Satellite IoT Market by Service Type (Satellite IoT Backhaul, Direct-to-satellite), Frequency Band (L-Band, Ku and Ka-Band, S-band), Organization Size (Large Enterprises, Small and Medium Sized Enterprises), Vertical & Region - Global Forecast to 2027

Updated on : Jan 28, 2026

Satellite IoT Market - Worldwide | Future Scope & Trends

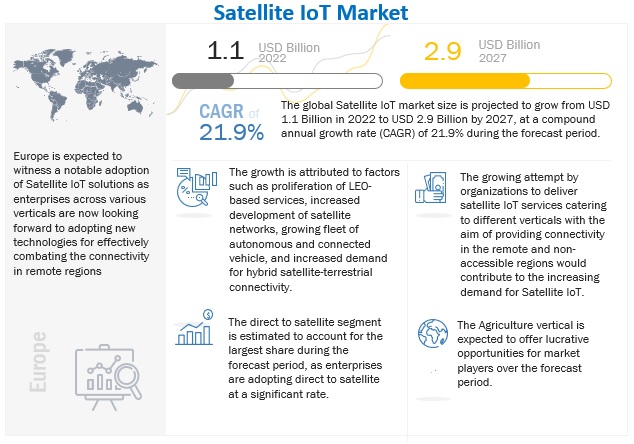

The Satellite IoT Market is projected to grow significantly, increasing from USD 1.1 billion in 2022 to USD 2.9 billion by 2027, with a robust CAGR of 21.9%. Increasing use of satellite IoT solutions in Defense organizations to protect their borders, establish communications in desert areas, and access real-time data and imaging is driving the satellite IoT market.

To know about the assumptions considered for the study, Request for Free Sample Report

Satellite IoT Market Dynamics

Driver: Rising proliferation of LEO-based services to connect remote regions

Recently, billions of dollars have been invested in a new generation of satellites that orbit the Earth at a low altitude. These LEO satellites better connect remote and inaccessible regions. The demand for LEO-based services, availability of funding, high-speed broadband, growth of governments in industrialized countries, and demand for low-cost broadband among consumers in less developed countries are driving the market for satellite IoT. These market drivers inspire investments in smallsat-based LEO constellations. According to the Science and Technology Policy Institute, satellite broadband capacity demand (served by both small and larger satellites in Geo-synchronous Earth Orbit (GEO), Medium Earth Orbit (MEO), and LEO orbits) is projected to grow at a CAGR of 29% by 2024, reaching more than three terabits of bandwidth 12; however, proposed LEO constellations can collectively deliver almost 10 times as much, if operational. This, in turn, would lead to some LEO constellations either not deploying fully or failing. If this were to occur, it would not be too dissimilar to the dot-com bubble of the 1990s, where several companies failed, leaving behind many robust organizations, infrastructure, and a trained workforce.

Restraint: High costs associated with development and maintenance of satellite IoT

The high cost incurred in developing and maintaining earth station infrastructure is one of the major factors hindering the market growth. Most of the required components are typically custom-fabricated or purchased from commercial off-the-shelf (COTS) vendors. Significant investments are also required in the R&D, manufacturing, system integration, and assembly stages of the value chains of these systems.

Moreover, satellite IoT services are used for highly sophisticated defense systems, due to which any incident of system failure is unfavorable. Apart from being highly accurate and reliable, they must be durable and energy-efficient and have wide detection ranges. As a result, to maintain market leadership and stay competitive, companies in this market must develop highly functional and efficient ground facilities. This translates into significant investments in testing and infrastructure and collaborations with universities, research institutes, and other companies.

Opportunity: Rising technological advancements

Ka-band and V-band spectrum usage has been observed in newer LEO satellites as they provide higher data rates, greater security, narrow beams, and smaller antennas. Along with advanced spectrum usage, superior active antennas and processing have increased the information/data transfer per satellite, thereby increasing the LEO constellation capacity.

Recent advances in analytics, combined with the increasing computational power and AI-based algorithms, help reduce operating costs and response times.

