Reactive Diluents Market by Type (Aliphatic, Aromatic, Cycloaliphatic), Application (Paints & Coatings, Composites, Adhesives & Sealants), Region (APAC, North America, Europe, Middle East & Africa, South America) - Global Forecast to 2025

Updated on : March 31, 2023

Reactive Diluents Market

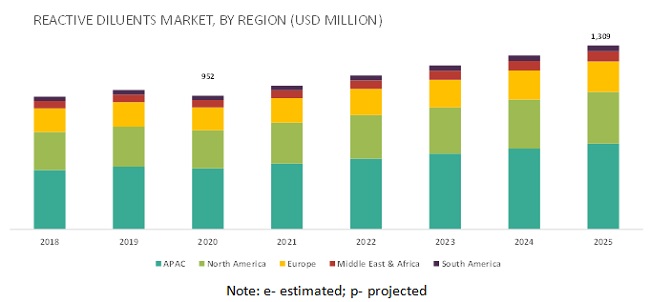

Reactive Diluents Market was valued at USD 952 million in 2020 and is projected to reach USD 1,309 million by 2025, growing at a cagr 6.6% from 2020 to 2025.. This high growth is primarily driven by rising global infrastructure spending. The growing use of composite materials in electronics, wind turbine, and aerospace industries is also driving the market. However, the outbreak of the novel coronavirus (COVID-19) pandemic will act as a challenge for the reactive diluents market in 2020.

By type, the aliphatic segment accounts for the major share of the reactive diluents market.

The aliphatic type is the largest type of reactive diluents owing to low raw material costs and the simple manufacturing process. Aliphatic reactive diluents are widely used in the automobile, aerospace, and wind energy industries. The increasing use of composites in these industries is driving the demand for aliphatic reactive diluents.

The composites application is expected to grow at the highest rate during the forecast period.

The composites segment is the fastest-growing application of reactive diluents. Recent technological advancements in composites materials and their rapid adoption are the key factors for the market growth in this application. The use of composites is increasing as more and better substitutes for conventional materials are found. The paints & coatings application is expected to grow at the second-fastest rate during the forecast period.

APAC is expected to account for the largest market share during the forecast period.

Based on the region, the reactive diluents market has been segmented into APAC, Europe, North America, the Middle East & Africa, and South America. APAC is the largest and fastest-growing reactive diluents market owing to the increasing investments in the construction and industrial sectors, along with the rapidly growing population of the region. Increasing consumer purchasing power has propelled the growth of various industries in this region. These factors are expected to lead to increasing demand for reactive diluents in the region during the forecast period

Reactive Diluents Market Players

The key players in the reactive diluents market are Hexion (US), Huntsman Corporation (US), Kukdo Chemical (South Korea), Aditya Birla Chemicals (India), Evonik Industries (Germany), Adeka Corporation (Japan), Cargill (US), EMS-Griltech (Switzerland), Olin Corporation (US), Sachem (US), Arkema (France), Bluestar Wuxi Petrochemical (China), Atul Chemicals (India), Cardolite (US), DIC Corporation (Japan), Hubei Phoenix Chemical Company (China), Ipox Chemicals (Hungary), Sakamoto Yakuhin Kogyo (Japan), Geo Specialty Chemicals (US), BASF SE (Germany), Nippon Shokubai Co. Ltd (Japan), Air Products and Chemicals (US), Royce (US), King Industries (US), and Leuna-Harze (Germany).

Reactive Diluents Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018-2025 |

|

Base year |

2019 |

|

Forecast period |

2020-2025 |

|

Units considered |

Volume (Kiloton, Ton) |

|

Segments |

Type, Application, and Region |

|

Regions covered |

North America, APAC, Europe, South America, and Middle East & Africa |

|

Companies profiled |

Hexion (US), Huntsman Corporation (US), Kukdo Chemical (South Korea), Aditya Birla Chemicals (India), and Evonik Industries (Germany), among others |

This report categorizes the global reactive diluent market based on type, application, and region.

