Molding Compound Market by Thermoset Resin Type (Phenolic, Epoxy, Polyester and Others), by Applications (Electricals, Aerospace, Automotive and Others), and by Region- Global Forecasts to 2020

The molding compound market by thermoset resin type is estimated to grow from USD 8.04 Billion in 2015 to USD 10.96 Billion by 2020, at a compound annual growth rate (CAGR) of 6.40% between 2015 and 2020. The base year considered for the study is 2014 and the market size is forecast from 2015 to 2020. The report aims at estimating the market size and future growth potential of thermoset molding compound market across different segments such as application, resin type, and region. A shift in the trend from traditional materials toward thermoset molding compounds is witnessed by customers. Thermoset molding compounds offer properties such as thermal performance, corrosion resistance, dimensional stability, and a few others resulting in increased demand of the product. Phenolic molding compounds product is expected to substantially increase the growth of the market during the forecast period.

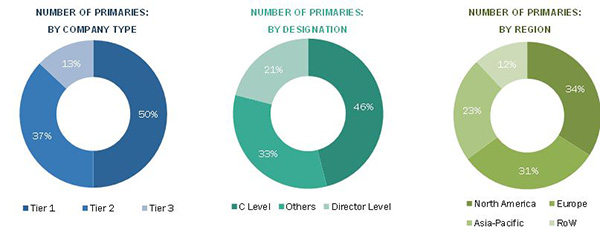

The research methodology used to estimate and forecast the molding compound market by thermoset resin type begins with acquiring data on key company revenues and raw material costs through secondary research. The product offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global thermoset molding compounds from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, Directors, and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments.

The breakdown of profiles of primary discussion participants is depicted in the below figure:

The thermoset molding compound market comprises of manufacturers such as Hexion Inc. (U.S.), BASF SE (Germany), Kyocera Chemical Corporation (Japan), Hitachi Chemical Co. (Japan), Eastman Chemical Co. (U.S.), and so on.

Target audience

- Thermoset molding compound manufacturers

- Raw material suppliers

- Distributors & suppliers

- End-use industries

- Industry associations

- Investment research firms

Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments.

Scope of the Report

The research report segments the thermoset molding compound market to following submarkets:

By Resin Type:

- Phenolic

- Epoxy

- Polyester

- Other Resins

By Application:

- Electrical

- Automotive

- Aerospace

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Regional Analysis

- Further breakdown of the North America thermoset molding compound market

- Further breakdown of the Europe thermoset molding compounds market

- Further breakdown of the Asia-Pacific thermoset molding compounds market

- Further breakdown of the RoW thermoset molding compounds market

Company Information

- Detailed analysis and profiling of additional market players

The global molding compound market by thermoset resin type to grow from USD 8.04 Billion in 2015 to USD 10.96 Billion by 2020, at a compound annual growth rate (CAGR) of 6.40% between 2015 and 2020. The global market by thermoset resin type has witnessed a strong growth in the past few years considering the high demand from the electrical application market. Thermoset molding compounds provides anti-corrosive and heat resistant properties which increase product life cycle and greater efficiency in electrical applications.

The major applications of thermoset molding compounds are in electrical, automotive, aerospace, and other sectors. The electrical segment is the fastest-growing application in thermoset molding compound market during the forecast period. The properties offered by thermoset molding compounds such as corrosion resistance, thermal performance, and heat resistant when exposed to elevated temperatures and extreme environmental conditions. The second-largest market share is occupied by the automotive application market, as the thermoset molding compounds provide great advantages in preventing rust and corrosion on vehicles body and key metal parts, thus saving maintenance costs and increasing average lifespan. They are used in applications areas such as electric motor mounts, automotive valve corners, and headlight liners.

The major resins used for the manufacturing of thermoset molding compounds include phenolic, epoxy, polyester, and others. The phenolic based thermoset molding compounds has the largest market share in the global thermoset molding compound market. Phenolic resin has high mechanical strength and heat resistance which is ideal for electrical application. Phenolic molding compounds are also the fastest-growing resin type in the thermoset molding compound market, globally.

