Signal Conditioning Modules Market with COVID-19 impact by Form Factor (Din Rail-Mounted Modules, Standalone Modules), Input Type (Temperature, Process, Frequency, LVDT/RVDT), Application, End-User Industry, and Geography - Global Forecast to 2025

Signal Conditioning Modules Market

Signal Conditioning Modules Market and Top Companies

- Rockwell Automation, Inc. provides industrial automation, information, control, and power solutions in the US and internationally. The company operates its businesses through two segments–Control Products & Solutions and Architecture & Software. The Architecture & Software segment contains a wide portfolio of information and automation platforms, including software and hardware. The Control Products & Solutions segment includes a portfolio of industrial control and intelligent motor control products, value-added solutions, and professional lifecycle services. Also, the company owns many registered trademarks, including Rockwell Automation, Allen-Bradley, and PlantPAx. The company serves customers in ~100 countries worldwide.

- Siemens is a technology company that focuses on automation and digitization in process and manufacturing industries, conventional and renewable power generation and power distribution, intelligent infrastructure for buildings and distributed energy systems, smart mobility solutions for rail and road, and digital healthcare and medical technology services. Siemens comprises Siemens AG as a parent company and its subsidiaries. The company provides a wide range of industrial automation products and solutions that include automation systems, industrial controls, operator control and monitoring systems, process instrumentation, distributed control systems, and related software.

- Phoenix Contact is a global provider of components, systems, and solutions in the area of automation, electrical engineering, and electronics. The company is headquartered in Blomberg, Germany. The Phoenix Contact Group has 19 companies globally and has international sales subsidiaries in more than 50 countries worldwide. The company has a presence in more than 100 countries worldwide. The company offers a wide range of signal conditioners, field devices, and process indicators for industrial automation.

- Pepperl+Fuchs is one of the prominent players in the field of active electronic proximity sensors. The company offers its products and services through two major divisions, namely, Factory Automation and Process Automation. The company provides a wide range of components for factory automation that includes sensor types such as inductive, ultrasonic, capacitive, rotary encoders, photoelectric, barcodes, identification systems, data-matrix-codes, and vision sensors. It also provides various components and solutions for process automation that include interface modules, remote I/O systems, level control devices, and electrical explosion protection equipment.

Signal Conditioning Modules Market and Top End-user Industries

- Oil & Gas - In the supply chain of the oil & gas industry, from exploration through delivery, there is a high demand for automation. This high demand is due to the global demand for affordable energy, meeting stringent government regulations, and reducing costs. With industrial automation initiatives and process control, oil & gas companies are focusing on designing, fabrication, and implementation of control systems. Superior isolation of signals for accurate signal conversion, scaling of process values, and elimination of ground loops and noise filtration are some of the key requirements in the oil & gas industry. Reliable and certified signal conditioners help achieve this objective with their excellent signal isolation and monitoring capabilities.

- Energy & Power - Signal conditioning modules used in power plants must remain accurate even when subjected to high vibration, high levels of electrical noise, and other disturbances. Even small measurement errors in the energy & power sector can have large consequences, so superior quality signal conditioners are used in these processes. The need for affordable, reliable, and environmentally safe energy continues to grow, challenging the energy & power industry. Many energy & power plants around the world are aging rapidly. Most of these power plants are planning retrofits or complete replacement of their hardware components or control systems. Maintaining an efficient and operational power plant is a critical task.

- Chemical Processing - A growing number of chemical companies are now adopting industrial automation technologies to better manage their operations. Complex operating conditions, plant safety, industry trends, and stringent environmental compliances are major challenges for operating a chemical processing facility. Signal conditioning in the chemical & petrochemical processing industries is a matter of reducing process costs as most of the chemicals require special manufacturing processes. Signal conditioners are widely used in the chemical processing industries in batch processing and storage & blending of chemicals.

Signal Conditioning Modules Market and Top Applications

- Data Acquisition: Data acquisition is a crucial application for signal conditioning modules. Proper signal conditioning is critical to any data acquisition application. For instance, a thermocouple operating in a noisy environment with large electric motors will pick up electrical noise, which affects the signal and results in difficulties in sensing and acquiring accurate temperature from raw signals. Such signals require proper signal conditioning before being processed by data acquisition devices.

- Process Control: Signal conditioners are cost-effective tools for safeguarding signals and maintaining uptime. Faulty signal transmission may lead to critical measuring and control errors. This might cause interruptions in controlled processes. Signal conditioners provide galvanic isolation, which allows safe transmission of signals. A variety of signal conditioning modules can seamlessly fit the needs of an existing control system.

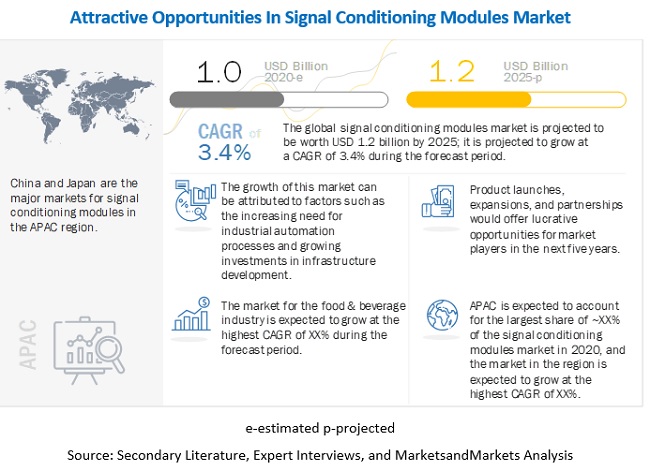

[240 Pages Report] The global signal conditioning modules market size is expected to grow from USD 1.0 billion in 2020 to USD 1.2 billion by 2025 at a CAGR of 3.4%. The market growth is fueled by the increasing need for industrial automation processes, surging investments in infrastructure development, and growing need to comply with government policies and regulations.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Signal Conditioning Modules Market

COVID-19 has affected the production capacities and financial condition of signal conditioning modules providers. The pandemic has resulted in a widespread health crisis, which is adversely affecting the financial markets and economies of countries and end-user industries. This is expected to lead to an economic downturn and negatively affect the demand for signal conditioning modules. The overall long-term impact of COVID-19 on the signal conditioning modules market is expected to depend on various factors, such as the global spread and duration of the pandemic, the actions taken by various government authorities worldwide in response to the pandemic, and the severity of the disease.

