Remote Power Panel Market by Type (Wall-mounted, Floor-standing), Application (Network Cabinets, Server Rooms, Data Centers (Cloud, Enterprise)) & Region (North America, Europe, Asia Pacific, South America, Middle East & Africa) - Global Forecast to 2028

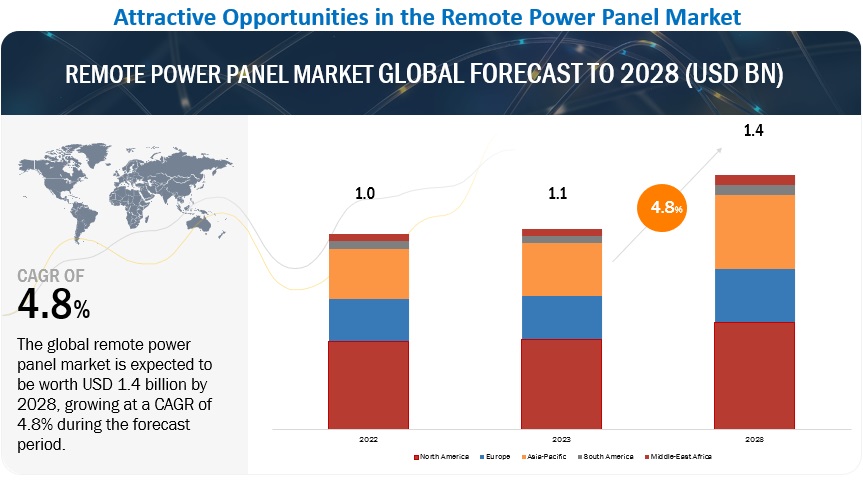

[188 Pages Report] The global remote power panel market is estimated to grow from USD 1.1 billion in 2023 to USD 1.4 billion by 2028; it is expected to record a CAGR of 4.8% during the forecast period. Data centers is one of the major application areas of remote power panels. Data centers would continue to grow by the explosive growth in data generation and storage requirements as a result of widespread adoption of the Internet of Things (IoT), digital technologies, automation, robotics, and artificial intelligence (AI) by business entities. Additionally, more and more businesses and organizations are moving their operations online. This is anticipated to enhance the remote power panel market size.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Remote Power Panel Market Dynamics

Driver: Adoption of digital technologies in IT sector

The IT sector is rapidly growing owing to massive digitalization drive. There is an increasing adoption of cloud storage solutions to prevent data losses and ensure automatic data backups. The requirement for robust data centers is increasing with rapid advancements in the IT sector and the growing preference for digital technologies and cloud services. Investments toward digitalization are also creating multiple opportunities for data center investments. Such efforts are anticipated to drive the demand for RPPs as they provide a critical layer of redundancy and failover protection, help optimize power usage and reduce energy costs, and enable IT administrators to manage power usage from anywhere in the world.

Restraint: Technological advancements in power distribution systems will reduce the usage of RPPs

Nowadays, different power distribution structural designs using overhead busway distribution systems are increasingly being incorporated in data centers for power distribution, owing to their multiple benefits. Originally power distribution in data centers was followed as a standard industrial practice, wherein main power distribution units (PDUs) branch out to smaller remote power panels (RPPs) that feed power whips to racks. The replacement rate of components at the rack for power distribution requirements is high, which forces electricians to use new whips all the time, even when they are excessively heated. If a raised floor space is not available, then the installation cost of power whips can be higher, as they must be installed on a dedicated cable ladder/tray. This is reducing the need of PDUs and RPPs for power distribution.

Opportunities: Huge investments, along with enforcement of stringent standards, to reduce carbon footprint in data centers

Data centers are intense consumers of water and electricity and are responsible for significant carbon emissions. These developments give investors opportunities to secure data centers with carbon-free energy supplies. Measurement and monitoring of data center energy consumption is also gaining traction to enhance achieving sustainability goals. Rack PDUs, PDUs, bus drops, busway end feeds, remote power panels, UPS, and building meters help monitor power consumption and improve energy efficiency. RPPs allow data center operators to remotely monitor and manage power usage, enabling them to identify areas where energy is being wasted and make adjustments to reduce energy consumption. By using remote power panels to optimize energy usage, data centers can reduce their carbon emissions and environmental impact. This is particularly important as the demand for data storage and processing continues to grow and data centers become an increasingly important part of the global technology infrastructure.

