Slaughtering Equipment Market by Type (Stunning, Killing, Cut-up, Deboning & Skinning, Evisceration), Livestock (Poultry, Swine, Bovine, Seafood), Automation (Fully Automated, Semi-automated), Process Type, and Region - Global Forecast to 2023

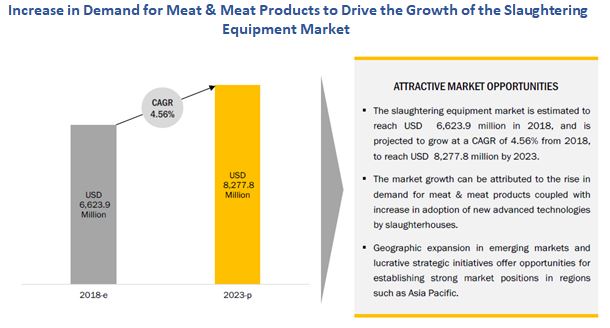

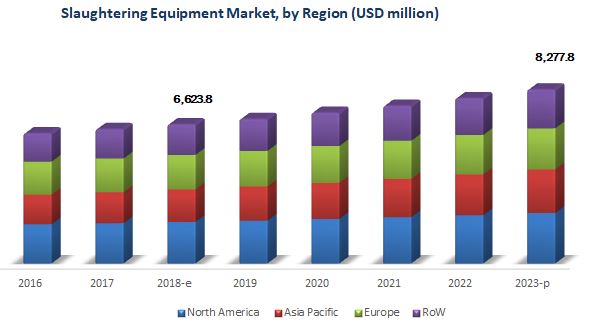

[146 Pages Report] The global slaughtering equipment market was valued at USD 6.39 Billion in 2017; this is projected to grow at a CAGR of 4.56% from 2018, to reach USD 8.28 Billion by 2023. The objectives of the report are to define, segment, and estimate the size of the global market, in both quantitative and qualitative terms. Furthermore, the market has been segmented on the basis of type, process type, automation, livestock, and region. The report also aims to provide detailed information about the crucial factors influencing the growth of the market, strategical analysis of micro markets, opportunities for stakeholders, details of the competitive landscape, and profiles of the key players, with respect to their market shares and competencies.

For more details on this research, Request Free Sample Report

The years considered for the study are as follows:

- Base year: 2017

- Estimated year: 2018

- Forecast period: 20182023

Research Methodology:

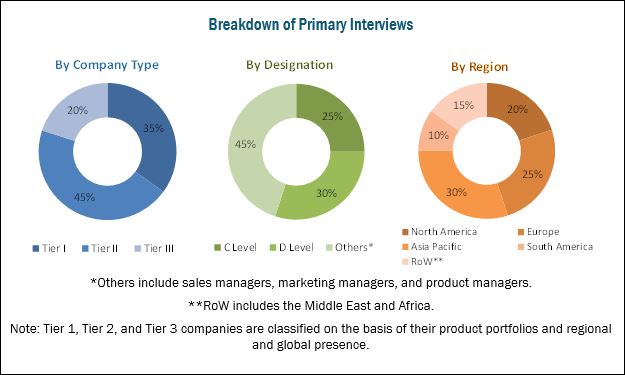

This research study involved the extensive use of secondary sources (which included directories and databases) such as Hoovers, Forbes, Bloomberg Businessweek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the slaughtering equipment market. The primary sources that have been involved include industry experts from the core and related industries and preferred suppliers, dealers, manufacturers, alliances, standards & certification organizations from companies, and organizations related to all the segments of this industrys value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess future prospects. The following figure depicts the market research methodology applied in drafting this report on the market.

To know about the assumptions considered for the study, download the pdf brochure

The key manufacturers in the slaughtering equipment market include Marel (Iceland), BADDER Group (Denmark), BAYLE SA (France), Prime Equipment Group (US), and CTB (US). These companies have diversified product portfolios and advanced technologies for slaughtering equipment at major strategic locations. The other companies which are profiled include Brower Equipment (US), Jarvis Equipment (India), Industries Riopel (Canada), ASENA (Azerbaijan), Dhopeshwar Engineering Private Limited (India), Meatek Food Machineries (India), BANSS (Germany), Limos (Slovenia), Best & Donovan (US), and Blasau (Spain).

