Rigid Foam Market by Type (Polyurethane, Polystyrene, Polyethylene, Polypropylene, Polyvinyl-Chloride), End-Use Industry (Building & Construction, Appliances, Packaging, Automotive), Region - Global Forecast to 2022

[142 Pages Report] The Rigid Foam Market is projected to reach USD 99.78 Billion by 2022, at a CAGR of 8.2% from 2017 to 2022. In this study, 2016 is considered the base year to estimate the size of the rigid foam market, while 2017 to 2022 is the forecast period.

The objectives of this study are -

- To analyze, define, segment, and forecast the rigid foam market

- To determine the size of the rigid foam market in various regions, namely, North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the rigid foam market

- To strategically analyze micro-markets with respect to individual growth trends, future prospects, and contribution to the rigid foam market

- To strategically profile the key players in the rigid foam market and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as investments, expansions, joint ventures, mergers & acquisitions, new product launches, and Research & Development (R&D) activities in the rigid foam market

- To analyze the opportunities in the rigid foam market for the key players and provide a detailed competitive landscape for the market leaders

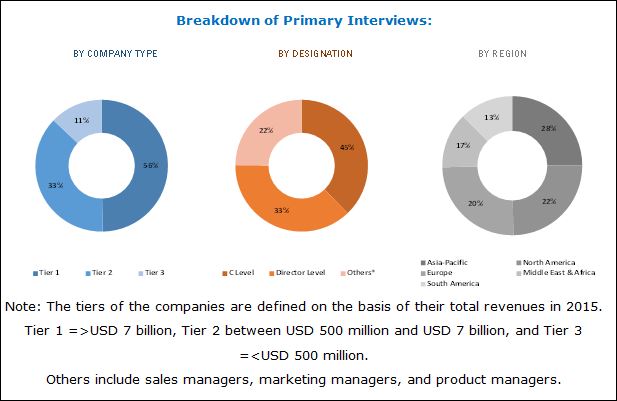

Both, top-down and bottom-up approaches have been used to estimate and validate the global size of the rigid foam market and to estimate the sizes of various other dependent submarkets. The research study involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, British Plastics Federation (BPF), and other government, private, and company websites to identify and collect information useful for this technical, market-oriented, and commercial study of the rigid foam market. After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure given below provides a breakdown of primary interviews on the basis of company type, designation, and region during the research study on the rigid foam market.

To know about the assumptions considered for the study, download the pdf brochure

The rigid foam market has a diversified and well-established ecosystem of upstream players such as raw material suppliers and downstream stakeholders, such as manufacturers, vendors, and end users. BASF SE (Germany), The Dow Chemical Company (U.S), Huntsman Corporation (U.S.), Covestro AG (Germany), JSP Corporation (Japan), Borealis AG (Austria), Sealed Air Corporation (U.S.), Armacell International S.A (Luxembourg), Nitto Denko Corporation (Japan), Woodbridge Foam Corporation (Canada), Kaneka Corporation (Japan), and Zotefoams Plc (U.K.) are the leading manufacturers and suppliers of rigid foam.

Key Target Audience:

- Manufacturers of rigid foam

- Raw material suppliers

- Traders, distributors, and suppliers of rigid foam

- Regional associations of manufacturers of rigid foam

- Government and regional agencies, and research organizations

- Investment research firms

The scope of the Report:

This research report categorizes the rigid foam market on the basis of type, end-use industry, and region.

Rigid foam market, by Type:

- Polyurethane (PU)

- Polystyrene (PS)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Others

Rigid foam market, by End-use Industry:

- Building & construction

- Appliances

- Packaging

- Automobile

- Others

Rigid foam market, by Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the rigid foam market on the basis of type and end-use industry

Company Information:

- Detailed analysis and profiles of additional market players

The rigid foam market is projected to reach USD 99.78 Billion by 2022, at a CAGR of 8.2% from 2017 to 2022. The growth of the rigid foam market is driven by the increasing use of rigid foam in the building & construction industry and appliances industry for insulation and energy saving, and in the automobile industry for weight reduction. These foams are also being increasingly used in the packaging end-use industry, owing to their light weight and durability.