Challenges: Entry barriers due to difficulty in complying with complex standards

Remote power panel vendors must comply with government regulations applicable for data center power equipment. Data centers must consume power according to the regulations provided by the International Organization for Standardization (ISO), the European Committee for Electrotechnical Standardization, the American National Standards Institute/Building Industry Consulting Services International (ANSI/BICSI). This has hindered the growth of the data center power market as most of the vendors prefer to consume power based on the requirement of data centers. New market entrants face difficulties in receiving accreditation while conforming to these standards.

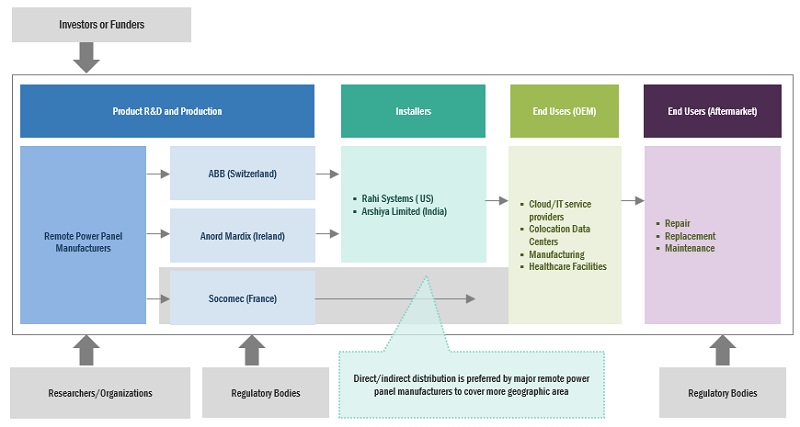

Remote Power Panel Market Ecosystem

Leading companies in this market include well-established, financially secure producers of remote power panels. These corporations have been long operating in the market and have a differentiated product portfolio, modern manufacturing technologies, and robust sales and marketing networks. Major companies in this market include ABB (Switzerland), Schneider Electric (France), Toshiba International Corporation (Japan), Vertiv Group Corporation (US), and Socomec (France).

The network cabinets segment, by wall-mounted type, is expected to be the largest market during the forecast period.

This report analyzes the wall-mounted type market based on based on applications such as network cabinets, server rooms, and data centers. The network cabinets segment is expected to be the largest application of wall-mounted type remote power panels in the forecast period. The low footprint of wall-mounted remote power panels, and the lower capacity makes them ideal for smaller spaces like network cabinets. Additionally, their significantly low price provides an incentive for end users to adopt wall-mounted remote power panels in network cabinets.

By Application, the server rooms segment is expected to be the second fastest growing segment during the forecast period

This report segments the remote power panel market based on application into three segments: network cabinets, server rooms, and data centers. The server rooms segment is expected to be the second-fastest growing segment during the forecast period. Remote power panels can be configured to accommodate a range of power capacities, which makes them scalable and adaptable to changing power requirements without significant disruptions in server rooms. This flexibility is expected to bolster the segmental growth.

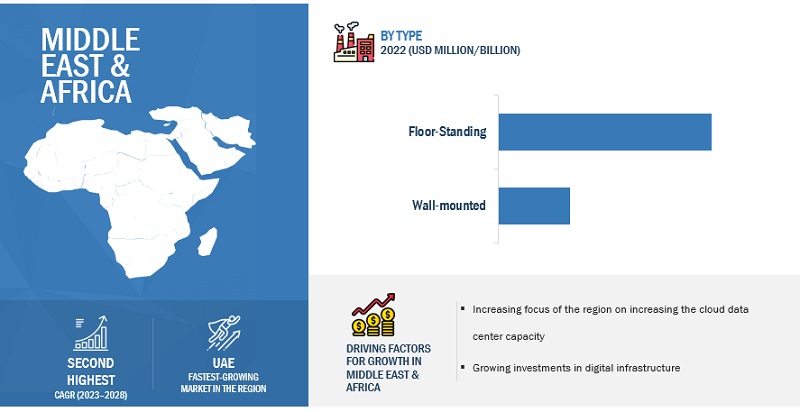

“Middle East & Africa”: The second-fastest in the remote power panel market”

