART WATER MANAGEMENT MARKET, 2023–2030

- TABLE 12 MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 13 SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 14 WATER METERS: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 15 WATER METERS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 16 WATER METERS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 17 WATER METERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 AMR METERS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 AMR METERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 AMI METERS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 AMI METERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 SOLUTIONS: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 23 SOLUTIONS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 24 SOLUTIONS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 ENTERPRISE ASSET MANAGEMENT: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 27 ENTERPRISE ASSET MANAGEMENT: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 28 ENTERPRISE ASSET MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 ENTERPRISE ASSET MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 ASSET CONDITION MONITORING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 ASSET CONDITION MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 PREDICTIVE MAINTENANCE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 PREDICTIVE MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 ANALYTICS & DATA MANAGEMENT: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 35 ANALYTICS & DATA MANAGEMENT: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 36 ANALYTICS & DATA MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 ANALYTICS & DATA MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 METER DATA MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 METER DATA MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 SUPERVISORY CONTROL & DATA ACQUISITION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 SUPERVISORY CONTROL & DATA ACQUISITION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 SECURITY: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 SMART IRRIGATION MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 SMART IRRIGATION MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 ADVANCED PRESSURE MANAGEMENT: SMART WATER MANAGEMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 ADVANCED PRESSURE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 MOBILE WORKFORCE MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 MOBILE WORKFORCE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 NETWORK MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 NETWORK MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 CIS AND BILLING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 CIS AND BILLING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 LEAK DETECTION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 LEAK DETECTION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 OTHER SOLUTIONS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 OTHER SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 SERVICES: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 59 SERVICES: SMART WATER MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 60 SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 63 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 64 PROFESSIONAL SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 CONSULTING SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 CONSULTING SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 SYSTEM INTEGRATION & DEPLOYMENT SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 SYSTEM INTEGRATION & DEPLOYMENT SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 SUPPORT & MAINTENANCE SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 71 SUPPORT & MAINTENANCE SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 MANAGED SERVICES: SMART WATER MANAGEMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 73 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 75 SMART WATER MANAGEMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 76 RESIDENTIAL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 77 RESIDENTIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 COMMERCIAL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 79 COMMERCIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 INDUSTRIAL: SMART WATER MANAGEMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 81 INDUSTRIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 INDUSTRIAL: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 83 INDUSTRIAL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 84 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 85 SMART WATER MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY WATER METER, 2018–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY WATER METER, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: SMART WATER MANAGEMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: MARKET, BY INDUSTRIAL TYPE, 2018–2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: MARKET, BY INDUSTRIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 106 US: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 107 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 108 US: MARKET, BY WATER METER, 2018–2022 (USD MILLION)

- TABLE 109 US: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2023–2028 (USD MILLION)

- TABLE 110 US: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 111 US: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 112 US: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 113 US: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 114 US: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 115 US: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 116 US: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 117 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 118 US: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 119 US: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 120 US: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 121 US: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 122 US: MARKET, BY INDUSTRIAL TYPE, 2018–2022 (USD MILLION)

- TABLE 123 US: MARKET, BY INDUSTRIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 124 EUROPE: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 125 EUROPE: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: MARKET, BY WATER METER, 2018–2022 (USD MILLION)

- TABLE 127 EUROPE: MARKET, BY WATER METER, 2023–2028 (USD MILLION)

- TABLE 128 EUROPE: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 129 EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 131 EUROPE: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 132 EUROPE: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 133 EUROPE: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 134 EUROPE: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 135 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 136 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 137 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 138 EUROPE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 139 EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 140 EUROPE: MARKET, BY INDUSTRIAL TYPE, 2018–2022 (USD MILLION)

- TABLE 141 EUROPE: MARKET, BY INDUSTRIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 142 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 143 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 144 UK: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 145 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 146 UK: MARKET, BY WATER METER, 2018–2022 (USD MILLION)

- TABLE 147 UK: MARKET, BY WATER METER, 2023–2028 (USD MILLION)

