Remote Automotive Exhaust Sensing Market Size, Share & Industry Growth Analysis Report by Component (Hardware, Software and Service), Fuel Type (Petrol and Diesel), Different Pollutants (Carbon Monoxide, Carbon Dioxide, Nitrogen Oxide) and Geography - Global Forecast to 2027

Updated on : Oct 23, 2024

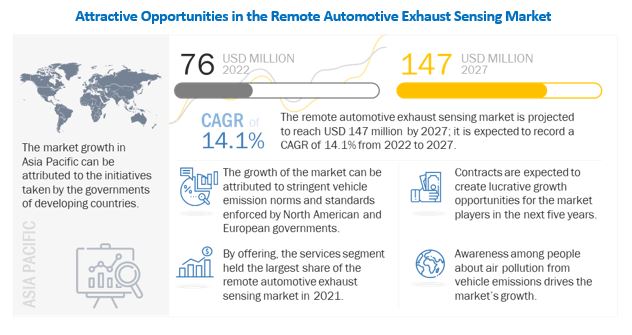

The global remote automotive exhaust sensing market size is projected to grow from USD 76 Million in 2022 to USD 147 Million by 2027; it is expected to grow at a CAGR of 14.1% from 2022 to 2027. Government initiatives in developing countries for emission reduction are among the factors driving the growth of the remote automotive exhaust sensing industy.

To know about the assumptions considered for the study, Request for Free Sample Report

Remote Automotive Exhaust Sensing Market Dynamics:

Driver: Stringent emission norms and standards enforced by North American and European governments

Installing remote exhaust sensing systems is regulated and mandated for the automotive sector because of increasing worldwide environmental awareness. The governments of various countries have executed strict standards and regulations for the use of emission monitoring systems.

For instance, the Environmental Protection Agency’s (EPA) (US) new greenhouse gas (GHG) emissions standard will impact cars and light truck manufacturers in the near future. The new standards would require automobile manufacturers to further reduce the carbon dioxide emissions from vehicles, which is expected to decrease ~28% greenhouse gas emissions from cars and trucks. Moreover, engine and vehicle emissions regulations are adopted by the California Air Resources Board (CARB), a regulatory body within the California EPA.

The US EPA’s most recent emission standards for light-duty vehicles are the Tier 3 standards. These standards are the successor of earlier Tier 2, Tier 1, and pre-Tier 1 federal emission regulations.

- Tier 1 Standards: Was published as a final rule on June 5, 1991; this standard is applied to all new light-duty vehicles (LDV) of less than 8500 lbs gross vehicle weight rating.

- Tier 2 Standards: The standard was adopted on December 21, 1999; this rule extended the applicability of the light-duty emission standards to medium-duty passenger vehicles (MDPV) with GVWR between 8500 and 10,000 lbs.

- Tier 3 Standards: This standard was finalized on March 3, 2014; the regulation includes emission standards for chassis-certified heavy-duty vehicles up to 14,000 lbs.

Also, the Federal Climate Policy 104 (US) includes policies to mitigate climate change by reducing greenhouse gas emissions, removing greenhouse gases from the atmosphere produced by vehicles, and adapting to climate change. They have developed a series of major federal regulations for reducing emissions caused by vehicles. One such policy includes zero-emission vehicle standards in the automotive sector.

Furthermore, the protection of air quality and reduction of greenhouse gas emissions is a priority for the European Commission. The European Commission, the European Parliament, and the European Council agreed on a compromise for the European Union (EU) regulation setting binding carbon dioxide (CO2) emission targets for new passenger cars and light-commercial vehicles for 2025 and 2030.

Restraint: : Inability to perform in harsh weather conditions

Remote sensing instrument surveys are hampered by harsh weather conditions. Weather conditions such as snow, rain, fog, and strong wind may increase the proportion of incorrect records for open path systems.

