Small Cell 5G Network Market by Component (Solutions and Services), Radio Technology (5G NR (Standalone and Non-standalone)), Cell Type (Picocells, Femtocells, and Microcells), Deployment Mode, End User, and Region - Global Forecast to 2025

Small Cell 5G Network Market Size, Share, Industry Growth, Latest Trends, Forecast - 2025

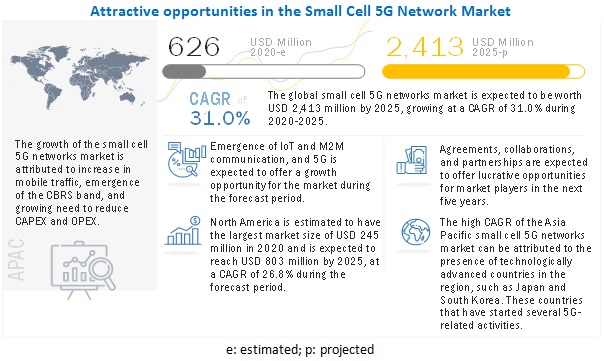

The global Small Cell 5G Network Market size was valued at $626 million in 2020 and it is projected to reach $2413 million by the end of 2025 at a CAGR of 31.0% during the forecast period.

Small cells are low-power base stations that are used to improve network coverage and network capacity, helping end users to bolster their wireless connectivity. These cells are mostly deployed over indoor and outdoor environments to deliver rapid data services to customers. The small cell network would play a pivotal role in 5G networks. Currently, 5G telecom operators are more focused on deploying small cell under low-frequency band for delivering improved bandwidth services to customers. In the later stage of 5G deployment post-2021–2022, the adoption of small cell network for mmWave would be expected to increase, as operators are expected to massively deploy small cell solutions for Internet of Things (IoT) and Machine-to-Machine (M2M) communications.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global Small Cell 5G Network Market:

The outbreak of the COVID-19 has medium impact on the growth of the global small cell 5G network market. In the North America, the US is expected to be highly impacted by the COVID-19 outbreak because of its dependency on China as a major chip and equipment supplier for the telecommunication industry. The blacklisting of Huawei Technologies due to the US-China trade war has resulted in high tensions between the two countries, and the COVID-19 outbreak will only cause further damage. In Europe, most of the countries including the UK, Italy, and Germany are hit by COVID-19. In Italy, 5G rollout plans are badly hit due to COVID-19 in Italy. In APAC, despite being the epicenter of COVID-19, China has maintained its dominant position as a global 5G leader. With the number of COVID-19 cases in China slowing down, the country is easing restrictions, and manufacturing companies are resuming their production facilities. The outbreak of coronavirus is expected to result in the increasing implementation of industrial automation across processes and discrete manufacturing, eCommerce, and logistics and transportation sectors. Middle Eastern countries are severely impacted by COVID-19. It is expected to slow down several investment activities in the region focused on smart city infrastructure, the preparation of FIFA World Cup Qatar 2022, and implementation of industrial automation technologies. This would impact the deployment of small cell 5G networks in the region. Latin America has become a hotspot of the COVID-19 pandemic intensified by weak social protection, fragmented health systems, and profound inequalities. The pandemic has impacted the 5G auction schedule, and also the 5G supply chain in the short- and long-term.

Small Cell 5G Network Market Dynamics:

Driver: Increasing mobile data traffic

There has been continuous increase in data traffic due to the advent of IoT, Augmented Reality (AR), Virtual Realities (VR) technologies, smartphones, voice applications, and audio and video content, giving rise to demand for higher network bandwidth. Approximately, the bandwidth of 1 Gigabits per second (Gbps) is expected to be provided by small cell 5G network services, whereas 4G can only provide a bandwidth of 200 Megabits per second (Mbps). According to Ericsson, the monthly data traffic per smartphone usage would increase by 10 times from 2017 to 2023. The increase in mobile data traffic leads to increase in demand for small cell 5G network. 5G-ready small cell network plays a key role in improving mobile coverage and capacity

Restraint: Poor backhaul connectivity

The major backhaul challenge that mobile network operators had to deal with up to 5G network includes ultralow latency of ~1 Millisecond (ms) (roundtrip) connectivity requirements. Small cells are deployed at high rate network congestion places or where macrocells coverage is poor, and backhaul and power are usually not available. Radio backhaul is one of the potential solutions for this issue, but unit size reduction and throughput testing is a must for the small cell deployment, which may result in increased deployment cost. Unavailability of an alternative backhaul solution creates a significant barrier for the proper deployment and working of small cells. Thus, to overcome such issues, service providers must have a strong service delivery process that is reliable and flexible to terminate backhaul services in a variety of non-traditional locations, such as billboards, telephone poles, and sides of buildings. To tackle the backhaul connectivity problem, denser small cell deployment is required under 5G network, and over a period of time if the issue of poor backhaul is not resolved then vendors may need to find alternative backhaul options such as Wi-Fi and next-generation satellites to satisfy service expectations.

Opportunity: Emergence of 5G

The small cell market is driven due to emerging 5G technology and its increasing deployment rate. The high speeds and low latencies of 5G networks lend themselves to the small cells 5G network market. Next-generation wireless networks will be essential to solve the issue of mobile traffic congestions. Supporting policies have been drawn by the governments across the globe to assist industry in R&D and strive for 5G commercialization. China is expected to implement 5G technology for a multitude of life transforming applications from 3D video to immersive media and audio quality due to its ultrahigh data rates, enhanced capacity, and reduced latency. China is planning to reach 576 million 5G connections by 2025, almost 40% of 5G connections globally. Small cells are a perfect fit into 5G revolution as they provide increased data capacity and assist service providers in reducing the overall cost by eliminating expensive rooftop systems and installations or rental costs. The small cell 5G network also helps to improve the performance of mobile handsets, as it transmits at lower levels, which effectively lowers the power of cell phones and substantially increases their battery life.

