Sequence of Events Recorder Market by Mount type (Rack mounted, Rail mounted), End user (Data Center, Power Generation, Manufacturing, Others (Hospitals, Laboratories, Petrochemicals, and Pharmaceutical industries)), Region- Global Forecast to 2026

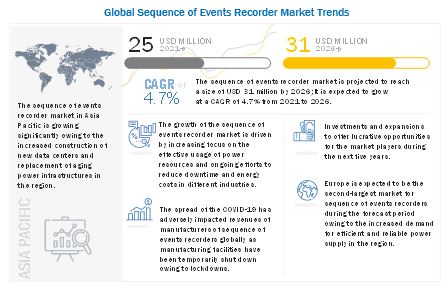

[171 Pages Report] The global sequence of events recorder market is projected to reach a size of USD 31 million by 2026, at a CAGR of 4.7%, from an estimated USD 25 million in 2021. The increasing focus on the effective usage of power resources and the ongoing efforts to reduce downtime and energy costs in different industries are factors driving the growth of the sequence of events recorder market.

To know about the assumptions considered for the study, download the pdf brochure

Sequence of events recorder market Dynamics

Driver: Growing focus on effective use of power sources worldwide

With the continuous increase in the global population and rapid industrialization, the demand for energy resources is increasing worldwide. According to the International Energy Outlook published by the Energy Information Administration (EIA) in 2020, the global energy demand is primarily driven by the non-Organisation for Economic Co-operation and Development (OECD) countries, such as Argentina, Brazil, India, Malaysia, Singapore, South Africa, and Thailand, with high population growth and increased economic development. The energy demand from OECD countries such as the US, the UK, the Czech Republic, Germany, Norway, and France, is expected to increase gradually over the years with growth in their gross domestic product (GDP).

Half of the increase in the global energy demand is contributed by the power sector owing to surged electricity consumption worldwide. According to the International Energy Agency (IEA), the global energy sector is focusing on new capital investments to replace aging power plants and meet the growing demand for power across the world. The total global installed power generation capacity in 2009 was 4,957 GW. The estimated gross capacity additions of 5,900 GW are required to take place till 2035, while ~2,000 GW of existing capacity needs to be replaced by the same year. The cumulative global investments in the power sector have been estimated to be USD 16.9 trillion from 2011 to 2035, with an average of USD 675 billion per year. New power-generating capacity accounts for a share of ~58% of the total investments in the global power sector, with transmission and distribution accounting for a share of the remaining 42%. Thus, the increased demand for the effective monitoring of global power consumption has led to the surged installations of sequence of events recorders to ensure uninterrupted power supply around-the-clock.

Operators often are concerned about the proper functioning of electronic equipment installed in assets/facilities. Sequence of events recorders help in identifying anomalies in electronic equipment for their early rectification. These recorders can be coupled with electronic power monitoring systems and/or supervisory control and data acquisition (SCADA) systems for the effective monitoring of assets/facilities. This also helps asset/facility operators to quickly identify the root cause of anomalies and take informed decisions to resolve them.

Restraints: Easy availability of substitutes of sequence of events recorders

There are various equipment available in the market other than sequence of events recorders for measuring and controlling the power supply chain. These alternatives can be used to monitor the power quality and cost allocations. They are also used for controlling and automating power supplies. Alternatives/substitutes of sequence of events recorders include programmable logic controllers (PLC), protective relays, input/output modules, etc.

Protective relays are components that sense abnormalities or faults in power systems and initiate control circuit operations. The key power system components such as transmission lines, feeders, busbars, transformers, motors, generators, and capacitor banks are capital-intensive assets that require to be protected in case of faults. Protective relays serve this purpose by continuously monitoring the health of power systems, along with initiating switchgear operations to disconnect faulty sections of power networks.

Programmable logic controllers (PLC) are industrial computer control systems that continuously monitor the state of input devices and make decisions based on customized programs to control the state of output devices. These devices can change and replicate operations or processes while collecting and communicating vital information from sensors, actuators, and control valves, which are parts of control systems. Hence, the easy availability of alternatives of sequence of events recorders to carry out automated controlling and monitoring operations in power systems hinder the growth of the sequence of events recorder market.

Opportunities: Growing investments in data center infrastructures

Data centers face continuously increasing pressure owing to large-scale rise in volumes of data generated. According to Avnet, the data center traffic is expected to double every two years. In addition, Cisco estimates that cloud traffic will account for a share of ~95% of the global data traffic by 2021. The adoption of cloud services is expected to result in surged demand for new data centers. It estimates data traffic to reach 19.5 zettabytes (ZB) by 2021 from 6 ZB in 2016. Organizations across the world are increasingly spending on the development of their data center infrastructures. According to a press release by Mckinsey in 2019, companies such as Microsoft, Amazon, Alphabet, Apple, and Facebook account for a combined share of ~70% of the total expenditure on data center projects. These data centers require power systems that are compact and efficient owing to the proximity of these centers to the population using them. The rapid growth in the use of social media and the increased number of users of online games in Asia Pacific have further increased the demand for explicitly scalable data center architectures that are capable of handling complex operations. This increased amount of data generated is expected to fuel the demand for data centers. It, in turn, is expected to contribute to risen demand for electronic and power equipment, including sequence of events recorders.

