Epoxy Composite Market by Fiber Type (Glass, Carbon), Manufacturing Process (Lay-up, Compression Molding, Resin Injection, Resin Transfer Molding, Filament Winding, and Pultrusion), End-use Industry, and Region - Global Forecast to 2021

[164 Pages Report] The epoxy composite market was valued at USD 21.6 billion in 2015 and is projected to reach USD 33.1 billion by 2021, at a CAGR of 7.3% during the forecast period. In this study, 2015 has been considered as the base year, while the forecast period is from 2016 to 2021.

Market Dynamics

Drivers

- Increasing demand for epoxy composite from wind energy industry

- Emerging demand from developing countries

- Need for material with high mechanical strength, lightweight, and resistance against corossion

Opportunities

- Adoption of low cost production technologies

- Growing wind energy industry in developing economies

Challenges

- High cost of raw material and research & development activities

- Reduce cycle time of epoxy composite part manufacturing

Increasing demand for epoxy composite from wind energy industry

Governments in countries of regions such as Asia-Pacific, Europe, and North America have imposed stringent environmental regulations to reduce greenhouse gas emissions. This has led to the shift towards renewable energy for energy generation. Wind energy capacity installation is increasing at a rapid pace in these regions to reduce carbon emissions. Manufacturers of wind turbine prefer lightweight materials such as epoxy composite for production of wind turbine parts such as turbine blades, nacelles, and hubs. Epoxy composite is replacing the use of traditional materials such as metals and alloys in wind turbine due to their superior mechanical properties. Wind turbine parts demand low maintenance and high strength-to-weight ratio, which is achieved with the help of epoxy composite. Lightweight materials increase the efficiency and performance of wind turbines by increasing the length of the blades. In addition, the use of epoxy composite provides high strength, stiffness, and compression strength to turbines, thus, helping wind turbines to enhance their load bearing capacity.

Objectives of the Study:

- To define, describe, and forecast the epoxy composite market on the basis of fiber type, application, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note1: Micromarkets are the subsegments of the epoxy composite market included in the report

Note2: Core competencies of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

In this report, various secondary sources such as company websites, encyclopedias, directories, and databases such as Composite World, Factiva, and American Composites Manufacturers Association and so on have been used to understand and gain insights into the epoxy composite market. In the primary research process, sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The bottom-up approach has been used to estimate the market size, in terms of value. The top-down approach has also been implemented to validate the market size, in terms of value. With the data triangulation procedure and validation of data through primaries, exact values of the sizes of the overall parent market and individual markets have been determined and confirmed in this study.

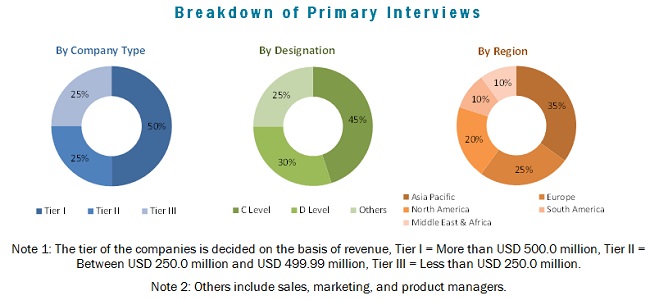

The figure below illustrates the breakdown of profiles of primary interview participants.

To know about the assumptions considered for the study, download the pdf brochure

The epoxy composite market has a diversified ecosystem, including downstream stakeholders such as manufacturers, vendors, end-users, and government organizations. Some of the major raw material suppliers are Arkema (France), Mitsubishi Plastics, Inc. (Japan), Formosa Plastics Corporation (Taiwan), SGL Group (Germany), SABIC (Saudi Arabia), Toray Carbon Fibers America Inc. (U.S), Huntsman Corporation (U.S) and others.

