Recycled Materials for Mobility Applications Market by Material Type (Polymer Materials, Composites), Vehicle Type (Passenger Cars, Commercial Vehicles), Component, Application (OEMs, Aftermarkets), And Region - Global Forecast to 2027

Recycled Materials for Mobility Applications Market

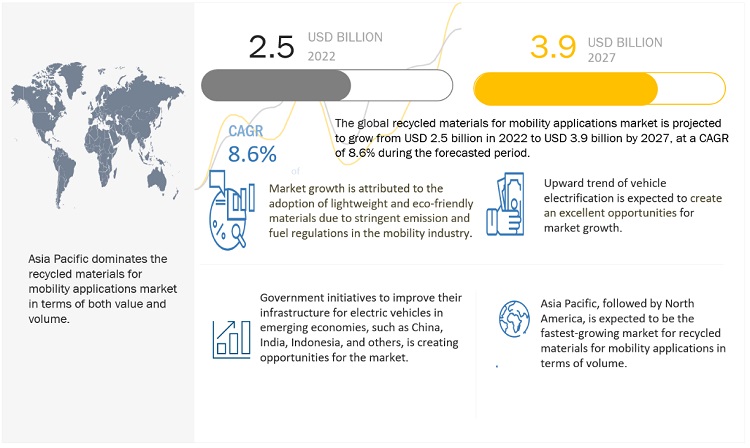

The global recycled materials for mobility applications market was valued at USD 2.5 billion in 2022 and is projected to reach USD 3.9 billion by 2027, growing at 8.6% cagr from 2022 to 2027. The market's growth is attributed to the factors such as government regulations, growing awareness of energy savings, and the increasing use of recycled plastics in automobiles. However, the preference for virgin plastics in many applications is a major concern for the market.

Recycled Materials for Mobility Applications Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Recycled Materials for Mobility Applications Market Dynamics

Driver: Growing awareness regarding energy savings and government responses

The use of recycled materials eliminates the need to make materials from scratch, which in turn saves a lot of energy. The production of any kind of virgin materials, such as plastics and carbon fiber, is an extremely labor-intensive and energy-expensive process consisting of extracting, transporting, and refining natural resources. Thus, the use of recycled materials instead of new resources allows manufacturers to make the same products with much lesser energy requirements. For instance, the process of recycling plastics from waste requires USD 7.1 trillion but less energy than the ones required to produce the equivalent amount of virgin PET and HDPE plastics. Therefore, the amount of energy saved from recycling PET and HDPE containers is equivalent to the annual energy use of 750,000 US homes. The corresponding savings in GHG emissions would be 2.1 million tons of CO2 equivalents, which would be comparable to taking 360,000 cars off the road. Thus, awareness about saving energy is likely to play a positive role in augmenting the demand for recycled plastics during the forecast period.

Restraint: Strong competition from virgin materials

In terms of quality and application, recycled plastics face stiff competition from virgin plastics. Only virgin materials can be used for high-end products where the chemical composition of the plastic must be precise. Although recycled plastics have had a price advantage over their virgin counterpart, the scenario has changed recently owing to the announcement of the Chinese scrap ban (the country has stopped importing recycled plastics). Moreover, with the discovery of shale gas in the US, there is a new source to produce fossil fuels, including natural gas, which is a major source of producing virgin plastics. This has facilitated an enormous increase in the amount of low-cost virgin plastic materials in the marketplace. Therefore, the strong competition posed by virgin plastics restrains the growth of recycled plastics.

Opportunity: Government regulations regarding use of environment-friendly products

Developed countries such as Germany, the US, and Japan are focusing on increasing the use of environment-friendly products instead of petroleum-based products. Automotive manufacturers are increasingly using recycled carbon fiber in various automobile models. Regulatory legislations imposed by the EU and other countries such as the US, India, and Japan are expected to increase the use of recycled carbon fiber, primarily in the automotive & transportation industry. The EU legislation sets mandatory emission reduction targets for new cars for improvements in fuel economy and reduction of CO2 emissions.