By Type:

- Aliphatic

- Aromatic

- Cycloaliphatic

By Application:

- Paints & coatings

- Composites

- Adhesives & sealants

- Others (electrical casting, electrical encapsulation, and fibers)

By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In February 2020, Huntsman launched a snap cure VITROX RTM 00410 resin. This new resin will help in the high-volume manufacturing of lightweight and cost-effective composite parts. This new development will help the company meet the customer needs in the composites industry.

- In March 2019, Hexion completed the construction of its Application Development Center (ADC) in Shanghai. The 4,800-square meter ADC will support new product development and customer collaboration. This will help in strengthening its R&D and technical services. It will accelerate the growth of waterborne coatings and composite applications and positively influence the usage of reactive diluents in these applications.

- In April 2017, Evonik industries extended its portfolio of silane-modified polymers for construction and adhesive industries. They launched silane-modified reactive diluents: Tegopac RD-1, Tegopac RD-2. They are used in polymers during curing; therefore, migration-free adhesive and sealant formulations can be produced.

Key questions addressed by the report

- What are the upcoming hot bets for the reactive diluents market?

- How are the market dynamics changing for different types of reactive diluents?

- How are the market dynamics changing for different application of reactive diluents?

- Who are the major manufacturers of reactive diluents?

- How are the market dynamics changing in different regions for reactive diluents?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 19)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.3.1 REACTIVE DILUENTS MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

2.4 LIMITATIONS

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 27)

4 PREMIUM INSIGHTS (Page No. - 30)

4.1 ATTRACTIVE OPPORTUNITIES IN REACTIVE DILUENTS MARKET

4.2 REACTIVE DILUENTS MARKET, BY TYPE

4.3 REACTIVE DILUENTS MARKET, BY APPLICATION

4.4 REACTIVE DILUENTS MARKET, BY KEY COUNTRIES

4.5 APAC REACTIVE DILUENTS MARKET, BY APPLICATION AND COUNTRY, 2019

5 MARKET OVERVIEW (Page No. - 33)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth of the global construction industry

5.2.1.2 Increasing use of composite materials

5.2.2 RESTRAINTS

5.2.2.1 Growing popularity of alternative resins

5.2.2.2 Stringent regulations related to the production of epoxy resin

5.2.3 OPPORTUNITIES

5.2.3.1 Rapid industrialization in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Volatile price of raw materials of epoxy resin

5.3 PORTER’S FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 IMPACT OF COVID-19 PANDEMIC ON REACTIVE DILUENTS MARKET