Polyurethane rigid foam is closed cell structure, has high crosslinking density with good heat stability, high compressive strength and excellent insulation properties. It is used in the building & construction, appliances, automotive, packaging, and various other end-use industries. Polyurethane rigid foam is used in the building & construction end-use industry for thermal insulation and energy savings. In the automobile industry, it is used for energy absorption, structural strength, and weight reduction. Increased demand for automobiles and infrastructure developments across the globe are expected to lead to an increase in their production and is thus expected to fuel the growth of the polyurethane foam market during the forecast period.

On the basis of end-use industry, the rigid foam market has been classified into building & construction, appliances, automobile, packaging, and others. In terms of value and volume, the building & construction end-use industry segment is projected to lead the rigid foam market during the forecast period, 2017 to 2022. Increasing concerns across the globe regarding insulation and energy savings have led to the development of use of rigid foam in the building and construction end-use industry.

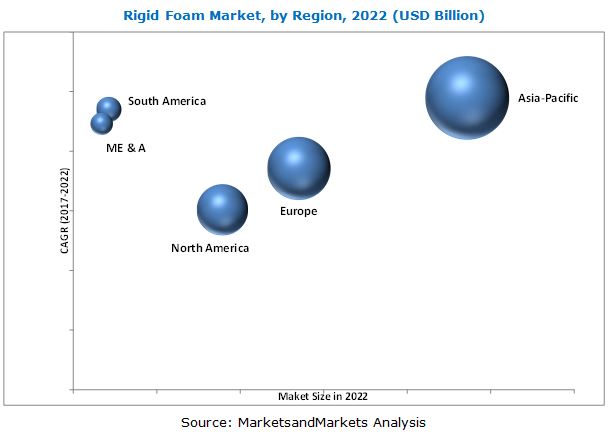

In 2016, the Asia-Pacific rigid foam market witnessed the highest growth, in terms of both, volume as well as value. This trend is projected to continue during the forecast period as well. Emerging markets, such as China, India, and various Southeast Asian countries are attracting a number of global players to establish their manufacturing bases in the Asia-Pacific region. Manufacturers are competing to reach the wide customer base in countries, such as China and India to cater to the increasing demand for technologically advanced and high-quality products. Increased investments in the infrastructure and automobile sectors are driving the growth of the Asia-Pacific rigid foam market.

Though the rigid foam market is witnessing growth across the globe, factors such as volatility in the prices of raw materials are expected to restrain the growth of the rigid foam market, globally.

BASF SE (Germany), The Dow Chemical Company (U.S), Huntsman Corporation (U.S.), Covestro AG (Germany), JSP Corporation (Japan), Borealis AG (Austria), Sealed Air Corporation (U.S.), Armacell International S.A (Luxembourg), Woodbridge Foam Corporation (U.S.), and Zotefoams Plc (U.K.), are the key market players in the rigid foam market. Diverse product portfolios, strategically positioned R&D centers, adoption of various growth strategies, and advancements in technologies for the development of new types of rigid foam are the factors responsible for the strong positions of these companies in the rigid foam market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions & Limitations

2.4.1 Research Assumptions

2.4.2 Research Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in Rigid Foam Market

4.2 Rigid Foam Market, By Type

4.3 Rigid Foam Market, By End-Use Industry

4.4 Global Rigid Foam Market Attractiveness

5 Market Overview (Page No. - 31)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Government Regulations on Greenhouse Gas Emissions

