Ransomware Protection Market by Solution (Anti-Ransomware Software, Secure Web Gateways, Application Control, IDS/IPS, Threat Intelligence), Service, Application, Deployment, Organization Size, Vertical, Region - Global Forecast to 2021

[179 Pages Report] The ransomware protection market size is expected to grow from USD 8.16 billion in 2016 to USD 17.36 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 16.3% during the forecast period. The base year considered for the study is 2015 and the market size is calculated from 2016 to 2021. As the global threat environment is changing rapidly, the rise in volume of security breaches and exposure to Personally Identifiable Information (PII) is the biggest concern. There has been a notable spike in the phishing attacks in Q1, 2016. Phishing attacks are used by cybercriminal and fraudsters, employing both social engineering and technical maneuver to steal customers personal identity data and other sensitive information via deceptive emails and texts. The innovation in market is driven by the development and upgradation of new security products to protect end users from ransomware and other advanced threats.

Ransomware Protection Market Dynamics

Drivers

- Rise in the volume of phishing attacks and targeted security breaches

- Emergence of Ransomware-as-a-Service model

- Advent of crypto-currencies for ransom payments

Restraints

- Availability of free endpoint security solutions for ransomware protection

Opportunities

- Organizations looking for multi-layered security approach

- Sharing of threat intelligence among enterprises

- Rise in demand for data backup and recovery solutions

Challenges

- Lack of awareness among security professionals about new ransomware families

- Rise in average ransom amount

Advent of crypto-currencies for ransom payments

Crypto-currencies, predominantly the Bitcoin have taken the financial technology world by storm. The increasing acceptance of cryptocurrencies by large organization and other local enterprises has influence the faith in this disruptive technology and has brought revolution in the currency and payment mechanism. With the rise in ransomware attacks, the cybercriminals are demanding their victims to pay in cryptocurrency, most commonly Bitcoin, to pay for delivery of a decryption key. According to the FBI report, ransomware victims reported total costs from such attacks of USD 209 million in the Q1, 2016 that is up dramatically from USD 24 million recorded in the entire year of 2015.

The following are the major objectives of the study

- To define, describe, and forecast the global ransomware protection market on the basis of solutions, services, applications, deployment modes, organization sizes, verticals, and regions.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To strategically analyze each sub-segment with respect to individual growth trends, future prospects, and contribution to the total market.

- To forecast the market size of segments with respect to the five main regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the market.

- To strategically profile the key players of the market and comprehensively analyze their core competencies in the market.

- To track and analyze competitive developments, such as new product launches, mergers and acquisitions, partnerships, agreements, and collaborations in the global market.

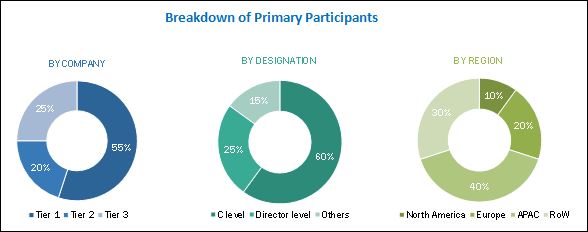

The research methodology used to estimate and forecast the ransomware protection market begins with capturing data on key security vendors through secondary sources such as the Information Systems Security Association (ISSA), Information Systems Audit and Control Association (ISACA), the SANS institute, National Cyber Security Alliance (NCSA), and other national agencies and associations for cybersecurity as well as other sources such as company financials, journals, press releases, paid databases, and annual reports. The vendor products and services offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments, which were then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, executives, and security technologists. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments & sub-segments. The breakdown of primary profiles is depicted in the below figure.

To know about the assumptions considered for the study, download the pdf brochure

The ransomware protection ecosystem comprises major vendors such as Intel Security, Symantec Corporation, Trend Micro, FireEye, Sophos, Bitdefender, Kaspersky Lab, Malwarebytes, Zscaler, SentinelOne, and others. Other stakeholders include cyber security solutions providers, consulting firms, IT service providers, value added resellers, and security technology providers.

Major Market Developments

- In November 2016, Intel Security formed Intel Security Innovation Alliance with companies such as Huawei, Check Point, and other leading players to protect and secure against the advanced cyber threats as well as enhance product integration and market growth.