5.5 MACROECONOMIC INDICATORS

5.5.1 GLOBAL GDP TRENDS AND FORECASTS

5.5.2 TRENDS IN AUTOMOTIVE INDUSTRY

5.6 PATENT ANALYSIS

5.6.1 METHODOLOGY

5.6.2 PATENTS APPLIED AND REGISTERED

6 REACTIVE DILUENTS MARKET, BY TYPE (Page No. - 44)

6.1 INTRODUCTION

6.2 ALIPHATIC REACTIVE DILUENTS

6.2.1 MOST WIDELY CONSUMED REACTIVE DILUENT TYPE

6.3 AROMATIC REACTIVE DILUENTS

6.3.1 DIFFERENT MOLECULAR STRUCTURE LEAD TO IMPROVED VISCOSITY

6.4 CYCLOALIPHATIC REACTIVE DILUENTS

6.4.1 PROVIDE INCREASED VISCOSITY REDUCTION IN FORMULATIONS

7 REACTIVE DILUENTS MARKET, BY APPLICATION (Page No. - 47)

7.1 INTRODUCTION

7.2 PAINTS & COATINGS

7.2.1 LARGEST APPLICATION OF REACTIVE DILUENTS

7.3 COMPOSITES

7.3.1 GROWING USAGE OF COMPOSITE MATERIALS AS A SUBSTITUTE FOR TRADITIONAL PRODUCTS TO BOOST THE MARKET

7.4 ADHESIVES & SEALANTS

7.4.1 EXTENSIVE USE OF EPOXY ADHESIVES AS STRUCTURAL ADHESIVES TO DRIVE THE MARKET

7.5 OTHERS

8 REACTIVE DILUENTS MARKET, BY REGION (Page No. - 57)

8.1 INTRODUCTION

8.2 APAC

8.2.1 CHINA

8.2.1.1 Growing demand for paints and coatings to have a positive impact on the market

8.2.2 INDIA

8.2.2.1 Growing construction and composites sectors to propel the market

8.2.3 JAPAN

8.2.3.1 Increasing automobile production to boost the market

8.2.4 SOUTH KOREA

8.2.4.1 South Korea’s economic growth driving the reactive diluents market

8.2.5 AUSTRALIA

8.2.5.1 Australia to register the slowest growth in the APAC reactive diluents market

8.2.6 REST OF APAC

8.3 NORTH AMERICA

8.3.1 US

8.3.1.1 Composites and paints & coatings applications to drive the reactive diluents market

8.3.2 CANADA

8.3.2.1 Recovery of the country’s economy favorable for market growth

8.3.3 MEXICO

8.3.3.1 Construction and automobile industries to help in the market growth

8.4 EUROPE

8.4.1 GERMANY

8.4.1.1 Presence of a strong industrial base likely to drive the market

8.4.2 FRANCE

8.4.2.1 Growing paints & coating application to boost the market

8.4.3 UK

8.4.3.1 Growth of the construction sector to spur the demand for reactive diluents

8.4.4 ITALY

8.4.4.1 Paints & coatings application to fuel the market

8.4.5 SPAIN

8.4.5.1 Growth of various industries to propel the market in the country

8.4.6 RUSSIA

8.4.6.1 Automotive and construction sectors to contribute to the market growth

8.4.7 REST OF EUROPE

8.5 MIDDLE EAST & AFRICA

8.5.1 SAUDI ARABIA

8.5.1.1 Increasing investments in infrastructure to spur the demand for reactive diluents

8.5.2 UAE

8.5.2.1 UAE’s growing infrastructure to drive the reactive diluents demand

8.5.3 SOUTH AFRICA

8.5.3.1 Increased investment in construction industry boosting the market

8.5.4 REST OF MIDDLE EAST & AFRICA

8.6 SOUTH AMERICA

8.6.1 BRAZIL

8.6.1.1 A lucrative market for reactive diluents with a growing industrial sector

8.6.2 ARGENTINA

8.6.2.1 Recovery in Argentina’s economy to favor the growth of the reactive diluents market

8.6.3 REST OF SOUTH AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 108)

9.1 INTRODUCTION

9.2 COMPETITIVE LEADERSHIP MAPPING, 2019

9.2.1 VISIONARY LEADERS

9.2.2 INNOVATORS

