Sales Enablement Platform Market by Component (Platform And Services), Organization Size, Deployment Type, Industry Vertical (BFSI, IT & Telecom, Consumer Goods & Retail, Healthcare & Life Sciences, Manufacturing), and Region - Global Forecast to 2024

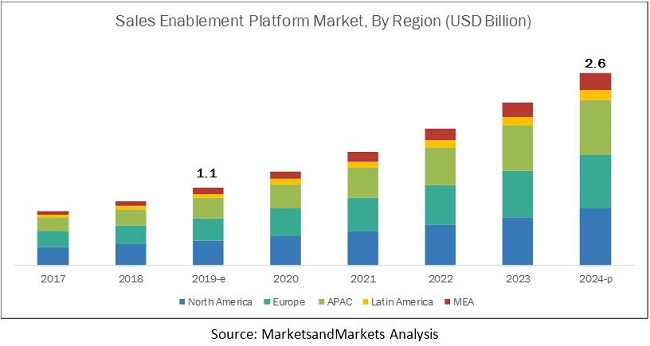

[123 Pages Report] MarketsandMarkets expects the global sales enablement platform market size to grow from USD 1.1 billion in 2019 to USD 2.6 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 19.8% during the forecast period. Growing need among enterprises to improve the internal business process and boost sales performance is expected to drive the growth of sales enablement platform market across various industries globally.

By component type, the platform segment is expected to hold the largest market size during the forecast period

The sales enablement platform empowers organizations with a centralized platform to efficiently manage their sales processes. Growing focus of organizations to automate and enhance their sales processes is expected to drive the demand for sales enablement platform in the global market. The sales enablement platform provides sales and marketing professionals with efficient tools, content, and information to effectively engage with buyers throughout their journey. Organizations across industries are adopting the sales enablement platform, as it enables their sales and marketing teams to enhance their efficiencies in various areas, including sales communication, content management, onboarding, and training. The sales enablement platform helps sales and marketing teams enhance the customer win rate by enabling them to pitch relevant content as per the needs of the client. The platform helps in detailed content analysis, which enables sales and marketing teams to understand the customer buying behavior better and connect accordingly.

The cloud deployment type is expected to grow at a higher CAGR during the forecast period

Organizations nowadays are looking forward to having their solution deployed on the cloud, as cloud deployment offers various advantages, such as scalability, flexibility in capacity, enhanced collaboration, and cost efficiency. Implementation of cloud-based sales enablement platform facilitates SMEs and large enterprises to focus on their core competencies, rather than IT processes. With the help of the cloud-based sales enablement platform, organizations can avoid costs related to software, storage, and technical staff. The cloud-based sales enablement platform offers a centralized way to integrate the system and its components with web and mobile applications and helps organizations boost their sales performance. Cloud-based platform is a good option for organizations with a limited budget, as the cloud offers enhanced speed and scalability.

IT and Telecom industry vertical is expected to have the largest market size during the forecast period

The IT and telecom companies need to respond to varying market conditions for service variations and varying consumer behavior. Hence, these companies engage their sales executives and domain experts in managing the requirements of their clients efficiently. The sales enablement platform enables IT and telecom enterprises to remain competitive in the market and change their sales approach as per industry requirements. The sales enablement platform is transforming the IT and telecom industry vertical by empowering enterprises with increased speed-to-market and the capability to close larger deals at a faster rate. Moreover, the IT and telecom industry vertical has adopted the sales enablement platform to extensively maximize their subscriber business value through a creative sales approach. The sales enablement platform provides sales teams with improved content, which helps close deals faster using suggestions from content engagement analytics.

North America is expected to account for the largest market size during the forecast period

North America is the major contributor holding the highest market share in the sales enablement platform market as the region is a major hub for technological innovations and an early adopter of new technologies. Organizations in the region are focused on offering the best-in-class services to the customers ensuring that they are engaged at the right time with the right content and assets. Higher penetration of Internet, communicating device, and mobiles have significantly changed the buying behavior of customers and to remain competitive, it is imperative to approach customers with the right content. Sales enablement platform is designed to help the brand reach high-potential prospects, increase conversions, and close high-value deals. The presence of major players in the region also supports the demand and awareness regarding the benefits achieved by adoption of sales enablement platforms. Enterprises in the North American region have realized that sales enablement bridges the gap between sales and marketing to generate more business.

