Refrigeration Monitoring Market by Offering (Hardware, Software, and Service), Sensor (temperature, defrost, touch, liquid level, gas detector, contact, motion detector, pressure), Application, Industry, and Region - Global Forecast to 2025

Updated on : October 07, 2024

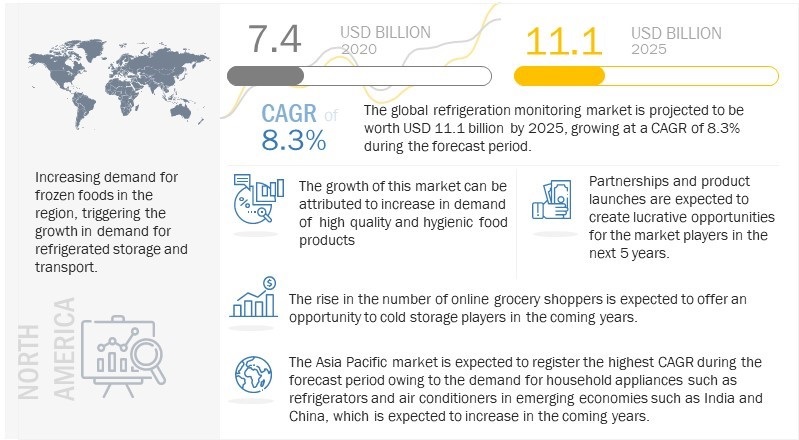

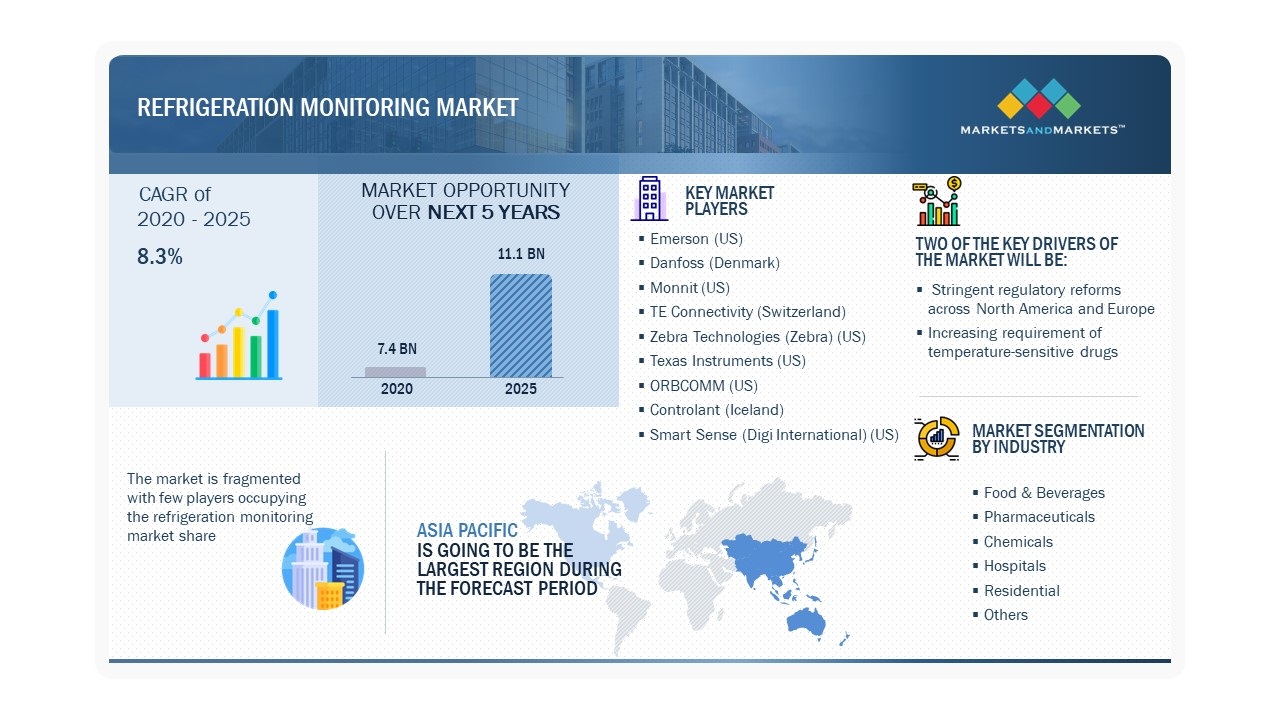

The global refrigeration monitoring market is projected to grow from USD 7.4 billion in 2020 to USD 11.1 billion by 2025, at a CAGR of 8.3%.

Key factors fueling the growth of this market include changing food consumption patterns, shifting consumer preferences for organic food products, increasing demand for high-quality packed food products, growing demand for temperature-sensitive drugs, high disposable income, and the need to reduce food wastage.

Impact of AI in Refrigeration Monitoring Market

The integration of artificial intelligence (AI) in the refrigeration monitoring market is transforming the way temperature-sensitive environments are managed by enabling real-time analytics, predictive maintenance, and energy optimization. AI-powered systems can continuously analyze data from sensors to detect anomalies, forecast equipment failures, and adjust cooling parameters dynamically, ensuring optimal performance and preventing spoilage or equipment downtime. This is particularly beneficial in industries such as food and beverage, pharmaceuticals, and logistics, where maintaining precise temperature control is critical. By enhancing operational efficiency, reducing energy consumption, and improving compliance with regulatory standards, AI is driving the adoption of smart refrigeration monitoring solutions across the market.

