Data Classification Market by Component (Solutions (Standalone and Integrated) and Services), Application (Access Control, GRC, Web, Mobile & Email Protection, and Centralized Management), Methodology, Vertical, and Region - Global Forecast to 2023

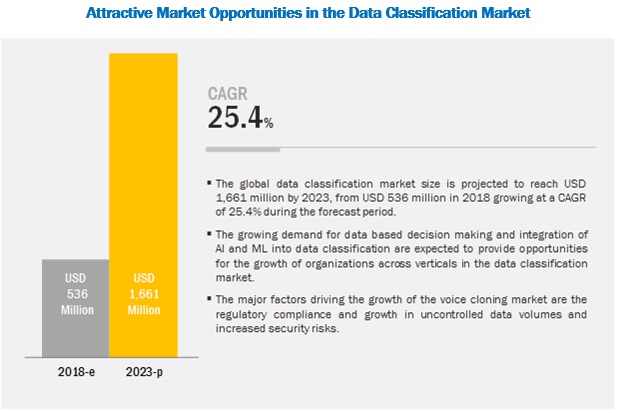

[174 Pages Report] MarketsandMarkets forecasts the global data classification market size to grow from USD 536 million in 2018 to USD 1,661 million by 2023, at a Compound Annual Growth Rate (CAGR) of 25.4% during 20182023. Major growth drivers for the market include regulatory compliance, growth in uncontrolled data volumes, and increased security risks.

In the data classification market by application, web, mobile and email protection application to grow at the highest CAGR during the forecast period

Data classification in web, mobile, and email protection is playing a crucial role, as the classification of data will help in determining baseline security controls for the protection of data. Data classification solution providers offer tools that provide a classification label on an email or document instantly alerts the user to the sensitivity of the information they are dealing with, immediately reducing the chance of inadvertent loss or mishandling. By providing users with simple-to-use tools that allow them to classify sensitive information and empower people across the organization to proactively improve information security.

In the data classification market by methodology, the user-based classification segment to hold the largest market size during the forecast period

User-based classification relies on manual, end-user selection. A user-based classification approach allows data owners to apply their knowledge to improve classification accuracy. User classification relies on the data owner to apply the tag to the document at creation, or after modification. Moreover, the user-based classification provides real-time alerts for potentially risky behavior allowing users to self-correct.

In the data classification market by solution, the standalone solution segment to grow at a higher CAGR during the forecast period

The solution segment is subsegmented into integrated and standalone solutions. Standalone solution providers offer best-of-breed data classification solutions to end users to categorize, label, and protect sensitive data. The solution providers enable organizations to better manage and control their data, streamline operational performance, and improve return on technology investment.

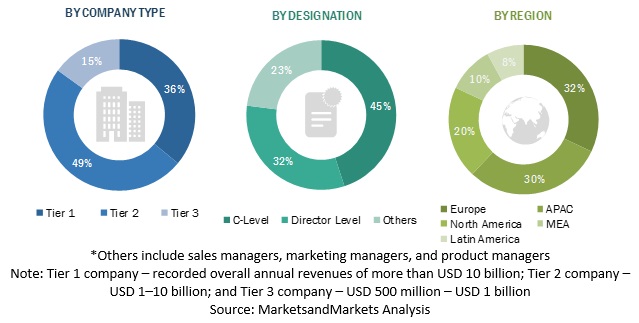

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global data classification market, while APAC to grow at the highest CAGR during the forecast period. In APAC, the highest growth rate can be attributed to the heavy investments made by private and public sectors for enhancing their marketing technologies, resulting in an increased demand for data classification solutions for data security and privacy. North America is expected to be the leading region in terms of adoption and development of the data classification solutions. Growing investments in data management strategies, presence of maximum number of data classification solution providers, and increasing government spending on analytics-based technologies are expected to contribute to the market growth during the forecast period.

