Serverless Security Market by Service Model (BaaS and FaaS), Security Type (Data, Network, Perimeter, and Application), Deployment Mode (Public and Private), Organization Size (SMEs and Large enterprises), Vertical, and Region - Global Forecast to 2026

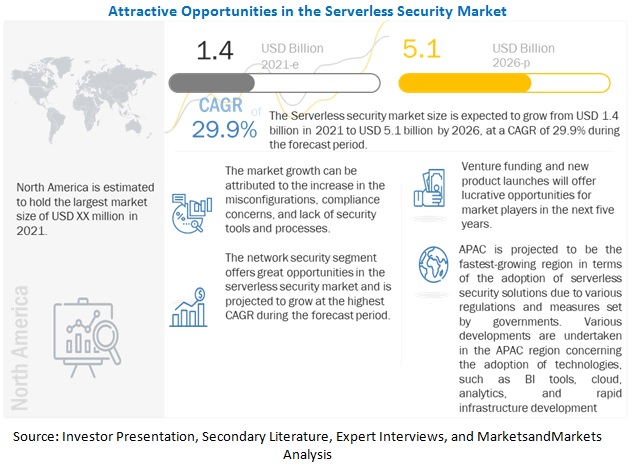

[219 Pages Report] The Serverless Security Market size is expected to grow from USD 1.4 billion in 2021 to USD 5.1 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 29.9% during the forecast period.

The major factors fueling the serverless security market include Serverless architectures are prone to several security risks such as event injection, broken authentication, insecure deployment settings, over-privileged function permission and roles, insufficient logging and monitoring, DoS, improper exception handling, and vulnerability management. Moreover, increasing adoption of cloud-based applications, serverless architectures, and the emergence of IoT applications are potential opportunities for vendors in the serverless security market.

To know about the assumptions considered for the study, Request for Sample Report

COVID 19 Impact

With the emergence of remote work and collaboration, cloud computing has emerged as an ally for enterprises. The COVID-19 situation has acted as a catalyst for a surge in demand for cloud solutions. Before this pandemic situation, many organizations believed that moving sensitive data stored on the cloud can be risky. Partnerships with AWS, Microsoft Azure, the Google Cloud Platform (GCP), and Alibaba Cloud enables organizations to easily migrate data to the cloud by embracing BYOD and mobility in a hybrid IT environment. Businesses are moving critical data on the cloud at a faster pace. However, growing cloud consumption also poses security challenges. There is an opportunity for cloud security services and solutions to grow amid the increasing demand for the cloud environment. With the adoption of new devices, security and access patterns and processes used to maintain cloud environments while working from home have increased the risk of data breaches. An increase in the remote workforce has surged the usage of security tools

Market Dynamics

Driver: Increase in the misconfiguration to boost the growth of serverless security

The COVID-19 emergency has caused significant interruptions across worldwide supply chains. Two factor plays a major role: numerous factories shut down due to safety and hygiene concerns, and the unparalleled demand for specific products, such as PPE kits and medical supplies. Various users are feeling pressured to secure supplies from unknown origins or quality due to the increased demand for these products. Lengthy supply chains cause excessive obscurity, making it hard to calculate and plan the entire supply process. Blockchain is the best option for supply chains as it can connect all stakeholders into one supply chain network universal source while maintaining transparency and being able to securely break down data silos. Therefore, huge numbers of blockchain arrangements exist in the supply chain process, which accelerated during the COVID-19 pandemic. Blockchain accelerates the validation procedure by expelling third-party delegates and innate delays in handling and processing operations. The advantages include quicker handling and processing time, reduced costs, lower operational risks, and faster settlements for all parties included.