Signal Conditioning Modules Market Dynamics

Driver : Increasing need for industrial automation processes and surging investments in infrastructure development

Factors such as globalization, increasing need to conform to quality benchmarks, and rising competition in global markets have led to increased use of automation solutions in the manufacturing and process industries worldwide. The global industrial automation market for these industries is expected to register high growth in the next few years. This is primarily due to the capital and R&D investments in developing and implementing automation solutions. Several industries worldwide are embracing automation as a part of their growing investment allocations in R&D and new projects. Precise and high-quality signal conditioners increase industry efficiency with more accurate signal measurements and improved plant safety.

Restraint: Supply chain disruptions due to lockdowns in leading economies due to COVID-19

Multiple countries worldwide have announced a complete or partial lockdown to stop the spread of the COVID-19 pandemic. These lockdowns have impacted the overall supply chain, as raw material suppliers are not able to transport the goods to manufacturers. Complete closures or partial business operations with a limited workforce have also resulted in the decreasing demand for products from various end-use industries. Delays in the production and sales of signal conditioning modules will severely hamper the financial performance of companies.

Opportunity : Opportunities in untapped geographies and developing economies

Industrial automation is gaining significant importance in developing nations such as India, Brazil, and Mexico, as it provides advantages that include high productivity, high flexibility, high safety, and high information accuracy. Increasing investments in the automation sector, growing modernization of existing facilities, and rising demand for the conditioning of sensor input signals for accurate and precise measurement would generate huge opportunities for the signal conditioning modules market in various industries such as water & wastewater, chemicals processing, and energy & power.

Challenge: Competitive pricing among global and regional manufacturers

The global signal conditioning modules market is highly competitive with the presence of several global and regional players. The regional players, with the advantage of low manufacturing and overhead costs, sell their products at considerably lower prices compared with that of the global players. To sustain in the pricing competition, the global players need to sell their products at comparatively lesser prices, which, in turn, hampers their profit margins. On the other hand, to sustain in the highly competitive market, manufacturing companies are focusing on the development of state-of-the-art, advanced products to meet the requirements of customers. This is leading to an increase in their R&D investments, resulting in reduced operating profits.

The market for DIN rail-mounted signal conditioning modules to grow at the highest CAGR from 2020 to 2025

DIN rail-/rack-mounted signal conditioning modules are widely adopted across several industries, as they are a critical part of data acquisition systems. These modules provide signal conversion and isolation for a wide range of process inputs, such as thermocouples, RTDs, frequency, current, resistance, and potentiometers, among others. These modules are mounted on an industry-standard DIN rail. The DIN rail concept can save installation time, as the signal conditioning modules can be mounted onto the metal rail. Module racks can be quickly assembled in linear configurations, which provide high flexibility and density, and save design time.

Signal conditioning modules market for food & beverage to exhibit high growth during the forecast period

The signal conditioning modules market in the food and beverage industry is projected to grow at the highest rate during the forecast period. This growth is attributed to the growing adoption of process automation and instrumentation to increase the productivity and efficiency of manufacturing plants. Countries such as the US, China, Brazil, and India are experiencing high demand for processed foods owing to the growing population. As a result, F&B companies are increasingly adopting process automation and instrumentation to optimize infrastructure and processes to increase operations efficiency. This is expected to create demand for control instruments and devices, thus driving the market for signal conditioning modules.

To know about the assumptions considered for the study, download the pdf brochure

The signal conditioning modules market in APAC to grow at highest CAGR during the forecast period

Increasing demand for applications such as galvanic isolation of standard signals, measurement of voltages and currents, and interface to the control system or SCADA is projected to boost the growth of the signal conditioning modules market in APAC. The signal conditioning modules market in APAC is expected to register the highest CAGR. High economic growth and rising demand for energy and oil & gas have led to an increase in the implementation of signal conditioners across data acquisition and process control applications, which, in turn, is driving the growth of the market.

Key Market Players

As of 2019, Rockwell Automation, Inc. (US), Siemens (Germany), Phoenix Contact GmbH & Co. KG (Germany), Schneider Electric (France), Pepperl+Fuchs (Germany), Yokogawa Electric Corporation (Japan), TE Connectivity Ltd. (US), Advantech Co., Ltd. (Taiwan), ABB (Switzerland), and AMETEK, Inc. (US) were the major players in the signal conditioning modules market. The study includes an in-depth competitive analysis of these key players in the signal conditioning modules market with their company profiles, recent developments, and key market strategies.

Signal Conditioning Modules Market Report Scope :

|

Report Metric |

Details |

|

Years considered |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

|

|

Regions covered |

|

|

Companies covered |

Rockwell Automation, Inc. (US), Siemens (Germany), Phoenix Contact GmbH & Co. KG (Germany), Schneider Electric (France), Pepperl+Fuchs (Germany), Yokogawa Electric Corporation (Japan), TE Connectivity Ltd. (US), Advantech Co., Ltd. (Taiwan), ABB (Switzerland), and AMETEK, Inc. (US), Weidmüller Interface GmbH & Co. Kg (Germany), Moore Industries (US), PR electronics (Denmark), Acromag, Inc. (US), Dwyer Instruments, Inc. (US), Keysight Technologies, Inc. (US), ICP DAS CO., LTD. (Taiwan), Omega Engineering Inc. (US), Hans Turck GmbH & Co. KG (Germany), Vega Grieshaber Kg (Germany), Curtiss-Wright Corporation (US), Dataforth Corporation (US), HBM (Germany), MTL Group – EATON (UK), and Red Lion Controls Inc. (US). |

In this report, the overall signal conditioning modules market has been segmented based on form factor, input type, application, end-user industry, and region.

