Security Assertion Markup Language (SAML) Authentication Market by Component (Solution and Services), Deployment Mode (On-Premises and Cloud), Organization Size (SMEs and Large Enterprises), Vertical, and Region - Global Forecast to 2024

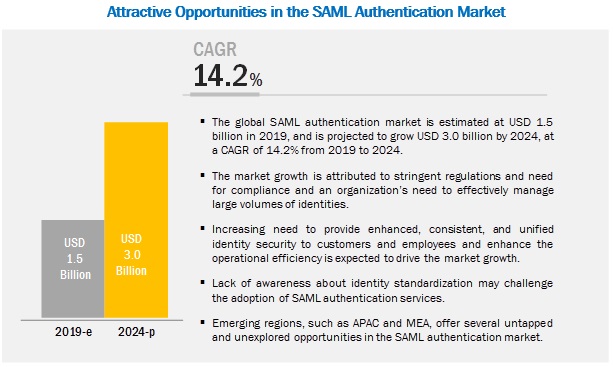

[123 Pages Report] The security assertion markup language (SAML) authentication market is expected to grow from USD 1.5 billion in 2019 to USD 3.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 14.2% during the forecast period. The key factors driving the SAML authentication market include organizations’ need to effectively manage large volumes of identities; organizations’ need to provide enhanced, consistent, and unified identity security to customers and employees and enhance the operational efficiency; and effective management of stringent regulatory compliances

The solution segment to constitute the largest market size during the forecast period

The SAML authentication protocol used in the Single sign-on (SSO) software solutions passes the SAML assertion, authentication, and authorization information from identity providers to service providers. The types of SAML assertions passed from identity providers to service providers include authentication, attribute, and authorization decision. Authentication assertion make use of Kerberos, 2 Factor, and other authentication methods to prove the identity of the user. The attribution assertion includes detailed user information, which is used by authorization decision functionality to authenticate and authorize the user using the service. Various identity providers available in the market include Gemalto, One Login, miniOrange, and various others. Identity providers pass the user credentials to service providers, which include Office 365, Salesforce, AWS, Zendesk, and DropBox. SAML protocol is available as direct integration with SSO, directory integration, and Multi-Factor Authentication (MFA) solutions. SAML authentication solutions are available as on-premises and cloud-based solutions.

The SMEs segment to grow at the highest CAGR during the forecast period

The SMEs segment is expected to grow at the highest CAGR during the forecast period, owing to the increasing incidence of cyber-attacks on these enterprises. SMEs are small in terms of their size but cater to a large number of customers globally. Robust and comprehensive security solutions are not implemented in SMEs, due to financial constraints in these organizations. However, the large enterprises segment accounts for the highest share of the SAML authentication market in 2019.

SAML authentication solutions and services have been deployed across various verticals, including Banking, Financial Services, and Insurance (BFSI); government and defense; retail; healthcare; IT and telecommunication; energy and utilities; manufacturing; and others. The retail vertical is expected to grow at the highest CAGR during the forecast period, while the healthcare vertical is estimated to have the largest market size in 2019.

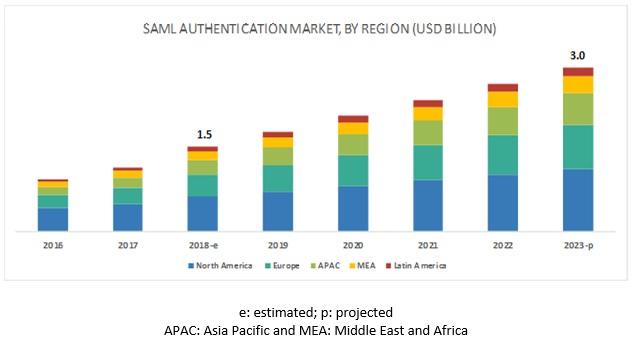

North America to account for the largest market size during the forecast period

The global SAML authentication market has been segmented on the basis of regions into North America, Europe, APAC, MEA, and Latin America to provide a region-specific analysis in the report. The North American region, followed by Europe, is expected to become the largest revenue-generating region for SAML authentication solution and service vendors in 2019. Increasing Internet of Things (IoT), cloud adoption, and Bring Your Own Device (BYOD) trend, and growing internal and external threats are some of the key factors expected to fuel the growth of the SAML authentication market in North America. The APAC SAML Authentication market is gaining traction as the number of smart devices and BYOD trend is increasing in developed and developing nations in APAC. SMEs as well as large-scale organizations in the APAC region have become more aware of the increasing identity theft and frauds and have started adopting SAML Authentication solutions and services to combat them.