Restraint: Lack of awareness toward serverless resources, serverless architecture, serverless security and strategy

Along with the trend of migration toward serverless technology, many organizations are unaware of the number of serverless resources running and the process of configuring them. Many organizations still lack key identity-related security controls. This lack of visibility causes misconfigurations that go undetected for a long period, which makes it even harder to secure cloud applications. Organizations migrating a portion of their IT infrastructure to public clouds face the improper implementation of security architecture to withstand cyberattacks. Lack of understanding about the shared security responsibility model also contributes toward cyber breaches. Cloud environments have become large and complex for many enterprises for which automation is of utmost necessity. Lack of awareness of a major number of enterprises toward the benefit of serverless security, serverless security architecture, and strategy acts as a restraint for the serverless security market

Opportunity: Migration to serverless technology to give an opportunity for serverless security

An increase in the agility, storage, and quick delivery of new applications and services has given a major boost to the serverless market. With technological advancements, traditional organizations are under huge competitive pressure. To become faster, secure, and competitive, most organizations transfer their legacy IT infrastructure from on-premises to the cloud and serverless infrastructure. Organizations who migrate their legacy data center processes to a serverless environment can face problems such as insecure configuration, function permissions, and event data injection, which increase the requirement of serverless security.

Challenge: Challenges to prove compliance

Regulated industries must adhere to specific industry benchmarks, such as PCI DSS for retail, HIPAA for healthcare, FFIEC for financial services, and NIST. Gathering the evidence and control of the frameworks are massive tasks to fulfill. The compliance frameworks provide high-level controls, which are mandatorily required to be met. Many compliance frameworks (such as PCI DSS) incorporate the concept of continuous compliance as a requirement. Though many organizations have migrated to the cloud with the help of the AWS framework, that does not help them comply with the regulations. These compliance frameworks provide high-level controls, which need to be regularly met. All of these problems get compounded for cloud workloads that are changing rapidly. Hence, this could prove to be a challenge for serverless service providers.

Network security segment to grow at a higher CAGR during the forecast period

Network security is the technique of securing networks from advanced threats on the serverless architecture. Sophisticated threats are negatively impacting the serverless computing platform by evading network defenses and targeting vulnerabilities in the system. With the growth in cloud adoption, the chances of misconfigurations have increased significantly. Serverless security helps monitor serverless applications to prevent unauthorized access and misuse of networking resources. The key trends that contribute to the serverless network security market growth are the growing usage of cloud computing services and serverless architectures. Hence is expected to grow at the highest CAGR.

BFSI vertical to hold the largest market size during the forecast period

The banks and financial institutions are increasingly moving their data on the serverless environment amid the COVID-19 outbreak. With the widespread adoption of cloud computing and serverless platforms, finance and insurance companies are required to meet the highest security standards set by the financial regulatory authorities. Financial service institutes are extending their partnerships with serverless security service providers to implement a comprehensive serverless application security environment with global and regional regulatory requirements fulfilled.

To know about the assumptions considered for the study, download the pdf brochure

North America to hold the largest market size during the forecast period

North America is home to two developed economies, the US and Canada, that contribute heavily to the growth of the regional market. The region is estimated to have the largest market size in the global serverless security market, and the trend is expected to continue until 2026. One of the key reasons for the growth is the early adoption of technologies and the globalization of the cloud in this region. The strong financial position of the US and Canada enables them to invest heavily in leading services of the serverless security market. Some of the major vendors operating in this region are Microsoft, AWS, Google, and IBM. R&D investments in the cloud-native architecture have standardized the application development approach to streamline the operational process. The market has been steadily showing positive trends in the region, as several companies and industries are adopting serverless security services. In addition, North America is the most developed market in terms of cloud adoption, due to various factors such as standard regulations, advanced IT infrastructure, presence of a large number of enterprises, and availability of technical expertise.

Asia Pacific to grow at the highest CAGR during the forecast period

APAC countries comprise emerging economies, such as China, Japan, India, ANZ, and the Rest of APAC. APAC is projected to be the fastest-growing region in the global serverless security market. APAC is expected to provide significant growth opportunities during the forecast period. The untapped potential markets, high penetration of advanced technologies, growth in application development in various industries, and economic developments and government regulations are expected to drive the serverless security market during the forecast period. Various developments are undertaken in the APAC region concerning the adoption of technologies, such as BI tools, cloud, analytics, and rapid infrastructure development. APAC is the fastest-growing region in terms of the adoption of serverless security solutions. A survey conducted by Palo Alto Networks among 500 respondents from various vertical industries of large enterprises across five countries in APAC- Australia, China, Hong Kong, India, and Singapore, revealed that insecure interfaces and APIs, and data breaches and data losses are the top cybersecurity risks in the region.

