Shoulder Fired Weapons Market by Component (Launcher, Ammunition), Technology (Guided, Unguided), Range (Short range, Medium Range, Extended Range) and Region - Global Forecast to 2022

Updated date -

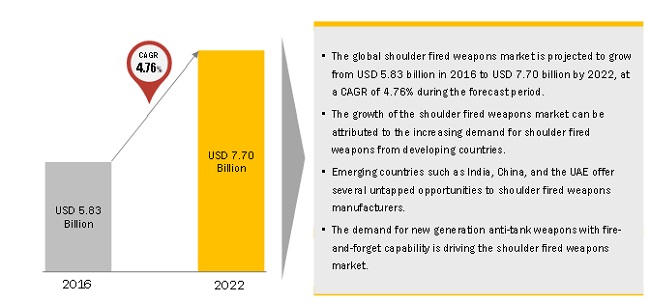

The Shoulder fired weapons market size is expected to grow at a CAGR of 4.76% during the forecast period The base year considered for the study is 2015 and the forecast period is from 2016 to 2022. The objective of the report is to forecast the shoulder fired weapons market based on component, technology, range, and region.

Market Overview:

Based on component, the ammunition segment is expected to lead the shoulder fired weapons market during the forecast period

Based on component, the shoulder fired weapons market was dominated by the ammunition segment in 2016 and is expected to continue its dominance till 2022. Developing countries such as China and India, among others, are investing more in man portable weapon systems. Shoulder fired weapons enhance military land warfare capabilities at very low cost as compared to other weapon systems. These countries are investing more in advanced technologies and focusing on manufacturing a wide range of offensive fighting vehicles. For instance, India recently signed a contract with Israel for acquiring more than 275 launchers and 5,500 spike missiles. The deal includes transfer of technology to build another 1,500 launchers and 30,000 missiles.

Based on technology, the guided segment is projected to grow at the highest CAGR during the forecast period

The shoulder fired weapons market has been analyzed and segmented on the basis of technology into guided and unguided. Based on technology, the shoulder fired weapons market is dominated by the guided segment. This segment is projected to grow at the highest CAGR during the forecast period, primarily driven by upgrade and modernization programs, procurement of new fire-and-forget missiles, and use of advance guidance systems.

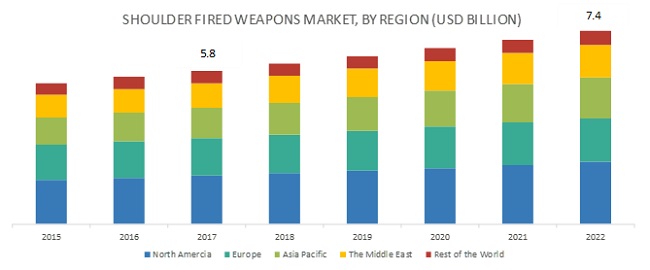

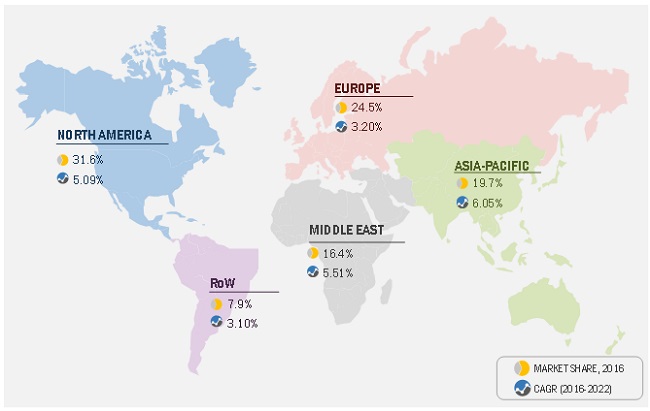

Based on region, North America is expected to grow at the fastest rate during the forecast period.

The US, China and India are expected to lead the shoulder fired weapons market in the coming years. The US is estimated to lead the shoulder fired weapons market during the forecast period. This rapid growth can be attributed to the increasing research and development activities undertaken in the region for the development of advanced technology-based designs of man portable warfare systems. The Indian shoulder fired weapons market is projected to grow at the highest CAGR from 2016 to 2022. The demand for shoulder fired weapons in India is increasing due to modernization of existing battalions, and delivery of these systems for anti-tank and anti-air roles.

Need for new-generation anti-tank weapons

New generation tanks are equipped with the Explosive Reactive Armor (ERA) technology for effective protection against previous generation shaped charged warheads such as High Explosive Anti-Tank (HEAT) of Anti-Tank Guided Missiles (ATGMs). The armor protects tanks’ main ceramic armor plates from rocket propelled weapons and ATGMs. Main armor such as the composite Chobham armor is actively used in modern day tanks such as the U.S.-built M1 Abrams, U.K. Challenger, and Israeli Merkava tanks, which provide protection to tank crews and are effective against kinetic energy penetrator warheads such as the RPG-7. New developments in the armor technology have made a requirement for new generation anti-tank weapons to defeat new generation armor.

Restraint: System requirements and design constraints

The ATGM (Anti-Tank Guided Missiles) need to fulfill certain requirements such as fire-and-forget and top attack capability, Lock-On-Before Launch (LOBL), and high-impact accuracy, minimize the minimum range, and maximize the impact angle for warhead effectiveness. The weight of the missile should be within the permissible limit to be operated by a single soldier. This includes velocity-time profile, which decides thrust-time profiles and propulsion system choices. It also needs to restrict its diameter, length, and L/D ratio. Incorporating new technologies as well addressing end-user requirement is a time-consuming process. These requirements increase the cost of the system, which could pose as a restraint in the growth of the shoulder fired weapons market.