Challenge: Vulnerability of satellite IoT devices to cybersecurity attacks

Incidents of cybersecurity breaches have increased across the world in the past few years. Security is the most significant area of technical concern for most organizations deploying IoT systems and 5G networks, with multiple devices connected across networks, platforms, and devices. This is also true for satellites, given the size and scope, as well as the number of earth station access points. IoT proliferation means if one single device isn’t encrypted or the communication isn’t protected, a bad actor can manipulate it and potentially a whole network of connected devices. It isn’t just the devices that need to be protected, but every stage of data transmission.

By service type, direct-to-satellite to account for the largest market share during the forecast period

Direct-to-satellite connectivity in remote places can facilitate cutting-edge applications for nature monitoring, situational awareness, and improved safety and economic activities in remote areas. This type of architecture allows devices to communicate directly with the satellite without needing any intermediate ground gateway. The satellite receives data from IoT devices and transmits it to the ground station nearest to the device. The data then gets stored in the application server for further processing. This model can be used for a wide area sensor network with sensors spread over a wide geographical territory. Myriota (an Australian-based startup), Hiberband Direct (a Netherland-based startup), Astrocast, etc., are some of the global providers of low-cost, low-power, secure direct-to-orbit satellite connectivity for the Internet of Things.<

By vertical, agriculture vertical to register higher CAGR during the forecast period.

Precision agriculture, also known as Precision Farming, Agriculture 4.0, or New Farming in some countries, is the key to more effective and sustainable farms. It enables farmers to manage their workforce, resources, and farm operations more effectively while also increasing productivity and crop yield, which has a significant positive impact on profits. However, having connectivity is essential for implementing precision agriculture because the Internet of Things makes it possible. However, the bulk of rural areas has poor cellphone service due to a lack of infrastructure, and the nations that produce most of the world's food are very big. Agriculture has had a long-standing issue with the connection. Here, satellite IoT solutions provide global coverage without a gap. Devices can connect directly to space from any location in the world and provide low-cost connectivity.

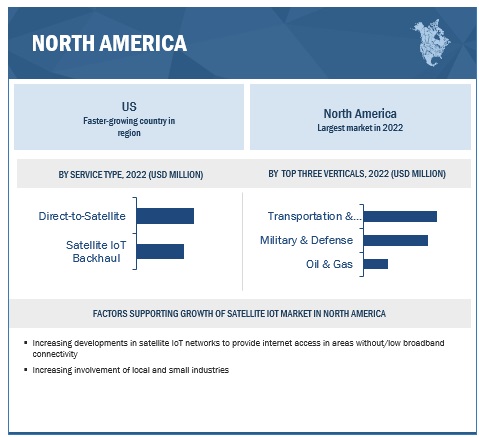

North America to account for the largest market share during the forecast period

The market for satellite IoT has grown significantly in North America, which now holds the majority of the industry. The demand for satellite IoT in North America is being driven by the booming digitalization across industries, along with the surging demand for Earth observation satellites, which offer extremely high-resolution Earth images and videos, as close as 1 meter or less, of the Earth’s surface.

The US has the largest market share in North America due to the presence of a very strong and fast-growing space industry. Canada is a fast-developing market with the presence of multiple technology innovators. Both countries have invested heavily in launching various CubeSats and small satellites, medium-sized satellites, and large satellites into LEO for applications, such as earth observation, communications, and entertainment

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major vendors in this satellite IoT market include Orbcomm (US), Iridium Communication (US), Globalstar (US), Astrocast (Switzerland), Inmarsat Global (UK), Airbus (Netherlands), Intelsat (US), Thales (France), Eutelsat (France), Northrop Grumman (US), Thuraya (Singapore), Vodafone (UK), Surrey Satellite Technology (UK), Head Aerospace (China), I.M.T. SRL (Italy), Fleetspace Technologies (Australia), Swarm Technologies (US), Alenspace (Spain), OQ Technology (Luxembourg), Fossa Systems (Spain), Kepler Communications (Canada), Sateliot (Spain), Myriota (Australia), Kineis (France), and Nanoavionics (Lithuania). The study includes an in-depth competitive analysis of these key market players along with their profiles, recent developments, and key market strategies.

