Sensitive Data Discovery Market by Component, Organization Size, Deployment Mode, Application (Security and Risk Management, Compliance Management, Asset Management), Vertical (BFSI, Healthcare and Life Sciences), and Region - Global Forecast to 2026

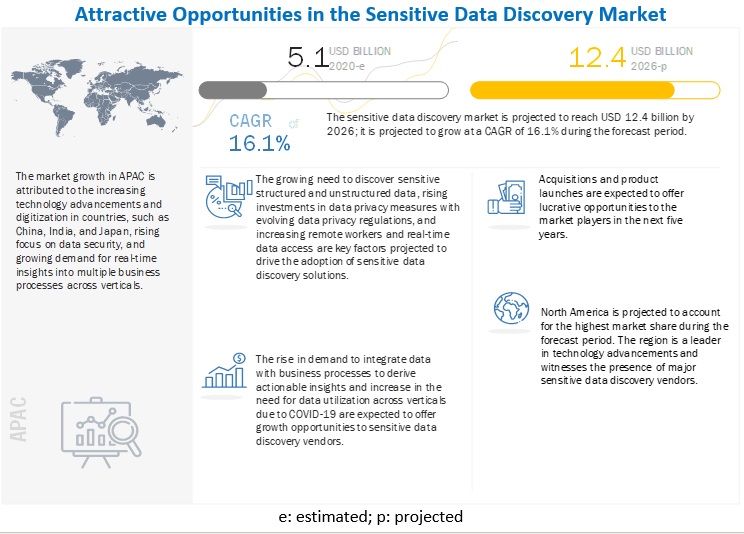

[295 Pages Report] The global Sensitive Data Discovery Market size was valued USD 5.1 billion in 2020 and is projected to reach USD 12.4 billion by 2026, at a CAGR of 16.1% during the forecast period. The growing importance of data-driven decision-making, rising trends in self-service business intelligence (BI) tools, and insight generation from a growing number of multi-structured data sources are expected to drive the adoption of the sensitive data discovery solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

Businesses providing sensitive data discovery solutions and services are expected to witness a minor decline in their growth for a short span of time. However, the focus on vaccine development, adoption work from home initiatives, and eHealth are leading to explosion of structured and unstructured data, which needs to be discovered and managed efficiently to derive insights. The market would witness a minimal slowdown in 2020, followed by positive growth during the forecast period. The global spread of COVID-19 has led numerous privacy, data protection, security and compliance questions. These challenges are driving the need for companies and organizations to ensure their sensitive data discovery solutions not only secure, but also support data analysis for strategic business decisions.

Sensitive Data Discovery Market Dynamics

Driver: Growing need to discover sensitive structured and unstructured data

Unlike structured data that resides in well-protected IT perimeters, sensitive content exists in unstructured formats such as office documents, files, or images, and is distributed and published through file sharing, social media, and email. Most enterprises across industries realize the growing importance of collecting their data and gaining meaningful analysis for improving business growth and building competitive advantages. Every day, a huge volume of data is generated in various forms and from different sources. Every organization generates a vast amount of data due to the use of IoT devices, sensors, and geospatial devices. Moreover, they generate insights from structured and unstructured data by unifying them into specific formats that could be used by end users to validate and understand, and help them accomplish their daily tasks. Sensitive data discovery is an integral part that helps in creating and maintaining an effective data security plan.

Restraint: Lack of skilled professional workforce

Significant technology advancements have taken place in the ICT domain. IoT, AI, Machine Learning (ML), cloud, analytics, and sensitive data discovery are a few trends that have gained tremendous traction in the past few years. Sensitive data discovery is transforming businesses by providing actionable insights. However, companies do face issues while extracting these insights. Data across organizations grows constantly, and organizations often fail to capitalize on opportunities and extract actionable data. Organizations also fail to identify where they need to allocate their resources, which results in not deriving the full potential of sensitive data discovery. Most organizations still cannot harness the complete benefits of sensitive data discovery tools in cloud due to the lack of awareness and professional expertise to optimally utilize cloud-based sensitive data discovery solutions.