By Form Factor:

- DIN rail-/rack-mounted modules

- Standalone/modular modules

By Input Type:

- Temperature input

- Process input

- Frequency input

- LVDT/RVDT

By Application:

- Data acquisition

- Process control

- Others

By End-user Industry:

- Oil & Gas

- Energy & Power

- Chemical Processing

- Food & Beverage

- Metal & Mining

- Paper & Pulp

- Water & Wastewater

- Aerospace & Defense

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

Which region is expected to generate the highest revenues during the forecast period?

The APAC region is expected to generate the highest revenue during the forecast period

Does this report include the impact of COVID-19 on the signal conditioning modules market?

Yes, the report includes the impact of COVID-19 on the signal conditioning modules market. It illustrates the post- COVID-19 market scenario.

Who are the top five players in the signal conditioning modules market?

The major vendors operating in the signal conditioning modules market include Rockwell Automation, Inc. (US), Siemens (Germany), Phoenix Contact GmbH & Co. KG (Germany), Schneider Electric (France), Pepperl+Fuchs (Germany).

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Italy, and the rest of European countries.

Which is the highest revenue-generating end-use industry during the forecast period?

The oil & gas industry is expected to generate the highest revenue during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SIGNAL CONDITIONING MODULES MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM SIGNAL CONDITIONING MODULES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP MARKET ESTIMATION FOR SIGNAL CONDITIONING MODULES MARKET, BY INPUT TYPE

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating the market size by bottom-up analysis (demand side)

FIGURE 6 SIGNAL CONDITIONING MODULES MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating the market size by top-down analysis (supply side)

FIGURE 7 SIGNAL CONDITIONING MODULES MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 9 ANALYSIS OF COVID-19 IMPACT ON SIGNAL CONDITIONING MODULES MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 10 DIN RAIL-/RACK-MOUNTED MODULES SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 DATA ACQUISITION IS EXPECTED TO HOLD LARGEST SHARE OF SIGNAL CONDITIONING MODULES MARKET BY 2025

FIGURE 12 PROCESS INPUT SEGMENT MODULE TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 13 SIGNAL CONDITIONING MODULES MARKET IN FOOD & BEVERAGE INDUSTRY TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 14 APAC HELD LARGEST SHARE OF SIGNAL CONDITIONING MODULES MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN SIGNAL CONDITIONING MODULES MARKET

FIGURE 15 SIGNAL CONDITIONING MODULES MARKET WOULD GROW DUE TO INCREASING DEMAND FROM APAC

4.2 SIGNAL CONDITIONING MODULES MARKET, BY FORM FACTOR

FIGURE 16 DIN RAIL-/RACK-MOUNTED MODULES SEGMENT EXPECTED TO LEAD SIGNAL CONDITIONING MODULES MARKET BY 2025

4.3 SIGNAL CONDITIONING MODULES MARKET, BY APPLICATION

FIGURE 17 PROCESS CONTROL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 SIGNAL CONDITIONING MODULES MARKET, BY INPUT TYPE

FIGURE 18 PROCESS INPUT SEGMENT TO HOLD LARGEST MARKET SIZE BY 2025

4.5 SIGNAL CONDITIONING MODULES MARKET, BY END-USER INDUSTRY AND COUNTRY

FIGURE 19 OIL & GAS INDUSTRY AND US TO HOLD LARGEST SHARE OF SIGNAL CONDITIONING MODULES MARKET BY 2025

4.6 SIGNAL CONDITIONING MODULES MARKET, BY COUNTRY

FIGURE 20 US TO HOLD LARGEST SHARE OF SIGNAL CONDITIONING MODULES MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MARKET DYNAMICS: OVERVIEW

5.2.1 DRIVERS

5.2.1.1 Shift from traditional data acquisition systems to PC-based systems

5.2.1.2 Rising demand for signal conditioners from water & wastewater industry

TABLE 1 APPLICATIONS OF SIGNAL CONDITIONING MODULES IN WATER & WASTEWATER INDUSTRY

5.2.1.3 Wide distribution network of manufacturers

5.2.1.4 Increasing need for industrial automation processes, surging investments in infrastructure development, and growing need to comply with government policies and regulations

5.2.1.5 Advanced features of signal conditioning modules

5.2.2 RESTRAINTS

5.2.2.1 Supply chain disruptions due to lockdowns in leading economies due to COVID-19

5.2.2.2 Stringent compliances/certifications across various regions

TABLE 2 DIRECTIVES/COMPLIANCES AND THEIR APPLICABILITY IN REGIONS/COUNTRIES/ APPLICATIONS

5.2.3 OPPORTUNITIES

5.2.3.1 Opportunities in untapped geographies and developing economies

5.2.3.2 Industry 4.0 revolution

5.2.4 CHALLENGES

5.2.4.1 Competitive pricing among global and regional manufacturers

5.3 SIGNAL CONDITIONING MODULES MARKET: ECOSYSTEM AND VALUE CHAIN ANALYSIS

FIGURE 22 MARKET: ECOSYSTEM

FIGURE 23 MARKET: VALUE CHAIN ANALYSIS

5.3.1 RESEARCH & PRODUCT DEVELOPMENT

5.3.2 RAW MATERIAL/COMPONENT SUPPLIERS

5.3.3 MANUFACTURING & ASSEMBLY

5.3.4 SYSTEM INTEGRATORS

5.3.5 DISTRIBUTION & SALES

5.3.6 END-USER INDUSTRIES

5.4 IMPACT OF COVID-19 ON SIGNAL CONDITIONING MODULES MARKET

5.5 TECHNOLOGY TRENDS

5.5.1 INTEGRATED BLUETOOTH

5.5.2 ASIC TECHNOLOGY ENABLES RTD SIGNAL CONDITIONING ADVANCES

5.5.3 SELF-CONFIGURING DIGITAL SIGNAL CONDITIONER TECHNOLOGY

5.6 CASE STUDIES

5.6.1 USE CASE 1: PR ELECTRONICS

5.6.2 USE CASE 2: PR ELECTRONICS

5.6.3 USE CASE 3: ADVANTECH CO., LTD.

5.7 MARKET REGULATIONS

5.8 PATENT ANALYSIS

5.8.1 PATENTS PERTAINING TO SIGNAL CONDITIONING MODULES

6 SIGNAL CONDITIONING MODULES MARKET, BY FUNCTION (Page No. - 74)

6.1 INTRODUCTION

6.2 SIGNAL CONVERSION

6.3 LINEARIZATION

6.4 AMPLIFYING

6.5 FILTERING

6.6 SMART FUNCTIONS

7 SIGNAL CONDITIONING MODULES MARKET, BY FORM FACTOR (Page No. - 76)

7.1 INTRODUCTION

FIGURE 24 SIGNAL CONDITIONING MODULES MARKET, BY FORM FACTOR

TABLE 3 MARKET, BY FORM FACTOR, 2016–2019 (USD MILLION)