Key Data Classification Market Players

Major vendors in the global data classification market include IBM (US), Google (US), Microsoft (US), AWS (US), Symantec (US), OpenText (Canada), Covata (Australia), Boldon James (England), Varonis (US), Innovative Routines International (IRI), Informatica (US), Dataguise (US), Spirion (US), Digital Guardian (US), Titus (Canada), Netwrix Corporation (US), PKWARE (US), GTB Technologies (US), Forcepoint (US), Sienna Group (US), MinerEye (Israel), SoftWorks AI (US), Expert TechSource (India), Clearswift (UK), Seclore (US), and Janusnet (Australia). They have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to further expand their presence in the global market.

IBM, a large player, delivers solutions in the data classification market. IBMs solutions use Watsons capability for various applications. The company is focusing on scaling its platforms, delivering productivity through automation, infusing AI into its offerings, and investing to expand its cloud infrastructure. The company uses organic and inorganic growth strategies to improve its market share. As a part of its organic growth strategies, IBM introduced PowerAI, a deep learning software designed to address the challenges faced by data scientists and developers in May 2017. It simplifies the development experience with tools and data preparation while reducing the time required for AI system training from weeks to hours.

Google is one of the key technology players in the data classification market. It relies heavily on its organic growth strategy and aims for launching innovative next-gen products. The company is significantly investing in Research and Development (R&D) activities in areas of strategic focus, such as advertising, cloud, machine learning, and search, as well as in innovative products and services. The company is adopting an organic growth strategy to gain a competitive edge in the market. For instance, in November 2018, Google updated its Data Loss Prevention (DLP) API, a tool that helps users better understand and manage sensitive data. Google added new manipulation techniques in the tool, including redaction, masking, and tokenization. The DLP API provides programmatic access to a powerful, sensitive data inspection, classification, and de-identification platform.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component, Deployment, Methodology, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA) |

|

Companies covered |

IBM (US), Google (US), Microsoft (US), AWS (US), Symantec (US), OpenText (Canada), Covata (Australia), Boldon James (England), Varonis (US), Innovative Routines International (IRI), Informatica (US), Dataguise (US), Spirion (US), Digital Guardian (US), Titus (Canada), Netwrix Corporation (US), PKWARE (US), GTB Technologies (US), Forcepoint (US), Sienna Group (US), MinerEye (Israel), SoftWorks AI (US), Expert TechSource (India), Clearswift (UK), Seclore (US), and Janusnet (Australia) |

This research report categorizes the data classification market based on component, deployment, methodology, application, vertical, and region.

Based on Components, the data classification market has been segmented as follows:

- Solutions

- Standalone

- Integrated

- Services

- Professional Services

- Managed Services

Based on Deployment, the data classification market has been segmented as follows:

- On-premises

- Cloud

Based on Methodology, the data classification market has been segmented as follows:

- Content-based Classification

- Context-based Classification

- User-based Classification

Based on Applications, the data classification market has been segmented as follows:

- Access Control

- Governance and Regulatory Compliance

- Web, Mobile, and Email Protection

- Centralized Management

Based on Verticals, the data classification market has been segmented as follows:

- BFSI

- Healthcare and Lifesciences

- Government and Defense

- Education

- Telecom

- Media and Entertainment

- Others (Retail and Ecommerce, Manufacturing, and Energy and Utilities)

Based on Regions, the data classification market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Critical questions the report answers:

- What are the current trends that are driving the data classification market?

- What are the steps that vendors follow for effective data classification process?

- Where will all these developments take the industry in the mid to long term?

- Which are the vendors in the market and competitive analysis?

- What are the drivers and challenges of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Forecast

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the Market

4.2 Market Top 3 Applications

4.3 Market By Region

4.4 Data Classification Market in North America, By Application and Methodology

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Mandatory Compliance With Stringent Regulations