Challenge: High costs of recycled plastics

Petrochemicals such as oil and natural gas are the primary raw materials required for the production of virgin plastics. R-polyethylene terephthalate is a recycled plastic (PET). According to Tim Gutowski, a mechanical engineering professor, the issue with recycling plastic is the generation of a pure stream of recycled material. Several additives are used in the manufacture of plastic products, including fillers and colorants. The elements added to plastic that affect the manufacturing of recycled plastic products are usually unknown to recycling companies.

Recycled Materials for Mobility Applications Market Ecosystem

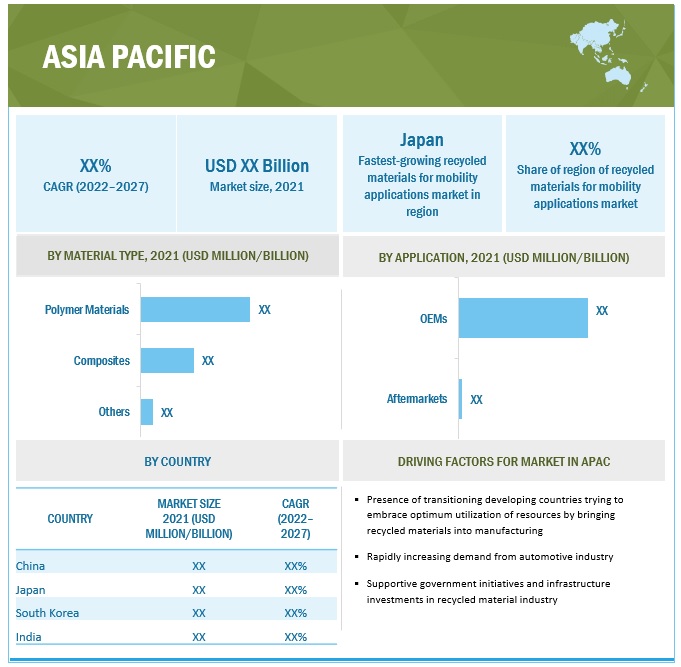

Asia Pacific to hold the largest market share in the recycled materials for mobility applications market

According to the World Bank, Asia Pacific is the fastest-growing region in terms of population and economic growth. The region has experienced significant growth in the last decade, accounting for over a third of the world’s GDP. The high economic growth, coupled with the mounting population, is expected to boost the industrial sector in the region, which will increase the need for recycled materials such as recycled plastic polymers and recycled composites from industries. Continuous and easy availability of recycled materials, low-cost labor, lower price, and environmental benefits drive the recycled materials for mobility applications market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Recycled Materials for Mobility Applications Market Players

Key players in the global recycled materials for mobility applications market are Toray Industries, Inc., (Japan), Solvay (Belgium), Faurecia (France), Continental AG (Germany), Neste (Finland), Unifi, Inc. (US), Celanese Corporation (US), Custom Polymers, Inc. (US), Procotex (Belgium), Carbon Fiber Recycling (US), SGL Carbon (Germany), and Wellman Advanced Materials (US).

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the recycled materials for mobility applications market. The research includes a detailed competitive analysis of these key players in the recycled materials for mobility applications market, including company profiles, recent developments, and key market strategies.

Recycled Materials for Mobility Applications Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 2.5 billion |

|

Revenue Forecast in 2027 |

USD 3.9 billion |

|

CAGR |

8.6% |

|

Years considered for the study |

2020–2021 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD million/billion), Volume (Kiloton) |

|

Segments |

Material Type, Vehicle Type, Component, Application, Region |

|

Regions |

Europe, North America, Asia Pacific, Latin America, Middle East and Africa |

|

Companies |

Toray Industries Inc., (Japan), Solvay (Belgium), Faurecia (France), Continental AG (Germany), Neste (Finland), Unifi, Inc. (US), Celanese Corporation (US), Custom Polymers (US), Procotex (Belgium). |

This research report categorizes the recycled materials for mobility applications market based on By Material Type, Vehicle Type, Component, Application, and Region.