Serverless Security Companies

Major vendors in the global Serverless security market include AWS (US), Google (US), Microsoft (US), and Imperva (US)

Amazon Web Services (AWS) is a business unit of Amazon. It was founded in 2006 and is headquartered in Washington, US. The company majorly delivers services designed specifically for security, compliance, privacy, and governance requirements of large organizations as well as SMEs, which include startups, public agencies, and academic institutions. AWS also provides cloud-computing services internationally across 190 countries and is located in over 12 geographical regions with its major presence in the UK, North America, Germany, and Japan. AWS offers cloud infrastructure services, platform services, application services, developer tools, security, and identity services. It also provides cloud solutions for backup and recovery, websites, disaster recovery, archiving, big data, and development and testing. The company provides secure technology platforms to all verticals with utmost reliability, safety, and flexibility.

AWS Serverless Platform is a one-stop solution, which includes data storage, application integration services, analytics, API gateway, compute, and orchestration. Users are charged for the compute time they have consumed on the platform. The platform handles everything required to run and scale codes with high availability. The company caters to its customer base in more than 190 countries. Its clientele consists of Nasdaq, Netflix, Liberty Mutual, Hess, Canary, SoundCloud, and Delaware North. Security solutions in the AWS marketplace help in strengthening the security posture with best cloud compliance practices, container security, secure AWS environments, vulnerability assessment, firewalls, endpoint detection, IDS, SIEM, disaster recovery, and cyber risk management. AWS is present across 77 Availability Zones across 24 geographic locations with plans to launch 12 more Availability Zones and four more AWS Regions in Indonesia, Italy, Japan, and Spain, respectively. Silver Lining, Cloudticity, Databricks, and TensorIoT are among some partners of the company.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Service model, Security type, Deployment Mode, Organization Size, Vertical, And Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

List of Companies in Serverless Security |

AWS (US), Microsoft (US), Google (US), Palo Alto Networks (US), Imperva (US), Aqua Security (Israel), Signal Sciences (US), Rackspace (US), Micro Focus (UK), Serverless (US), IBM (US), Sophos (UK), Cisco (US), Fortinet (US), Oracle (US), Check Point (Israel), Cloudflare (US), Sysdig (US), Deepfence (US), Stackery (US), StackPath (US), Lumigo (US), Thundra (US), Snyk (England), Alcide (Israel). |

This research report categorizes the Serverless Security Market to forecast revenues and analyze trends in each of the following subsegments:

Based on Service Model:

- Backend as a Service (BaaS)

- Function as a Service (FaaS)

Based on Security Type:

- Data Security

- Network Security

- Perimeter Security

- Application Security

- Others (Endpoint, policy management, operations, and monitoring and response)

Based on Deployment Mode:

- Public

- Private

Based on Organization Size:

- SMEs

- Large enterprises

Based on Verticals:

- BFSI

- Telecom

- Energy and Utility

- IT and ITeS

- Healthcare

- Manufacturing

- Retail and eCommerce

- Media and Entertainment

- Others (transportation and logistics, travel and hospitality, and education)

Based on Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

APAC

- Australia and New Zealand

- China

- Japan

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2021, AWS announced the general availability of AWS Proton, a fully managed application delivery service for modern container and serverless applications. AWS Proton would provide platform developers an easy means to deploy and monitor applications with built-in AWS practices such as security, pipeline, and monitoring.

- In April 2020, Thundra, an application observability and security platform was made AWS Lambda ready. Thundra demonstrated successful integration with AWS Lambda from observability, debugging, and security aspects

- In February 2020, 3M selected AWS to move its IT enterprise data to the cloud to leverage AWS’ service portfolio, which includes ML, analytics, storage, serverless security, and databases to drive operational efficiency and business continuity.

Frequently Asked Questions (FAQ):

How big is the Serverless Security Market?