Opportunity: Rise in demand to integrate data with business processes to derive actionable insights

In today’s digital and big data era, data can be structured or unstructured, and most of it resides outside enterprises. Thus, it has become crucial to have a platform that can be used to integrate various information, perform a lot of discovery-based analysis (to separate noise from real signals), perform analytics on top of it, and finally consume it through an intuitive visualization interface. This avenue is now being explored in the form of a sensitive data discovery platform in many enterprises. The increasing volume of digital information is providing meaningful insights for businesses such as customer trends, shifts in consumer behaviors, the outbreak of epidemics, changing weather patterns, and the rise in crime rate. These data, when managed well, can provide an opportunity to unlock new business avenues and solutions for better governance among business houses and governments. Currently, enterprises need a comprehensive sensitive data discovery platform that can process huge volumes of data in real time to provide meaningful insights. This sensitive data discovery or decision-making platform can assimilate data, structure, refine, provide the exploratory capability, identify and evaluate various patterns, and help make insight-based decisions faster.

Challenge: Data security and privacy concerns

Security threats are projected to grow even further in the future. In the past four years, the financial impact of cybercrimes has increased by nearly 78%, and the time it takes to resolve cyberattacks has doubled. The increase in data from various sources is cumbersome for several IT teams. The inefficiency of managing exabytes and petabytes of data has increased chances of security breaches and data losses. It may seem as if sensitive data discovery is a threat to data privacy. However, the actual threat is poorly managed data. The sensitive data discovery comes with three privacy risks: data breaches, data brokerage, and data discrimination. Data breaches occur when information is retrieved without consent. In most cases, data breaches are the result of out-of-date software, weak passwords, and targeted malware attacks. These incidents can lead to a damaged reputation and financial loss for organizations. The data breaches can be prevented by keeping software up-to-date, changing passwords, and educating employees on best security practices.

Among verticals, the BFSI segment is expected to hold the larger market size during the forecast period

The sensitive data discovery market is segmented based on verticals into BFSI, government, healthcare and life sciences, retail, manufacturing, telecommunications and IT, and other verticals (education, and travel and hospitality). The BFSI vertical is expected to account for the largest market size during the forecast period. The emergence of data analytics in finance has necessitated the development of sensitive data discovery solutions that are capable enough of handling data in real time. Numerous banks have turned to sensitive data discovery solutions for data preparation, integration, and analysis from a variety of internal divisions, including mortgage, loans, consumer and retail banking, individual and corporate lending, and treasury banking.

The on-premises segments is expected to hold the larger market size during the forecast period

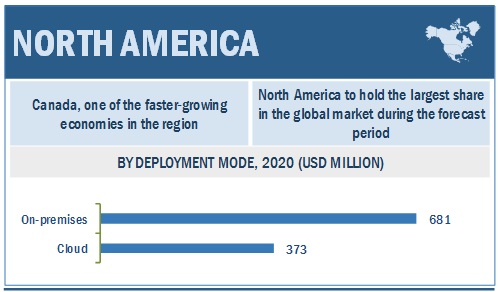

The sensitive data discovery market by deployment mode has been segmented into on-premises and cloud. Cloud is further segmented by type in public cloud, private cloud, and hybrid cloud. The cloud segment is expected to grow at a rapid pace during the forecast period. The high CAGR of the cloud segment can be attributed to the availability of easy deployment options and minimal requirements of capital and time. These factors are supporting the current lockdown scenario of COVID-19 as social distancing and lack of workforce hit the industry, and are expected to drive the adoption of cloud-based sensitive data discovery solutions. Highly secure data encryption and complete data visibility and control feature are responsible for the higher adoption of on-premises-based sensitive data discovery solutions.

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global sensitive data discovery market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The growing awareness for data security and privacy among organizations is expected to fuel the adoption of sensitive data discovery solutions and services in US and Canada. The commercialization of the AI and ML technology, giving rise to increased data generation, and the need for further advancements to leverage its benefits to the maximum are expected to drive the adoption of sensitive data discovery solutions in the region. Furthermore, falling server prices have increased the adoption of cloud computing businesses across North America, fuelling the construction of efficient and sustainable data, and thus boosting the market under consideration.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The sensitive data discovery vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global sensitive data discovery market include IBM (US), Microsoft (US), Oracle (US), AWS (US), Proofpoint (US), Google (US), SolarWinds (US), Micro Focus (UK), PKWARE (US), Thales (France), Spirion (US), Egnyte (US), Netwrix (US), Varonis (US), Digital Guardian (US), Solix (US), Immuta (US), MENTIS (US), Ground Labs (US), Hitachi (Japan), Nightfall (US), Securiti (US), DataGrail (US), Dathena (Singapore), BigID (US), DataSunrise (US), and 1touch.io (US). The study includes an in-depth competitive analysis of these key players in the sensitive data discovery market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2020 |