Refrigeration Monitoring Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

The refrigeration monitoring market in this study has been segmented based on offering, sensor, application, industry, and geography. The major factors driving the growth of the refrigeration monitoring market are the growth in the food retail sector, stringent regulatory reforms across North America and Europe, the increasing requirement for temperature-sensitive drugs, and the increasing focus on food wastage reduction.

Refrigeration Monitoring Market Dynamics:

Driver: Increasing requirement of temperature-sensitive drugs

The demand for temperature-sensitive medical products is increasing owing to their capability to match with the natural biological processes in the human body, thereby lowering the risk of adverse impact. According to the International Institute of Refrigeration (IIR), across the world, the demand for heat-sensitive health products such as drugs, vaccines, insulin, derived blood products, oncology products, etc. is on the rise, and every year, the turnover of such products increases by more than 20%.

The transportation of these drugs is the most critical phase in the cold chain due to the possibility of unforeseen environmental variations. Any change in temperature during transportation can affect the medicine, causing it to lose its potency to cure the ailment it is meant for, thereby leading to ineffective treatment in many cases. To avoid the degradation of pharmaceutical products, it is crucial to maintain parameters such as air quality levels and temperature ranges of the product’s specific environment.

Restraint: High cost of installation

The installation cost of refrigeration monitoring systems in the supply chain and in cold storage is significantly high. Deploying sensors and connectivity networks incur high costs. Shipping high-value consignments over long distances within their prescribed temperature range also require significant investment. Therefore, companies involved in cold storage and cold transportation remain skeptical about spending on developing monitoring networks. Cost is the major hindering factor for the introduction of real-time cold chain monitoring systems, particularly for small and medium-sized players, and many participants in the food industry are SMEs, often operating on lean margins. Similarly, the high cost of commercial refrigerators and the costs associated with their repair and maintenance services have been restraining market growth.

Opportunity: Phasing out of fluorinated refrigerants, which boosts retrofit market

The demand for refrigerators and air conditioners is continuously increasing across the globe. In high-temperature regions, the use of air conditioners is becoming a necessity. In emerging economies such as India, China, and Brazil, the demand for household appliances such as refrigerators and air conditioners is expected to increase in the coming years. This growing demand is expected to lead to increased emission of harmful greenhouse gases in the atmosphere. Thus, different countries across the globe have formulated regulations such as the Kyoto Protocol, Regulation (EC) No. 1005/2009: to regulate the use of ozone layer depletion substances, and Regulation (EU) No. 517/2014: to regulate the production and use of fluorinated gas (F-gas) containing substances.

Challenge: Complexities involved in installation of refrigeration monitoring solutions in cold chains

Refrigeration monitoring in cold chains has become even more complex in recent years because of the rapid increase in customer expectations. Cold chain networks can be spread out in terms of area as they can extend from manufacturing plants, laboratories, and storage warehouses to various transportation modes. Installing various sensors across all these locations can be a daunting task. Additionally, the distributed network needs to be mapped to efficiently manage the data generated from these sensors. Further, this data must be analyzed, and actionable data has to be generated to maximize profit. It is generally difficult to map such a vast network and derive useful data from it. Hence, issues such as scale visualization, error type pinpointing, and formulation of responses could prove to be challenging.

Refrigeration Monitoring Market Segment Insights:

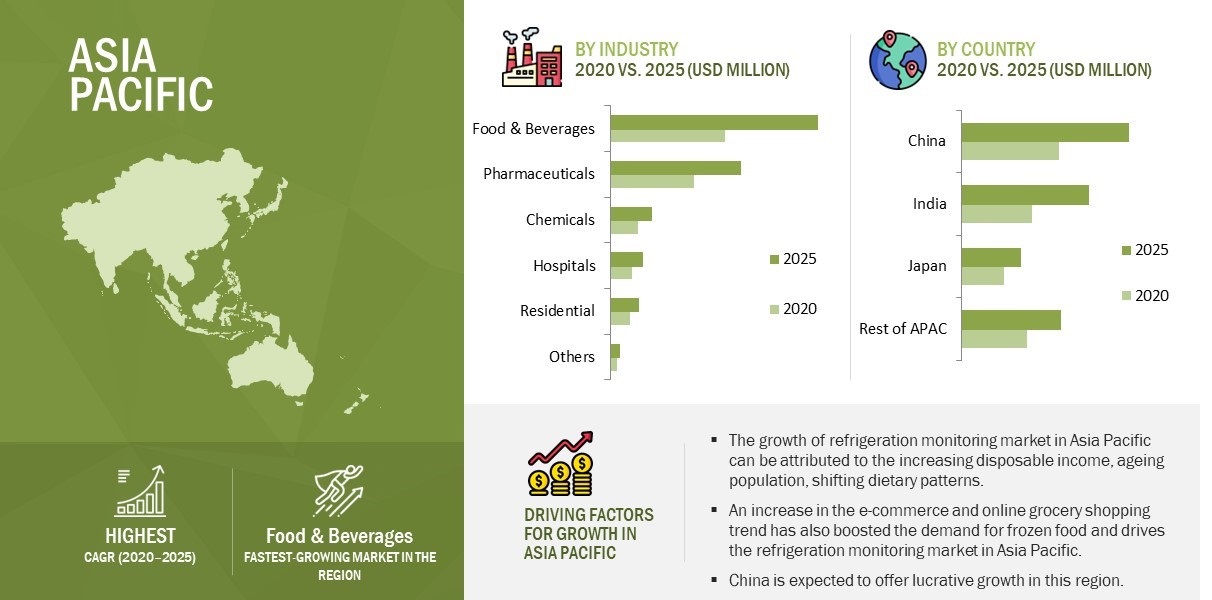

Based on Industry, the food & beverages segment to dominate the refrigeration monitoring market during forecast period

The growth of food & beverages segment is attributed to factors such as government regulations for food safety, a rise in demand for packaged food, and the adoption of refrigeration systems by retail, cold storage, and transport companies to minimize losses. Food & beverages form a major part of refrigeration applications. The quality and durability of the food are directly related to the efficient monitoring of the refrigeration unit. With the increase in the disposable income of individuals worldwide, the refrigerated foods market is growing at a fast pace. Foods that require continuous refrigeration include seafood, meat, fruits & vegetables, and processed food.