Challenge: Difficulties in deploying small cells in 5G networks

Constraints to deploying small cells include prolonged permitting processes, lengthy procurement exercises, excessive fees, and outdated regulations that prevent access. Following are some of the issues that are faced by the operators while deploying small cell 5G networks:

- Local permission and planning processes

- Lengthy engagement and procurement exercises

- High fees and charges to access street furniture

Human exposure to radiofrequency Electromagnetic Fields (EMF)

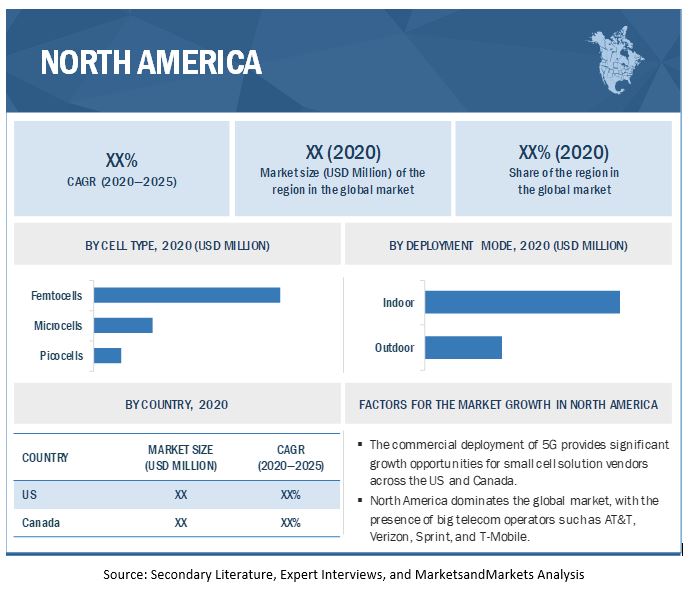

Outdoor segment to account for higher CAGR during the forecast period

Outdoor small cells are expensive as compared to that of indoor small cells; however, they have more coverage area than the indoor small cells. The coverage range of the outdoor small cells is approximately 500 meters to 2.5 kilometers. The outdoor small cells are suitable to expand cellular network coverage in various parts of cities, big public facilities, and residential societies. They have capacity to connect over 200 users/systems simultaneously, as the area covered by them is more than 500 meters. Densely populated areas may require a number of outdoor small cells to effectively connect a large number of users. Post 2021, telecom operators are expected to deploy small cell solutions in mmWave frequency bands. This is expected to drive the deployment of outdoor small cells among telecom operators.

Among cell types, femtocells segment to account for larger market size during the forecast period

Femtocells have the smallest coverage range of approximately 10 to 50 meters. They are preferred by customers, due to their low power consumption and cost. They are a good choice for small residential buildings and small enterprises and can support approximately 8 to 16 cellular connections leading to its larger contribution to the small cell 5G network.

Among radio technologies, the 5G NR standalone segment to grow at a higher CAGR during the forecast period

3rd Generation Partnership Project (3GPP) has completed the specification for the 5G New Radio (NR) non-standalone technology, which would be rollout in the early 2019 and the 5G NR standalone version is expected to be available by 3rd or 4th quarter of 2019. 5G NR standalone solutions are expected to be more effective than 5G NR non-standalone solutions. 5G NR standalone solutions are expected to have various new in-built capabilities. In the early phase of 5G deployment, small cell deployment for 5G NR standalone segment is expected to be in a niche stage and projected to grow exponentially during the forecast period.

North America to account for the largest market size during the forecast period.

The global small cell 5G network market by region covers 5 major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America. North America is estimated to account for the largest market size during the forecast period. North America is an eminent leader in adopting advanced technologies. Operators across North America are expected to deploy small cell solutions on their 5G mobile infrastructures; for example, AT&T, Verizon, Sprint, and T-Mobile have shown positive approach toward commercializing 5G networks. These operators have signed billion-dollar deals with network equipment providers, such as Nokia, Samsung, Ericsson, Huawei, and ZTE, to build up their 5G network infrastructure.

To know about the assumptions considered for the study, download the pdf brochure

Small Cell 5G Network Companies

Key players and innovating vendors in the global small cell 5G network market include Ericsson (Sweden), Huawei (China), ZTE (China), Cisco (US), NEC (Japan), Nokia (Finland), CommScope (US), Airspan Networks (US), ip.access (UK), Corning (US), Fujitsu (Japan), Samsung (South Korea), Comba Telecom (Hong Kong), Contela (South Korea), Baicells Technologies (US), Acceleran (Belgium), Accuver (US), Casa Systems (US), CommAgility (England), Radisys (US), Altiostar (US), Siradel (France), Qualcomm (US), Octasic (Canada), PC-TEL (US), and Microsemi (US). These players have adopted various strategies to grow in the global small cell 5G network market. They have adopted organic and inorganic growth strategies, such as new product launches, acquisitions, business expansions, and partnerships, to expand their business reach and drive their business revenue growth. Moreover, various small cell 5G network providers are adopting different strategies, including venture capital funding, funding through Initial Coin Offering (ICO), new product launches, acquisitions, and partnerships and collaborations, to expand their presence in the global small cell 5G network market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2025 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Components, Radio Technologies, Cell Types, Deployment Modes, End Users, and Regions |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