The market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 1 1 billion |

|

Revenue forecast for 2027 |

USD 2.9 billion |

|

Growth Rate |

21.9% CAGR |

|

Market size available for years |

2017-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By service type, frequency band, organization size, vertical, and region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Orbcomm (US), Iridium Communication (US), Globalstar (US), Astrocast (Switzerland), Inmarsat Global (UK), Airbus (Netherlands), Intelsat (US), Thales (France), Eutelsat (France), Northrop Grumman (US), Thuraya (Singapore), Vodafone (UK), Surrey Satellite Technology (UK), Head Aerospace (China), I.M.T. SRL (Italy), Fleetspace Technologies (Australia), Swarm Technologies (US), Alenspace (Spain), OQ Technology (Luxembourg), Fossa Systems (Spain), Kepler Communications (Canada), Sateliot (Spain), Myriota (Australia), Kineis (France), and Nanoavionics (Lithuania). |

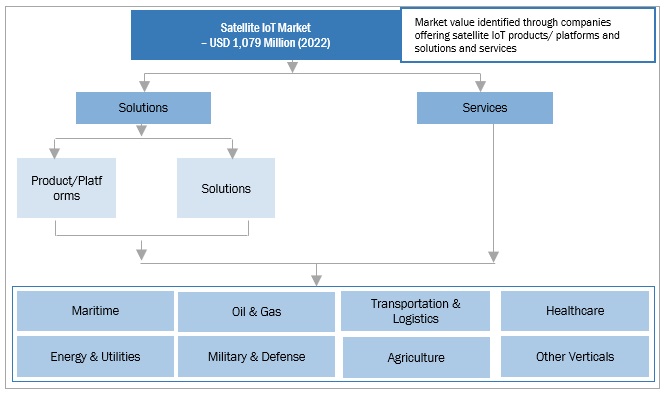

This research report categorizes the satellite IoT market to forecast revenues and analyze trends in each of the following subsegments:

By Service Type:

- Satellite IoT Backhaul

- Direct-to-Satellite

By Frequency Band:

- L-Band

- Ku-and Ka-Band

- S-Band

- Other Bands

By Organization Size:

- Large Enterprises

- Small and Medium Sized Enterprises

By Vertical:

- Maritime

- Oil & Gas

- Transportation & Logistics

- Energy & Utilities

- Agriculture

- Healthcare

- Military & Defense

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- ANZ

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

Middle East

- UAE

- KAS

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Nigeria

- Rest of Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In January 2023, Iridium and Qualcomm collaborated to support satellite messaging in smartphones. The collaboration aims to support satellite services into a variety of smartphone brands and has the potential to expand to other consumer devices in the future.

- In December 2022, Globalstar announced a commercial agreement with Wiagro, an Agtech startup from Argentina. Globalstar is supplying Wiagro with 2,500 ST100 satellite modem transmitters for its Smart Silobag, which allows for the remote monitoring of grain conditions stored in silo bags.

- In February 2022, Astrocast SA launched its commercially available cost-effective, bidirectional satellite IoT (SatIoT) service to connect IoT devices globally outside of cell-based terrestrial networks at a comparable cost.

Frequently Asked Questions (FAQ):

What is satellite IoT?

Satellite IoT refers to connecting IoT devices or nodes using a satellite network and satellite communication. A satellite network is the best solution to connect terrestrial and remote devices that are difficult to reach through a cellular network. Satellite IoT leverages low-power wireless technology and LEO satellites to enable IoT connectivity.

Which countries are considered in the North American region?

The report includes an analysis of the US and Canada in the North American region.

Which are the key drivers supporting the growth of the satellite IoT market?

The key drivers supporting the growth of the satellite IoT market include proliferation of LEO-based services to better connect remote and inaccessible regions and increasing development of satellite network to provide internet access in area without low broadband connectivity.

What are some of the technological advancements in the market?

Technological advancements like Machine learning (ML) and AI enable the analysis of satellite data obtained from earth observation (EO), global navigation satellite systems (GNSS), and remote sensing, to extend IoT coverage beyond cities into remote regions; satellite and IoT networks are merged.

Who are the key vendors in the satellite IoT market?