Key Target Audience:

- Epoxy composite Manufacturers

- Epoxy composite Traders, Distributors, and Suppliers

- Raw Material Suppliers

- Governments and Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

Scope of the Report

This research report categorizes the epoxy composite market based on resin type, application, manufacturing process, and region. It forecasts revenue growth and analyzes trends in each of the submarkets till 2021.

On the Basis of Fiber type

- Glass

- Carbon

- Others

On the Basis of End-use Industry,

- Wind Energy

- Aerospace & Defense

- Sporting Goods

- Automotive & Transportation

- Electrical & Electronics

- Pipe & Tank

- Marine

- Others

On the Basis of Manufacturing process,

- Lay-up

- Compression Moulding

- Resin Injection

- Resin Transfer Moulding

- Filament Winding

- Pultrusion

On the Basis of Region,

- North America

- Europe

- Asia-Pacific

- Latin America

- ME&A

Each region has been further segmented into key countries in that region.

Critical questions which the report answers

- What are the upcoming trends for epoxy composite in developing nations?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

The With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the North American epoxy composite market

- Further breakdown of the European epoxy composite market

- Further breakdown of the Asia-Pacific epoxy composite market

- Further breakdown of the Latin American epoxy composite market

- Further breakdown of the ME&A epoxy composite market

Company Information

- Detailed analysis and profiles of additional market players

The global epoxy composite market is projected to reach USD 33.1 billion by 2021, at a CAGR of 7.34%, during the forecast period, 2016 and 2021. Epoxy composite offers excellent compression and tensile strength, light weight, excellent modulus of elasticity, high corrosion resistance, and among others. The increase in the penetration of advanced materials such as epoxy composite in various industries such as wind energy, aerospace & defense, automotive & transportation, sporting goods, electrical & electronics, pipe & tank and others are key factors responsible for the growth of the epoxy composite market. In addition, the long life & low maintenance requirement, rapid urbanization & rapid economic growth in the emerging countries and the development of innovative products are significantly boosting the growth of epoxy composite market.

The epoxy composite market, by fiber type is segmented into glass, carbon, and others. The glass fiber based epoxy composite market is expected to grow faster during the forecast period, as it is used in industries such as wind energy, electrical & electronics, and pipe & tank, and it is economically cheaper as compared to other fibers.

The high cost of research & development has been an important concern associated with the development of epoxy composite. Due to high R&D cost, developing low-cost technologies is a major challenge for all researchers and key manufacturers. Hence, epoxy composite is only introduced in high-end applications such as luxury cars in the automotive & transportation industry. Production of low-cost epoxy composite can increase the demand from different end-use sectors. Many applications of epoxy composite have been discovered. However, due to high-cost constraints, commercialization of these applications is yet to begin.

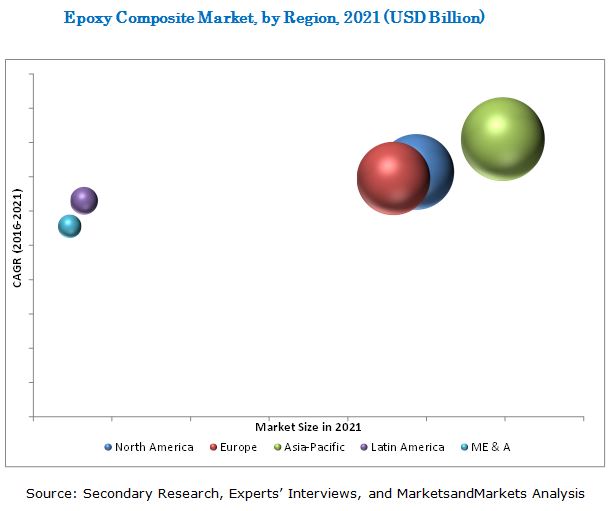

Asia Pacific is expected to be the fastest-growing region for epoxy composite market during the next five years. The main factor that contributed to its growth is the increasing demand from the wind energy, aerospace & defence, automotive & transportation, and construction industries. The presence of established epoxy composite manufactures and increased wind energy capacity especially in China is driving epoxy composite market in this region.