List of Companies in Small Cell 5G Network |

Ericsson (Sweden), Huawei (China), ZTE (China), Cisco (US), NEC (Japan), Nokia (Finland), CommScope (US), Airspan Networks (US), ip.access (UK), Corning (US), Fujitsu (Japan), Samsung (South Korea), Comba Telecom (Hong Kong), Contela (South Korea), Baicells Technologies (US), Acceleran (Belgium), Accuver (US), Casa Systems (US), CommAgility (England), Radisys (US), Altiostar (US), Siradel (France), Qualcomm (US), Octasic (Canada), PC-TEL (US), and Microsemi (US). |

This research report categorizes the small cell 5G network market based on components, radio technologies, cell types, deployment modes, end users, and regions.

Based on component, the small cell 5G network market has been segmented as follows:

- Solutions

-

Services

- Consulting

- Integration and Deployment

- Training and Support

Based on radio technology, the small cell 5G network market has been segmented as follows:

- 5G New Radio (NR) Standalone

- 5G NR Non-Standalone

Based on deployment mode, the small cell 5G network market has been segmented as follows:

- Outdoor

- Indoor

Based on cell type, the small cell 5G network market has been segmented as follows:

- Picocells

- Femtocells

- Microcells

Based on end users, the small cell 5G network market has been segmented as follows:

- Telecom Operators

- Enterprises

Based on regions, the small cell 5G network market has been segmented as follows:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent developments

- In April 2020, Ericsson partnered with GCI, a telecommunication corporation operating in Alaska, US, to deploy first 5G cell sites in Anchorage, US. By the end of the year, GCI intends to upgrade a majority of cell sites in Anchorage, Eagle River, and Girdwood to the 5-band 5G NR solution.

- In February 2020, CommScope enhanced its OneCell, a small cell solution, with the introduction of open interfaces, virtualized RAN functions, and new radio points. The enhanced OneCell solution leverages the latest open RAN and management frameworks providing an innovative and open approach to operators to deploy 5G networks and deliver in-building wireless services in enterprises and venues for all types of subscribers and use cases.

- In October 2019, Huawei launched the latest 5G full-series solutions at 2019 Global Mobile Broadband Forum. The solutions portfolio includes BladeAAU, Easy Macro 3.0, BookRRU 3.0, and LampSite Sharing, as well as mmWave macro sites, pole sites, and small cells.

- In February 2019, Nokia announced two new additions to its AirScale small cells portfolio. These additions are compact mmWave small cells and new 5G pico Remote Radio Heads. The new additions extend the high performance of 5G both indoors and outdoors, and support a wide range of use cases.

- In February 2019, Comba Telecom partnered with Parallel Wireless to deliver 4G and 5G Open VRAN solutions. The solutions integrate Parallel Wireless’ software with Comba’s Remote Radio Unit (RRU) and base station antennas and leverage its integration services. The fully Open vRAN solutions enable mobile operators to deliver faster time-to-market and better ROI for providing coverage or capacity.

- In December 2018, Samsung partnered with NEC to strengthen its next generation 5G solutions. The partnership will leverage NEC and Samsung's leadership in 5G and IT solutions and would provide mobile carriers with flexible 5G solutions that are localized for each region with customized services.

FAQs:

What is Small Cell 5G Network?

Small Cell Forum defines small cells as radio access points with low Radio Frequency (RF) power output, footprint, and range. The small cells are operator-controlled and deployed indoors or outdoors, and in licensed, shared, or unlicensed spectrums.

Small cells, low-power base stations, are used to improve network capacity and the coverage of 5G networks. Telecom operators or Mobile Network Operators (MNOs) deploy small cells in indoor and outdoor environments to provide seamless connectivity to end users. These cells also increase spectrum efficiency and data transfer capacity. They complement macro networks to improve coverage, add targeted capacity, and support new services.

What is the projected market value of the global small cell 5G network market?

The small cell 5G network is expected to grow from USD 626 million in 2020 to USD 2,413 billion by 2025.

What is the estimated growth rate of the global small cell 5G network market?

The global small cell 5G market is projected to register a moderate 31.0% CAGR in the forecast period.

Which end users of the global small cell 5G network market expected to witness the highest growth?

Enterprises segment is expected to grow as the fastest-growing end user, during the forecast period. The availability of CBRS and MulteFire bands in unlicensed spectrums can open several opportunities for vendors who would offer small cell solutions to enterprises.

Who are the key players operative in the global market?

Some of the key vendors in the market are Ericsson, Huawei, Nokia, ip.access, Nokia, and Samsung, among others.

What are the top trends in small cell 5G network market?

