Sheet Molding Compound and Bulk Molding Compound Market by Resin Type (Polyester and Others), Fiber Type (Glass Fiber and Carbon Fiber), Application (Transportation, Electrical & Electronics, Construction and Others) and Region - Global Forecasts to 2020

[102 Pages Report] SMC is a mixture of inert fillers, resins, and fiber reinforcements. It is a fiber-reinforced polymer composite. It is often used in applications such as transportation, construction, among others, pertaining to its high strength to density ratio and corrosion resistance. The low cost of SMC makes it favorable over other traditional materials, for instance, iron and steel. BMC is also a mixture of inert fillers, fiber reinforcements, and resins. BMC is generally produced by the injection molding process, whereas SMC is mainly produced by the compression molding process. The SMC and BMC market is estimated to grow from USD 2.36 Billion in 2015 to USD 3.26 Billion by 2020, at a compound annual growth rate (CAGR) of 6.69% from 2015 to 2020.

The report aims at estimating the market size and future growth potential of SMC and BMC market across different segments such as application, fiber types, resin types, and region. The base year considered for the study is 2014 and the market size is forecasted from 2015 to 2020. A shift in the trend from traditional materials such as iron, aluminum, and steel towards the usage of light weight SMC and BMC is witnessed. SMC and BMC offers properties such high strength, corrosion resistance, fire & flame resistance, good electrical insulation and a few others resulting in increased demand of the product. Usage of light weight SMC and BMC in the transportation application is expected to substantially increase the growth of the market during the forecasted period.

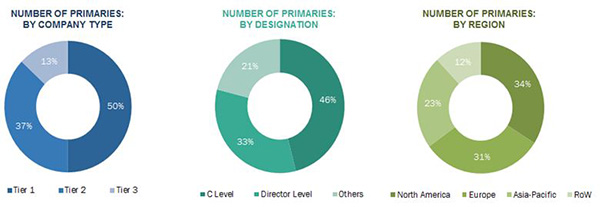

The research methodology used to estimate and forecast the SMC and BMC market begins with capturing data on key company revenues and raw material costs through secondary research. The product offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global SMC and BMC from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, Directors and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments.

The breakdown of profiles of primary discussion participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

Raw materials used in manufacturing of SMC and BMC are resins and fibers. The major resins suppliers consist of companies such as Huntsman Corporation, Hexion Inc, Dow Chemical Company, and among others. The fiber manufactures include PPG Industries, Toray Industries, Jushi Groups, Owens Corning and others. The SMC and BMC market comprises of manufacturers such as IDI Composite International (U.S.), Menzolit GmbH (Germany), Continental Structural Plastics (U.S.), Core Molding Technologies Inc. (U.S.), Showa Denko K.K. (Japan) and so on. The application industries of SMC and BMC majorly include transportation, electrical & electronics, and construction.

Target Audience

- SMC and BMC manufacturers

- Resin manufacturers

- Raw material suppliers

- Distributors & suppliers

- Industry associations

“Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments”.

Scope of the Report

The research report segments the SMC and BMC market to following submarkets:

By Fiber Type:

- Glass Fiber

- Carbon Fiber

By Resin Type:

- Polyester

- Others

By Application:

- Transportation

- Electrical & Electronics

- Construction

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America SMC and BMC market

- Further breakdown of the Europe SMC and BMC market

- Further breakdown of the Asia-Pacific SMC and BMC market

- Further breakdown of the RoW SMC and BMC market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets projects the global sheet molding compound and bulk molding compound market to grow from USD 2.36 Billion in 2015 to USD 3.26 Billion by 2020, at a compound annual growth rate (CAGR) of 6.69% during the same period. The global SMC and BMC market witnessed a strong growth in the past few years considering the high demand for lightweight and superior mechanical properties materials, in the U.S., Germany, and developing countries such as the Middle East, Brazil, and China. The growing transportation and electrical & electronics industries in these countries are driving the Sheet Molding Compound Market & Bulk Molding Compound Market

The major applications of SMC and BMC are transportation, electrical & electronics, construction, and others. Other applications include industrial, medical, household appliances, renewable energy, and so on. Transportation is estimated to be the fastest-growing application for SMC, whereas electrical & electronics to be the fastest-growing market for BMC during the forecast period. Due to their excellent electrical insulation, good mechanical properties, and surface appearance, SMC and BMC materials are preferred over other traditional materials such as iron, aluminum, and steel regarding their usage in end-use industries. Depending upon the end use application SMC and BMC are formulated to achieve strength, stiffness, corrosion resistance, flame resistance, and high dimensional stability.