- TABLE 148 UK: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 149 UK: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 150 UK: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 151 UK: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 152 UK: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 153 UK: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 154 UK: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 155 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 156 UK: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 157 UK: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 158 UK: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 159 UK: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 160 UK: MARKET, BY INDUSTRIAL TYPE, 2018–2022 (USD MILLION)

- TABLE 161 UK: MARKET, BY INDUSTRIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: MARKET, BY WATER METER, 2018–2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: MARKET, BY WATER METER, 2023–2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MARKET, BY INDUSTRIAL TYPE, 2018–2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MARKET, BY INDUSTRIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 182 CHINA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 183 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 184 CHINA: MARKET, BY WATER METER, 2018–2022 (USD MILLION)

- TABLE 185 CHINA: MARKET, BY WATER METER, 2023–2028 (USD MILLION)

- TABLE 186 CHINA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 187 CHINA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 188 CHINA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 189 CHINA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 190 CHINA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 191 CHINA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 192 CHINA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 193 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 194 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 195 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 196 CHINA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 197 CHINA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 198 CHINA: MARKET, BY INDUSTRIAL TYPE, 2018–2022 (USD MILLION)

- TABLE 199 CHINA: MARKET, BY INDUSTRIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: SMART WATER MANAGEMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: MARKET, BY WATER METER, 2018–2022 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY WATER METER, 2023–2028 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY INDUSTRIAL TYPE, 2018–2022 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: MARKET, BY INDUSTRIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 221 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: MARKET, BY WATER METER, 2018–2022 (USD MILLION)

- TABLE 223 LATIN AMERICA: SMART WATER MANAGEMENT MARKET, BY WATER METER, 2023–2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 225 LATIN AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 227 LATIN AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 228 LATIN AMERICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 229 LATIN AMERICA: ANALYTICS & DATA MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 230 LATIN AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 231 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 232 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 233 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 234 LATIN AMERICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 235 LATIN AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 236 LATIN AMERICA: MARKET, BY INDUSTRIAL TYPE, 2018–2022 (USD MILLION)

- TABLE 237 LATIN AMERICA: MARKET, BY INDUSTRIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 238 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 239 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 240 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 241 MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 242 DETAILED LIST OF STARTUPS/SMES

- TABLE 243 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 244 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 245 SMART WATER MANAGEMENT MARKET: PRODUCT LAUNCHES, 2021–2023

- TABLE 246 SMART WATER MANAGEMENT MARKET: DEALS, 2021–2023

- TABLE 247 SMART WATER MANAGEMENT MARKET: OTHERS, 2020–2021

- TABLE 248 SIEMENS: BUSINESS OVERVIEW

- TABLE 249 SIEMENS: PRODUCTS OFFERED

- TABLE 250 SIEMENS: DEALS

- TABLE 251 IBM: BUSINESS OVERVIEW

- TABLE 252 IBM: PRODUCTS OFFERED

- TABLE 253 IBM: DEALS

- TABLE 254 ABB: BUSINESS OVERVIEW

- TABLE 255 ABB: PRODUCTS OFFERED

- TABLE 256 ABB: PRODUCT LAUNCHES

- TABLE 257 ABB: DEALS

- TABLE 258 HONEYWELL ELSTER: BUSINESS OVERVIEW

- TABLE 259 HONEYWELL ELSTER: PRODUCTS OFFERED

- TABLE 260 HONEYWELL ELSTER: DEALS

- TABLE 261 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- TABLE 262 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

- TABLE 263 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 264 SCHNEIDER ELECTRIC: DEALS