- In November 2016, FireEye collaborated with Pillsbury and Thomson Reuters to manage the increasing risks related to cyber threats.

- In November 2016, Zscaler partnered with Carahsoft Technology Corp with the help of which Zscaler can offer cloud security to the public sector, which would result in low cost and minimized complexity.

Key Target Audience For Ransomware Protection Market

- Government agencies

- Cyber security vendors

- IT service providers

- Consulting firms

- System integrators

- Value-Added Resellers (VARs)

- Managed Security Service Providers (MSSPs)

The study answers several questions for the stakeholders; primarily, which market segments will focus in the next two to five years for prioritizing their efforts and investments.

Scope of the Market

The research report segments the market to following submarkets:

By Solution

- Standalone anti-ransomware software

- Secure web gateways

- Application control

- IDS/IPS

- Web filtering

- Threat intelligence

- Others

By Service

- Professional Services

- Consulting

- Training and Education

- Support and Maintenance

- Managed Services

By Application

- Network protection

- Endpoint protection

- Email protection

- Database protection

- Web protection

By Deployment Mode

- Cloud

- On-Premise

By Organization Size

- SMEs

- Large Enterprises

By Vertical

- Government & Defense

- BFSI

- IT & Telecom

- Healthcare

- Education

- Energy & Utilities

- Retail

- Others

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Critical questions which the report answers

- What are the new opportunities which the ransomware protection vendors are exploring?

- Who are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North America market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin America ransomware protection market

The ransomware protection market size is expected to grow from USD 8.16 billion in 2016 to USD 17.36 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 16.3% during the forecast period. The major growth drivers of the market include rise in phishing attacks and security breaches and emergence of Ransomware-as-a-Service (RaaS) model, through which cybercriminals are reaping billions of dollars from the victims.

Ransomware protection refers to the set of security solutions deployed by organizations to safeguard themselves against ransomware threat. Ransomware is a type of sophisticated malware that is designed to block access to a computer system or encrypt the data unless a ransom is paid to the cybercriminal. The attacker encrypts the victims data and demands payment for the decryption key. Ransomware can be spread via suspicious emails with malicious attachments, infected programs, and compromised websites. To protect against such predominant threat, organizations are looking forward towards a multi-layered security approach to defend, prevent, and respond to ransomware attacks.

The ransomware protection market is segmented by solution, services, application, deployment mode, organization size, vertical, and region. Secure web gateways solution is estimated to contribute the largest market size in 2016, as it protects the computers from user-initiated web traffic and enforces strong company policies. Furthermore, threat intelligence solution is expected to grow at the highest CAGR during the forecast period, as it provide real-time understanding of sophisticated cyber threats, their detection, analysis, and predictive remediation.

Managed services segment is estimated to grow at the highest CAGR during the forecast period. The SMEs are looking forward to the third-party vendors as managed security service providers for improved cybersecurity operations, within the organization. Moreover, professional services segment is expected to have the highest market size in 2016, as it includes consulting, training & education, and support & maintenance services.

Ransomware protection solutions have been deployed across various industry verticals, including government and defense, BFSI, healthcare, education, and others. The healthcare vertical is expected to witness the highest CAGR during the forecast period, as the cybercriminals are targeting valuable electronic patient health information, which has huge demand in the black market. However, BFSI vertical is estimated to have the largest market size in 2016, which is fueled by the advent of crypto-currencies such as Bitcoins.