The major resins used for the manufacturing of sheet molding compound and bulk molding compound are polyester and other resins. The polyester-based SMC and BMC have the largest market share in the global SMC and BMC market. Polyester resins show good corrosion resistance, dimensional stability, and chemical resistance properties, which enhance the longevity of SMC and BMC materials. SMC and BMC composites based on polyester resin exhibit good fire and flame resistance properties, thus, they are being used in electrical & electronics application. Retention of electrical properties even at elevated temperatures has made polyester insulators the materials of choice in many applications. Polyester resins are generally reinforced with glass fibers to impart strength and stiffness to the composite materials. Polyester resin-based SMC and BMC are the fastest-growing resins in the SMC and BMC market. Other resins includes vinyl ester, epoxy, phenolic, and PEEK resins

There are two major fibers used as reinforcements for the SMC and BMC, which are glass fiber and carbon fiber. Glass and carbon fiber majorly determines the rigidity and strength of SMC and BMC materials. Glass fiber largely dominates the SMC and BMC market, as they are comparatively cheaper and readily available. The mechanical properties of SMC and BMC are majorly determined by the type of reinforcement. Carbon fiber is mostly used as reinforcement where high strength and rigidity are required. Due to high cost of carbon fiber, it is used in small quantity in the global Sheet Molding Compound Market & Bulk Molding Compound Market. Asia-Pacific is the major market for glass fiber-based SMC and BMC due to low raw material cost in the region. The usage of carbon fiber is expected to increase in the European region due to increase in application of carbon fiber SMC and BMC in the aerospace industry. The increasing need of lightweight and fuel-efficient vehicles is driving the SMC and BMC market.

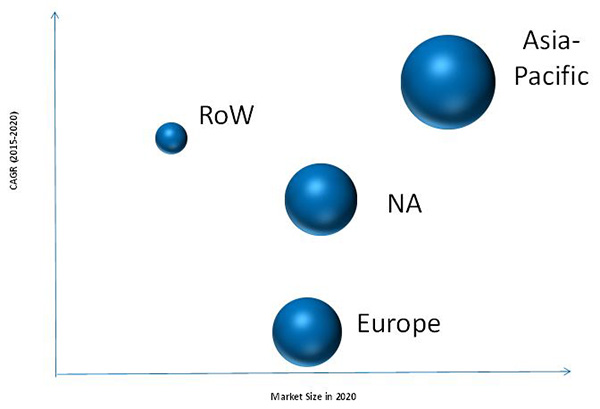

Currently, Asia-Pacific is the largest consumer of SMC and BMC. China, Germany, and Brazil are among the major markets of SMC and BMC. The Asia-Pacific region is projected to register the highest CAGR during the forecast period. The market for SMC and BMC in the Middle East within the RoW region is expected to grow with the highest CAGR during the forecast period. The growth of the transportation and electrical & electronics industries has led to increase in demand for SMC and BMC.

Plastic alloys and superior composite materials are some of the substitute products available in the SMC and BMC market. Continental Structural Plastics (U.S.) and Core Molding Technologies Inc. (U.S.) are the few leading players in the Sheet Molding Compound Market & Bulk Molding Compound Market.

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 20)

4 Premium Insights (Page No. - 24)

4.1 SMC and BMC Market Size, 2015 vs 2020

4.2 Sheet Molding Compound Market Size, By Application, 2015-2020

4.3 BMC Market Size, By Application, 2015-2020

4.4 SMC Market, By Region and By Application, 2014

4.5 Bulk Molding Compound Market Size By Region and By Application, 2014

4.6 SMC and BMC Market Share, By Country, 2014

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Light Weight and Fuel Efficient Vehicles

5.2.2 Restraints

5.2.2.1 High Cost of Raw Materials in Comparison With Traditional Materials

5.2.2.2 Issue Related to Recyclability of SMC and BMC

5.2.3 Opportunities

5.2.3.1 Increasing Need for Bio-Based Materials

5.2.3.2 Increasing Usage of SMC and BMC in the Transportation Industry

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Intensity of Competitive Rivalry