TABLE 4 MARKET, BY FORM FACTOR, 2020–2025 (USD MILLION)

7.2 DIN RAIL-/RACK-MOUNTED MODULES

7.2.1 DIN MODULES ARE RUGGED, SMALL, AND DESIGNED FOR HIGH-DENSITY INSTALLATIONS

7.3 STANDALONE/MODULAR MODULES

7.3.1 STANDALONE/MODULAR MODULES ARE USED TO CONDITION SIGNALS FROM SEVERAL INPUT SENSORS INCLUDING ACCELEROMETERS, RTDS, AND THERMOCOUPLES

8 SIGNAL CONDITIONING MODULES MARKET, BY INPUT TYPE (Page No. - 79)

8.1 INTRODUCTION

FIGURE 25 SIGNAL CONDITIONING MODULES MARKET, BY INPUT TYPE

TABLE 5 SIGNAL CONDITIONING MODULES SHIPMENTS, BY INPUT TYPE, 2016–2019 (THOUSAND UNITS)

TABLE 6 SIGNAL CONDITIONING MODULES SHIPMENTS, BY INPUT TYPE, 2020–2025 (THOUSAND UNITS)

TABLE 7 MARKET, BY INPUT TYPE, 2016–2019 (USD MILLION)

TABLE 8 MARKET, BY INPUT TYPE, 2020–2025 (USD MILLION)

8.2 TEMPERATURE INPUT SIGNAL CONDITIONING MODULES

8.2.1 CHEMICALS PROCESSING INDUSTRY IS EXPECTED TO RAPIDLY ADOPT TEMPERATURE INPUT SIGNAL CONDITIONING MODULES IN COMING YEARS

TABLE 9 TEMPERATURE INPUT SIGNAL CONDITIONING MODULES MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 10 TEMPERATURE INPUT SIGNAL CONDITIONING MODULES MARKET, BY END-USER INDUSTRY, 2020–2025 (USD MILLION)

8.3 PROCESS INPUT SIGNAL CONDITIONING MODULES

8.3.1 MARKET FOR PROCESS INPUT SIGNAL CONDITIONING MODULES TO GROW AT HIGHEST RATE

TABLE 11 MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 12 MARKET, BY END-USER INDUSTRY, 2020–2025 (USD MILLION)

8.4 FREQUENCY INPUT SIGNAL CONDITIONING MODULES

8.4.1 INCREASING USE OF FREQUENCY INPUT SIGNAL CONDITIONING MODULES IN MONITORING & CONTROLLING MOTOR OR LINE SPEED, CONVERTING SPEED & FREQUENCY SIGNALS, AND AVOIDING INTERFACING OF FREQUENCY SENSORS WILL DRIVE GROWTH

TABLE 13 FREQUENCY INPUT SIGNAL CONDITIONING MODULES MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 14 MARKET, BY END-USER INDUSTRY, 2020–2025 (USD MILLION)

8.5 LVDT/RVDT SIGNAL CONDITIONING MODULES

8.5.1 INCREASING ADOPTION OF FACTORY AUTOMATION SOLUTIONS FOR HARSH WORKING ENVIRONMENTS IS LIKELY TO CREATE DEMAND FOR LVDT/RVDT SIGNAL CONDITIONERS

TABLE 15 LVDT/RVDT SIGNAL CONDITIONING MODULES MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 16 MARKET, BY END-USER INDUSTRY, 2020–2025 (USD MILLION)

9 SIGNAL CONDITIONING MODULES MARKET, BY APPLICATION (Page No. - 88)

9.1 INTRODUCTION

FIGURE 26 SIGNAL CONDITIONING MODULES MARKET, BY APPLICATION

FIGURE 27 MARKET FOR PROCESS CONTROL APPLICATION EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 17 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 18 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

9.2 DATA ACQUISITION

9.2.1 INCREASING ADOPTION OF INDUSTRIAL AND PROCESS AUTOMATION AND DEMAND FOR REAL-TIME DATA PROCESSING WILL DRIVE DEMAND FOR SIGNAL CONDITIONERS

TABLE 19 MARKET FOR DATA ACQUISITION APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 MARKET FOR DATA ACQUISITION APPLICATION, BY REGION, 2020–2025 (USD MILLION)

FIGURE 28 APAC EXPECTED TO HOLD LARGEST SHARE OF SIGNAL CONDITIONING MODULES MARKET FOR DATA ACQUISITION APPLICATION DURING FORECAST PERIOD

9.3 PROCESS CONTROL

9.3.1 PROCESS CONTROL SEGMENT IS PROJECTED TO GROW AT HIGHEST CAGR IN APAC

TABLE 21 MARKET FOR PROCESS CONTROL APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 MARKET FOR PROCESS CONTROL APPLICATION, BY REGION, 2020–2025 (USD MILLION)

9.4 OTHER APPLICATIONS

TABLE 23 MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

10 SIGNAL CONDITIONING MODULES MARKET, BY END-USER INDUSTRY (Page No. - 95)

10.1 INTRODUCTION

FIGURE 29 SIGNAL CONDITIONING MODULES MARKET, BY END-USER INDUSTRY

FIGURE 30 OIL & GAS SEGMENT TO DOMINATE SIGNAL CONDITIONING MODULES MARKET DURING FORECAST PERIOD

TABLE 25 MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 26 MARKET, BY END-USER INDUSTRY, 2020–2025 (USD MILLION)