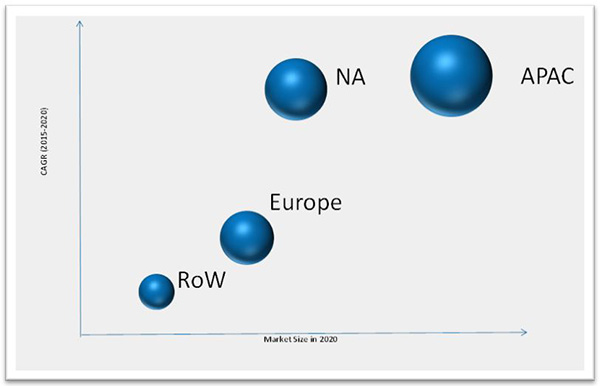

Currently, Asia-Pacific is the largest market of thermoset molding compounds. China, the U.S., Japan, Germany, and Canada are among the major markets of thermoset molding compounds. The Brazilian market for thermoset molding compounds within the RoW region is projected to register the highest CAGR during the forecast period. The growth of the industries and improving financial condition in the region has led to an increase in the demand of thermoset molding compounds.

Hexion Inc. (U.S.), BASF SE (Germany), and Hitachi Chemical Co. (Japan) are few of the leading players in the thermoset molding compound market. High processing and manufacturing cost of thermoset molding compounds is a barrier for of thermoset molding compounds in various applications but the companys strategies to build a strong foothold in the market by various developmental activities is helping the growth of the thermoset molding compounds industries.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Introduction

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.3.1 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Thermoset Molding Compound Market Size (Value), By 2020

4.2 Thermoset Molding Compounds Market: Resin Segments

4.3 Thermoset Molding Compounds Electrical Application Accounts for the Largest Market Share

4.4 Thermoset Molding Compound Market Attractiveness, By Country

4.5 Thermoset Molding Compounds, Application Industry, Growth Matrix

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Thermoset Molding Compound Market, By Resin Type

5.2.2 Thermoset Molding Compounds Market, By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Need for Corrosion and Heat-Resistant Components in Electricals

5.3.1.2 Weight Saving Advantage for Automotive

5.3.1.3 Ease in Manufacturing Small and Complex Parts

5.3.2 Restraints

5.3.2.1 High Investment Costs

5.3.2.2 High Cost of Raw Materials

5.3.3 Opportunities

5.3.3.1 Entry of Thermoset Molding Compounds in New Application Markets

5.3.3.2 Green Molding Compounds

5.3.4 Challenges

5.3.4.1 to Produce Low-Cost Products

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.1.1 Threat of New Entrants

6.1.2 Threat of Substitutes

6.1.3 Bargaining Power of Suppliers

6.1.4 Bargaining Power of Buyers

6.1.5 Intensity of Competitive Rivalry

7 Thermoset Molding Compound Market, By Resin Type (Page No. - 46)

7.1 Introduction

7.2 Phenolic

7.3 Polyester

7.4 Epoxy

7.5 Others

8 Thermoset Molding Compound Market, By Applications (Page No. - 49)

8.1 Introduction

8.2 Automotive

8.3 Aerospace

8.4 Electrical

8.5 Other Applications

9 Thermoset Molding Compound Market, By Region (Page No. - 58)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Italy

9.3.5 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 RoW

9.5.1 Brazil

9.5.2 South Africa

9.5.3 Rest of RoW

10 Competitive Landscape (Page No. - 88)

10.1 Introduction

10.2 Competitive Situation & Trends

10.3 Investments & Expansions

10.4 New Product Launches

10.5 Acquisitions

11 Company Profiles (Page No. - 93)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

11.1 Introduction

11.2 Hexion Inc

11.3 Hitachi Chemical Company Ltd.

11.4 BASF SE

11.5 Huntsman International LLC.

11.6 Eastman Chemical Company

11.7 Kyocera Chemical Corporation

11.8 Ashland Inc.

11.9 Evonik Industries

11.10 Kolon Industries Inc.

11.11 Kukdo Chemical Co. Ltd.

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 116)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (69 Tables)

Table 1 Thermoset Molding Compound Market Size, 20132020

Table 2 Impact Analysis of Drivers

Table 3 Impact Analysis of Restraints

Table 4 Impact Analysis of Opportunities

Table 5 Impact Analysis of Challenges

Table 6 Thermoset Molding Compounds Market Size, By Resin Type, 20132020 (USD Million)

Table 7 Market Size, By Resin Type, 20132020 (Kiloton)

Table 8 Thermoset Molding Compound Market Size, By Application, 20132020 (USD Million)