Trends that are impacting the small cell 5G network market includes:

- Increasing Mobile Data Traffic

- Emergence of Citizens Broadband Radio Service Band

- Minimization of Capital Expenditure and Operational Expenditure

- Emergence of Internet of Things and Machine to Machine Communication

- Emergence of 5G

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SEGMENTATION

1.7 YEARS CONSIDERED FOR THE STUDY

1.8 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2020

1.9 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 6 SMALL CELL 5G NETWORK MARKET: RESEARCH DESIGN

FIGURE 7 RESEARCH METHODOLOGY

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

TABLE 2 PRIMARY INTERVIEWS

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 SMALL CELL 5G NETWORK MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 9 SMALL CELL 5G NETWORK MARKET HOLISTIC VIEW

FIGURE 10 MARKET: GROWTH TREND

FIGURE 11 ASIA PACIFIC TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL SMALL CELL 5G NETWORK MARKET

FIGURE 12 GROWING MOBILE DATA TRAFFIC TO DRIVE THE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 SMALL CELL 5G NETWORK MARKET, BY COMPONENT, 2020

FIGURE 13 SOLUTIONS SEGMENT TO HOLD A HIGHER SHARE IN THE MARKET IN 2020

4.3 MARKET, BY SERVICE, 2020

FIGURE 14 INTEGRATION AND DEPLOYMENT SEGMENT TO HOLD THE HIGHEST SHARE IN THE MARKET IN 2020

4.4 MARKET, BY DEPLOYMENT MODE, 2020

FIGURE 15 INDOOR SEGMENT TO HOLD A HIGHER SHARE IN THE MARKET IN 2020

4.5 MARKET, BY CELL TYPE, 2020

FIGURE 16 FEMTOCELLS SEGMENT TO HOLD THE HIGHEST SHARE IN THE MARKET IN 2020

4.6 SMALL CELL 5G NETWORK MARKET, BY END USER, 2020

FIGURE 17 TELECOM OPERATORS SEGMENT TO HOLD A HIGHER SHARE IN THE MARKET IN 2020

4.7 MARKET, BY RADIO TECHNOLOGY, 2020

FIGURE 18 5G NR NON-STANDALONE SEGMENT TO HOLD A HIGHER SHARE IN THE MARKET IN 2020

4.8 NORTH AMERICA MARKET, BY COMPONENT

FIGURE 19 SOLUTIONS AND INDOOR SEGMENTS TO ACCOUNT FOR HIGHER SHARES IN THE MARKET IN 2020

4.9 ASIA PACIFIC MARKET, BY COMPONENT

FIGURE 20 SOLUTIONS AND INDOOR SEGMENTS TO ACCOUNT FOR HIGHER SHARES IN THE MARKET IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMALL CELL 5G NETWORK MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing mobile data traffic

5.2.1.2 Emergence of citizens broadband radio service band

5.2.1.3 Need to minimize CAPEX and OPEX

5.2.2 RESTRAINTS

5.2.2.1 Poor backhaul connectivity

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of IoT and M2M Communication

5.2.3.2 Emergence of 5G

5.2.4 CHALLENGES

5.2.4.1 Difficulties in deploying small cells in 5G networks

5.2.4.2 Implications of government regulations

5.3 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.4 STATE OF 5G COMMERCIALIZATION

FIGURE 22 5G COMMERCIALIZATION

5.5 REGULATORY IMPLICATIONS

TABLE 4 REGULATORY IMPLICATIONS IN THE UNITED STATES

5.6 INDUSTRY USE CASES

5.6.1 USE CASE 1: CHINA UNICOM IN COLLABORATION WITH ERICSSON DEPLOYED RADIO DOT SYSTEM IN 500 BUILDINGS WITHIN THREE MONTHS

5.6.2 USE CASE 2: KT AND ERICSSON SUCCESSFULLY HELD TRIALS AND DEPLOYED INDOOR 5G NETWORK FOR KT SUBSCRIBERS USING ERICSSON RADIO DOT SYSTEM

5.7 IMPACT OF DISRUPTIVE TECHNOLOGIES

5.7.1 ARTIFICIAL INTELLIGENCE/MACHINE LEARNING

5.7.2 BLOCKCHAIN

6 SMALL CELL 5G NETWORK MARKET, BY FREQUENCY BAND (Page No. - 64)

6.1 INTRODUCTION

FIGURE 23 EVOLUTION OF SMALL CELLS

6.2 LOW FREQUENCY

6.3 MMWAVE

7 SMALL CELL 5G NETWORK MARKET, BY 5G APPLICATION (Page No. - 66)

7.1 INTRODUCTION

7.2 ENHANCED MOBILE BROADBAND

7.3 MASSIVE IOT

7.4 MASSIVE MACHINE TYPE COMMUNICATIONS AND ULTRA RELIABLE LOW LATENCY COMMUNICATIONS

8 SMALL CELL 5G NETWORK MARKET, BY COMPONENT (Page No. - 67)

8.1 INTRODUCTION

8.1.1 COMPONENTS: MARKET DRIVERS

8.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 24 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 5 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

FIGURE 25 SMALL CELL SHIPMENT, 2019—2025

TABLE 6 SMALL CELL SHIPMENT, 2019–2025 (UNIT MILLION)

8.2 SOLUTIONS

FIGURE 26 VIRTUAL SMALL CELLS

TABLE 7 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 SERVICES

FIGURE 27 INTEGRATION AND DEPLOYMENT SEGMENT TO HOLD THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 8 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 9 SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

8.3.1 CONSULTING

TABLE 10 CONSULTING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.2 INTEGRATION AND DEPLOYMENT

TABLE 11 INTEGRATION AND DEPLOYMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.3 TRAINING AND SUPPORT

TABLE 12 TRAINING AND SUPPORT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 SMALL CELL 5G NETWORK MARKET, BY CELL TYPE (Page No. - 76)

9.1 INTRODUCTION

9.1.1 CELL TYPES: MARKET DRIVERS

9.1.2 CELL TYPES: COVID-19 IMPACT

FIGURE 28 IMPACT OF COVID-19 ON MACRO CELL DEPLOYMENTS

FIGURE 29 MICROCELLS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY CELL TYPE, 2019–2025 (USD MILLION)