Key Market Players

Major vendors that offer SAML Authentication services across the globe are Gemalto (Netherlands), Ping Identity (US), AWS (US), Microsoft (US), Oracle (US), miniOrange (India), Onelogin (US), RCDevs (Luxembourg), Ariel Software Solutions (India), SAASPASS (US), SSO Easy (US), ManageEngine (US), Okta (US), Auth0 (US), and PortalGuard (US). These vendors have adopted different types of organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and acquisitions, to expand their offerings in the SAML authentication market.

Gemalto (Netherlands) is one of the leading operators of the world’s largest global SAML authentication market that provides SAML authentication with identity-as-a-service/access management/SAML-based SSO, where every time a user accesses an application, the authentication process is transferred to the SAML identity provider. Its key strategy in the SAML authentication market is to develop business-specific solutions and services according to the current scenario of evolving vulnerabilities. It plans to develop new business models and integrate multi-application solutions as a part of its future strategy. Similarly, Ping Identity, another leading SAML authentication solution provider, offers the Ping Identity Platform that accepts SAML for SSO into SaaS and internal applications because of its versatility and design provided to work with any standards-based identity provider. The company has implemented various strategies to deliver cutting-edge SAML authentication to global organizations. Various organic and inorganic growth strategies are helping the SAML authentication vendors stay ahead in the global SAML authentication market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Organization Size, Deployment Mode, Vertical, and Region |

|

Regions covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

Gemalto (Netherlands), Ping Identity (US), AWS (US), Microsoft (US), Oracle (US), miniOrange (India), OneLogin (US), RCDevs (Luxembourg), Ariel Software Solutions (India), SAASPASS (US), SSO Easy (US), ManageEngine (US), Okta (US), Auth0 (US), and PortalGuard (US) |

This research report categorizes the SAML authentication market based on component, organization size, deployment mode, vertical, and region.

Based on Components, the SAML authentication market has been segmented as follows:

- Solution

- Services

- Consulting

- Support and maintenance

- Training and education

Based on Organization Size, the SAML authentication market has been segmented as follows

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Based on Deployment Modes, the SAML authentication market has been segmented as follows

- Cloud

- On-premises

Based on verticals, the SAML authentication market has been segmented as follows:

- Banking, Financial Services, and Insurance (BFSI)

- Government and defense

- IT and telecommunications

- Manufacturing

- Retail

- Healthcare

- Energy and utilities

- Others (media and entertainment, travel and hospitality, and education)

Based on Regions, the SAML authentication market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Australia and New Zealand (ANZ)

- Japan

- Rest of APAC

- MEA

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2019, Gemalto partnered with Entrust Datacard, an identity and secure transaction technology provider. Gemalto offers a trusted, cloud-based platform for integrated identity management and data protection solutions for the Internet of Things (IoT) devices and services.

Key questions addressed by the report:

- Define, describe, and forecast the SAML authentication market based on components (software and services), deployment modes, organization size, verticals, and regions

- Detailed analysis of the market’s subsegments with respect to individual growth trends, prospects, and contributors to the total market

- Revenue forecast of the market’s segments with respect to 5 major regions, namely, North America, Europe, APAC, MEA, and Latin America

- Detailed analysis of the competitive developments, such as mergers and acquisitions, new product developments, and business expansion activities, in the market

Frequently Asked Questions (FAQ):

What is SAML and how does it work?

What are the top trends in SAML authentication market?

The top trends impacting global SAML authentication market are as follows:

- Enhanced need of effective management of large volumes of organization identities

- Increased need to provide enhanced, consistent and unified security to customers and employees

- The increased need of adhering to stringent government regulations

- Rising need of remote access due to IoT and BYOD trends

- Proliferation of cloud based SAML authentication solutions and services among global organizations

Who are the prominent players in SAML authentication market?

What is the SAML authentication market size?

What are the major verticals in which SAML Authentication is implemented?

The major verticals in SAML Authentication market include BFSI, Government and Defense, IT and Telecom, Energy and Utilities, Manufacturing, Retail, and healthcare.