Key Sales Enablement Platform Market Players

The major sales enablement platform vendors include SAP (Germany), Bigtincan (US), Upland Software (US), Highspot (US), Seismic (US), Showpad (Belgium), Brainshark (US), ClearSlide (US), ClientPoint (US), Accent Technologies (US), Quark Software (US), Bloomfire (US), Qorus Software (US), Pitcher (Switzerland), Mediafly (US), Rallyware (US), MindTickle (US) and Qstream (US).

Seismic (US), one of the leading providers of sales enablement platform, was founded in 2010 and is headquartered in California, US. The company offers sales and marketing enablement platform to bridge the gap between sales and marketing. Seismic sales enablement platform helps the sales team of an organization to improve the deal conversion rate and improve the overall efficiency. Its sales enablement platform is deployed across organizations in various industry verticals such as asset management, BFSI, consumer packaged goods, healthcare and life sciences, manufacturing, media and advertising, and telecom and IT. Seismic has offices across the US, UK, France, and Australia. The company caters to several customers across 50 countries. In 2017, Seismic sales enablement platform helped its customers improve more than 2.5 million sales interactions.

Scope of Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Components (Platform and Services), Deployment Type, Organization Size, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

It includes 18 major vendors, namely, SAP (Germany); Bigtincan (US); Upland Software (US); Highspot (US); Seismic (US); Showpad (Belgium); Brainshark (US); ClearSlide (US); ClientPoint (US); Accent Technologies (US); Quark Software (US); Bloomfire (US); Qorus Software (US); Pitcher (Switzerland); Mediafly (US); Rallyware (US); MindTickle (US); and Qstream (US). |

This research report categorizes the sales enablement platform market to forecast revenues and analyze trends in each of the following submarkets:

On the basis of components, the sales enablement platform market has been segmented as follows:

-

Component

- Platform

- Services

- Integration and implementation

- Training and support

On the basis of deployment types, the sales enablement platform market has been segmented as follows:

- On-premises

- Cloud

On the basis of organization size, the sales enablement platform market has been segmented as follows:

- SMEs

- Large enterprises

On the basis of industry verticals, the sales enablement platform market has been segmented as follows:

- BFSI

- Consumer goods and retail

- IT and telecom

- Media and entertainment

- Healthcare and life sciences

- Manufacturing

- Others (Real estate, and travel and hospitality)

On the basis of regions, the sales enablement platform market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- APAC

- Australia and New Zealand (ANZ)

- China

- Rest of APAC

- MEA

- South Africa

- United Arab Emirates (UAE)

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In March 2019, Showpad launched Unified Sales Enablement Platform which offers sales content, training, and coaching in a single platform. By leveraging this platform, enterprises can improve sales effectiveness.

-

In March 2019, Upland Software announced New Enterprise Cloud Solution Suites which includes customer experience management, enterprise sales enablement, professional services automation, project and financial management, document lifecycle automation, secure document services, and enterprise knowledge management. This would help the company to deliver enhanced value to its global customers by leveraging the capabilities of related solutions.

Key questions addressed by the report

- How is the adoption trend of sales enablement platform across major economies?

- What are the challenges faced by sales enablement platform vendors in the global market?

- What is the potential of emerging application areas of sales enablement platform?

- The report provides insights on the global sales enablement platform market concerning different industry verticals.

- What are various developments happened in the global market?

Frequently Asked Questions (FAQ):

What is Sales Enablement Platform?

Sales enablement platform are defined as tools that help organizations streamline sales cycle by improving sales communication, sales operations and sales readiness. Some of the major features such as sales content management, customer engagement tracking, sales analytics.What are the top companies in Sales Enablement Platform market?

Major vendors in the Sales Enablement Platform market include SAP, Upland Software, Seismic, Highspot, Accent Technologies, ClearSide, Quark and others. These vendors have adopted various growth strategies in the Sales Enablement Platform market.What are the major factors driving the Sales Enablement Platform market?

Growing need to improve internal business process, coupled with scaling sales efforts with advanced technology and are expected to drive the Sales Enablement Platform market.Which regions are expected to contribute the highest to the Sales Enablement Platform market?