Heavy rain and snowfall may negatively impact the traffic flow and the air quality, impacting the data collected by the on-road sensing and emission monitoring devices. Measurements are more difficult to make when raining or on a wet surface as they dilute the emitted plume and manipulate the recording. Moreover, snow and rain improve the air quality. This is because the particulates or dissolved gaseous pollutants are scavenged out of the air and carried down to the ground. Therefore, harsh weather and temperature conditions pose a key hurdle for the growth of the remote automotive exhaust sensing market.

Opportunity: Government initiatives in developing countries for emission reduction

According to United Nations Framework Convention on Climate Change (UNFCCC), per capita emissions in developing countries are relatively low than the developed ones. The share of global emissions from developing countries will grow to meet their social and development needs.

The Government of China thus formulated China's National Climate Change Program (CNCCP), which outlines objectives, basic principles, key areas of action, policies, and measures to address climate change. The country has initiated a national climate plan for carbon dioxide emissions to peak in 2030 and for the country to become carbon-neutral by 2060. Also, the China VI emission standard includes complete vehicle PEMS testing requirements based on the European PEMS regulations. This standard will help transition all new heavy-duty vehicles in China to soot-free emission levels.

In India, the Air (Prevention and Control of Pollution) Act of 1981 established the right of the Government to set vehicular emission standards. Section 20 of the act is the Motor Vehicles Act, which prevents and controls air pollution from automobiles. Also, the Modified Indian Driving Cycle (MIDC) is used for assessing emissions from cars and LCVs. MIDC was adopted in the year 2000 and was later modified with a better cold start testing procedure.

Another initiative taken by the Indian Government is the Vehicle Scrappage Policy; it is a government-funded program to scrap old and unfit vehicles and replace them with modern and new vehicles on Indian roads. The primary goal of the policy is to create an ecosystem for phasing out (old) unfit and polluting vehicles to achieve a lower carbon footprint in the country. To promote the policy, the Government initiates a few incentives to motivate the owners to go through this process. This includes cash discounts on the purchase of the next vehicle, reduction in registration or road taxes, etc. These, in turn, are expected to create lucrative growth opportunities for the remote automotive exhaust sensing market.

Challenge: Limited access to vehicle registration data and inconsistency in number plate designs

Access to the registered vehicle information is important to recognize the vehicle specifications from the license plate. Most local authorities have control and access to this data; even if access is granted to the vehicle information, the approval process may be time-consuming and costly.

However, in most regions, obtaining real-time vehicle information is not possible. This limits the benefits that could probably come from real-time emissions information. Generally, access to registered vehicle information is determined by the type of information being requested and the reason for requesting the information. Access to the registered information is limited as it breaches the code of privacy of individuals and increases the risk of misuse of information.

Furthermore, a major challenge remote automotive exhaust sensing manufacturers face is the inconsistency in number plate designs. Number plates differ in size and fonts in every part of the world. So, it becomes difficult to construct an algorithm that would read all fonts without any discrepancy.

If the remote automotive exhaust sensing software is inaccurate, it may misread registration numbers, which may create problems in vehicle identification. In some countries in Asia Pacific, such as China and India, the license plate number and the license plate color code are required for identification of vehicle information. This may lead to increasing complexity in the vehicle identification process.

Remote Automotive Exhaust Sensing Market Segment Overview:

By offering, software segment is expected to grow with the highest CAGR during the forecast period

The software segment is expected to grow at the highest CAGR during the forecast period. The software segment is integral as it stores the monitored data and converts it into readable data. Ecosystem players such as Opus Group AB, Hager Environmental & Atmospheric Technologies (HEAT), and Doppler Environmental Protection Technology Co., Ltd offer software that stores the monitored data.

They offer customized software solutions as per the requirement of the client. Doppler Environmental Protection Technology Co., Ltd has huge software offerings in the ecosystem, such as motor vehicle exhaust remote sensing monitoring systems, electronic capture systems for black smoke cars, vehicle exhaust gas analysis systems, and diesel vehicle OBD remote monitoring terminals.