Refrigeration Monitoring Market Regional Insights:

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period

The increasing disposable income and aging population in the region have resulted in an increase in the healthcare expenditure in the region, resulting in the growth of multinational pharmaceutical and biotechnology companies. This has eventually led to rising demand for temperature-sensitive healthcare products such as vaccines, insulin, and blood products.

Governments in the region are making efforts to facilitate improvements in the cold chain service industry through regulations and subsidies. For instance, the Indian government is promoting the creation of cold chain facilities through its Scheme for Cold Chain, Value Addition, and Preservation Infrastructure and Mega Food Park Scheme. The Indian government also approved 101 cold chain projects across India in 2017. The growth of e-commerce and online grocery shopping has also boosted the demand for frozen food. All these trends have contributed to the rapid increase of cold storage facilities and infrastructure support in APAC, boosting the market for refrigeration monitoring.

Refrigeration Monitoring Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Refrigeration Monitoring Market Key Players:

The major players operating in the refrigeration monitoring market are Emerson (US), Danfoss (Denmark), Monnit (US), TE Connectivity (Switzerland), Zebra Technologies (Zebra) (US), Texas Instruments (US), ORBCOMM (US), Controlant (Iceland), Samsara (US), Smart Sense (Digi International) (US), Berlinger (Switzerland), Tempmate (Germany), Tek Troniks (UK), Sensaphone (US), and Swift Sensors (US). Strong distribution networks, wide product portfolios, and strong brand image are contributing to the large market share of these companies in the overall market. These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to expand their presence in the refrigeration monitoring market.

Emerson was one of the leading companies in the refrigeration monitoring market in 2019 with main focus on refrigeration monitoring sensors. It has adopted collaboration as a strategy to strengthen its position in the market. For instance, in February 2019, Emerson and HID Global (US) announced a strategic collaboration to enhance monitoring capabilities that help healthcare providers ensure the proper temperature for vaccines, medications, and other bio-specimens. The temperature monitoring and control solution combines Emerson’s expertise in environmental monitoring and the behind-the-scenes refrigeration network known as the cold chain with HID Global’s broad spectrum of connected health systems and Internet of Things solutions, enabled by Bluvision.

Monnit is a key player in the refrigeration monitoring ecosystem, serving customers across different areas. The company has 3 sensor families, namely, environmental sensors, power sensors, and motion sensors. It offers low-cost, wireless, remote monitored, and cloud connected simple sensors to monitor refrigeration units. The company has a presence in more than 85 countries in North America, Europe, and APAC though distribution partnerships. Monnit has adopted product launches & development as a key growth strategy to increase its production efficiency and gain a competitive edge over other players in the market.

Refrigeration Monitoring Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast unit |

Value (USD million/billion) |

|

Segments covered |

Offering, sensor, application, industry, and region |

|

Geographic regions covered |

APAC, North America, Europe, and RoW |

|

Companies covered |

Emerson (US), Danfoss (Denmark), Monnit (US), TE Connectivity (Switzerland), Zebra Technologies (Zebra) (US), Texas Instruments (US), ORBCOMM (US), Controlant (Iceland), Samsara (US), Smart Sense (Digi International) (US), Berlinger (Switzerland), Tempmate (Germany), Tek Troniks (UK), Sensaphone (US), Swift Sensors (US), Proges-plus (France), EpiSensor (Ireland), Cargo Data Corporation (US), Vaisala (Finland), and Oceasoft (France) |

This report categorizes the refrigeration monitoring market based on offering, sensor, application, industry, and region.

Refrigeration Monitoring Market, by Offering

- Hardware

- Software

- Service

Refrigeration Monitoring Market, by Sensor

- Temperature Sensors

- Defrost Sensors

- Touch Sensors

- Liquid Level Sensors

- Gas Detectors

- Contact Sensors

- Motion Detectors

- Pressure Sensors

- AC Current Meters

- Water Detection Sensors

Refrigeration Monitoring Market, by Application:

- Storage

- Transportation

Refrigeration Monitoring Market, by Industry:

-

Food & Beverages

- Retail

- Transportation

- Warehouse

-

Pharmaceuticals

- Retail

- Transportation

- Warehouse

- Chemicals

- Hospitals

- Residential

- Others

Refrigeration Monitoring Market, by Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

-

Rest of the World (RoW)

- Middle East

- Africa

- South America

Refrigeration Monitoring Market Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

The refrigeration monitoring market has witnessed high growth due to stringent regulations in food & beverages industry. Substantial investments have been made in the refrigeration monitoring product's research & development and upgrades. The value chain of the refrigeration monitoring ecosystem starts with research and development (R&D), which comprises system requirements analysis, comparison of electronics specifications, and prototype development, followed by manufacturing and system integration phases.

