Sales Intelligence Market by Component (Software and Services), Application (Lead Management, Data Management, Analytics and Reporting, and Others), Organization Size, Deployment Model, Vertical, and Region - Global Forecast to 2024

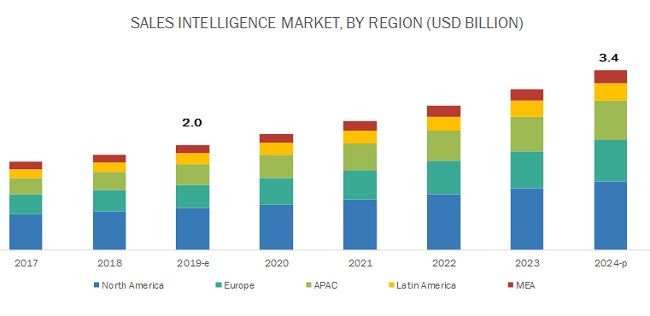

The global sales intelligence market size to reach USD 3.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 11.4% during the forecast period. The market for sales intelligence was valued at USD 2.0 billion in 2019. Factors that drive the growth of the market are imminent need for advanced software to improve customer targeting and connect rates, and growing demand for data enrichment software to improve sales conversions. Moreover, factors such as infusion of Artificial Intelligence (AI) and Machine Learning (ML) capabilities to automate the pre-sales processes and increasing use of company technographics to identify buying intent and improve prospecting, are expected to create ample opportunities for sales intelligence vendors.

Software segment to hold a larger market size during the forecast period

The sales intelligence market by component covers software and services. The software segment is estimated to hold a larger market size during the forecast period. This is mainly due to the integration capabilities of software to integrate with existing systems, such as Customer Relationship Management (CRM) and marketing platform, for enabling quality data enrichment and availability of multiple deployment options. Furthermore, advanced features of sales intelligence software, such as lead management, data management, analytics and reporting, and messaging and alerting, fuels the demand for sales intelligence software.

Lead management to hold the largest market size during the forecast period

The adoption of sales intelligence software for lead management is high because lead management provides coverage on entire process starting from lead generation, gathering insights on leads, and lead scoring to build a comprehensive list of leads. Lead generation also provides them with effective lead scoring and account-level insights, thereby helping them improve their prospecting strategies, which is another factor that adds to the adoption of sales intelligence for lead management.

Large enterprises to hold the largest market size during the forecast period

The adoption of sales intelligence software among large enterprises is high due to increasing competition, and rising rates of data decay. Sales intelligence software help eliminate such data inaccuracies with data enrichment capabilities and help companies maintain edge over their competitors. Furthermore, rising technological proficiency among the large enterprises further compels large enterprises to adopt sales intelligence software for improving sales productivity and reducing sales cycles.

North America to account for the largest market size during the forecast period

The global sales intelligence market by region covers 5 major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period due to increasing technology adoption among North American enterprises for improving sales productivity and the presence of a large number of sales intelligence vendors.

Key Market Players

The major players in the sales intelligence market are DiscoverOrg (US), Dun & Bradstreet (US), LinkedIn (US), Oracle (US), Demandbase (US), InsideView (US), Clearbit (US), HG Insights (US), LeadGenius (US), Infogroup (US), UpLead (US), RelPro (US), DueDil (UK), EverString (US), RingLead (US), Gryphon Networks (US), List Partners (US), FullContact (US), Zoho (US), and Yesware (US).

The study includes an in-depth competitive analysis of these key players in the sales intelligence market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Application, Deployment Model, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, Latin America, and MEA |

|

Companies covered |

DiscoverOrg (US), Dun & Bradstreet (US), LinkedIn (US), Oracle (US), Demandbase (US), InsideView (US), Clearbit (US), HG Insights (US), LeadGenius (US), InfoGroup (US), UpLead (US), RelPro (US), DueDil (UK), EverString (US), RingLead (US), Gryphon Networks (US), List Partners (US), FullContact (US), Zoho (US), and Yesware (US) |

This research report categorizes the sales intelligence market based on component, application, deployment model, organization size, vertical, and region.

