Side View Camera System Market by Camera Type (Single Camera & Multi-Camera), Component (Camera, ECU, and Display), Vehicle (Passenger Car & Commercial Vehicle), and Region (Asia Pacific, Europe, North America and RoW) – Global Forecast to 2027

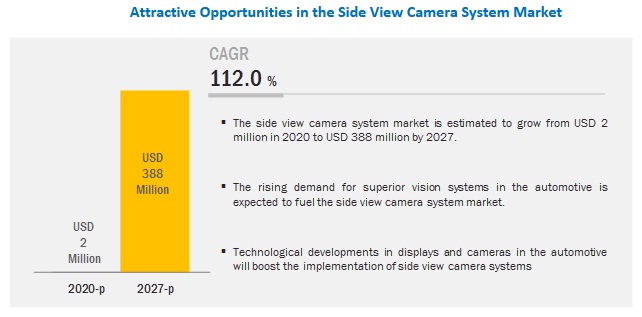

[159 Pages Report] The global side view camera system market in terms of revenue was estimated to be worth USD 2 million in 2020 and is poised to reach USD 388 million by 2027, growing at a CAGR of 112.0% from 2020 to 2027. Factors such increased passenger car and commercial vehicle production, focus on improving fuel efficiency by adopting lightweight technology, increased use of electrical and electronic components in vehicles are driving the side view camera system market.

Display component is expected to be the largest market during the forecast period

The display component is expected to be the largest market during the forecast period. The display segment will hold the largest market among all other parts due to the higher cost of displays. Side camera system requires 2 displays and cost of such displays will always surpass the cost of other components. Increasing investments and developments regarding mass production of high-quality Organic Light-Emitting Diode (OLED) panels created new design opportunities for lighting and HMI manufacturers. For instance, in August 2018, Denso Corporation, one of the major players inside the view camera system market, invested USD 270 million in JOLED Inc. JOLED was the first company to commercialize printed OLED displays. With increasing adoption of advanced display solutions in the automotive industry would drive the demand for various display types in the side view camera systems market during the forecast period.

Passenger car is the fastest growing side view camera system market during the forecast period

The passenger car is expected to be the fastest-growing market. Initially, side view camera systems are expected to be incorporated into premium passenger cars. Due to fierce competition in the premium car segment, luxury carmakers such as Audi, BMW, Mercedes Benz, and others have increased their focus towards superior comfort and safety features supported by automotive cameras. More and more features in this segment are being automated and handled by the onboard systems. OEMs such as Lexus already launched vehicles without side-view mirrors in 2018. Existing regulations regarding side view camera systems in the European region would be a major factor for growth in the region.

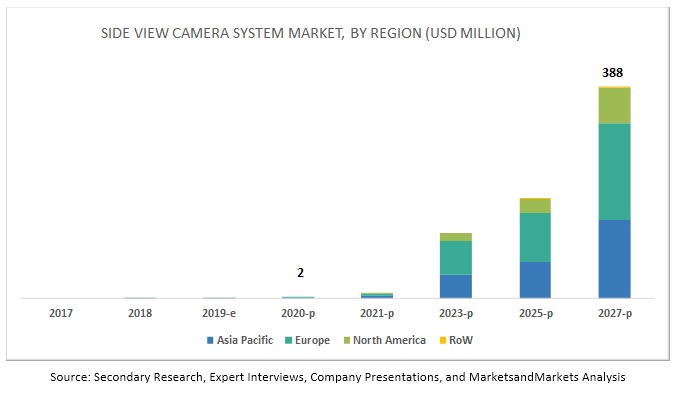

Asia Pacific is expected to be the fastest-growing market during the forecast period.

Asia Pacific is projected to be the fastest-growing market by 2027. The market growth in the Asia Pacific region is driven by a significant demand for increasing innovations and production volume in China, Japan, South Korea. For instance, Japanese luxury automaker Lexus launched ES300h version L sedan with side view camera systems in 2018. Japan passed regulations for side view camera systems in 2016 allowing OEMs to integrate camera systems in place of side-view mirrors. Favorable regulations and innovations for Japanese OEMs are expected to drive the market in this region. Japan has already embraced the advantages of side view camera systems in 2018. Other major countries in this region such as China and the South are expected to follow the same in the future. Higher vehicle production in China will drive the market in the future in this region.