10.2 OIL & GAS

10.2.1 SIGNAL CONDITIONING MODULES MARKET FOR OIL & GAS INDUSTRY IS PROJECTED TO REGISTER HIGHEST CAGR IN ASIA PACIFIC

TABLE 27 MARKET FOR OIL & GAS, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 MARKET FOR OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

TABLE 29 MARKET FOR OIL & GAS, BY INPUT TYPE, 2016–2019 (USD MILLION)

TABLE 30 MARKET FOR OIL & GAS, BY INPUT TYPE, 2020–2025 (USD MILLION)

TABLE 31 MARKET FOR OIL & GAS IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 32 MARKET FOR OIL & GAS IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 33 MARKET FOR OIL & GAS IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 34 MARKET FOR OIL & GAS IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 35 MARKET FOR OIL & GAS IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 36 MARKET FOR OIL & GAS IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 37 SIGNAL CONDITIONING MODULES MARKET FOR OIL & GAS IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 38 SIGNAL CONDITIONING MODULES MARKET FOR OIL & GAS IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

10.3 ENERGY & POWER

10.3.1 GROWING IMPLEMENTATION OF AUTOMATION SOLUTIONS TO INCREASE OVERALL EFFICIENCY OF POWER PLANTS

FIGURE 31 ASIA PACIFIC SIGNAL CONDITIONING MODULES MARKET FOR ENERGY & POWER TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 39 MARKET FOR ENERGY & POWER, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 MARKET FOR ENERGY & POWER, BY REGION, 2020–2025 (USD MILLION)

TABLE 41 MARKET FOR ENERGY & POWER, BY INPUT TYPE, 2016–2019 (USD MILLION)

TABLE 42 MARKET FOR ENERGY & POWER, BY INPUT TYPE, 2020–2025 (USD MILLION)

TABLE 43 MARKET FOR ENERGY & POWER IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 44 MARKET FOR ENERGY & POWER IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 45 MARKET FOR ENERGY & POWER IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 46 SIGNAL CONDITIONING MODULES MARKET FOR ENERGY & POWER IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 47 MARKET FOR ENERGY & POWER IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 48 MARKET FOR ENERGY & POWER IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 49 MARKET FOR ENERGY & POWER IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 50 MARKET FOR ENERGY & POWER IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

10.4 CHEMICAL PROCESSING

10.4.1 CHEMICAL PROCESSING INDUSTRY USES SIGNAL CONDITIONERS TO ENHANCE PLANT SAFETY AND PRODUCTIVITY

TABLE 51 MARKET FOR CHEMICAL PROCESSING, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 MARKET FOR CHEMICAL PROCESSING, BY REGION, 2020–2025 (USD MILLION)

TABLE 53 SIGNAL CONDITIONING MODULES MARKET FOR CHEMICAL PROCESSING, BY INPUT TYPE, 2016–2019 (USD MILLION)

TABLE 54 MARKET FOR CHEMICAL PROCESSING, BY INPUT TYPE, 2020–2025 (USD MILLION)

TABLE 55 MARKET FOR CHEMICAL PROCESSING IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 56 MARKET FOR CHEMICAL PROCESSING IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 57 MARKET FOR CHEMICAL PROCESSING IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 58 SIGNAL CONDITIONING MODULES MARKET FOR CHEMICAL PROCESSING IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 59 MARKET FOR CHEMICAL PROCESSING IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 60 MARKET FOR CHEMICAL PROCESSING IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 61 MARKET FOR CHEMICAL PROCESSING IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 62 MARKET FOR CHEMICAL PROCESSING IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

FIGURE 32 INCREASING APPLICATIONS ACROSS VARIOUS INDUSTRIES TO DRIVE GROWTH OF SIGNAL CONDITIONING MODULES MARKET DURING FORECAST PERIOD

10.5 FOOD & BEVERAGE

10.5.1 REQUIREMENT OF HIGH DEGREE OF AUTOMATION IN FOOD & BEVERAGE INDUSTRY TO DRIVE MARKET GROWTH

TABLE 63 MARKET FOR FOOD & BEVERAGE, BY REGION, 2016–2019 (USD MILLION)

TABLE 64 MARKET FOR FOOD & BEVERAGE, BY REGION, 2020–2025 (USD MILLION)

TABLE 65 MARKET FOR FOOD & BEVERAGE, BY INPUT TYPE, 2016–2019 (USD MILLION)

TABLE 66 MARKET FOR FOOD & BEVERAGE, BY INPUT TYPE, 2020–2025 (USD MILLION)

TABLE 67 SIGNAL CONDITIONING MODULES MARKET FOR FOOD & BEVERAGE IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 68 MARKET FOR FOOD & BEVERAGE IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 69 MARKET FOR FOOD & BEVERAGE IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 70 MARKET FOR FOOD & BEVERAGE IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 71 MARKET FOR FOOD & BEVERAGE IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 72 MARKET FOR FOOD & BEVERAGE IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 73 MARKET FOR FOOD & BEVERAGE IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 74 MARKET FOR FOOD & BEVERAGE IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

10.6 METALS & MINING

10.6.1 SIGNAL CONDITIONING MODULES MARKET FOR METALS & MINING INDUSTRY IN APAC TO REGISTER HIGHEST CAGR

TABLE 75 MARKET FOR METALS & MINING, BY REGION, 2016–2019 (USD MILLION)

TABLE 76 SIGNAL CONDITIONING MODULES MARKET FOR METALS & MINING, BY REGION, 2020–2025 (USD MILLION)

TABLE 77 MARKET FOR METALS & MINING, BY INPUT TYPE, 2016–2019 (USD MILLION)

TABLE 78 MARKET FOR METALS & MINING, BY INPUT TYPE, 2020–2025 (USD MILLION)

TABLE 79 MARKET FOR METALS & MINING IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 80 MARKET FOR METALS & MINING IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 81 SIGNAL CONDITIONING MODULES MARKET FOR METALS & MINING IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 82 MARKET FOR METALS & MINING IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 83 MARKET FOR METALS & MINING IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 84 SIGNAL CONDITIONING MODULES MARKET FOR METALS & MINING IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 85 MARKET FOR METALS & MINING IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 86 MARKET FOR METALS & MINING IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