5.2.1.2 Growth in Uncontrolled Data Volumes and Increased Security Risks

5.2.2 Restraints

5.2.2.1 Complicated Classification Schemes and Terminologies

5.2.3 Opportunities

5.2.3.1 Integration of AI and ML Into Data Classification

5.2.3.2 Growing Demand for Data Driven Decision-Making Process

5.2.4 Challenges

5.2.4.1 Lack of Awareness About Data Classification

5.2.4.2 Data Pattern Complexities Involved in Data Classification

5.3 Use Cases

5.3.1 Introduction

5.3.1.1 Use Case: Scenario 1

5.3.1.2 Use Case: Scenario 2

5.3.1.3 Use Case: Scenario 3

5.3.1.4 Use Case: Scenario 4

5.3.1.5 Use Case: Scenario 5

5.4 Regulatory Implications

5.4.1 Introduction

5.4.2 Sarbanes Oxley Act (SOX)

5.4.3 National Institute of Standards and Technology Special Publication (Nist Sp) 800-53

5.4.4 Payment Card Industry Data Security Standard (PCI DSS)

5.4.5 American Institute of Certified Public Accountants (AICPA) SOC 2

5.4.6 General Data Protection Regulation (GDPR)

5.4.7 Health Insurance Portability and Accountability Act (HIPAA)

5.5 Effective Data Classification Process

6 Data Classification Market, By Component (Page No. - 46)

6.1 Introduction

6.2 Solutions

6.2.1 Standalone Solution

6.2.1.1 Increasing Demand for Advanced Level of Data Classification Capabilities for Strengthening Data Security to Drive the Growth of the Standalone Solution

6.2.2 Integrated Solution

6.2.2.1 Growing Adoption of Integrated Solution as It Integrates Various Data Protection Features Within A Single Solution

6.3 Services

6.3.1 Professional Services

6.3.1.1 Technicalities Involved in Implementing Data Classification Solutions to Boost the Demand for Professional Services

6.3.2 Managed Services

6.3.2.1 Requirement for Managed Services to Increase With Rising Deployment of Data Classification Solutions

7 Data Classification Market, By Methodology (Page No. - 54)

7.1 Introduction

7.2 Content-Based Classification

7.2.1 Companies to Adopt Content-Based Classification to Protect the Regulated Data

7.3 Context-Based Classification

7.3.1 Need to Protect Ip Data to Drive the Adoption of Context-Based Classification Solutions

7.4 User-Based Classification

7.4.1 Need to Enhance Accuracy With User-Based Classification to Drive Its Demand

8 Data Classification Market By Application (Page No. - 59)

8.1 Introduction

8.2 Access Control

8.2.1 Increasing Criticality for Strengthening Data Access Control Within an Organization to Boost the Growth of the Application

8.3 Governance, Risk, and Compliance

8.3.1 GRC Application to Grow Rapidly in the Market With Increasing Data Privacy Rules and Regulations

8.4 Web, Mobile, and Email Protection

8.4.1 The Need to Safeguard the Sensitive Data Leakage Outside an Enterprise to Boost the Demand for Web, Mobile, and Email Protection

8.5 Centralized Management

8.5.1 Need to Centralize the Overall Enterprises Data to Fuel the Growth of the Centralized Management Application

9 Data Classification Market By Vertical (Page No. - 64)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.2.1 Growing Need to Protect the Sensitive Information in the BFSI Vertical to Drive the Adoption of Data Classification Solutions

9.3 Healthcare and Life Sciences

9.3.1 Increasing Need to Safeguard the Health Information of Patients for Delivering Quality Care to Drive the Adoption of Data Classification Solutions

9.4 Government and Defense

9.4.1 Government to Adopt Data Classification Solutions for Stringent Regulatory Compliance and Data Security

9.5 Education

9.5.1 Increasing Need to Protect Students Data for Effective Workload Management to Drive the Adoption of Data Classification Solutions

9.6 Telecom

9.6.1 Growing Demand to Secure Large Volumes of Data for Enhanced Operational Efficiency to Pave the Way for the Telecom Industry to Adopt Data Classification Solutions

9.7 Media and Entertainment

9.7.1 Media and Entertainment Firms to Adopt Data Classification Tools to Understand Customer Behavior and Enhance Marketing Strategies

9.8 Others

10 Data Classification Market, By Region (Page No. - 73)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Growing Opportunities to Create Data Security Based Applications Fueling the Demand for Data Classification in the Us

10.2.2 Canada

10.2.2.1 Canada to Witness an Increase in Investments and Research Activities

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 Growing Investments to Offer More Opportunities to Deploy Data Classification Solutions