Key Market Players

The global side view camera system market is dominated by major players such as Hyundai Mobis (South Korea), Continental AG (Germany), Valeo (France), Samvardhana Motherson (India), Magna International (Canada), Robert Bosch (Germany), Denso Corporation (Japan), and Stoneridge (US). Denso Corporation (Japan) and many others. These companies have secure distribution networks at a global level. Besides, these companies offer a wide range of services in the market. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2020–2027 |

|

Forecast units |

Volume (units) and Value (USD Million) |

|

Segments covered |

Camera Type, Component, Vehicle Type, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World. |

|

Companies Covered |

Hyundai Mobis (South Korea), Continental AG (Germany), Valeo (France), Samvardhana Motherson (India), Magna International (Canada), Robert Bosch (Germany), Denso Corporation (Japan), and Stoneridge (US). Denso Corporation (Japan) and many others. |

This research report categorizes the side view camera system market based on camera Type, component vehicle type, and region.

Based on Camera type, the market has been segmented as follows:

- Single Camera System

- Multi Camera System

Based on component, the market has been segmented as follows:

- Camera

- ECU

- Display

Based on vehicle type, the market has been segmented as follows:

- PC

- CV

Based on region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Russia

- Spain

- UK

- Turkey

- Rest of Europe

-

Rest of the World

- Brazil

- Iran

- Others

Recent Developments

- In April 2019, Robert Bosch GmbH launched a digital mirror system for new Nikola Two trucks. Along with the digital mirror, Nikola and Bosch worked together to develop a new fuel cell powertrain. These new Nikola trucks will be equipped with a mirror cam system, perfectly keyless, and serve the twin steering system.

- In December 2018, Continental AG demonstrated next-generation digital cockpit at CES 2018, equipped with displays and touchscreens covering the entire width of the vehicle to form a complete system, ranging from the digital side mirror to the central display.

- In January 2019, Stoneridge finally received approval from the Federal Motor Carrier Safety Administration (FMCSA). Post that, MirrorEye became only CMS that allows complete removal of traditional mirrors in the US. A 5 years exemption from FMCSA initialized the commercialization of MirrorEye in the US. According to the company, vehicles equipped with digital mirrors can achieve up to 2.5% fuel economy improvement due to superior aerodynamics.

- In April 2019, Magna International set up a new facility in Kenitra, Morocco. The company invested USD 11.3 million to build the new 61,400 sq. foot facility for the production of exterior and interior mirror systems. The production expected to begin in spring 2020.

Critical Questions:

- Where will the side view camera system take the industry in the long term?

- How will the side-view camera system market cope with the challenge of replacing side mirrors?

- What is the impact of government regulations on the side view camera system market?

- What are the upcoming trends in the side view camera system? What impact would they make post-2022?

- What are the key strategies adopted by the top players to increase their revenue?

Frequently Asked Questions (FAQ):

What is the market size of the side view camera system?

The side view camera system market is estimated to be USD 2 million in 2020 and is projected to reach USD 388 million by 2027, at a CAGR of 112.0% from 2020 to 2027.

What is market scenario in terms of components required for a side view camera system?

The displays will cost more than any other components as there are minimum two displays in a typical side view camera system. The display segment will have the largest share in the side view camera system market.

Which is the most promising vehicle type for side view camera system manufacturers?

The passenger car segment is the fastest growing vehicle type in the side view camera system market. OEMs such as Lexus already launched vehicles with side view camera system in 2018. More such early adoptions by major automakers would further drive the passenger car segment.

What are major challenges to implement side view camera systems?

Lack of standards/regulations, reliability of camera based vision systems, and behavioural changes are some of the challenges faced by the side view camera system manufacturers. Commercialization of such technology is challenging as there are no standard regulations in major automotive markets such as China, the US, and major European countries. Side view camera systems are under heavy scrutiny in the US.

Who are the top players in the side view camera system market?