Opportunity: Growing demand for shoulder fired weapons in emerging nations

Even though advanced economies are reducing their overall defense expenditure, developing economies are exhibiting the opposite trend. For instance, China was estimated to increase its overall defense spending by 7%-8% in 2016. India is increasing its defense budget with an average annual increase of 9.8% from 2011 to 2016.

These growing economic powers are increasing their military spending to remain ahead of other countries, in terms of weapons and increase their regional dominance.

Regional tensions between various countries, especially in the Middle East are anticipated to fuel the demand for shoulder fired weapons in this region. Defense forces around the world are mostly using MANPADS (Man-Portable Air Defense System) to neutralize terrorists and reduce the collateral damage.

Huge investments have been made by emerging nations in shoulder fired weapons technology, which help in developing a highly reliable, robust, and durable weapon system.

Challenge: Defeating active protection systems and countermeasures

Newer versions of armored vehicles are equipped with active protection systems. These systems are used to protect armored vehicles from fire against guided and unguided weapons. The systems use hard and soft kill measures to defend against incoming projectiles. Hard kill measures include firing of counter-projectile shots to destroy enemy fired missiles, while soft kill measures implement electromagnetic interference techniques to prevent lock-on from enemy units. Active protection systems are a challenge for shoulder launched weapons and better technologies are required to defeat active protection systems.

Presence of strong armor and newer armor technologies such as Explosive Reactive Armor (ERA) is a major challenge for shoulder fired anti-tank missiles to destroy them. Similarly, aircraft use various countermeasure techniques such as decoys against incoming Infrared-based heat seeking missile fired from shoulder launched weapons. These decoys dissipate excessive heat to deviate incoming missiles off the target.

Regional market shares and CAGRs of the Shoulder Fired Weapons Market

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2014-2022 |

|

Base year considered |

2015 |

|

Forecast period |

2016-2022 |

|

Forecast units |

Value (USD) |

|

Segments covered for the Shoulder Fired Weapons Market |

Component, Technology, Range and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Rest of the World |

|

Companies covered |

Lockheed Martin Corporation (US), Thales Group (France), Saab AB (Sweden), KBP Instrument Design Bureau (Russia), Raytheon Company (US), and Rafael Advanced Defense Systems (Israel) |

Shoulder Fired Weapons Market, By Component

-

Launcher

-

Missile/Rocket Launcher

- Manpats (Man-Portable Anti-Tank Systems)

- Manpads (Man-Portable Anti-Aircraft Systems)

-

RPG (Rocket Propelled Grenade) Launcher

- Single Shot

- Reloadable

- Tripod

-

Missile/Rocket Launcher

-

Ammunition

-

Missile/Rocket

- Anti-Tank

- Anti-Aircraft

-

RPG (Rocket Propelled Grenade)

-

RPG, By Product Type

- Anti-Tank

- Anti-Bunker

- Anti-Personnel

-

RPG, By Product Type

-

RPG, By Warhead Type

- Heat (High Explosive Anti-Tank)

- Tandem

- Fragmentation

- Thermobaric

-

Missile/Rocket

Shoulder Fired Weapons Market, By Technology

-

Guided

- Infrared Homing

-

Semi-Automatic Command Line-Of-Sight (SACLOS)

- Wire and Radio Guided

- Beam Guided

- Semi Active Laser Homing (SALH)

- Unguided

Shoulder Fired Weapons Market, By Range

- Short Range (>1 Km)

- Medium Range (1km–≤5km)

- Extended Range (>5km)

Shoulder Fired Weapons Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Key Market Players:

Lockheed Martin Corporation (US), Thales Group (France), Saab AB (Sweden), KBP Instrument Design Bureau (Russia), Raytheon Company (US), and Rafael Advanced Defense Systems (Israel)

Recent Developments:

- In 2017, Saab AB secured a contract worth USD 11.8 million from the Brazilian Army for the supply of RBS-70 systems.

- In 2017, Saab AB secured a contract worth USD 14.3 million from the Swedish Defence Material Administration (FMV) for the supply of Carl Gustaf ammunition.

- In 2016, Rafael Advanced Defense Systems Ltd. secured a contract worth USD 1.0 billion from India for the supply of 5,500 Spike missiles and 275 Command Launch units.

- In 2016, Rafael Advanced Defense Systems Ltd. secured a contract worth USD 400 million from Lithuania for the supply of Spike missiles weapon stations.

- In 2015, Lockheed Martin & Raytheon Company secured a contract worth USD 55 million from Lithuania for the supply of 220 Javelin missiles and 74 Command Launch units.