The epoxy composite market by fiber type is segmented into glass, carbon and others

Glass Fiber

Glass fiber is the oldest and the most common reinforcement used in most applications. There are various types of glass fibers such as E-glass, S-glass, and ER-glass which are used according to the specific requirement in different industries. E-glass is the most commonly used glass fiber due to its high strength and electrical resistance, whereas S-glass is used in applications that require higher tensile modulus. Glass fiber provides superior properties such as high strength, flexibility, durability, stability, lightweight, and resistance to heat, temperature, and moisture.

Carbon Fiber

Carbon fiber epoxy composite is very light in weight and also provides excellent structural strength, toughness, rigidity, and very good tensile strength properties. It is corrosion resistant, fatigue resistant, fire resistant, and provides high thermal and electrical conductivity properties. It also provides ease of processing and reduced cycle time. Owing to all these properties, it is used in aerospace & defense, sporting goods, and automotive & transportation industries where weight, strength, and durability plays a very significant role.

Others

Other fibers include natural fibers and aramid fibers. Natural fiber epoxy composite are formed by reinforcing natural fibers such as flax, hemp, jute, and kenaf with an epoxy matrix. Natural fiber epoxy composites are used in automotive, aerospace, electrical & electronics, sporting goods, and construction applications.

Critical questions the report answers:

- What are the upcoming hot bets for epoxy composite market?

- How market dynamics is changing for different forms in different applications?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Gurit Holdings AG (Wattwil, Switzerland), Park Electrochemical Corporation (Melville, U.S.), Toray Industries (Tokyo, Japan), Teijin Limited (Osaka, Japan), Hexcel Corporation (Connecticut, U.S.),and Cytec Solvay Group (Brussels, Belgium)are some of the major players in epoxy composite market. They have been adopting various organic and inorganic growth strategies such as agreements, new product launched, acquisitions and expansions to enhance their shares in the global epoxy composite market.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Key Industry Insights

2.1.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Epoxy Composite Market: Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 31)

4.1 Significant Opportunities in the Epoxy Composite Market, 20162021

4.2 Epoxy Composite Market, By Fiber Type

4.3 Epoxy Composite Market, By End-Use Industry and Region

4.4 Epoxy Composite Market, By Manufacturing Process

4.5 Epoxy Composite Market Growth, By Country (Value)

4.6 Epoxy Composite Market Size, By Country

4.7 Epoxy Composite Market Size, By End-Use Industry

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Epoxy Composite From Wind Energy Industry

5.2.1.2 Emerging Demand From Developing Countries

5.2.1.3 Need for Material With High Mechanical Strength, Lightweight, and Resistance Against Corrosion

5.2.2 Restraints

5.2.2.1 Increasing Popularity of Alternative Resins

5.2.2.2 Issues Related to Remouldability and Recyclability

5.2.2.3 High Volatility in Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Adoption of Low Cost Production Technologies