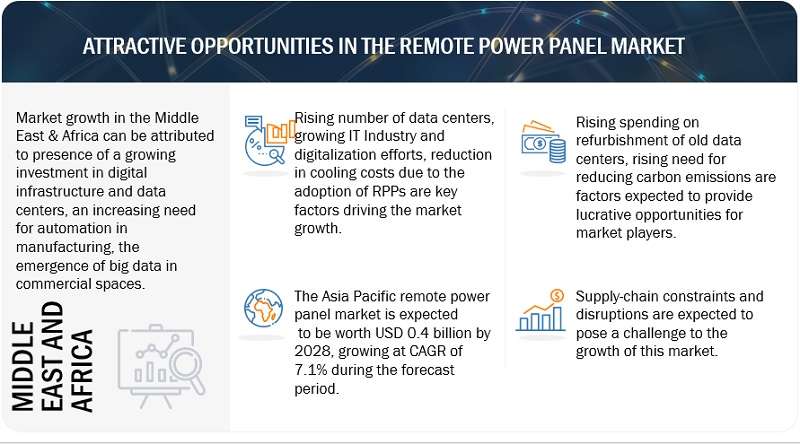

Middle East & Africa is expected to be the second-fastest growing region in the remote power panel market between 2023–2028, preceded by the Asia Pacific, and followed by South America. Rising investments in hyperscale and colocation data center infrastructure and enhanced adoption of cloud computing and digitalization are the key factors fostering the growth of the remote power panel market in the Middle East & Africa.

Key Market Players

The remote power panel market is dominated by a few major players that have a wide regional presence. The major players in the market are Schneider Electric (France), ABB (Switzerland), Toshiba International Corporation (Japan), Vertiv Group Corporation (US), and Socomec (France). Between 2019 and 2023, strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the remote power panel market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Remote power panel market by type, and by application |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies covered |

Schneider Electric(France), ABB(Switzerland), Toshiba International Corporation(Japan), Vertiv Group Corporation(US), Socomec(France), Eaton(Ireland), Anord Mardix (Ireland), C&C Power, Inc. (US), Delta Group (Taiwan), Lutron Electronics Co., Inc. (US), Lyntec (US), LayerZero Power Systems, Inc. (Canada), Universal Power and Cooling (US), Raptor Power Systems (US), Jiangsu Acrel Electrical Manugfacturing Co., Ltd. (China), The EA Group, Hanley Energy (Irreland), Allied Power and Control (Germany), United Engineering Company, Inc. (India). |

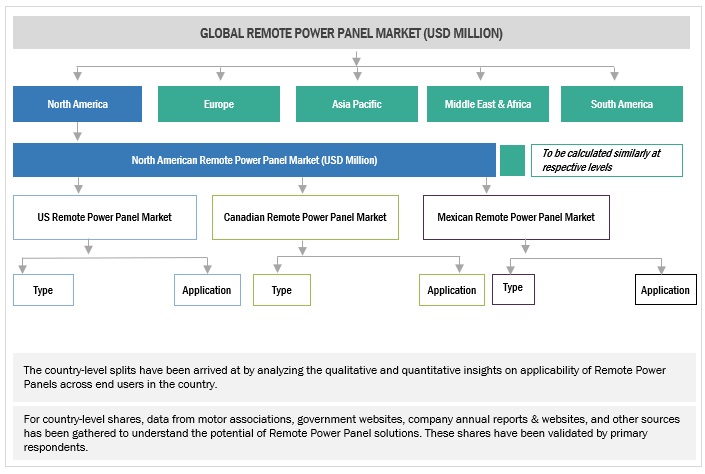

This research report categorizes the remote power panel market by component, power source, application, and region.

By type:

- Wall-mounted

- Floor-standing

By application:

- Data centers

- Network cabinets

- Server rooms

By region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2023, Schneider Electric acquired AVEVA, a provider of industrial software solutions. The acquisition will enable both companies to digitally transform customers’ operations and drive improvements through a reduction in energy, carbon, and resource intensity, encouraging customers to achieve their goals regarding efficiency and sustainability.

- In September 2021, Flex acquired Anord Mardix to shift toward higher margin lines of business and offer data center power solutions. This acquisition will help Anord Mardix to accelerate growth in the data center market. Anord Mardix leveraged Flex’s global footprint and supply chain to establish itself as quality provider across regions.