5.3.5 Bargaining Power of Buyers

6 SMC and BMC Market, By Fiber Type (Page No. - 36)

6.1 Introduction

6.2 Glass Fiber

6.3 Carbon Fiber

7 SMC and BMC Market, By Resin Type (Page No. - 41)

7.1 Introduction

7.2 Polyester

7.3 Others

8 SMC and BMC Market, By Application (Page No. - 46)

8.1 Introduction

8.2 Transportation

8.3 Electrical & Electronics

8.4 Construction

8.5 Other Applications

9 SMC and BMC Market, By Region (Page No. - 57)

9.1 Introduction

9.2 Asia-Pacific

9.3 North America

9.4 Europe

9.5 RoW

10 Competitive Landscape (Page No. - 72)

10.1 Overview

10.2 New Product Developments/Launches: the Most Popular Growth Strategies

10.3 Maximum Developments in 2014

10.4 Key Growth Strategies

10.4.1 Expansion

10.4.2 Mergers & Acquisitions

10.4.3 New Product Launches

10.4.4 Partnership, Joint Ventures & Agreements

11 Company Profile (Page No. - 78)

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.1 IDI Composites International

11.2 Citadel Plastics Holdings Inc.

11.3 Menzolit GmbH

11.4 Polynt S.P.A

11.5 Core Molding Technologies Inc.

11.6 Continental Structural Plastics Inc.

11.7 Royal Tencate N.V.

11.8 Showa Denko K.K.

11.9 Changzhou Runxia Fiberglass Products Co., Ltd.

11.10 Astar S.A.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 98)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (71 Tables)

Table 1 SMC and Bulk Molding Compound Market Size, By Value (USD Million), 2013-2020

Table 2 Sheet Molding Compound & Bulk Molding Compound Market Size, By Volume (Kilotons) 2013-2020

Table 3 SMC and Bulk Molding Compound Market, By Fiber Type

Table 4 Sheet Molding Compound & Bulk Molding Compound Market, By Resin Type

Table 5 Sheet Molding Compound Market, By Application

Table 6 BMC Market, By Application

Table 7 SMC and Bulk Molding Compound Market Size, By Fiber Type,2013-2020 (Kiloton)

Table 8 SMC and Bulk Molding Compound Market Size, By Fiber Type, 2013-2020 (USD Million)

Table 9 Glass Fiber SMC and Bulk Molding Compound Market Size, By Region, 2013-2020 (Kiloton)

Table 10 Glass Fiber Sheet Molding Compound & Bulk Molding Compound Market Size, By Region, 2013-2020 (USD Million)

Table 11 Carbon Fiber Sheet Molding Compound Market and Bulk Molding Compound Market Size, By Region, 2013-2020 (Kiloton)

Table 12 Carbon Fiber Sheet Molding Compound Market and Bulk Molding Compound Market Size, By Region, 2013-2020 (USD Million)

Table 13 Sheet Molding Compound and Bulk Molding Compound Market Size, By Resin Type, 2013-2020 (Kiloton)

Table 14 Sheet Molding Compound and Bulk Molding Compound Market Size, By Resin Type, 2013-2020 (USD Million)

Table 15 Polyester Resin Based Sheet Molding Compound Market and Bulk Molding Compound Market Size, By Region, 2013-2020 (Kiloton)

Table 16 Polyester Resin Based Sheet Molding Compound Market and Bulk Molding Compound Market Size, By Region, 2013-2020 (USD Million)

Table 17 Other Resin-Based Sheet Molding Compound Market and Bulk Molding Compound Market Size, By Region, 2013-2020 (Kiloton)

Table 18 Other Resin-Based Sheet Molding Compound Market and Bulk Molding Compound Market Size, By Region, 2013-2020 (USD Million)

Table 19 Sheet Molding Compound Market Size, By Application, 2013-2020 (Kiloton)

Table 20 Sheet Molding Compound Market Size, By Application, 2013-2020 (USD Million)

Table 21 Bulk Molding Compound Market Size, By Application, 2013-2020 (Kiloton)

Table 22 Bulk Molding Compound Market Size, By Application, 2013-2020 (USD Million)

Table 23 Sheet Molding Compound Market, By Application Description

Table 24 Bulk Molding Compound Market, By Application Description

Table 25 Sheet Molding Compound Market in Transportation Application, By Region, 2013-2020 (Kiloton)