- In 2014, Lockheed Martin & Raytheon Company secured a contract worth USD 49.8 million from Estonia for the supply of 80 Javelin missiles.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends in the Shoulder Fired Weapons market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 25)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 29)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increase in Military Spending of Emerging Countries

2.2.2.2 Rising Incidences of Regional Disputes, Terrorism, and Political Conflicts

2.2.3 Supply-Side Analysis

2.2.3.1 Technological Advancement in Shoulder Fired Weapons

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 41)

4 Premium Insights (Page No. - 44)

4.1 Attractive Opportunities in the Shoulder Fired Weapons Market, 2016-2022

4.2 Shoulder Fired Weapons market Size, By Subsegment

4.3 Shoulder Fired Weapons market Size, By Subsegment

4.4 Shoulder Fired Weapons Market Size, By Technology

4.5 Shoulder Fired Weapons Market Size, By Range

4.6 Shoulder Fired Weapons Market in Asia-Pacific

4.7 Shoulder Fired Weapons Market, By Region

5 Market Overview (Page No. - 48)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By Technology

5.2.3 By Range

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Need for New-Generation Anti-Tank Weapons

5.3.1.2 Demand for Lightweight Guided Weapons

5.3.1.3 Indigenization

5.3.2 Restraints

5.3.2.1 System Requirements and Design Constraints

5.3.2.2 Transfer of Technology and Restriction on Sale

5.3.2.3 Long-Range Weapon System

5.3.3 Opportunities

5.3.3.1 Growing Demand for Shoulder Fired Weapons in Emerging Nations

5.3.3.2 Need for Weapons to Fight Terrorism

5.3.4 Challenge

5.3.4.1 Defeating Active Protection Systems and Countermeasures

6 Industry Trends (Page No. - 58)

6.1 Introduction

6.2 Manpads Guidance Systems

6.2.1 Command Line-Of-Sight

6.2.2 Laser Guided

6.2.3 Infrared Guided

6.3 Fiber Optic Guided Missiles (FOG-M)

6.4 Semi-Active Laser Guidance

6.5 Precision Guided Ammunition

6.6 Advanced Seeker Technology

6.6.1 Millimeter Wave Seeker Technology

6.7 Innovation & Patent Registrations

7 Shoulder Fired Weapons Market, By Component (Page No. - 66)

7.1 Introduction

7.2 Launcher

7.2.1 Missile/Rocket Launcher

7.2.1.1 Manpats (Man-Portable Anti-Tank Systems)

7.2.1.1.1 Increasing Need for Accurate Fire-And-Forget Anti-Tank Weapon Systems is Driving the Market

7.2.1.2 Manpads (Man-Portable Anti-Aircraft Systems)

7.2.1.2.1 Need for Man-Portable Missiles to Combat Airborne Threats is Driving the Market

7.2.2 RPG (Rocket Propelled Grenade) Launcher

7.2.2.1 Single Shot

7.2.2.1.1 Need for Low Cost Weapons to Combat Surface and Airborne Targets is Driving the Market

7.2.2.2 Reloadable

7.2.2.2.1 Need for Rocket Launchers With Greater Adaptability is Driving the Market

7.2.3 Tripod

7.2.3.1 Need for a Portable, Stable Platform to Fire Accurately is Driving the Market

7.3 Ammunition

7.3.1 Missile/Rocket

7.3.1.1 Anti-Tank

7.3.1.1.1 Need for Portable Anti-Tank Weaponry for Infantry Soldiers to Combat Armored Vehicles is Driving the Market

7.3.1.2 Anti-Aircraft

7.3.1.2.1 Increasing Need for Anti-Aircraft Missiles to Combat Airborne Threats is Driving the Market

7.3.2 RPG (Rocket Propelled Grenade)

7.3.2.1 RPG, By Product Type

7.3.2.1.1 Increased Adoption of RPGs for Taking on Soft and Hard Targets is Driving the Market

7.3.2.1.1.1 Anti-Tank

7.3.2.1.1.2 Anti-Bunker

7.3.2.1.1.3 Anti-Personnel

7.3.2.2 RPG, By Warhead Type

7.3.2.2.1 Use of Different Types of Warheads to Combat Different Threats is Driving the Market

7.3.2.2.1.1 Heat (High Explosive Anti-Tank)

7.3.2.2.1.2 Tandem

7.3.2.2.1.3 Fragmentation

7.3.2.2.1.3.1 Thermobaric

8 Shoulder Fired Weapons Market, By Technology (Page No. - 84)

8.1 Introduction

8.2 Guided

8.2.1 Increasing Adpotion of Guided Shoulder Fired Weaopns for Destroying Targets With Minimal Collateral Damage is Driving the Market