Challenges: Lack of awareness among end users about potential benefits of sequence of events recorder

Sequence of events recorders are niche devices, but still, there are a number of alternatives of these devices available in the market, including protective relays, PLC, input/output modules, etc., that can perform the function of monitoring power equipment. Increasing requirement of enhanced operational efficiency and optimum resource utilization has led to the surged automation of electrical infrastructures. Hence, owners/operators of mission-critical facilities often choose PLC, relays, power monitoring systems, and SCADA systems to monitor and control instruments deployed in their facilities. Most of these users are unaware of the potential benefits of sequence of events recorders in the form of cost-effectiveness, ease of installation, and high accuracy of the order of 1 m/s. These recorders are mainly preferred for power monitoring applications, thereby leading to their deployment only in mission-critical facilities that lack in terms of completely upgraded and automated energy infrastructures. Such factors hinder the growth of the sequence of events recorder market.

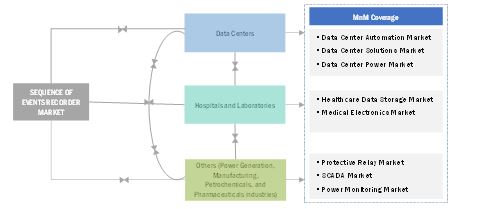

Market Interconnection

By mount type, the rack mounted segment is the largest contributor in the sequence of events recorder market in 2020.

The rack mounted segment dominated the sequence of events recorder market by mount type in 2020.

Rack-mounted sequence of events recorders are electronic equipment, which are housed in metal frameworks, namely, equipment racks. Usually, equipment racks contain multiple bays, each designed to hold a unit of equipment such as computer servers, test instruments, sequence of events recorders, storage drives, telecommunication components, and electronics devices. Typically, the equipment unit is mounted (inserted into a bay in a rack) and secured with screws. Rack-mounted sequence of events recorders are easy to mount within racks, thereby leading to space saving. They enable improved tracking down of issues and are easy to update. These recorders make maintenance and troubleshooting activities efficient by enabling time saving. Rack-mounted sequence of events recorders also enable improved airflow by keeping different equipment evenly spaced without creating any airflow obstructions.

By end-user, power generation is expected to be the largest contributor during the forecast period.

Power generation segment is expected to hold the largest share of the end-user segment during the forecast period. The power generation industry is a major user of automation products. It comprises of a large number of transformers, feeders, busbars, and several other assets to ensure un-interrupted power supply to the end-users. A power system comprises power generation, transmission, and distribution, and these 3 functions can be carried out in different sites, namely, power plants, transformers, transmission lines, substations, distribution lines, and distribution transformers. It is essential to monitor these functions and facilities for flexibility, reliability, and stability of the power supply system. The SER can be used monitoring the plant status from operator level to managerial level. It records all events successfully without skipping any event and guards against any manipulation. Hence, the sequence of events recorder are crucial in analyzing and optimizing the power distribution system.

Asia Pacific accounted for the largest share of the sequence of events recorder market in 2020 .

The sequence of events recorder market in Asia Pacific has been studied for China, Australia, Japan, India, South Korea, Singapore, and the Rest of Asia Pacific. Factors such as increasing penetration of the Internet and cloud computing, growing economy, and ongoing infrastructure development projects contribute to risen demand for data centers in the region. This, in turn, contributes to the growth of the market in Asia Pacific. The key vendors providing data center power solutions in Asia Pacific are ABB, Schneider Electric, and Delta Electronics. Countries such as Australia and China are witnessing increased investments in BFSI, retail, healthcare, manufacturing, and telecommunications verticals that have resulted in the development and economic growth in Asia Pacific. The construction of data centers in Asia Pacific is comparatively higher than other regions of the world owing to the largely untapped market areas for data center providers. The implementation of 5G has commenced in several countries of the region that will have a significant impact on the market. Telecommunication providers are anticipated to partner with service providers in establishing edge data centers throughout the region. According to Cisco, Asia Pacific will use twice the amount of mobile data per month than North America and Western Europe combined by 2021. The spread of internet-enabled devices is expected to continue increasing the demand for data centers in this region, thereby fueling the growth of the sequence of events recorder market in Asia Pacific.

Key Market Players

The key players profiled in this report are AMETEK (US), Yokogawa Electric Corporation (Japan), Emerson (US), and Qualitrol Corp. (US).