The key vendors operating in the satellite IoT market include Orbcomm (US), Iridium Communication (US), Globalstar (US), Astrocast (Switzerland), Inmarsat Global (UK), Airbus (Netherlands), Intelsat (US), Thales (France), Eutelsat (France), Northrop Grumman (US), Thuraya (Singapore), Vodafone (UK), Surrey Satellite Technology (UK), Head Aerospace (China), I.M.T. SRL (Italy), Fleetspace Technologies (Australia), Swarm Technologies (US), Alenspace (Spain), OQ Technology (Luxembourg), Fossa Systems (Spain), Kepler Communications (Canada), Sateliot (Spain), Myriota (Australia), Kineis (France), and Nanoavionics (Lithuania).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising proliferation of LEO-based services to connect remote regions- Increasing development in satellite networks- Growing fleet of autonomous and connected vehicles- Increasing demand for hybrid satellite-terrestrial connectivityRESTRAINTS- High costs associated with development and maintenance of satellite IoT- Stringent government regulationsOPPORTUNITIES- Rising technological advancements- Growing use of small satellites for various applicationsCHALLENGES- Vulnerability of satellite IoT devices to cybersecurity attacks- High capital requirements

- 5.3 CUMULATIVE GROWTH ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.8 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCEINTERNET OF THINGSDYNAMIC SPECTRUM ACCESS TECHNOLOGIESULTRA-HIGH FREQUENCY (UHF)VERY HIGH FREQUENCY (VHF)TRENDS AND DISRUPTIONS IMPACTING BUYERS

-

5.9 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONSTOP APPLICANTS

- 5.10 PRICING ANALYSIS

-

5.11 CASE STUDY ANALYSISCASE STUDY 1: PONCE UTILIZED ORBCOMM’S SOLUTIONS TO ACHIEVE EFFECTIVE IRRIGATIONCASE STUDY 2: ORATEK BROUGHT SATELLITE IOT CONNECTIVITY TO SENEGAL CLEAN WATER PROJECTCASE STUDY 3: INMARSAT ENABLED REAL-TIME MONITORING FOR RWE’S HYDROELECTRIC POWER-GENERATING FACILITIES IN WALES

- 5.12 KEY CONFERENCES & EVENTS, 2022–2023

-

5.13 TARIFF AND REGULATORY IMPACTSATCOM POLICYITU RADIO REGULATIONSCENTRE NATIONAL D’ETUDES SPATIALES (CNES)ASIA-PACIFIC SPACE COOPERATION ORGANIZATIONBRAZILIAN TELECOMMUNICATIONS AGENCYFEDERAL COMMUNICATIONS COMMISSION (FCC)SOUTH AFRICAN NATIONAL SPACE AGENCY (SANSA)