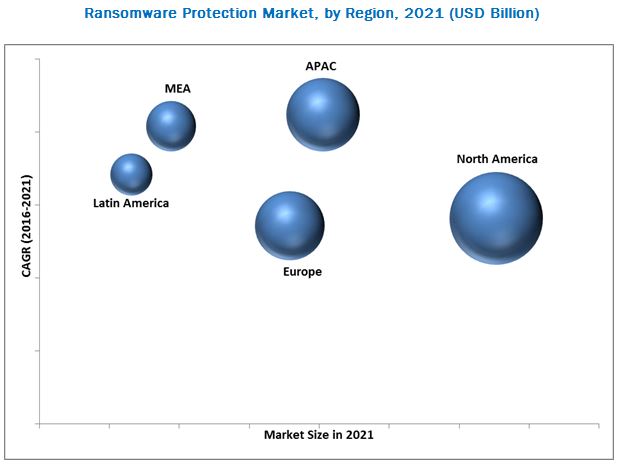

The global ransomware protection market has been segmented on the basis of regions into North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America to provide a region-specific analysis in the report. The North American region is expected to become the largest revenue generating region for cybersecurity vendors in 2016, followed by Europe. This is mainly because the businesses in the U.S. are highly targeted by hackers via ransomware attacks to extort large ransom. The APAC region is expected to be the fastest growing region in the market, as ransomware perpetrators are targeting SMEs in this region via large number of phishing attacks.

Increased usage of ransomware protection solutions in BFSI, healthcare, and government and defense industry verticals drive the growth of the ransomware protection market

Banking, Financial Services, and Insurance

The BFSI vertical represents the companies that offer a wide range of financial products and services to the customers. These include commercial banks, credit unions, insurance companies, exchanges, cooperatives institutions, mutual funds, pension funds, and other similar financial entities. The BFSI vertical has always been a prime target for cybercriminals because of the business function they operate that is huge amount of money. The advent of crypto currencies like Bitcoin has also fueled the growth of ransomware attacks in this sector. FireEye, Trend Micro, Sophos, Intel Security, and Symantec Corporation are some of the key vendors offering ransomware protection solutions to the BFSI vertical.

Retail

Ransomware is among the top five cyber threat for retailers nowadays. Large retailers are increasingly becoming targets for ransomware, targeting sensitive information of customers such as credit card and debit card details and other critical merchant information. However, the attack surface has now shifted to small retailers as well, as the target is easy and far more numerous. With the growing online retail transaction volume, the threat for ransomware is expected to grow in the coming years.

Government and Defense

Ransomware is growing as one of the major threat in government and defense vertical. These government agencies have access to and stored personal information about the citizens, which are the prime target for cybercriminals, as this Personal Identifiable Information (PII) about the citizens is worth a lot of money in the criminal market. Cybersecurity vendors such as Intel Security, Trend Micro, FireEye, Sophos, and others offer ransomware protection solutions to government and defense agencies to fight against such sophisticate crypto-malwares.

Critical questions which the report answers

- What are the new opportunities which the ransomware protection vendors are exploring?

- Who are the key players in the market and how intense is the competition?

Lack of awareness among security professionals about new and emerging ransomware families is the biggest challenge, which the enterprise are facing in the ransomware protection market.

Major vendors that offer ransomware protection solution across the globe are Intel Security, Symantec Corporation, Trend Micro, FireEye, Sophos, Bitdefender, Kaspersky Lab, Malwarebytes, Zscaler, SentinelOne, and others. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships & agreements, and mergers & acquisitions to expand their offerings in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Market

4.2 Market By Component

4.3 Global Ransomware Protection Market

4.4 Lifecycle Analysis, By Region, 2016

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Evolution of the Ransomware

5.3 Market Segmentation

5.3.1 By Solution

5.3.2 By Service

5.3.3 By Application

5.3.4 By Deployment Mode

5.3.5 By Organization Size

5.3.6 By Vertical

5.3.7 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Rise in the Volume of Phishing Attacks and Targeted Security Breaches

5.4.1.2 Emergence of Ransomware-As-A-Service Model

5.4.1.3 Advent of Crypto-Currencies for Ransom Payments

5.4.2 Restraints

5.4.2.1 Availability of Free Endpoint Security Solutions for Ransomware Protection

5.4.3 Opportunities

5.4.3.1 Organizations Looking for Multi-Layered Security Approach

5.4.3.2 Sharing of Threat Intelligence Among Enterprises

5.4.3.3 Rise in Demand for Data Backup and Recovery Solutions

5.4.4 Challenges

5.4.4.1 Lack of Awareness Among Security Professionals About New Ransomware Families

5.4.4.2 Rise in Average Ransom Amount

5.5 Regulatory Implications

5.5.1 The International Organization for Standardization (ISO) Standard 27001

5.5.2 Payment Card Industry Data Security Standard (PCIDSS)

5.5.3 Health Insurance Portability and Accountability Act (HIPAA)

5.5.4 Federal Information Security Management Act (FISMA)

5.5.5 Gramm-Leach-Bliley Act (GLB Act)

5.6 Innovation Spotlight

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Best Practices for Ransomware Protection