The stakeholders for global slaughtering equipment market are mentioned below:

- Raw material suppliers

- Traders and distributors of feed processing equipment

- Feed processing equipment manufacturers

- Regulatory bodies

- Intermediary suppliers

- Feed manufacturers

- Trade associations and industry bodies

- Government and research organizations

Scope of the Report:

On the basis of Type, the slaughtering equipment market has been segmented into the following:

- Stunning

- Killing

- Cut-up

- Deboning & skinning

- Evisceration

- Others (Equipment for cooling & freezing, filleting, and weighing)

On the basis of Automation, the market has been segmented into the following:

- Fully automated line

- Semi-automated line

On the basis of Process Type, the market has been segmented into the following:

- Line slaughter

- Batch slaughter

- Small-sized slaughter

On the basis of Livestock, the market has been segmented into the following:

- Poultry

- Swine

- Bovine

- Seafood

- Others (Ovine and caprine)

On the basis of Region, the slaughtering equipment market has been segmented into the following:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (the Middle East and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Equipment type Analysis

- Further breakdown of slaughtering equipment into stunning, killing, and cut-up

Regional Analysis

- Further breakdown of the Rest of Europe slaughtering equipment market into Italy, the UK, Poland, Denmark, the Netherlands, and Belgium

- Further breakdown of the Rest of Asia Pacific slaughtering equipment market into Japan, Pakistan, and Indonesia

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The slaughtering equipment market is projected to reach USD 8.28 Billion by 2023 from USD 6.62 Billion in 2018, growing at a CAGR of 4.56%. Increase in demand for processed meat, lenient trade policies, and an increase in meat exports are some of the major factors that are expected to drive the demand for slaughtering equipment.

Based on livestock, the market has been segmented into poultry, swine, bovine, seafood, and others, which include ovine and caprine. The poultry segment dominated the global market for slaughtering equipment in 2017, and this trend is expected to continue through the forecast period. The demand for poultry has been growing significantly worldwide, which led to an increase in demand for poultry slaughtering equipment such as killing, cut-up, deboning & skinning, and evisceration equipment. Most large-scale poultry meat producers use automated poultry slaughtering line for high capacity production.

On the basis of automation, the slaughtering equipment market has been segmented into fully automated line and semi-automated line. The semi-automated line method segment dominated the global market for slaughtering equipment in 2017. Semi-automatic slaughtering lines consist of some automatic machines as well as manual labor-oriented processes during slaughtering. Semi-automated lines have lower initial investments and require low maintenance costs, which are its main advantages over automated slaughtering equipment.

North America is expected to account for the largest share in the global market through 2023, owing to urbanization and growth of fast food and restaurant chains. Industry players in the North American region address consumer demand for processed meat to cater to the demand of various consumers in the region. This has resulted in the innovation of various slaughtering equipment such as stunners and deboning & skinning equipment by various companies. Manufacturers in the US are utilizing an optimized approach to deliver slaughtering equipment on time in order to meet the demand for meat products in the market

Asia Pacific is projected to be the fastest-growing region in the global market during the forecast period, owing to the rise in meat consumption, population growth, and increase in awareness about quality and hygienic meat products in the region. High consumption of meat in urban areas and the increase in demand for processed meat products drive the growth of the market for slaughtering equipment in the region.

For more details on this research, Request Free Sample Report

Market consolidation is one of the major factors restraining the growth of the slaughtering equipment market, globally. The slaughtering industry has been experiencing consolidation during the last few decades (20-30 years), which has had a relative effect on the slaughtering equipment industry. Globally, leading slaughterhouses process a large number of livestock with their high production capacity slaughtering equipment; this results in low cost of production per unit when compared to the small and local slaughterhouses.

The key players in the global slaughtering equipment market include Marel (Iceland), BADDER Group (Denmark), BAYLE SA (France), Prime Equipment Group (US), CTB (US), Brower Equipment (US), Jarvis Equipment (India), Industries Riopel (Canada), ASENA (Azerbaijan), Dhopeshwar Engineering Private Limited (India), Meatek Food Machineries (India), BANSS (Germany), Limos (Slovenia), Best & Donovan (US), and Blasau (Spain).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Periodization Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Market

4.2 Market Size For Slaughtering Equipment, By Type, 2018 vs 2023

4.3 Market Size For Slaughtering Equipment, By Automation, 2017

4.4 Market Share, By Livestock, 2018 vs 2023

4.5 Market For Slaughtering Equipment, By Process Type

4.6 North America: Slaughtering Equipment Market, By Type & Country

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of Fast Food and Restaurant Chains