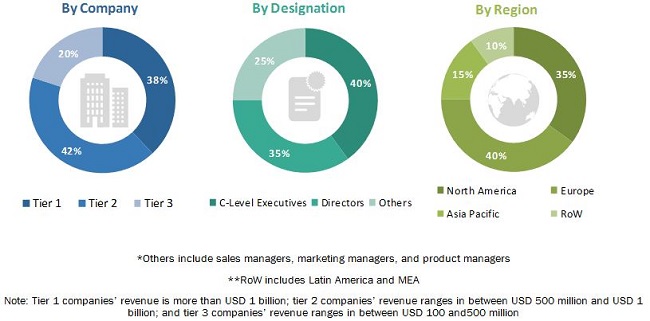

North America and Europe are expected to contribute the highest to the sales enablement platform market ,where these regions are expected to contribute 40% to the market in the year 2019.To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Sales Enablement Platform Market

4.2 Market in North America, By Industry Vertical and Country (2019)

4.3 Market Major Countries

5 Market Overview and Industry Trends (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Need to Improve the Internal Business Process

5.2.1.2 Scaling Sales Efforts With the Help of Advanced Technology

5.2.2 Restraints

5.2.2.1 Inconsistent User Experience Across Various Access Channels

5.2.3 Opportunities

5.2.3.1 Growing Focus of Organization Toward Optimizing Sales Workforce Efficiency

5.2.4 Challenges

5.2.4.1 Upkeeping Sales Communication and Maintaining A Buyer-Seller Relationship

5.2.4.2 Keeping the Customer Better Informed About Products at First Instance

5.3 Industry Trends

5.3.1 Use Case 1: Dun & Bradstreet

5.3.2 Use Case 2: Nxstage Medical, Inc.

6 Sales Enablement Platform Market By Component (Page No. - 36)

6.1 Introduction

6.2 Platform

6.2.1 Growing Focus of Organizations to Automate and Enhance Their Sales Processes to Drive the Demand for Sales Enablement Platform

6.3 Services

6.3.1 Integration and Implementation

6.3.1.1 Efficient Deployment of Sales Enablement Platform Within Organizations’ Systems to Drive the Growth of Integration and Implementation Services

6.3.2 Training and Support

6.3.2.1 Growing Need to Empower Sales Representatives With Enhanced Skills for Fully Utilizing the Sales Enablement Platform to Drive the Growth of Training and Support Services

7 Sales Enablement Platform Market By Organization Size (Page No. - 42)

7.1 Introduction

7.2 Large Enterprises

7.2.1 Growing Need to Have Long-Lasting Relationships With Customers to Drive the Demand for Sales Enablement Platform Solutions Among Large Enterprises

7.3 Small and Medium-Sized Enterprises

7.3.1 The Need for A Cost-Effective and Comprehensive Solution to Drive the Adoption of Sales Enablement Platforms Across SMEs

8 Sales Enablement Platform Market By Deployment Type (Page No. - 46)

8.1 Introduction

8.2 On-Premises

8.2.1 Security Concern Among Enterprises to Drive the Adoption of On-Premises Sales Enablement Platform

8.3 Cloud

8.3.1 Scalability and Cost-Effectiveness are the Major Factors Driving the Adoption of Cloud-Based Sales Enablement Platform

9 Sales Enablement Platform Market By Industry Vertical (Page No. - 50)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.2.1 The Growing Need to Offer Best-In-Class Customer Experience to Drive the Growth of Sales Enablement Platform in the BFSI Industry Vertical

9.3 Consumer Goods and Retail

9.3.1 Growing Competition to Enhance Market Share and Increase Margins to Drive the Growth of Sales Enablement Platform in the Consumer Goods and Retail Industry Vertical

9.4 IT and Telecom

9.4.1 Growing Need to Offer Best-In-Class Customer Experience to Drive the Growth of Sales Enablement Platform in the IT and Telecom Industry Vertical

9.5 Media and Entertainment

9.5.1 Growing Need to Automate Content Creation to Drive the Growth of Sales Enablement Platform in the Media and Entertainment Industry Vertical

9.6 Healthcare and Life Sciences

9.6.1 Growing Need to Share Personalized and Updated Compliance-Approved Content With Prospects to Drive the Growth of Sales Enablement Platform in the Healthcare and Life Sciences Industry Vertical

9.7 Manufacturing

9.7.1 Growing Need to Automate and Enhance Sales Processes to Drive the Growth of Sales Enablement Platform in the Manufacturing Industry Vertical

9.8 Others

10 Sales Enablement Platform Market By Region (Page No. - 59)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Automating Sales Process to Improve Deal Closure Rate to Drive the US Sales Enablement Platform Market