The side view camera system market is dominated by global such as Hyundai Mobis (South Korea), Continental AG (Germany), Valeo (France), Samvardhana Motherson (India), Magna International (Canada), Robert Bosch (Germany), Denso Corporation (Japan), and Stoneridge (US). The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions & Exclusions

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.3 Key Data From Primary Sources

2.4 Market Size Estimation

2.4.1 Data Triangulation Approach

2.4.2 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

2.7 Risk Assessment & Ranges

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Side View Camera System Market to Grow at a Significant Rate During the Forecast Period (2020–2027)

4.2 Europe is Expected to Lead the Global Market in 2022

4.3 Market, By Component and Camera Type

4.4 Market, By Component Type

4.5 Market, By Camera Type

4.6 Market, By Vehicle Type

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Operational Data

5.2.1 Fuel Efficiency Standards in Countries

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Lower Fuel Consumption

5.3.1.2 Improved Ergonomics of Luxury Cars

5.3.1.3 Increased Production of Light & Heavy Trucks

5.3.2 Restraints

5.3.2.1 Reliability of Technology

5.3.2.2 Behavioral Changes

5.3.3 Opportunities

5.3.3.1 Emergence of Autonomous Vehicles

5.3.3.2 Demand for Active Safety Features (Real Time)

5.3.3.3 Growth of Electric Vehicle (EV)

5.3.4 Challenges

5.3.4.1 Country-Specific Regulations

5.3.4.2 High R&D Cost

5.3.5 Impact of Market Dynamics

5.4 Vehicle Model Analysis for Side View Camera System Market

5.5 Revenue Shift Driving Market Growth

5.6 Revenue Missed: Opportunities for Side View Camera System Manufacturers

5.7 Market, Scenarios (2019–2027)

5.7.1 Market, Most Likely Scenario

5.7.2 Market, Optimistic Scenario

5.7.3 Market, Pessimistic Scenario

6 Industry Trends (Page No. - 50)

6.1 Introduction

6.2 Technological Overview

6.2.1 Multi Camera Support for Autonomous/Semi Autonomous Vehicles

6.2.2 Conjunction of ADAS, Camera, and AI

6.2.3 Requirements of a Camera Monitor System (CMS)

6.2.3.1 High Image Quality and Low Light Performance

6.2.3.2 Led Flicker Mitigation and Obstruction Detection

6.3 Porters Five Forces

6.4 Regulatory Overview

6.4.1 Japan Side View Camera System Regulations

6.4.2 European Union Side View Camera System Regulations

6.4.3 United States Side View Camera System Regulations

7 Side View Camera System Market, By Camera Type (Page No. - 54)

7.1 Introduction

7.2 Operational Data

7.3 Research Methodology

7.4 Assumptions

7.5 Single Camera System

7.5.1 Low Cost of Cameras is Expected to Drive the Adoption of Single Camera Systems

7.6 Multi Camera System

7.6.1 Additional Camera Features Will Fuel the Demand for Multi Camera Systems

7.7 Market Leaders

8 Side View Camera System Market, By Component Type (Page No. - 61)

8.1 Introduction

8.2 Operational Data

8.3 Research Methodology

8.4 Assumptions

8.5 Camera

8.5.1 Extensive use of Cameras in Automotive Will Increase the Adoption of HD Cameras in Side View Camera System

8.6 ECU

8.6.1 Advancements in ECU Will Allow Easy Integration of Side View Camera Systems

8.7 Display

8.7.1 Planned Mass Adoption of OLED in Panel Lighting and HMI Will Reduce Cost of Displays in the Future

8.7.2 Liquid Crystal Display (LCD)

8.7.3 Thin Film Transistor-Liquid Crystal Display (TFT-LCD)

8.7.4 Organic Light Emitting Diode (OLED)

8.8 Others

8.8.1 Early Adoption in Asian Countries Will Impact the Market

8.9 Market Leaders

9 Side View Camera System Market, By Vehicle Type (Page No. - 70)

9.1 Introduction

9.2 Operational Data

9.3 Research Methodology

9.4 Assumptions

9.5 Passenger Car

9.5.1 Incorporation of Advanced Safety Features Will Boost the Adoption of Side View Camera System in Passenger Cars

9.6 Commercial Vehicle

9.6.1 Bus

9.6.2 Truck

9.6.2.1 Increasing Concern Over Blind Spot Reduction in Trucks and Trailers Will Drive the Adoption of Side View Camera System in Commercial Vehicles