- In September 2021, ABB reached an agreement to sell the Power Conversion division to AcBel Polytech Inc. The transaction is subject to regulatory approvals and is expected to be completed in the second half of 2023. This segment offers power solutions for telecommunication, data center, and industrial applications. Upon closing, ABB expects to record a small non-operational book gain in income from operations on the sale.

- In August 2020, Schneider Electric launched the Galaxy RPP. Galaxy RPP products are highly configurable and modular. It also offers anytime, anywhere monitoring and service support via cellphone. They are easy to install and maintain due to their compact design. The products compleiments all 75–500 kVA PDUs.

Frequently Asked Questions (FAQ):

What is the current size of the remote power panel market?

The current market size of the remote power panel market is USD 1.1 billion in 2023.

What are the major drivers for the remote power panel market?

Digitalization of industrial processes and offices, cloud computing and investments in data center infrastructure are the major driving factors for the remote power panel market.

Which is the largest region during the forecasted period in the remote power panel market?

North America is expected to dominate the remote power panel market between 2023–2028, followed by Asia Pacific and Europe. Rising urbanization and data center demand with increased data capacity are driving the market for this region.

Which is the largest segment, by type during the forecasted period in the remote power panel market?

The floor-standing segment is expected to be the largest market during the forecast periodowing to their larger and more robust designs than wall-mounted panels, which accommodates more circuit breakers and other electrical components.

Which is the fastest segment, by the application during the forecasted period in the remote power panel market?

The data center segment is expected to be the fastest growing market during the forecast period due to the massive adoption of cloud computing, that is giving rise to development of hyperscale, colocation, and edge cloud data centers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Focus of tech giants on data center expansion- Adoption of digital technologies in IT sector- Reduction in cooling costs with deployment of remote power panels in data centers or server roomsRESTRAINTS- Reduced adoption of remote power panels in power distribution systems due to technological advancementsOPPORTUNITIES- Huge investments, along with enforcement of stringent standards, to reduce carbon footprint in data centers- Data center renovations to achieve reliability and sustainability goalsCHALLENGES- Entry barriers due to difficulty in complying with complex standards- Supply chain constraints and disruptions

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR REMOTE POWER PANEL PROVIDERS

- 5.4 MARKET MAP

-

5.5 VALUE CHAIN ANALYSISRAW MATERIAL PROVIDERS/SUPPLIERSCOMPONENT MANUFACTURERSRPP MANUFACTURERSDISTRIBUTORS AND END USERSPOST-SALES SERVICE PROVIDERS

- 5.6 PRICING ANALYSIS

-

5.7 TARIFF AND REGULATORY LANDSCAPETARIFF RELATED TO REMOTE POWER PANELSCODES AND REGULATIONS RELATED TO REMOTE POWER PANEL MARKETCODES AND REGULATIONS RELATED TO REMOTE POWER PANELS

-

5.8 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

- 5.9 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 TRENDS IN COLOCATION AND HYPERSCALE DATA CENTERS

-

5.13 TECHNOLOGY ANALYSISTECHNOLOGY TRENDS RELATED TO REMOTE POWER PANELS- Intelligent power distribution units

-

5.14 PATENT ANALYSIS

-

5.15 CASE STUDY ANALYSISTABOOLA OVERCOMES PDU FAILURE IN DATA CENTERSNREL REDUCES DATA CENTER LOADS IN ITS FACILITY

- 6.1 INTRODUCTION

-

6.2 NETWORK CABINETSINCREASED UPTIME AND SPACE-SAVING FEATURES TO DRIVE DEMAND FOR NETWORK CABINET APPLICATIONS

-

6.3 SERVER ROOMSSCALABILITY AND MINIMAL SPACE REQUIREMENTS BOOST USE OF REMOTE POWER PANELS IN SERVER ROOMS

-

6.4 DATA CENTERSCENTRALIZED POWER DISTRIBUTION AND EFFICIENT POWER MANAGEMENT FEATURES TO SUPPORT SEGMENTAL GROWTHCLOUD- Flexibility and reliability features to stimulate requirement for remote power panelsENTERPRISE- Control, security, and performance features to fuel demand for remote power panels in enterprises