10.3.2 Germany

10.3.2.1 Increasing Adoption of Data Classification Solutions Across Major Verticals is Expected to Drive the Market in Germany

10.3.3 France

10.3.3.1 Data Classification to Gain Popularity in France Due to Favorable Investment Climate

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Increasing Dependency on the Internet to Create the Demand for Data Classification Solutions in China

10.4.2 Japan

10.4.2.1 Strengthening Regulatory and Compliance Landscape and the Mandate to Abide By Data Privacy Laws to Increase the Adoption of Data Classification Solutions in Japan

10.4.3 India

10.4.3.1 Government Push to Adopt Advanced Technologies Would Lead to Increased Demand for Data Classification Solution in India

10.4.4 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Israel

10.5.1.1 Regulatory Compliances Backed By the Presence of Multiple Data Classification Vendors Would Lead to Adoption of Data Classification Solutions

10.5.2 South Africa

10.5.2.1 Increasing Adoption of Advanced Technologies to Fuel the Need to Classify and Protect Data

10.5.3 United Arab Emirates

10.5.3.1 Complex Legal, Regulatory, and Economic Resolutions to Compel Organizations to Adopt Data Classification Solutions

10.5.4 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Growth in Cyber-Attacks Leading to Strict Regulations to Secure Regulated Data Fueling the Demand for Data Classification Solution in Brazil

10.6.2 Mexico

10.6.2.1 Increase in the Number of Internet Users and Cross-Border Issues to Create the Demand for Data Classification Solutions

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 103)

11.1 Overview

11.2 Ranking of Key Players, 2018

11.3 Competitive Scenario

11.3.1 New Product/Service Launches and Product/Service Enhancements

11.3.2 Agreements and Partnerships

11.3.3 Acquisitions

11.3.4 Expansions

12 Company Profiles (Page No. - 112)

12.1 IBM

(Business Overview, Products,Solutions, & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 Google

12.3 Microsoft

12.4 AWS

12.5 Symantec

12.6 Opentext

12.7 Boldon James

12.8 Covata

12.9 Varonis

12.10 Innovative Routines International (IRI), Inc.

12.11 Minereye

12.12 Pkware, Inc.

12.13 Informatica

12.14 Dataguise

12.15 Spirion

12.16 Clearswift

12.17 Seclore

12.18 Digital Guardian

12.19 Titus

12.20 Netwrix Corporation

12.21 GTB Technologies, Inc.

12.22 Forcepoint

12.23 Sienna Group, LLC.

12.24 Softworks AI

12.25 Expert Techsource

12.26 Janusnet

*Details on Business Overview, Products, Solutions, & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 165)

13.1 Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (70 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 Factor Analysis

Table 3 Global Data Classification Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y %)

Table 4 Global Ai-Focused Spending (USD Billion), 20152023

Table 5 Market Size, By Component, 20162023 (USD Million)

Table 6 Solutions: Market Size, By Type, 20162023 (USD Million)

Table 7 Solutions: Market Size, By Region, 20162023 (USD Million)

Table 8 Standalone Solution Market Size, By Region, 20162023 (USD Million)

Table 9 Integrated Solution Market Size, By Region, 20162023 (USD Million)

Table 10 Services: Market Size, By Type, 20162023 (USD Million)

Table 11 Services: Market Size, By Region, 20162023 (USD Million)

Table 12 Professional Services Market Size, By Region, 20162023 (USD Million)

Table 13 Managed Services Market Size, By Region, 20162023 (USD Million)

Table 14 Data Classification Market Size, By Methodology, 20162023 (USD Million)

Table 15 Content-Based Classification: Market Size, By Region, 20162023 (USD Million)

Table 16 Context-Based Classification: Market Size, By Region, 20162023 (USD Million)

Table 17 User-Based Classification: Market Size, By Region, 20162023 (USD Million)

Table 18 Data Classification Market Size, By Application, 20162023 (USD Million)

Table 19 Access Control: Market Size, By Region, 20162023 (USD Million)

Table 20 Governance, Risk, and Compliance: Market Size, By Region, 20162023 (USD Million)

Table 21 Web, Mobile, and Email Protection: Market Size, By Region, 20162023 (USD Million)