Scope of the report

|

Report Metric |

Details |

|

Market Size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Mount type, end-user, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

AMETEK(US), Qualitrol Corp.(US), Emerson(US), Eaton(Ireland), Yokogawa Electric Corporation(Japan), Cyber Sciences (US), Ronan Engineering Company (US), Pacific Microsystems (India), E-MAX Instruments (US), ETAP (US), General Electric (US), Rockwell Automation (US), Schneider Electric (France), ABB (Switzerland), Mitsubishi Electric (Japan), Delphin Technology (Germany), Schweitzer Engineering Laboratories (US), Chino Corporation (Japan) |

This research report categorizes the sequence of events recorder market-based on mount type, end-users, and region

On the basis of mount type, the market has been segmented as follows:

- Rank Mounted

- Rail Mounted

On the basis of end user, the market has been segmented as follows:

- Data Centers

- Power Generation

- Manufacturing

- Others (Hospitals, Laboratories, Petrochemicals, and Pharmaceutical industries)

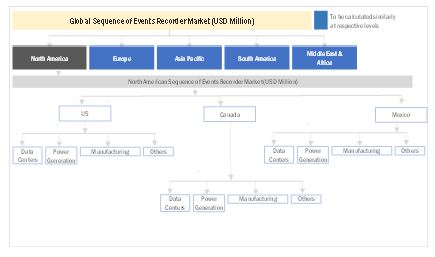

On the basis of region, the market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In January 2021, Emerson announced the opening of the new Branson welding and assembly technologies’ global headquarters in Brookfield, Conn. This facility supports plastic joining, ultrasonic metal welding, and ultrasonic cleaning technologies for the medical, textile, automotive, food and beverage, packaging, and electronics industries.

- In December 2020, Cyber Sciences entered a strategic partnership with ZI-ARGUS, a provider of system integration in Process Control, Automation, Engineering, Process Consultancy and Plant Optimization. The partnership is expected to enhance Cyber Sciences' strategic solutions offering to its customers. The companies plan+G24 to serving the Australian and New Zealand markets together.

- In October 2020, Emerson acquired Progea Group, a provider of industrial internet of things (IIoT), plant analytics, human-machine interface (HMI), and supervisory control and data acquisition (SCADA) technologies. The acquisition strengthens Emerson's ability to provide customers with an integrated package of control, visualization, and IoT to improve overall equipment efficiency and accelerate their digital transformation.

- In December 2019, Yokogawa Electric Corporation entered a strategic alliance with Saudi Basic Industries Corporation (SABIC), a petrochemical manufacturer. As a result of this alliance, Yokogawa promotes the localization of its business operations in Saudi Arabia. The integrated control systems and safety-instrumented systems of the company are preferentially selected for plants operated by SABIC in the Middle East and Asia Pacific. Additionally, Yokogawa promotes manufacturing excellence by collaborating with SABIC on innovative digitalization technologies, as well as energy optimization programs.

Frequently Asked Questions (FAQ):

What is the current size of the sequence of events recorder market?

The current market size of global sequence of events recorder market is USD 24 million in 2020.

What is the major drivers for sequence of events recorder market?

The increasing focus on the effective usage of power resources and the ongoing efforts to reduce downtime and energy costs in different industries are factors driving the growth of the sequence of events recorder market.

Which is the fastest growing region during the forecasted period in sequence of events recorder market?

Asia Pacific is the fastest growing region during the forecasted period owing to the increased construction of new data centers and replacement of aging power infrastructures in the region.

Which is the fastest growing segment, by end-user during the forecasted period in sequence of events recorder market?

The data centers segment, by end-user is the fastest growing segment during the forecasted period owing increasing focus on achieving proper uptime of data centers and detecting abnormal conditions in them. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 SEQUENCE OF EVENTS RECORDERS MARKET: INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

TABLE 1 SEQUENCE OF EVENTS RECORDER MARKET: PLAYERS/COMPANIES CONNECTED

2.2.2.2 Breakdown of primaries

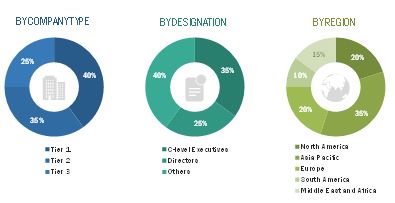

FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 SCOPE

2.4 MARKET SIZE ESTIMATION

2.4.1 INDUSTRY AND COUNTRY-WISE ANALYSIS

TABLE 2 SEQUENCE OF EVENTS RECORDERS MARKET: INDUSTRY/COUNTRY-WISE ANALYSIS

2.4.1.1 Key parameters/trends

2.4.2 SUPPLY-SIDE ANALYSIS

FIGURE 4 RESEARCH METHODOLOGY: ILLUSTRATION OF REVENUE ESTIMATION OF A COMPANY OFFERING SEQUENCE OF EVENTS RECORDERS, 2019

2.4.2.1 Supply-side calculation

2.4.2.1.1 Key primary insights for supply-side analysis

2.4.2.2 Supply-side assumptions

2.4.3 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 35)

TABLE 3 SEQUENCE OF EVENTS RECORDERS MARKET SNAPSHOT

FIGURE 5 ASIA PACIFIC LED MARKET IN 2020

FIGURE 6 RACK MOUNTED SEGMENT TO LEAD MARKET FROM 2021 TO 2026

FIGURE 7 DATA CENTERS SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 8 INCREASING FOCUS ON EFFECTIVE USAGE OF POWER RESOURCES TO DRIVE GROWTH OF MARKET FROM 2021 TO 2026

4.2 SEQUENCE OF EVENTS RECORDER MARKET, BY REGION

FIGURE 9 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4.3 MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

FIGURE 10 POWER GENERATION SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2020

4.4 MARKET, BY MOUNT TYPE

FIGURE 11 RACK MOUNTED SEGMENT TO HOLD LARGE SHARE OF MARKET IN 2026

4.5 MARKET, BY END USER

FIGURE 12 POWER GENERATION SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2026