-

6.1 INTRODUCTIONSERVICE TYPES: SATELLITE IOT MARKET DRIVERSSATELLITE IOT MARKET: RECESSION IMPACT

-

6.2 SATELLITE IOT BACKHAULRISING PREFERENCE FOR IOT GATEWAY BACKHAUL AS NEW SATCOM APPLICATION

-

6.3 DIRECT-TO-SATELLITEGROWING NEED FOR ENHANCED SAFETY

-

7.1 INTRODUCTIONFREQUENCY BANDS: SATELLITE IOT MARKET DRIVERSSATELLITE IOT MARKET: RECESSION IMPACT

-

7.2 L-BANDGROWING DEMAND FOR L-BAND FREQUENCY IN SPACE-BASED PLATFORMS

-

7.3 KU AND KA-BANDRISING DEMAND FOR SHORT-RANGE AND HIGH-RESOLUTION IMAGING CAPABILITIES

-

7.4 S-BANDGROWING AWARENESS REGARDING COST-EFFECTIVE TRANSMISSION FREQUENCY BAND

- 7.5 OTHER BANDS

-

8.1 INTRODUCTIONORGANIZATION SIZES: SATELLITE IOT MARKET DRIVERSSATELLITE IOT MARKET: RECESSION IMPACT

-

8.2 LARGE ENTERPRISESRISING ADVANCEMENTS IN MINIATURIZED TECHNOLOGY

-

8.3 SMALL & MEDIUM-SIZED ENTERPRISESRISING ADOPTION OF IOT TO REDUCE OPERATIONAL COSTS

-

9.1 INTRODUCTIONVERTICALS: SATELLITE IOT MARKET DRIVERSSATELLITE IOT MARKET: RECESSION IMPACT

-

9.2 MARITIMEGROWING USE OF SATELLITE IOT TO TRACK SHIPPING CONTAINERS

-

9.3 OIL & GASINCREASING NEED TO IMPROVE SAFETY AND GUARANTEE FLEET COMPLIANCE

-

9.4 TRANSPORTATION & LOGISTICSLACK OF CONNECTIVITY IN TRANSPORTATION AND LOGISTICS

-

9.5 ENERGY & UTILITIESINSTALLATION OF SUSTAINABLE ENERGY SYSTEMS BY GOVERNMENT AND UTILITY COMPANIES

-

9.6 AGRICULTUREGROWING NEED TO BOOST PRODUCTIVITY AND CROP YIELD

-

9.7 HEALTHCARESATELLITE IOT CONNECTIVITY FACILITATES EFFECTIVE DIAGNOSIS AND TREATMENT

-

9.8 MILITARY & DEFENSEIOT TO IMPROVE SUCCESS RATES OF DEFENSE DUTIES

- 9.9 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTNORTH AMERICA: PESTLE ANALYSISUS- Growing use of satellite IoT in agriculture, maritime, transportation, and logisticsCANADA- Increased government funding and initiatives

-

10.3 EUROPEEUROPE: RECESSION IMPACTEUROPE: PESTLE ANALYSISUK- Government support to encourage development of satellite IoTGERMANY- Increase in demand for CubeSatsFRANCE- Governments’ support for satellite IoT solutionsSPAIN- Increasing development through partnerships and contractsITALY- Active involvement of satellite IoT in Italian space agenciesNORDICS- Growing use of space infrastructure in promoting high-quality researchREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: PESTLE ANALYSISCHINA- Government policies to attract satellite operatorsJAPAN- Role of private space industry in government space programsINDIA- Rising demand for observation and navigation satellitesAUSTRALIA & NEW ZEALAND- Government initiatives and supportive policies to defend against cybercrimeSOUTHEAST ASIA- Increasing investments in smart network infrastructureREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: PESTLE ANALYSISMIDDLE EAST- Increasing private investments in space technology- UAE- Saudi Arabia- Rest of Middle EastAFRICA- Emergence of small and easy-to-construct nanosatellites- South Africa- Egypt- Nigeria- Rest of Africa

-

10.6 LATIN AMERICALATIN AMERICA: RECESSION IMPACTLATIN AMERICA: PESTLE ANALYSISBRAZIL- Rising need to deepen cooperation with India in space technologiesMEXICO- Collaborative studies and CubeSat launch initiatives by universitiesREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2022

- 11.3 HISTORICAL REVENUE ANALYSIS

- 11.4 RANKING OF KEY PLAYERS

-

11.5 EVALUATION QUADRANT FOR KEY PLAYERS, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.7 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS

-

11.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 MAJOR PLAYERSORBCOMM- Business overview- Solutions offered- Recent developmentsIRIDIUM COMMUNICATIONS- Business overview- Products/Services offered- Recent developments- MnM viewASTROCAST- Business overview- Solutions/Services offered- Recent developmentsGLOBALSTAR- Business overview- Solutions offered- Recent developments- MnM viewINMARSAT GLOBAL- Business overview- Solutions/Services offered- Recent developments- MnM viewAIRBUS- Business overview- Services offered- Recent developmentsINTELSAT- Business overview- Services offered- Recent developmentsTHALES- Business overview- Services offered- Recent developmentsEUTELSAT- Business overview- Services offered- Recent developmentsNORTHROP GRUMMAN- Business overview- Services offered- Recent developmentsTHURAYAVODAFONESURREY SATELLITE TECHNOLOGYHEAD AEROSPACEIMT SRL

-

12.2 STARTUPS/SMESFLEET SPACE TECHNOLOGIESALEN SPACESWARM TECHNOLOGIESOQ TECHNOLOGYFOSSA SYSTEMSKEPLER COMMUNICATIONSSATELIOTMYRIOTAKINEISNANOAVIONICS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 SMALL SATELLITE MARKETMARKET DEFINITIONSMALL SATELLITE MARKET, BY MASSSMALL SATELLITE MARKET, BY SUBSYSTEM

-

13.4 SATELLITE COMMUNICATION (SATCOM) EQUIPMENT MARKETMARKET DEFINITIONSATELLITE COMMUNICATION (SATCOM) EQUIPMENT MARKET, BY SOLUTION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 KEY INFORMATION ON SATELLITE AND TERRESTRIAL CONNECTIVITY