10.2.2 Canada

10.2.2.1 Deployment of Cloud-Based Sales Enablement Platform to Get Actionable Insights From Information to Fuel the Market Growth in Canada

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 Ability to Measure and Analyze Sales Result to Drive the Adoption of Sales Enablement Platform and Services in the Uk

10.3.2 Germany

10.3.2.1 Developed Communication Infrastructure to Propel the Market Growth in Germany

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 Australia and New Zealand

10.4.1.1 Customer-Centric Sales Approach to Drive the Adoption of Sales Enablement Technologies in Anz

10.4.2 China

10.4.2.1 Growing Need Among Sales Representative to Adopt Smart Techniques to Fuel the Market Growth in China

10.4.3 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 South Africa

10.5.1.1 Ability to Align Various Departments in an Organization to Boost the Sales Enablement Market Growth in South Africa

10.5.2 United Arab Emirates

10.5.2.1 Digital Trend Among Various Industry Verticals to Boost the Adoption of Sales Enablement Platform and Services in UAE

10.5.3 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Increasing Awareness About Sales Enablement Techniques to Smoothen the Business Process to Drive the Adoption of Sales Enablement Platform and Services in Brazil

10.6.2 Mexico

10.6.2.1 Increased Productivity of the Sales Workforce By Using Sales Enablement Platform to Boost the Market Growth in Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 81)

11.1 Overview

11.2 Competitive Scenario

11.2.1 New Product/Solution Launches and Product Enhancements

11.2.2 Business Expansions

11.2.3 Acquisitions

11.2.4 Partnerships, Agreements, and Collaborations

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

12 Company Profiles (Page No. - 88)

12.1 Introduction

(Business Overview, Solution, Platform, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 SAP

12.3 Bigtincan

12.4 Upland Software

12.5 Showpad

12.6 Seismic

12.7 Highspot

12.8 Accent Technologies

12.9 ClearSlide

12.10 Brainshark

12.11 Quark

12.12 Bloomfire

12.13 ClientPoint

12.14 Qorus Software

12.15 Pitcher

12.16 Mediafly

12.17 Rallyware

12.18 MindTickle

12.19 Qstream, Inc.

*Details on Business Overview, Solution, Platform, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 116)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (58 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Factor Analysis

Table 3 Sales Enablement Platform Market Size, By Component, 2017–2024 (USD Million)

Table 4 Platform: Market Size By Region, 2017–2024 (USD Million)

Table 5 Services: Market Size By Type, 2017–2024 (USD Million)

Table 6 Services: Market Size By Region, 2017–2024 (USD Million)

Table 7 Integration and Implementation Market Size, By Region, 2017–2024 (USD Million)

Table 8 Training and Support Market Size, By Region, 2017–2024 (USD Million)

Table 9 Sales Enablement Platform Market Size, By Organization Size, 2017–2024 (USD Million)

Table 10 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 11 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 12 Sales Enablement Platform Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 13 On-Premises: Market Size By Region, 2017–2024 (USD Million)

Table 14 Cloud: Market Size By Region, 2017–2024 (USD Million)

Table 15 Sales Enablement Platform Market Size, By Industry Vertical, 2017–2024 (USD Million)

Table 16 Banking, Financial Services, and Insurance: Market Size By Region, 2017–2024 (USD Million)

Table 17 Consumer Goods and Retail: Market Size By Region, 2017–2024 (USD Million)

Table 18 IT and Telecom: Market Size By Region, 2017–2024 (USD Million)

Table 19 Media and Entertainment: Market Size By Region, 2017–2024 (USD Million)

Table 20 Healthcare and Life Sciences: Market Size By Region, 2017–2024 (USD Million)

Table 21 Manufacturing: Market Size By Region, 2017–2024 (USD Million)

Table 22 Others: Market Size By Region, 2017–2024 (USD Million)

Table 23 Sales Enablement Platform Market Size, By Region, 2017–2024 (USD Million)

Table 24 North America: Market Size By Component, 2017–2024 (USD Million)

Table 25 North America: Market Size By Service, 2017–2024 (USD Million)

Table 26 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 27 North America: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 28 North America: Market Size By Industry Vertical, 2017–2024 (USD Million)

Table 29 North America: Market Size By Country, 2017–2024 (USD Million)

Table 30 Europe: Sales Enablement Platform Market Size, By Component, 2017–2024 (USD Million)