- 7.1 INTRODUCTION

-

7.2 WALL-MOUNTEDSMALL SIZE, EASY INSTALLATION, AND AESTHETIC FEATURES TO DRIVE SEGMENTAL GROWTH

-

7.3 FLOOR-STANDINGHIGH-POWER CAPACITY, INCREASED DURABILITY, AND FLEXIBLE INSTALLATION BENEFITS TO BOOST SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICRECESSION IMPACT: ASIA PACIFICBY TYPEBY APPLICATIONBY COUNTRYCHINA- Investments in big data centers to drive marketJAPAN- Scaling up operations of data centers to boost marketINDIA- Rapid digitalization and industrialization to accelerate market growthAUSTRALIA- Data center expansion plans of cloud service providers to drive marketTAIWAN- Plan of tech companies to build new data centers to drive marketSOUTH KOREA- Optimization of IT load in data centers to drive marketREST OF ASIA PACIFIC

-

8.3 NORTH AMERICARECESSION IMPACT: NORTH AMERICAUS- Space constraints and growing developments in data centers to drive marketCANADA- Need for power distribution solutions owing to growing number of data centers to propel marketMEXICO- Investments in data center projects to support market growth

-

8.4 EUROPERECESSION IMPACT: EUROPEBY COUNTRYUK- Rising power demand in data centers to boost marketGERMANY- Increasing focus on reducing energy consumption and expanding data centers to drive marketFRANCE- Expansion of cloud-based services to boost marketNETHERLANDS- Data center expansion plans to stimulate market growthITALY- Focus on developing innovative remote power panels to fuel marketSWITZERLAND- Rising demand for reliable power to contribute to market growthSPAIN- Growing cloud and enterprise data center applications to promote market growthREST OF EUROPE

-

8.5 SOUTH AMERICARECESSION IMPACT: SOUTH AMERICABRAZIL- Adoption of digital technology and huge investment in power grid infrastructure to drive marketARGENTINA- Need for power distribution devices in data centers to drive marketCHILE- Investments in critical infrastructure projects to fuel marketURUGUAY- Expansion of cloud service providers to propel marketCOLOMBIA- Increasing investments in cloud and enterprise data centers to support market growthREST OF SOUTH AMERICA

-

8.6 MIDDLE EAST & AFRICARECESSION IMPACT: MIDDLE EAST & AFRICATURKEY- Increasing number of colocation data centers to drive marketSOUTH AFRICA- Investments in data center construction to boost marketIRAN- Growing investments in building enterprise-level data centers to fuel market growthSAUDI ARABIA- Investments by technology companies in improving data center infrastructure to propel marketISRAEL- Development of new data centers to boost need for remote power panelsUAE- Increase in cloud-based data centers to drive marketREST OF MIDDLE EAST & AFRICA

- 9.1 STRATEGIES ADOPTED BY MAJOR PLAYERS

- 9.2 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2021

- 9.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

9.4 COMPANY EVALUATION MATRIX/QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 9.5 MARKET: COMPANY FOOTPRINT

- 9.6 COMPETITIVE SCENARIO

-

10.1 KEY PLAYERSSCHNEIDER ELECTRIC- Business overview- Recent developments- Deals- MnM viewABB- Business overview- Recent developments- MnM viewTOSHIBA INTERNATIONAL CORPORATION- Business overview- Recent developments- MnM viewVERTIV GROUP CORPORATION- Business overview- MnM viewSOCOMEC- Business overview- MnM viewEATON- Business overviewANORD MARDIX- Business overview- Recent developmentsC&C POWER, INC.- Business overviewDELTA GROUP- Business overviewLUTRON ELECTRONICS CO., INC.- Business overviewLYNTEC- Business overview- Products/Solutions offeredLAYERZERO POWER SYSTEMS, INC.- Business overview- Products/Solutions offeredUNIVERSAL POWER AND COOLING- Business overview- Products/Solutions offeredRAPTOR POWER SYSTEMS- Business overview- Products/Solutions offeredJIANGSU ACREL ELECTRICAL MANUFACTURING CO., LTD.- Business overview- Products/Solutions offeredTHE EA GROUPHANLEY ENERGYALLIED POWER AND CONTROLUNITED ENGINEERING COMPANY, INC.