8.2.1.1 Infrared Homing

8.2.1.2 Semi-Automatic Command Line-Of-Sight (SACLoS)

8.2.1.2.1 Wire and Radio Guided

8.2.1.2.2 Beam Guided

8.2.1.3 Semi Active Laser Homing (SALH)

8.3 Unguided

8.3.1 Need for Inexpensive Soldier Fired Weapons for Anti-Tank use is Driving the Market

9 Shoulder Fired Weapons Market, By Range (Page No. - 90)

9.1 Introduction

9.2 Short Range (>1 Km)

9.2.1 High Adpotion of Short Range Shoulder Fired Weapons for Anti-Tank and Anti-Weapon Warfare is Driving the Market

9.3 Medium Range (1km–≤5km)

9.3.1 Need for Shoulder Fired Weapons for Anti-Air Roles is Driving the Market

9.4 Extended Range (>5km)

9.4.1 Increasing use of Tripod Based Guided Missiles for Destroying Targets at a Long Range are Driving the Market

10 Regional Analysis (Page No. - 95)

10.1 Introduction

10.2 North America

10.2.1 Shoulder Fired Weapons Market, By Component

10.2.1.1 Launcher Segment, By Subsegment

10.2.1.1.1 Missile/Rocket Launcher Subsegment, By Type

10.2.1.1.2 RPG Launcher Subsegment, By Type

10.2.1.2 Ammunition Segment, By Subsegment

10.2.1.2.1 Missile/Rocket Subsegment, By Type

10.2.1.2.2 RPG (Rocket Propelled Grenade)Subsegment, By Product Type

10.2.1.2.3 Rocket Propelled Grenade Market, By Warhead Type

10.2.2 Shoulder Fired Weapons Market, By Technology

10.2.3 Shoulder Fired Weapons Market, By Range

10.2.4 Shoulder Fired Weapons Market, By Country

10.2.4.1 U.S.

10.2.4.1.1 Shoulder Fired Weapon Market, By Component

10.2.4.1.1.1 Launcher Segment, By Subsegment

10.2.4.1.1.2 Ammunition Segment, By Subsegment

10.2.4.2 Canada

10.2.4.2.1 Shoulder Fired Weapon Market, By Component

10.2.4.2.1.1 Launcher Segment, By Subsegment

10.2.4.2.1.2 Ammunition Segment, By Subsegment

10.3 Europe

10.3.1 Shoulder Fired Weapon Market, By Component

10.3.1.1 Launcher Segment, By Subsegment

10.3.1.1.1 Missile/Rocket Launcher Subsegment, By Type

10.3.1.1.2 RPG Launcher Subsegment, By Type

10.3.1.2 Ammunition Segment, By Subsegment

10.3.1.2.1 Missile/Rocket Subsegment, By Type

10.3.1.2.2 RPG (Rocket Propelled Grenade) Subsegment, By Product Type

10.3.1.2.3 Rocket Propelled Grenade Market, By Warhead Type

10.3.2 Shoulder Fired Weapons Market, By Technology

10.3.3 Shoulder Fired Weapons Market, By Range

10.3.4 Shoulder Fired Weapons Market, By Country

10.3.4.1 Russia

10.3.4.1.1 Shoulder Fired Weapon Market, By Component

10.3.4.1.1.1 Launcher Segment, By Subsegment

10.3.4.1.1.2 Ammunition Segment, By Subsegment

10.3.4.2 Germany

10.3.4.2.1 Shoulder Fired Weapon Market, By Component

10.3.4.2.1.1 Launcher Segment, By Subsegment

10.3.4.2.1.2 Ammunition Segment, By Subsegment

10.3.4.3 U.K.

10.3.4.3.1 Shoulder Fired Weapon Market, By Component

10.3.4.3.1.1 Launcher Segment, By Subsegment

10.3.4.3.1.2 Ammunition Segment, By Subsegment

10.3.4.4 France

10.3.4.4.1 Shoulder Fired Weapon Market, By Component

10.3.4.4.1.1 Launcher Segment, By Subsegment

10.3.4.4.1.2 Ammunition Segment, By Subsegment

10.3.4.5 Rest of Europe

10.3.4.5.1 Shoulder Fired Weapon Market, By Component

10.3.4.5.1.1 Launcher Segment, By Subsegment

10.3.4.5.1.2 Ammunition Segment, By Subsegment

10.4 Asia-Pacific

10.4.1 Shoulder Fired Weapon Market, By Component

10.4.1.1 Launcher Segment, By Subsegment

10.4.1.1.1 Missile/Rocket Launcher Subsegment, By Type

10.4.1.1.2 RPG Launcher Subsegment, By Type

10.4.1.2 Ammunition Segment, By Subsegment

10.4.1.2.1 Missile/Rocket Subsegment, By Type

10.4.1.2.2 RPG (Rocket Propelled Grenade) Subsegment, By Product Type

10.4.1.2.3 Rocket Propelled Grenade Market, By Warhead Type

10.4.2 Shoulder Fired Weapons Market, By Technology

10.4.3 Shoulder Fired Weapons Market, By Range

10.4.4 Shoulder Fired Weapons Market, By Country

10.4.4.1 China

10.4.4.1.1 Shoulder Fired Weapon Market, By Component

10.4.4.1.1.1 Launcher Segment, By Subsegment

10.4.4.1.1.2 Ammunition Segment, By Subsegment

10.4.4.2 India

10.4.4.2.1 Shoulder Fired Weapon Market, By Component

10.4.4.2.1.1 Launcher Segment, By Subsegment

10.4.4.2.1.2 Ammunition Segment, By Subsegment

10.4.4.3 Australia

10.4.4.3.1 Shoulder Fired Weapon Market, By Component

10.4.4.3.1.1 Launcher Segment, By Subsegment

10.4.4.3.1.2 Ammunition Segment, By Subsegment

10.4.4.4 Japan

10.4.4.4.1 Shoulder Fired Weapon Market, By Component

10.4.4.4.1.1 Launcher Segment, By Subsegment

10.4.4.4.1.2 Ammunition Segment, By Subsegment

10.4.4.5 South Korea

10.4.4.5.1 Shoulder Fired Weapon Market, By Component

10.4.4.5.1.1 Launcher Segment, By Subsegment

10.4.4.5.1.2 Ammunition Segment, By Subsegment

10.4.4.6 Rest of Asia-Pacific

10.4.4.6.1 Shoulder Fired Weapon Market, By Component

10.4.4.6.1.1 Launcher Segment, By Subsegment

10.4.4.6.1.2 Ammunition Segment, By Subsegment

10.5 Middle East

10.5.1 Shoulder Fired Weapon Market, By Component

10.5.1.1 Launcher Segment, By Subsegment

10.5.1.1.1 Missile/Rocket Launcher Subsegment, By Type