9.2 PICOCELLS

TABLE 14 PICOCELLS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 FEMTOCELLS

TABLE 15 FEMTOCELLS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.4 MICROCELLS

TABLE 16 MICROCELLS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 SMALL CELL 5G NETWORK MARKET, BY DEPLOYMENT MODE (Page No. - 81)

10.1 INTRODUCTION

10.1.1 DEPLOYMENT MODES: MARKET DRIVERS

10.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 30 IMPACT OF COVID-19 ON SMALL CELL DEPLOYMENTS

FIGURE 31 OUTDOOR DEPLOYMENT MODE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 17 MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

10.2 OUTDOOR

TABLE 18 OUTDOOR: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.3 INDOOR

TABLE 19 INDOOR: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11 SMALL CELL 5G NETWORK MARKET, BY RADIO TECHNOLOGY (Page No. - 86)

11.1 INTRODUCTION

11.1.1 RADIO TECHNOLOGIES: MARKET DRIVERS

11.1.2 RADIO TECHNOLOGIES: COVID-19 IMPACT

FIGURE 32 5G NEW RADIO STANDALONE SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 20 MARKET SIZE, BY RADIO TECHNOLOGY, 2019–2025 (USD MILLION)

11.2 5G NEW RADIO STANDALONE

TABLE 21 5G NEW RADIO STANDALONE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.3 5G NEW RADIO NON-STANDALONE

TABLE 22 5G NEW RADIO NON-STANDALONE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12 SMALL CELL 5G NETWORK MARKET, BY END USER (Page No. - 90)

12.1 INTRODUCTION

12.1.1 END USERS: MARKET DRIVERS

12.1.2 END USERS: COVID-19 IMPACT

FIGURE 33 ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 23 MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

12.2 TELECOM OPERATORS

TABLE 24 TELECOM OPERATORS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.3 ENTERPRISES

TABLE 25 ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13 SMALL CELL 5G NETWORK MARKET, BY REGION (Page No. - 95)

13.1 INTRODUCTION

13.1.1 IMPACT OF COVID-19 BY REGION

FIGURE 34 NORTH AMERICA TO DOMINATE THE WORK MARKET DURING THE FORECAST PERIOD

FIGURE 35 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 26 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: SMALL CELL 5G NETWORK MARKET DRIVERS

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 27 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY CELL TYPE, 2019–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY RADIO TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.2.2 UNITED STATES

TABLE 34 UNITED STATES: SMALL CELL 5G NETWORK MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 35 UNITED STATES: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 36 UNITED STATES: MARKET SIZE, BY CELL TYPE, 2019–2025 (USD MILLION)

TABLE 37 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 38 UNITED STATES: MARKET SIZE, BY RADIO TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 39 UNITED STATES: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

13.2.3 CANADA

TABLE 40 CANADA: SMALL CELL 5G NETWORK MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 41 CANADA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 42 CANADA: MARKET SIZE, BY CELL TYPE, 2019–2025 (USD MILLION)

TABLE 43 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 44 CANADA: MARKET SIZE, BY RADIO TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 45 CANADA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

13.3 EUROPE

13.3.1 EUROPE: SMALL CELL 5G NETWORK MARKET DRIVERS

TABLE 46 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 47 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY CELL TYPE, 2019–2025 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY RADIO TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.3.2 UK

13.3.3 GERMANY

13.3.4 REST OF EUROPE

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: SMALL CELL 5G NETWORK MARKET DRIVERS

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY CELL TYPE, 2019–2025 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY RADIO TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.4.2 CHINA

13.4.3 JAPAN

13.4.4 REST OF ASIA PACIFIC

13.5 MIDDLE EAST AND AFRICA

13.5.1 MIDDLE EAST AND AFRICA: SMALL CELL 5G NETWORK MARKET DRIVERS

TABLE 60 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CELL TYPE, 2019–2025 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA: MARKET SIZE, BY RADIO TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.5.2 GULF COOPERATION COUNCIL

13.5.3 REST OF MIDDLE EAST AND AFRICA

13.6 LATIN AMERICA

13.6.1 LATIN AMERICA: SMALL CELL 5G NETWORK MARKET DRIVERS

TABLE 67 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 68 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 69 LATIN AMERICA: MARKET SIZE, BY CELL TYPE, 2019–2025 (USD MILLION)

TABLE 70 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 71 LATIN AMERICA: MARKET SIZE, BY RADIO TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 72 LATIN AMERICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 73 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.6.2 BRAZIL

13.6.3 MEXICO

13.6.4 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE (Page No. - 128)

14.1 OVERVIEW

FIGURE 38 KEY DEVELOPMENTS IN THE SMALL CELL 5G NETWORK MARKET, 2018–2020

14.2 COMPETITIVE SCENARIO

FIGURE 39 MARKET EVALUATION FRAMEWORK, 2018–2020

14.2.1 PARTNERSHIPS

TABLE 74 PARTNERSHIPS, 2019–2020

14.2.2 NEW PRODUCT LAUNCHES

TABLE 75 NEW PRODUCT LAUNCHES, 2018–2020

14.2.3 ACQUISITIONS

TABLE 76 ACQUISITIONS, 2018

15 COMPANY PROFILES (Page No. - 132)

(Business overview, Solutions Offered, Recent Developments, SWOT Analysis, MNM view)*