6.4 Ransomware Market Key Statistics

6.5 Strategic Benchmarking

6.5.1 Strategic Benchmarking: Technology Integration and Product Enhancement

7 Ransomware Protection Market Analysis, By Solution (Page No. - 51)

7.1 Introduction

7.2 Standalone Anti-Ransomware Software

7.3 Secure Web Gateways

7.4 Application Control

7.5 Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

7.6 Web Filtering

7.7 Threat Intelligence

7.8 Others

8 Market Analysis, By Service (Page No. - 61)

8.1 Introduction

8.2 Managed Services

8.3 Professional Services

8.3.1 Consulting

8.3.2 Training and Education

8.3.3 Support and Maintenance

9 Ransomware Protection Market Analysis, By Application (Page No. - 68)

9.1 Introduction

9.2 Network Protection

9.3 Email Protection

9.4 Endpoint Protection

9.5 Database Protection

9.6 Web Protection

10 Market Analysis, By Deployment Mode (Page No. - 75)

10.1 Introduction

10.2 Cloud

10.3 On-Premises

11 Market Analysis, By Organization Size (Page No. - 79)

11.1 Introduction

11.2 Small and Medium Enterprises (SMES)

11.3 Large Enterprises

12 Ransomware Protection Market Analysis, By Vertical (Page No. - 83)

12.1 Introduction

12.2 Government & Defense

12.3 Banking, Financial Services, and Insurance (BFSI)

12.4 IT & Telecom

12.5 Healthcare

12.6 Education

12.7 Energy & Utilities

12.8 Retail

12.9 Others

13 Geographic Analysis (Page No. - 93)

13.1 Introduction

13.2 North America

13.3 Europe

13.4 Asia-Pacific

13.5 Middle East and Africa

13.6 Latin America

14 Competitive Landscape (Page No. - 119)

14.1 Overview

14.2 Competitive Situation and Trends

14.3 Ransomware Protection Market: MnM Vendor Analysis

14.4 Agreements, Partnerships, and Collaborations

14.5 Mergers and Acquisitions

14.6 New Product Launches

14.7 Business Expansions

15 Company Profiles (Page No. - 128)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

15.1 Introduction

15.2 Intel Security (McAfee)

15.3 Symantec Corporation

15.4 Trend Micro, Inc.

15.5 Fireeye, Inc.

15.6 Sophos Group PLC

15.7 Bitdefender

15.8 Kaspersky Lab

15.9 Malwarebytes

15.10 Zscaler, Inc.

15.11 Sentinelone

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 163)

16.1 Other Developments

16.1.1 Partnerships, Agreements, and Collaborations

16.1.2 Mergers and Acquisitions

16.1.3 New Product Launches

16.2 Industry Experts

16.3 Discussion Guide

16.4 Knowledge Store: Marketsandmarkets Subscription Portal

16.5 Introduction RT: Real-Time Market Intelligence

16.6 Available Customizations

16.7 Related Reports

16.8 Author Details

List of Tables (83 Tables)

Table 1 Ransomware Protection Market Size and Growth, 20142021 (USD Billion, Y-O-Y %)

Table 2 Market Size, By Component, 20142021 (USD Million)

Table 3 Innovation Spotlight: Latest Innovations in the Market

Table 4 Best Practices: Ransomware Protection

Table 5 Market Size, By Solution, 20142021 (USD Million)

Table 6 Standalone Anti-Ransomware Software: Market Size, By Region, 20142021 (USD Million)

Table 7 Secure Web Gateways: Market Size, By Region, 20142021 (USD Million)

Table 8 Application Control: Market Size, By Region, 20142021 (USD Million)

Table 9 IDS/IPS: Market Size, By Region, 20142021 (USD Million)

Table 10 Web Filtering: Market Size, By Region, 20142021 (USD Million)

Table 11 Threat Intelligence: Market Size, By Region, 20142021 (USD Million)