5.2.1.2 Technological Advancements in the Slaughtering Equipment Industry

5.2.1.3 Increase in Demand for Processed Meat

5.2.1.4 Lenient Trade Policies and Increase in Meat Exports

5.2.2 Restraints

5.2.2.1 Market Consolidation

5.2.3 Opportunities

5.2.3.1 Growth Opportunities in Developing Markets

5.2.3.2 Slaughterhouse Upgradation With Advanced Slaughtering Equipment

5.2.4 Challenges

5.2.4.1 High Capital Investments & Infrastructural Challenges

6 Slaughtering Equipment Market, By Type (Page No. - 44)

6.1 Introduction

6.2 Stunning

6.2.1 Electrical Stunning

6.2.2 Controlled Atmosphere Stunning

6.3 Killing

6.4 Cut-Up

6.5 Deboning & Skinning

6.6 Evisceration

6.7 Others

7 Slaughtering Equipment Market, By Automation (Page No. - 49)

7.1 Introduction

7.2 Fully Automated Line

7.3 Semi-Automated Line

8 Slaughtering Equipment Market, By Livestock (Page No. - 52)

8.1 Introduction

8.2 Poultry

8.2.1 Chicken

8.2.2 Duck

8.2.3 Other Poultry

8.3 Swine

8.4 Bovine

8.4.1 Cow

8.4.2 Buffalo

8.5 Seafood

8.5.1 Fish

8.5.2 Other Seafood

8.6 Other Livestock

9 Slaughtering Equipment Market, By Process Type (Page No. - 58)

9.1 Introduction

9.2 Line Slaughter

9.3 Batch Slaughter

9.4 Small-Sized Slaughter

10 Slaughtering Equipment Market, By Region (Page No. - 61)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Russia

10.3.4 Spain

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Australia & New Zealand

10.4.4 Rest of Asia Pacific

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 Rest of the World (RoW)

10.6.1 Africa

10.6.2 Middle East

11 Competitive Landscape (Page No. - 102)

11.1 Overview

11.2 Company Ranking

11.3 Competitive Scenario

11.3.2 Expansions

11.3.4 Agreements, Partnerships, & Joint Venture

12 Company Profiles (Page No. - 108)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Marel

12.2 Baader Group

12.3 Bayle SA

12.4 Prime Equipment Group

12.5 CTB

12.6 Brower Equipment

12.7 Jarvis Equipment

12.8 Industries Riopel

12.9 Asena

12.10 Dhopeshwar Engineering Private Limited

12.11 Meatek Food Machineries

12.12 Banss

12.13 Limos

12.14 Best & Donovan

12.15 Blasau

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 138)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (73 Tables)

Table 1 US Dollar Exchange Rates Considered for the Study, 20142016

Table 2 Meat Statistics (Thousand Tons, Carcass Weight Equivalent): Worlds Major Exporting Countries

Table 3 Per Capita Consumption of Livestock Products Across Regions 19642030 (Kg Per Year)

Table 4 Market Size, By Type, 20162023 (USD Million)

Table 5 Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 6 Global Meat Production, 20142016 (Million Tons)

Table 7 Market Size For Slaughtering Equipment, By Livestock, 20162023 (USD Million)

Table 8 Market Size For Slaughtering Equipment, By Process Type, 20162023 (USD Million)

Table 9 Market Size, By Region, 20162023 (USD Million)

Table 10 North America: Market Size For Slaughtering Equipment, By Country, 20162023 (USD Million)

Table 11 North America: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 12 North America: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 13 North America: Market Size For Slaughtering Equipment, By Process Type, 20162023 (USD Million)

Table 14 North America: Market Size For Slaughtering Equipment, By Livestock, 20162023 (USD Million)

Table 15 US: Slaughtering Equipment Market Size, By Type, 20162023 (USD Million)

Table 16 US: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 17 Canada: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 18 Canada: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 19 Mexico: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 20 Mexico: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 21 Europe: Market Size For Slaughtering Equipment, By Country, 20162023 (USD Million)

Table 22 Europe: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 23 Europe: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 24 Europe: Market Size For Slaughtering Equipment, By Process Type, 20162023 (USD Million)

Table 25 Europe: Market Size For Slaughtering Equipment, By Livestock, 20162023 (USD Million)

Table 26 Germany: Slaughtering Equipment Market Size, By Type, 20162023 (USD Million)

Table 27 Germany: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 28 France: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 29 France: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 30 Russia: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 31 Russia: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 32 Spain: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 33 Spain: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 34 Rest of Europe: Slaughtering Equipment Market Size, By Type, 20162023 (USD Million)