- TABLE 4 ECOSYSTEM ANALYSIS

- TABLE 5 PORTER’S FIVE FORCES MODEL

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 PATENTS FILED, 2019–2022

- TABLE 9 AVERAGE SELLING PRICING MODEL

- TABLE 10 KEY CONFERENCES & EVENTS, 2022–2023

- TABLE 11 SATELLITE IOT MARKET, BY SERVICE TYPE, 2017–2021 (USD MILLION)

- TABLE 12 SATELLITE IOT MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 13 SATELLITE IOT BACKHAUL: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 14 SATELLITE IOT BACKHAUL: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 15 DIRECT-TO-SATELLITE: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 16 DIRECT-TO-SATELLITE: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 17 SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017–2021 (USD MILLION)

- TABLE 18 SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022–2027 (USD MILLION)

- TABLE 19 L-BAND: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 20 L-BAND: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 21 KU AND KA-BAND: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 22 KU AND KA-BAND: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 S-BAND: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 24 S-BAND: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 25 OTHER BANDS: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 26 OTHER BANDS: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 28 SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 29 LARGE ENTERPRISES: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 30 LARGE ENTERPRISES: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 31 SMES: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 32 SMES: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 SATELLITE IOT MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 34 SATELLITE IOT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 35 MARITIME: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 36 MARITIME: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 OIL & GAS: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 38 OIL & GAS: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 TRANSPORTATION & LOGISTICS: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 40 TRANSPORTATION & LOGISTICS: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 ENERGY & UTILITIES: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 42 ENERGY & UTILITIES: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 AGRICULTURE: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 44 AGRICULTURE: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 HEALTHCARE: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 46 HEALTHCARE: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 MILITARY & DEFENSE: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 48 MILITARY & DEFENSE: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 OTHER VERTICALS: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 50 OTHER VERTICALS: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 52 SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017–2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017–2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022–2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: SATELLITE IOT MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: SATELLITE IOT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: SATELLITE IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: SATELLITE IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 63 US: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017–2021 (USD MILLION)

- TABLE 64 US: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 65 US: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017–2021 (USD MILLION)

- TABLE 66 US: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022–2027 (USD MILLION)

- TABLE 67 US: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 68 US: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 69 US: SATELLITE IOT MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 70 US: SATELLITE IOT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 71 EUROPE: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017–2021 (USD MILLION)

- TABLE 72 EUROPE: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 73 EUROPE: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017–2021 (USD MILLION)

- TABLE 74 EUROPE: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022–2027 (USD MILLION)

- TABLE 75 EUROPE: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 76 EUROPE: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 77 EUROPE: SATELLITE IOT MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 78 EUROPE: SATELLITE IOT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 79 EUROPE: SATELLITE IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 80 EUROPE: SATELLITE IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 81 UK: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017–2021 (USD MILLION)

- TABLE 82 UK: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 83 UK: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017–2021 (USD MILLION)

- TABLE 84 UK: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022–2027 (USD MILLION)

- TABLE 85 UK: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 86 UK: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 87 UK: SATELLITE IOT MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 88 UK: SATELLITE IOT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017–2021 (USD MILLION)

- TABLE 90 ASIA PACIFIC: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017–2021 (USD MILLION)

- TABLE 92 ASIA PACIFIC: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022–2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 94 ASIA PACIFIC: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SATELLITE IOT MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 96 ASIA PACIFIC: SATELLITE IOT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 97 ASIA PACIFIC: SATELLITE IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 98 ASIA PACIFIC: SATELLITE IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017–2021 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017–2021 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022–2027 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 109 MIDDLE EAST: SATELLITE IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 110 MIDDLE EAST: SATELLITE IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 111 AFRICA: SATELLITE IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 112 AFRICA: SATELLITE IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 113 LATIN AMERICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017–2021 (USD MILLION)

- TABLE 114 LATIN AMERICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 115 LATIN AMERICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017–2021 (USD MILLION)

- TABLE 116 LATIN AMERICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022–2027 (USD MILLION)