What is the growth rate of Serverless Security Market?

What are the driving factors for global Serverless Security Market growth?

Who are the key players in Serverless Security Market?

Which region is the leading hub for Serverless Security Market?

What is the Serverless Security Market Segmentation provided in report?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2014–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 6 SERVERLESS SECURITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/PLATFORMS OF SERVERLESS SECURITY VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND PLATFORMS OF SERVERLESS SECURITY VENDORS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP-DOWN (DEMAND SIDE)

2.3 DATA TRIANGULATION

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

FIGURE 10 LIMITATIONS OF THE SERVERLESS SECURITY MARKET

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 3 MARKET SIZE AND GROWTH, 2021–2026 (USD MILLION)

FIGURE 11 GLOBAL MARKET TO WITNESS A SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

FIGURE 12 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2021

FIGURE 13 FASTEST-GROWING SEGMENTS OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE SERVERLESS SECURITY MARKET

FIGURE 14 INCREASE IN THE MISCONFIGURATION TO BOOST THE GROWTH OF SERVERLESS SECURITY

4.2 MARKET, BY SERVICE MODEL

FIGURE 15 FUNCTION-AS-A-SERVICE TO ACCOUNT FOR THE LARGER MARKET SHARE IN 2021

4.3 MARKET, BY SECURITY TYPE

FIGURE 16 DATA SECURITY SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4.4 MARKET, BY DEPLOYMENT MODE

FIGURE 17 PUBLIC CLOUD TO ACCOUNT FOR LARGER MARKET SIZE DURING THE FORECAST PERIOD

4.5 MARKET, BY ORGANIZATION SIZE

FIGURE 18 LARGE ENTERPRISES TO ACCOUNT FOR THE LARGER MARKET SIZE DURING THE FORECAST PERIOD

4.6 SERVERLESS SECURITY MARKET, BY VERTICAL

FIGURE 19 BANKING, FINANCIAL SERVICES AND INSURANCE SEGMENT TO BE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4.7 MARKET INVESTMENT SCENARIO

FIGURE 20 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN NEXT THE FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 SERVERLESS SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increase in the misconfiguration to boost the growth of serverless security

5.2.1.2 Compliance concerns in traditional cloud computing

5.2.1.3 Future of microservices lies in serverless and function-as-a-service

5.2.1.4 Lack of security tools and processes

5.2.2 RESTRAINTS

5.2.2.1 Lack of awareness toward serverless resources, serverless architecture, serverless security and strategy

5.2.2.2 Distrust and weak collaboration among enterprises and serverless security service providers

5.2.3 OPPORTUNITIES

5.2.3.1 Migration to serverless technology to give an opportunity for serverless security

5.2.3.2 New marketplaces for serverless functions

5.2.3.3 Usage of edge computing with serverless technology

5.2.4 CHALLENGES

5.2.4.1 Cost-efficiency for long-running computation

5.2.4.2 Challenges in proving compliance

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 SERVERLESS SECURITY ECOSYSTEM

FIGURE 22 SERVERLESS SECURITY MARKET ECOSYSTEM

5.4.1 ECOSYSTEM

TABLE 4 MARKET ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.5.2 CLOUD COMPUTING

5.6 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MARKET

5.7 REVENUE SHIFT: TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 24 REVENUE SHIFT DISRUPTIONS: SERVERLESS SECURITY MARKET

5.8 PATENT ANALYSIS

FIGURE 25 DOCUMENT COUNTS RELATED TO THE SERVERLESS SECURITY, 1994–2021

FIGURE 26 TOP APPLICANTS FOR SERVERLESS SECURITY-RELATED PATENTS. 2021

FIGURE 27 CLOUD SECURITY-RELATED DOCUMENT COUNT, BY COUNTRY, 2021

5.8.1 USE CASES

5.8.1.1 Use case: Aqua Security

5.8.1.2 Use case: Palo Alto Networks

5.8.1.3 Use case: Signal Sciences

5.8.2 REGULATORY LANDSCAPE

5.8.2.1 General data protection regulation

5.8.2.2 Personal information protection and electronic documents act

5.8.2.3 The International Organization for Standardization 27001

5.8.2.4 Cloud Security Alliance Security Trust Assurance and Risk

5.9 PRICING ANALYSIS

TABLE 5 MONTHLY PRICING STRUCTURE OF FEW SERVERLESS SECURITY VENDORS

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON THE SERVERLESS SECURITY MARKET