9.7 Market Leaders

10 Side View Camera System Market, By Region (Page No. - 77)

10.1 Introduction

10.2 Operational Data

10.3 Asia Pacific

10.3.1 China

10.3.1.1 Technological Advancements in Autonomous Driving Will Boost the Side View Camera System Market in China

10.3.2 India

10.3.2.1 Increasing Demand for Trucks Will Fuel the Demand for Safety Features in India

10.3.3 Japan

10.3.3.1 Increasing Innovation By Automakers Will Drive Market Growth in Japan

10.3.4 South Korea

10.3.4.1 Developments By Local Component Manufacturers Will Drive the Market

10.3.5 Thailand

10.3.5.1 Favorable Government Policy Would Drive the Market

10.3.6 Rest of Asia Pacific

10.3.6.1 Growth of Autonomous Vehicles Will Fuel Demand in This Region

10.4 Europe

10.4.1 France

10.4.1.1 Growth of Premium Automakers Will Drive Market Growth in France

10.4.2 Germany

10.4.2.1 Early Adoption of Side View Camera System Will Drive the Market in Germany

10.4.3 Italy

10.4.3.1 Government Collaborations and Strategies Will Drive the Market in Italy

10.4.4 Russia

10.4.4.1 Increasing Innovation and Developments in Trucking Will Fuel the Demand for Side View Camera Systems in Russia

10.4.5 Spain

10.4.5.1 Growing Vehicle Production and Export Will Fuel the Demand for Side View Camera Systems

10.4.6 Turkey

10.4.6.1 Developments By Component Manufacturers Will Drive the Market

10.4.7 UK

10.4.7.1 Increasing Sales of Premium Passenger Cars Would Fuel the Demand for Side View Camera Systems

10.4.8 Rest of Europe

10.4.8.1 Increasing Passenger Car Production in Other European Countries Will Drive the Market

10.5 North America

10.5.1 Canada

10.5.1.1 Upcoming Fuel Efficiency Regulations Will Drive the Market in Canada

10.5.2 Mexico

10.5.2.1 Increasing Focus on LCV Will Drive the Market in Mexico

10.5.3 US

10.5.3.1 Nhtsa Initiatives Would Fuel the Demand for Side View Camera Systems in the US

10.6 Rest of the World (RoW)

10.6.1 Brazil

10.6.1.1 Demand for Trucks in Agriculture and Highway Construction Would Fuel the Demand for Safety Features

10.6.2 Iran

10.6.2.1 Partnerships With Global OEMs Will Help Incorporate Innovations in the Country

10.6.3 RoW Others

10.6.3.1 New Vehicle Safety Assessments Will Influence the Adoption of Side View Camera Systems

11 Recommendations By Marketsandmarkets (Page No. - 106)

11.1 Europe Will be the Key Market for Automotive Side View Camera Systems

11.2 Multi Camera System in Commercial Vehicles Can be a Key Focus for Manufacturers

11.3 Conclusion

12 Competitive Landscape (Page No. - 107)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Innovators

12.3.3 Dynamic Differentiators

12.3.4 Emerging Companies

12.4 Strength of Product Portfolio

12.5 Business Strategy Excellence

12.6 Winners Vs. Losers

12.7 Competitive Scenario

12.7.1 New Product Development

12.7.2 Acquisition

12.7.3 Expansion

13 Company Profiles (Page No. - 117)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

13.1 Valeo

13.2 Robert Bosch GmbH

13.3 Continental AG

13.4 Stoneridge Inc.

13.5 Magna International Inc

13.6 Panasonic Corporation

13.7 Hyundai Mobis

13.8 Samsung Electro-Mechanics

13.9 Mitsubishi Electric

13.1 Gentex Corporation

13.11 Samvardhana Motherson Group

13.12 Kyocera Corporation

13.13 Denso Corporation

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not be Captured in Case of Unlisted Companies.