Table 12 Others: Market Size, By Region, 20142021 (USD Million)

Table 13 Ransomware Protection Market Size, By Service, 20142021 (USD Million)

Table 14 Managed Services: Market Size, By Region, 20142021 (USD Million)

Table 15 Professional Services: Market Size, By Type, 20142021 (USD Million)

Table 16 Professional Services: Market Size, By Region, 20142021 (USD Million)

Table 17 Consulting: Market Size, By Region, 20142021 (USD Million)

Table 18 Training and Education: Market Size, By Region, 20142021 (USD Million)

Table 19 Support and Maintenance: Market Size, By Region, 20142021 (USD Million)

Table 20 Market Size, By Application, 20142021 (USD Million)

Table 21 Network Protection: Market Size, By Region, 20142021 (USD Million)

Table 22 Email Protection: Market Size, By Region, 20142021 (USD Million)

Table 23 Endpoint Protection: Market Size, By Region, 20142021 (USD Million)

Table 24 Database Protection: Market Size, By Region, 20142021 (USD Million)

Table 25 Web Protection: Market Size, By Region, 20142021 (USD Million)

Table 26 Ransomware Protection Market Size, By Deployment Mode, 20142021 (USD Million)

Table 27 Cloud: Market Size, By Region, 20142021 (USD Million)

Table 28 On-Premises: Market Size, By Region, 20142021 (USD Million)

Table 29 Market Size, By Organization Size, 20142021 (USD Million)

Table 30 Small and Medium Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 31 Large Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 32 Market Size, By Vertical, 20142021 (USD Million)

Table 33 Government and Defense: Market Size, By Region, 20142021 (USD Million)

Table 34 Banking, Financial Services, and Insurance: Market Size, By Region, 20142021 (USD Million)

Table 35 IT & Telecom: Market Size, By Region, 20142021 (USD Million)

Table 36 Healthcare: Market Size, By Region, 20142021 (USD Million)

Table 37 Education: Market Size, By Region, 20142021 (USD Million)

Table 38 Energy & Utilities: Market Size, By Region, 20142021 (USD Million)

Table 39 Retail: Market Size, By Region, 20142021 (USD Million)

Table 40 Others: Market Size, By Region, 20142021 (USD Million)

Table 41 Ransomware Protection Market Size, By Region, 20142021 (USD Million)

Table 42 North America: Ransomware Protection Market Size, By Solution, 20142021 (USD Million)

Table 43 North America: Market Size, By Service, 20142021 (USD Million)

Table 44 North America: Market Size, By Professional Service, 20142021 (USD Million)

Table 45 North America: Market Size, By Application, 20142021 (USD Million)

Table 46 North America: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 47 North America: Market Size, By Organization Size, 20142021 (USD Million)

Table 48 North America: Market Size, By Vertical, 20142021 (USD Million)

Table 49 Europe: Ransomware Protection Market Size, By Solution, 20142021 (USD Million)

Table 50 Europe: Market Size, By Service, 20142021 (USD Million)

Table 51 Europe: Market Size, By Professional Service, 20142021 (USD Million)

Table 52 Europe: Market Size, By Application, 20142021 (USD Million)

Table 53 Europe: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 54 Europe: Market Size, By Organization Size, 20142021 (USD Million)

Table 55 Europe: Market Size, By Vertical, 20142021 (USD Million)

Table 56 Asia-Pacific: Ransomware Protection Market Size, By Solution, 20142021 (USD Million)

Table 57 Asia-Pacific: Market Size, By Service, 20142021 (USD Million)

Table 58 Asia-Pacific: Market Size, By Professional Service, 20142021 (USD Million)

Table 59 Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 60 Asia-Pacific: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 61 Asia-Pacific: Market Size, By Organization Size, 20142021 (USD Million)

Table 62 Asia-Pacific: Market Size, By Vertical, 20142021 (USD Million)

Table 63 Middle East and Africa: Ransomware Protection Market Size, By Solution, 20142021 (USD Million)

Table 64 Middle East and Africa: Market Size, By Service, 20142021 (USD Million)

Table 65 Middle East and Africa: Market Size, By Professional Service, 20142021 (USD Million)