By Material Type:

- Polymer Materials

- Composites

- Others

By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

By Component Type:

- Interiors

- Exteriors

- Others

By Application Type:

- OEMs

- Aftermarket

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments

- In March 2022, Faurecia, a company of the Group FORVIA, and Veolia have signed a cooperation and research agreement to jointly develop innovative compounds for automotive interior modules, aiming to achieve an average of 30% of recycled content by 2025. Through this partnership, the two companies will accelerate the deployment of breakthrough sustainable interior solutions implemented in instrument panels, door panels, and center consoles in Europe. Veolia will start the production of these secondary raw materials at its existing recycling sites in France starting from 2023.

- In October 2021, Vartega Inc. and Aditya Birla signed an MoU to develop the recycling value chain for Recyclamine based composites.

- In November 2020, SGL Carbon and Koller Kunststofftechnik partnered to manufacture novel recycled carbon fiber profiles for windshields for a future high-volume model of the BMW Group. This helped SGL Carbon improve its automobile product applications and increase the demand for recycled carbon fiber.

- In September 2019, Solvay expanded its thermoplastic composites and recycled composite materials capacity with a new production line at its US facility in California, highlighting its commitment to meeting growth in demand from automobile and aerospace customers for this high-performance material and Solvay’s proprietary and unique technology. Solvay multiplied its qualified capacity by four times since 2016 with the commissioning of this new line and upgrades to existing lines. The expansion aims to improve output, quality, consistency, and industrial reliability.

- In August 2018, Solvay, Premium AEROTEC, and Faurecia Clean Mobility launched IRG CosiMo, the industry’s first private group focusing on developing material and process technologies that are expected to enable the high-volume production of thermoplastic composites for the aerospace and automotive industries.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of recycled materials for mobility applications materials?

Increasing adoption of recyclable and lightweight materials in automotive and transportation industry has increased the demand for recycled materials globally.

Which is the largest country for the recycled materials for mobility applications market?

China holds the largest share in the recycled materials for mobility applications market. China is a major producer and consumer of recycled materials. It is the world's largest importer of recycled materials, such as plastics, composites, and metals, and has a significant recycling industry. China's recycling industry is driven by the demand for raw materials from its manufacturing sector.

What are the challenges in the recycled materials for mobility applications market?

High costs of recycled plastics and difficulty in the collection of raw materials are the major challenges for the recycled materials for mobility applicationsmarket.

Which material type of recycled materials for mobility applications holds the largest market share?

Polymer materials hold the largest share due to its high strength and aesthetic appeal which makes them suitable for producing structural automotive parts.

How is the recycled materials for mobility applications market aligned?

The market is growing at a significant pace. The market is a potential market, and many manufactures are planning business strategies to expand their existing business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 MARKET DYNAMICSDRIVERS- Growing awareness of energy savings- Increasing adoption of recyclable and lightweight materials in automotive & transportation sectorRESTRAINTS- Strong competition from virgin materials- Lack of technical knowledgeOPPORTUNITIES- Favorable initiatives to promote recycled plastics in developed countries- Government regulations regarding use of environment-friendly productsCHALLENGES- High costs of recycled plastics- Difficulty in raw material collection

-

5.2 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 TECHNOLOGY ANALYSISMECHANICAL RECYCLINGTHERMAL RECYCLINGCHEMICAL RECYCLING

-

5.6 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOSOPTIMISTIC SCENARIOPESSIMISTIC SCENARIOREALISTIC SCENARIO

-

5.7 ECOSYSTEM: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- 5.8 VALUE CHAIN ANALYSIS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