5.1.1.2 Growth in End-Use Industries

5.1.2 Restraints

5.1.2.1 Stringent Regulations on the Use of Selective Blowing Agents

5.1.3 Opportunities

5.1.3.1 Development of Eco-Friendly Raw Materials

5.1.4 Challenges

5.1.4.1 Volatility in Raw Material Prices

5.1.4.2 Lack of Awareness

6 Industry Trends (Page No. - 36)

6.1 Introduction

6.2 Porters Five Forces Analysis of Rigid Foam

6.2.1 Threat of New Entrants

6.2.2 Threat of Substitutes

6.2.3 Bargaining Power of Suppliers

6.2.4 Bargaining Power of Buyers

6.2.5 Intensity of Competitive Rivalry

7 Rigid Foam Market, By Foam Type (Page No. - 39)

7.1 Introduction

7.2 Polyurethane (PUR/PIR) Foam

7.3 Polystyrene Foam

7.4 Polypropylene Foams

7.5 Polyethylene Foam

7.6 Polyvinyl Chloride Foam

7.7 Others

8 Rigid Foams Market, By End Use Industry (Page No. - 49)

8.1 Introduction

8.2 Building & Construction

8.3 Appliances

8.4 Packaging

8.5 Automotive

8.6 Others

8.7 Macroeconomic Overview and Key Trends

8.8 Trends and Forecast of GDP

8.9 Trends and Sales of Automotive Industry

8.10 Trends and Forecast of Construction Industry

8.10.1 North America: Trends and Forecast of Construction Industry

8.10.2 Europe: Trends and Forecast of Construction Industry

8.10.3 Asia-Pacific: Trends and Forecast of Construction Industry

8.10.4 Middle East & Africa: Trends and Forecast of Construction Industry

8.10.5 South America: Trends and Forecast of Construction Industry

9 Rigid Foam Market, By Region (Page No. - 63)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 Italy

9.3.4 U.K.

9.3.5 Spain

9.3.6 Turkey

9.3.7 Russia

9.3.8 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 South Korea

9.4.4 India

9.4.5 Thailand

9.4.6 Indonesia

9.4.7 Malaysia

9.4.8 Rest of Asia-Pacific

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Morocco

9.5.3 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 98)

10.1 Introduction

10.1.1 Vanguards

10.1.2 Innovators

10.1.3 Dynamic

10.1.4 Emerging

10.2 Competitive Benchmarking

10.2.1 Product Offerings

10.2.2 Business Strategy

11 Market Share Analysis (Page No. - 102)

12 Company Profiles (Page No. - 103)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 BASF SE

12.2 DOW Chemical Company

12.3 Huntsman Corporation

12.4 Covestro AG

12.5 JSP Corporation

12.6 Roger Corporation

12.7 Borealis AG

12.8 Armacell International S.A.

12.9 Sealed Air Corporation

12.10 Zotefoams PLC

12.11 List of Other Companies

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 133)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (92 Tables)

Table 1 Rigid Foam Market Size, By Type, 20152022 (USD Billion)

Table 2 Rigid Foam Market Size, By Type, 20152022 (Kiloton)

Table 3 Polyurethane Rigid Foam Market Size, By Region, 20152022 (USD Billion)

Table 4 Polyurethane Market Size, By Region, 20152022 (Kiloton)

Table 5 Polystyrene Rigid Foam Market Size, By Region, 20152022 (USD Million)

Table 6 Polystyrene Market Size, By Region, 20152022 (Kiloton)

Table 7 Polypropylene Rigid Foams Market Size, By Region, 20152022 (USD Million)

Table 8 Polypropylene Rigid Foams Market Size, By Region, 20152022 (Kiloton)

Table 9 Polyethylene Rigid Foam Market Size, By Region, 20152022 (USD Million)

Table 10 Polyethylene Market Size, By Region, 20152022 (Kiloton)

Table 11 Polyvinyl Chloride Rigid Foam Market Size, By Region, 20152022 (USD Million)

Table 12 Polyvinyl Chloride Rigid Foam Market Size, By Region, 20152022 (Kiloton)

Table 13 Other Rigid Foams Market Size, By Region, 20152022 (USD Million)

Table 14 Other Rigid Foams Market Size, By Region, 20152022 (Kiloton)

Table 15 Global Rigid Foam Market Size, By End Use Industry, 20152022 (USD Billion)

Table 16 Global Market Size, By End Use Industry, 20152022 (Kiloton)

Table 17 Rigid Foam Market Size in Building &Construction, By Region, 20152022 (USD Billion)

Table 18 Building &Construction: Rigid Foam Market Size, By Region, 20152022 (Kiloton)

Table 19 By Market Size in Appliances, By Region, 20152022 (USD Million)

Table 20 By Market Size in Appliances, By Region, 20152022 (Kiloton)

Table 21 By Market Size in Packaging, By Region, 20152022 (USD Million)