5.2.3.2 Growing Wind Energy Industry in Developing Economies

5.2.4 Challenges

5.2.4.1 High Cost of Raw Material and Research & Development Activities

5.2.4.2 Reduce Cycle Time of Epoxy Composite Part Manufacturing

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Raw Material Analysis

6.2.1 Raw Material Analysis of Epoxy Composite

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Competitive Rivalry

7 Macro Economic Overview and Key Trends (Page No. - 46)

7.1 Introduction

7.2 Trends and Forecast of GDP

7.3 Per Capita GDP vs Per Capita Composite Materials Demand

7.4 Trends of Wind Energy Industry

7.5 Trends of Aerospace Industry

7.6 Trends of Automotive Industry

8 Epoxy Composite Market, By Fiber Type (Page No. - 55)

8.1 Introduction

8.2 Glass Fiber

8.3 Carbon Fiber

8.4 Other Fibers

9 Epoxy Composite Market, By Manufacturing Process (Page No. - 64)

9.1 Introduction

9.2 Layup Process

9.3 Compression Molding Process

9.4 Resin Injection Molding Process

9.5 Resin Transfer Molding Process

9.6 Filament Winding Process

9.7 Pultrusion Process

10 Epoxy Composite Market, By End-Use Industry (Page No. - 75)

10.1 Introduction

10.2 Wind Energy

10.3 Aerospace & Defense

10.4 Automotive & Transportation

10.5 Sporting Goods

10.6 Electrical & Electronics

10.7 Pipe & Tank

10.8 Marine

10.9 Others

11 Epoxy Composite Market, By Region (Page No. - 91)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 U.K.

11.3.4 Italy

11.3.5 Spain

11.3.6 Netherlands

11.3.7 Poland

11.3.8 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Australia

11.4.5 Malaysia

11.4.6 Rest of Asia-Pacific

11.5 Latin America

11.5.1 Brazil

11.5.2 Mexico

11.5.3 Argentina

11.5.4 Rest of Latin America

11.6 Middle East & Africa

11.6.1 UAE

11.6.2 South Africa

11.6.3 Saudi Arabia

11.6.4 Rest of Middle East & Africa

12 Competitive Landscape (Page No. - 120)

12.1 Introduction

12.2 Competitive Benchmarking

12.3 Market Leaders

12.3.1 Gurit Holding AG (Switzerland)

12.3.2 Cytec Solvay Group (U.S.)

12.3.3 Hexcel Corporation (U.S.)

12.4 Market Challengers

12.4.1 Park Electrochemical Corporation (U.S.)

12.4.2 Barrday (Canada)

12.4.3 Axiom Materials (U.S.)

12.5 Market Followers

12.5.1 Quantum Composites (U.S.)

12.5.2 Composites One (U.S.)

12.5.3 Myko Engineering (Israel)

13 Company Profiles (Page No. - 123)

(Overview, Financial*, Products & Services, Strategy, and Developments)

13.1 Cytec Solvay Group

13.2 Hexcel Corporation

13.3 Royal Tencate N.V.

13.4 Teijin Limited

13.5 Toray Industries Inc.

13.6 Gurit Holding AG

13.7 SGL Group

13.8 Axiom Materials

13.9 Mitsubishi Rayon Co., Ltd.

13.10 Park Electrochemical Corporation

13.11 Kemrock Industries and Exports Limited

13.12 Sumitomo Bakelite Co., Ltd.

13.13 Myko Engineering

13.14 Rotec Composite Group B.V.

13.15 Barrday

13.16 Gordon Composites, Inc.

13.17 Hindoostan Composite Solutions

13.18 ATL Composites

13.19 IDI Composites

13.20 Isosport

*Details Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 157)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (78 Tables)

Table 1 Epoxy Composite Market Size, 20142021 (Value and Volume)

Table 2 Trends and Forecast of GDP, USD Billion (20152021)

Table 3 Per Capita GDP vs Per Capita Composite Materials Demand, 2015

Table 4 Wind Energy Installation, Mw (20122016)

Table 5 Market of New Airplanes, 2016

Table 6 Automobile Production, Million Units (20122016)

Table 7 Epoxy Composite Market Size, By Fiber Type, 20142021 (Kiloton)

Table 8 Epoxy Composite Market Size ,By Fiber Type, 20142021 (USD Million)

Table 9 Glass Fiber Epoxy Composite Market Size, By Region, 20142021 (Kiloton)

Table 10 Glass Fiber Epoxy Composite Market Size, By Region, 20142021 (USD Million)

Table 11 Carbon Fiber Epoxy Composite Market Size, By Region, 20142021 (Kiloton)

Table 12 Carbon Fiber Epoxy Composite Market Size, By Region, 20142021 (USD Million)

Table 13 Others Fiber Epoxy Composite Market Size, By Region, 20142021 (Kiloton)

Table 14 Others Fiber Epoxy Composite Market Size, By Region, 20142021 (USD Million)