The BFSI vertical is expected to be the highest revenue generating vertical due to the growing use of mobile and web-based applications for online payment transactions. The retail vertical is expected to grow at a higher CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Security Assertion Markup Language Authentication Market

4.2 Security Assertion Markup Language Authentication Market, Market Share of Top 3 Verticals and Regions, 2019

4.3 Security Assertion Markup Language Authentication Market, By Component, 2019 vs 2024

4.4 Security Assertion Markup Language Authentication Market, By Service, 2019 vs 2024

4.5 Security Assertion Markup Language Authentication Market, By Deployment Mode, 2019

4.6 Security Assertion Markup Language Authentication Market, By Organization Size, 2019

4.7 Security Assertion Markup Language Authentication Market, By Vertical, 2019 vs 2024

4.8 Security Assertion Markup Language Authentication Market, By Region, 2019 vs 2024

4.9 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Organizations’ Need to Effectively Manage Large Volumes of Identities

5.2.1.2 Organizations’ Need to Provide Enhanced, Consistent, and Unified Identity Security to Customers and Employees and Enhance the Operational Efficiency

5.2.1.3 Effective Management of Stringent Regulatory Compliances

5.2.2 Restraints

5.2.2.1 Lack of Awareness About Identity Standardization

5.2.3 Opportunities

5.2.3.1 Organizations’ Need for Remote Access Due to IoT and Byod Trends

5.2.3.2 Proliferation of Cloud-Based SAML Authentication Solution and Services Among Global Organizations

5.2.4 Challenges

5.2.4.1 A Single Point of Failure to Affect the Authentication Process

5.3 Regulatory Compliances

5.3.1 General Data Protection Regulation

5.3.2 Health Insurance Portability and Accountability Act

5.3.3 Federal Information Security Management Act

5.3.4 Sarbanes–Oxley Act

5.3.5 Gramm–Leach–Bliley Act

5.3.6 Payment Card Industry Data Security Standard

5.3.7 Federal Information Processing Standards

6 Security Assertion Markup Language Authentication Market, By Component (Page No. - 42)

6.1 Introduction

6.2 Solution

6.2.1 Increasing Identity Frauds on Networks, Applications, Endpoints, Clouds, and Data of Organizations to Fuel the Demand for SAML Authentication Solution

6.3 Services

6.3.1 Consulting

6.3.1.1 Need to Provide Constant Consultation for the Implementation of SAML Authentication Solution to Increase the Adoption of Consulting Services

6.3.2 Training and Education

6.3.2.1 Need for Imparting Professional Training to Increase the Demand for Training and Education Services

6.3.3 Support and Maintenance

6.3.3.1 Continuous Support Toward Installation and Maintenance to Boost the Demand for Support and Maintenance Services

7 Security Assertion Markup Language Authentication Market, By Deployment Type (Page No. - 49)

7.1 Introduction

7.2 Cloud

7.2.1 Low Cost of Installation, Upgrade, and Maintenance to Increase the Adoption of Cloud-Based SAML Authentication Solution

7.3 On-Premises

7.3.1 Need to Maintain Strict Confidentiality of Records in Government and Defense, and Banking Verticals to Fuel the Demand for On-Premises SAML Authentication Solution

8 Security Assertion Markup Language Authentication Market, By Organization Size (Page No. - 53)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.2.1 Increasing Identity-Based Attacks on Small and Medium-Sized Enterprises to Contribute to the Greater Adoption of SAML Authentication Solution

8.3 Large Enterprises

8.3.1 Hefty Financial Losses, Owing to the Rising Cyber-Attacks on Organizations’ Infrastructure to Contribute to the Adoption of SAML Authentication Solution in Large Enterprises

9 Security Assertion Markup Language Authentication Market, By Vertical (Page No. - 57)

9.1 Introduction

9.2 Banking, Financial Services and Insurance

9.2.1 Need for Enhanced Authentication Solution to Drive the Demand for SAML Authentication Solution in the BFSI Vertical

9.3 Government and Defense

9.3.1 Governments Mandate to Adopt Authentication Solution to Fuel the Demand for SAML Authentication Solution in the Government and Defense Sector

9.4 IT and Telecommunication

9.4.1 Organizations’ Focus on Managing the Identity of Users to Increase the Adoption of SAML Authentication Solution in the IT and Telecommunication Vertical