- 5.10 AVERAGE SELLING PRICE

-

5.11 KEY IMPORTS/EXPORTS MARKETUSGERMANYFRANCECHINAJAPAN

- 5.12 KEY CONFERENCES & EVENTS, 2023–2024

-

5.13 TARIFF AND REGULATORY LANDSCAPEREGULATIONS IN RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKETUSEUROPEJAPANINDIAREGULATIONS FOR AUTOMOTIVE INTERIORSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 CASE STUDY ANALYSIS

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.16 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS’ ANALYSESPATENTS BY AUTONEUM HOLDING AGPATENTS BY EASTMAN CHEMICAL COMPANYPATENTS BY ARIES GASIFICATION, LLCTOP 10 PATENT OWNERS (US) DURING LAST 10 YEARS

- 6.1 INTRODUCTION

-

6.2 COMPOSITESLEADING MATERIAL TYPE IN MOBILITY APPLICATIONSCOMPOSITES: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

-

6.3 POLYMERSFAVORABLE INITIATIVES TO PROMOTE USE OF RECYCLED POLYMERS IN DEVELOPED AND DEVELOPING COUNTRIESPOLYMERS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

-

6.4 OTHERSOTHERS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

- 7.1 INTRODUCTION

-

7.2 PASSENGER CARSPOPULATION GROWTH, RISING INCOMES, URBANIZATION, AND INCREASED AVAILABILITY OF FINANCING OPTIONS FOR CONSUMERS TO DRIVE DEMANDPASSENGER CARS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

-

7.3 COMMERCIAL VEHICLESSTRICTER EMISSION REGULATIONS AND FUEL ECONOMY STANDARDS TO DRIVE MARKETCOMMERCIAL VEHICLES: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

- 8.1 INTRODUCTION

-

8.2 INTERIORSDEMAND FOR SUSTAINABLE AND ESTHETICALLY APPEALING MATERIALS TO DRIVE MARKETINTERIOR COMPONENTS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

-

8.3 EXTERIORSINCREASED USAGE OF SUSTAINABILITY MATERIALS TO MEET SAFETY NEEDS OF VEHICLESEXTERIOR COMPONENTS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

-

8.4 OTHERSOTHER COMPONENTS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

- 9.1 INTRODUCTION

-

9.2 OEMSNORTH AMERICA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIODOEMS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

-

9.3 AFTERMARKETSADOPTION OF RECYCLED MATERIALS IN MASS PRODUCTION OF COMPONENTS TO DRIVE MARKETAFTERMARKETS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

-

10.1 INTRODUCTIONRECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION

-

10.2 NORTH AMERICANORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPENORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPENORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATIONNORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY- US- Canada

-

10.3 ASIA PACIFICASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPEASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPEASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATIONASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY- China- Japan- South Korea- India- Rest of Asia Pacific

-

10.4 EUROPEEUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPEEUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPEEUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATIONEUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY- Germany- UK- France- Italy- Rest of Europe

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPEMIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPEMIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY- South Africa- UAE- Rest of Middle East & Africa

-

10.6 LATIN AMERICALATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPELATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPELATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATIONLATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY- Mexico- Brazil- Rest of Latin America

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS

- 11.3 MARKET RANKING

- 11.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

11.5 COMPANY EVALUATION MATRIX

-

11.6 COMPETITIVE LANDSCAPE MAPPINGSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

- 11.7 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

-

11.8 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.9 COMPETITIVE SCENARIO AND TRENDS

-

12.1 KEY COMPANIESTORAY INDUSTRIES, INC.- Business overview- MnM viewSOLVAY- Business overview- MnM viewFAURECIA- Business overview- MnM viewCONTINENTAL AG- Business overview- MnM viewNESTE- Business overview- MnM viewUNIFI, INC.- Business overview- MnM viewCELANESE CORPORATION- Business overview- MnM viewCUSTOM POLYMERS, INC.- Business overview- MNM viewPROCOTEX- Business overview- MnM viewCARBON CONVERSIONS- Business overview- MnM viewCARBON FIBER RECYCLING- Business overview- MnM viewSGL CARBON- Business overview- MnM viewVARTEGA INC.- Business overview- Deals- MnM viewCARBON FIBER REMANUFACTURING- Business overview- MNM viewWELLMAN ADVANCED MATERIALS- Business overview- MNM view