-

Emerging Technology Trends

- Internet of Things (IoT)

- Radio Frequency Identification (RFID)

- Predictive Analytics

- Addition/refinement in segmentation–Increase the depth or width of market segmentation.

-

Refrigeration Monitoring Market, by Sensors

- Temperature Sensors

- Motion Sensor

- Contact Sensor

- Gas Sensor

- Touch Sensor

- Liquid Detection Sensor

-

Refrigeration Monitoring Market, by Industry

- Food & Beverages

- Medical and Pharmaceuticals

- Agriculture

- Retail

- Others.

- Inclusion of new players and change in the market share of existing players – Refrigeration Monitoring Market

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have a total of 25 players (15 major, 10 Startups/SME). Moreover, the share of companies operating in the refrigeration monitoring market and start-up matrix have also been provided in the report.

- Updated financial information and product portfolios of players operating in the Refrigeration Monitoring Market

Newer and improved representation of financial information: The latest edition of the report provides updated financial information in the Refrigeration Monitoring Market till 2021/2022 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- Recent market developments of the profiled players

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new product launches, investments, funding, and certification have been mapped for 2020 to 2022.

- New data points/analysis which was not present in the previous version of the report

- Competitive benchmarking of startups/SMEs covers employee details, financial status, the latest funding round, and total funding (if available).

- Inclusion of the impact of megatrends on the Refrigeration Monitoring Market that includes a shift in global climate change, rapid urbanization, greater customization, and disruptive technologies

- Technology analysis and case studies are added in this edition of the report to give the technological perspective and the significance of the advancements in the Refrigeration Monitoring Market

- We have included brief patent information for the overall market of Refrigeration Monitoring.

- The startup evaluation matrix is added in this edition of the report, covering startups.

The new edition of the report consists of trends/disruptions in customer business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to better understand refrigeration monitoring market dynamics.

Recent Developments in Refrigeration Monitoring Industry

- In December 2021, Budderfly partnered with KE2 Therm Solutions. KE2 Therm refrigeration controllers and Budderfly’s EnergyCloud learning algorithms integrated together to enable commercial refrigeration units to upload operational status to Budderfly’s dashboard to monitor and ensure peak efficiency and avoid failure.

- May 2020, Climate Pros, an HVAC&R contractor based in Glendale Heights (US), has launched WatchTower, a monitoring software product providing users such as supermarkets and cold storage operators with a comprehensive view of their refrigeration assets.

Frequently Asked Questions (FAQ)

What is the current size of the Refrigeration Monitoring Market?

The global refrigeration monitoring market was valued at USD 7.4 billion in 2020 and is expected to reach USD 11.1 billion by 2025, at a CAGR of 8.3% from 2020 to 2025.

Who are the winners in the Market?

Emerson (US), Danfoss (Denmark), Monnit (US), TE Connectivity (Switzerland), Zebra Technologies (Zebra) (US), Texas Instruments (US), and ORBCOMM (US), Controlant (Iceland)

What are some of the technological advancements in the Refrigeration Monitoring market?

- Smart Sensors

- Internet of Things (IoT)

- Artificial Intelligence (AI)

- MEMS Technology

What are the factors driving the growth of the Refrigeration Monitoring market?

The major factors driving the growth of the refrigeration monitoring market are the growth in the food retail sector, and stringent regulatory reforms across North America and Europe.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Study Objectives

1.2 Definition

1.2.1 Inclusions and Exclusions

1.3 Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach to Capture Market Size By Bottom-Up Analysis(Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach to Capture Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 37)

4.1 Attractive Growth Opportunities in Refrigeration Monitoring Market

4.2 Market, By Offering

4.3 Market, By Country

4.4 Market, By Industry and APAC Country

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Food Retail Sector

5.2.1.2 Stringent Regulatory Reforms Across North America and Europe

5.2.1.3 Increasing Requirement of Temperature-Sensitive Drugs

5.2.1.4 Increasing Focus on Food Wastage Reduction

5.2.2 Restraints

5.2.2.1 High Installation Cost

5.2.3 Opportunities

5.2.3.1 Growing Trend of Online Grocery Shopping

5.2.3.2 Phasing Out of Fluorinated Refrigerants, Which Boosts Retrofit Market

5.2.4 Challenges

5.2.4.1 Complexities Involved in Installation of Refrigeration Monitoring Solutions in Cold Chains

5.3 Value Chain Analysis

5.4 Key Industry Trends

6 Refrigeration Monitoring Market, By Offering (Page No. - 52)

6.1 Introduction

6.2 Hardware

6.2.1 Sensors and Networking Devices to Hold the Largest Share of the Market

6.3 Software

6.3.1 Software Market to Grow at the Highest Rate Due to the Increasing Applications of Analytical and Predictive Tools

6.4 Service

6.4.1 Service Market is Expected to Grow Due to the Need for Regular Maintenance of Refrigeration Units

7 Refrigeration Monitoring Market, By Sensor (Page No. - 60)

7.1 Introduction

7.2 Temperature Sensors

7.2.1 Temperature Sensors are Most Widely Used in Food & Beverages and Pharmaceuticals

7.3 Defrost Sensors

7.3.1 Defrost Sensors Help Save Energy Costs Due to Overheating, Thus Driving the Market

7.4 Touch Sensors

7.4.1 Touch Sensors Market to Grow Rapidly in Cold Storage and Residential Sector

7.5 Liquid Level Sensors

7.5.1 Liquid Level Sensors are Widely Used to Monitor the Level of Refrigerant in Refrigeration Systems

7.6 Gas Detectors

7.6.1 Gas Detectors Find Application in Food & Beverages and Pharmaceuticals to Detect Leakage of Methane, Ammonia, Or Hydrogen