In 2027, Asia Pacific is projected to hold the largest share of the overall remote automotive exhaust sensing market

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific accounted for the largest share of the market in 2027. The adoption of remote exhaust sensing systems is growing rapidly in China due to climatic conditions worsening from vehicle emissions.

The large market size for remote exhaust sensing systems in the region can be attributed to initiatives taken by the governments of countries such as India and China to detect emissions from vehicles and regulate them. This region has emerged as a major market manufacturing hub for automobiles owing to the rise in manufacturing activities in countries such as China and South Korea, thereby fueling the demand for remote exhaust sensing systems. This, in turn, is expected to boost the growth of the remote automotive exhaust sensing market in Asia Pacific.

Additionally, the presence of several remote exhaust sensing systems manufacturers and other remote exhaust system providers, such as Doppler Environmental Protection Technology Co., Ltd., Anhui Baolong Environmental Protection Technology Co., Ltd., Hangzhou Chunlai Technology Co., Ltd., and Korea Environment Corporation (K-eco) are attributed for the growth in the region.

Key Market Players in Remote Automotive Exhaust Sensing Industry

Some of the major remote automotive exhaust sensing companies are Opus Group AB (Sweden), Hager Environmental & Atmospheric Technologies (US), Doppler Environmental Protection Technology Co., Ltd. (China), Anhui Baolong Environmental Protection Technology Co., Ltd. (China), Korea Environment Corporation (South Korea), and Hangzhou Chunlai Technology Co., Ltd. (China).

Remote Automotive Exhaust Sensing Market Report Scope

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 76 Million |

| Market Size Value in 2027 | USD 147 Million |

| Growth Rate | CAGR of 14.1% |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By offering, fuel type, types of pollutants, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Opus Group AB (Sweden), Hager Environmental & Atmospheric Technologies (US), Doppler Environmental Protection Technology Co., Ltd. (China), Anhui Baolong Environmental Protection Technology Co., Ltd. (China), Korea Environment Corporation (South Korea), and Hangzhou Chunlai Technology Co., Ltd. (China) are some of the key players in the remote automotive exhaust sensing market. |

This research report categorizes the remote automotive exhaust sensing market based on offering, fuel type, type of pollutants, and region.

Based on Offerings:

- Introduction

-

Hardware

- Sensors

- Camera

- Emission Monitoring Systems

- Software

- Services

Based on Fuel Type:

- Introduction

- Petrol

- Diesel

Types Of Pollutants in Remote Automotive Exhaust Sensing Systems

- Introduction

- Carbon Monoxide (CO)

- Carbon Dioxide (CO2)

- Nitrogen Oxide (NOx)

- Hydrocarbon (HC)

- Particulate Matter (PM)

Based on Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Rest of the world

- Middle East & Africa

- South America

Recent Developments in Remote Automotive Exhaust Sensing Industry

- In August 2021, Hager Environmental & Atmospheric Technologies (HEAT) and their partners Element Energy and The International Council for Clean Transportation (ICCT) got a three-year contract. The contract was from Transport Scotland to install a monitoring network to detect real-world emissions using EDAR (Emissions Detection and Reporting) on roadways throughout major cities of Scotland.

- In May 2020, Hager Environmental & Atmospheric Technologies (HEAT) got a three-year contract from the Arizona Department of Environmental Quality (ADEQ); they administer the state’s environmental laws and delegated federal programs to prevent air, water, and land pollution and ensure cleanup. This contract is held to operate remote vehicle inspection pilot programs. This contract will evaluate advanced solutions that should provide convenience, efficiency, and cost-effectiveness to the motorist.

- In April 2020, Arizona Department of Environmental Quality (ADEQ) and Gordan-Darby signed a four-year contract. With this contract, the state’s centralized emission testing program will take place and pilot Opus’ emission remote sensing technology in the state. Gordan-Darby would advance new technologies and features into the vehicle inspection program with the contract.