10.7 PAPER & PULP

10.7.1 INCREASING USE OF PROCESS AUTOMATION SOLUTIONS IN PAPER & PULP INDUSTRY TO MINIMIZE USE OF ENERGY AND WATER

TABLE 87 SIGNAL CONDITIONING MODULES MARKET FOR PAPER & PULP, BY REGION, 2016–2019 (USD MILLION)

TABLE 88 MARKET FOR PAPER & PULP, BY REGION, 2020–2025 (USD MILLION)

TABLE 89 SIGNAL CONDITIONING MODULES MARKET FOR PAPER & PULP, BY INPUT TYPE, 2016–2019 (USD MILLION)

TABLE 90 MARKET FOR PAPER & PULP, BY INPUT TYPE, 2020–2025 (USD MILLION)

TABLE 91 MARKET FOR PAPER & PULP IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 92 SIGNAL CONDITIONING MODULES MARKET FOR PAPER & PULP IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 93 MARKET FOR PAPER & PULP IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 94 MARKET FOR PAPER & PULP IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 95 SIGNAL CONDITIONING MODULES MARKET FOR PAPER & PULP IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 96 MARKET FOR PAPER & PULP IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 97 MARKET FOR PAPER & PULP IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 98 SIGNAL CONDITIONING MODULES MARKET FOR PAPER & PULP IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

FIGURE 33 APAC EXPECTED TO DOMINATE SIGNAL CONDITIONING MODULES MARKET FOR PAPER & PULP DURING FORECAST PERIOD

FIGURE 34 EFFICIENT SIGNAL CONDITIONING RESULTS IN INDUSTRY-WIDE INTEGRATION AND PLANT OPTIMIZATION

10.8 WATER & WASTEWATER

10.8.1 CONTINUOUS INVESTMENTS IN WATER & WASTEWATER INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR SIGNAL CONDITIONING MODULES MARKET

TABLE 99 SIGNAL CONDITIONING MODULES MARKET FOR WATER & WASTEWATER, BY REGION, 2016–2019 (USD MILLION)

TABLE 100 MARKET FOR WATER & WASTEWATER, BY REGION, 2020–2025 (USD MILLION)

TABLE 101 SIGNAL CONDITIONING MODULES MARKET FOR WATER & WASTEWATER, BY INPUT TYPE, 2016–2019 (USD MILLION)

TABLE 102 MARKET FOR WATER & WASTEWATER, BY INPUT TYPE, 2020–2025 (USD MILLION)

TABLE 103 MARKET FOR WATER & WASTEWATER IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 SIGNAL CONDITIONING MODULES MARKET FOR WATER & WASTEWATER IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 105 MARKET FOR WATER & WASTEWATER IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 106 MARKET FOR WATER & WASTEWATER IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 107 MARKET FOR WATER & WASTEWATER IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 MARKET FOR WATER & WASTEWATER IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 109 MARKET FOR WATER & WASTEWATER IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 110 MARKET FOR WATER & WASTEWATER IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

FIGURE 35 NORTH AMERICA TO DOMINATE SIGNAL CONDITIONING MODULES MARKET FOR WATER & WASTEWATER INDUSTRY DURING FORECAST PERIOD

10.9 AEROSPACE & DEFENSE

10.9.1 MODERNIZATION IN AEROSPACE OPERATIONS AND DEMAND FOR REAL-TIME DATA MONITORING ARE DRIVING MARKET GROWTH

TABLE 111 SIGNAL CONDITIONING MODULES MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2016–2019 (USD MILLION)

TABLE 112 MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2020–2025 (USD MILLION)

TABLE 113 MARKET FOR AEROSPACE & DEFENSE, BY INPUT TYPE, 2016–2019 (USD MILLION)

TABLE 114 MARKET FOR AEROSPACE & DEFENSE, BY INPUT TYPE, 2020–2025 (USD MILLION)

TABLE 115 MARKET FOR AEROSPACE & DEFENSE IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 116 SIGNAL CONDITIONING MODULES MARKET FOR AEROSPACE & DEFENSE IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 117 MARKET FOR AEROSPACE & DEFENSE IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 118 MARKET FOR AEROSPACE & DEFENSE IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 119 MARKET FOR AEROSPACE & DEFENSE IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 120 MARKET FOR AEROSPACE & DEFENSE IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 121 MARKET FOR AEROSPACE & DEFENSE IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 122 MARKET FOR AEROSPACE & DEFENSE IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

10.1 OTHER INDUSTRIES

TABLE 123 MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 124 MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2020–2025 (USD MILLION)

TABLE 125 MARKET FOR OTHER END-USER INDUSTRIES, BY INPUT TYPE, 2016–2019 (USD MILLION)

TABLE 126 MARKET FOR OTHER END-USER INDUSTRIES, BY INPUT TYPE, 2020–2025 (USD MILLION)

TABLE 127 MARKET FOR OTHER END-USER INDUSTRIES IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 128 SIGNAL CONDITIONING MODULES MARKET FOR OTHER END-USER INDUSTRIES IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 129 SIGNAL CONDITIONING MODULES MARKET FOR OTHER END-USER INDUSTRIES IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 130 MARKET FOR OTHER END-USER INDUSTRIES IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 131 MARKET FOR OTHER END-USER INDUSTRIES IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 132 MARKET FOR OTHER END-USER INDUSTRIES IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 133 MARKET FOR OTHER END-USER INDUSTRIES IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 134 MARKET FOR OTHER END-USER INDUSTRIES IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

11 SIGNAL CONDITIONING MODULES MARKET, BY GEOGRAPHY (Page No. - 138)

11.1 INTRODUCTION

FIGURE 36 INDIA AND CHINA TO EXHIBIT HIGH GROWTH IN APAC SIGNAL CONDITIONING MODULES MARKET DURING FORECAST PERIOD

TABLE 135 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 136 MARKET, BY REGION, 2020–2025 (USD MILLION)