Table 15 Epoxy Composite Market Size, By Manufacturing Process, 20142021 (Kiloton)

Table 16 Epoxy Composite Market Size, By Manufacturing Process, 20142021 (USD Million)

Table 17 Epoxy Composite Market Size for Layup Process, By Region, 20142021 (Kiloton)

Table 18 Epoxy Composite Market Size for Layup Process, By Region, 20142021 (USD Million)

Table 19 Epoxy Composite Market Size for Compression Molding Process, By Region, 20142021 (Kiloton)

Table 20 Epoxy Composite Market Size for Compression Molding Process, By Region, 20142021 (USD Million)

Table 21 Epoxy Composite Market Size for Injection Molding Process, By Region, 20142021 (Kiloton)

Table 22 Epoxy Composite Market Size for Injection Molding Process, By Region, 20142021 (USD Million)

Table 23 Epoxy Composite Market Size for Resin Transfer Moulding Process, By Region, 20142021 (Kiloton)

Table 24 Epoxy Composite Market Size for Resin Transfer Moulding Process, By Region, 20142021 (USD Million)

Table 25 Epoxy Composite Market Size for Filament Winding Process, By Region, 20142021 (Kiloton)

Table 26 Epoxy Composite Market Size for Filament Winding Process, By Region, 20142021 (USD Million)

Table 27 Epoxy Composite Market Size for Pultrusion Process, By Region, 20142021 (Kiloton)

Table 28 Epoxy Composite Market Size for Pultrusion Process, By Region, 20142021 (USD Million)

Table 29 Epoxy Composite Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 30 Epoxy Composite Market Size, By End-Use Industry, 20142021 (USD Million)

Table 31 Epoxy Composite Market Size in Wind Energy Industry, By Region, 20142021 (Kiloton)

Table 32 Epoxy Composite Market Size in Wind Energy Industry, By Region, 20142021 (USD Million)

Table 33 Epoxy Composite Market Size in Aerospace & Defense Industry, By Region, 20142021 (Kiloton)

Table 34 Epoxy Composite Market Size in Aerospace & Defense Industry, By Region, 20142021 (USD Million)

Table 35 Epoxy Composite Market Size in Automotive & Transportation Industry, By Region, 20142021 (Kiloton)

Table 36 Epoxy Composite Market Size in Automotive & Transportation Industry, By Region, 20142021 (USD Million)

Table 37 Epoxy Composite Market Size in Sporting Goods, By Region, 20142021 (Kiloton)

Table 38 Epoxy Composite Market Size in Sporting Goods Industry, By Region, 20142021 (USD Million)

Table 39 Epoxy Composite Market Size in Electrical & Electronics Industry, By Region, 20142021 (Kiloton)

Table 40 Epoxy Composite Market Size in Electrical & Electronics Industry, By Region, 20142021 (USD Million)

Table 41 Epoxy Composite Market Size in Pipe & Tank Industry, By Region, 20142021 (Kiloton)

Table 42 Epoxy Composite Market Size in Pipe & Tank Industry, By Region, 20142021 (USD Million)

Table 43 Epoxy Composite Market Size in Marine Industry, By Region, 20142021 (Kiloton)

Table 44 Epoxy Composite Market Size in Marine Industry, By Region, 20142021 (USD Million)

Table 45 Epoxy Composite Market Size in Other Industries, By Region, 20142021 (Kiloton)

Table 46 Epoxy Composite Market Size in Other Industries, By Region, 20142021 (USD Million)

Table 47 Epoxy Composite Market Size, By Region, 20142021 (Kiloton)

Table 48 Epoxy Composite Market Size, By Region, 20142021 (USD Million)

Table 49 North America: Epoxy Composite Market Size, By Country, 20142021 (Kiloton)

Table 50 North America: Epoxy Composite Market Size, By Country, 20142021 (USD Million)

Table 51 North America: Epoxy Composite Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 52 North America: Epoxy Composite Market Size, By End-Use Industry, 20142021 (USD Million)