FIGURE 28 PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT FROM NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

6 SERVERLESS SECURITY MARKET, BY SERVICE MODEL (Page No. - 74)

6.1 INTRODUCTION

6.1.1 MARKET DRIVERS, BY SERVICE MODEL

6.1.2 COVID-19 IMPACT ON THE MARKET, BY SERVICE MODEL

FIGURE 29 BACKEND-AS-A-SERVICE SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 7 MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

6.2 FUNCTION-AS-A-SERVICE

TABLE 8 FUNCTION-AS-A-SERVICE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 BACKEND-AS-AS-SERVICE

TABLE 9 BACKEND-AS-A-SERVICE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 SERVERLESS SECURITY MARKET, BY SECURITY TYPE (Page No. - 78)

7.1 INTRODUCTION

7.1.1 MARKET DRIVERS, BY SECURITY TYPE

7.1.2 COVID-19 IMPACT ON THE MARKET, BY SECURITY TYPE

FIGURE 30 NETWORK SECURITY SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

7.2 DATA SECURITY

TABLE 11 DATA SECURITY: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.3 APPLICATION SECURITY

TABLE 12 APPLICATION SECURITY: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4 NETWORK SECURITY

TABLE 13 NETWORK SECURITY: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.5 PERIMETER SECURITY

TABLE 14 PERIMETER SECURITY: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.6 OTHER SECURITY TYPES

TABLE 15 OTHER SECURITY TYPES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8 SERVERLESS SECURITY MARKET, BY ORGANIZATION SIZE (Page No. - 84)

8.1 INTRODUCTION

8.1.1 MARKET DRIVERS, BY ORGANIZATION SIZE

8.1.2 COVID-19 IMPACT ON THE MARKET, BY ORGANIZATION SIZE

FIGURE 31 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 16 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 17 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3 LARGE ENTERPRISES

TABLE 18 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 SERVERLESS SECURITY MARKET, BY DEPLOYMENT MODEL (Page No. - 88)

9.1 INTRODUCTION

9.1.1 MARKET DRIVERS, BY DEPLOYMENT MODEL

9.1.2 COVID-19 IMPACT ON THE MARKET, BY DEPLOYMENT MODEL

FIGURE 32 PUBLIC CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 19 MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2026 (USD MILLION)

9.2 PUBLIC CLOUD

TABLE 20 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.3 PRIVATE CLOUD

TABLE 21 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10 SERVERLESS SECURITY MARKET, BY VERTICAL (Page No. - 92)

10.1 INTRODUCTION

10.1.1 MARKET DRIVERS, BY VERTICAL

10.1.2 COVID-19 IMPACT ON THE MARKET, BY VERTICAL

FIGURE 33 BSFI TO BE THE LARGEST SEGMENT DURING THE FORECAST PERIOD

TABLE 22 MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 23 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.3 TELECOM

TABLE 24 TELECOM: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.4 RETAIL AND ECOMMERCE

TABLE 25 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.5 HEALTHCARE

TABLE 26 HEALTHCARE: SERVERLESS SECURITY MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.6 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY-ENABLED SERVICES

TABLE 27 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY-ENABLED SYSTEMS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.7 ENERGY AND UTILITY

TABLE 28 ENERGY AND UTILITY: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.8 MEDIA AND ENTERTAINMENT

TABLE 29 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.9 OTHER VERTICALS

TABLE 30 OTHER VERTICALS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11 SERVERLESS SECURITY MARKET, BY REGION (Page No. - 102)

11.1 INTRODUCTION

TABLE 31 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 32 NORTH AMERICA: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

11.2.4 US

TABLE 38 US: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 39 US: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 40 US: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 41 US: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.2.5 CANADA