15.1 ERICSSON

FIGURE 40 ERICSSON: COMPANY SNAPSHOT

FIGURE 41 SWOT ANALYSIS: ERICSSON

15.2 HUAWEI

FIGURE 42 HUAWEI: COMPANY SNAPSHOT

FIGURE 43 SWOT ANALYSIS: HUAWEI

15.3 IP.ACCESS

FIGURE 44 SWOT ANALYSIS: IP.ACCESS

15.4 NOKIA

FIGURE 45 NOKIA: COMPANY SNAPSHOT

FIGURE 46 SWOT ANALYSIS: NOKIA

15.5 SAMSUNG

FIGURE 47 SAMSUNG: COMPANY SNAPSHOT

FIGURE 48 SWOT ANALYSIS: SAMSUNG

15.6 AIRSPAN

15.7 CISCO

FIGURE 49 CISCO: COMPANY SNAPSHOT

15.8 COMMSCOPE

FIGURE 50 COMMSCOPE: COMPANY SNAPSHOT

15.9 COMBA TELECOM

FIGURE 51 COMBA TELECOM: COMPANY SNAPSHOT

15.10 CONTELA

15.11 CORNING

FIGURE 52 CORNING: COMPANY SNAPSHOT

15.12 FUJITSU

FIGURE 53 FUJITSU: COMPANY SNAPSHOT

15.13 NEC

FIGURE 54 NEC: COMPANY SNAPSHOT

15.14 ZTE

FIGURE 55 ZTE: COMPANY SNAPSHOT

15.15 BAICELLS TECHNOLOGIES

15.16 ACCELLERAN

15.17 ACCUVER

15.18 CASA SYSTEMS

15.19 COMMAGILITY

15.20 RADISYS

15.21 ALTIOSTAR

15.22 SIRADEL

15.23 QUALCOMM

15.24 OCTASIC

15.25 PC-TEL

15.26 MICROSEMI

*Details on Business overview, Solutions Offered, Recent Developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 172)

16.1 ADJACENT/RELATED MARKETS

16.1.1 5G SERVICES MARKET

16.1.1.1 Market definition

16.1.1.2 Market overview

TABLE 77 GLOBAL 5G SERVICES MARKET SIZE, 2018–2025 (USD BILLION)

16.1.1.3 5G services market, by vertical

TABLE 78 5G SERVICES MARKET SIZE, BY VERTICAL, 2020–2025 (USD BILLION)

TABLE 79 5G SERVICES MARKET SIZE, BY SMART CITY, 2020–2025 (USD BILLION)

TABLE 80 5G SERVICES MARKET SIZE, BY CONNECTED FACTORY, 2020–2025 (USD BILLION)

TABLE 81 5G SERVICES MARKET SIZE, BY SMART BUILDING, 2020–2025 (USD BILLION)

TABLE 82 5G SERVICES MARKET SIZE, BY CONNECTED VEHICLE, 2020–2025 (USD BILLION)

TABLE 83 5G SERVICES MARKET SIZE, BY CONNECTED HEALTHCARE, 2020–2025 (USD BILLION)

TABLE 84 5G SERVICES MARKET SIZE, BY CONNECTED RETAIL, 2020–2025 (USD BILLION)

TABLE 85 5G SERVICES MARKET SIZE, BY BROADBAND, 2020–2025 (USD BILLION)

16.1.1.4 5G services market, by application

TABLE 86 5G SERVICES MARKET SIZE, BY APPLICATION, 2020–2025 (USD BILLION)

16.1.1.5 5G services market, by region

TABLE 87 5G SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD BILLION)

16.1.2 5G ENTERPRISE MARKET

16.1.2.1 Market definition

16.1.2.2 Market Overview

TABLE 88 GLOBAL 5G ENTERPRISE MARKET SIZE, 2020–2026 (USD MILLION)

16.1.2.3 5G enterprise market, by access equipment

TABLE 89 5G ENTERPRISE MARKET SIZE, BY ACCESS EQUIPMENT, 2020–2026 (USD MILLION)

16.1.2.4 5G enterprise market, by core network technology

TABLE 90 5G ENTERPRISE MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 91 5G ENTERPRISE MARKET FOR SDN, BY REGION, 2020–2026 (USD MILLION)

TABLE 92 5G ENTERPRISE MARKET FOR NFV, BY REGION, 2020–2026 (USD MILLION)

16.1.2.5 5G enterprise market, by service

TABLE 93 5G ENTERPRISE MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 94 5G ENTERPRISE MARKET FOR PLATFORM SERVICES, BY REGION, 2020–2026 (USD MILLION)

TABLE 95 5G ENTERPRISE MARKET FOR SOFTWARE SERVICES, BY REGION, 2020–2026 (USD MILLION)

16.1.2.6 5G enterprise market, by organization size

TABLE 96 5G ENTERPRISE MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

16.1.2.7 5G enterprise market, by end user

TABLE 97 5G ENTERPRISE MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

16.1.2.8 5G enterprise market, by region

TABLE 98 5G ENTERPRISE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

16.1.3 5G INFRASTRUCTURE MARKET

16.1.3.1 Market definition

16.1.3.2 Market overview

TABLE 99 GLOBAL 5G INFRASTRUCTURE MARKET SIZE, 2018–2027 (USD MILLION)

16.1.3.3 5G infrastructure market, by communication infrastructure

TABLE 100 5G INFRASTRUCTURE MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 101 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (THOUSAND UNITS)

16.1.3.4 5G infrastructure market, By core network technology

TABLE 102 5G INFRASTRUCTURE MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

16.1.3.5 5G infrastructure market, by network architecture

TABLE 103 5G INFRASTRUCTURE MARKET SIZE, BY NETWORK ARCHITECTURE, 2018–2027 (USD MILLION)