USD 5.1 billion |

|

Revenue forecast in 2026 |

USD 12.4 billion |

|

Growth Rate |

16.1% CAGR |

|

Market size available for years |

2014–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2026 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, organization size, deployment mode, application, vertical, and region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

IBM (US),Microsoft (US),Oracle (US), AWS (US), Proofpoint (US), Google (US), Micro Focus (UK), SolarWinds (US), PKWARE (US), Thales (France), Spirion (US), Egnyte (US), Netwrix (US), Varonis (US), Digital Guardian (US), Solix (US), Immuta (US), MENTIS (US), Ground Labs (US), Hitachi (Japan), Nightfall (US), Securiti (US), DataGrail (US), Dathena (Singapore), BigID (US), 1touch.io (US), and DataSunrise (US) |

This research report categorizes the sensitive data discovery market based on components, deployment mode, organization size, application, vertical, and region.

By component:

- Solutions

-

Services

- Managed Services

-

Professional Services

- Support and Maintenance

- Deployment and Integration

- Consulting

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By deployment mode:

- On-premises

-

Cloud

- Public Cloud

- Private Cloud

- Hybrid Cloud

By application:

- Security and Risk Management

- Compliance Management

- Asset Management

- Other Applications (Network Management and Access Management)

By vertical:

- BFSI

- Government

- Healthcare and Life Sciences

- Retail

- Manufacturing

- Telecommunications and IT

- Other Verticals (Education, and Travel and Hospitality)

By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In January 2021, Netwrix and Stealthbits merged to address the increasing demand for sensitive data protection. Both companies merged to offer data security and privacy solutions to organizations of all size and in any region around the world.

- In November 2020, PKWARE acquired Dataguise, a company with innovative technology for businesses to discover and protect personal data stored across diverse IT systems and environments. The acquisition will expand PKWARE’s global footprint as it continues the operations of Dataguise’s existing offices in the US, India, Europe, and Canada.

- In October 2020, SolarWinds announced SolarWinds Endpoint Detection and Response (EDR). The solution would be fully integrated with SolarWinds Remote Monitoring and Management (RMM). The integration would allow users to efficiently configure and manage endpoint security while helping mitigate security risks for customers and their business.

- In October 2020, Micro Focus launched a new digital resource, CISO Resource to accelerate enterprise resilience during unprecedented global challenges. The launch of CyberResilient. Com, a digital resource designed to support CISOs and board members as they navigate the shifting demands of the digital economy, and attempt to continue to drive business growth during times of uncertainty.

- In September 2020, IBM launched a new risk-based service IBM Risk Analytics. The solution is designed to help organizations apply the same analytics used for traditional business decisions to cybersecurity spending priorities. The new service creates risk assessments to help clients identify, prioritize and quantify security risk as they weigh decisions such as deploying new technologies, making investments in their business and changing processes.

- In September 2020, Proofpoint launched two new products named Enterprise Data Loss Prevention (DLP) and Nexus People Risk Explorer. The Enterprise DLP solution helps organizations identify and quickly respond to data losses resulting from negligent, compromised, or malicious users. Nexus People Risk Explorer provides a unified view of vulnerable, attacked, and privileged users.

- In May 2020, Google Cloud and Splunk partnered to help customers gain deeper insights from data. This partnership aimed to help organizations drive actionable insights from their data and enable better, faster decisions with real-time visibility across the enterprise.

- In February 2020, Google acquired Looker, a provider of a unified platform for business intelligence, data applications, and embedded analytics. This acquisition would enable Google to extend its analytics offering by defining two capabilities that would define business metrics and provide an analytical platform to make business decisions.

- In June 2019, Oracle introduced a new feature in Oracle Analytics. The new feature would provide AI-powered self-service capabilities. Oracle Analytics with the features of data preparation, visualization, and Natural Language Processing (NLP) would help business analysts get data insights to make business decisions.

Frequently Asked Questions (FAQ):

How big is the Sensitive Data Discovery Market?

What is growth rate of the Sensitive Data Discovery Market?

Who are the key players in Sensitive Data Discovery Market?

Who will be the leading hub for Sensitive Data Discovery Market?