Frequently Asked Questions (FAQs):

Which are the major companies in the remote automotive exhaust sensing market? What are their major strategies to strengthen their market presence?

The major companies in the remote automotive exhaust sensing market are – Opus Group AB (Sweden), Hager Environmental & Atmospheric Technologies (US), Doppler Environmental Protection Technology Co., Ltd. (China), Anhui Baolong Environmental Protection Technology Co., Ltd. (China), Korea Environment Corporation (South Korea), and Hangzhou Chunlai Technology Co., Ltd. (China) are some of the key players in the remote automotive exhaust sensing market. The major strategies adopted by these players are contracts.

Which is the potential market for remote automotive exhaust sensing systems in terms of the region?

Asia Pacific region is expected to dominate the remote automotive exhaust sensing market owing to the high demand of remote vehicle exhaust sensing system.

Who are the winners in the global remote automotive exhaust sensing market?

Companies such as Opus Group AB (Sweden), Hager Environmental & Atmospheric Technologies (US); fall under the winner’s category. These companies cater to the requirements of their customers by providing advanced automotive exhaust sensing systems. Moreover, these companies are highly adopting inorganic growth strategies to strengthen their market position and customer base worldwide.

What are the drivers and opportunities for the remote automotive exhaust sensing market?

Factors such as stringent emission norms and standards enforced by North American and European governments are among the driving factors of the remote automotive exhaust sensing market. Moreover, government initiatives in developing countries for vehicle emission reduction is expected to offer lucrative opportunities for the remote automotive exhaust sensing market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 REMOTE AUTOMOTIVE EXHAUST SENSING MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 2 REMOTE AUTOMOTIVE EXHAUST SENSING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 List of key primary interview participants

2.1.3.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARIES

2.1.3.3 Key data from primary sources

2.1.3.4 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for obtaining market share using bottom-up analysis (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for obtaining market share using top-down analysis (supply side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.3 GROWTH PROJECTION AND FORECAST ASSUMPTIONS

TABLE 1 MARKET GROWTH ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 REMOTE AUTOMOTIVE EXHAUST SENSING MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 2 KEY ASSUMPTIONS: MACRO AND MICRO-ECONOMIC ENVIRONMENT

2.5 RESEARCH LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 3 RISK ASSESSMENT: REMOTE AUTOMOTIVE EXHAUST SENSING MARKET

3 EXECUTIVE SUMMARY (Page No. - 35)

3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 8 SERVICES SEGMENT TO HOLD LARGEST MARKET SHARE BY 2022

FIGURE 9 ASIA PACIFIC TO LEAD MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS IN REMOTE AUTOMOTIVE EXHAUST SENSING MARKET

FIGURE 10 GOVERNMENT INITIATIVES IN DEVELOPING COUNTRIES FOR EMISSION REDUCTION TO DRIVE MARKET GROWTH

4.2 MARKET, BY OFFERING

FIGURE 11 SERVICES SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 12 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN 2027

4.4 MARKET, BY COUNTRY

FIGURE 13 CHINA TO RECORD HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

FIGURE 14 REMOTE AUTOMOTIVE EXHAUST SENSING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Stringent emission norms and standards enforced by North American and European governments