16.1.3.6 5G infrastructure market, by operational frequency

TABLE 104 5G INFRASTRUCTURE MARKET SIZE, BY OPERATIONAL FREQUENCY, 2018–2027 (USD MILLION)

16.1.3.7 5G infrastructure market, by end user

TABLE 105 5G INFRASTRUCTURE MARKET SIZE, BY END USER, 2018–2027 (USD MILLION)

16.1.3.8 5G infrastructure market, by region

TABLE 106 5G INFRASTRUCTURE MARKET SIZE, BY REGION, 2018–2027 (USD MILLION)

16.1.4 5G IOT MARKET

16.1.4.1 Market definition

16.1.4.2 Market overview

TABLE 107 GLOBAL 5G IOT MARKET SIZE, 2020–2025 (USD MILLION)

16.1.4.3 5G IoT market, by radio technology

TABLE 108 5G IOT MARKET SIZE, BY RADIO TECHNOLOGY, 2020–2025 (USD MILLION)

16.1.4.4 5G IoT market, by range

TABLE 109 5G IOT MARKET SIZE, BY RANGE, 2020–2025 (USD MILLION)

TABLE 110 SHORT-RANGE IOT DEVICES: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 111 WIDE-RANGE IOT DEVICES: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

16.1.4.5 5G IoT market, by vertical

TABLE 112 5G IOT MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 113 MANUFACTURING: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 114 ENERGY AND UTILITIES: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 115 GOVERNMENT: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 116 HEALTHCARE: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 117 TRANSPORTATION AND LOGISTICS: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 118 MINING: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 119 OTHERS: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

16.1.4.6 5G IoT market, by region

TABLE 120 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 121 5G IOT CONNECTIONS, BY REGION, 2020–2025 (MILLION)

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

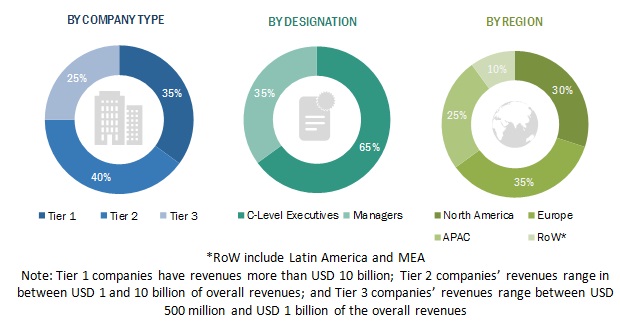

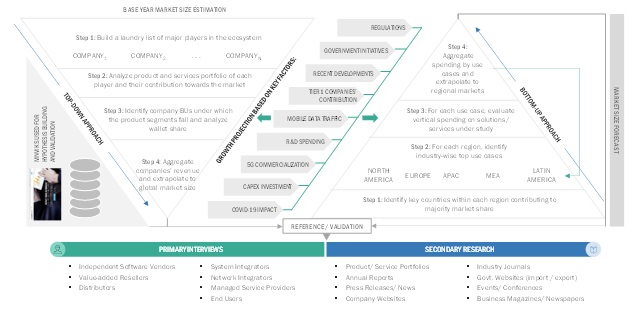

The study involved 4 major activities to estimate the current market size for small cell 5G network market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the small cell 5G network market.

Secondary research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, have been referred to, for identifying and collecting information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; small cell 5G network technology Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary research

Various primary sources from both supply and demand sides of the small cell 5G network market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives, from various vendors who provide the small cell 5G network software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Small Cell 5G Network Market size estimation

For making market estimates and forecasting the small cell 5G network market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global small cell 5G network market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

The following figure provides an illustrative representation of the overall market size estimation process employed for this study:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To determine and forecast the global small cell 5th Generation (5G) network market by component (solutions and services), deployment mode, cell type, radio technology, end user, and region from 2019 to 2025, and analyze the various macroeconomic and microeconomic factors, which affect the market growth

- To forecast the size of the market segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall small cell 5G network market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the small cell 5G network market

- To profile the key market players; generate a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials; and to illustrate the market’s competitive landscape

- To track and analyze competitive developments, such as acquisitions; product launches; partnerships; and Research and Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Geographical Analysis

- Further breakdown of the European corporate small cell 5G networks market

- Further breakdown of the APAC corporate small cell 5G networks market

- Further breakdown of the Latin American corporate small cell 5G networks market

- Further breakdown of the MEA corporate small cell 5G networks market

5G Market Impact on the Small Cell 5G Network Market

- Increased demand for small cell networks: 5G networks requires a higher density of cell sites to provide coverage and capacity. This means that there will be an increased demand for small cell networks to support 5G deployments. As a result, the small cell 5G network market is expected to grow rapidly in the coming years.

- Increased competition: With the demand for small cell networks on the rise, there will be increased competition in the market. This could lead to lower prices and higher innovation as companies strive to differentiate their products and services.

- Deployment challenges: While the deployment of 5G networks will increase the demand for small cell networks, it will also present new challenges. For example, small cell deployment in dense urban areas can be difficult due to regulatory issues, site acquisition challenges, and cost concerns.

- New use cases: The increased bandwidth and low latency of 5G networks will enable new use cases, such as augmented reality, virtual reality, and autonomous vehicles. These applications will require highly reliable and low-latency connections, which small cell networks can provide.

Futuristic Growth Use-Cases of 5G Market

- Smart Cities: 5G networks will enable the development of smart cities, where everything from traffic lights to public transportation is connected to the internet. This will enable cities to be more efficient, safe and sustainable.