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 13 COVID-19 GLOBAL PROPAGATION

FIGURE 14 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

5.3.1 RECOVERY ROAD FOR 2020 & 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 15 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 16 SEQUENCE OF EVENTS RECORDER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Growing focus on effective use of power resources worldwide

5.5.1.2 Increasing emphasis on reducing industrial downtime and global energy costs

5.5.2 RESTRAINTS

5.5.2.1 Easy availability of substitutes of sequence of events recorders

5.5.3 OPPORTUNITIES

5.5.3.1 Growing investments in data center infrastructures

FIGURE 17 GLOBAL DATA CENTER ENERGY DEMAND, BY REGION, 2014–2022

5.5.3.2 Ongoing replacement of aging power infrastructures

FIGURE 18 INVESTMENT IN SMART GRIDS, BY POWER EQUIPMENT, 2014–2019 (USD BILLION)

5.5.4 CHALLENGES

5.5.4.1 Lack of AWARENESS among end users about potential benefits of sequence of events recorders

5.5.4.2 Reduced investments for development of new power infrastructures owing to COVID-19

5.6 TRENDS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MANUFACTURERS OF SEQUENCE OF EVENTS RECORDERS

FIGURE 19 REVENUE SHIFT FOR MANUFACTURERS OF SEQUENCE OF EVENTS RECORDERS

5.7 MARKET MAP

FIGURE 20 SEQUENCE OF EVENTS RECORDER MARKET MAP

5.8 AVERAGE SELLING PRICES

5.9 REGULATORY LANDSCAPE

5.10 SUPPLY CHAIN OVERVIEW

FIGURE 21 SEQUENCE OF EVENTS RECORDER MARKET SUPPLY CHAIN

TABLE 4 MARKET: SUPPLY CHAIN/ECOSYSTEM

5.10.1 KEY INFLUENCERS

5.10.1.1 Sequence of events recorder manufacturers/original equipment manufacturers (OEM)

5.10.1.2 Distributors

5.10.1.3 End users

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF SUBSTITUTES

5.11.2 BARGAINING POWER OF SUPPLIERS

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 THREAT OF NEW ENTRANTS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

6 SEQUENCE OF EVENTS RECORDER MARKET, BY MOUNT TYPE (Page No. - 57)

6.1 INTRODUCTION

FIGURE 23 SEQUENCE OF EVENTS RECORDER MARKET SHARE, BY MOUNT TYPE, 2020

TABLE 6 MARKET, BY MOUNT TYPE, 2019–2026 (USD THOUSAND)

6.2 RACK MOUNTED

6.2.1 IMPROVED AIRFLOW AND ACCESSIBILITY LEAD TO RISEN DEMAND FOR RACK-MOUNTED SEQUENCE OF EVENTS RECORDERS

TABLE 7 RACK-MOUNTED MARKET, BY REGION, 2019–2026 (USD THOUSAND)

6.3 RAIL MOUNTED

6.3.1 EASE OF UPGRADATION AND ALTERATION CONVENIENCE OFFERED BY RAIL-MOUNTED SEQUENCE OF EVENTS RECORDERS TO FUEL THEIR GLOBAL DEMAND

TABLE 8 RAIL-MOUNTED MARKET, BY REGION, 2019–2026 (USD THOUSAND)

7 SEQUENCE OF EVENTS RECORDER MARKET, BY END USER (Page No. - 61)

7.1 INTRODUCTION

FIGURE 24 SEQUENCE OF EVENTS RECORDER MARKET SHARE, BY END USER, 2020

TABLE 9 MARKET, BY END USER, 2019–2026 (USD THOUSAND)

7.2 DATA CENTERS

7.2.1 INCREASING FOCUS ON ACHIEVING PROPER UPTIME OF DATA CENTERS AND DETECTING ABNORMAL CONDITIONS IN THEM TO FUEL MARKET GROWTH

TABLE 10 MARKET FOR DATA CENTERS, BY REGION, 2019–2026 (USD THOUSAND)

7.3 POWER GENERATION

7.3.1 GROWING REQUIREMENT OF RELIABLE POWER SUPPLY TO END USERS FUELING MARKET GROWTH

TABLE 11 MARKET FOR POWER GENERATION, BY REGION, 2019–2026 (USD THOUSAND)

7.4 MANUFACTURING

7.4.1 SURGING REQUIREMENT OF EFFECTIVE ENERGY MONITORING TO CONTRIBUTE TO MARKET GROWTH

TABLE 12 MARKET FOR MANUFACTURING, BY REGION, 2019–2026 (USD THOUSAND)

7.5 OTHERS

TABLE 13 MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD THOUSAND)

8 GEOGRAPHIC ANALYSIS (Page No. - 68)

8.1 INTRODUCTION

FIGURE 25 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 26 MARKET SHARE, BY REGION, 2020

TABLE 14 MARKET, BY REGION, 2019–2026 (USD THOUSAND)