- TABLE 117 LATIN AMERICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 118 LATIN AMERICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 119 LATIN AMERICA: SATELLITE IOT MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 120 LATIN AMERICA: SATELLITE IOT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 121 LATIN AMERICA: SATELLITE IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 122 LATIN AMERICA: SATELLITE IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 123 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 124 COMPANY FOOTPRINT, BY SERVICE TYPE

- TABLE 125 COMPANY FOOTPRINT, BY FREQUENCY BAND

- TABLE 126 COMPANY FOOTPRINT, BY REGION

- TABLE 127 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 128 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- TABLE 129 PRODUCT LAUNCHES, 2020–2022

- TABLE 130 DEALS, 2020–2023

- TABLE 131 ORBCOMM: BUSINESS OVERVIEW

- TABLE 132 ORBCOMM: SOLUTIONS OFFERED

- TABLE 133 ORBCOMM: PRODUCT LAUNCHES

- TABLE 134 ORBCOMM: DEALS

- TABLE 135 IRIDIUM COMMUNICATIONS: BUSINESS OVERVIEW

- TABLE 136 IRIDIUM COMMUNICATIONS: PRODUCTS/SERVICES OFFERED

- TABLE 137 IRIDIUM COMMUNICATIONS: PRODUCT LAUNCHES

- TABLE 138 IRIDIUM COMMUNICATIONS: DEALS

- TABLE 139 ASTROCAST: BUSINESS OVERVIEW

- TABLE 140 ASTROCAST: SOLUTIONS/SERVICES OFFERED

- TABLE 141 ASTROCAST: PRODUCT LAUNCHES

- TABLE 142 ASTROCAST: DEALS

- TABLE 143 GLOBALSTAR: BUSINESS OVERVIEW

- TABLE 144 GLOBALSTAR: SOLUTIONS OFFERED

- TABLE 145 GLOBALSTAR: PRODUCT LAUNCHES

- TABLE 146 GLOBALSTAR: DEALS

- TABLE 147 INMARSAT GLOBAL: BUSINESS OVERVIEW

- TABLE 148 INMARSAT GLOBAL: SOLUTIONS/SERVICES OFFERED

- TABLE 149 INMARSAT GLOBAL: DEALS

- TABLE 150 AIRBUS: BUSINESS OVERVIEW

- TABLE 151 AIRBUS: SERVICES OFFERED

- TABLE 152 AIRBUS: DEALS

- TABLE 153 INTELSAT: BUSINESS OVERVIEW

- TABLE 154 INTELSAT: SERVICES OFFERED

- TABLE 155 INTELSAT: DEALS

- TABLE 156 THALES: BUSINESS OVERVIEW

- TABLE 157 THALES: PRODUCTS/SERVICES OFFERED

- TABLE 158 THALES: DEALS

- TABLE 159 EUTELSAT: BUSINESS OVERVIEW

- TABLE 160 EUTELSAT: SOLUTIONS OFFERED

- TABLE 161 EUTELSAT: DEALS

- TABLE 162 NORTHROP GRUMMAN: BUSINESS OVERVIEW

- TABLE 163 NORTHROP GRUMMAN: PRODUCTS OFFERED

- TABLE 164 NORTHROP GRUMMAN: DEALS

- TABLE 165 SMALL SATELLITE MARKET, BY MASS, 2018–2020 (USD MILLION)

- TABLE 166 SMALL SATELLITE MARKET, BY MASS, 2021–2026 (USD MILLION)

- TABLE 167 SMALL SATELLITE MARKET, BY SUBSYSTEM, 2018–2020 (USD MILLION)

- TABLE 168 SMALL SATELLITE MARKET, BY SUBSYSTEM, 2021–2026 (USD MILLION)

- TABLE 169 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2017–2020 (USD MILLION)

- TABLE 170 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OFFERED BY SATELLITE IOT VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OFFERED BY SATELLITE IOT VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 3, TOP-DOWN APPROACH: DEMAND-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 SATELLITE IOT MARKET, 2020–2027

- FIGURE 9 SATELLITE IOT MARKET, REGIONAL SHARE, 2022

- FIGURE 10 EUROPE TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

- FIGURE 11 GROWING DEMAND FOR HYBRID SATELLITE-TERRESTRIAL CONNECTIVITY AND DEVELOPMENT OF SATELLITE NETWORKS

- FIGURE 12 NORTH AMERICA AND TRANSPORTATION AND LOGISTICS SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE IN 2022