7.7 Contact Sensors

7.7.1 Contact Sensors are Used in Almost All Cold Refrigeration Units to Monitor the Door

7.8 Motion Detectors

7.8.1 Motion Detectors are Widely Used in the Retail Industry

7.9 Pressure Sensors

7.9.1 Pressure Sensors are Used to Detect Refrigerant Leakage and Prevent Overheating of the Compressor

7.1 AC Current Sensors

7.10.1 AC Current Sensors Help Measure Current Fluctuations

7.11 Water Detection Sensors

7.11.1 Water Detection Sensors Such as Water Detection Ropes are Widely Used in Cold Storage Units

8 Refrigeration Monitoring Market, By Application (Page No. - 69)

8.1 Introduction

8.2 Storage

8.2.1 Growth in Cold Storage Capacity in APAC Expected to Drive the Market During the Forecast Period

8.3 Transportation

8.3.1 Refrigeration Monitoring is Important to Minimize Losses Due to Temperature Variations in Transit

9 Refrigeration Monitoring Market, By Industry (Page No. - 76)

9.1 Introduction

9.2 Food & Beverages

9.2.1 Retail

9.2.1.1 Open-Shelf Refrigerators, Closed Cabinets, Display Cabinets, and Walk-In Refrigerators are the Key Units Contributing to the Market

9.2.2 Transportation

9.2.2.1 Deployment of Monitoring Solutions in Reefers and Refrigerated Containers Drives the Growth of the Market

9.2.3 Warehouses

9.2.3.1 Increasing Capacity of Cold Storage Warehouses Boosts the Market

9.3 Pharmaceuticals

9.3.1 Retail

9.3.1.1 Adoption of Inventory Management Solutions to Monitor Inventory of Temperature-Sensitive Drugs and Vaccines Contributes to Market

9.3.2 Transportation

9.3.2.1 Compliance Regulations to Transfer Temperature-Sensitive Drugs Through Refrigerated Vehicles Fuels Growth of Market

9.3.3 Warehouse

9.3.3.1 Temperature-Controlled Warehouses Play A Key Role in the Storage of Temperature-Sensitive Products

9.4 Chemicals

9.4.1 Refrigeration Monitoring is Essential in Chemicals Industry to Prevent Contamination of Volatile Chemicals

9.5 Hospitals

9.5.1 Refrigeration Monitoring is Essential in Hospitals to Store Specimens Such as Blood Samples, Vaccines, and Specialty Drugs

9.6 Residential

9.6.1 Increase in Spending Power Boosts the Sale of Smart Refrigerators, Contributing to Growth of Market

9.7 Others

9.7.1 Leisure and Hospitality are Key Contributors to the Growth of the Market

10 Refrigeration Monitoring Market, By Region (Page No. - 105)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 US Expected to Lead Market in North America

10.2.2 Canada

10.2.2.1 Emphasis on Health and Sustainability is Expected to Drive the Market in Canada

10.2.3 Mexico

10.2.3.1 Government Regulations to Increase Demand for Refrigeration Monitoring in Mexico

10.3 Europe

10.3.1 Germany

10.3.1.1 Growing Pharmaceutical Industry and Innovation in the Transportation Sector Boost Demand for Refrigeration Monitoring in Germany

10.3.2 UK

10.3.2.1 Increasing Investment in R&D By Government Drives the Market in the UK

10.3.3 France

10.3.3.1 Strong Export Base of Agro-Food Sector Drives Market Growth in France

10.3.4 Rest of Europe

10.3.4.1 Growth in the Logistics Sector Spain, Russia, and the Netherlands to Drive the Market

10.4 APAC

10.4.1 China

10.4.1.1 Developing Consumer Class With High Purchasing Power Drives Market

10.4.2 Japan

10.4.2.1 Shift Toward Dual-Income Household Increases the Demand for Readymade and Packed Food Products in Japan

10.4.3 India

10.4.3.1 Market to Grow at the Highest Rate in India

10.4.4 Rest of APAC

10.4.4.1 South Korea, Malaysia, and Australia are Key Countries That Boost the Market

10.5 Rest of the World (RoW)

10.5.1 Middle East

10.5.1.1 Demand for International Cuisine and Organic Food Products From the Tourism Sector Boosts the Market in the UAE

10.5.2 Africa

10.5.2.1 Need for the Preservation of Specialty Drugs to Drive Market in Africa

10.5.3 South America

10.5.3.1 Export of Health and Wellness Foods Drives the Market in South America

11 Competitive Landscape (Page No. - 125)

11.1 Overview

11.2 Key Players in Refrigeration Monitoring Market

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

11.4 Competitive Benchmarking

11.4.1 Strength of Product Portfolio (25 Companies)

11.4.2 Business Strategy Excellence (25 Companies)

11.5 Competitive Scenario

11.5.1 Product Launches & Developments

11.5.2 Partnerships, Collaborations, and Agreements

11.5.3 Mergers & Acquisitions and Expansions

12 Company Profiles (Page No. - 135)

(Business Overview, Products & Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Introduction