13.14 Other Key Players

13.14.1 Asia Pacific

13.14.1.1 Mcnex Co. Ltd

13.14.1.2 Clarion

13.14.1.3 Murakami Corporation

13.14.1.4 Tokai Rika Co. Ltd

13.14.1.5 Stonkam Co. Ltd

13.14.1.6 SL Corporation

13.14.2 Europe

13.14.2.1 Kappa Optronics GmbH

13.14.2.2 Brigade Electronics Group PLC

13.14.2.3 ZF Friedrichshafen AG

13.14.3 North America

13.14.3.1 Ambarella Inc

13.14.3.2 Texas Instruments

13.14.3.3 Omnivision Technologies Inc

14 Appendix (Page No. - 153)

14.1 Discussion Guide

14.2 Currency

14.3 Package Size

14.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (170 Tables)

Table 1 Inclusions & Exclusions for Side View Camera System Market

Table 2 Primary Data Sources

Table 3 Major Assumptions

Table 4 Risk Assessment & Ranges

Table 5 United States: Fuel Efficiency Standards

Table 6 Europe: Fuel Efficiency Standards

Table 7 China: Fuel Efficiency Standards

Table 8 Light Commercial Vehicle Production, By Country, 2017 Vs. 2018 (Units)

Table 9 Heavy Trucks Production, By Country, 2017 Vs. 2018 (Units)

Table 10 Battery Electric Vehicle Sales, By Country, 2017 Vs. 2018 (Units)

Table 11 Market: Impact of Market Dynamics

Table 12 Market (Most Likely), By Region, 2019–2027 (Units)

Table 13 Market (Optimistic), By Region, 2019–2027 (Units)

Table 14 Market (Pessimistic), By Region, 2019–2027 (Units)

Table 15 Japan Side View Camera System Regulations

Table 16 European Union Side View Camera System Regulations

Table 17 United States Side View Camera System Regulations

Table 18 Market, By Camera Type, 2018–2027 (000’ Units)

Table 19 Market, By Camera Type, 2018–2027 (USD Million)

Table 20 Major Assumptions, By Camera Type

Table 21 Single Camera System: Market, By Region, 2018–2027 (000’ Units)

Table 22 Single Camera System: Market, By Region, 2018–2027 (USD Thousand)

Table 23 Multi Camera System: Market, By Region, 2018–2027 (000’ Units)

Table 24 Multi Camera System: Market, By Region, 2018–2027 (USD Thousand)

Table 25 Recent Developments, By Camera Type

Table 26 Side View Camera System Components

Table 27 Market, By Component Type, 2018–2027 (000’ Units)

Table 28 Market, By Component Type, 2018–2027 (USD Million)

Table 29 Major Assumptions, By Component

Table 30 Camera: Market, By Region, 2018–2027 (000’ Units)

Table 31 Camera: Market, By Region, 2018–2027 (USD Thousand)

Table 32 ECU: Market, By Region, 2018–2027 (000’ Units)

Table 33 ECU: Market, By Region, 2018–2027 (USD Thousand)

Table 34 Display: Market, By Region, 2018–2027 (000’ Units)

Table 35 Display: Market, By Region, 2018–2027 (USD Thousand)

Table 36 Others: Market, By Region, 2018–2027 (USD Thousand)

Table 37 Recent Developments, By Component Type

Table 38 Vehicle Production, 2017 and 2018

Table 39 Side View Camera System Market, By Vehicle Type, 2018–2027 (000’ Units)

Table 40 Market, By Vehicle Type, 2018–2027 (USD Million)

Table 41 Major Assumptions, By Vehicle Type

Table 42 Passenger Car: Market, By Region, 2018–2027 (000’ Units)

Table 43 Passenger Car: Market, By Region, 2018–2027 (USD Thousand)

Table 44 Commercial Vehicle: Market, By Region, 2018–2027 (000’ Units)

Table 45 Commercial Vehicle: Market, By Region, 2018–2027 (USD Thousand)

Table 46 Recent Developments, By Vehicle Type

Table 47 Global Vehicle Production, 2017 Vs. 2018

Table 48 Market, By Region, 2018–2027 (000’ Units)

Table 49 Market, By Region, 2018–2027 (USD Million)

Table 50 Asia Pacific: Market, By Country, 2018–2027 (000’ Units)

Table 51 Asia Pacific: Market, By Country, 2018–2027 (USD Thousand)

Table 52 China: Vehicle Production Data (Units)

Table 53 China: Market, By Vehicle Type, 2018–2027 (Units)

Table 54 China: Market, By Vehicle Type, 2018–2027 (USD)

Table 55 India: Vehicle Production Data (Units)

Table 56 India: Market, By Vehicle Type, 2018–2027 (Units)

Table 57 India: Market, By Vehicle Type, 2018–2027 (USD)

Table 58 Japan: Vehicle Production Data (Units)