Table 26 Sheet Molding Compound Market in Transportation Application, By Region, 2013-2020 (USD Million)

Table 27 Bulk Molding Compound Market in Transportation Application, By Region, 2013-2020 (Kiloton)

Table 28 Bulk Molding Compound Market in Transportation Application, By Region, 2013-2020 (USD Million)

Table 29 Sheet Molding Compound Market in Electrical & Electronics Application, By Region, 2013-2020 (Kiloton)

Table 30 Sheet Molding Compound Market in Electrical & Electronics Application, By Region, 2013-2020 (USD Million)

Table 31 Bulk Molding Compound Market in Electrical & Electronics Application, By Region, 2013-2020 (Kiloton)

Table 32 Bulk Molding Compound Market in Electrical & Electronics Application, By Region, 2013-2020 (USD Million)

Table 33 Sheet Molding Compound Market in Construction Application, By Region, 2013-2020 (Kiloton)

Table 34 Sheet Molding Compound Market in Construction Application, By Region, 2013-2020 (USD Million )

Table 35 Sheet Molding Compound Market in Other Applications, By Region, 2013-2020 (Kiloton)

Table 36 Sheet Molding Compound Market in Other Applications, By Region, 2013-2020 (USD Million)

Table 37 Bulk Molding Compound Market in Other Applications, By Region, 2013-2020 (Kiloton)

Table 38 Bulk Molding Compound Market in Other Applications, By Region, 2013-2020 (USD Million)

Table 39 Sheet Molding Compound Market and Bulk Molding Compound Market Size, By Region, 2013-2020 (Kiloton)

Table 40 Sheet Molding Compound Market and Bulk Molding Compound Market Size, By Region, 2013-2020 (USD Million)

Table 41 Sheet Molding Compound Market Size, By Region, 2013-2020 (Kiloton)

Table 42 Sheet Molding Compound Market Size, By Region, 2013-2020 (USD Million)

Table 43 BMC Market Size, By Region, 2013-2020 (Kiloton)

Table 44 Bulk Molding Compound Market Size, By Region, 2013-2020 (USD Million)

Table 45 Asia-Pacific: Sheet Molding Compound Market and BMC Market Size, By Country, 2013-2020 (Kiloton)

Table 46 Asia-Pacific: Sheet Molding Compound Market Size, By Country, 2013-2020 (USD Million )

Table 47 Asia-Pacific: Sheet Molding Compound Market Size, By Application, 2013-2020 (Kiloton)

Table 48 Asia-Pacific: Sheet Molding Compound Market Size, By Application, 2013-2020 (USD Million)

Table 49 Asia-Pacific: Bulk Molding Compound Market Size, By Application, 2013-2020 (Kiloton)

Table 50 Asia-Pacific: Sheet Molding Compound Market Size, By Application, 2013-2020 (USD Million)

Table 51 North America: Sheet Molding Compound and BMC Market Size, By Country, 2013-2020 (Kiloton)

Table 52 North America: Sheet Molding Compound Market Size, By Country, 2013-2020 (USD Million)

Table 53 North America: Sheet Molding Compound Market Size, By Application, 2013-2020 (Kiloton)

Table 54 North America: Sheet Molding Compound Market Size, By Application, 2013-2020 (USD Million)

Table 55 North America: BMC Market Size, By Application, 2013-2020 (Kiloton)

Table 56 North America: Bulk Molding Compound Market Size, By Application, 2013-2020 (USD Million)

Table 57 Europe: Sheet Molding Compound and BMC Market Size, By Country, 2013-2020 (Kiloton)

Table 58 Europe: Sheet Molding Compound Market Size, By Country, 2013-2020 (USD Million)

Table 59 Europe:Sheet Molding Compound Market Size, By Application, 2013-2020 (Kiloton)

Table 60 Europe: Sheet Molding Compound Market Size, By Application, 2013-2020 (USD Million)

Table 61 Europe: Sheet Molding Compound & BMC Market Size, By Application, 2013-2020 (Kiloton)

Table 62 Europe: Sheet Molding Compound & Bulk Molding Compound Market Size, By Application, 2013-2020 (USD Million)

Table 63 RoW: Sheet Molding Compound and BMC Market Size, By Country, 2013-2020 (Kiloton)