Table 22 Centralized Management: Market Size, By Region, 20162023 (USD Million)

Table 23 Data Classification Market Size, By Vertical, 20162023 (USD Million)

Table 24 Banking, Financial Services and Insurance: Market Size, By Region, 20162023 (USD Million)

Table 25 Healthcare and Life Sciences: Market Size, By Region, 20162023 (USD Million)

Table 26 Government and Defense: Market Size, By Region, 20162023 (USD Million)

Table 27 Education: Market Size, By Region, 20162023 (USD Million)

Table 28 Telecom: Market Size, By Region, 20162023 (USD Million)

Table 29 Media and Entertainment: Market Size, By Region, 20162023 (USD Million)

Table 30 Others: Market Size, By Region, 20162023 (USD Million)

Table 31 Market Size, By Region, 20162023 (USD Million)

Table 32 North America: Data Classification Market Size, By Component, 20162023 (USD Million)

Table 33 North America: Market Size, By Solution, 20162023 (USD Million)

Table 34 North America: Market Size, By Service, 20162023 (USD Million)

Table 35 North America: Market Size, By Methodology, 20162023 (USD Million)

Table 36 North America: Market Size, By Application, 20162023 (USD Million)

Table 37 North America: Market Size, By Vertical, 20162023 (USD Million)

Table 38 North America: Market Size, By Country, 20162023 (USD Million)

Table 39 Europe: Data Classification Market Size, By Component, 20162023 (USD Million)

Table 40 Europe: Market Size, By Solution, 20162023 (USD Million)

Table 41 Europe: Market Size, By Service, 20162023 (USD Million)

Table 42 Europe: Market Size, By Methodology, 20162023 (USD Million)

Table 43 Europe: Market Size, By Application, 20162023 (USD Million)

Table 44 Europe: Market Size, By Vertical, 20162023 (USD Million)

Table 45 Europe: Market Size, By Country, 20162023 (USD Million)

Table 46 Asia Pacific: Data Classification Market Size, By Component, 20162023 (USD Million)

Table 47 Asia Pacific: Market Size, By Solution, 20162023 (USD Million)

Table 48 Asia Pacific: Market Size, By Service, 20162023 (USD Million)

Table 49 Asia Pacific: Market Size, By Methodology, 20162023 (USD Million)

Table 50 Asia Pacific: Market Size, By Application, 20162023 (USD Million)

Table 51 Asia Pacific: Market Size, By Vertical, 20162023 (USD Million)

Table 52 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 53 Middle East and Africa: Data Classification Market Size, By Component, 20162023 (USD Million)

Table 54 Middle East and Africa: Market Size, By Solution, 20162023 (USD Million)

Table 55 Middle East and Africa: Market Size, By Service, 20162023 (USD Million)

Table 56 Middle East and Africa: Market Size, By Methodology, 20162023 (USD Million)

Table 57 Middle East and Africa: Market Size, By Application, 20162023 (USD Million)

Table 58 Middle East and Africa: Market Size, By Vertical, 20162023 (USD Million)

Table 59 Middle East and Africa: Market Size, By Country, 20162023 (USD Million)

Table 60 Latin America: Data Classification Market Size, By Component, 20162023 (USD Million)

Table 61 Latin America: Market Size, By Solution, 20162023 (USD Million)

Table 62 Latin America: Market Size, By Service, 20162023 (USD Million)

Table 63 Latin America: Market Size, By Methodology, 20162023 (USD Million)

Table 64 Latin America: Market Size, By Application, 20162023 (USD Million)

Table 65 Latin America: Market Size, By Vertical, 20162023 (USD Million)

Table 66 Latin America: Market Size, By Country, 20162023 (USD Million)

Table 67 New Product/Service Launches and Product/Service Enhancements, 20172018

Table 68 Agreements and Partnerships, 20172018

Table 69 Acquisitions, 20172018

Table 70 Expansions, 20162018

List of Figures (52 Figures)

Figure 1 Global Data Classification Market: Research Design

Figure 2 Breakup of Primary Participants Profiles: By Company, Designation, and Region

Figure 3 Data Triangulation

Figure 4 Market: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology Top-Down Approach