12.2 Key Players

12.2.1 Emerson

12.2.2 Danfoss

12.2.3 TE Connectivity

12.2.4 Texas Instruments

12.2.5 Monnit

12.2.6 Zebra

12.2.7 Orbcomm

12.2.8 ContRoLAnt

12.2.9 Samsara

12.2.10 Smartsense (Digi International)

12.3 Other Companies

12.3.1 Berlinger

12.3.2 Tempmate (Imec Messtechnik GmbH)

12.3.3 TEK Troniks

12.3.4 Sensaphone

12.3.5 Swift Sensors

12.3.6 Proges-Plus

12.3.7 Episensor

12.3.8 Cargo Data Corporation

12.3.9 Vaisala

12.3.10 Oceasoft

*Details on Business Overview, Products & Solutions Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 167)

13.1 Insights of Industry Experts

13.2 Questionnaire for Market

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Report

13.6 Author Details

List of Tables (107 Tables)

Table 1 Refrigeration Monitoring Market, By Offering, 2018–2025 (USD Million)

Table 2 Refrigeration Monitoring Hardware Market, By Type, 2018–2025 (USD Million)

Table 3 Refrigeration Monitoring Hardware Market, By Application, 2018–2025 (USD Billion)

Table 4 Refrigeration Monitoring Hardware Market, By Industry, 2018–2025 (USD Million)

Table 5 Refrigeration Monitoring Hardware Market, By Region, 2018–2025 (USD Million)

Table 6 Refrigeration Monitoring Software Market, By Application, 2018–2025 (USD Million)

Table 7 Refrigeration Monitoring Software Market, By Industry, 2018–2025 (USD Million)

Table 8 Refrigeration Monitoring Software Market, By Region, 2018–2025 (USD Million)

Table 9 Refrigeration Monitoring Services Market, By Application, 2018–2025 (USD Million)

Table 10 Refrigeration Monitoring Services Market, By Industry, 2018–2025 (USD Million)

Table 11 Refrigeration Monitoring Services Market, By Region, 2018–2025 (USD Million)

Table 12 Market, By Sensor, 2018–2025 (USD Million)

Table 13 Market for Temperature Sensors, By Industry, 2018–2025 (USD Million)

Table 14 Market for Defrost Sensors, By Industry, 2018–2025 (USD Million)

Table 15 Market for Touch Sensors, By Industry, 2018–2025 (USD Million)

Table 16 Refrigeration Monitoring Market for Liquid Level Sensors, By Industry, 2018–2025 (USD Million)

Table 17 Market for Gas Detectors, By Industry, 2018–2025 (USD Million)

Table 18 Market for Contact Sensors, By Industry, 2018–2025 (USD Million)

Table 19 Market for Motion Detectors, By Industry, 2018–2025 (USD Million)

Table 20 Market for Pressure Sensors, By Industry, 2018–2025 (USD Million)

Table 21 Market for AC Current Sensors, By Industry, 2018–2025 (USD Million)

Table 22 Market for Water Detection Sensors, By Industry, 2018–2025 (USD Million)

Table 23 Approximate Number of Refrigeration Units and Cold Storage Capacity in 2018

Table 24 Market, By Application, 2018–2025 (USD Billion)

Table 25 Market for Storage, By Offering, 2018–2025 (USD Million)

Table 26 Market for Storage, By Industry, 2018–2025 (USD Million)

Table 27 Market for Storage, By Sensor, 2018–2025 (USD Million)

Table 28 Market for Storage, By Region, 2018–2025 (USD Million)

Table 29 Market for Transportation, By Offering, 2018–2025 (USD Million)

Table 30 Market for Transportation, By Industry, 2018–2025 (USD Million)

Table 31 Market for Transportation, By Sensor, 2018–2025 (USD Million)

Table 32 Market for Transportation, By Region, 2018–2025 (USD Million)

Table 33 Refrigeration Monitoring Market, By Industry, 2018–2025 (USD Million)

Table 34 Market for Food & Beverages, By Offering, 2018–2025 (USD Million)

Table 35 Market in Storage for Food & Beverages, By Offering, 2018–2025 (USD Million)

Table 36 Market in Transportation for Food & Beverages, By Offering, 2018–2025 (USD Million)

Table 37 Market for Food & Beverages, By Sensor, 2018–2025 (USD Million)

Table 38 Market in Storage for Food & Beverages, By Sensor, 2018–2025 (USD Million)

Table 39 Market in Transportation for Food & Beverages, By Sensor, 2018–2025 (USD Million)

Table 40 Market for Food & Beverages, By Application, 2018–2025 (USD Million)

Table 41 Market for Food & Beverages, By Region, 2018–2025 (USD Million)

Table 42 Market for Food & Beverages, By Subapplication, 2018–2025 (USD Million)

Table 43 Market for Pharmaceuticals, By Offering, 2018–2025 (USD Million)

Table 44 Market in Storage for Pharmaceuticals, By Offering, 2018–2025 (USD Million)

Table 45 Market in Transportation for Pharmaceuticals, By Offering, 2018–2025 (USD Million)

Table 46 Market for Pharmaceuticals, By Sensor, 2018–2025 (USD Million)

Table 47 Market in Storage for Pharmaceuticals, By Sensor, 2018–2025 (USD Million)

Table 48 Market in Transportation for Pharmaceuticals, By Sensor, 2018–2025 (USD Million)

Table 49 Market for Pharmaceuticals, By Application, 2018–2025 (USD Million)

Table 50 Market for Pharmaceuticals, By Region, 2018–2025 (USD Million)

Table 51 Market for Pharmaceuticals, By Subapplication, 2018–2025 (USD Million)

Table 52 Market for Chemicals, By Offering, 2018–2025 (USD Million)