Based on Components, the market has been segmented as follows:

- Software

- Services

Based on Applications, the sales intelligence market has been segmented as follows:

- Lead Management

- Data Management

- Analytics and Reporting

- Others (Messaging and Alerting)

Based on Deployment Model, the market has been segmented as follows:

- On-premises

- Cloud

Based on Organization Sizes, the sales intelligence market has been segmented as follows

- SMEs

- Large Enterprises

Based on Verticals, the market has been segmented as follows

- BFSI

- Consumer Goods and Retail

- IT and Telecom

- Media and Entertainment

- Healthcare and Life Sciences

- Manufacturing

- Others (Real Estate, Travel and Hospitality)

Based on Regions, the sales intelligence market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- France

- Rest of Europe

- APAC

- China

- India

- Rest of APAC

- MEA

- South Africa

- UAE

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Frequently Asked Questions (FAQ):

What is sales intelligence?

Sales intelligence software provides for the collection, integration, analysis, and presentation of information to help salespeople find, monitor and understand data that provides insights into prospects and existing clients daily business.

What are the top companies providing sales intelligence solution and services?

The top sales intelligence vendors comprise of DiscoverOrg, Dun & Bradstreet, LinkedIn, Oracle, Demandbase , InsideView , Clearbit , HG Insights , LeadGenius , Infogroup , UpLead , RelPro , among others. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships and collaborations, and mergers and acquisitions to expand their offerings in the sales intelligence market.

What are the top industries adopting sales intelligence?

The following are major industries adopting sales intelligence; BFSI, Consumer goods and retail, IT and Telecom, Media and Entertainment among others.

What are the various use case areas where sales intelligence is used?

Sales intelligence can be used in various areas such as optimizing and cleaning data set, lead identification and many others.

What are various applications of sales intelligence?

There are three major application areas of sales intelligence including lead management, data management and analytics and reporting.

What are various trends in sales intelligence market?

The below are current market trends impacting sales intelligence market;

Driver:

- Imminent Need for Advanced Solutions to Improve Customer Targeting and Connect Rates

- Growing Demand for Data Enrichment Solutions to Improve Sales Conversions

Opportunities:

- Infusion of AI and ML Capabilities to Automate the Pre-Sales Processes

- Increasing Use of Technographics to Identify Buying Intent and Improve Targeting

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.4 Market Forecast

2.5 Competitive Leadership Mapping Research Methodology

2.5.1 Vendor Inclusion Criteria

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in the Market

4.2 North America Sales Intelligence Market, By Application and Country

4.3 Market Major Countries

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Imminent Need for Advanced Solutions to Improve Customer Targeting and Connect Rates

5.2.1.2 Growing Demand for Data Enrichment Solutions to Improve Sales Conversions

5.2.2 Restraints

5.2.2.1 Complexities of the Processes Involved in Maintaining Data Integrity

5.2.3 Opportunities

5.2.3.1 Infusion of AI and ML Capabilities to Automate the Pre-Sales Processes

5.2.3.2 Increasing Use of Technographics to Identify Buying Intent and Improve Targeting

5.2.4 Challenges

5.2.4.1 Achieving 100% Accuracy of Company and Customer Contact Information

5.3 Industry Trends

5.3.1 Case Study 1: Improving Sales Agility and Connect Rates Through Effective Data Consolidation and Data Cleansing

5.3.2 Case Study 2: Optimizing Marketing Database and Enriching Lead List to Enhance Sales and Marketing Productivity and Accelerate Revenue