Table 31 Europe: Market Size By Service, 2017–2024 (USD Million)

Table 32 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 33 Europe: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 34 Europe: Market Size By Industry Vertical, 2017–2024 (USD Million)

Table 35 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 36 Asia Pacific: Sales Enablement Platform Market Size, By Component, 2017–2024 (USD Million)

Table 37 Asia Pacific: Market Size By Service, 2017–2024 (USD Million)

Table 38 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 39 Asia Pacific: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 40 Asia Pacific: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 41 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 42 Middle East and Africa: Sales Enablement Platform Market Size, By Component, 2017–2024 (USD Million)

Table 43 Middle East and Africa: Market Size By Service, 2017–2024 (USD Million)

Table 44 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 45 Middle East and Africa: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 46 Middle East and Africa: Market Size By Industry Vertical, 2017–2024 (USD Million)

Table 47 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

Table 48 Latin America: Sales Enablement Platform Market Size, By Component, 2017–2024 (USD Million)

Table 49 Latin America: Market Size By Service, 2017–2024 (USD Million)

Table 50 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 51 Latin America: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 52 Latin America: Market Size By Industry Vertical, 2017–2024 (USD Million)

Table 53 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 54 New Product/Solution Launches and Product Enhancements, 2018–2019

Table 55 Business Expansions, 2018–2019

Table 56 Acquisitions, 2018–2019

Table 57 Partnerships, Agreements, and Collaborations, 2017–2019

Table 58 Evaluation Criteria

List of Figures (26 Figures)

Figure 1 Sales Enablement Platform Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Integration and Implementation Segment to Hold the Highest Market Share in the Market in 2019

Figure 4 North America to Account for the Highest Share of the Market in 2019

Figure 5 Growing Focus of Organizations Toward Optimizing Sales Workforce Efficiency to Drive the Growth of the Market

Figure 6 IT and Telecom Industry Vertical and United States to Account for the Highest Shares in the North American Sales Enablement Platform Market in 2019

Figure 7 Australia and New Zealand to Grow at the Highest Rate During the Forecast Period

Figure 8 Drivers, Restraints, Opportunities, and Challenges: Sales Enablement Platform Market

Figure 9 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 10 Integration and Implementation Segment to Grow at A Higher CAGR During the Forecast Period

Figure 11 Small and Medium-Sized Enterprises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 12 Cloud Segment to Grow at A Higher CAGR During the Forecast Period

Figure 13 Consumer Goods and Retail Industry Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 14 Asia Pacific to Witness Significant Growth During the Forecast Period

Figure 15 North America: Market Snapshot

Figure 16 Asia Pacific: Market Snapshot

Figure 17 Key Developments By the Leading Players in the Sales Enablement Platform Market, 2017–2019

Figure 18 Sales Enablement Platform Market (Global) Competitive Leadership Mapping, 2018

Figure 19 Geographic Revenue Mix of the Top Market Players

Figure 20 SAP: Company Snapshot

Figure 21 SAP: SWOT Analysis

Figure 22 Bigtincan: Company Snapshot

Figure 23 Bigtincan: SWOT Analysis

Figure 24 Upland Software: Company Snapshot

Figure 25 Upland Software: SWOT Analysis

Figure 26 Seismic: SWOT Analysis

The study involved 4 major activities in estimating the current market size for the sales enablement platform market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the sales enablement platform market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The sales enablement platform market comprises several stakeholders, such as sales enablement platform vendors, cloud solution providers, cloud service brokers, system integrators, consulting service providers, managed service providers, resellers and distributors, research organizations, government agencies, enterprise users, venture capitalists, private equity firms, and startup companies. The demand side of the market consists of enterprises from different industry verticals, such as BFSI, IT and telecom, consumer goods and retail, media and entertainment, healthcare and life sciences, manufacturing, and others (real state, and travel and hospitality). The supply side includes sales enablement platform providers, offering sales enablement platform and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Sales Enablement Platform Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the sales enablement platform market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides.

Report Objectives

- To define, describe, and forecast the sales enablement platform market by component (platform and services), deployment type, organization size, industry vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegments

- To analyze the competitive developments, such as agreements, partnerships, acquisitions, and product/solution launches, in the sales enablement platform market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the European Sales enablement platform market into countries

- Further breakup of the APAC market into countries

- Further breakup of the MEA market into countries

- Further breakup of the Latin American market into countries

Company information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Sales Enablement Platform Market