- Autonomous Vehicles: 5G networks will enable autonomous vehicles to communicate with each other and with infrastructure, leading to improved safety, efficiency, and reduced congestion.

- Virtual and Augmented Reality: 5G networks will enable high-quality virtual and augmented reality experiences, such as immersive gaming, remote training, and virtual tourism.

- Industrial Automation: 5G networks will enable factories and other industrial settings to be more efficient and productive using advanced automation and robotics.

- Healthcare: 5G networks will enable the development of remote monitoring and telemedicine applications, allowing doctors to remotely monitor patients and perform procedures in real-time.

- Education: 5G networks will enable the development of immersive and interactive education experiences, such as remote learning, virtual field trips, and interactive whiteboards.

- Entertainment: 5G networks will enable the delivery of high-quality, immersive entertainment experiences, such as live-streamed concerts, sports events, and immersive gaming.

Industries Getting Impacted in the Future by 5G Market

- Healthcare: 5G networks will enable the development of remote monitoring and telemedicine applications, allowing doctors to remotely monitor patients and perform procedures in real-time. For example, 5G could enable the use of virtual reality technology to train medical students and enable surgeons to perform remote surgery.

- Manufacturing: 5G networks will enable factories and other industrial settings to be more efficient and productive using advanced automation and robotics. For example, 5G could enable the use of real-time data analytics to optimize supply chain management and enable predictive maintenance of industrial equipment.

- Transportation: 5G networks will enable autonomous vehicles to communicate with each other and with infrastructure, leading to improved safety, efficiency and reduced congestion. For example, 5G could enable the use of advanced traffic management systems that optimize traffic flow and reduce traffic accidents.

- Media and Entertainment: 5G networks will enable the delivery of high-quality, immersive entertainment experiences, such as live-streamed concerts, sports events, and immersive gaming. For example, 5G could enable the use of augmented and virtual reality technology to create immersive and interactive entertainment experiences.

- Agriculture: 5G networks will enable the use of advanced sensors and automation technology to optimize crop yields and reduce waste. For example, 5G could enable the use of precision agriculture techniques, such as real-time soil and weather monitoring, to optimize crop growth.

Top Players in 5G Market

- Huawei Technologies Co., Ltd

- Ericsson

- Nokia Corporation

- Qualcomm Inc

- Samsung Electronics

- ZTE Corporation

- Intel Corporation

- Verizon Communications Inc.

- AT&T Inc.

- Cisco Systems Inc

It's worth noting that this list is not exhaustive, and there are many other companies that are playing significant roles in the 5G market.

New Business Opportunities in 5G Market

- Internet of Things (IoT): 5G technology provides high-speed and low-latency connections that can support a large number of IoT devices. This creates new business opportunities for companies that develop IoT devices and services, as well as those that provide the infrastructure to support them.

- Smart Cities: 5G networks can support the development of smart cities by enabling the deployment of advanced sensors, cameras, and other devices that can collect data and provide insights into traffic, air quality, energy use, and other aspects of urban life. This creates new business opportunities for companies that provide smart city infrastructure, as well as those that develop applications and services that leverage smart city data.

- Virtual and Augmented Reality (VR/AR): 5G networks provide the low-latency connections required to support high-quality VR and AR experiences, creating new business opportunities for companies that develop VR/AR hardware, software, and content.

- Telemedicine: 5G networks can support the development of telemedicine services that allow doctors and other healthcare professionals to provide remote consultations and treatment. This creates new business opportunities for companies that provide telemedicine services, as well as those that develop the infrastructure and technology to support them.

- Autonomous Vehicles: 5G networks can support the development of autonomous vehicles by providing the low-latency connections required for real-time communication between vehicles and infrastructure. This creates new business opportunities for companies that develop autonomous vehicle technology, as well as those that provide the infrastructure to support it.

Growth Drivers for 5G Business from Macro to Micro

5G Market - Macro-Level Growth Drivers:

- Increasing Demand for Data: As the volume of data continues to grow, driven by the rise of IoT devices, streaming video, and other data-intensive applications, there is a growing need for high-speed and low-latency connections that can support these applications. 5G networks are designed to meet this need.

- Emergence of New Technologies: The emergence of new technologies, such as autonomous vehicles, virtual reality, and augmented reality, is driving demand for high-speed and low-latency connections that can support these applications. 5G networks are well-suited to meet the requirements of these new technologies.

- Digital Transformation: Many businesses are undergoing digital transformation, adopting new technologies to improve efficiency, productivity, and customer experience. 5G networks are a key enabler of digital transformation, providing the high-speed and low-latency connections required to support advanced applications and services.

5G Market - Micro-Level Growth Drivers:

- Expansion of Network Infrastructure: As 5G networks continue to roll out, there is a growing need for network infrastructure, including base stations, routers, and other equipment. This creates business opportunities for companies that provide network infrastructure.

- Development of 5G Applications and Services: There is a growing need for applications and services that can leverage the capabilities of 5G networks. This creates business opportunities for companies that develop 5G applications and services.

- Adoption of 5G Devices: As more 5G-enabled devices become available, there will be growing demand for these devices. This creates business opportunities for companies that develop 5G devices, including smartphones, tablets, and IoT devices.

- Development of Industry-Specific Solutions: 5G networks are well-suited to support industry-specific solutions, such as smart factories, connected cars, and telemedicine services. This creates business opportunities for companies that develop industry-specific solutions.

Speak to our Analyst today to know more about "5G Market".

Growth opportunities and latent adjacency in Small Cell 5G Network Market