- TABLE 265 ITRON: BUSINESS OVERVIEW

- TABLE 266 ITRON: PRODUCTS OFFERED

- TABLE 267 ITRON: DEALS

- TABLE 268 SUEZ: BUSINESS OVERVIEW

- TABLE 269 SUEZ: PRODUCTS OFFERED

- TABLE 270 SUEZ: PRODUCT LAUNCHES

- TABLE 271 SUEZ: DEALS

- TABLE 272 ORACLE: BUSINESS OVERVIEW

- TABLE 273 ORACLE: PRODUCTS OFFERED

- TABLE 274 ORACLE: PRODUCT LAUNCHES

- TABLE 275 ORACLE: DEALS

- TABLE 276 ORACLE: OTHERS

- TABLE 277 LANDIS+GYR: BUSINESS OVERVIEW

- TABLE 278 LANDIS+GYR: PRODUCTS OFFERED

- TABLE 279 LANDIS+GYR: PRODUCT LAUNCHES

- TABLE 280 LANDIS+GYR: DEALS

- TABLE 281 TRIMBLE WATER: BUSINESS OVERVIEW

- TABLE 282 TRIMBLE WATER: PRODUCTS OFFERED

- TABLE 283 TRIMBLE WATER: PRODUCT LAUNCHES

- TABLE 284 TRIMBLE WATER: DEALS

- TABLE 285 TRIMBLE WATER: OTHERS

- TABLE 286 IOT IN SMART CITIES MARKET, BY OFFERING, 2016–2019 (USD BILLION)

- TABLE 287 IOT IN SMART CITIES MARKET, BY OFFERING, 2019–2025 (USD BILLION)

- TABLE 288 IOT IN SMART CITIES MARKET, BY SOLUTION, 2016–2019 (USD BILLION)

- TABLE 289 IOT IN SMART CITIES MARKET, BY SOLUTION, 2019–2025 (USD BILLION)

- TABLE 290 SERVICES: IOT IN SMART CITIES MARKET, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 291 SERVICES: IOT IN SMART CITIES MARKET, BY TYPE, 2019–2025 (USD BILLION)

- TABLE 292 PROFESSIONAL SERVICES: IOT IN SMART CITIES MARKET, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 293 PROFESSIONAL SERVICES: IOT IN SMART CITIES MARKET, BY TYPE, 2019–2025 (USD BILLION)

- TABLE 294 IOT IN SMART CITIES MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

- TABLE 295 IOT IN SMART CITIES MARKET, BY APPLICATION, 2019–2025 (USD BILLION)

- TABLE 296 IOT IN SMART CITIES MARKET, BY REGION, 2016–2019 (USD BILLION)

- TABLE 297 IOT IN SMART CITIES MARKET, BY REGION, 2019–2025 (USD BILLION)

- TABLE 298 SMART BUILDINGS MARKET, BY COMPONENT, 2017–2019 (USD MILLION)

- TABLE 299 SMART BUILDINGS MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

- TABLE 300 SOLUTIONS: SMART BUILDINGS MARKET, BY TYPE, 2017–2019 (USD MILLION)

- TABLE 301 SOLUTIONS: SMART BUILDINGS MARKET, BY TYPE, 2019–2025 (USD MILLION)

- TABLE 302 SERVICES: SMART BUILDINGS MARKET, BY TYPE, 2017–2019 (USD MILLION)

- TABLE 303 SERVICES: SMART BUILDINGS MARKET, BY TYPE, 2019–2025 (USD MILLION)

- TABLE 304 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2017–2019 (USD MILLION)

- TABLE 305 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2019–2025 (USD MILLION)

- TABLE 306 SMART BUILDINGS MARKET, BY REGION, 2017–2019 (USD MILLION)

- TABLE 307 SMART BUILDINGS MARKET, BY REGION, 2019–2025 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 SMART WATER MANAGEMENT MARKET SIZE ESTIMATION