5.3.3 Case Study 3: Identifying Correct Leads for Improved Business Communication and Deal Closing Rates

6 Sales Intelligence Market By Component (Page No. - 43)

6.1 Introduction

6.2 Software

6.2.1 Need to Improve Lead Conversion Rate Driving the Demand for Sales Intelligence Software

6.3 Services

6.3.1 Increasing Need to Enhance Performance With Tailored Services Driving the Demand for Sales Intelligence Services Among Organizations

7 Market By Application (Page No. - 47)

7.1 Introduction

7.2 Lead Management

7.2.1 Growing Need for Lead Scoring and Account-Level Insights to Drive the Demand for Lead Management

7.3 Data Management

7.3.1 Increasing Need to Filter and Cleanse the Data Driving the Demand for Data Management

7.4 Analytics and Reporting

7.4.1 Growing Need to Analyze Lead Performance Driving the Demand for Analytics and Reporting

7.5 Others

8 Sales Intelligence Market By Service (Page No. - 54)

8.1 Introduction

8.2 Consulting

8.2.1 Focus on Adopting Optimal Sales Intelligence Tools to Drive the Demand for Consulting Services in the Coming Years

8.3 Integration and Deployment

8.3.1 Need for Seamless Integration With Existing Sales Technology to Drive the Demand for Integration and Deployment Services

8.4 Training, Maintenance, and Support

8.4.1 Need for Upgrading Sales Skillsets to Drive the Demand for Training, Maintenance, and Support Services

9 Market By Organization Size (Page No. - 58)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.2.1 Need for Flexible Pricing Models and Cost-Effective Deployment to Boost the Adoption of Sales Intelligence Software in Small and Medium-Sized Enterprises

9.3 Large Enterprises

9.3.1 Need to Improve Sales Performance Driving the Adoption of Sales Intelligence Software Among Large Enterprises

10 Sales Intelligence Market By Deployment Model (Page No. - 62)

10.1 Introduction

10.2 Cloud

10.2.1 Reduced Cost of Implementation to Boost the Adoption of Cloud-Based Sales Intelligence Software

10.3 On-Premises

10.3.1 Need to Improve Data Security Driving the Adoption of On-Premises Sales Intelligence Software

11 Market By Vertical (Page No. - 66)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.2.1 Increased Need to Create Ideal Customer Profiles and Identify High-Risk Accounts Driving the Adoption of Sales Intelligence Software in the BFSI Vertical

11.3 Consumer Goods and Retail

11.3.1 Analyzing Competitor Strategies and Creating Unified Customer Profiles to Fuel the Adoption of Sales Intelligence Software in the Consumer Goods and Retail Vertical

11.4 IT and Telecom

11.4.1 Growing Data Volume and Data Decay Rates Compelling IT and Telecom Companies to Adopt Sales Intelligence Software

11.5 Media and Entertainment

11.5.1 Need for Understanding Customer Needs and Improving Customer Experience to Boost the Adoption of Sales Intelligence Software in the Media and Entertainment Vertical

11.6 Healthcare and Life Sciences

11.6.1 Need for Delivering More Personalized Experiences to Drive the Adoption of Sales Intelligence Software in the Healthcare and Life Sciences Vertical

11.7 Manufacturing

11.7.1 Rising Need to Reach Correct Prospects and Increase Deal Sizes Driving the Adoption of Sales Intelligence Software in the Manufacturing Vertical

11.8 Others

12 Sales Intelligence Market By Region (Page No. - 76)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.1.1 Increasing Need Among Enterprises to Build and Nurture Relationship With Customers and Prospects to Drive the Adoption of Sales Intelligence Software in the Us

12.2.2 Canada

12.2.2.1 Deployment of Sales Intelligence Software to Get Actionable Insights Into Customer and Prospect Requirements to Fuel the Market Growth in Canada

12.3 Europe

12.3.1 United Kingdom

12.3.1.1 Focus of Organizations Across Industries to Anticipate Customer Needs Driving the Adoption of Sales Intelligence Software in the Uk