Table 59 Japan: Market, By Vehicle Type, 2018–2027 (Units)

Table 60 Japan: Market, By Vehicle Type, 2018–2027 (USD)

Table 61 South Korea: Vehicle Production Data (Units)

Table 62 South Korea: Market, By Vehicle Type, 2018–2027 (Units)

Table 63 South Korea: Market, By Vehicle Type, 2018–2027 (USD)

Table 64 Thailand: Market, By Vehicle Type, 2018–2027 (Units)

Table 65 Thailand: Market, By Vehicle Type, 2018–2027 (USD)

Table 66 Rest of Asia Pacific: Market, By Vehicle Type, 2018–2027 (Units)

Table 67 Rest of Asia Pacific: Market, By Vehicle Type, 2018–2027 (USD)

Table 68 Europe: Market, By Country, 2018–2027 (000’ Units)

Table 69 Europe: Market, By Country, 2018–2027 (USD Thousand)

Table 70 France: Market, By Vehicle Type, 2018–2027 (Units)

Table 71 France: Market, By Vehicle Type, 2018–2027 (USD)

Table 72 Germany: Vehicle Production Data (Units)

Table 73 Germany: Market, By Vehicle Type, 2018–2027 (Units)

Table 74 Germany: Market, By Vehicle Type, 2018–2027 (USD)

Table 75 Italy: Vehicle Production Data (Units)

Table 76 Italy: Market, By Vehicle Type, 2018–2027 (Units)

Table 77 Italy: Market, By Vehicle Type, 2018–2027 (USD)

Table 78 Russia: Vehicle Production Data (Units)

Table 79 Russia: Market, By Vehicle Type, 2018–2027 (Units)

Table 80 Russia: Market, By Vehicle Type, 2018–2027 (USD)

Table 81 Spain: Vehicle Production Data (Units)

Table 82 Spain: Market, By Vehicle Type, 2018–2027 (Units)

Table 83 Spain: Market, By Vehicle Type, 2018–2027 (USD)

Table 84 Turkey: Vehicle Production Data (Units)

Table 85 Turkey: Market, By Vehicle Type, 2018–2027 (Units)

Table 86 Turkey: Market, By Vehicle Type, 2018–2027 (USD)

Table 87 UK: Vehicle Production Data (Units)

Table 88 UK: Market, By Vehicle Type, 2018–2027 (Units)

Table 89 UK: Market, By Vehicle Type, 2018–2027 (USD)

Table 90 Rest of Europe: Market, By Vehicle Type, 2018–2027 (Units)

Table 91 Rest of Europe: Market, By Vehicle Type, 2018–2027 (USD)

Table 92 North America: Market, By Country, 2018–2027 (000’ Units)

Table 93 North America: Market, By Country, 2018–2027 (USD Thousand)

Table 94 Canada: Vehicle Production Data (Units)

Table 95 Canada: Market, By Vehicle Type, 2018–2027 (Units)

Table 96 Canada: Market, By Vehicle Type, 2018–2027 (USD)

Table 97 Mexico: Vehicle Production Data (Units)

Table 98 Mexico: Market, By Vehicle Type, 2018–2027 (Units)

Table 99 Mexico: Market, By Vehicle Type, 2018–2027 (USD)

Table 100 US: Vehicle Production Data (Units)

Table 101 US: Market, By Vehicle Type, 2018–2027 (Units)

Table 102 US: Market, By Vehicle Type, 2018–2027 (USD)

Table 103 Rest of the World: Market, By Country, 2018–2027 (Units)

Table 104 Rest of the World: Market, By Country, 2018–2027 (USD)

Table 105 Brazil: Vehicle Production Data (Units)

Table 106 Brazil: Market, By Vehicle Type, 2018–2027 (Units)

Table 107 Brazil: Market, By Vehicle Type, 2018–2027 (USD)

Table 108 Iran: Vehicle Production Data (Units)

Table 109 Iran: Market, By Vehicle Type, 2018–2027 (Units)

Table 110 Iran: Market, By Vehicle Type, 2018–2027 (USD)

Table 111 South Africa: Vehicle Production Data (Units)

Table 112 RoW Others: Market, By Vehicle Type, 2018–2027 (Units)

Table 113 RoW Others: Side View Camera System Market, By Vehicle Type, 2018–2027 (USD)