10.5.1.1.2 RPG Launcher Subsegment, By Type

10.5.1.2 Ammunition Segment, By Subsegment

10.5.1.2.1 Missile/Rocket Subsegment, By Type

10.5.1.2.2 RPG (Rocket Propelled Grenade) Subsegment, By Product Type

10.5.1.2.3 Rocket Propelled Grenade Market, By Warhead Type

10.5.2 Shoulder Fired Weapon Market, By Technology

10.5.3 Shoulder Fired Weapon Market, By Range

10.5.4 Shoulder Fired Weapon Market, By Country

10.5.4.1 Israel

10.5.4.1.1 Shoulder Fired Weapon Market, By Component

10.5.4.1.1.1 Launcher Segment, By Subsegment

10.5.4.1.1.2 Israel Ammunition Segment, By Subsegment

10.5.4.2 Turkey

10.5.4.2.1 Shoulder Fired Weapon Market, By Component

10.5.4.2.1.1 Launcher Segment, By Subsegment

10.5.4.2.1.2 Ammunition Segment, By Subsegment

10.5.4.3 Saudi Arabia

10.5.4.3.1 Shoulder Fired Weapon Market, By Component

10.5.4.3.1.1 Launcher Segment, By Subsegment

10.5.4.3.1.2 Ammunition Segment, By Subsegment

10.5.4.4 UAE

10.5.4.4.1 Shoulder Fired Weapon Market, By Component

10.5.4.4.1.1 Launcher Segment, By Subsegment

10.5.4.4.1.2 Ammunition Segment, By Subsegment

10.5.4.5 Rest of Middle East

10.5.4.5.1 Shoulder Fired Weapon Market, By Component

10.5.4.5.1.1 Launcher Segment, By Subsegment

10.5.4.5.1.2 Ammunition Segment, By Subsegment

10.6 Rest of the World (RoW)

10.6.1 Shoulder Fired Weapon Market, By Component

10.6.1.1 Launcher Segment, By Subsegment

10.6.1.1.1 Missile/Rocket Launcher Subsegment, By Type

10.6.1.1.2 RPG Launcher Subsegment, By Type

10.6.1.2 Ammunition Segment, By Subsegment

10.6.1.2.1 Missile/Rocket Subsegment, By Type

10.6.1.2.2 RPG (Rocket Propelled Grenade) Subsegment, By Product Type

10.6.1.2.3 Rocket Propelled Grenade Market, By Warhead Type

10.6.2 Shoulder Fired Weapon Market, By Technology

10.6.3 Shoulder Fired Weapon Market, By Range

10.6.4 Shoulder Fired Weapon Market, By Country

10.6.4.1 South Africa

10.6.4.1.1 Shoulder Fired Weapon Market, By Component

10.6.4.1.1.1 Launcher Segment, By Subsegment

10.6.4.1.1.2 Ammunition Segment, By Subsegment

10.6.4.2 Brazil

10.6.4.2.1 Shoulder Fired Weapon Market, By Component

10.6.4.2.1.1 Launcher Segment, By Subsegment

10.6.4.2.1.2 Ammunition Segment, By Subsegment

10.6.4.3 Others

10.6.4.3.1 Shoulder Fired Weapon Market, By Component

10.6.4.3.1.1 Launcher Segment, By Subsegment

10.6.4.3.1.2 Ammunition Segment, By Subsegment

11 Competitive Landscape (Page No. - 156)

11.1 Introduction

11.2 Vendor Dive Overview

11.2.1 Vanguards

11.2.2 Innovator

11.2.3 Dynamic

11.2.4 Emerging

11.3 Analysis of Product Portfolio of Major Players in the Sfw Market

11.4 Business Strategy Adopted By Major Players in the Sfw Market

12 Company Profiles (Page No. - 160)

12.1 Saab AB

12.1.1 Business Overview

12.1.2 Company Scorecard

12.1.2.1 Product Offerings

12.1.2.2 Business Strategy

12.1.3 Recent Developments

12.2 the Raytheon Company

12.2.1 Business Overview

12.2.2 Company Scorecard

12.2.2.1 Product Offerings

12.2.2.2 Business Strategy

12.2.3 Recent Developments

12.3 Lockheed Martin

12.3.1 Business Overview

12.3.2 Company Scorecard

12.3.2.1 Product Offerings

12.3.2.2 Business Strategy

12.3.3 Recent Developments

12.4 Rafael Advanced Defense Systems Ltd.

12.4.1 Business Overview

12.4.2 Company Scorecard

12.4.2.1 Product Offerings

12.4.2.2 Business Strategy

12.4.3 Recent Developments

12.5 Thales Group

12.5.1 Business Overview

12.5.2 Company Scorecard

12.5.2.1 Product Offerings

12.5.2.2 Business Strategy

12.5.3 Recent Developments

12.6 MBDA Holdings SAS

12.6.1 Business Overview

12.6.2 Company Scorecard

12.6.2.1 Product Offerings

12.6.2.2 Business Strategy

12.6.3 Recent Developments

12.7 JSC SPA Bazalt

12.7.1 Business Overview

12.7.2 Company Scorecard

12.7.2.1 Product Offerings

12.7.2.2 Business Strategy

12.7.3 Recent Developments

12.8 Nammo as

12.8.1 Business Overview

12.8.2 Company Scorecard

12.8.2.1 Product Offerings

12.8.2.2 Business Strategy

12.8.3 Recent Developments

12.9 KBP Instrument Design Bureau

12.9.1 Business Overview

12.9.2 Company Scorecard

12.9.2.1 Product Offerings

12.9.2.2 Business Strategy

12.9.3 Recent Developments

12.10 JSC KBM

12.10.1 Business Overview

12.10.2 Company Scorecard

12.10.2.1 Product Offerings

12.10.2.2 Business Strategy

12.10.3 Recent Developments

12.11 Norinco (China North Industries Corporation)

12.11.1 Business Overview

12.11.2 Company Scorecard

12.11.2.1 Product Offerings

12.11.2.2 Business Strategy

12.12 Denel Soc Ltd.

12.12.1 Business Overview

12.12.2 Company Scorecard

12.12.2.1 Product Offerings

12.12.2.2 Business Strategy

12.12.3 Recent Developments

12.13 Roketsan A.S.

12.13.1 Business Overview

12.13.2 Company Scorecard

12.13.2.1 Product Offerings

12.13.2.2 Business Strategy

13 Appendix (Page No. - 197)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customization

13.5 Related Reports

13.6 Author Details

List of Tables (143 Tables)