FIGURE 37 MARKET, BY REGION

FIGURE 38 MARKET IN APAC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

11.2 NORTH AMERICA

TABLE 137 SIGNAL CONDITIONING MODULES MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 138 SIGNAL CONDITIONING MODULES MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 39 NORTH AMERICA: SIGNAL CONDITIONING MODULES MARKET SNAPSHOT

TABLE 139 MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 140 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 141 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 142 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2020–2025 (USD MILLION)

11.2.1 US

11.2.1.1 Large industrial base and high production capacity of companies in US would drive market growth

11.2.2 CANADA

11.2.2.1 Canadian signal conditioning modules market to register highest CAGR

11.2.3 MEXICO

11.2.3.1 Healthy growth of several process industries to boost demand for signal conditioners

11.3 EUROPE

TABLE 143 SIGNAL CONDITIONING MODULES MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 144 SIGNAL CONDITIONING MODULES MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 40 EUROPE: SIGNAL CONDITIONING MODULES MARKET SNAPSHOT

TABLE 145 MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 146 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 147 MARKET IN EUROPE, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 148 MARKET IN EUROPE, BY END-USER INDUSTRY, 2020–2025 (USD MILLION)

11.3.1 UK

11.3.1.1 Increasing need for automation in food & beverage industry to drive market growth

11.3.2 GERMANY

11.3.2.1 Smart factory initiatives to create significant growth opportunities in Germany

11.3.3 FRANCE

11.3.3.1 Ongoing industrial transformation in France to support market growth

11.3.4 ITALY

11.3.4.1 Favorable government initiatives to drive market growth in Italy

11.3.5 REST OF EUROPE

11.4 APAC

TABLE 149 SIGNAL CONDITIONING MODULES MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 150 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 41 APAC: SIGNAL CONDITIONING MODULES MARKET SNAPSHOT

TABLE 151 MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 152 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 153 MARKET IN APAC, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 154 MARKET IN APAC, BY END-USER INDUSTRY, 2020–2025 (USD MILLION)

11.4.1 CHINA

11.4.1.1 China is projected to dominate APAC market during forecast period

11.4.2 JAPAN

11.4.2.1 Japan was second-largest contributor to APAC signal conditioning modules market in 2019

11.4.3 INDIA

11.4.3.1 India is projected to register highest CAGR

11.4.4 REST OF APAC

11.5 ROW

TABLE 155 SIGNAL CONDITIONING MODULES MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 156 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 157 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 158 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 159 MARKET IN ROW, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 160 MARKET IN ROW, BY END-USER INDUSTRY, 2020–2025 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Growing need for automation control to increase workplace safety and reduce industrial expenditure to fuel demand for advanced process controls and signal conditioners

11.5.2 SOUTH AMERICA

11.5.2.1 Need for safe operations in processing plants and increasing productivity are driving demand for signal conditioners in South America

12 COMPETITIVE LANDSCAPE (Page No. - 158)

12.1 OVERVIEW

FIGURE 42 PRODUCT LAUNCHES EMERGED AS KEY GROWTH STRATEGY ADOPTED BY PLAYERS IN SIGNAL CONDITIONING MODULES MARKET FROM 2018 TO 2019

12.2 MARKET SHARE ANALYSIS OF KEY PLAYERS IN SIGNAL CONDITIONING MODULES MARKET

FIGURE 43 MARKET SHARE: SIGNAL CONDITIONING MODULES MARKET, 2019

12.3 COMPETITIVE LEADERSHIP MAPPING, 2019

12.3.1 VISIONARY LEADERS

12.3.2 INNOVATORS

12.3.3 DYNAMIC DIFFERENTIATORS

12.3.4 EMERGING COMPANIES

FIGURE 44 SIGNAL CONDITIONING MODULES MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

12.4 COMPETITIVE SITUATIONS & TRENDS

FIGURE 45 MARKET EVOLUTION FRAMEWORK: PRODUCT LAUNCHES FUELED GROWTH OF SIGNAL CONDITIONING MODULES MARKET FROM 2018 TO 2020

FIGURE 46 PRODUCT LAUNCHES WERE KEY STRATEGIES ADOPTED BY PLAYERS IN SIGNAL CONDITIONING MODULES MARKET FROM 2018 TO 2020