FIGURE 15 AVERAGE HISTORICAL AND TARGETED CO2 EMISSION VALUES BY NEW CARS IN EUROPE

5.1.1.2 Awareness among consumers about vehicle pollution

FIGURE 16 DRIVERS AND THEIR IMPACT ON MARKET

5.1.2 RESTRAINTS

5.1.2.1 Inability to perform in harsh weather conditions

FIGURE 17 RESTRAINTS AND THEIR IMPACT ON REMOTE AUTOMOTIVE EXHAUST SENSING MARKET

5.1.3 OPPORTUNITIES

5.1.3.1 Government initiatives in developing countries for emission reduction

FIGURE 18 OPPORTUNITIES AND THEIR IMPACT ON MARKET

5.1.4 CHALLENGES

5.1.4.1 Limited access to vehicle registration data and inconsistency in number plate designs

FIGURE 19 CHALLENGES AND THEIR IMPACT ON REMOTE AUTOMOTIVE EXHAUST SENSING MARKET

5.2 SUPPLY CHAIN ANALYSIS

FIGURE 20 MARKET: SUPPLY CHAIN

TABLE 4 MARKET: ECOSYSTEM

5.3 MARKET: ECOSYSTEM

FIGURE 21 ECOSYSTEM OF REMOTE AUTOMOTIVE EXHAUST SENSING SYSTEM

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

FIGURE 22 REVENUE SHIFT IN REMOTE AUTOMOTIVE EXHAUST SENSING MARKET

5.4 KEY TECHNOLOGY TRENDS

TABLE 5 GAS DETECTION ACCURACY, BY TECHNOLOGY

5.4.1 LASER-BASED TECHNOLOGY

5.4.2 NDIR/NDUV

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 CASE STUDIES

5.6.1 BEAMS OF LIGHT MEASURE CAR EMISSIONS AND CAMERAS FILM LICENSE PLATES

5.6.2 HEAT DEPLOYED EDAR SYSTEM IN ONTARIO

5.6.3 OPUS RSE OFFERED EFFICIENT SOLUTION FOR IDENTIFYING EMISSIONS FROM HEAVY-DUTY TRUCKS IN DENMARK

5.6.4 HEAT PERFORMED REMOTE SENSING EMISSIONS TESTING CAMPAIGN IN BELGIUM

5.7 TRADE ANALYSIS

5.7.1 IMPORT SCENARIO

TABLE 7 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

5.7.2 EXPORT SCENARIO

TABLE 8 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

5.8 PATENT ANALYSIS

TABLE 9 LIST OF A FEW PATENTS PERTAINING TO REMOTE AUTOMOTIVE EXHAUST SENSING

5.9 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 10 REMOTE AUTOMOTIVE EXHAUST SENSING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.10 STANDARDS AND REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 REGULATIONS

5.10.3 STANDARDS

5.10.4 VOICE OF CUSTOMERS: CHINA

TABLE 15 OVERVIEW OF REMOTE SENSING TECHNOLOGY IN CHINA

5.10.5 VEHICLE EMISSIONS REGULATIONS IN INDIA

TABLE 16 HISTORY OF INDIAN EMISSION NORMS

TABLE 17 BS-VI VS. BS-IV POLLUTANTS EMISSION LIMITATION

5.11 TARIFF ANALYSIS

TABLE 18 TARIFF FOR HS CODE 902710 EXPORTED BY US (2021)

TABLE 19 TARIFF FOR HS CODE 902710 EXPORTED BY CHINA (2021)

6 REMOTE AUTOMOTIVE EXHAUST SENSING MARKET, BY OFFERING (Page No. - 66)

6.1 INTRODUCTION

FIGURE 24 SCHEMATIC SETUP OF CROSSROAD REMOTE AUTOMOTIVE EXHAUST SENSING SYSTEMS

FIGURE 25 SCHEMATIC SETUP OF OVERHEAD REMOTE AUTOMOTIVE EXHAUST SENSING SYSTEMS

6.1.1 KEY PRIMARY INSIGHTS ON OFFERING

FIGURE 26 SERVICES SEGMENT PROJECTED TO OCCUPY LARGEST MARKET SHARE IN 2027

TABLE 20 REMOTE AUTOMOTIVE EXHAUST SENSING MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 21 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 HARDWARE

6.2.1 NECESSARY TO COLLECT AND MONITOR DATA

6.2.1.1 Emission monitoring sensors

6.2.1.2 Cameras

6.2.1.3 Other sensors

TABLE 22 HARDWARE: MARKET, BY TYPE, 2021 AND 2027 (SHARE %)