Table 53 Market in Storage for Chemicals, By Offering, 2018–2025 (USD Million)

Table 54 Market in Transportation for Chemicals, By Offering, 2018–2025 (USD Million)

Table 55 Market for Chemicals, By Sensor, 2018–2025 (USD Million)

Table 56 Market in Storage for Chemicals, By Sensor, 2018–2025 (USD Million)

Table 57 Market in Transportation for Chemicals, By Sensor, 2018–2025 (USD Million)

Table 58 Market for Chemicals, By Application, 2018–2025 (USD Million)

Table 59 Market for Chemicals, By Region, 2018–2025 (USD Million)

Table 60 Market for Hospitals, By Offering, 2018–2025 (USD Million)

Table 61 Refrigeration Monitoring Market in Storage for Hospitals, By Offering, 2018–2025 (USD Million)

Table 62 Market in Transportation for Hospitals, By Offering, 2018–2025 (USD Million)

Table 63 Market for Hospitals, By Sensor, 2018–2025 (USD Million)

Table 64 Market in Storage for Hospitals, By Sensor, 2018–2025 (USD Million)

Table 65 Market in Transportation for Hospitals, By Sensor, 2018–2025 (USD Million)

Table 66 Market for Hospitals, By Application, 2018–2025 (USD Million)

Table 67 Market for Hospitals, By Region, 2018–2025 (USD Million)

Table 68 Market for Residential, By Offering, 2018–2025 (USD Million)

Table 69 Market in Storage for Residential, By Offering, 2018–2025 (USD Million)

Table 70 Market in Transportation for Residential, By Offering, 2018–2025 (USD Million)

Table 71 Market for Residential, By Sensor, 2018–2025 (USD Million)

Table 72 Market in Storage for Residential, By Sensor, 2018–2025 (USD Million)

Table 73 Market in Transportation for Residential, By Sensor, 2018–2025 (USD Million)

Table 74 Market for Residential, By Location, 2018–2025 (USD Million)

Table 75 Market for Residential, By Region, 2018–2025 (USD Million)

Table 76 Market for Other Industries, By Offering, 2018–2025 (USD Million)

Table 77 Market in Storage for Other Industries, By Offering, 2018–2025 (USD Million)

Table 78 Market in Transportation for Other Industries, By Offering, 2018–2025 (USD Million)

Table 79 Market for Other Industries, By Sensor, 2018–2025 (USD Million)

Table 80 Market in Storage for Other Industries, By Sensor, 2018–2025 (USD Million)

Table 81 Refrigeration Monitoring Market in Transportation for Other Industries, By Sensor, 2018–2025 (USD Billion)

Table 82 Market for Other Industries, By Location, 2018–2025 (USD Million)

Table 83 Market for Other Industries, By Region, 2018–2025 (USD Million)

Table 84 Market, By Region, 2018–2025 (USD Million)

Table 85 Market in North America, By Offering, 2018–2025 (USD Million)

Table 86 Refrigeration Monitoring Hardware Market in North America, By Type, 2018–2025 (USD Million)

Table 87 Market in North America, By Application, 2018–2025 (USD Million)

Table 88 Market in North America, By Industry, 2018–2025 (USD Million)

Table 89 Market in North America, By Country, 2018–2025 (USD Million)

Table 90 Market in Europe, By Offering, 2018–2025 (USD Million)

Table 91 Refrigeration Monitoring Hardware Market in Europe, By Type, 2018–2025 (USD Million)

Table 92 Refrigeration Monitoring Market in Europe, By Application, 2018–2025 (USD Million)

Table 93 Market in Europe, By Industry, 2018–2025 (USD Million)

Table 94 Market in Europe, By Country, 2018–2025 (USD Million)

Table 95 Market in APAC, By Offering, 2018–2025 (USD Million)

Table 96 Refrigeration Monitoring Hardware Market in APAC, By Type, 2018–2025 (USD Million)

Table 97 Market in APAC, By Application, 2018–2025 (USD Million)

Table 98 Market in APAC, By Industry, 2018–2025 (USD Million)

Table 99 Market in APAC, By Country, 2018–2025 (USD Million)

Table 100 Market in RoW, By Offering, 2018–2025 (USD Million)

Table 101 Refrigeration Monitoring Hardware Market in RoW, By Type, 2018–2025 (USD Million)

Table 102 Market in RoW, By Application, 2018–2025 (USD Million)

Table 103 Market in RoW, By Industry, 2018–2025 (USD Million)

Table 104 Market in RoW, By Country, 2018–2025 (USD Million)

Table 105 Top 10 Product Launches & Developments, January 2016–December 2019

Table 106 Top 10 Partnerships, Collaborations, and Agreements, January 2016– December 2019

Table 107 Mergers & Acquisitions and Expansions, January 2016– December 2019

List of Figures (49 Figures)

Figure 1 Refrigeration Monitoring Market: Research Design

Figure 2 Market Size Estimation Methodology: Approach 1 (Supply Side): Revenue of Products of the Refrigeration Monitoring Component Market Size

Figure 3 Market Size Estimation Methodology: Approach 2 Bottom-Up (Supply Side): Illustration of Company Refrigeration Monitoring Component Revenue Estimation

Figure 4 Market Size Estimation Methodology: Approach 4 – Bottom-Up Market Estimation for Refrigeration Monitoring, By Sensor

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Software Segment Expected to Grow at Highest CAGR During Forecast Period

Figure 9 Temperature Sensors to Grow at Highest Rate in Market During Forecast Period