Table 9 Market Size, By Application, 20132020 (Kiloton)

Table 10 Market Size in Automotive Application, By Region, 20132020 (USD Million)

Table 11 Market Size in Automotive Application, By Region, 20132020 (Kiloton)

Table 12 Market Size in Aerospace Application, By Region, 20132020 (USD Million)

Table 13 Thermoset Molding Compounds Market Size in Aerospace Application, By Region, 20132020 (Kiloton)

Table 14 Market Size in Electrical Application, By Region, 20132020 (USD Million)

Table 15 Market Size in Electrical Application, By Region, 20132020 (Kiloton)

Table 16 Market Size in Other Applications, By Region, 20132020 (USD Million)

Table 17 Market Size in Other Applications, By Region, 20132020 (Kiloton)

Table 18 Thermoset Molding Compound Market Size, By Region, 2013-2020 (Kiloton)

Table 19 Market Size, By Region, 2013-2020 (USD Million)

Table 20 Asia-Pacific: Thermoset Molding Compound Market Size, By Country, 2013-2020 (Kiloton)

Table 21 Asia-Pacific: Market Size, By Country, 20132020 (USD Million)

Table 22 Asia-Pacific: Market Size, By Application, 2013-2020 (Kiloton)

Table 23 Asia-Pacific: Market Size, By Application, 20132020 (USD Million)

Table 24 China: Market Size, By Application, 2013-2020 (Kiloton)

Table 25 China: Market Size, By Application, 20132020 (USD Million)

Table 26 India: Market Size, By Application, 2013 2020 (Kiloton)

Table 27 India: Market Size, By Application, 20132020 (USD Million)

Table 28 Japan: Market Size, By Application, 2013 2020 (Kiloton)

Table 29 Japan: Market Size, By Application, 20132020 (USD Million)

Table 30 Rest of Asia-Pacific: Thermoset Molding Compound Market Size, 2013 2020 (Kiloton)

Table 31 Rest of Asia-Pacific: Market Size, 20132020 (USD Million)

Table 32 Europe: Market Size, By Country, 2013 2020 (Kiloton)

Table 33 Europe: Market Size, By Country, 20132020 (USD Million)

Table 34 Europe: Market Size, By Application, 2013-2020 (Kiloton)

Table 35 Europe: Market Size, By Application, 20132020 (USD Million)

Table 36 Germany: Market Size, By Application, 2013 2020 (Kiloton)

Table 37 Germany: Market Size, By Application, 20132020 (USD Million)

Table 38 France: Market Size, By Application, 2013 2020 (Kiloton)

Table 39 France: Market Size, By Application, 20132020 (USD Million)

Table 40 U.K.: Thermoset Molding Compound Market Size, By Application, 2013 2020 (Kiloton)

Table 41 U.K.: Market Size, By Application, 20132020 (USD Million)

Table 42 Italy: Market Size, By Application, 2013 2020 (Kiloton)

Table 43 Italy: Market Size, By Application, 20132020 (USD Million)

Table 44 Rest of Europe: Market Size, By Application, 2013 2020 (Kiloton)

Table 45 Rest of Europe: Market Size, By Application, 20132020 (USD Million)

Table 46 North America: Market Size, By Country, 2013 2020 (Kiloton)

Table 47 North America: Market Size, By Country, 20132020 (USD Million)

Table 48 North America: Market Size, By Application, 2013-2020 (Kiloton)

Table 49 North America: Market Size, By Application, 20132020 (USD Million)

Table 50 U.S.: Thermoset Molding Compound Market Size, By Application, 2013 2020 (Kiloton)

Table 51 U.S.: Market Size, By Application, 20132020 (USD Million)

Table 52 Canada: Market Size, By Application, 2013 2020 (Kiloton)

Table 53 Canada: Market Size, By Application, 20132020 (USD Million)

Table 54 Mexico: Market Size, By Application, 2013 2020 (Kiloton)

Table 55 Mexico: Market Size, By Application, 20132020 (USD Million)

Table 56 RoW: Thermoset Molding Compound Market Size, By Country, 2013 2020 (Kiloton)

Table 57 RoW: Market Size, By Country, 20132020 (USD Million)

Table 58 RoW: Market Size, By Application, 2013 2020 (Kiloton)