Table 35 Rest of Europe: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 36 Asia Pacific: Market Size For Slaughtering Equipment, By Country, 20162023 (USD Million)

Table 37 Asia Pacific: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 38 Asia Pacific: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 39 Asia Pacific: Dry Slaughtering Equipment Market Size, By Process Type, 20162023 (USD Million)

Table 40 Asia Pacific: Market Size For Slaughtering Equipment, By Livestock, 20162023 (USD Million)

Table 41 China: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 42 China: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 43 India: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 44 India: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 45 Australia & New Zealand: Slaughtering Equipment Market Size, By Type, 20162023 (USD Million)

Table 46 Australia & New Zealand: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 47 Rest of Asia Pacific: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 48 Rest of Asia Pacific: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 49 South America: Slaughtering Equipment Market Size, By Country, 20162023 (USD Million)

Table 50 South America: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 51 South America: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 52 South America: Market Size For Slaughtering Equipment, By Process Type, 20162023 (USD Million)

Table 53 South America: Market Size For Slaughtering Equipment, By Livestock, 20162023 (USD Million)

Table 54 Brazil: Slaughtering Equipment Market Size, By Type, 20162023 (USD Million)

Table 55 Brazil: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 56 Argentina: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 57 Argentina: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 58 Rest of South America: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 59 Rest of South America: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 60 RoW: Slaughtering Equipment Market Size, By Region, 20162023 (USD Million)

Table 61 RoW: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 62 RoW: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 63 RoW: Market Size For Slaughtering Equipment, By Process Type, 20162023 (USD Million)

Table 64 RoW: Market Size For Slaughtering Equipment, By Livestock, 20162023 (USD Million)

Table 65 Africa: Market Size For Slaughtering Equipment, By Type, 20162023 (USD Million)

Table 66 Africa: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 67 Middle East: Market Size, By Type, 20162023 (USD Million)

Table 68 Middle East: Market Size For Slaughtering Equipment, By Automation, 20162023 (USD Million)

Table 69 Top Five Companies in the Slaughtering Equipment Market, 2017

Table 70 Acquisitions, 20132018

Table 71 Expansions, 20132018

Table 72 New Product Launches, 20132018

Table 73 Agreements, 20132018

List of Figures (34 Figures)

Figure 1 Market Segmentation

Figure 2 Geographic Scope

Figure 3 Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation & Methodology

Figure 7 Market For Slaughtering Equipment, By Type, 2018 vs 2023

Figure 8 Slaughtering Equipment Market, By Automation, 2018 vs 2023

Figure 9 Market Size For Slaughtering Equipment, By Livestock, 2018 vs 2023

Figure 10 Market Size For Slaughtering Equipment, By Process Type, 2018 vs 2023

Figure 11 Market Size For Slaughtering Equipment, By Region, 2017

Figure 12 Increase in Demand for Meat & Meat Products to Drive the Growth of the Market For Slaughtering Equipment

Figure 13 Killing Equipment Segment is Projected to Dominate the Market By 2023

Figure 14 Semi-Automated Line Segment is Estimated to Dominate the Market in 2018

Figure 15 Poultry Segment is Projected to Remain the Largest Market Through 2023

Figure 16 Line Slaughter Segment Accounted for the Largest Share Across All Regions in 2017

Figure 17 US Accounted for the Largest Share in 2017

Figure 18 Slaughtering Equipment Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Killing Segment Projected to Hold A Larger Share During the Forecast Period

Figure 20 Semi-Automated Line is Projected to Form the Larger Segment During the Forecast Period

Figure 21 Poultry Segment is Projected to Form the Larger Segment During the Forecast Period

Figure 22 Line Slaughter to Form the Largest Segment During the Forecast Period

Figure 23 Market Size For Slaughtering Equipment, By Region, 2018 vs 2023 (USD Million)

Figure 24 North America: Market Snapshot

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Key Strategies Adopted By Leading Players in the Market For Slaughtering Equipment Between 2013 & 2018

Figure 27 Strengthening Market Developments, in Percentage, Between 2013 & 2018

Figure 28 Market Developments, in Percentage, 20132018

Figure 29 Marel: Company Snapshot

Figure 30 Marel: SWOT Analysis

Figure 31 Baader Company: SWOT Analysis

Figure 32 Bayle SA: SWOT Analysis

Figure 33 Prime Equipment Group: SWOT Analysis

Figure 34 CTB: SWOT Analysis

Growth opportunities and latent adjacency in Slaughtering Equipment Market