Table 1 Number of Terrorist Incidents, Deaths, and Injuries, By Country (2015)

Table 2 Number of Active Conflicts and Casualties Due to Missile Attacks Across the Globe Between 2008 and 2014

Table 3 Important Innovation & Patent Registrations, 2002-2015

Table 4 Shoulder Fired Weapon Market Size, By Component, 2014-2022 (USD Million)

Table 5 Shoulder Fired Weapon Market Size for Launcher, By Subsegment, 2014-2022 (USD Million)

Table 6 Shoulder Fired Weapon Market Size for Launcher, By Region, 2014-2022 (USD Million)

Table 7 Shoulder Fired Weapon Market Size for Missile/Rocket Launcher Subsegment, By Type, 2014-2022 (USD Million)

Table 8 Shoulder Fired Weapon Market Size for RPG Launcher Subsegment, By Type, 2014-2022 (USD Million)

Table 9 Shoulder Fired Weapon Market Size for Ammunition, By Subsegment, 2014-2022 (USD Million)

Table 10 Shoulder Fired Weapon Market Size for Ammunition, By Region, 2014-2022 (USD Million)

Table 11 Shoulder Fired Weapon Market Size for Missile/Rocket Subsegment, By Type, 2014-2022 (USD Million)

Table 12 Shoulder Fired Weapon Market Size for RPG (Rocket Propelled Grenade) Subsegment, By Type, 2014-2022 (USD Million)

Table 13 Rocket Propelled Grenade Market, By Warhead Type, 2014-2022 (USD Million)

Table 14 Rocket Propelled Grenade Market Size for Heat Warhead Type, By Region, 2014-2022 (USD Million)

Table 15 Rocket Propelled Grenade Market Size for Tandem Warhead Type, By Region, 2014-2022 (USD Million)

Table 16 Rocket Propelled Grenade Market Size for Fragmentation Warhead Type, By Region, 2014-2022 (USD Million)

Table 17 Rocket Propelled Grenade Market Size for Thermobaric Warhead Type, By Region, 2014-2022 (USD Million)

Table 18 Shoulder Fired Weapon Market Size, By Technology, 2014-2022 (USD Million)

Table 19 Shoulder Fired Weapon Market Size for Guided Segment, By Region, 2014-2022 (USD Million)

Table 20 Wire Guided and Radio Guided Shoulder Fired Weapons

Table 21 Shoulder Fired Weapon Market Size for Unguided Segment, By Region, 2014-2022 (USD Million)

Table 22 Shoulder Fired Weapon Market Size, By Range, 2014-2022 (USD Million)

Table 23 Shoulder Fired Weapon Market Size for Short Range, By Region, 2014-2022 (USD Million)

Table 24 Shoulder Fired Weapon Market Size for Medium Range, By Region, 2014-2022 (USD Million)

Table 25 Shoulder Fired Weapon Market Size for Extended Range, By Region, 2014-2022 (USD Million)

Table 26 North America Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 27 North America Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 28 North America Shoulder Fired Weapons for Missile/Rocket Launcher Subsegment, By Type, 2014–2022 (USD Million)

Table 29 North America Shoulder Fired Weapons for RPG Launcher Subsegment, By Type, 2014–2022 (USD Million)

Table 30 North America Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 31 North America Shoulder Fired Weapons for Missile/Rocket Subsegment, By Type, 2014–2022 (USD Million)

Table 32 North America Shoulder Fired Weapons for RPG (Rocket Propelled Grenade) Subsegment, By Type, 2014–2022 (USD Million)

Table 33 North America Shoulder Fired Weapons for Rocket Propelled Grenade, By Warhead Type, 2014–2022 (USD Million)

Table 34 North America Shoulder Fired Weapon Market Size, By Technology, 2014–2022 (USD Million)

Table 35 North America Shoulder Fired Weapon Market Size, By Range, 2014–2022 (USD Million)

Table 36 North America Shoulder Fired Weapon Market Size, By Country, 2014–2022 (USD Million)

Table 37 U.S. Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 38 U.S. Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 39 U.S. Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 40 Canada Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 41 Canada Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 42 Canada Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 43 Europe Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 44 Europe Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 45 Europe Shoulder Fired Weapons for Missile/Rocket Launcher Subsegment, By Type, 2014–2022 (USD Million)

Table 46 Europe Shoulder Fired Weapons for RPG Launcher Subsegment, By Type, 2014–2022 (USD Million)

Table 47 Europe Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 48 Europe Shoulder Fired Weapons for Missile/Rocket Subsegment, By Type, 2014–2022 (USD Million)

Table 49 Europe Shoulder Fired Weapons for RPG (Rocket Propelled Grenade) Subsegment, By Type, 2014–2022 (USD Million)

Table 50 Europe Shoulder Fired Weapons for Rocket Propelled Grenade, By Warhead Type, 2014–2022 (USD Million)