12.3.2 France

12.3.2.1 Increased Dependency of Enterprises on Technologies to Meet Buyers Evolving Expectations Driving the Growth of Sales Intelligence Market in France

12.3.3 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.1.1 Growing Cloud Deployment and Government Support for the Adoption of Advance Technologies to Drive the Growth of Market in China

12.4.2 India

12.4.2.1 Growing Interest of Organizations Toward Implementing Cloud-Based Solutions and Various Government Initiatives to Fuel the Growth of Market in India

12.4.3 Rest of Asia Pacific

12.5 Middle East and Africa

12.5.1 South Africa

12.5.1.1 Increase in Purchasing Power and Influx of Cloud Services to Fuel the Adoption of Cloud-Based Sales Intelligence Software in South Africa

12.5.2 United Arab Emirates

12.5.2.1 Rising Digitization and High IT Spending to Drive the Growth of Sales Intelligence Market in UAE

12.5.3 Rest of Middle East and Africa

12.6 Latin America

12.6.1 Brazil

12.6.1.1 Increasing Awareness of Sales Intelligence Software Among Enterprises and Huge Demand From Telecom Companies to Improve Customer Prospecting Driving the Market Growth in Brazil

12.6.2 Mexico

12.6.2.1 Growing Focus on Understanding the Needs of Customers Due to Free Trade Agreements Driving the Growth of Market in Mexico

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 115)

13.1 Introduction

13.2 Competitive Scenario

13.2.1 New Product/Solution Launches and Product Enhancements

13.2.2 Acquisitions

13.2.3 Partnerships and Agreements

13.3 Competitive Leadership Mapping

13.3.1 Visionary Leaders

13.3.2 Dynamic Differentiators

13.3.3 Innovators

13.3.4 Emerging Companies

14 Company Profiles (Page No. - 121)

14.1 Introduction

(Business Overview, Platforms, Products, and Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.2 Dun & Bradstreet

14.3 Linkedin

14.4 Discoverorg

14.5 Oracle

14.6 Demandbase

14.7 Clearbit

14.8 Insideview

14.9 Leadgenius

14.10 Infogroup

14.11 Uplead

14.12 Relpro

14.13 Duedil

14.14 Everstring

14.15 Ringlead

14.16 Gryphon Networks

14.17 List Partners

14.18 FuLLContact

14.19 Yesware

14.20 Zoho

*Details on Business Overview, Platforms, Products, and Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 147)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (110 Tables)

Table 1 Factor Analysis

Table 2 Evaluation Criteria

Table 3 Sales Intelligence Market Size, By Component, 20172024 (USD Million)

Table 4 Software: Market Size By Region, 20172024 (USD Million)

Table 5 Services: Market Size By Region, 20172024 (USD Million)

Table 6 Market Size, By Application, 20172024 (USD Million)

Table 7 Lead Management: Market Size By Region, 20172024 (USD Million)

Table 8 Data Management: Market Size By Region, 20172024 (USD Million)

Table 9 Analytics and Reporting: Market Size By Region, 20172024 (USD Million)

Table 10 Other Applications: Market Size By Region, 20172024 (USD Thousand)

Table 11 Market Size, By Service, 20172024 (USD Million)

Table 12 Consulting: Market Size By Region, 20172024 (USD Thousand)

Table 13 Integration and Deployment: Market Size By Region, 20172024 (USD Million)

Table 14 Training, Maintenance, and Support: Market Size By Region, 20172024 (USD Thousand)

Table 15 Sales Intelligence Market Size, By Organization Size, 20172024 (USD Million)

Table 16 Small and Medium-Sized Enterprises: Market Size By Region, 20172024 (USD Million)

Table 17 Large Enterprises: Market Size By Region, 20172024 (USD Million)

Table 18 Market Size, By Deployment Model, 20172024 (USD Million)

Table 19 Cloud: Market Size By Region, 20172024 (USD Million)

Table 20 On-Premises: Market Size By Region, 20172024 (USD Million)