Table 66 Middle East and Africa: Market Size, By Application, 20142021 (USD Million)

Table 67 Middle East and Africa: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 68 Middle East and Africa: Market Size, By Organization Size, 20142021 (USD Million)

Table 69 Middle East and Africa: Market Size, By Vertical, 20142021 (USD Million)

Table 70 Latin America: Ransomware Protection Market Size, By Solution, 20142021 (USD Million)

Table 71 Latin America: Market Size, By Service, 20142021 (USD Million)

Table 72 Latin America: Market Size, By Professional Service, 20142021 (USD Million)

Table 73 Latin America: Market Size, By Application, 20142021 (USD Million)

Table 74 Latin America: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 75 Latin America: Market Size, By Organization Size, 20142021 (USD Million)

Table 76 Latin America: Market Size, By Vertical, 20142021 (USD Million)

Table 77 Agreements, Partnerships, and Collaborations, 2016

Table 78 Mergers and Acquisitions, 20152016

Table 79 New Product Launches, 2016

Table 80 Business Expansions, 20142016

Table 81 Other Developments: Partnerships, Agreements, and Collaborations, 20142016

Table 82 Other Developments: Mergers and Acquisitions, 20142016

Table 83 Other Developments: New Product Launches, 20142016

List of Figures (53 Figures)

Figure 1 Ransomware Protection Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 7 Threat Intelligence Solution is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 8 Managed Services Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Network Protection Segment is Expected to Contribute the Largest Share in the Ransomware Protection Market in 2016

Figure 10 Healthcare Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 11 North America Estimated to Hold the Largest Share of the Market in 2016

Figure 12 Rise in Phishing Attacks and Security Breaches is Expected to Boost the Market

Figure 13 Services Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Secure Web Gateway Solution is Expected to Hold the Largest Share of the Market in 2016

Figure 15 Asia-Pacific Region has Immense Opportunities for the Growth of the Ransomware Protection Market, Followed By Middle East and Africa

Figure 16 Evolution of the Ransomware

Figure 17 Market Segmentation By Solution

Figure 18 Market Segmentation By Service

Figure 19 Market Segmentation By Application

Figure 20 Market Segmentation By Deployment Mode

Figure 21 Market Segmentation By Organization Size

Figure 22 Market Segmentation By Vertical

Figure 23 Market Segmentation By Region

Figure 24 Market Drivers, Restraints, Opportunities, and Challenges

Figure 25 Ransomware Protection Market Value Chain

Figure 26 Key Statistics About Ransomware Threat

Figure 27 Strategic Benchmarking: Technology Integration and Product Enhancement

Figure 28 Threat Intelligence Solution is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Managed Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Email Protection Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 Cloud-Based Deployment Mode is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Small and Medium Enterprises Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 33 Healthcare Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 34 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 35 Regional Snapshot: Asia-Pacific is the Emerging Region in the Ransomware Protection Market

Figure 36 North America Market Snapshot

Figure 37 Asia-Pacific Market Snapshot

Figure 38 Top Companies Adopted Partnership, Agreement, and Collaboration as the Key Growth Strategy During the Period 20142016

Figure 39 Battle for Market Share: Partnership, Agreement, and Collaboration Was the Key Strategy of the Leading Market Players

Figure 40 Market Evaluation Framework: New Product Launch Was the Key Strategy of the Leading Market Players in 2016

Figure 41 Product Offerings Comparison

Figure 42 Business Strategy Comparison

Figure 43 Geographic Revenue Mix of Top Players

Figure 44 Intel Security (McAfee): Company Snapshot

Figure 45 Intel Security (McAfee): SWOT Analysis

Figure 46 Symantec Corporation: Company Snapshot

Figure 47 Symantec Corporation: SWOT Analysis

Figure 48 Trend Micro, Inc.: Company Snapshot

Figure 49 Trend Micro, Inc.: SWOT Analysis

Figure 50 Fireeye, Inc.: Company Snapshot

Figure 51 Fireeye, Inc.: SWOT Analysis

Figure 52 Sophos Group PLC: Company Snapshot

Figure 53 Sophos Group PLC: SWOT Analysis

Growth opportunities and latent adjacency in Ransomware Protection Market

Interested in cyber security