Table 53 North America: Epoxy Composite Market Size, By Fiber Type, 20142021 (Kiloton)

Table 54 North America: Epoxy Composite Market Size, By Fiber Type, 20142021 (USD Million)

Table 55 Europe: Epoxy Composite Market Size, By Country, 20142021 (Kiloton)

Table 56 Europe: Epoxy Composite Market Size, By Country, 20142021 (USD Million)

Table 57 Europe: Epoxy Composite Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 58 Europe: Epoxy Composite Market Size, By End-Use Industry, 20142021 (USD Million)

Table 59 Europe: Epoxy Composite Market Size, By Fiber Type, 20142021 (Kiloton)

Table 60 Europe: Epoxy Composite Market Size, By Fiber Type, 20142021 (USD Million)

Table 61 Asia-Pacific: Epoxy Composite Market Size, By Country, 20142021 (Kiloton)

Table 62 Asia-Pacific: Epoxy Composite Market Size, By Country, 20142021 (USD Million)

Table 63 Asia-Pacific: Epoxy Composite Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 64 Asia-Pacific: Epoxy Composite Market Size, By End-Use Industry, 20142021 (USD Million)

Table 65 Asia-Pacific: Epoxy Composite Market Size, By Fiber Type, 20142021 (Kiloton)

Table 66 Asia-Pacific: Epoxy Composite Market Size, By Fiber Type, 20142021 (USD Million)

Table 67 Latin America: Epoxy Composite Market Size, By Country, 20142021 (Kiloton)

Table 68 Latin America: Epoxy Composite Market Size, By Country, 20142021 (USD Million)

Table 69 Latin America: Epoxy Composite Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 70 Latin America: Epoxy Composite Market Size, By End-Use Industry, 20142021 (USD Million)

Table 71 Latin America: Epoxy Composite Market Size, By Fiber Type, 20142021 (Kiloton)

Table 72 Latin America: Epoxy Composite Market Size, By Fiber Type, 20142021 (USD Million)

Table 73 ME&A: Epoxy Composite Market Size, By Country, 20142021 (Kiloton)

Table 74 ME&A: Epoxy Composite Market Size, By Country, 20142021 (USD Million)

Table 75 ME&A: Epoxy Composite Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 76 ME&A: Epoxy Composite Market Size, By End-Use Industry, 20142021 (USD Million)

Table 77 ME&A: Epoxy Composite Market Size, By Fiber Type, 20142021 (Kiloton)

Table 78 ME&A: Epoxy Composite Market Size, By Fiber Type, 20142021 (USD Million)

List of Figures (56 Figures)

Figure 1 Epoxy Composite: Market Segmentation

Figure 2 Epoxy Composite Market: Research Design

Figure 3 Carbon Fiber Segment to Witness Highest Growth in the Epoxy Composite Market, 2016 and 2021

Figure 4 Lay-Up Manufacturing Process Dominated the Epoxy Composite Market

Figure 5 Wind Energy Dominates the Epoxy Composite Market in the Forecast Period

Figure 6 China Projected to Be the Fastest-Growing Market for Epoxy Composite in the Forecast Period

Figure 7 Asia-Pacific to Be the Fastest-Growing Market for Epoxy Composite During Forecast Period

Figure 8 Attractive Opportunities in the Epoxy Composite Market

Figure 9 Glass to Be the Fastest-Growing Fiber Type in the Overall Epoxy Composite Market

Figure 10 Wind Energy Dominates the Epoxy Composite Market in 2016

Figure 11 Layup Manufacturing Process Dominates the Epoxy Composite Market

Figure 12 China Accounted for Biggest Share of Global Epoxy Composite Market

Figure 13 China to Witness Highest Growth Rate in the Epoxy Composite Market

Figure 14 Wind Energy Accounts for Largest Market Share

Figure 15 Factors Governing the Epoxy Composite Market

Figure 16 Oil Price Fluctuation

Figure 17 Porters Five Forces Analysis of the Epoxy Composite Market

Figure 18 Trends and Forecast of GDP, USD Billion (20162021)