Table 22 By Market Size in Packaging, By Region, 20152022 (Kiloton)

Table 23 By Market Size in Automotive, By Region, 20152022 (USD Million)

Table 24 By Market Size in Automotive, By Region, 20152022 (Kiloton)

Table 25 By Market Size in Others, By Region, 20152022 (USD Million)

Table 26 By Market Size in Others:, By Region, 20152022 (Kiloton)

Table 27 Trends and Forecast of GDP, USD Billion (20162022)

Table 28 Trends and Sales of Automotive, USD Million (2015 and 2016)

Table 29 Contribution of the Construction Industry to GDP in North America, By Country, USD Billion (20152022)

Table 30 Contribution of the Construction Industry to GDP in Europe, By Country, USD Billion (20152022)

Table 31 Contribution of the Construction Industry to GDP in Asia-Pacific, By Country, USD Billion (20152022)

Table 32 Contribution of the Construction Industry to GDP in Middle East & Africa, USD Billion (20152022)

Table 33 Contribution of the Construction Industry to GDP in South America, USD Billion (20152022)

Table 34 By Market Size, By Region, 20152022 (USD Billion)

Table 35 By Market Size, By Region, 20152022 (Kiloton)

Table 36 North America: Rigid Foam Market Size, By Type, 20152022 (USD Million)

Table 37 North America: Market Size, By Type, 20152022 (Kiloton)

Table 38 North America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 39 North America: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 40 North America: Market Size, By Country, 20152022 (USD Million)

Table 41 North America: Market Size, By Country, 20152022 (Kiloton)

Table 42 U.S.: Rigid Foam Market Size, 20152022 (USD Million & Kiloton)

Table 43 Canada: Rigid Foam Market Size, 20152022 (USD Million & Kiloton)

Table 44 Mexico: Rigid Foam Market Size, 20152022 (USD Million & Kiloton)

Table 45 Europe: Market Size, By Country, 20152022 (Kiloton)

Table 46 Europe: Market Size, By Country, 20152022 (USD Million)

Table 47 Europe: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 48 Europe: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 49 Europe:Market Size, By Type, 20152022 (Kiloton)

Table 50 Europe: Market Size, By Type, 20152022 (USD Million)

Table 51 Germany: Rigid Foam Market Size, 20152022 (Kiloton & USD Million)

Table 52 France: Market Size, 20152022 (Kiloton & USD Million)

Table 53 Italy: Rigid Foam Market Size, 20152022 (Kiloton & USD Million)

Table 54 U.K.: Market Size, 20152022 (Kiloton & USD Million)

Table 55 Spain: Rigid Foam Market Size, 20152022 (Kiloton & USD Million)

Table 56 Turkey: Market Size, 20152022 (Kiloton & USD Million)

Table 57 Russia: Rigid Foam Market Size, 20152022 (Kiloton)

Table 58 Rest of Europe: Market Size, 20152022

Table 59 Asia-Pacific: Rigid Foam Market Size, By Country, 20152022 (Kiloton)

Table 60 Asia-Pacific: Market Size, By Country, 20152022(USD Million)

Table 61 Asia-Pacific: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 62 Asia-Pacific: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 63 Asia-Pacific: Market Size, By Type, 20152022 (Kiloton)

Table 64 Asia-Pacific: Market Size, By Type, 20152022 (USD Million)

Table 65 North America: Rigid Foam Market Size, By Country, 20152022 (USD Million)

Table 66 North America: Market Size, By Country, 20152022 (Kiloton)

Table 67 China: Rigid Foam Market Size, 20152022 (USD Million & Kiloton)

Table 68 Japan: Market Size, 20152022 (Kiloton & USD Million)

Table 69 South Korea: Rigid Foam Market Size, 20152022 (Kiloton & USD Million)

Table 70 India: Market Size, 20152022 (Kiloton & USD Million)

Table 71 Thailand: Rigid Foam Market Size, 20152022(Kiloton & USD Million)

Table 72 Indonesia: Market Size, 20152022 (Kiloton & USD Million)

Table 73 Malaysia: Rigid Foam Market Size, 20152022 (Kiloton & USD Million)