Table 51 Europe Shoulder Fired Weapon Market Size, By Technology, 2014–2022 (USD Million)

Table 52 Europe Shoulder Fired Weapon Market Size, By Range, 2014–2022 (USD Million)

Table 53 Europe Shoulder Fired Weapon Market Size, By Country, 2014–2022 (USD Million)

Table 54 Russia Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 55 Russia Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 56 Russia Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 57 Germany Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 58 Germany Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 59 Germany Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 60 U.K. Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 61 U.K. Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 62 U.K. Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 63 France Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 64 France Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 65 France Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 66 Rest of Europe Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 67 Rest of Europe Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 68 Rest of Europe Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 69 Asia-Pacific Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 70 Asia-Pacific Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 71 Asia-Pacific Shoulder Fired Weapons for Missile/Rocket Launcher Subsegment, By Type, 2014–2022 (USD Million)

Table 72 Asia-Pacific Shoulder Fired Weapons for RPG Launcher Subsegment, By Type, 2014–2022 (USD Million)

Table 73 Asia-Pacific Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 74 Asia-Pacific Shoulder Fired Weapons for Missile/Rocket Subsegment, By Type, 2014–2022 (USD Million)

Table 75 Asia-Pacific Shoulder Fired Weapons for RPG (Rocket Propelled Grenade) Subsegment, By Product Type, 2014–2022 (USD Million)

Table 76 Asia-Pacific Shoulder Fired Weapons for Rocket Propelled Grenade, By Warhead Type, 2014–2022 (USD Million)

Table 77 Asia-Pacific Shoulder Fired Weapon Market Size, By Technology, 2014–2022 (USD Million)

Table 78 Asia-Pacific Shoulder Fired Weapon Market Size, By Range, 2014–2022 (USD Million)

Table 79 Asia-Pacific Shoulder Fired Weapon Market Size, By Country, 2014–2022 (USD Million)

Table 80 China Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 81 China Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 82 China Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 83 India Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 84 India Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 85 India Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 86 Australia Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 87 Australia Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 88 Australia Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 89 Japan Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 90 Japan Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 91 Japan Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 92 South Korea Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 93 South Korea Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 94 South Korea Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 95 Rest of Asia-Pacific Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 96 Rest of Asia-Pacific Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 97 Rest of Asia-Pacific Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 98 Middle East Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 99 Middle East Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 100 Middle East Shoulder Fired Weapons for Missile/Rocket Launcher Subsegment, By Type, 2014–2022 (USD Million)

Table 101 Middle East Shoulder Fired Weapons for RPG Launcher Subsegment, By Type, 2014–2022 (USD Million)

Table 102 Middle East Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 103 Middle East Shoulder Fired Weapons for Missile/Rocket Subsegment, By Type, 2014–2022 (USD Million)

Table 104 Middle East Shoulder Fired Weapons for RPG (Rocket Propelled Grenade) Subsegment, By Product Type, 2014–2022 (USD Million)

Table 105 Middle East Shoulder Fired Weapons for Rocket Propelled Grenade, By Warhead Type, 2014–2022 (USD Million)

Table 106 Middle East Shoulder Fired Weapon Market Size, By Technology, 2014–2022 (USD Million)

Table 107 Middle East Shoulder Fired Weapon Market Size, By Range, 2014–2022 (USD Million)

Table 108 Middle East Shoulder Fired Weapon Market Size, By Country, 2014–2022 (USD Million)

Table 109 Israel Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 110 Israel Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 111 Israel Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 112 Turkey Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 113 Turkey Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 114 Turkey Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 115 Saudi Arabia Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 116 Saudi Arabia Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 117 Saudi Arabia Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 118 UAE Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 119 UAE Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 120 UAE Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 121 Rest of Middle East Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 122 Rest of Middle East Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 123 Rest of Middle East Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 124 RoW Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 125 RoW Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 126 RoW Missile/Rocket Shoulder Fired Weapons for Launcher Subsegment, By Type, 2014–2022 (USD Million)

Table 127 RoW RPG Shoulder Fired Weapons for Launcher Subsegment, By Type, 2014–2022 (USD Million)

Table 128 RoW Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 129 RoW Missile/Rocket Shoulder Fired Weapons for Subsegment, By Type, 2014–2022 (USD Million)

Table 130 RoW Shoulder Fired Weapons for RPG (Rocket Propelled Grenade) Subsegment, By Product Type, 2014–2022 (USD Million)

Table 131 RoW Shoulder Fired Weapons for Rocket Propelled Grenade, By Warhead Type, 2014–2022 (USD Million)

Table 132 RoW Shoulder Fired Weapon Market Size, By Technology, 2014–2022 (USD Million)

Table 133 RoW Shoulder Fired Weapon Market Size, By Range, 2014–2022 (USD Million)

Table 134 RoW Shoulder Fired Weapon Market Size, By Country, 2014–2022 (USD Million)

Table 135 South Africa Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 136 South Africa Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 137 South Africa Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 138 Brazil Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 139 Brazil Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 140 Brazil Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

Table 141 Others Shoulder Fired Weapon Market Size, By Component, 2014–2022 (USD Million)

Table 142 Others Shoulder Fired Weapons for Launcher Segment, By Subsegment, 2014–2022 (USD Million)

Table 143 Others Shoulder Fired Weapons for Ammunition Segment, By Subsegment, 2014–2022 (USD Million)

List of Figures (82 Figures)

Figure 1 Shoulder Fired Weapon Market: Market Segmentation

Figure 2 Shoulder Fired Weapon Market: Regional Scope

Figure 3 Shoulder Fired Weapon Market: Research Flow

Figure 4 Shoulder Fired Weapon Market: Research Design

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 6 Increasing Defense Budgets of Countries, 2005 & 2015