8.2 ASIA PACIFIC

FIGURE 27 SNAPSHOT: SEQUENCE OF EVENTS RECORDER MARKET IN ASIA PACIFIC

TABLE 15 MARKET IN ASIA PACIFIC, BY MOUNT TYPE, 2019–2026 (USD THOUSAND)

TABLE 16 MARKET IN ASIA PACIFIC, BY END USER, 2019–2026 (USD THOUSAND)

TABLE 17 MARKET IN ASIA PACIFIC FOR DATA CENTERS, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 18 MARKET IN ASIA PACIFIC FOR POWER GENERATION, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 19 MARKET IN ASIA PACIFIC FOR MANUFACTURING, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 20 MARKET IN ASIA PACIFIC FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 21 MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD THOUSAND)

8.2.1 CHINA

8.2.1.1 Increasing construction of data centers to lead to market growth in China

TABLE 22 MARKET IN CHINA, BY END USER, 2019–2026 (USD THOUSAND)

8.2.2 AUSTRALIA

8.2.2.1 Ongoing replacement of aging utility infrastructures with smart grids to fuel market growth in Australia

TABLE 23 MARKET IN AUSTRALIA, BY END USER, 2019–2026 (USD THOUSAND)

8.2.3 JAPAN

8.2.3.1 Growing requirement of reliable and efficient power supply to contribute to market growth in Japan

TABLE 24 MARKET IN JAPAN, BY END USER, 2019–2026 (USD THOUSAND)

8.2.4 INDIA

8.2.4.1 Establishing of India as manufacturing hub to lead to increased demand for sequence of events recorders in country

TABLE 25 MARKET IN INDIA, BY END USER, 2019–2026 (USD THOUSAND)

8.2.5 SOUTH KOREA

8.2.5.1 Growing focus of government on development of smart grids to contribute to market growth in South Korea

TABLE 26 MARKET IN SOUTH KOREA, BY END USER, 2019–2026 (USD THOUSAND)

8.2.6 SINGAPORE

8.2.6.1 Surging focus on connectivity to contribute to market growth in Singapore

TABLE 27 MARKET IN SINGAPORE, BY END USER, 2019–2026 (USD THOUSAND)

8.2.7 REST OF ASIA PACIFIC

TABLE 28 MARKET IN REST OF ASIA PACIFIC, BY END USER, 2019–2026 (USD THOUSAND)

8.3 NORTH AMERICA

FIGURE 28 SNAPSHOT: MARKET IN NORTH AMERICA

TABLE 29 MARKET IN NORTH AMERICA, BY MOUNT TYPE, 2019–2026 (USD THOUSAND)

TABLE 30 MARKET IN NORTH AMERICA, BY END USER, 2019–2026 (USD THOUSAND)

TABLE 31 MARKET IN NORTH AMERICA FOR DATA CENTERS, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 32 MARKET IN NORTH AMERICA FOR POWER GENERATION, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 33 MARKET IN NORTH AMERICA FOR MANUFACTURING, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 34 MARKET IN NORTH AMERICA FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 35 MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD THOUSAND)

8.3.1 US

8.3.1.1 Surging focus on upgrading aging power equipment and growing number of data centers to contribute to market growth in US

TABLE 36 MARKET IN US, BY END USER, 2019–2026 (USD THOUSAND)

8.3.2 CANADA

8.3.2.1 Increasing government initiatives to promote cloud computing and renew aging electricity infrastructure to fuel market growth in Canada

TABLE 37 MARKET IN CANADA, BY END USER, 2019–2026 (USD THOUSAND)

8.3.3 MEXICO

8.3.3.1 Growing investments for development of hyperscale data centers in Mexico driving market growth

TABLE 38 MARKET IN MEXICO, BY END USER, 2019–2026 (USD THOUSAND)

8.4 EUROPE

TABLE 39 MARKET IN EUROPE, BY MOUNT TYPE, 2019–2026 (USD THOUSAND)

TABLE 40 MARKET IN EUROPE, BY END USER, 2019–2026 (USD THOUSAND)

TABLE 41 MARKET IN EUROPE FOR DATA CENTERS, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 42 MARKET IN EUROPE FOR POWER GENERATION, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 43 MARKET IN EUROPE FOR MANUFACTURING, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 44 MARKET IN EUROPE FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 45 SEQUENCE OF EVENTS RECORDER MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD THOUSAND)

8.4.1 SPAIN

8.4.1.1 Growing investments in power sector driving market growth in Spain

TABLE 46 MARKET IN SPAIN, BY END USER, 2019–2026 (USD THOUSAND)

8.4.2 UK

8.4.2.1 Increasing requirement of efficient and reliable power supply to fuel market growth in UK

TABLE 47 MARKET IN UK, BY END USER, 2019–2026 (USD THOUSAND)

8.4.3 GERMANY

8.4.3.1 Growing demand for cloud computing to contribute to market growth in Germany

TABLE 48 MARKET IN GERMANY, BY END USER, 2019–2026 (USD THOUSAND)

8.4.4 ITALY

8.4.4.1 Rising number of colocation data centers drive market growth in Italy

TABLE 49 MARKET IN ITALY, BY END USER, 2019–2026 (USD THOUSAND)