Table 64 RoW: Sheet Molding Compound Market Size, By Country, 2013-2020 (USD Million)

Table 65 RoW: Sheet Molding Compound Market Size, By Application, 2013-2020 (Kiloton)

Table 66 RoW: Sheet Molding Compound Market Size, By Application, 2013-2020 (USD Million)

Table 67 RoW: Sheet Molding Compound & Bulk Molding Compound Market Size, By Application, 2013-2020 (Kiloton)

Table 68 RoW: Sheet Molding Compound Market Size, By Application, 2013-2020 (USD Million)

Table 69 Expansion, 2010-2015

Table 70 New Product Launches, 2010-2015

Table 71 Partnership, Contracts, Agreements & Partnerships, 2010-2015

List of Figures (41 Figures)

Figure 1 SMC and BMC Market Segmentation

Figure 2 Sheet Molding Compound Market & Bulk Molding Compound Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 SMC and BMC Market Snapshot, By Application (2015 vs 2020)

Figure 6 Sheet Molding Compound & Bulk Molding Compound Market Ranking, By Country, 2014

Figure 7 SMC and BMC Market Share, By Geography, 2014

Figure 8 Attractive Market Opportunities in SMC and BMC Market, 2015–2020

Figure 9 Transportation to Be the Major Application Market for SMC Between 2015 and 2020

Figure 10 Electrical & Electronics to Be the Major Application Market for BMC Between 2015 and 2020

Figure 11 Asia-Pacific Dominated the SMC Market By Application

Figure 12 Asia-Pacific Dominated the BMC Market, By Application

Figure 13 U.S. and China Command Major Share of the SMC and BMC Market

Figure 14 Asia-Pacific to Experience Exponential Growth

Figure 15 Lightweight and Superior Mechanical Properties are Expected to Drive the SMC and BMC Market

Figure 16 Porter’s Five Forces: Intensity of Rivalry is High Due to Presence of Large Number of Players

Figure 17 Glass Fiber Dominates the SMC and BMC Market, 2015 vs 2020

Figure 18 Europe Leads the Carbon Fiber Market, 2015 vs 2020

Figure 19 Polyester Resin is Expected to Dominate the SMC and BMC Market, 2015 vs 2020

Figure 20 Polyester-Based SMC and BMC in Asia-Pacific Expected to Grow at A Higher Rate

Figure 21 Transportation to Be the Largest Application Segment of SMC Till 2020

Figure 22 Sheet Molding Compound Transportation Application to Be Lead By Asia-Pacific

Figure 23 Asia-Pacific is Expected to Dominate the BMC Market in Electrical & Electronics Applications, 2015 vs 2020

Figure 24 Rising Industrial Activities are Increasing the Demand for SMC in Asia-Pacific

Figure 25 SMC and BMC Regional Market Snapshot–Rapidly Growing Markets are Emerging as New Hotspots (2015-2020)

Figure 26 Asia-Pacific SMC and BMC Market Snapshot- China is the Most Lucrative Market

Figure 27 North America SMC and BMC Market Snapshot - U.S. is the Key Market

Figure 28 Other Applications Expected to Be the Fastest-Growing Market for SMC in Europe (2015-2020)

Figure 29 Companies Adopted New Product Developments/Launches as the Key Growth Strategy (2010-2015)

Figure 30 Major Growth Strategies in the Sheet Molding Compound & Bulk Molding Compound Market, 2010-2015

Figure 31 Developments in SMC and BMC Market, 2010–2015

Figure 32 IDI Composites International: SWOT Analysis

Figure 33 Citadel Plastics Holdings Inc.: Company Snapshot

Figure 34 Citadel Plastics Holding Inc. : SWOT Analysis

Figure 35 Menzolit GmbH: SWOT Analysis

Figure 36 Polynt S.P.A.: Company Snapshot

Figure 37 Polynt S.P.A. : SWOT Analysis

Figure 38 Core Molding Technologies Inc.: Company Snapshot

Figure 39 Core Molding Technologies Inc.: SWOT Analysis

Figure 40 Royal Tencate N.V.: Company Snapshot

Figure 41 Showa Denko K.K.: Company Snapshot

Growth opportunities and latent adjacency in Sheet Molding Compound and Bulk Molding Compound Market