TABLE 42 CANADA: MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 43 CANADA: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 44 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 45 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 46 EUROPE: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 47 EUROPE: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

11.3.4 UK

TABLE 52 UK: MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 53 UK: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 54 UK: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 55 UK: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.3.5 GERMANY

TABLE 56 GERMANY: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 57 GERMANY: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 58 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 59 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.3.6 FRANCE

TABLE 60 FRANCE: MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 61 FRANCE: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 62 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 63 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 64 REST OF EUROPE: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 65 REST OF EUROPE: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 66 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 67 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

TABLE 68 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 69 ASIA PACIFIC: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2019–2026 (USD MILLION)

11.4.4 AUSTRALIA AND NEW ZEALAND

TABLE 75 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 76 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 77 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 78 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.4.5 CHINA

TABLE 79 CHINA: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 80 CHINA: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 81 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 82 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.4.6 JAPAN

TABLE 83 JAPAN: MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 84 JAPAN: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 85 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 86 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.4.7 INDIA

TABLE 87 INDIA: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 88 INDIA: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 89 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 90 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.4.8 REST OF ASIA PACIFIC

TABLE 91 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 92 REST OF ASIA PACIFIC: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 93 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 94 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: SERVERLESS SECURITY MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 95 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 96 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 98 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 99 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 100 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 101 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.5.4 MIDDLE EAST

TABLE 102 MIDDLE EAST: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 103 MIDDLE EAST: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 104 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 105 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.5.5 AFRICA

TABLE 106 AFRICA: MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 107 AFRICA: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 108 AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 109 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: SERVERLESS SECURITY MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 110 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 111 LATIN AMERICA: MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 112 LATIN AMERICA: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 113 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 114 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 115 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 116 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

11.6.4 BRAZIL

TABLE 117 BRAZIL: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 118 BRAZIL: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 119 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 120 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.6.5 MEXICO

TABLE 121 MEXICO: MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 122 MEXICO: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 123 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 124 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

TABLE 125 REST OF LATIN AMERICA: SERVERLESS SECURITY MARKET SIZE, BY SERVICE MODEL, 2019–2026 (USD MILLION)

TABLE 126 REST OF LATIN AMERICA: MARKET SIZE, BY SECURITY TYPE, 2019–2026 (USD MILLION)

TABLE 127 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 128 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 148)

12.1 INTRODUCTION

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 36 SERVERLESS SECURITY: MARKET EVALUATION FRAMEWORK

12.3 KEY MARKET DEVELOPMENTS

12.3.1 PRODUCT LAUNCHES

TABLE 129 SERVERLESS SECURITY MARKET: PRODUCT LAUNCHES, MAY 2019–JUNE 2021

12.3.2 DEALS

TABLE 130 MARKET: KEY DEALS, FEBRUARY 2020–JUNE 2021

12.4 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 37 MARKET: REVENUE ANALYSIS

12.5 MARKET SHARE ANALYSIS OF THE TOP MARKET PLAYERS

TABLE 131 MARKET: DEGREE OF COMPETITION

12.6 HISTORICAL REVENUE ANALYSIS

FIGURE 38 REVENUE ANALYSIS OF THE TOP FIVE MARKET PLAYERS, 2016–2020 (USD MILLION)

12.7 RANKING OF KEY PLAYERS IN THE SERVERLESS SECURITY MARKET, 2021

FIGURE 39 KEY PLAYERS RANKING, 2021

12.8 COMPANY EVALUATION MATRIX

12.8.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 132 EVALUATION CRITERIA

12.8.2 STARS

12.8.3 PERVASIVE PLAYERS

12.8.4 EMERGING LEADERS

12.8.5 PARTICIPANTS

FIGURE 40 SERVERLESS SECURITY MARKET COMPANY EVALUATION MATRIX, 2021

12.9 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 41 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

12.10 BUSINESS STRATEGY EXCELLENCE

FIGURE 42 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

12.11 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 133 COMPANY PRODUCT FOOTPRINT