Table 21 Market Size, By Vertical, 20172024 (USD Million)

Table 22 Banking, Financial Services, and Insurance: Market Size By Region, 20172024 (USD Thousand)

Table 23 Consumer Goods and Retail: Market Size By Region, 20172024 (USD Thousand)

Table 24 IT and Telecom: Market Size, By Region, 20172024 (USD Thousand)

Table 25 Media and Entertainment: Market Size By Region, 20172024 (USD Thousand)

Table 26 Healthcare and Life Sciences: Market Size By Region, 20172024 (USD Thousand)

Table 27 Manufacturing: Market Size By Region, 20172024 (USD Thousand)

Table 28 Other Verticals: Market Size By Region, 20172024 (USD Thousand)

Table 29 Sales Intelligence Market Size, By Region, 20172024 (USD Million)

Table 30 North America: Market Size By Component, 20172024 (USD Million)

Table 31 North America: Market Size By Application, 20172024 (USD Million)

Table 32 North America: Market Size By Service, 20172024 (USD Million)

Table 33 North America: Market Size By Organization Size, 20172024 (USD Million)

Table 34 North America: Market Size By Deployment Model, 20172024 (USD Million)

Table 35 North America: Market Size By Vertical, 20172024 (USD Million)

Table 36 North America: Market Size By Country, 20172024 (USD Million)

Table 37 United States: Market Size, By Component, 20172024 (USD Million)

Table 38 United States: Market Size By Organization Size, 20172024 (USD Million)

Table 39 United States: Market Size By Deployment Model, 20172024 (USD Million)

Table 40 Canada: Sales Intelligence Market Size, By Component, 20172024 (USD Million)

Table 41 Canada: Market Size By Organization Size, 20172024 (USD Million)

Table 42 Canada: Market Size By Deployment Model, 20172024 (USD Million)

Table 43 Europe: Market Size By Component, 20172024 (USD Million)

Table 44 Europe: Market Size By Application, 20172024 (USD Million)

Table 45 Europe: Market Size By Service, 20172024 (USD Million)

Table 46 Europe: Market Size By Organization Size, 20172024 (USD Million)

Table 47 Europe: Market Size By Deployment Model, 20172024 (USD Million)

Table 48 Europe: Market Size By Vertical, 20172024 (USD Million)

Table 49 Europe: Market Size By Country, 20172024 (USD Million)

Table 50 United Kingdom: Market Size, By Component, 20172024 (USD Million)

Table 51 United Kingdom: Market Size By Organization Size, 20172024 (USD Million)

Table 52 United Kingdom: Market Size By Deployment Model, 20172024 (USD Million)

Table 53 France: Sales Intelligence Market Size, By Component, 20172024 (USD Million)

Table 54 France: Market Size By Organization Size, 20172024 (USD Million)

Table 55 France: Market Size By Deployment Model, 20172024 (USD Million)

Table 56 Rest of Europe: Market Size, By Component, 20172024 (USD Million)

Table 57 Rest of Europe: Market Size By Organization Size, 20172024 (USD Million)

Table 58 Rest of Europe: Market Size By Deployment Model, 20172024 (USD Million)

Table 59 Asia Pacific: Market Size, By Component, 20172024 (USD Million)

Table 60 Asia Pacific: Market Size By Application, 20172024 (USD Million)

Table 61 Asia Pacific: Market Size By Service, 20172024 (USD Million)

Table 62 Asia Pacific: Market Size By Organization Size, 20172024 (USD Million)

Table 63 Asia Pacific: Market Size By Deployment Model, 20172024 (USD Million)

Table 64 Asia Pacific: Market Size By Vertical, 20172024 (USD Million)

Table 65 Asia Pacific: Market Size By Country, 20172024 (USD Million)

Table 66 China: Sales Intelligence Market Size, By Component, 20172024 (USD Million)

Table 67 China: Market Size By Organization Size, 20172024 (USD Million)