What is the Sensitive Data Discovery Market Segmentation?

What are the key applications end-users looking for sensitive data discovery solutions?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.5.2 SENSITIVE DATA TYPES

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 6 SENSITIVE DATA DISCOVERY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF SENSITIVE DATA DISCOVERY MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF SENSITIVE DATA DISCOVERY THROUGH OVERALL SENSITIVE DATA DISCOVERY SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON MARKET

3 EXECUTIVE SUMMARY (Page No. - 51)

TABLE 4 GLOBAL SENSITIVE DATA DISCOVERY MARKET SIZE AND GROWTH RATE, 2014–2019 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2019–2026 (USD MILLION, Y-O-Y%)

FIGURE 15 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE IN 2020

FIGURE 16 PROFESSIONAL SERVICES SEGMENT TO HOLD HIGHER MARKET SHARE IN 2020

FIGURE 17 DEPLOYMENT AND INTEGRATION SEGMENT TO HOLD LARGEST MARKET SIZE IN 2020

FIGURE 18 LARGE ENTERPRISES SEGMENT TO HOLD HIGHER MARKET SHARE IN 2020

FIGURE 19 ON-PREMISES SEGMENT TO HOLD LARGER MARKET SIZE IN 2020

FIGURE 20 PUBLIC CLOUD SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2020

FIGURE 21 SECURITY AND RISK MANAGEMENT SEGMENT TO HOLD LARGEST MARKET SIZE IN 2020

FIGURE 22 BANKING, INSURANCE, AND FINANCIAL SERVICES VERTICAL TO HOLD HIGHEST MARKET SHARE IN 2020

FIGURE 23 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN SENSITIVE DATA DISCOVERY MARKET

FIGURE 24 GROWING NEED TO DISCOVER SENSITIVE STRUCTURED AND UNSTRUCTURED DATA AND INCREASING IMPORTANCE OF DATA UTILIZATION DURING COVID-19 SCENARIO AMONG ORGANIZATIONS TO DRIVE MARKET GROWTH

4.2 MARKET, TOP THREE APPLICATIONS

FIGURE 25 COMPLIANCE MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR FROM 2020 TO 2026

4.3 MARKET, BY REGION

FIGURE 26 NORTH AMERICA TO ACCOUNT FOR HIGHEST SHARE IN MARKET IN 2020

4.4 NORTH AMERICAN MARKET, BY DEPLOYMENT MODE AND APPLICATION

FIGURE 27 ON-PREMISES AND SECURITY AND RISK MANAGEMENT SEGMENTS TO ACCOUNT FOR HIGH MARKET SHARES IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 60)

5.1 INTRODUCTION

5.2 SENSITIVE DATA DISCOVERY: EVOLUTION

FIGURE 28 EVOLUTION OF SENSITIVE DATA DISCOVERY MARKET

5.3 SENSITIVE DATA DISCOVERY: ARCHITECTURE

FIGURE 29 MARKET ARCHITECTURE

5.4 MARKET DYNAMICS

FIGURE 30 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

5.4.1 DRIVERS

5.4.1.1 Growing need to discover sensitive structured and unstructured data

5.4.1.2 Increasing investments in data privacy measures with the evolving data privacy regulations

5.4.1.3 Rise of remote workers and real-time data access to drive the demand for cloud-based sensitive data discovery solutions

5.4.2 RESTRAINTS

5.4.2.1 Difficulties in justifying RoI from sensitive data discovery solutions

5.4.2.2 Lack of skilled professional workforce

5.4.3 OPPORTUNITIES

5.4.3.1 Rise in demand to integrate data with business processes to derive actionable insights

5.4.3.2 Increase in the need for data utilization across verticals due to COVID-19

5.4.4 CHALLENGES

5.4.4.1 Data security and privacy concerns

5.4.4.2 Incoherency in enterprise-wide data management standards and governance

5.4.4.3 Major dependence on manual systems for sensitive data discovery

5.4.5 CUMULATIVE GROWTH ANALYSIS

5.5 SENSITIVE DATA DISCOVERY MARKET: ECOSYSTEM

FIGURE 31 MARKET ECOSYSTEM

5.6 CASE STUDY ANALYSIS

5.6.1 DEPARTMENT OF HEALTH AND HUMAN SERVICES USED SOLIX SECURE TEST AND DEVELOPMENT SOLUTION FOR DEVELOPMENT OF UNIFIED FINANCIAL MANAGEMENT SYSTEM