12.4.1 PRODUCT LAUNCHES

TABLE 161 PRODUCT LAUNCHES, 2018 TO 2020

12.4.2 EXPANSIONS AND PARTNERSHIPS

TABLE 162 EXPANSIONS AND PARTNERSHIPS, 2018 TO 2020

12.4.3 ACQUISITIONS AND AGREEMENTS

TABLE 163 ACQUISITIONS AND AGREEMENTS, 2018 TO 2020

13 COMPANY PROFILES (Page No. - 167)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1.1 ROCKWELL AUTOMATION, INC.

FIGURE 47 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

13.1.2 SIEMENS

FIGURE 48 SIEMENS: COMPANY SNAPSHOT

13.1.3 PHOENIX CONTACT GMBH & CO. KG

13.1.4 SCHNEIDER ELECTRIC

FIGURE 49 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

13.1.5 ABB

FIGURE 50 ABB: COMPANY SNAPSHOT

13.1.6 PEPPERL+FUCHS

13.1.7 YOKOGAWA ELECTRIC CORPORATION

FIGURE 51 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

13.1.8 ADVANTECH, CO., LTD.

FIGURE 52 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

13.1.9 TE CONNECTIVITY LTD.

FIGURE 53 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

13.1.10 AMETEK, INC.

FIGURE 54 AMETEK, INC.: COMPANY SNAPSHOT

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13.2 RIGHT TO WIN

13.3 OTHER KEY PLAYERS

13.3.1 ICP DAS CO., LTD.

13.3.2 KEYSIGHT TECHNOLOGIES, INC.

13.3.3 DWYER INSTRUMENTS, INC.

13.3.4 ACROMAG, INC.

13.3.5 PR ELECTRONICS

13.3.6 RED LION CONTROLS INC.

13.3.7 DATAFORTH CORPORATION

13.3.8 HOTTINGER BALDWIN MESSTECHNIK GMBH

13.3.9 ELECTRO-SENSORS, INC.

13.3.10 WEIDMÜLLER INTERFACE GMBH & CO. KG

13.3.11 DEWETRON GMBH

13.3.12 CURTISS-WRIGHT CORPORATION (INDUSTRIAL DIVISION)

13.3.13 MOORE INDUSTRIES-INTERNATIONAL, INC.

13.3.14 OMEGA ENGINEERING INC.

13.3.15 HANS TURCK GMBH CO. KG

13.3.16 VEGA GRIESHABER KG

13.3.17 EATON - MTL GROUP

13.4 KEY DISTRIBUTORS

13.4.1 GALCO INDUSTRIAL ELECTRONICS, INC.

13.4.2 ARROW ELECTRONICS, INC.

FIGURE 55 ARROW ELECTRONICS, INC.: COMPANY SNAPSHOT

13.4.3 SONEPAR USA

13.4.4 ELECTROCOMPONENTS PLC

FIGURE 56 ELECTROCOMPONENTS PLC: COMPANY SNAPSHOT

13.5 OTHER KEY DISTRIBUTORS

13.5.1 FARNELL

13.5.2 AUTOMATIONDIRECT

13.5.3 INDUSTRIAL AUTOMATION SUPPLY, INC.

13.5.4 WESCO INTERNATIONAL, INC.

13.5.5 INDUSTRIAL CONTROLS DISTRIBUTORS, LLC

14 ADJACENT & RELATED REPORTS (Page No. - 214)

14.1 INTRODUCTION

14.2 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET, BY COMPONENT

14.2.1 INTRODUCTION

FIGURE 57 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET, BY COMPONENT

TABLE 164 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET, BY COMPONENT, 2017–2025 (USD BILLION)

TABLE 165 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR COMPONENT, BY PROCESS INDUSTRY, 2017–2025 (USD BILLION)

TABLE 166 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR COMPONENT, BY DISCRETE INDUSTRY, 2017–2025 (USD BILLION)

14.2.2 INDUSTRIAL ROBOTS

TABLE 167 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL ROBOTS, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 168 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL ROBOTS, BY DISCRETE INDUSTRY, 2017–2025 (USD MILLION)

TABLE 169 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL ROBOTS, BY REGION, 2017–2025 (USD BILLION)

14.2.3 MACHINE VISION

FIGURE 58 DEVICES USED FOR MACHINE VISION

TABLE 170 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR MACHINE VISION, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 171 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR MACHINE VISION, BY DISCRETE INDUSTRY, 2017–2025 (USD MILLION)

TABLE 172 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR MACHINE VISION, BY REGION, 2017–2025 (USD MILLION)

14.2.4 CONTROL VALVES

TABLE 173 ADVANTAGES AND DISADVANTAGES OF DIFFERENT TYPES OF VALVES

TABLE 174 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR CONTROL VALVES, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 175 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR CONTROL VALVES, BY REGION, 2017–2025 (USD MILLION)

14.2.5 FIELD INSTRUMENTS

14.2.5.1 Flowmeters

14.2.5.2 Transmitters

TABLE 176 TYPES OF TRANSMITTERS USED IN FIELD INSTRUMENTS

TABLE 177 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR FIELD INSTRUMENTS, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 178 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR FIELD INSTRUMENTS, BY REGION, 2017–2025 (USD MILLION)

14.2.6 HUMAN–MACHINE INTERFACE (HMI)

TABLE 179 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR HMI, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 180 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR HMI, BY DISCRETE INDUSTRY, 2017–2025 (USD MILLION)

TABLE 181 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR HMI, BY REGION, 2017–2025 (USD MILLION)

14.2.7 INDUSTRIAL PC

TABLE 182 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL PC, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 183 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL PC, BY DISCRETE INDUSTRY, 2017–2025 (USD MILLION)

TABLE 184 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL PC, BY REGION, 2017–2025 (USD MILLION)

14.2.8 SENSORS

TABLE 185 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR SENSORS, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 186 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR SENSORS, BY DISCRETE INDUSTRY, 2017–2025 (USD MILLION)

TABLE 187 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR SENSORS, BY REGION, 2017–2025 (USD MILLION)

14.2.9 INDUSTRIAL 3D PRINTING

TABLE 188 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL 3D PRINTING, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 189 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL 3D PRINTING, BY DISCRETE INDUSTRY, 2017–2025 (USD MILLION)

TABLE 190 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL 3D PRINTING, BY REGION, 2017–2025 (USD MILLION)

15 APPENDIX (Page No. - 232)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

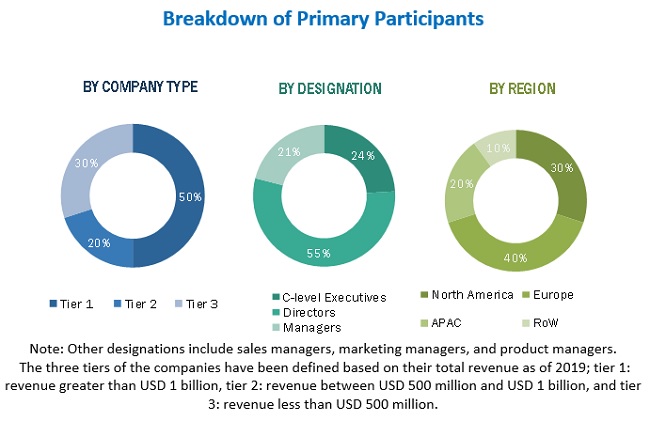

The study involves four major activities for estimating the size of the signal conditioning modules market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the signal conditioning modules market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, databases, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, & professional associations have been used to identify and collect information for an extensive technical and commercial study of the signal conditioning modules market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the signal conditioning modules market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the signal conditioning modules market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To estimate and forecast the size of the signal conditioning modules market, in terms of value, based on form factor, input type, application, and end-user industry

- To describe and forecast the market size, in terms of value, for four key regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To forecast the market size, in terms of volume, by input type

- To provide detailed information regarding the COVID-19 impact on the signal conditioning modules market

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain of the signal conditioning modules ecosystem

- To strategically analyze micro markets concerning individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Signal Conditioning Modules Market