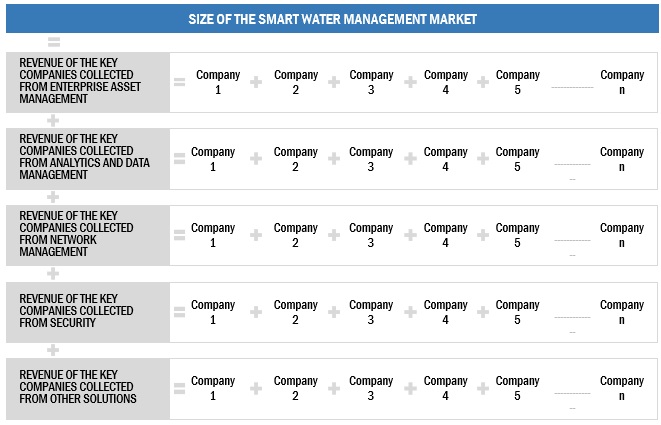

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE OF SMART WATER MANAGEMENT SERVICES

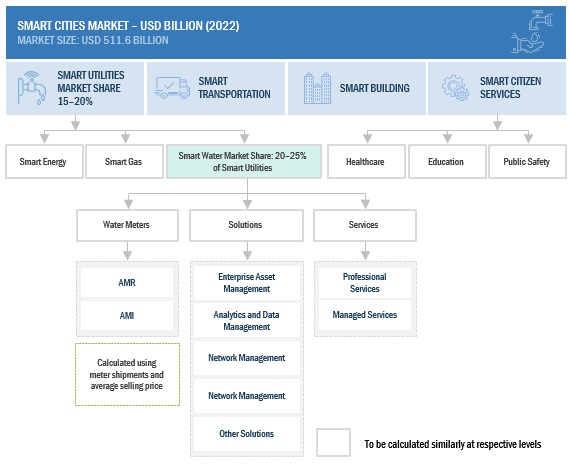

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF FOCUS AREAS OF SMART WATER MANAGEMENT MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (TOP-DOWN): SHARE OF SMART WATER MANAGEMENT MARKET THROUGH SMART CITIES

- FIGURE 6 SMART WATER MANAGEMENT MARKET, 2021–2028 (USD MILLION)

- FIGURE 7 SMART WATER MANAGEMENT MARKET: HOLISTIC VIEW

- FIGURE 8 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 9 REPLACEMENT OF AGING INFRASTRUCTURE TO DRIVE SMART WATER MANAGEMENT MARKET GROWTH

- FIGURE 10 SMART WATER MANAGEMENT MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

- FIGURE 11 NORTH AMERICA: SOLUTIONS AND INDUSTRIAL SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 12 EUROPE: SOLUTIONS AND INDUSTRIAL SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 13 ASIA PACIFIC: SOLUTIONS AND INDUSTRIAL SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 14 SMART WATER MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 EVOLUTION OF SMART WATER MANAGEMENT SERVICES

- FIGURE 16 ECOSYSTEM MAP

- FIGURE 17 SMART WATER MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- FIGURE 19 NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 20 EXPORT OF WATER METERS, BY KEY COUNTRY, 2015–2022 (USD MILLION)

- FIGURE 21 IMPORT OF WATER METERS, BY KEY COUNTRY, 2015–2022 (USD MILLION)

- FIGURE 22 SMART WATER MANAGEMENT MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- FIGURE 25 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 AMR METERS SEGMENT TO GROW AT HIGHER CAGR BY 2028

- FIGURE 27 ENTERPRISE ASSET MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE

- FIGURE 28 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 RESIDENTIAL SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 33 HISTORICAL REVENUE ANALYSIS, 2020–2022

- FIGURE 34 RANKING OF KEY PLAYERS, 2023

- FIGURE 35 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 36 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 37 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 38 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 39 SIEMENS: COMPANY SNAPSHOT

- FIGURE 40 IBM: COMPANY SNAPSHOT

- FIGURE 41 ABB: COMPANY SNAPSHOT

- FIGURE 42 HONEYWELL ELSTER: COMPANY SNAPSHOT

- FIGURE 43 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 44 ITRON: COMPANY SNAPSHOT

- FIGURE 45 SUEZ: COMPANY SNAPSHOT

- FIGURE 46 ORACLE: COMPANY SNAPSHOT

- FIGURE 47 LANDIS+GYR: COMPANY SNAPSHOT

- FIGURE 48 TRIMBLE WATER: COMPANY SNAPSHOT

This research study used extensive secondary sources, directories, and databases, such as Factiva, D&B Hoovers, and Bloomberg, to identify and collect information useful for the comprehensive market research study on the SWM market. Additionally, sources such as the Smart Water Networks Forum (SWAN), International Water Resources Association (IWRA), and International Water Association (IWA) were used to collect information specific to the smart water management market. The primary sources were mainly industry experts from the core and related industries, preferred smart water management solution providers, third-party service providers, end users, and other stakeholders. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the prospects.