5.6.2 LEADING US-BASED UTILITY COMPANY IMPLEMENTED SOX COMPLIANCE WITH MENTIS

5.6.3 SITTERCITY USES CLOUD DATA LOSS PROTECTION API TO DETECT AND REDACT PERSONAL DATA

5.6.4 LEADING AIRLINES IN DUBAI IMPLEMENTED MENTIS FOR STATIC AND DYNAMIC DATA MASKING

5.6.5 FLEETPRIDE TRANSFORMED SUPPLY CHAIN MANAGEMENT WITH IBM COGNOS ANALYTICS

5.6.6 GRÄNGES REDUCES DATA SECURITY BREACHES WITH MICROSOFT AZURE INFORMATION PROTECTION

5.6.7 TINUITI CENTRALIZED 100+ DATA SOURCES THROUGH TABLEAU PREP

5.6.8 STATISTICS ESTONIA INCREASES INFORMATION DELIVERY THROUGH SAS DATA DISCOVERY

5.6.9 CISCOWEBX IMPLEMENTED CLOUDERA SENSITIVE DATA DISCOVERY FOR IMPROVING CUSTOMER EXPERIENCE

5.6.10 EDMUNDS USES AMAZON MACIE TO INCREASE DATA VISIBILITY AND SECURITY

5.6.11 CENTERS FOR MEDICARE AND MEDICAID SERVICES ADOPTED PKWARE SMARTCRYPT TO ENHANCE PROTECTION FOR SENSITIVE MEDICAL DATA

5.6.12 ILLINOIS COLLEGE SELECTED SPIRION TO MAKE DATA PRIVACY PROGRAM SMARTER

5.6.13 FIRST NATIONAL BANK MINNESOTA SELECTED NETWRIX SOLUTION TO SECURE SENSITIVE DATA AND REBUILD ACTIVE DIRECTORY

5.7 SENSITIVE DATA DISCOVERY MARKET: COVID-19 IMPACT

FIGURE 32 MARKET TO WITNESS SLOWDOWN IN GROWTH IN 2020

5.8 PATENT ANALYSIS

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 33 SUPPLY CHAIN ANALYSIS

5.10 VALUE CHAIN ANALYSIS

FIGURE 34 VALUE CHAIN ANALYSIS

5.11 TECHNOLOGY ANALYSIS

5.11.1 ARTIFICIAL INTELLIGENCE AND SENSITIVE DATA DISCOVERY

5.11.2 BLOCKCHAIN AND SENSITIVE DATA DISCOVERY

5.11.3 INTERNET OF THINGS AND SENSITIVE DATA DISCOVERY

5.12 PRICING MODEL ANALYSIS

5.13 PORTER’S FIVE FORCE ANALYSIS

FIGURE 35 PORTER’S FIVE FORCE ANALYSIS

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF SUPPLIERS

5.13.4 BARGAINING POWER OF BUYERS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

6 SENSITIVE DATA DISCOVERY MARKET, BY COMPONENT (Page No. - 86)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 36 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 6 MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 7 MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

6.2 SOLUTIONS

TABLE 8 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 9 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 SERVICES

FIGURE 37 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 10 SERVICES: SENSITIVE DATA DISCOVERY MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 11 SERVICES: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 12 SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 13 SERVICES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 38 CONSULTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 14 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 15 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 16 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 17 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.1.1 Consulting

TABLE 18 CONSULTING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 19 CONSULTING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.1.2 Support and maintenance

TABLE 20 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 21 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.1.3 Deployment and integration

TABLE 22 DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 23 DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.2 MANAGED SERVICES

TABLE 24 MANAGED SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 25 MANAGED SERVICES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 SENSITIVE DATA DISCOVERY MARKET, BY ORGANIZATION SIZE (Page No. - 100)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 39 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 26 MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 27 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

7.2 LARGE ENTERPRISES

TABLE 28 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 29 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 30 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 31 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8 SENSITIVE DATA DISCOVERY MARKET, BY DEPLOYMENT MODE (Page No. - 106)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODES: MARKET DRIVERS

8.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 40 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 32 MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 33 MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

8.2 ON-PREMISES

TABLE 34 ON-PREMISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 35 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3 CLOUD