8.4.5 FRANCE

8.4.5.1 Strengthening of energy supply chain to lead to market growth in France

TABLE 50 MARKET IN FRANCE, BY END USER, 2019–2026 (USD THOUSAND)

8.4.6 RUSSIA

8.4.6.1 Ongoing execution of Energy Strategy 2035 to fuel market growth in Russia

TABLE 51 MARKET IN RUSSIA, BY END USER, 2019–2026 (USD THOUSAND)

8.4.7 REST OF EUROPE

TABLE 52 MARKET IN REST OF EUROPE, BY END USER, 2019–2026 (USD THOUSAND)

8.5 MIDDLE EAST AND AFRICA

TABLE 53 MARKET IN MIDDLE EAST AND AFRICA, BY MOUNT TYPE, 2019–2026 (USD THOUSAND)

TABLE 54 SEQUENCE OF EVENTS RECORDER MARKET IN MIDDLE EAST AND AFRICA, BY END USER, 2019–2026 (USD THOUSAND)

TABLE 55 MARKET IN MIDDLE EAST AND AFRICA FOR DATA CENTERS, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 56 MARKET IN MIDDLE EAST AND AFRICA POWER GENERATION, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 57 MARKET IN MIDDLE EAST AND AFRICA FOR MANUFACTURING, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 58 MARKET IN MIDDLE EAST AND AFRICA FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 59 MARKET IN MIDDLE EAST AND AFRICA, BY COUNTRY, 2019–2026 (USD THOUSAND)

8.5.1 SAUDI ARABIA

8.5.1.1 Transitioning from on-premises infrastructures to colocation and managed services to fuel market growth in Saudi Arabia

TABLE 60 MARKET IN SAUDI ARABIA, BY END USER, 2019–2026 (USD THOUSAND)

8.5.2 SOUTH AFRICA

8.5.2.1 Rising number of smart grid initiatives to contribute to market growth in South Africa

TABLE 61 SEQUENCE OF EVENTS RECORDER MARKET IN SOUTH AFRICA, BY END USER, 2019–2026 (USD THOUSAND)

8.5.3 REST OF MIDDLE EAST AND AFRICA

TABLE 62 MARKET IN REST OF MIDDLE EAST AND AFRICA, BY END USER, 2019–2026 (USD THOUSAND)

8.6 SOUTH AMERICA

TABLE 63 MARKET IN SOUTH AMERICA, BY MOUNT TYPE, 2019–2026 (USD THOUSAND)

TABLE 64 SEQUENCE OF EVENTS RECORDER MARKET IN SOUTH AMERICA, BY END USER, 2019–2026 (USD THOUSAND)

TABLE 65 MARKET IN SOUTH AMERICA FOR DATA CENTERS, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 66 MARKET IN SOUTH AMERICA FOR POWER GENERATION, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 67 MARKET IN SOUTH AMERICA FOR MANUFACTURING, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 68 MARKET IN SOUTH AMERICA FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 69 MARKET IN SOUTH AMERICA, BY COUNTRY, 2019–2026 (USD THOUSAND)

8.6.1 BRAZIL

8.6.1.1 Increasing development of data centers to contribute to market growth in Brazil

TABLE 70 MARKET IN BRAZIL, BY END USER, 2019–2026 (USD THOUSAND)

8.6.2 ARGENTINA

8.6.2.1 Ongoing economic and regulatory changes in energy sector to fuel market growth in Argentina

TABLE 71 MARKET IN ARGENTINA, BY END USER, 2019–2026 (USD THOUSAND)

8.6.3 REST OF SOUTH AMERICA

TABLE 72 MARKET IN REST OF SOUTH AMERICA, BY END USER, 2019–2026 (USD THOUSAND)