9.2.3 DYNAMIC DIFFERENTIATORS

9.2.4 EMERGING PLAYERS

9.2.5 STRENGTH OF PRODUCT PORTFOLIO

9.2.6 BUSINESS STRATEGY EXCELLENCE

9.3 RANKING OF KEY PLAYERS

9.4 COMPETITIVE SCENARIO

9.4.1 NEW PRODUCT LAUNCH

9.4.2 INVESTMENT & EXPANSION

9.4.3 PARTNERSHIP

10 COMPANY PROFILE (Page No. - 116)

10.1 HEXION

10.1.1 BUSINESS OVERVIEW

10.1.2 PRODUCTS OFFERED

10.1.3 RECENT DEVELOPMENTS

10.1.4 SWOT ANALYSIS

10.1.5 CURRENT FOCUS AND STRATEGIES

10.1.6 RIGHT TO WIN

10.2 HUNTSMAN

10.2.1 BUSINESS OVERVIEW

10.2.2 PRODUCTS OFFERED

10.2.3 RECENT DEVELOPMENTS

10.2.4 SWOT ANALYSIS

10.2.5 CURRENT FOCUS AND STRATEGIES

10.2.6 RIGHT TO WIN

10.3 ADITYA BIRLA CHEMICALS

10.3.1 BUSINESS OVERVIEW

10.3.2 PRODUCTS OFFERED

10.3.3 SWOT ANALYSIS

10.3.4 CURRENT FOCUS AND STRATEGIES

10.3.5 RIGHT TO WIN

10.4 KUKDO CHEMICALS

10.4.1 BUSINESS OVERVIEW

10.4.2 PRODUCTS OFFERED

10.4.3 RECENT DEVELOPMENTS

10.4.4 SWOT ANALYSIS

10.4.5 CURRENT FOCUS AND STRATEGIES

10.4.6 RIGHT TO WIN

10.5 EVONIK INDUSTRIES

10.5.1 BUSINESS OVERVIEW

10.5.2 PRODUCTS OFFERED

10.5.3 RECENT DEVELOPMENTS

10.5.4 SWOT ANALYSIS

10.5.5 CURRENT FOCUS AND STRATEGIES

10.5.6 RIGHT TO WIN

10.6 ADEKA CORPORATION

10.6.1 BUSINESS OVERVIEW

10.6.2 PRODUCTS OFFERED

10.6.3 MNM VIEW

10.7 CARGILL

10.7.1 BUSINESS OVERVIEW

10.7.2 PRODUCTS OFFERED

10.7.3 NM VIEW

10.8 EMS-GRILTECH

10.8.1 BUSINESS OVERVIEW

10.8.2 PRODUCTS OFFERED

10.8.3 MNM VIEW

10.9 OLIN CORPORATION

10.9.1 BUSINESS OVERVIEW

10.9.2 PRODUCTS OFFERED

10.9.3 MNM VIEW

10.10 SACHEM

10.10.1 BUSINESS OVERVIEW

10.10.2 PRODUCTS OFFERED

10.10.3 MNM VIEW

10.11 OTHER COMPANIES

10.11.1 ATUL

10.11.2 ARKEMA

10.11.3 BLUESTAR WUXI PETROCHEMICAL

10.11.4 CARDOLITE

10.11.5 DIC CORPORATION

10.11.6 HUBEI PHOENIX CHEMICAL COMPANY

10.11.7 IPOX CHEMICALS

10.11.8 KING INDUSTRIES

10.11.9 LEUNA-HARZE

10.11.10 ROYCE

10.11.11 SAKAMOTO YAKUHIN KOGYO

10.11.12 AIR PRODUCTS AND CHEMICALS INC.

10.11.13 BASF SE

10.11.14 GEO SPECIALTY CHEMICALS

10.11.15 NIPPON SHOKUBAI CO. LTD.

11 APPENDIX (Page No. - 140)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

LIST OF TABLES (90 Tables)

TABLE 1 HOUSEHOLD DISPOSABLE INCOME, NET ANNUAL GROWTH RATE (%)

TABLE 2 PROJECTED GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2020-2024

TABLE 3 AUTOMOBILE PRODUCTION STATISTICS, BY COUNTRY, 2014–2018 (UNITS)

TABLE 4 LIST OF PATENTS BY 3M INNOVATIVE PROPERTIES COMPANY

TABLE 5 LIST OF PATENTS BY HILTI CORPORATION

TABLE 6 LIST OF PATENTS BY CHENGDU NASHUO TECHNOLOGY COMPANY

TABLE 7 LIST OF PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

TABLE 8 REACTIVE DILUENTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 9 REACTIVE DILUENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 10 REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 11 REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 12 REACTIVE DILUENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2018–2025 (TON)

TABLE 13 REACTIVE DILUENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 14 REACTIVE DILUENTS MARKET SIZE IN COMPOSITES, BY REGION, 2018–2025 (TON)