-

12.2 OTHER COMPANIESMALLINDA INC.MIKO SRLGEN 2 CARBON LIMITEDCATACK-HNEOCOMP GMBHCARBON FIBER RECYCLE INDUSTRY CO.LTD.GLOBAL FIBERGLASS SOLUTIONSFRESH PAK CORPORATIONDOMO CHEMICALSECONYL

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: SUPPLY CHAIN

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS

- TABLE 4 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- TABLE 5 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: CAGR (BY VALUE) IN REALISTIC, PESSIMISTIC, AND OPTIMISTIC SCENARIOS

- TABLE 6 AVERAGE SELLING PRICE OF RECYCLED MATERIALS FOR MOBILITY APPLICATIONS, BY REGION

- TABLE 7 AVERAGE SELLING PRICE OF RECYCLED MATERIALS FOR MOBILITY APPLICATIONS, BY COMPONENT

- TABLE 8 AVERAGE SELLING PRICE OF RECYCLED MATERIALS FOR MOBILITY APPLICATIONS, BY VEHICLE TYPE

- TABLE 9 AVERAGE SELLING PRICE OF RECYCLED MATERIALS FOR MOBILITY APPLICATIONS, BY APPLICATION

- TABLE 10 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 11 SCENARIOS FOR FUTURE OF VEHICULAR EMISSIONS IN INDIA

- TABLE 12 REGULATIONS FOR AUTOMOTIVE INTERIORS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: GLOBAL PATENTS

- TABLE 18 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

- TABLE 19 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY MATERIAL TYPE, 2020–2027 (KILOTON)

- TABLE 20 COMPOSITES: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 21 COMPOSITES: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

- TABLE 22 POLYMERS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 23 POLYMERS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

- TABLE 24 OTHERS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 25 OTHERS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

- TABLE 26 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPE, 2020–2027 (USD MILLION)

- TABLE 27 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPE, 2020–2027 (KILOTON)

- TABLE 28 PASSENGER CARS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 29 PASSENGER CARS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 30 COMMERCIAL VEHICLES: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 31 COMMERCIAL VEHICLES: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 32 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

- TABLE 33 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COMPONENT, 2020–2027 (KILOTON)

- TABLE 34 INTERIOR COMPONENTS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 35 INTERIOR COMPONENTS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 36 EXTERIOR COMPONENTS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 37 EXTERIOR COMPONENTS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 38 OTHER COMPONENTS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 39 OTHER COMPONENTS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 40 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 41 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 42 OEMS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 43 OEMS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

- TABLE 44 AFTERMARKETS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 45 AFTERMARKETS: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

- TABLE 46 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 47 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 48 NORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPE, 2020–2027 (KILOTON)

- TABLE 50 NORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPE, 2020–2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPE, 2020–2027 (KILOTON)

- TABLE 52 NORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 54 NORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 56 US: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 57 US: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 58 CANADA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 59 CANADA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 60 ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

- TABLE 61 ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPE, 2020–2027 (KILOTON)

- TABLE 62 ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPE, 2020–2027 (USD MILLION)

- TABLE 63 ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPE, 2020–2027 (KILOTON)

- TABLE 64 ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 65 ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 66 ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 67 ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 68 CHINA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 69 CHINA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 70 JAPAN: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 71 JAPAN: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 72 SOUTH KOREA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 73 SOUTH KOREA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 74 INDIA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 75 INDIA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 76 REST OF ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 78 EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

- TABLE 79 EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPE, 2020–2027 (KILOTON)