- FIGURE 13 UK AND LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE IN 2022

- FIGURE 14 EUROPE TO WITNESS HIGHEST GROWTH BY 2027

- FIGURE 15 SATELLITE IOT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 NUMBER OF SATELLITE IOT SUBSCRIBERS (MILLION), 2021–2027

- FIGURE 17 VALUE CHAIN ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 20 REVENUE SHIFT FOR SATELLITE IOT MARKET

- FIGURE 21 NUMBER OF PATENTS GRANTED, 2019–2022

- FIGURE 22 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

- FIGURE 23 DIRECT-TO-SATELLITE SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 24 KU AND KA-BAND SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 25 SMES SEGMENT TO ACCOUNT FOR HIGHER SHARE DURING FORECAST PERIOD

- FIGURE 26 AGRICULTURE SEGMENT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 27 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 28 EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 30 EUROPE: MARKET SNAPSHOT

- FIGURE 31 MARKET SHARE ANALYSIS, 2022

- FIGURE 32 HISTORICAL REVENUE ANALYSIS, 2019–2021

- FIGURE 33 RANKING OF KEY PLAYERS, 2022

- FIGURE 34 EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 35 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- FIGURE 36 IRIDIUM COMMUNICATIONS: COMPANY SNAPSHOT

- FIGURE 37 GLOBALSTAR: COMPANY SNAPSHOT

- FIGURE 38 INMARSAT GLOBAL: COMPANY SNAPSHOT

- FIGURE 39 AIRBUS: COMPANY SNAPSHOT

- FIGURE 40 INTELSAT: COMPANY SNAPSHOT

- FIGURE 41 THALES: COMPANY SNAPSHOT

- FIGURE 42 EUTELSAT: COMPANY SNAPSHOT

- FIGURE 43 NORTHROP GRUMMAN: COMPANY SNAPSHOT

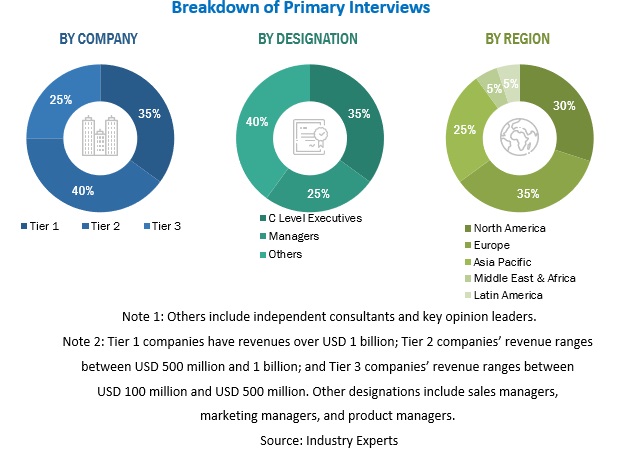

This research study involved extensive secondary sources, directories, and databases, to identify and collect information useful for this technical, market-oriented, and commercial study of the satellite IoT market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess prospects.

Secondary Research

The market size of companies offering satellite IoT solutions and services to various segments is based on the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of the major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications, such as the Institute of Electrical and Electronics Engineers (IEEE), satellite IoT Journal, NASA, ESA, UCS Satellite Database, Committee on Earth Observation Satellites (CEOS), Nanosats Database (Erik Kulu); and articles from recognized associations and government publishing sources research papers.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from market and technology-oriented perspective–all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing automated testing applications across industry verticals. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians, and technologists.

In the market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market’s segments and subsegments listed in the report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types; industry trends; key players; competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges; industry trends; and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the satellite IoT market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This entire research methodology included the study of annual and financial presentations of the top market players as well as interviews with experts for key insights (quantitative and qualitative).

The percentage share, splits, and breakdowns were determined using secondary sources and verified through primary research. All the possible parameters that affect the satellite IoT market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Satellite IoT Market: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the satellite IoT market based on service type, frequency band, organization size, vertical, and region from 2017 to 2027, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the satellite IoT market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total satellite IoT market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the satellite IoT market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities, in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per a company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Satellite IoT Market