TABLE 134 COMPANY SECURITY TYPE FOOTPRINT

TABLE 135 COMPANY SERVICE MODEL FOOTPRINT

TABLE 136 COMPANY REGION FOOTPRINT

12.12 STARTUP/SME EVALUATION QUADRANT

12.12.1 PROGRESSIVE COMPANIES

12.12.2 RESPONSIVE COMPANIES

12.12.3 DYNAMIC COMPANIES

12.12.4 STARTING BLOCKS

FIGURE 43 SERVERLESS SECURITY MARKET STARTUP/SME EVALUATION QUADRANT, 2021

12.13 RIGHT TO WIN

TABLE 137 RIGHT TO WIN

13 COMPANY PROFILES (Page No. - 164)

13.1 INTRODUCTION

(Business Overview, Solutions and Services Offered, Recent Developments, COVID-19-related Developments, MNM View, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.1.1 AMAZON WEB SERVICES

TABLE 138 AMAZON WEB SERVICES: BUSINESS OVERVIEW

FIGURE 44 AMAZON WEB SERVICES: COMPANY SNAPSHOT

TABLE 139 AMAZON WEB SERVICES: SOLUTIONS OFFERED

TABLE 140 AMAZON WEB SERVICES: PRODUCT LAUNCHES

TABLE 141 AMAZON WEB SERVICES: DEALS

13.1.2 PALO ALTO NETWORKS

TABLE 142 PALO ALTO NETWORKS: BUSINESS OVERVIEW

FIGURE 45 PALO ALTO NETWORKS: COMPANY SNAPSHOT

TABLE 143 PALO ALTO NETWORKS: SOLUTIONS OFFERED

TABLE 144 PALO ALTO NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 145 PALO ALTO NETWORKS: DEALS

13.1.3 MICROSOFT

TABLE 146 MICROSOFT: BUSINESS OVERVIEW

FIGURE 46 MICROSOFT: COMPANY SNAPSHOT

TABLE 147 MICROSOFT: SOLUTIONS OFFERED

TABLE 148 MICROSOFT: SERVICES OFFERED

TABLE 149 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 150 MICROSOFT: DEALS

13.1.4 GOOGLE

TABLE 151 GOOGLE: BUSINESS OVERVIEW

FIGURE 47 GOOGLE: COMPANY SNAPSHOT

TABLE 152 GOOGLE: SOLUTIONS OFFERED

TABLE 153 GOOGLE: PRODUCT LAUNCHES

TABLE 154 GOOGLE: DEALS

13.1.5 IMPERVA

TABLE 155 IMPERVA: BUSINESS OVERVIEW

TABLE 156 IMPERVA: SOLUTIONS OFFERED

TABLE 157 IMPERVA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 158 IMPERVA: DEALS