- TABLE 80 EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPE, 2020–2027 (USD MILLION)

- TABLE 81 EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY VEHICLE TYPE, 2020–2027 (KILOTON)

- TABLE 82 EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 83 EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 84 EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 85 EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 86 GERMANY: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 87 GERMANY: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 88 UK: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 89 UK: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 90 FRANCE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 91 FRANCE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 92 ITALY: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 93 ITALY: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 94 REST OF EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 95 REST OF EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 96 MIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY MATERIAL TYPE, 2020–2027 (KILOTON)

- TABLE 98 MIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY VEHICLE TYPE, 2020–2027 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY VEHICLE TYPE, 2020–2027 (KILOTON)

- TABLE 100 MIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 102 MIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 104 SOUTH AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 105 SOUTH AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 106 UAE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 107 UAE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 108 REST OF MIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 109 REST OF MIDDLE EAST & AFRICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 110 LATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY MATERIAL TYPE, 2020–2027 (USD MILLION)

- TABLE 111 LATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

- TABLE 112 LATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY VEHICLE TYPE, 2020–2027 (USD MILLION)

- TABLE 113 LATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY VEHICLE TYPE, 2020–2027 (KILOTON)

- TABLE 114 LATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 115 LATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 116 LATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 117 LATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 118 MEXICO: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 119 MEXICO: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 120 BRAZIL: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 121 BRAZIL: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 122 REST OF LATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 123 REST OF LATIN AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 124 DEGREE OF COMPETITION: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- TABLE 125 COMPANY PRODUCT FOOTPRINT

- TABLE 126 COMPANY BY TYPE FOOTPRINT

- TABLE 127 COMPANY REGION FOOTPRINT

- TABLE 128 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: KEY START-UPS/SMES

- TABLE 129 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 130 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: PRODUCT LAUNCH/DEVELOPMENT, 2015 –2022

- TABLE 131 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: DEALS, 2015-2022

- TABLE 132 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: OTHER DEVELOPMENTS, 2015–2022

- TABLE 133 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 134 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 TORAY INDUSTRIES, INC.: PRODUCT/TECHNOLOGY DEVELOPMENTS

- TABLE 136 TORAY INDUSTRIES, INC.: DEALS

- TABLE 137 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 138 SOLVAY: COMPANY OVERVIEW

- TABLE 139 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 SOLVAY: DEALS

- TABLE 141 SOLVAY: OTHER DEVELOPMENTS

- TABLE 142 FAURECIA: COMPANY OVERVIEW

- TABLE 143 FAURECIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 FAURECIA: DEALS

- TABLE 145 FAURECIA: PRODUCT/TECHNOLOGY DEVELOPMENTS

- TABLE 146 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 147 CONTINENTAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 CONTINENTAL AG: PRODUCT/TECHNOLOGY DEVELOPMENTS

- TABLE 149 NESTE: COMPANY OVERVIEW

- TABLE 150 NESTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 NESTE: PRODUCT/TECHNOLOGY DEVELOPMENTS

- TABLE 152 UNIFI, INC.: COMPANY OVERVIEW

- TABLE 153 UNIFI, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 155 CELANESE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 CELANESE CORPORATION: DEALS

- TABLE 157 CUSTOM POLYMERS, INC.: COMPANY OVERVIEW

- TABLE 158 CUSTOM POLYMERS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 CUSTOM POLYMERS, INC.: OTHER DEVELOPMENTS