Figure 10 Transportation Segment to Dominate the Market During the Forecast Period

Figure 11 Food & Beverages Expected to Witness Highest Growth Between 2020 and 2025

Figure 12 APAC to Hold Largest Market Share in 2019

Figure 13 Increasing Demand for High-Quality Packed Food Products to Spur Market Growth During Forecast Period

Figure 14 Hardware to Account for Largest Share of Market Till 2025

Figure 15 India to Record Highest CAGR in Overall Market During Forecast Period

Figure 16 Food & Beverages and China Likely to Be Largest Shareholders in Overall APAC Market in 2025

Figure 17 Refrigeration Monitoring Market Dynamics

Figure 18 Growth in Number of Convenience Stores in the US, 2010–2018

Figure 19 Market Drivers and Their Impact

Figure 20 Market Restraints and Their Impact

Figure 21 US: Online Share of Total Grocery Spending

Figure 22 Phase-Down of F-Gas Containing Substances From 2015 to 2030

Figure 23 Market Opportunities and Their Impact

Figure 24 Market Challenges and Their Impact

Figure 25 Value Chain Analysis of Market

Figure 26 Digital Transformation in Refrigeration Monitoring is the Key Trend for Market Growth

Figure 27 Market for Software to Grow at Highest CAGR During Forecast Period

Figure 28 Market for Temperature Sensors to Grow at Highest CAGR During Forecast Period

Figure 29 Storage to Account for Largest Share of Market

Figure 30 Food & Beverages to Account for Largest Share of Market Among All Industries (2020-2025)

Figure 31 Storage to Account for Largest Share of Market in Food & Beverages

Figure 32 Storage to Dominate the Market for Pharmaceuticals (2020-2025)

Figure 33 Storage to Account for Largest Share of Market in Chemicals (2020-2025)

Figure 34 Storage to Lead the Market in Hospitals (2020-2025)

Figure 35 Storage to Account for Largest Share of Market in Residential (2020-2025)

Figure 36 Storage to Hold the Largest Share of Market in Other Industries (2020-2025)

Figure 37 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 38 North America: Market Snapshot

Figure 39 Europe: Market Snapshot

Figure 40 APAC: Market Snapshot

Figure 41 Companies Adopted Product Launches & Developments as Key Growth Strategy From January 2016 to December 2019

Figure 42 Refrigeration Monitoring Market: Company Ranking Analysis (2019)

Figure 43 Market Competitive Leadership Mapping, 2019

Figure 44 Emerson: Company Snapshot

Figure 45 Danfoss: Company Snapshot

Figure 46 TE Connectivity: Company Snapshot

Figure 47 Texas Instruments: Company Snapshot

Figure 48 Zebra: Company Snapshot

Figure 49 Orbcomm: Company Snapshot

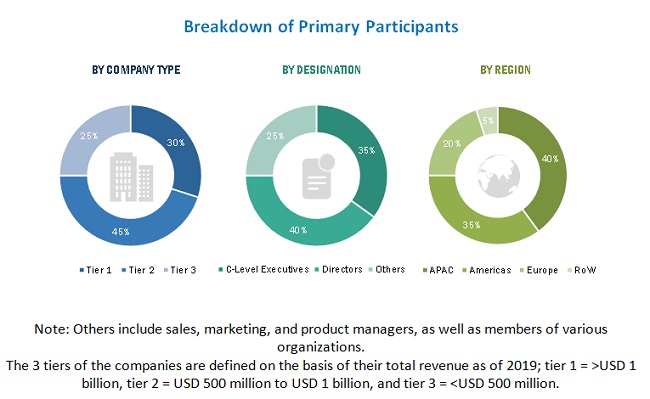

This study involved 4 major activities to estimate the size of the refrigeration monitoring market. Exhaustive secondary research was carried out to collect information relevant to the market, the peer market, and the parent market. Primary research was undertaken to validate these findings, assumptions, and sizing with industry experts across the value chain of the refrigeration monitoring. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology used to estimate and forecast the size of the refrigeration monitoring market began with capturing data related to the revenue of key vendors in the market through secondary research. This study involved the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information for a technical, market-oriented, and commercial study of the refrigeration monitoring market. Vendor offerings were taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors, directories, and databases.

Primary Research

The refrigeration monitoring market comprises several stakeholders, such as suppliers of standard components, equipment manufacturers, and original equipment manufacturers (OEMs). The demand side of this market includes sensor, refrigerator, software, and service companies. The supply side is characterized by advancements carried out in refrigeration systems and cold chain using different techniques and their diverse applications. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the refrigeration monitoring market and its segments. The research methodology used to estimate the market size included the following:

- Key players in the market were identified through extensive secondary research.

- The supply chain of the manufacturing industry and the size of the refrigeration monitoring market, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides of the refrigeration monitoring market.

Research Objectives

- To describe, segment, and forecast the overall size of the refrigeration monitoring market, by offering, sensor, application , industry, and region

- To describe and forecast the market size for various segments with regard to 4 main regions—Asia Pacific (APAC), North America, and Europe, and Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To describe the refrigeration monitoring value chain in brief

- To analyze competitive developments such as product launches and developments, agreements, partnerships, acquisitions, expansions, and research & development (R&D) activities in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Market size by different subsegments of the market

Critical Questions

- What are new application areas being explored by the providers of the refrigeration monitoring solution?

- Who are the key players in the refrigeration monitoring market, and how intense is the competition in this market?

Growth opportunities and latent adjacency in Refrigeration Monitoring Market