Secondary Research

The market size of companies offering smart water management solutions and services was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of the major companies and rating companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from secondary sources, such as SWAN, Smart Energy International, IWRA, IWA, and the European Smart Metering Industry Group. Additionally, market trends and projects in various countries were extracted from the respective government associations, such as the Australian Water Association (AWA), the American Water Works Association (AWWA), and the Canadian Water Resources Association.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify the key players according to their offerings and industry trends related to technology, end users, and region, and key developments from the market and technology-oriented perspectives.

Primary Research

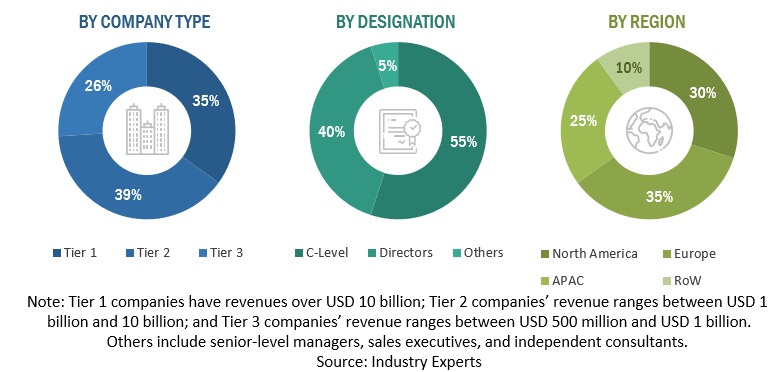

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from smart water management solution vendors, system integrators, professional and managed service providers, industry associations, independent asset management consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from the products and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and installation teams of the governments/end users who are using smart water management solutions were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage of smart water management solutions, which will affect the overall smart water management market.

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the SWM market. The key players in the market were identified through secondary research, and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Smart water management market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Smart water management market: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Smart water management is an integration of smart meters, smart technology solutions, and services that use Information and Communication Technology (ICT) and real-time data and responses as a vital part of the solution for challenges. It brings transparency and improved control to the whole water supply chain, improves water distribution network efficiency, reduces energy costs in pumping water through the distribution network, streamlines water utility operations, and enhances asset management for water and wastewater utility infrastructure by continuously and remotely monitoring critical water infrastructure. It focuses on prioritizing the flow of data for informed decisions through enterprise asset management, analytics and data management, smart irrigation management, Advanced Pressure Management (APM), and network management.

Key Stakeholders

- SWM Vendors

- Network and System Integrators (SIs)

- SWM Infrastructure Providers

- SWM Support Service Providers

- Value-added Resellers (VARs) and Distributors

- Water and Wastewater Utilities

- Water Regulatory Authorities

- Water Meter Manufacturers

- Managed Service Providers

- Water Distribution Network Monitoring Solution Providers

- Advanced Pressure Management Solution Providers

- Smart Irrigation Management Solution Providers

Report Objectives

- To determine and forecast the global smart water management (SWM) market by offering (water meter, solution, and service), technology, end user, and region from 2018 to 2028, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five key regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA)

- To provide detailed information related to the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the SWM market

- To analyze each sub-segment for individual growth trends, prospects, and contribution to the total SWM

- To analyze the impact of the recession on the SWM

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the SWM

- To profile key market players comprising top vendors and start-ups; provide comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscapes

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, partnerships & collaborations, and Research and Development (R&D) activities

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Water Management Market