- 11.1 INSIGHTS FROM INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.4 AVAILABLE CUSTOMIZATIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS

- TABLE 1 MARKET SNAPSHOT

- TABLE 2 MAJOR COUNTRIES WITH COLOCATION DATA CENTERS, 2022

- TABLE 3 DATA CENTER SUSTAINABILITY TARGETS AND INVESTMENTS BY MAJOR COMPANIES

- TABLE 4 MAJOR STANDARDS AND REGULATIONS PERTAINING TO DATA CENTER INFRASTRUCTURE

- TABLE 5 MARKET: ECOSYSTEM ANALYSIS

- TABLE 6 AVERAGE SELLING PRICE OF REMOTE POWER PANEL, BY TYPE (USD), 2021 VS. 2028

- TABLE 7 PRICING ANALYSIS, BY REGION (USD), 2021 VS. 2028

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: CODES AND REGULATIONS

- TABLE 14 ASIA PACIFIC: CODES AND REGULATIONS

- TABLE 15 EUROPE: CODES AND REGULATIONS

- TABLE 16 GLOBAL: CODES AND REGULATIONS

- TABLE 17 EXPORT SCENARIO FOR HS CODE: 8537, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 18 IMPORT SCENARIO FOR HS CODE: 8537, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 19 MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 20 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 22 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 23 MARKET: INNOVATION AND PATENT REGISTRATION

- TABLE 24 MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 25 MARKET, BY DATA CENTER APPLICATION, 2016–2020 (USD MILLION)

- TABLE 26 MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 27 NETWORK CABINETS: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 SERVER ROOMS: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 DATA CENTERS: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 31 CLOUD: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 ENTERPRISE: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 34 MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 35 WALL-MOUNTED: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 WALL-MOUNTED: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 37 WALL-MOUNTED: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 38 FLOOR-STANDING: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 FLOOR-STANDING: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 40 FLOOR-STANDING: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 41 MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 42 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 44 ASIA PACIFIC: MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: WALL-MOUNTED MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: WALL-MOUNTED MARKET, DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: FLOOR-STANDING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: FLOOR-STANDING MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 CHINA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 53 CHINA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 54 JAPAN: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 55 JAPAN: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 56 INDIA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 57 INDIA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 AUSTRALIA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 59 AUSTRALIA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 TAIWAN: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 61 TAIWAN: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 62 SOUTH KOREA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 63 SOUTH KOREA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: WALL-MOUNTED MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: WALL-MOUNTED MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: FLOOR-STANDING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: FLOOR-STANDING MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 US: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 75 US: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 76 CANADA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 77 CANADA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 MEXICO: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 79 MEXICO: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 83 EUROPE: WALL-MOUNTED MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 84 EUROPE: WALL-MOUNTED MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 85 EUROPE: FLOOR-STANDINGS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 EUROPE: FLOOR-STANDING MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 UK: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 UK: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 90 GERMANY: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 91 GERMANY: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 92 FRANCE: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 93 FRANCE: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 NETHERLANDS: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 NETHERLANDS: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 96 ITALY: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 97 ITALY: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 98 SWITZERLAND: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 99 SWITZERLAND: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 100 SPAIN: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 101 SPAIN: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 102 REST OF EUROPE: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 103 REST OF EUROPE: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 104 SOUTH AMERICA: MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 105 SOUTH AMERICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 106 SOUTH AMERICA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 107 SOUTH AMERICA: WALL-MOUNTED MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 108 SOUTH AMERICA: WALL-MOUNTED MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 109 SOUTH AMERICA: FLOOR-STANDING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 110 SOUTH AMERICA: FLOOR-STANDING MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 SOUTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 112 BRAZIL: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 113 BRAZIL: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 114 ARGENTINA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 115 ARGENTINA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 116 CHILE: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 117 CHILE: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 118 URUGUAY: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 119 URUGUAY: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 120 COLOMBIA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 121 COLOMBIA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 122 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 123 REST OF SOUTH AMERICA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: WALL-MOUNTED MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: WALL-MOUNTED MARKET, DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: FLOOR-STANDING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: FLOOR-STANDING MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 132 TURKEY: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 133 TURKEY: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 134 SOUTH AFRICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 135 SOUTH AFRICA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 136 IRAN: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 137 IRAN: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 138 SAUDI ARABIA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 139 SAUDI ARABIA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 140 ISRAEL: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 141 ISRAEL: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 142 UAE: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 143 UAE: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 144 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: MARKET, BY DATA CENTER APPLICATION, 2021–2028 (USD MILLION)