Figure 6 Market Snapshot, By Component

Figure 7 Market Snapshot, By Solution

Figure 8 Market Snapshot, By Service

Figure 9 Market Snapshot, By Application

Figure 10 Market Snapshot, By Methodology

Figure 11 Market Snapshot, By Vertical

Figure 12 Market Snapshot, By Region

Figure 13 Growing Mandatory Compliance With Stringent Regulations to Drive the Overall Growth of the Data Classification Market in the Forecast Period

Figure 14 Web, Mobile, and Email Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 North America to Hold the Highest Market Share in 2018

Figure 16 Content-Based Classification and GRC in North America Accounted for the Highest Share in the Market in 2018

Figure 17 Drivers, Restraints, Opportunities, and Challenges: Data Classification Market

Figure 18 Number of Targeted Attacks Between 2015 and 2017

Figure 19 Steps in Data Classification Process

Figure 20 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 21 Standalone Solution Segment to Grow at A Higher CAGR During the Forecast Period

Figure 22 Managed Services to Grow at A Higher CAGR During the Forecast Period

Figure 23 Content-Based Classification Segment to Witness the Highest CAGR During the Forecast Period

Figure 24 Web, Mobile, and Email Protection Segment to Register the Highest CAGR During the Forecast Period

Figure 25 Healthcare and Life Sciences Vertical to Witness the Highest CAGR During the Forecast Period

Figure 26 Asia Pacific to Register the Highest CAGR During the Forecast Period

Figure 27 India to Register the Highest CAGR During the Forecast Period

Figure 28 Asia Pacific to Account for the Highest CAGR in 2018

Figure 29 North America: Market Snapshot

Figure 30 Web, Mobile, and Email Protection Application to Grow at the Highest CAGR During the Forecast Period

Figure 31 Web, Mobile, and Email Protection Application to Grow at the Highest CAGR During the Forecast Period

Figure 32 Asia Pacific: Market Snapshot

Figure 33 Web, Mobile, and Email Protection Application to Grow at the Highest CAGR During the Forecast Period

Figure 34 Web, Mobile, and Email Protection Application to Grow at the Highest CAGR During the Forecast Period

Figure 35 Web, Mobile, and Email Protection Application to Grow at the Highest CAGR During the Forecast Period

Figure 36 Key Developments By Leading Players in the Data Classification Market During 20162018

Figure 37 ACI Worldwide, Led the Market in 2018

Figure 38 IBM: Company Snapshot

Figure 39 SWOT Analysis: IBM

Figure 40 Google: Company Snapshot

Figure 41 SWOT Analysis: Google

Figure 42 Microsoft: Company Snapshot

Figure 43 SWOT Analysis: Microsoft

Figure 44 AWS: Company Snapshot

Figure 45 SWOT Analysis: AWS

Figure 46 Symantec: Company Snapshot

Figure 47 SWOT Analysis: Symantec

Figure 48 Opentext: Company Snapshot

Figure 49 SWOT Analysis: Opentext

Figure 50 SWOT Analysis: Boldon James

Figure 51 Covata: Company Snapshot

Figure 52 Varonis: Company Snapshot

The study consists of 4 major activities to estimate the current market size of the data classification market. An exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the data classification market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides of the data classification market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors of data classification solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of the primary respondents profiles:

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Market Size Estimation

For making market estimates and forecasting the data classification market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global data classification market using key companies revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the size of the data classification market by solutions (standalone and integrated), services (professional, and managed services), deployment (on-premises and cloud), methodology (content-based classification, context-based classification, and user-based classification), application (access control; governance and regulatory compliance; web, mobile, and email protection; and, centralized management), and region (North America, Europe, Asia Pacific [APAC], Latin America, and Middle East and Africa [MEA])

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the data classification market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of data classification market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the data classification ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches, such as product launches, acquisitions, contracts, agreements, and partnerships, in the data classification market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American data classification market

- Further breakup of the European data classification market

- Further breakup of the APAC data classification market

- Further breakup of the Latin American data classification market

- Further breakup of the MEA data classification market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Data Classification Market