9 COMPETITIVE LANDSCAPE (Page No. - 105)

9.1 KEY PLAYERS STRATEGIES

TABLE 73 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2018–FEBRUARY 2021

9.2 SHARE ANALYSIS OF TOP THREE PLAYERS

TABLE 74 SEQUENCE OF EVENTS RECORDER MARKET: DEGREE OF COMPETITION

FIGURE 29 MARKET SHARE ANALYSIS, 2019

9.3 MARKET EVALUATION FRAMEWORK

TABLE 75 MARKET EVALUATION FRAMEWORK, JANUARY 2018–FEBRUARY 2021

9.4 REVENUE ANALYSIS OF TOP THREE MARKET PLAYERS

FIGURE 30 TOP THREE PLAYERS DOMINATED MARKET FROM 2015 TO 2019

9.5 COMPANY EVALUATION QUADRANT

9.5.1 STAR

9.5.2 EMERGING LEADER

9.5.3 PERVASIVE

9.5.4 PARTICIPANT

FIGURE 31 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2019

TABLE 76 COMPANY END USER FOOTPRINT

TABLE 77 COMPANY REGIONAL FOOTPRINT

9.6 COMPETITIVE SCENARIO

TABLE 78 SEQUENCE OF EVENTS RECORDER MARKET: NEW PRODUCT LAUNCHES, JANUARY 2018–FEBRUARY 2021

TABLE 79 MARKET: DEALS, JANUARY 2018–FEBRUARY 2021

TABLE 80 MARKET: OTHERS, JANUARY 2018–FEBRUARY 2021

10 COMPANY PROFILES (Page No. - 117)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 MAJOR PLAYERS

10.1.1 CYBER SCIENCES

TABLE 81 CYBER SCIENCES: COMPANY OVERVIEW

TABLE 82 CYBER SCIENCES: PRODUCTS/SOLUTIONS OFFERED

TABLE 83 CYBER SCIENCES: DEALS, JANUARY 2018–FEBRUARY 2021

10.1.2 AMETEK

TABLE 84 AMETEK: COMPANY OVERVIEW

FIGURE 32 AMETEK: COMPANY SNAPSHOT

TABLE 85 AMETEK: PRODUCTS/SOLUTIONS OFFERED

TABLE 86 AMETEK: OTHERS, JANUARY 2018–FEBRUARY 2021

10.1.3 EATON

TABLE 87 EATON: COMPANY OVERVIEW

FIGURE 33 EATON: COMPANY SNAPSHOT

TABLE 88 EATON: PRODUCTS/SOLUTIONS OFFERED

10.1.4 RONAN ENGINEERING COMPANY

TABLE 89 RONAN ENGINEERING COMPANY: COMPANY OVERVIEW

TABLE 90 RONAN ENGINEERING COMPANY: PRODUCTS/SOLUTIONS OFFERED

10.1.5 QUALITROL CORP.

TABLE 91 QUALITROL CORP.: COMPANY OVERVIEW

TABLE 92 QUALITROL CORP: PRODUCTS/SOLUTIONS OFFERED

10.1.6 EMERSON

TABLE 93 EMERSON: COMPANY OVERVIEW

FIGURE 34 EMERSON: COMPANY SNAPSHOT

TABLE 94 EMERSON: PRODUCTS/SOLUTIONS OFFERED

TABLE 95 EMERSON: DEALS, JANUARY 2018–FEBRUARY 2021

TABLE 96 EMERSON: OTHERS, JANUARY 2018–FEBRUARY 2021

10.1.7 PACIFIC MICROSYSTEMS

TABLE 97 PACIFIC MICROSYSTEMS: COMPANY OVERVIEW

TABLE 98 PACIFIC MICROSYSTEMS: PRODUCTS/SOLUTIONS OFFERED

10.1.8 YOKOGAWA ELECTRIC CORPORATION

TABLE 99 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

FIGURE 35 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 100 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS OFFERED

TABLE 101 YOKOGAWA ELECTRIC CORPORATION: OTHERS, JANUARY 2018–FEBRUARY 2021

10.1.9 E-MAX INSTRUMENTS

TABLE 102 E-MAX INSTRUMENTS: COMPANY OVERVIEW

TABLE 103 E-MAX INSTRUMENTS: PRODUCTS/SOLUTIONS OFFERED

10.1.10 ETAP

TABLE 104 ETAP: COMPANY OVERVIEW

TABLE 105 ETAP: PRODUCTS/SOLUTIONS OFFERED

TABLE 106 ETAP: OTHERS, JANUARY 2018–FEBRUARY 2021

10.1.11 MONAGHAN ENGINEERING

10.1.12 GENERAL ELECTRIC

TABLE 107 GENERAL ELECTRIC: COMPANY OVERVIEW

FIGURE 36 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 108 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 109 GENERAL ELECTRIC: OTHERS, JANUARY 2018–FEBRUARY 2021

10.1.13 ROCKWELL AUTOMATION

TABLE 110 ROCKWELL AUTOMATION: COMPANY OVERVIEW

FIGURE 37 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

TABLE 111 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS OFFERED

TABLE 112 ROCKWELL AUTOMATION: OTHERS, JANUARY 2018–FEBRUARY 2021

TABLE 113 ROCKWELL AUTOMATION: DEALS, JANUARY 2018–FEBRUARY 2021

10.1.14 SCHNEIDER ELECTRIC

TABLE 114 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

FIGURE 38 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 115 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 116 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES, JANUARY 2018–FEBRUARY 2021

TABLE 117 SCHNEIDER ELECTRIC: DEALS, JANUARY 2018–FEBRUARY 2021

TABLE 118 SCHNEIDER ELECTRIC: OTHERS, NOVEMBER 2019

10.1.15 ABB

TABLE 119 ABB: COMPANY OVERVIEW

FIGURE 39 ABB: COMPANY SNAPSHOT

TABLE 120 ABB: PRODUCTS/SOLUTIONS OFFERED

TABLE 121 ABB: DEALS, JANUARY 2018–FEBRUARY 2021

TABLE 122 ABB: OTHERS, JANUARY 2018–FEBRUARY 2021

10.1.16 MITSUBISHI ELECTRIC

TABLE 123 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

FIGURE 40 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 124 MITSUBISHI ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