Figure 19 Per Capita GDP vs Per Capita Composite Materials Demand

Figure 20 Wind Energy Installed Capacity, Mw (20152016)

Figure 21 New Airplanes Deliveries, By Region, 2016

Figure 22 Automobile Production in Key Countries, Million Units (2012 vs 2016)

Figure 23 Carbon Fiber Epoxy Composite to Outpace Other Segments in Growth, in Terms of Value,

Figure 24 Asia-Pacific Dominates Glass Fiber Epoxy Composite Market, in Terms of Value

Figure 25 North America Set to Dominate the Carbon Fiber Epoxy Composite Market, in Terms of Value

Figure 26 Europe Set to Dominate the Others Fiber Epoxy Composite Market, in Terms of Value

Figure 27 Layup Manufacturing Process to Dominate the Epoxy Composite Market , in Terms of Value

Figure 28 Asia-Pacific to Drive Epoxy Composite Market for Layup Process Segment, in Terms of Value

Figure 29 Asia-Pacific to Drive the Epoxy Composite Market for Compression Moulding Process, in Terms of Value

Figure 30 Europe to Drive Epoxy Composite Market for Resin Injection Process Segment

Figure 31 Asia-Pacific to Drive Epoxy Composite Market for Resin Transfer Moulding Process

Figure 32 Asia-Pacific Dominates Epoxy Composite Market for Filament Winding Process

Figure 33 Wind Energy Dominates Epoxy Composite Market, in Terms of Value

Figure 34 Asia-Pacific Accounts for Major Share of Epoxy Composite Market in Wind Energy Industry, in Terms of Value

Figure 35 North America to Dominate the Epoxy Composite Market in Aerospace & Defense Industry, in Terms of Value

Figure 36 Asia-Pacific Leads Epoxy Composite Market in Automotive & Transportation End-Use Industry, in Terms of Value

Figure 37 Asia-Pacific Leads Epoxy Composite Market in Sporting Goods Industry, in Terms of Value

Figure 38 Asia-Pacific Accounts for Major Share of Epoxy Composite Market in Electrical & Electronics Industry, in Terms of Value

Figure 39 North America Accounts for Major Share of Epoxy Composite Market in Pipe & Tank End-Use Industry, in Terms of Value

Figure 40 Europe Accounts for Major Share of Epoxy Composite Market in Marine End-Use Industry, in Terms of Value

Figure 41 Europe Accounts for Major Share of Epoxy Composite Market in Other End-Use Industries, in Terms of Value

Figure 42 China, India, and Germany to Drive the Global Epoxy Composite Market, 20162021

Figure 43 Epoxy Composite Market Snapshot: U.S. is the Most Lucrative Market in North America

Figure 44 Epoxy Composite Market Snapshot: Germany is the Fastest-Growing Market

Figure 45 Epoxy Composite Market Snapshot: China to Be the Fastest-Growing Market in Asia-Pacific

Figure 46 Brazil is the Key Epoxy Composite Market in Latin America (20162021)

Figure 47 UAE to Be the Fastest-Growing Market for Epoxy Composite in Middle East & Africa, 20162021

Figure 48 Gurit Holding AG is the Leader in the Epoxy Composite Market

Figure 49 Cytec Solvay Group: Company Snapshot

Figure 50 Hexcel Corporation: Company Snapshot

Figure 51 Royal Tencate N.V.: Company Snapshot

Figure 52 Teijin Limited: Company Snapshot

Figure 53 Toray Industries Inc.: Company Snapshot

Figure 54 Gurit Holding AG: Company Snapshot

Figure 55 SGL Group: Company Snapshot

Figure 56 Park Electrochemical Corporation: Company Snapshot

Growth opportunities and latent adjacency in Epoxy Composite Market