Table 68 China: Market Size By Deployment Model, 20172024 (USD Million)

Table 69 India: Market Size By Component, 20172024 (USD Million)

Table 70 India: Market Size By Organization Size, 20172024 (USD Million)

Table 71 India: Market Size By Deployment Model, 20172024 (USD Million)

Table 72 Rest of Asia Pacific: Market Size, By Component, 20172024 (USD Million)

Table 73 Rest of Asia Pacific: Market Size By Organization Size, 20172024 (USD Million)

Table 74 Rest of Asia Pacific: Market Size By Deployment Model, 20172024 (USD Million)

Table 75 Middle East and Africa: Market Size, By Component, 20172024 (USD Million)

Table 76 Middle East and Africa: Market Size By Application, 20172024 (USD Million)

Table 77 Middle East and Africa: Market Size By Service, 20172024 (USD Million)

Table 78 Middle East and Africa: Market Size By Organization Size, 20172024 (USD Million)

Table 79 Middle East and Africa: Market Size By Deployment Model, 20172024 (USD Million)

Table 80 Middle East and Africa: Market Size By Vertical, 20172024 (USD Thousand)

Table 81 Middle East and Africa: Market Size By Country, 20172024 (USD Million)

Table 82 South Africa: Sales Intelligence Market Size, By Component, 20172024 (USD Million)

Table 83 South Africa: Market Size By Organization Size, 20172024 (USD Million)

Table 84 South Africa: Market Size By Deployment Model, 20172024 (USD Thousand)

Table 85 United Arab Emirates: Market Size, By Component, 20172024 (USD Thousand)

Table 86 United Arab Emirates: Market Size By Organization Size, 20172024 (USD Million)

Table 87 United Arab Emirates: Market Size By Deployment Model, 20172024 (USD Thousand)

Table 88 Rest of Middle East and Africa: Market Size, By Component, 20172024 (USD Million)

Table 89 Rest of Middle East and Africa: Market Size By Organization Size, 20172024 (USD Million)

Table 90 Rest of Middle East and Africa: Market Size By Deployment Model, 20172024 (USD Thousand)

Table 91 Latin America: Market Size, By Component, 20172024 (USD Million)

Table 92 Latin America: Market Size By Application, 20172024 (USD Million)

Table 93 Latin America: Market Size By Service, 20172024 (USD Thousand)

Table 94 Latin America: Market Size By Organization Size, 20172024 (USD Million)

Table 95 Latin America: Market Size By Deployment Model, 20172024 (USD Million)

Table 96 Latin America: Market Size By Vertical, 20172024 (USD Thousand)

Table 97 Latin America: Market Size By Country, 20172024 (USD Million)

Table 98 Brazil: Sales Intelligence Market Size, By Component, 20172024 (USD Million)

Table 99 Brazil: Market Size By Organization Size, 20172024 (USD Million)

Table 100 Brazil: Market Size, By Deployment Model, 20172024 (USD Thousand)

Table 101 Mexico: Market Size By Component, 20172024 (USD Million)

Table 102 Mexico: Market Size By Organization Size, 20172024 (USD Million)

Table 103 Mexico: Market Size By Deployment Model, 20172024 (USD Thousand)

Table 104 Rest of Latin America: Market Size, By Component, 20172024 (USD Million)

Table 105 Rest of Latin America: Market Size By Organization Size, 20172024 (USD Million)

Table 106 Rest of Latin America: Market Size By Deployment Model, 20172024 (USD Thousand)

Table 107 New Product/Solution Launches and Product Enhancements, 2019

Table 108 Acquisitions, 2019

Table 109 Partnerships and Agreements, 20172019

Table 110 Evaluation Criteria

List of Figures (34 Figures)

Figure 1 Global Sales Intelligence Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Market Overview

Figure 4 Highest Growing Segments of the Market

Figure 5 Software Segment to Account for the Larger Market Size During the Forecast Period