TABLE 15 REACTIVE DILUENTS MARKET SIZE IN COMPOSITES, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 16 REACTIVE DILUENTS MARKET SIZE IN ADHESIVES & SEALANTS, BY REGION, 2018–2025 (TON)

TABLE 17 REACTIVE DILUENTS MARKET SIZE IN ADHESIVES & SEALANTS, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 18 REACTIVE DILUENTS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (TON)

TABLE 19 REACTIVE DILUENTS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 20 REACTIVE DILUENTS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 21 REACTIVE DILUENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 APAC: REACTIVE DILUENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 23 APAC: REACTIVE DILUENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 24 APAC: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 25 APAC: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 26 CHINA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 27 CHINA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 28 INDIA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 29 INDIA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 30 JAPAN: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 31 JAPAN: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 32 SOUTH KOREA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 33 SOUTH KOREA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 34 AUSTRALIA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 35 AUSTRALIA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 36 REST OF APAC: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 37 REST OF APAC: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 38 NORTH AMERICA: REACTIVE DILUENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 39 NORTH AMERICA: REACTIVE DILUENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 NORTH AMERICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 41 NORTH AMERICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 42 US: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 43 US: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 44 CANADA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 45 CANADA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 46 MEXICO: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 47 MEXICO: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 48 EUROPE: REACTIVE DILUENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 49 EUROPE: REACTIVE DILUENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 EUROPE: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 51 EUROPE: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 52 GERMANY: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 53 GERMANY: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 54 FRANCE: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 55 FRANCE: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 56 UK: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 57 UK: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 58 ITALY: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 59 ITALY: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 60 SPAIN: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 61 SPAIN: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 62 RUSSIA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 63 RUSSIA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 64 REST OF EUROPE: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 65 REST OF EUROPE: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA: REACTIVE DILUENTS MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 67 MIDDLE EAST & AFRICA: REACTIVE DILUENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 69 MIDDLE EAST & AFRICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 70 SAUDI ARABIA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 71 SAUDI ARABIA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 72 UAE: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 73 UAE: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 74 SOUTH AFRICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 75 SOUTH AFRICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 76 REST OF MIDDLE EAST & AFRICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 77 REST OF MIDDLE EAST & AFRICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 78 SOUTH AMERICA: REACTIVE DILUENTS MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 79 SOUTH AMERICA: REACTIVE DILUENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 80 SOUTH AMERICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 81 SOUTH AMERICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 82 BRAZIL: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 83 BRAZIL: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 84 ARGENTINA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 85 ARGENTINA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 86 REST OF SOUTH AMERICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 87 REST OF SOUTH AMERICA: REACTIVE DILUENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 88 NEW PRODUCT LAUNCH (2015-2020)

TABLE 89 INVESTMENT & EXPANSION (2015-2020)

TABLE 90 PARTNERSHIP (2015-2020)

LIST OF FIGURES (39 Figures)

FIGURE 1 REACTIVE DILUENTS MARKET: RESEARCH DESIGN

FIGURE 2 REACTIVE DILUENTS MARKET: DATA TRIANGULATION

FIGURE 3 REACTIVE DILUENTS MARKET ANALYSIS THROUGH SECONDARY INTERVIEWS

FIGURE 4 ALIPHATIC TO BE THE LEADING TYPE OF REACTIVE DILUENTS

FIGURE 5 PAINTS & COATINGS APPLICATION DOMINATED THE MARKET IN 2019

FIGURE 6 APAC REACTIVE DILUENTS MARKET TO REGISTER THE HIGHEST CAGR

FIGURE 7 SIGNIFICANT GROWTH PROJECTED IN N THE MARKET BETWEEN 2020 AND 2025

FIGURE 8 ALIPHATIC TO BE THE DOMINANT REACTIVE DILUENT TYPE

FIGURE 9 PAINTS & COATINGS TO BE THE LARGEST APPLICATION

FIGURE 10 INDIA TO REGISTER HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 11 CHINA AND PAINTS & COATINGS SEGMENT ACCOUNTED FOR THE LARGEST SHARES