FIGURE 41 HYBRID CLOUD SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 36 CLOUD: SENSITIVE DATA DISCOVERY MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 37 CLOUD: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 CLOUD: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 39 CLOUD: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3.1 PUBLIC CLOUD

TABLE 40 PUBLIC CLOUD MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 41 PUBLIC CLOUD MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3.2 PRIVATE CLOUD

TABLE 42 PRIVATE CLOUD MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 43 PRIVATE CLOUD MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3.3 HYBRID CLOUD

TABLE 44 HYBRID CLOUD MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 45 HYBRID CLOUD MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 SENSITIVE DATA DISCOVERY MARKET, BY APPLICATION (Page No. - 116)

9.1 INTRODUCTION

9.1.1 APPLICATIONS: MARKET DRIVERS

9.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 42 COMPLIANCE MANAGEMENT SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 46 MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 47 MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2 SECURITY AND RISK MANAGEMENT

TABLE 48 SECURITY AND RISK MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 49 SECURITY AND RISK MANAGEMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.3 ASSET MANAGEMENT

TABLE 50 ASSET MANAGEMENT: SENSITIVE DATA DISCOVERY MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 51 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.4 COMPLIANCE MANAGEMENT

TABLE 52 COMPLIANCE MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 53 COMPLIANCE MANAGEMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.5 OTHER APPLICATIONS

TABLE 54 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 55 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10 SENSITIVE DATA DISCOVERY MARKET, BY VERTICAL (Page No. - 125)

10.1 INTRODUCTION

10.1.1 VERTICALS: MARKET DRIVERS

10.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 43 HEALTHCARE AND LIFE SCIENCES VERTICAL TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 56 MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 57 MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 58 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 59 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.3 GOVERNMENT

TABLE 60 GOVERNMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 61 GOVERNMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.4 HEALTHCARE AND LIFE SCIENCES

TABLE 62 HEALTHCARE AND LIFE SCIENCES: SENSITIVE DATA DISCOVERY MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 63 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.5 RETAIL

TABLE 64 RETAIL: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 65 RETAIL: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.6 MANUFACTURING

TABLE 66 MANUFACTURING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 67 MANUFACTURING: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.7 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY

TABLE 68 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 69 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.8 OTHER VERTICALS

TABLE 70 OTHER VERTICALS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 71 OTHER VERTICALS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11 SENSITIVE DATA DISCOVERY MARKET, BY REGION (Page No. - 139)

11.1 INTRODUCTION

FIGURE 44 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 45 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 72 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 73 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATIONS

11.2.3.1 Health Insurance Portability and Accountability Act of 1996

11.2.3.2 California Consumer Privacy Act

11.2.3.3 Gramm–Leach–Bliley Act

11.2.3.4 Health Information Technology for Economic and Clinical Health Act

11.2.3.5 Sarbanes Oxley Act

11.2.3.6 Federal Information Security Management Act

11.2.3.7 Payment Card Industry Data Security Standard

11.2.3.8 Federal Information Processing Standards

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

TABLE 74 NORTH AMERICA: SENSITIVE DATA DISCOVERY MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 83 NORTH AMERICA: SENSITIVE DATA DISCOVERY MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY CLOUD TYPE, 2014–2019 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY CLOUD TYPE, 2019–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

11.2.4 UNITED STATES

11.2.5 CANADA

11.3 EUROPE

11.3.1 EUROPE: MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATIONS

11.3.3.1 General Data Protection Regulation

11.3.3.2 European Committee for Standardization

11.3.3.3 European Technical Standards Institute

TABLE 92 EUROPE: SENSITIVE DATA DISCOVERY MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2026 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY CLOUD TYPE, 2014–2019 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY CLOUD TYPE, 2019–2026 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

11.3.4 UNITED KINGDOM

11.3.5 GERMANY

11.3.6 FRANCE

11.3.7 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: SENSITIVE DATA DISCOVERY MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATIONS

11.4.3.1 Privacy Commissioner for Personal Data

11.4.3.2 Act on the Protection of Personal Information

11.4.3.3 Critical Information Infrastructure

11.4.3.4 International Organization for Standardization 27001

11.4.3.5 Personal Data Protection Act

FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 110 ASIA PACIFIC: SENSITIVE DATA DISCOVERY MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY CLOUD TYPE, 2014–2019 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY CLOUD TYPE, 2019–2026 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