Table 114 New Product Development, 2015–2019

Table 115 Acquisition, 2017–2019

Table 116 Expansion, 2018–2019

Table 117 Valeo: Products Offered

Table 118 Valeo: New Product Developments

Table 119 Valeo: Acquisitions

Table 120 Valeo: Total Sales, 2014–2018 (USD Billion)

Table 121 Valeo: Net Profit, 2014–2018 (USD Million)

Table 122 Robert Bosch: Products Offered

Table 123 Robert Bosch: New Product Developments

Table 124 Robert Bosch GmbH: Total Sales, 2014–2018 (USD Billion)

Table 125 Robert Bosch GmbH: Net Profit, 2014–2018 (USD Billion)

Table 126 Continental AG: Products Offered

Table 127 Continental AG: New Product Developments

Table 128 Continental AG: Total Sales, 2014–2018 (USD Billion)

Table 129 Continental AG: Net Profit, 2014–2018 (USD Billion)

Table 130 Stoneridge Inc.: Products Offered

Table 131 Stoneridge Inc.: New Product Developments

Table 132 Stoneridge Inc.: Acquisition

Table 133 Stoneridge Inc.: Total Sales, 2014–2018 (USD Million)

Table 134 Stoneridge Inc.: Net Profit, 2014–2018 (USD Million)

Table 135 Magna International: Products Offered

Table 136 Magna International: New Product Developments

Table 137 Magna International: Expansions

Table 138 Magna International: Total Sales, 2014–2018 (USD Billion)

Table 139 Magna International: Net Profit, 2014–2018 (USD Billion)

Table 140 Panasonic Corporation: Products Offered

Table 141 Panasonic Corporation: New Product Developments

Table 142 Panasonic Corporation: Acquisitions

Table 143 Panasonic Corporation: Total Sales, 2014–2018 (USD Billion)

Table 144 Panasonic Corporation: Net Profit, 2014–2018 (USD Billion)

Table 145 Hyundai Mobis: Products Offered

Table 146 Hyundai Mobis: New Product Developments

Table 147 Hyundai Mobis: Total Sales, 2014–2018 (USD Billion)

Table 148 Hyundai Mobis: Net Profit, 2014–2018 (USD Billion)

Table 149 Samsung Electro-Mechanics: Products Offered

Table 150 Samsung Electro-Mechanics: Total Sales, 2014–2018 (USD Billion)

Table 151 Samsung Electro-Mechanics: Net Profit, 2014–2018 (USD Million)

Table 152 Mitsubishi Electric: Products Offered

Table 153 Mitsubishi Electric: New Product Developments

Table 154 Mitsubishi Electric: Total Sales, 2014–2018 (USD Billion)

Table 155 Mitsubishi Electric: Net Profit, 2014–2018 (USD Billion)

Table 156 Gentex Corporation: Products Offered

Table 157 Gentex Corporation: New Product Developments

Table 158 Gentex Corporation: Total Sales, 2014–2018 (USD Billion)

Table 159 Gentex Corporation: Net Profit, 2014–2018 (USD Million)

Table 160 Samvardhana Motherson Group: Products Offered

Table 161 Samvardhana Motherson Group: Total Sales, 2014–2018 (USD Billion)

Table 162 Samvardhana Motherson Group: Net Profit, 2014–2018 (USD Million)

Table 163 Kyocera Corporation: Products Offered

Table 164 Kyocera Corporation: Total Sales, 2014–2018 (USD Billion)

Table 165 Kyocera Corporation: Net Profit, 2014–2018 (USD Million)

Table 166 Denso Corporation: Products Offered

Table 167 Denso Corporation: New Product Developments

Table 168 Denso Corporation: Total Sales, 2014–2018 (USD Billion)

Table 169 Denso Corporation: Net Profit, 2014–2018 (USD Million)

Table 170 Currency Exchange Rates (W.R.T USD)

List of Figures (47 Figures)

Figure 1 Side View Camera System Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Side View Camera System: Market Outlook

Figure 8 Market, By Component Type, 2020 Vs. 2027 (USD Million)

Figure 9 Increasing Demand for Advanced Safety Features in Premium Passenger Cars Would Drive the Market

Figure 10 Market Share, By Region, 2022

Figure 11 Multi Camera System is Expected to Account for the Largest Share of Market in 2022