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN REACTIVE DILUENTS MARKET

FIGURE 13 REACTIVE DILUENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 14 REACTIVE DILUENTS PATENTS PUBLISHED TREND, 2015-2019

FIGURE 15 PATENTS JURISDICTION ANALYSIS

FIGURE 16 TOP APPLICANTS OF REACTIVE DILUENTS PATENTS

FIGURE 17 ALIPHATIC TO BE THE LEADING TYPE OF REACTIVE DILUENTS

FIGURE 18 PAINTS & COATINGS TO BE THE LARGEST APPLICATION OF REACTIVE DILUENTS

FIGURE 19 APAC TO BE THE LARGEST AND FASTEST-GROWING REACTIVE DILUENTS MARKET

FIGURE 20 APAC: REACTIVE DILUENTS MARKET SNAPSHOT

FIGURE 21 NORTH AMERICA: REACTIVE DILUENTS MARKET SNAPSHOT

FIGURE 22 EUROPE: REACTIVE DILUENTS MARKET SNAPSHOT

FIGURE 23 COMPANIES ADOPTED NEW PRODUCT LAUNCH AS THE KEY GROWTH STRATEGY BETWEEN 2015 AND 2020

FIGURE 24 REACTIVE DILUENTS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 25 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN REACTIVE DILUENTS MARKET

FIGURE 26 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN REACTIVE DILUENTS MARKET

FIGURE 27 HEXION LED THE MARKET IN 2019

FIGURE 28 HEXION: COMPANY SNAPSHOT

FIGURE 29 HEXION: SWOT ANALYSIS

FIGURE 30 HUNTSMAN: COMPANY SNAPSHOT

FIGURE 31 HUNTSMAN: SWOT ANALYSIS

FIGURE 32 SWOT ANALYSIS: ADITYA BIRLA CHEMICALS

FIGURE 33 KUKDO CHEMICALS: COMPANY SNAPSHOT

FIGURE 34 KUKDO CHEMICALS: SWOT ANALYSIS

FIGURE 35 EVONIK INDUSTRIES: COMPANY SNAPSHOT

FIGURE 36 EVONIK INDUSTRIES: SWOT ANALYSIS

FIGURE 37 ADEKA CORPORATION: COMPANY SNAPSHOT

FIGURE 38 CARGILL: COMPANY SNAPSHOT

FIGURE 39 OLIN CORPORATION: COMPANY SNAPSHOT

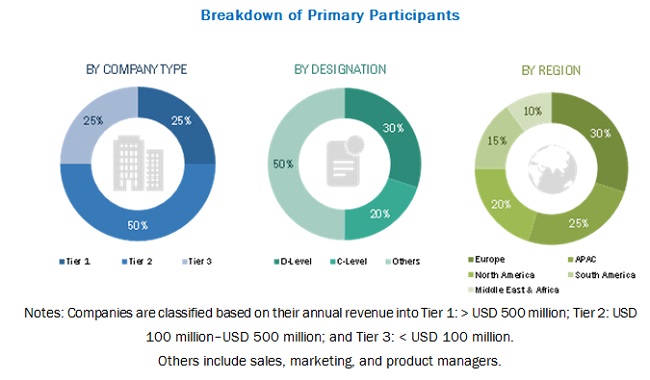

The study involved four major activities in estimating the current size of the reactive diluents market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Reuters, have been referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, and certified publications, articles by recognized authors, gold standard & silver standard websites

Primary Research

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the reactive diluents market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size in terms of value were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the applications

Report Objectives

- To define, describe, and forecast the reactive diluents market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market by type and by application

- To forecast the size of the market based on five regions: Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America, along with their countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments in the market, such as new product launch, investment & expansion, and partnership

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of APAC reactive diluents market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Reactive Diluents Market