11.4.4 CHINA

11.4.5 JAPAN

11.4.6 INDIA

11.4.7 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

11.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

11.5.3.2 Cloud Computing Framework

11.5.3.3 GDPR Applicability in the Kingdom of Saudi Arabia (KSA)

11.5.3.4 Protection of Personal Information Act

TABLE 128 MIDDLE EAST AND AFRICA: SENSITIVE DATA DISCOVERY MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2026 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 137 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 138 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CLOUD TYPE, 2014–2019 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CLOUD TYPE, 2019–2025 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.5.4 KINGDOM OF SAUDI ARABIA

11.5.5 UNITED ARAB EMIRATES

11.5.6 SOUTH AFRICA

11.5.7 REST OF MIDDLE EAST AND AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: SENSITIVE DATA DISCOVERY MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATIONS

11.6.3.1 Brazil Data Protection Law

11.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 146 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014-2019 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2026 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2026 (USD MILLION)

TABLE 156 LATIN AMERICA: SENSITIVE DATA DISCOVERY MARKET SIZE, BY CLOUD TYPE, 2014–2019 (USD MILLION)

TABLE 157 LATIN AMERICA: MARKET SIZE, BY CLOUD TYPE, 2019–2026 (USD MILLION)

TABLE 158 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET SIZE, BY COUNTRY, DONE2014–2019 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

11.6.4 BRAZIL

11.6.5 MEXICO

11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 199)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 48 MARKET EVALUATION FRAMEWORK: PARTNERSHIPS AND EXPANSIONS FROM 2018 TO 2020

12.3 MARKET SHARE, 2020

FIGURE 49 MICROSOFT TO LEAD SENSITIVE DATA DISCOVERY MARKET IN 2020

12.4 HISTORICAL REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 50 REVENUE ANALYSIS OF KEY MARKET PLAYERS

12.5 KEY PLAYERS IN MARKET, 2020

FIGURE 51 RANKING OF KEY PLAYERS, 2020

12.6 KEY MARKET DEVELOPMENTS

12.6.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 164 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2020

12.6.2 BUSINESS EXPANSIONS

TABLE 165 BUSINESS EXPANSIONS, 2019-2020

12.6.3 MERGERS AND ACQUISITIONS

TABLE 166 MERGERS AND ACQUISITIONS, 2018–2021

12.6.4 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS

TABLE 167 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS, 2018–2020

12.7 COMPANY EVALUATION MATRIX, 2020

12.7.1 STAR

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE

12.7.4 PARTICIPANTS

FIGURE 52 SENSITIVE DATA DISCOVERY MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

12.7.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 53 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

12.7.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 54 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

12.8 STARTUP/SME EVALUATION MATRIX, 2020

12.8.1 PROGRESSIVE COMPANIES

12.8.2 RESPONSIVE COMPANIES

12.8.3 DYNAMIC COMPANIES

12.8.4 STARTING BLOCKS

FIGURE 55 SENSITIVE DATA DISCOVERY MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

12.8.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 56 PRODUCT PORTFOLIO ANALYSIS OF TOP STARTUPS IN MARKET

12.8.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 57 BUSINESS STRATEGY EXCELLENCE OF TOP STARTUPS IN MARKET

13 COMPANY PROFILES (Page No. - 214)

13.1 INTRODUCTION

(Business overview, Solutions and services offered, Recent developments & MnM View)*

13.2 MICROSOFT

FIGURE 58 MICROSOFT: COMPANY SNAPSHOT

13.3 IBM

FIGURE 59 IBM: COMPANY SNAPSHOT

13.4 ORACLE

FIGURE 60 ORACLE: COMPANY SNAPSHOT

13.5 AMAZON WEB SERVICES

FIGURE 61 AMAZON WEB SERVICES: COMPANY SNAPSHOT

13.6 PROOFPOINT

FIGURE 62 PROOFPOINT: COMPANY SNAPSHOT

13.7 GOOGLE

FIGURE 63 GOOGLE: COMPANY SNAPSHOT

13.8 MICRO FOCUS

FIGURE 64 MICRO FOCUS: COMPANY SNAPSHOT

13.9 THALES

FIGURE 65 THALES: COMPANY SNAPSHOT

13.10 SOLARWINDS

FIGURE 66 SOLARWINDS: COMPANY SNAPSHOT

13.11 NETWRIX

13.12 PKWARE

13.13 HITACHI

13.14 SOLIX

13.15 MENTIS

13.16 GROUND LABS

13.17 IMMUTA

13.18 SPIRION

13.19 EGNYTE

13.20 VARONIS

13.21 DIGITAL GUARDIAN

13.22 STARTUP/SME PROFILES

13.22.1 NIGHTFALL

13.22.2 SECURITI

13.22.3 DATASUNRISE

13.22.4 DATAGRAIL

13.22.5 DATHENA

13.22.6 BIGID

13.22.7 1TOUCH.IO

*Details on Business overview, Solutions and services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 274)