9.5 Energy and Utilities

9.5.1 Need to Safeguard IT and Network Infrastructure From Threats to Boost the Demand for SAML Authentication Solution in the Energy and Utilities Vertical

9.6 Manufacturing

9.6.1 Need to Safeguard IT and Network Infrastructure From Threats to Boost the Demand for SAML Authentication Solution in the Energy and Utilities Vertical

9.7 Retail

9.7.1 Rising Identity Thefts to Compel Organizations to Embrace SAML Authentication Solution on A Large Scale in the Retail Vertical

9.8 Healthcare

9.8.1 Need to Comply to HIPAA and PCI DSS to Increase the Adoption of SAML Authentication Solution in Healthcare Vertical

9.9 Others

10 Security Assertion Markup Language Authentication Market, By Region (Page No. - 68)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Rising Instances of Cyber-Attacks Coupled With Financial Losses to Create Demand for SAML Authentication Solution in the US

10.2.2 Canada

10.2.2.1 Stringent Regulations and Government Initiatives to Fuel the Adoption of SAML Authentication Solution in Canada

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 Penetration of Byod and Need to Protect Enterprises Infrastructure From Unauthorized Access to Fuel the Demand for SAML Authentication Solution in the UK

10.3.2 Germany

10.3.2.1 Imminent Need for Managing Identity Frauds to Boost the Demand for SAML Authentication Solution in Germany

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Need to Protect Endpoints, Websites, and Applications From Unauthorized Access to Contribute to the Growth of the SAML Authentication Market in China

10.4.2 India

10.4.2.1 Concern Over the Security of Customers’ Data to Enable the Organizations to Drive the Adoption of SAML Authentication Solution on A Large Scale in India

10.4.3 Australia and New Zealand

10.4.3.1 Large-Scale Adoption By Various Verticals for Protecting Their Cloud and On-Premises Infrastructures From Identity Thefts to Fuel the Growth of SAML Authentication Market in Anz

10.4.4 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Organizations’ Focus on Seamless User Experience, Reliability, and High Security to Increase the Demand for SAML Authentication Solution in the Middle East

10.5.2 Africa

10.5.2.1 Rising Trends of Byod and Cloud Applications and the Need to Secure Them Against Identity Threats to Contribute to the Growth of SAML Authentication Market in Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 SMES Focus on Enhanced Authentication Solutions to Contribute to the Growth of the SAML Authentication Market in Brazil

10.6.2 Mexico

10.6.2.1 Increasing Cyber Threats Across Verticals to Fuel the Demand for SAML Authentication Solution in Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 90)

11.1 Competitive Leadership Mapping

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Competitive Benchmarking

11.2.1 Analysis of Product Portfolio of Major Players in the Security Assertion Markup Language Authentication Market

11.2.2 Business Strategies Adopted By Major Players in the Security Assertion Markup Language Authentication Market

11.3 Competitive Scenario

11.3.1 Partnerships, Agreements, and Collaborations

11.3.2 Business Expansion

11.3.3 New Product Launches/Product Enhancements

11.3.4 Mergers and Acquisitions

12 Company Profiles (Page No. - 97)

12.1 Introduction

(Business Overview, Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2 Gemalto

12.3 Ping Identity

12.4 AWS

12.5 Microsoft

12.6 Oracle

12.7 miniOrange

12.8 ManageEngine

12.9 Onelogin

12.10 Okta

12.11 SSO Easy

12.12 SAASPASS

12.13 Auth0

12.14 PortalGuard

12.15 RCDevs SA

12.16 Ariel Software Solutions

*Details on Business Overview, Solutions Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 117)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (60 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2018

Table 2 Factor Analysis

Table 3 Security Assertion Markup Language Authentication Market Size and Growth, 2017–2024 (USD Million, Y-O-Y %)

Table 4 Security Assertion Markup Language Authentication Market Size, By Component, 2017–2024 (USD Million)

Table 5 Solution: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 6 Services: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 7 Security Assertion Markup Language Authentication Market Size, By Service, 2017–2024 (USD Million)

Table 8 Consulting Market Size, By Region, 2017–2024 (USD Million)

Table 9 Training and Education Market Size, By Region, 2017–2024 (USD Million)

Table 10 Support and Maintenance Market Size, By Region, 2017–2024 (USD Million)