- TABLE 160 PROCOTEX: COMPANY OVERVIEW

- TABLE 161 PROCOTEX: PRODUCTS OFFERED

- TABLE 162 PROCOTEX: OTHER DEALS

- TABLE 163 CARBON CONVERSIONS: COMPANY OVERVIEW

- TABLE 164 CARBON CONVERSIONS: PRODUCTS OFFERED

- TABLE 165 CARBON CONVERSIONS: CARBON CONVERSIONS: DEALS

- TABLE 166 CARBON FIBER RECYCLING: BUSINESS OVERVIEW

- TABLE 167 CARBON FIBER RECYCLING: PRODUCTS OFFERED

- TABLE 168 CARBON FIBER RECYCLING, INC.: OTHER DEVELOPMENTS

- TABLE 169 SGL CARBON: COMPANY OVERVIEW

- TABLE 170 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 SGL CARBON: DEALS

- TABLE 172 VARTEGA INC.: COMPANY OVERVIEW

- TABLE 173 VARTEGA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 CARBON FIBER REMANUFACTURING: BUSINESS OVERVIEW

- TABLE 175 CARBON FIBER REMANUFACTURING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 CARBON FIBER REMANUFACTURING: DEALS

- TABLE 177 WELLMAN ADVANCED MATERIALS: COMPANY OVERVIEW

- TABLE 178 WELLMAN ADVANCED MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 MALLINDA, INC.: COMPANY OVERVIEW

- TABLE 180 MIKO SRL: COMPANY OVERVIEW

- TABLE 181 GEN 2 CARBON: COMPANY OVERVIEW

- TABLE 182 CATACK-H: COMPANY OVERVIEW

- TABLE 183 NEOCOMP GMBH: COMPANY OVERVIEW

- TABLE 184 CARBON FIBER RECYCLE INDUSTRY CO.LTD.: COMPANY OVERVIEW

- TABLE 185 GLOBAL FIBERGLASS SOLUTIONS: COMPANY OVERVIEW

- TABLE 186 FRESH PAK: COMPANY OVERVIEW

- TABLE 187 DOMO CHEMICALS: COMPANY OVERVIEW

- TABLE 188 ECONYL: COMPANY OVERVIEW

- FIGURE 1 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SEGMENTATION

- FIGURE 2 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: RESEARCH DESIGN

- FIGURE 3 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: RESEARCH APPROACH

- FIGURE 4 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: TOP-DOWN APPROACH

- FIGURE 6 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: DATA TRIANGULATION

- FIGURE 7 POLYMERS SEGMENT TO DRIVE RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- FIGURE 8 PASSENGER CARS TO LEAD RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- FIGURE 9 INTERIOR COMPONENT TO ACCOUNT FOR MAJOR SHARE OF RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- FIGURE 10 OEMS TO BE DOMINANT USER OF RECYCLED MATERIALS FOR MOBILITY APPLICATIONS

- FIGURE 11 ASIA PACIFIC DOMINATED RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET IN 2021

- FIGURE 12 CHINA TO BE FASTEST-GROWING RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- FIGURE 13 SIGNIFICANT GROWTH EXPECTED IN RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET BETWEEN 2022 AND 2027

- FIGURE 14 POLYMERS TO GROW AT FASTEST RATE DURING FORECAST PERIOD

- FIGURE 15 PASSENGER CARS TO LEAD RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- FIGURE 16 INTERIOR COMPONENTS ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 17 OEMS TO LEAD RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- FIGURE 18 JAPAN TO BE FASTEST-GROWING RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET, 2022–2027

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- FIGURE 20 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP TWO APPLICATIONS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- FIGURE 23 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: TECHNOLOGY ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TWO APPLICATIONS (USD/KG)

- FIGURE 26 PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 27 PATENT PUBLICATION TREND ANALYSIS: LAST TEN YEARS

- FIGURE 28 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: LEGAL STATUS OF PATENTS

- FIGURE 29 TOP JURISDICTIONS, BY DOCUMENT

- FIGURE 30 AUTONEUM HOLDING AG REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 31 POLYMERS SEGMENT TO LEAD RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC TO BE LEADING MARKET FOR COMPOSITES SEGMENT