10.1.17 DELPHIN TECHNOLOGY

TABLE 125 DELPHIN TECHNOLOGY: COMPANY OVERVIEW

TABLE 126 DELPHIN TECHNOLOGY: PRODUCTS/SOLUTIONS OFFERED

TABLE 127 DELPHIN TECHNOLOGY: PRODUCT LAUNCHES, JANUARY 2018–FEBRUARY 2021

10.1.18 SCHWEITZER ENGINEERING LABORATORIES

TABLE 128 SCHWEITZER ENGINEERING LABORATORIES: COMPANY OVERVIEW

TABLE 129 SCHWEITZER ENGINEERING LABORATORIES: PRODUCTS/SOLUTIONS OFFERED

TABLE 130 SCHWEITZER ENGINEERING LABORATORIES: PRODUCT LAUNCHES, JANUARY 2018–FEBRUARY 2021

TABLE 131 SCHWEITZER ENGINEERING LABORATORIES: OTHERS, JANUARY 2018–FEBRUARY 2021

10.1.19 CHINO CORPORATION

TABLE 132 CHINO CORPORATION: COMPANY OVERVIEW

TABLE 133 CHINO CORPORATION: PRODUCTS/SOLUTIONS OFFERED

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 164)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

This study involved 4 major activities in estimating the current size of the sequence of events recorder market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, market sizing, and our assumptions in arriving these with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Thereafter, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global sequence of events recorder market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The sequence of events recorder market comprises several stakeholders, such as OEMs, distributors, and end users in the supply chain. The demand side of this market is characterized by its end users such as operators / owners of data centers, power generation, manufacturing, and other industrial facilities. The supply side is characterized by OEMs of SER, raw material providers, suppliers, and ddistributors. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global sequence of events recorder market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Sequence of events recorder market Size: Top down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the energy and power industry.

Report Objectives

- To describe, segment, and forecast the sequence of events recorder market based on mount type, end user, and region, in terms of value

- To describe and forecast the size of the market in five regions, namely, North America, Europe, Asia Pacific, the Middle East and Africa, and South America

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the market and its end users with respect to individual growth trends, future expansions, and contribution of each segment to the overall market size

- To analyze the impact of the COVID-19 on the market

- To analyze the market opportunities for stakeholders and provide a detailed competitive landscape of the market

- To profile the key players operating in the market and comprehensively analyze their market share

- To analyze competitive developments such as contracts and agreements, investments and expansions, new product launches, mergers and acquisitions, partnerships and collaborations, alliances, and joint ventures in the market

Exaquantum & Its impact on Sequence of Events Recorder Market

Exaquantum enables users to collect, store, and analyse large amounts of data from various sources, including SERs, to provide insights into power system performance and efficiency. The system can assist operators in identifying trends, detecting anomalies, and optimising power system operation to improve reliability and reduce downtime. To capture and analyse data related to power system events and anomalies, Exaquantum is frequently used in conjunction with sequence of events recorders (SERs).

Utilities and other organisations can gain a comprehensive view of their power systems and better understand the root causes of events or anomalies by combining the capabilities of SERs with Exaquantum. This enables them to make more informed decisions about system maintenance, repairs, and upgrades, resulting in improved system performance, lower costs, and higher customer satisfaction.

Exaquantum can have a significant impact on the rolling stock market in several ways. Here are a few examples:

- Increased demand for SERs: Exaquantum provides advanced data analysis capabilities that enable operators to gain deeper insights into the performance of power systems.

- Higher quality data: Exaquantum can assist SERs in improving data quality by providing automated data validation and correction tools.

- Improved system performance: By combining SERs with Exaquantum, operators can gain a more comprehensive view of their power systems and better understand the causes of events or anomalies.

- Increased adoption of digital technologies: Exaquantum is a digital solution that can assist utilities and other organisations in making the transition to more digital, data-driven approaches to power system management.

Exaquantum is a powerful process information management system (PIMS) that has a wide range of potential use cases. Here are some futuristic growth use-cases of Exaquantum:

- Predictive maintenance: Exaquantum can be used to collect and analyze data from various sensors and equipment in industrial settings to predict when maintenance is needed.

- Energy management: Exaquantum can be used to collect and analyze data related to energy usage and performance in buildings and other facilities.

- Autonomous operation: Exaquantum can be used to support the development of autonomous industrial systems by providing real-time data analysis and decision-making capabilities.

- Digital twins: Exaquantum can be used to create digital twins of industrial processes and systems, which can be used for simulation, analysis, and optimization.

- Cybersecurity: Exaquantum can be used in industrial settings to improve cybersecurity by monitoring and analysing data from various sensors and devices for anomalies and security threats.

The top players in the Locomotive market are OSIsoft, Honeywell Process Solutions, ABB, Aspen Technology.

Some of the key industries that are going to get impacted because of the growth of Exaquantum are,

1. Oil and Gas: Exaquantum can help oil and gas companies optimize their operations by providing real-time data on production, maintenance, and safety.

2. Chemicals: Exaquantum can help chemical companies optimize their processes, reduce costs, and improve quality.

3. Power and Utilities: Exaquantum can help power and utility companies optimize their energy generation and distribution processes, reducing costs and improving reliability.

4. Mining: Exaquantum can help mining companies optimize their operations by providing real-time data on production, maintenance, and safety.

5. Manufacturing: Exaquantum can help manufacturing companies optimize their production processes, reducing costs and improving quality.

6. Transportation: By providing real-time data on performance, maintenance, and safety, Exaquantum can assist transportation companies in optimising their operations.

Speak to our Analyst today to know more about Exaquantum Market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sequence of Events Recorder Market