6.3 SOFTWARE

6.3.1 CONVERTS STORED DATA INTO DIGITAL FORMAT

6.4 SERVICES

6.4.1 OFFERS RENTAL OR LEASE-BASED REMOTE SENSING DEVICES

7 REMOTE AUTOMOTIVE EXHAUST SENSING MARKET, BY FUEL TYPE (Page No. - 73)

7.1 INTRODUCTION

7.1.1 KEY PRIMARY INSIGHTS ON FUEL TYPE

7.2 PETROL

7.2.1 POLLUTANTS COMBUSTED BY PETROL HAVE ADVERSE EFFECTS ON HUMAN BODY

TABLE 23 EUROPEAN UNION EMISSION STANDARDS FOR PETROL VEHICLES

7.3 DIESEL

7.3.1 ESTIMATING TAILPIPE CONCENTRATION DIFFICULT WITH DIESEL VEHICLES

TABLE 24 EUROPEAN UNION EMISSION STANDARDS FOR DIESEL VEHICLES

8 TYPES OF POLLUTANTS IN REMOTE AUTOMOTIVE EXHAUST SENSING SYSTEMS (Page No. - 76)

8.1 INTRODUCTION

8.2 CARBON MONOXIDE (CO)

8.2.1 CARBON MONOXIDE IS COLORLESS, ODORLESS, TASTELESS, FLAMMABLE GAS

8.3 CARBON DIOXIDE (CO2)

8.3.1 CARBON DIOXIDE CAN AFFECT RESPIRATORY FUNCTIONS OF HUMANS AND CAUSE EXCITATION

8.4 NITROGEN OXIDE (NOX)

8.4.1 NITROGEN OXIDES ARE FAMILY OF POISONOUS, HIGHLY REACTIVE GASES

8.5 HYDROCARBON (HC)

8.5.1 HYDROCARBONS ARE MOLECULES OF CARBON AND HYDROGEN IN VARIOUS COMBINATIONS

8.6 PARTICULATE MATTER (PM)

8.6.1 PARTICULATE MATTER IS MIXTURE OF MANY CHEMICAL SPECIES

9 REMOTE AUTOMOTIVE EXHAUST SENSING MARKET, BY REGION (Page No. - 78)

9.1 INTRODUCTION

9.1.1 KEY PRIMARY INSIGHTS ON GEOGRAPHY

FIGURE 27 ASIA PACIFIC PROJECTED TO OCCUPY LARGEST MARKET SHARE IN 2027

TABLE 25 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: REMOTE AUTOMOTIVE EXHAUST SENSING MARKET SNAPSHOT

TABLE 27 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 29% of greenhouse gas emissions come from transportation sector

9.2.2 CANADA

9.2.2.1 Governmental organizations to detect vehicle emissions and regulate laws

9.2.3 MEXICO

9.2.3.1 Vehicle evaporative emissions contribute to high ozone levels

9.3 EUROPE

FIGURE 29 EUROPE: REMOTE AUTOMOTIVE EXHAUST SENSING MARKET SNAPSHOT

TABLE 29 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 30 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 Transport remains highest carbon-emitting sector