Table 11 Security Assertion Markup Language Authentication Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 12 Cloud: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 13 On-Premises: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 14 Security Assertion Markup Language Authentication Market Size, By Organization Size, 2017–2024 (USD Million)

Table 15 Small and Medium-Sized Enterprises: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 16 Large Enterprises: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 17 Security Assertion Markup Language Authentication Market Size, By Vertical, 2017–2024 (USD Million)

Table 18 Banking, Financial Services, and Insurance: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 19 Government and Defense: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 20 IT and Telecommunication: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 21 Energy and Utilities: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 22 Manufacturing: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 23 Retail: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 24 Healthcare: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 25 Others: Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 26 Security Assertion Markup Language Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 27 North America: Security Assertion Markup Language Authentication Market Size, By Component, 2017–2024 (USD Million)

Table 28 North America: Security Assertion Markup Language Authentication Market Size, By Service, 2017–2024 (USD Million)

Table 29 North America: Security Assertion Markup Language Authentication Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 30 North America: Security Assertion Markup Language Authentication Market Size, By Organization Size, 2017–2024 (USD Million)

Table 31 North America: Security Assertion Markup Language Authentication Market Size, By Vertical, 2017–2024 (USD Million)

Table 32 North America: Security Assertion Markup Language Authentication Market Size, By Country, 2017–2024 (USD Million)

Table 33 Europe: Security Assertion Markup Language Authentication Market Size, By Component, 2017–2024 (USD Million)

Table 34 Europe: Security Assertion Markup Language Authentication Market Size, By Service, 2017–2024 (USD Million)

Table 35 Europe: Security Assertion Markup Language Authentication Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 36 Europe: Security Assertion Markup Language Authentication Market Size, By Organization Size, 2017–2024 (USD Million)

Table 37 Europe: Security Assertion Markup Language Authentication Market Size, By Vertical, 2017–2024 (USD Million)

Table 38 Europe: Security Assertion Markup Language Authentication Market Size, By Country, 2017–2024 (USD Million)

Table 39 Asia Pacific: Security Assertion Markup Language Authentication Market Size, By Component, 2017–2024 (USD Million)

Table 40 Asia Pacific: Security Assertion Markup Language Authentication Market Size, By Service, 2017–2024 (USD Million)

Table 41 Asia Pacific: Security Assertion Markup Language Authentication Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 42 Asia Pacific: Security Assertion Markup Language Authentication Market Size, By Organization Size, 2017–2024 (USD Million)

Table 43 Asia Pacific: Security Assertion Markup Language Authentication Market Size, By Vertical, 2017–2024 (USD Million)

Table 44 Asia Pacific: Security Assertion Markup Language Authentication Market Size, By Country, 2017–2024 (USD Million)

Table 45 Middle East and Africa: Security Assertion Markup Language Authentication Market Size, By Component, 2017–2024 (USD Million)

Table 46 Middle East and Africa: Security Assertion Markup Language Authentication Market Size, By Service, 2017–2024 (USD Million)

Table 47 Middle East and Africa: Security Assertion Markup Language Authentication Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 48 Middle East and Africa: Security Assertion Markup Language Authentication Market Size, By Organization Size, 2017–2024 (USD Million)

Table 49 Middle East and Africa: Security Assertion Markup Language Authentication Market Size, By Vertical, 2017–2024 (USD Million)

Table 50 Middle East and Africa: Security Assertion Markup Language Authentication Market Size, By Subregion, 2017–2024 (USD Million)

Table 51 Latin America: Security Assertion Markup Language Authentication Market Size, By Component, 2017–2024 (USD Million)

Table 52 Latin America: Security Assertion Markup Language Authentication Market Size, By Service, 2017–2024 (USD Million)

Table 53 Latin America: Security Assertion Markup Language Authentication Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 54 Latin America: Security Assertion Markup Language Authentication Market Size, By Organization Size, 2017–2024 (USD Million)

Table 55 Latin America: Security Assertion Markup Language Authentication Market Size, By Vertical, 2017–2024 (USD Million)

Table 56 Latin America: Security Assertion Markup Language Authentication Market Size, By Country, 2017–2024 (USD Million)

Table 57 Partnerships, Agreements, and Collaborations, 2017–2019

Table 58 Business Expansion, 2017–2019

Table 59 New Product Launches/Product Enhancements, 2017–2019

Table 60 Mergers and Acquisitions, 2018

List of Figures (36 Figures)