Figure 6 Lead Management Segment to Hold the Largest Market Size Among Applications During the Forecast Period

Figure 7 Large Enterprises Segment to Hold the Higher Market Share During the Forecast Period

Figure 8 Cloud Deployment Model to Hold the Higher Market Share During the Forecast Period

Figure 9 IT and Telecom Segment to Hold the Highest Market Share Among Verticals in 2019

Figure 10 Sales Intelligence Regional Snapshot: Country-Wise Market Share in 2019

Figure 11 Rising Technology Infusion to Streamline Pre-Sales Processes and Imminent Need for Improving Connect Rates and Reduce Sales Cycles to Drive the Growth of Market

Figure 12 Lead Management Application and the United States Expected to Account for the Highest Shares in the North American Sales Intelligence Market in 2019

Figure 13 Market in India to Grow at the Highest Rate During the Forecast Period

Figure 14 Drivers, Restraints, Opportunities, and Challenges: Market

Figure 15 Services Segment to Grow at A Higher Rate During the Forecast Period

Figure 16 Lead Management Segment to Grow at the Highest Rate During the Forecast Period

Figure 17 Objectives for Effective Lead Generation

Figure 18 Training, Maintenance, and Support Segment to Grow at the Highest Rate During the Forecast Period

Figure 19 Small and Medium-Sized Enterprises Segment to Grow at A Higher Rate During the Forecast Period

Figure 20 Cloud Segment to Grow at A Higher Rate During the Forecast Period

Figure 21 Cloud Deployment Preference By Year

Figure 22 Consumer Goods and Retail Vertical to Grow at the Highest Rate During the Forecast Period

Figure 23 Channel Sales Had the Highest Churn Rate of 17% Across Software-As-A-Service Companies in 2019

Figure 24 Asia Pacific to Grow at the Highest Rate During the Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Key Developments By the Leading Players in the Sales Intelligence Market

Figure 28 Market (Global) Competitive Leadership Mapping, 2019

Figure 29 Dun & Bradstreet: SWOT Analysis

Figure 30 Linkedin: SWOT Analysis

Figure 31 Discoverorg: SWOT Analysis

Figure 32 Oracle: Company Snapshot

Figure 33 Oracle: SWOT Analysis

Figure 34 Demandbase: SWOT Analysis

The study involved 4 major activities in estimating the current market size for sales intelligence software and services. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred for, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

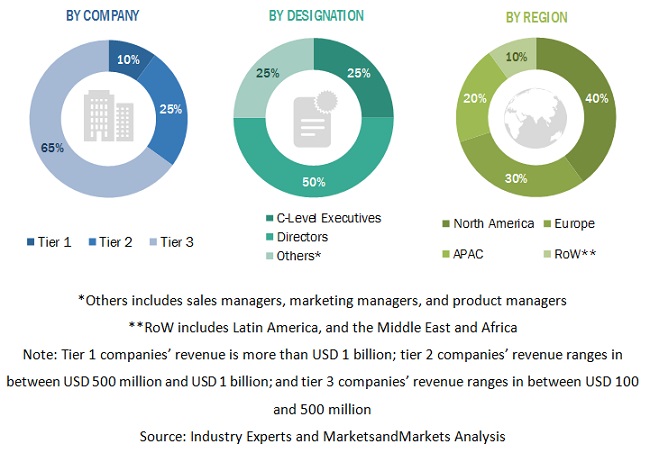

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the sales intelligence market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the sales intelligence market, and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the sales intelligence market by component (software and services), application, deployment model, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the sales intelligence market

- To forecast the market size of 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as new product launches and product enhancements, partnerships, collaborations, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Sales Intelligence Market

Looking for Sales Intelligence report with Company Description, Key contacts, Competitor Landscape, Upcoming IT Projects, Data science projects & Digital Projects, SWOT Analysis, Ongoing projects in IT with contract renewal date.