Figure 12 Display is Expected to Hold the Largest Market Share, 2020 Vs. 2027 (USD Million)

Figure 13 Multi Camera System is Estimated to Hold the Largest Market Share, 2020 Vs. 2027 (USD Million)

Figure 14 Passenger Car is Expected to Dominate the Market, 2020 Vs. 2027 (USD Million)

Figure 15 Market: Market Dynamics

Figure 16 Market– Future Trends & Scenario, 2019–2027 (Units)

Figure 17 Sensor Fusion Technology

Figure 18 Market, By Camera Type, 2020 Vs. 2027 (USD Million)

Figure 19 Key Primary Insights

Figure 20 Market, By Component Type, 2020 Vs. 2027 (USD Million)

Figure 21 Key Primary Insights

Figure 22 Market, By Vehicle Type, 2022 Vs. 2027 (USD Million)

Figure 23 Key Primary Insights

Figure 24 Market, By Region, 2022 Vs. 2027 (USD Million)

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Europe: Market Snapshot

Figure 27 Market Ranking of Key Industry Players

Figure 28 Side View Camera System Market (Global): Competitive Leadership Mapping, 2019

Figure 29 Key Developments By Leading Players in the Market, 2016–2019

Figure 30 Valeo: Company Snapshot

Figure 31 Valeo: SWOT Analysis

Figure 32 Robert Bosch GmbH: Company Snapshot

Figure 33 Robert Bosh GmbH: SWOT Analysis

Figure 34 Continental AG: Company Snapshot

Figure 35 Continental AG: SWOT Analysis

Figure 36 Stoneridge Inc.: Company Snapshot

Figure 37 Stoneridge Inc.: SWOT Analysis

Figure 38 Magna International Inc: Company Snapshot

Figure 39 Magna International: SWOT Analysis

Figure 40 Panasonic Corporation: Company Snapshot

Figure 41 Hyundai Mobis: Company Snapshot

Figure 42 Samsung Electro-Mechanics: Company Snapshot

Figure 43 Mitsubishi Electric: Company Snapshot

Figure 44 Gentex Corporation: Company Snapshot

Figure 45 Samvardhana Motherson Group: Company Snapshot

Figure 46 Kyocera Corporation: Company Snapshot

Figure 47 Denso Corporation: Company Snapshot

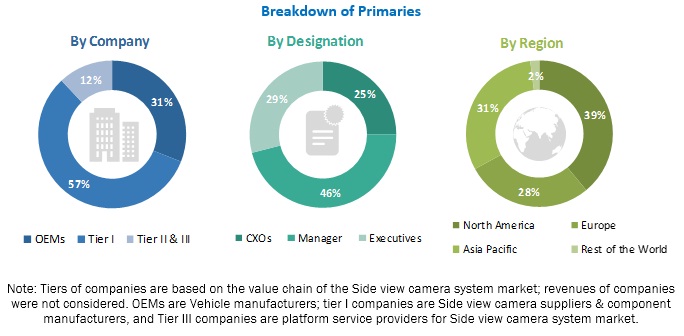

The study involved estimating the current size of the side view camera system market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used for determining the market size of segments and subsegments.

Secondary Research

Various secondary sources were used in the secondary research process to identify and collect information useful for an extensive commercial study of the global side view camera system market. Secondary sources include company annual reports/presentations, press releases, paid databases, journals, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and MarketsandMarkets data repository.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the Side view camera system market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side (OEMs/Car manufacturers) and supply-side (Side view camera manufacturers, suppliers, and side view camera part manufacturers) across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 37% and 63% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts from major companies, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the outcomes as described in the remainder of this report. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the side view camera system market. These methods were also used extensively to determine the extent of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the global side view camera system market, in terms of volume (Units) and value (USD million)

- To define, describe, and forecast the global market based on camera type, vehicle type, component type, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size, by camera type (single camera system and multi-camera system)

- To segment and forecast the market size, by vehicle type (passenger car and commercial vehicle)

- To segment and forecast the market size, by component (camera, ECU, display, and others)

- To predict the market size with respect to key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To examine recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the side view camera system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Side view camera system market, by electric vehicles at regional level

- Side view camera system market, by vehicle type at country level (for countries not covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Side View Camera System Market