Figure 1 SAML Authentication Market: Research Design

Figure 2 Security Assertion Markup Language Authentication Market: Top-Down and Bottom-Up Approaches

Figure 3 Security Assertion Markup Language Authentication Market to Witness Significant Growth in the Global Market During the Forecast Period

Figure 4 North America to Hold the Highest Market Share in 2019

Figure 5 Fastest-Growing Segments of the Security Assertion Markup Language Authentication Market

Figure 6 Factors Such as Stringent Regulations and Organizations’ Need to Effectively Manage Identities Driving the Demand for Security Assertion Markup Language Authentication Solution

Figure 7 BFSI Industry Vertical and North America to Have the Highest Market Shares in 2019

Figure 8 Services Segment to Grow at the Fastest Rate During the Forecast Period

Figure 9 Consulting Segment to Grow at the Fastest Rate During the Forecast Period

Figure 10 On-Premises to Have the Highest Market Share in 2019

Figure 11 Large Enterprises Segment to Hold A Higher Market Share in 2019

Figure 12 Retail Vertical to Grow at the Fastest Rate During the Forecast Period

Figure 13 Asia Pacific to Grow at the Fastest Rate During the Forecast Period

Figure 14 Asia Pacific to Emerge as the Best Market for Investment in the Next 5 Years

Figure 15 Drivers, Restraints, Opportunities, and Challenges: Security Assertion Markup Language Authentication Market

Figure 16 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 17 Consulting Segment to Grow at the Highest CAGR During the Forecast Period

Figure 18 Cloud Segment to Grow at A Higher CAGR During the Forecast Period

Figure 19 Small and Medium-Sized Enterprises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 20 Retail Vertical to Record the Highest Growth During the Forecast Period

Figure 21 North America to Hold the Highest Market Share During the Forecast Period

Figure 22 North America: Market Snapshot

Figure 23 Asia Pacific: Market Snapshot

Figure 24 Global Security Assertion Markup Language Authentication Market, Competitive Leadership Mapping, 2019

Figure 25 Key Developments By the Leading Players in the Security Assertion Markup Language Authentication Market for 2016–2018

Figure 26 Geographic Revenue Mix of the Top Players in the Security Assertion Markup Language Authentication Market

Figure 27 Gemalto: Company Snapshot

Figure 28 Gemalto: SWOT Analysis

Figure 29 Ping Identity: SWOT Analysis

Figure 30 AWS: Company Snapshot

Figure 31 AWS: SWOT Analysis

Figure 32 Microsoft: Company Snapshot

Figure 33 Microsoft: SWOT Analysis

Figure 34 Oracle: Company Snapshot

Figure 35 Oracle: SWOT Analysis

Figure 36 Okta: Company Snapshot

The study involved 4 major activities in estimating the current market size of the Security Assertion Markup Language (SAML) authentication market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the market’s segments and subsegments.

Secondary research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, for identifying and collecting information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; security technologies Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary research

Various primary sources from both the supply and demand sides of the SAML authentication market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, related key executives from various vendors who provide the SAML authentication solutions, associated services, and technology integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

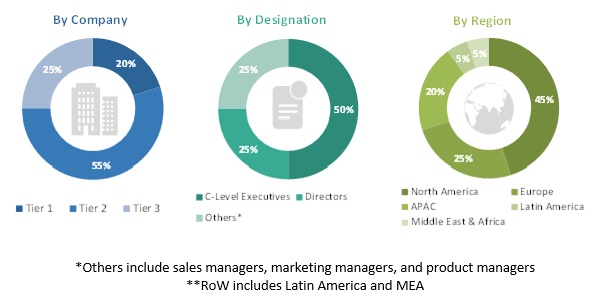

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market size Estimation

For making market estimates and forecasting the SAML authentication market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global SAML authentication market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined with the help of the primary and secondary research processes.

All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the SAML authentication market by component (solution and services), organization size, deployment mode, vertical, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the SAML authentication market

- To analyze the micromarkets with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze the market opportunities for stakeholders by identifying the high-growth segments of the SAML authentication market

- To forecast the market size of the market’s segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players in the SAML authentication market and comprehensively analyze their market size and core competencies

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations, in the global SAML authentication market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Security Assertion Markup Language (SAML) Authentication Market