13.1.6 AQUA SECURITY

TABLE 159 AQUA SECURITY: BUSINESS OVERVIEW

TABLE 160 AQUA SECURITY: SOLUTIONS OFFERED

TABLE 161 AQUA SECURITY: PRODUCT LAUNCHES

13.1.7 SIGNAL SCIENCES

TABLE 162 SIGNAL SCIENCES: BUSINESS OVERVIEW

TABLE 163 SIGNAL SCIENCES: SOLUTIONS OFFERED

TABLE 164 SIGNAL SCIENCES: PRODUCT LAUNCHES

TABLE 165 SIGNAL SCIENCES: DEALS

13.1.8 RACKSPACE

TABLE 166 RACKSPACE: BUSINESS OVERVIEW

FIGURE 48 RACKSPACE: COMPANY SNAPSHOT

TABLE 167 RACKSPACE: SERVICES OFFERED

TABLE 168 RACKSPACE: DEALS

13.1.9 MICRO FOCUS

TABLE 169 MICRO FOCUS: BUSINESS OVERVIEW

FIGURE 49 MICRO FOCUS: COMPANY SNAPSHOT

TABLE 170 MICRO FOCUS: SOLUTIONS OFFERED

TABLE 171 MICRO FOCUS: SERVICES OFFERED

TABLE 172 MICRO FOCUS: DEALS

13.1.10 SERVERLESS

TABLE 173 SERVERLESS: BUSINESS OVERVIEW

TABLE 174 SERVERLESS: SOLUTIONS OFFERED

13.2 OTHER PLAYERS

13.2.1 IBM

13.2.2 SOPHOS

13.2.3 CISCO

13.2.4 FORTINET

13.2.5 ORACLE

13.2.6 CHECK POINT

13.2.7 CLOUDFLARE

13.2.8 SYSDIG

13.3 STARTUP/SME PROFILES

13.3.1 DEEPFENCE

13.3.2 STACKERY

13.3.3 STACKPATH

13.3.4 LUMIGO

13.3.5 THUNDRA

13.3.6 SNYK

13.3.7 ALCIDE

*Details on Business Overview, Solutions and Services Offered, Recent Developments, COVID-19-related Developments, MNM View, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT MARKETS (Page No. - 202)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 SERVERLESS ARCHITECTURE MARKET

TABLE 175 SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 176 AUTOMATION AND INTEGRATION: SERVERLESS ARCHITECTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 177 MONITORING: SERVERLESS ARCHITECTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 178 API MANAGEMENT: SERVERLESS ARCHITECTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 179 SECURITY: SERVERLESS ARCHITECTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 180 ANALYTICS: SERVERLESS ARCHITECTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 181 DESIGN AND CONSULTING: SERVERLESS ARCHITECTURE MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 182 OTHERS: SERVERLESS ARCHITECTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 183 SERVERLESS ARCHITECTURE MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 184 SERVERLESS ARCHITECTURE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 185 SERVERLESS ARCHITECTURE MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 186 SERVERLESS ARCHITECTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14.4 CLOUD SECURITY MARKET

TABLE 187 CLOUD SECURITY MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

TABLE 188 DATA SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 189 APPLICATION SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 190 ENDPOINT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 191 NETWORK SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 192 PERIMETER SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 193 CLOUD SECURITY MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 194 VISIBILITY AND RISK ASSESSMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 195 USER AND DATA GOVERNANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 196 ACTIVITY MONITORING AND ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 197 THREAT PROTECTION AND REMEDIATION/MITIGATION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 198 OTHER APPLICATIONS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

15 APPENDIX (Page No. - 212)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities to estimate the current size of the serverless security market. An exhaustive secondary research was done to collect information on the serverless security market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

The market for companies offering serverless security offerings was arrived at based on the secondary data available through paid and unpaid sources, by analyzing product portfolios of the major companies in the ecosystem, and rating companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; and white papers, journals, and certified publications. Secondary sources were used to identify and collect useful information for this extensive, technical, and commercial study on the global serverless security market.

Primary Research

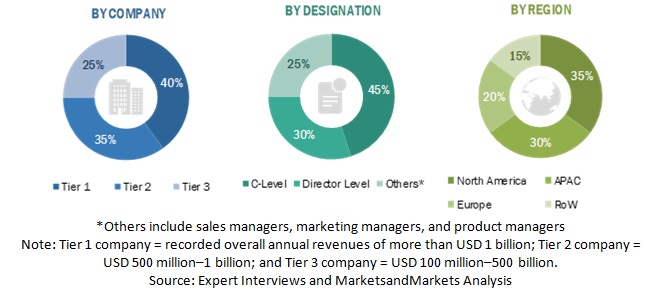

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from serverless security vendors, serverless security solution providers, industry associations, independent blockchain consultants, and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue collected from solutions and platforms, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of end users using serverless security solutions, were interviewed to understand the buyer’s perspective on the suppliers, and solution and platform providers, and their current use of solutions.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the serverless security market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

Key players in the market have been identified through extensive secondary research.

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the serverless security market by service model, security type, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Middle East and Africa (MEA), Asia Pacific (APAC), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, product developments, and Research and Development (R&D) activities, in the market

- To analyze the impact of the COVID-19 outbreak on the growth of the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of APAC into countries in Serverless security market size

- Further breakup of Latin America into countries in market size

- Further breakup of MEA into countries in market size

- Further breakup of Europe into countries in market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Serverless Security Market