- TABLE 146 REVIEW OF STRATEGIES ADOPTED BY KEY PROVIDERS OF REMOTE POWER PANELS

- TABLE 147 MARKET: DEGREE OF COMPETITION

- TABLE 148 TYPE: COMPANY FOOTPRINT

- TABLE 149 APPLICATION: COMPANY FOOTPRINT

- TABLE 150 REGION: COMPANY FOOTPRINT

- TABLE 151 COMPANY FOOTPRINT

- TABLE 152 MARKET: DEALS (SEPTEMBER 2021–JANUARY 2023)

- TABLE 153 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 154 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 155 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 156 SCHNEIDER ELECTRIC: DEALS

- TABLE 157 ABB: COMPANY OVERVIEW

- TABLE 158 ABB: PRODUCTS/SOLUTIONS OFFERED

- TABLE 159 ABB: DEALS

- TABLE 160 TOSHIBA INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 161 TOSHIBA INTERNATIONAL CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 162 TOSHIBA INTERNATIONAL CORPORATION: DEALS

- TABLE 163 VERTIV GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 164 VERTIV GROUP CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 165 SOCOMEC: COMPANY OVERVIEW

- TABLE 166 SOCOMEC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 167 EATON: COMPANY OVERVIEW

- TABLE 168 EATON: PRODUCTS/SOLUTIONS OFFERED

- TABLE 169 ANORD MARDIX: COMPANY OVERVIEW

- TABLE 170 ANORD MARDIX: PRODUCTS/SOLUTIONS OFFERED

- TABLE 171 ANORD MARDIX: DEALS

- TABLE 172 C&C POWER, INC: COMPANY OVERVIEW

- TABLE 173 C&C POWER, INC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 174 DELTA GROUP: COMPANY OVERVIEW

- TABLE 175 DELTA GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 176 LUTRON ELECTRONICS CO., INC.: COMPANY OVERVIEW

- TABLE 177 LUTRON ELECTRONICS CO., INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 178 LYNTEC: COMPANY OVERVIEW

- TABLE 179 LYNTEC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 180 LAYERZERO POWER SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 181 LAYERZERO POWER SYSTEMS, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 182 UNIVERSAL POWER AND COOLING: COMPANY OVERVIEW

- TABLE 183 UNIVERSAL POWER AND COOLING: PRODUCTS/SOLUTIONS OFFERED

- TABLE 184 RAPTOR POWER SYSTEMS: COMPANY OVERVIEW

- TABLE 185 RAPTOR POWER SYSTEMS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 186 JIANGSU ACREL ELECTRICAL MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 187 JIANGSU ACREL ELECTRICAL MANUFACTURING CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR REMOTE POWER PANELS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF REMOTE POWER PANELS

- FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 COMPANY REVENUE ANALYSIS, 2021

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET FROM 2023 TO 2028

- FIGURE 11 FLOOR-STANDING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 DATA CENTERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 RISING ADOPTION OF POWER DISTRIBUTION SOURCES TO DRIVE MARKET

- FIGURE 14 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 15 DATA CENTERS AND US WERE LARGEST SHAREHOLDERS IN NORTH AMERICAN MARKET IN 2022

- FIGURE 16 FLOOR-STANDING SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 17 DATA CENTERS TO CAPTURE LARGEST SHARE OF MARKET IN 2028

- FIGURE 18 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL DATA CENTER CAPACITY GROWTH, 2018–2026

- FIGURE 20 DATA CENTER ENERGY CONSUMPTION, BY EQUIPMENT/SYSTEM TYPE

- FIGURE 21 GLOBAL NOMINAL PRICES FOR ALUMINUM (USD/MT) AND COPPER (USD/MT), 2019–2023

- FIGURE 22 REVENUE SHIFT FOR REMOTE POWER PANEL MANUFACTURERS

- FIGURE 23 MARKET MAP/ECOSYSTEM ANALYSIS

- FIGURE 24 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE OF REMOTE POWER PANEL, BY TYPE, 2021 VS. 2028

- FIGURE 26 PRICING ANALYSIS, BY REGION (USD), 2021 VS. 2028

- FIGURE 27 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 29 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 30 MARKET SHARE, IN TERMS OF VALUE, BY APPLICATION, 2022