14.1 INTRODUCTION

14.2 BUSINESS INTELLIGENCE MARKET - GLOBAL FORECAST TO 2025

14.2.1 MARKET DEFINITION

14.2.2 MARKET OVERVIEW

14.2.2.1 Business intelligence market, by component

TABLE 168 BUSINESS INTELLIGENCE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 169 BUSINESS INTELLIGENCE MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

14.2.2.2 Business intelligence market, by deployment mode

TABLE 170 BUSINESS INTELLIGENCE MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 171 BUSINESS INTELLIGENCE MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

14.2.2.3 Business intelligence market, by organization size

TABLE 172 BUSINESS INTELLIGENCE MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 173 BUSINESS INTELLIGENCE MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

14.2.2.4 Business intelligence market, by business function

TABLE 174 BUSINESS INTELLIGENCE MARKET SIZE, BY BUSINESS FUNCTION, 2016–2019 (USD MILLION)

TABLE 175 BUSINESS INTELLIGENCE MARKET SIZE, BY BUSINESS FUNCTION, 2019–2025 (USD MILLION)

14.2.2.5 Business intelligence market, by industry vertical

TABLE 176 BUSINESS INTELLIGENCE MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 177 BUSINESS INTELLIGENCE MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

14.2.2.6 Business intelligence market, by region

TABLE 178 BUSINESS INTELLIGENCE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 179 BUSINESS INTELLIGENCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

14.3 DATA CLASSIFICATION MARKET - GLOBAL FORECAST TO 2023

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 180 GLOBAL DATA CLASSIFICATION MARKET SIZE AND GROWTH RATE, 2016–2023 (USD MILLION, Y-O-Y %)

14.3.2.1 Data classification market, by component

TABLE 181 DATA CLASSIFICATION MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

14.3.2.2 Data classification market, by methodology

TABLE 182 DATA CLASSIFICATION MARKET SIZE, BY METHODOLOGY, 2016–2023 (USD MILLION)

14.3.2.3 Data classification market, by application

TABLE 183 DATA CLASSIFICATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

14.3.2.4 Data classification market, by vertical

TABLE 184 DATA CLASSIFICATION MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

14.3.2.5 Data classification market, by region

TABLE 185 DATA CLASSIFICATION MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

15 APPENDIX (Page No. - 284)

15.1 INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

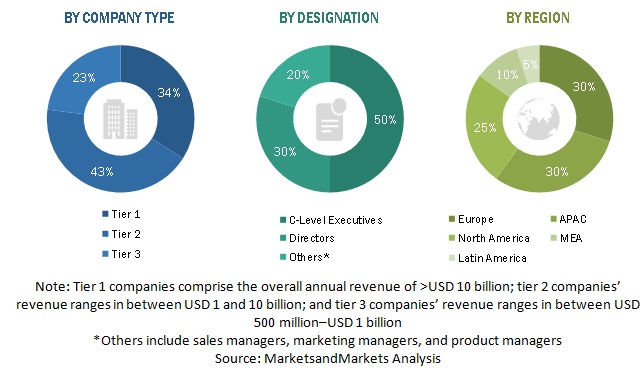

The study involved four major activities in estimating the current market size of sensitive data discovery market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the sensitive data discovery market.

Secondary Research

In the secondary research process, various secondary sources, such as Information Discovery and Delivery, Journal of Data Mining and Knowledge Discovery, and Data Science Journal, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases & investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from sensitive data discovery solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the sensitive data discovery market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global sensitive data discovery market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the sensitive data discovery market by component (solutions and services), organization size, deployment mode, application, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

- To analyze the impact of the COVID-19 pandemic on the sensitive data discovery market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American sensitive data discovery market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American overy market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

BODY>

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sensitive Data Discovery Market