- FIGURE 33 NORTH AMERICA TO BE FASTEST-GROWING MARKET FOR POLYMERS SEGMENT

- FIGURE 34 PASSENGER CARS SEGMENT TO LEAD RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA TO BE LEADING RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET FOR PASSENGER CARS

- FIGURE 36 NORTH AMERICA TO BE FASTEST-GROWING RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET FOR COMMERCIAL VEHICLES

- FIGURE 37 INTERIORS SEGMENT TO LEAD RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO LEAD RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET FOR INTERIOR COMPONENTS

- FIGURE 39 NORTH AMERICA TO BE FASTEST-GROWING RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET FOR EXTERIOR COMPONENTS

- FIGURE 40 OEMS TO BE FASTER-GROWING APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO BE LARGEST MARKET IN OEMS APPLICATION

- FIGURE 42 ASIA PACIFIC TO BE LARGEST MARKET IN AFTERMARKETS APPLICATION

- FIGURE 43 JAPAN TO WITNESS HIGHEST CAGR IN RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- FIGURE 44 NORTH AMERICA: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SNAPSHOT

- FIGURE 46 EUROPE: RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET SNAPSHOT

- FIGURE 47 SHARES OF TOP COMPANIES IN RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- FIGURE 48 RANKING OF TOP FIVE PLAYERS IN RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET

- FIGURE 49 REVENUE ANALYSIS

- FIGURE 50 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 51 RECYCLED MATERIALS FOR MOBILITY APPLICATIONS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

- FIGURE 52 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 53 SOLVAY: COMPANY SNAPSHOT

- FIGURE 54 FAURECIA: COMPANY SNAPSHOT

- FIGURE 55 CONTINENTAL AG.: COMPANY SNAPSHOT

- FIGURE 56 NESTE: COMPANY SNAPSHOT

- FIGURE 57 UNIFI, INC.: COMPANY SNAPSHOT

- FIGURE 58 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 SGL CARBON: COMPANY SNAPSHOT

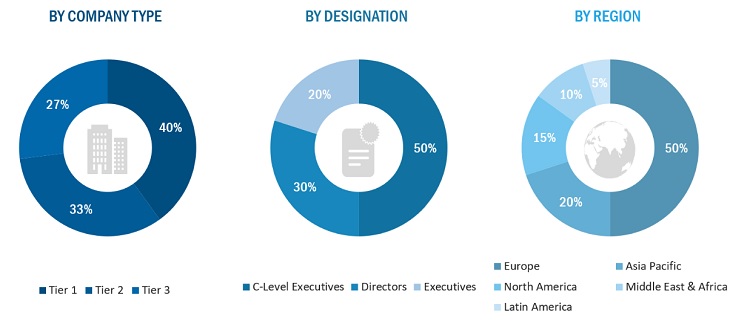

The study involves two major activities in estimating the current market size for recycled materials for mobility applications market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases, and investor presentations of companies; certified publications; articles from recognized authors; gold & silver standard websites; and various databases were referred to for identifying and collecting information for this study. Also, Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and related key executives from various leading companies and organizations operating in the recycled materials for mobility applications market. Primary sources from the demand side included procurement managers and experts from end-use industries.

Following is the breakdown of primary respondents

Notes: Tiers of companies are selected based on their ownership and revenues in 2021.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total recycled materials for mobility applications market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall recycled materials for mobility applications market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in aerospace & defense, automotive, wind energy, pipes & tanks, sporting goods, and others end-use industries.

Report Objectives

- To analyze and forecast the global market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide detailed information about the technological advancements influencing the growth of the market.

- To define, describe, and forecast the market based on five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific recycled materials for mobility applications market

- Further breakdown of North American recycled materials for mobility applications market

- Further breakdown of Rest of European recycled materials for mobility applications market

- Further breakdown of Rest of Middle East & Africa recycled materials for mobility applications market

- Further breakdown of Rest of Latin American recycled materials for mobility applications market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Recycled Materials for Mobility Applications Market