Table 74 Rest of Asia-Pacific: Market Size, 20152022 (Kiloton & USD Million)

Table 75 Middle East & Africa: Rigid Foam Market Size, By Country, 20152022 (Kiloton)

Table 76 Middle East & Africa: Market Size, By Country, 20152022 (USD Million)

Table 77 Middle East & Africa: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 78 Middle East & Africa: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 79 Middle East & Africa: Market Size, By Type, 20152022 (Kiloton)

Table 80 Middle East & Africa: Market Size, By Type, 20152022 (USD Million)

Table 81 South Africa: Rigid Foam Market Size, 20152022 (USD Million & Kiloton)

Table 82 Morocco: Market Size, 20152022 (USD Million & Kiloton)

Table 83 Rest of Middle East & Africa: Rigid Foam Market Size, 20152022 (USD Million & Kiloton)

Table 84 South America: Market Size, By Country, 20152022 (Kiloton)

Table 85 South America: Market Size, By Country, 20152022 (USD Million)

Table 86 South America: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 87 South America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 88 South America: Market Size, By Type, 20152022 (Kiloton)

Table 89 South America: Market Size, By Type, 20152022 (USD Million)

Table 90 Brazil: Rigid Foam Market Size, 20152022 (USD Million & Kiloton)

Table 91 Argentina: Market Size, 20152022 (Kiloton & USD Million)

Table 92 Rest of South America: Rigid Foam Market Size, 20152022 (Kiloton & USD Million)

List of Figures (39 Figures)

Figure 1 Rigid Foam: Market Segmentation

Figure 2 Rigid Foams Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Rigid Foam: Data Triangulation

Figure 6 Rigid Foam Market in Automotive End-Use Industry to Register High CAGR Between 2017 and 2022

Figure 7 Asia-Pacific to Register High CAGR Between 2017 and 2022

Figure 8 Polypropylene Rigid Foam to Register High CAGR Between 2017 and 2022

Figure 9 Asia-Pacific Dominates the Global Rigid Foam Market

Figure 10 Rigid Foam Market Expected to Register High CAGR in Emerging Economies

Figure 11 Rigid Polyurethane Foam to Register the Highest CAGR

Figure 12 Rigid Foam Market in Automotive End-Use Industry to Project High CAGR

Figure 13 China Leads Rigid Foam Market in Asia-Pacific

Figure 14 Asia Pacific is the Largest Rigid Foam Market Registering the Highest CAGR

Figure 15 Drivers, Restraints, Opportunities, and Challenges in the Rigid Foam Market

Figure 16 Fluctuations in the Price of Crude Oil Between 2011 and 2015

Figure 17 Polyurethane to Lead Rigid Foam Market, 2017 vs 2022 (USD Million)

Figure 18 Building & Construction End Use Industry Leads the Rigid Foam Market

Figure 19 GDP of Major Countries in the World in 2015

Figure 20 Asia-Pacific is the Rapidly Growing Rigid Foam Market

Figure 21 North America Market Snapshot: U.S. is the Largest Market

Figure 22 U.S. Leads the Market in North America

Figure 23 Germany Leads Rigid Foam Market in Europe

Figure 24 Asia-Pacific Market Snapshot: China is the Leading Market

Figure 25 China Leads the Rigid Foam Market in Asia-Pacific

Figure 26 South Africa Leads Market in Middle East & Africa

Figure 27 Brazil to Lead Rigid Foam Market in South America

Figure 28 Dive Chart

Figure 29 BASF SE Led the Rigid Foam Market in 2015

Figure 30 BASF SE: Company Snapshot

Figure 31 DOW Chemical Company: Company Snapshot

Figure 32 Huntsman Corporation: Company Snapshot

Figure 33 Covestro AG: Company Snapshot

Figure 34 JSP Corporation: Company Snapshot

Figure 35 Roger Corporation: Company Snapshot

Figure 36 Borealis AG: Company Snapshot

Figure 37 Armacell International S.A.: Company Snapshot

Figure 38 Sealed Air Corporation: Company Snapshot

Figure 39 Zotefoams PLC: Company Snapshot

Growth opportunities and latent adjacency in Rigid Foam Market