9.3.2 GERMANY

9.3.2.1 Germany has stringent emission standards

9.3.3 FRANCE

9.3.3.1 Tourism attracts more vehicle emissions

9.3.4 REST OF EUROPE

FIGURE 30 PETROL VEHICLE EMISSIONS AGAINST PETROL EURO STANDARD LIMITS FOR CO

FIGURE 31 PETROL VEHICLE EMISSIONS AGAINST PETROL EURO STANDARD LIMITS FOR HC

FIGURE 32 PETROL VEHICLE EMISSIONS AGAINST PETROL EURO STANDARD LIMITS FOR NOX

FIGURE 33 PETROL VEHICLE EMISSIONS AGAINST PETROL EURO STANDARD LIMITS FOR PM

FIGURE 34 DIESEL VEHICLE EMISSIONS AGAINST PETROL EURO STANDARD LIMITS FOR CO

FIGURE 35 DIESEL VEHICLE EMISSIONS AGAINST PETROL EURO STANDARD LIMITS FOR HC

FIGURE 36 DIESEL VEHICLE EMISSIONS AGAINST PETROL EURO STANDARD LIMITS FOR NOX

FIGURE 37 DIESEL VEHICLE EMISSIONS AGAINST PETROL EURO STANDARD LIMITS FOR PM

9.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: REMOTE AUTOMOTIVE EXHAUST SENSING MARKET SNAPSHOT

TABLE 31 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 32 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Government improving air quality by tackling air pollution

9.4.2 INDIA

9.4.2.1 Government taking multiple initiatives to implement remote sensing systems

9.4.3 JAPAN

9.4.3.1 Regulating standards and norms to reduce pollutants from vehicle emissions

9.4.4 SOUTH KOREA

9.4.4.1 Conducts periodic inspections to identify high-emitting vehicles

9.4.5 REST OF ASIA PACIFIC

9.5 ROW

TABLE 33 ROW: REMOTE AUTOMOTIVE EXHAUST SENSING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA (MEA)

9.5.1.1 Growing vehicle pollutants known to contribute to health concerns

9.5.2 SOUTH AMERICA

9.5.2.1 Opus RSE taking initiatives to detect emissions from driving vehicles

10 COMPETITIVE LANDSCAPE (Page No. - 97)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

TABLE 35 OVERVIEW OF STRATEGIES DEPLOYED BY KEY REMOTE AUTOMOTIVE EXHAUST SENSING COMPANIES

10.2.1 PRODUCT PORTFOLIO

10.2.2 REGIONAL FOCUS

10.2.3 MANUFACTURING FOOTPRINT

10.2.4 ORGANIC/INORGANIC STRATEGIES

10.3 MARKET SHARE ANALYSIS, 2021

TABLE 36 REMOTE AUTOMOTIVE EXHAUST SENSING MARKET: MARKET SHARE ANALYSIS (2021)

10.4 COMPANY FOOTPRINT

TABLE 37 COMPANY FOOTPRINT

TABLE 38 COMPANY OFFERING FOOTPRINT

TABLE 39 COMPANY REGION FOOTPRINT

10.5 COMPETITIVE SCENARIOS AND TRENDS

10.5.1 DEALS

TABLE 40 DEALS, JANUARY 2019 – AUGUST 2021

11 COMPANY PROFILES (Page No. - 102)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View)*

11.1.1 OPUS GROUP AB

TABLE 41 OPUS GROUP AB: COMPANY SNAPSHOT

TABLE 42 OPUS GROUP AB: PRODUCTS/SERVICES/SOLUTIONS OFFERINGS

TABLE 43 OPUS GROUP AB: DEALS

11.1.2 HAGER ENVIRONMENTAL & ATMOSPHERIC TECHNOLOGIES (HEAT)

TABLE 44 HAGER ENVIRONMENTAL & ATMOSPHERIC TECHNOLOGIES (HEAT): COMPANY SNAPSHOT

TABLE 45 HAGER ENVIRONMENTAL & ATMOSPHERIC TECHNOLOGIES (HEAT): PRODUCTS/SERVICES/SOLUTIONS OFFERINGS

TABLE 46 HAGER ENVIRONMENTAL & ATMOSPHERIC TECHNOLOGIES (HEAT): DEALS

11.1.3 DOPPLER ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.

TABLE 47 DOPPLER ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

TABLE 48 DOPPLER ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERINGS

11.1.4 ANHUI BAOLONG ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.

TABLE 49 ANHUI BAOLONG ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

TABLE 50 ANHUI BAOLONG ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERINGS

11.1.5 KOREA ENVIRONMENT CORPORATION (K-ECO)

TABLE 51 KOREA ENVIRONMENT CORPORATION: COMPANY SNAPSHOT

TABLE 52 KOREA ENVIRONMENT CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERINGS

11.1.6 HANGZHOU CHUNLAI TECHNOLOGY CO., LTD.

TABLE 53 HANGZHOU CHUNLAI TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

TABLE 54 HANGZHOU CHUNLAI TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERINGS

11.2 OTHER PLAYERS

11.2.1 UNIVERSITY OF DENVER

TABLE 55 UNIVERSITY OF DENVER: COMPANY SNAPSHOT

11.2.2 CALIFORNIA AIR RESOURCES BOARD (CARB)

TABLE 56 CALIFORNIA AIR RESOURCES BOARD: COMPANY SNAPSHOT

* Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 113)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the remote automotive exhaust sensing market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering remote automotive exhaust sensing systems have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the remote automotive exhaust sensing market. Secondary sources considered for this research study include government sources; corporate filings; and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of remote automotive exhaust sensing systems to identify key players based on their products and prevailing industry trends in the remote automotive exhaust sensing market by offerings, by fuel type, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

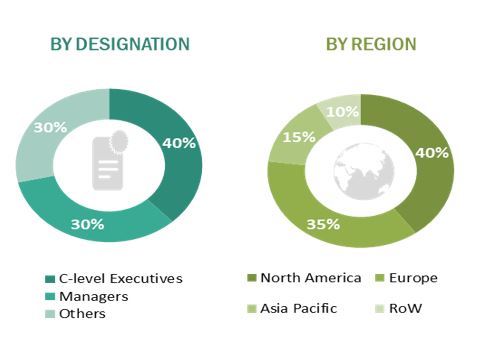

Extensive primary research has been conducted after understanding and analyzing the current scenario of the remote automotive exhaust sensing market through secondary research. Several primary interviews have been conducted with the key opinion leaders from demand and supply sides across four main regions—North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the remote automotive exhaust sensing market.

- Identifying approximate revenues of companies involved in the remote automotive exhaust sensing ecosystem

- Identifying different offerings of remote automotive exhaust sensing

- Analyzing the global penetration of each offering of the remote automotive exhaust sensing market through secondary and primary research

- Conducting multiple discussion sessions with key opinion leaders to understand the remote automotive exhaust sensing systems and their applications; analyzing the breakup of the work carried out by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally, with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as press releases, white papers, and databases of the company- and region-specific developments undertaken in the remote automotive exhaust sensing market

The top-down approach has been used to estimate and validate the total size of the remote automotive exhaust sensing market.

- Focusing initially on the top-line investments and expenditures made in the remote automotive exhaust sensing ecosystem; further splitting into offering and listing key developments in key market areas

- Identifying all major players offering a variety of remote automotive exhaust sensing systems, which was verified through secondary research and a brief discussion with industry experts

- Analyzing revenues, product mix, and geographic presence for which remote automotive exhaust sensing systems are offered by all identified players to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key growth domains across all major segments

- Breaking down the total market based on verified splits and key growth domains across all segments

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the remote automotive exhaust sensing market.

Report Objectives

- To describe and forecast the size of the remote automotive exhaust sensing market, based on offering, in terms of value

- To describe the fuel type and type of pollutants in automotive exhaust

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the remote automotive exhaust sensing market

- To provide an overview of the value chain pertaining to the remote automotive exhaust sensing ecosystem along with the average selling prices of remote automotive exhaust sensing systems

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, Porter’s five forces, regulations, import and export scenarios, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze competitive developments such as contracts in the remote automotive exhaust sensing market

- To profile key players in the remote automotive exhaust sensing market and comprehensively analyze their market ranking on the basis of their revenues, market shares, and core competencies

- Updated market developments of profiled players: The current report includes the market developments from January 2019 to August 2021.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Remote Automotive Exhaust Sensing Market