Table 59 RoW: Market Size, By Application, 20132020 (USD Million)

Table 60 Brazil: Market Size, By Application, 2013 2020 (Kiloton)

Table 61 Brazil: Market Size, By Application, 20132020 (USD Million)

Table 62 South Africa: Market Size, By Application, 2013 2020 (Kiloton)

Table 63 South Africa: Market Size, By Application, 20132020 (USD Million)

Table 64 Rest of RoW: Thermoset Molding Compound Market Size, By Application, 2013 2020 (Kiloton)

Table 65 Rest of RoW: Market Size, By Application, 20132020 (USD Million)

Table 66 Investments & Expansions, 20112015

Table 67 New Product Launches, 20112015

Table 68 Partnerships & Agreements 20112015

Table 69 Acquisitions, 20112014

List of Figures (47 Figures)

Figure 1 Thermoset Molding Compound Market Segmentation

Figure 2 Market: Research Design

Figure 3 Key Data From Secondary Sources

Figure 4 Key Data From Primary Sources

Figure 5 Key Industry Insights

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation Methodology

Figure 10 Assumptions for Research Study

Figure 11 Electrical Application to Register the Highest CAGR in Thermoset Molding Compound Market During the Forecast Period

Figure 12 China Dominated the Thermoset Molding Compounds Market,2014

Figure 13 Asia-Pacific is the Fastest-Growing Region in the Thermoset Molding Compounds Market (Value), 2014

Figure 14 Attractive Opportunities in the Thermoset Molding Compounds Market During the Forecast Period

Figure 15 Phenolic Resin Projected to Be the Fastest-Growing Market Among All the Thermoset Resin Types, 20152020

Figure 16 Asia-Pacific Was the Biggest Market for Thermoset Molding Compounds, in Terms of Value, 2014

Figure 17 China Projected to Be the Fastest-Growing Market (Kiloton), 20152020

Figure 18 Electrical Application Projected to Witness Highest Growth Rate Between 2015 and 2020

Figure 19 Asia-Pacific Market is Projected to Experience Exponential Growth During the Forecast Period

Figure 20 Drivers, Restraints, Opportunities, and Challenges in Thermoset Molding Compound Market

Figure 21 Porters Five Forces: Intensity of Rivalry is High Due to Low Level of Product Differentiation

Figure 22 Electrical Application Projected to Register the Highest Market Size (USD Million), 20152020

Figure 23 Rising Demand for Lightweight Components Will Boost the Growth of Automotive Application, 2015 vs 2020 (USD Million)

Figure 24 Market Size of Thermoset Molding Compounds in Aerospace Application, 2015 vs 2020, (USD Million)

Figure 25 Electrical Application to Dominate Other Applications in the Thermoset Molding Compound Market

Figure 26 Regional Snapshot: Rapid Growth Markets are Emerging as New Strategic Locations (20152020)

Figure 27 Asia-Pacific Market Snapshot: China is the Most Lucrative Market

Figure 28 Germany to Dominate the Thermoset Molding Compounds Market in Europe (20152020)

Figure 29 U.S. is the Key Market for the Thermoset Molding Compound Market in North America

Figure 30 Expansions Was the Main Strategy Adopted By Leading Companies Between 2011 and 2015

Figure 31 Expansions & Investments Was the Major Strategy Adopted By Leading Players Between 2011 and 2015

Figure 32 Regional Revenue Mix of Top5 Market Players

Figure 33 Hexion Inc.: Company Snapshot

Figure 34 Hexion Inc.: SWOT Analysis

Figure 35 Hitachi Chemical Company Ltd.: Company Snapshot

Figure 36 Hitachi Chemical Company Ltd.: SWOT Analysis

Figure 37 BASF SE : Company Snapshot

Figure 38 BASF SE : SWOT Analysis

Figure 39 Huntsman International LLC.: Company Snapshot

Figure 40 Huntsman International LLC: SWOT Analysis

Figure 41 Eastman Chemical Company: Company Snapshot

Figure 42 Eastman Chemical Company: SWOT Analysis

Figure 43 Kyocera Chemical Corporation: Company Snapshot

Figure 44 Ashland Inc.: Company Snapshot

Figure 45 Evonik Industries: Company Snapshot

Figure 46 Kolon Industries Inc: Company Snapshot

Figure 47 Kukdo Chemical Co. Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Molding Compound Market