Figure 7 Casualties Due to Terrorist Attacks Worldwide, 2006- 2015

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Market Size Estimation Methodology: Top-Down Approach

Figure 10 Data Triangulation

Figure 11 Assumptions of the Research Study

Figure 12 Based on Component, the Ammunition Segment is Expected to Lead the Shoulder Fired Weapon Market During the Forecast Period

Figure 13 Heat (High Explosives Anti-Tank) Warhead Type is Projected to Account for the Largest Share of the Rocket Propelled Grenade Subsegment Market, During the Forecast Period

Figure 14 The Shoulder Fired Weapon Market in Asia-Pacific is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 15 The U.S. is Projected to Lead the Shoulder Fired Weapon Market During the Forecast Period

Figure 16 Major Players Adopted the Strategy of Contracts to Grow in the Shoulder Fired Weapon Market Between January 2014 and December 2016

Figure 17 Huge Investments Being Made By the Asia-Pacific Countries to Procure Shoulder Fired Weapons are Driving the Shoulder Fired Weapon Market

Figure 18 RPG Launcher Subsegment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 RPG (Rocket Propelled Grenade) Subsegment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Based on Technology, the Guided Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Based on Range, the Short Range Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 22 China Accounted for the Largest Share in Asia-Pacific of the Shoulder Fired Weapon Market

Figure 23 North America Accounted for the Largest Share of the Shoulder Fired Weapon Market in 2016

Figure 24 Shoulder Fired Weapon Market Segmentation

Figure 25 Shoulder Fired Weapon Market Segmentation: By Component

Figure 26 Shoulder Fired Weapon Market Segmentation: By Technology

Figure 27 Shoulder Fired Weapon Market Segmentation: By Range

Figure 28 Need for New Generation Anti-Tank Weapons to Drive the Shoulder Fired Weapons

Figure 29 Defense Budgets of Emerging Economies, 2011-2015 (USD Billion)

Figure 30 Terrorist Attacks Between 2011 and 2015

Figure 31 Manpads Guidance Systems

Figure 32 Shoulder Fired Weapons Market, By Technology Trends

Figure 33 End User Requirements of Advanced Seeker Technology

Figure 34 Shoulder Fired Weapons Market, By Component

Figure 35 Launcher Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 36 RPG Launcher Subsegment is Projected to Lead the Market During the Forecast Period

Figure 37 Manpats in Missile/Rocket Launcher Subsegment is Projected to Lead the Market During the Forecast Period

Figure 38 Reloadable Type in RPG (Rocket Propelled Grenade) Subsegment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 39 RPG (Rocket Propelled Grenade) Subsegment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 40 Anti-Aircraft in Missile/Rocket Subsegment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 41 Anti-Bunker in RPG Subsegment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 42 Heat Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 43 Guided Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 44 Short Range Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 45 Regional Snapshot: Shoulder Fired Weapons Market

Figure 46 North America Shoulder Fired Weapons Market Snapshot

Figure 47 Europe Shoulder Fired Weapons Market Snapshot

Figure 48 Asia-Pacific Shoulder Fired Weapons Market Snapshot

Figure 49 Middle East Shoulder Fired Weapons Market Snapshot

Figure 50 MnM Dive–Vendor Comparison Matrix

Figure 51 Saab AB: Company Snapshot (2016)

Figure 52 Saab AB: Product Offerings Scorecard

Figure 53 Saab AB: Business Strategies Scorecard

Figure 54 Raytheon Company: Company Snapshot (2015)

Figure 55 Raytheon Company: Product Offerings Scorecard

Figure 56 Raytheon Company: Business Strategies Scorecard

Figure 57 Lockheed Martin: Company Snapshot (2016)

Figure 58 Lockheed Martin: Product Offerings Scorecard

Figure 59 Lockheed Martin: Business Strategies Scorecard

Figure 60 Rafael Advanced Defence Systems: Product Offerings Scorecard

Figure 61 Rafael Advanced Defence Systems: Business Strategies Scorecard

Figure 62 Thales Group: Company Snapshot (2016)

Figure 63 Thales Group: Product Offerings Scorecard

Figure 64 Thales Group: Business Strategy Scorecard

Figure 65 MBDA Holdings SAS: Product Offerings Scorecard

Figure 66 MBDA Holdings SAS: Business Strategy Scorecard

Figure 67 JSC SPA Bazalt: Product Offerings Scorecard

Figure 68 JSC SPA Bazalt: Business Strategies Scorecard

Figure 69 Nammo As: Company Snapshot (2016)

Figure 70 Nammo as : Product Offerings Scorecard

Figure 71 Nammo As: Business Strategies Scorecard

Figure 72 KBP Instrument Design Bureau: Product Offerings Scorecard

Figure 73 KBP Instrument Design Bureau: Business Strategies Scorecard

Figure 74 JSC KBM: Product Offerings Scorecard

Figure 75 JSC KBM: Business Strategies Scorecard

Figure 76 Norinco: Product Offerings Scorecard

Figure 77 Norinco: Business Strategies Scorecard

Figure 78 Denel SOC Ltd.: Company Snapshot (2015)

Figure 79 Denel SOC Ltd.: Product Offerings Scorecard

Figure 80 Denel SOC Ltd.: Business Strategies Scorecard

Figure 81 Roketsan A.S.: Product Offerings Scorecard

Figure 82 Roketsan A.S.: Business Strategies Scorecard

Growth opportunities and latent adjacency in Shoulder Fired Weapons Market