- FIGURE 31 MARKET SHARE, IN TERMS OF VALUE, BY TYPE, 2022

- FIGURE 32 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET FROM 2023 TO 2028

- FIGURE 33 MARKET SHARE, IN TERMS OF VALUE, BY REGION, 2022

- FIGURE 34 ASIA PACIFIC: SNAPSHOT OF MARKET

- FIGURE 35 NORTH AMERICA: SNAPSHOT OF MARKET

- FIGURE 36 EUROPE: SNAPSHOT OF MARKET

- FIGURE 37 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN REMOTE POWER PANEL MARKET, 2021

- FIGURE 38 REMOTE POWER PANEL MARKET SHARE ANALYSIS, 2021

- FIGURE 39 REVENUE ANALYSIS OF TOP 5 PLAYERS IN REMOTE POWER PANEL MARKET FROM 2017 TO 2021

- FIGURE 40 REMOTE POWER PANEL MARKET (GLOBAL) KEY COMPANY EVALUATION MATRIX, 2021

- FIGURE 41 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 42 ABB: COMPANY SNAPSHOT

- FIGURE 43 TOSHIBA INTERNATIONAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 VERTIV GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 EATON: COMPANY SNAPSHOT

- FIGURE 46 DELTA GROUP: COMPANY SNAPSHOT

The study involved major activities in estimating the current size of the remote power panel market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the remote power panel market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the remote power panel market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

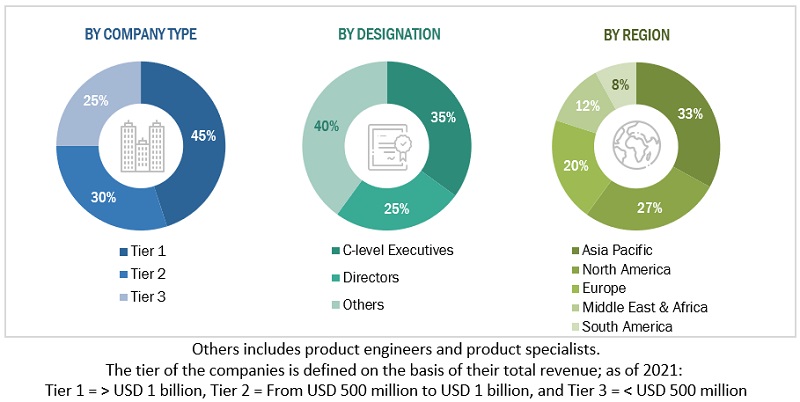

The remote power panel market comprises several stakeholders such as remote power panel manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for remote power panel in data center, network cabinets, and server rooms applications. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the remote power panel market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Remote power panel Market Size: Tow-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Defenition

A remote power panel (RPP) connects power distribution extensions from power distribution units (PDUs) or other power sources to server racks. Remote power panels can be seamlessly integrated into modern state-of-the-art data centers as advantageous modular systems. Maintaining an operational power chain is vital to protect servers from going offline. RPPs help increase power distribution capacity irrespective of the power distribution configuration in a data center.

The growth of the remote power panel market can be attributed to the development of data centers across major countries in North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Key Stakeholders

- Associations, forums, and alliances related to remote power panels.

- Consulting companies in the energy sector

- Government and research organizations

- Power companies

- Power equipment manufacturing companies.

- Data center power organizations, forums, alliances, and associations

- Public and private power generation, transmission, and distribution companies

- State and national regulatory authorities

- Energy management companies

- Government & research organizations

- OEMs

- Power distribution infrastructure installation service providers

- Remote power panel tools and equipment manufacturers

- Power Solutions’ software providers

- IT infrastructure equipment providers

- Support infrastructure equipment providers

- Cloud providers

- Colocation providers

Objectives of the Study

- To define, describe, segment, and forecast the remote power panel market based on type, and application, in terms of value

- To describe and forecast the market for various segments with respect to five main regions (along with respective countries), namely, North America, South America, Europe, Asia Pacific, and the Middle East & Africa, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the market

- To provide a detailed overview of the supply chain, patent analysis, and Porter’s five forces in the market

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders by identifying high-growth segments and detailing the competitive landscape in the market

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies*

- To track and analyze competitive developments such as sales contracts, acquisitions, collaborations, partnerships, agreements, and expansions in the remote power panel market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Remote Power Panel Market