Advanced Persistent Threat (APT) Protection Market by Offering (Solutions (Sandboxing, Endpoint Protection, SIEM, IDS/IPS, and Next-generation Firewall) and Services), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2025

Advanced Persistent Threat (APT) Protection Market Size, Industry Share Forecast [Latest]

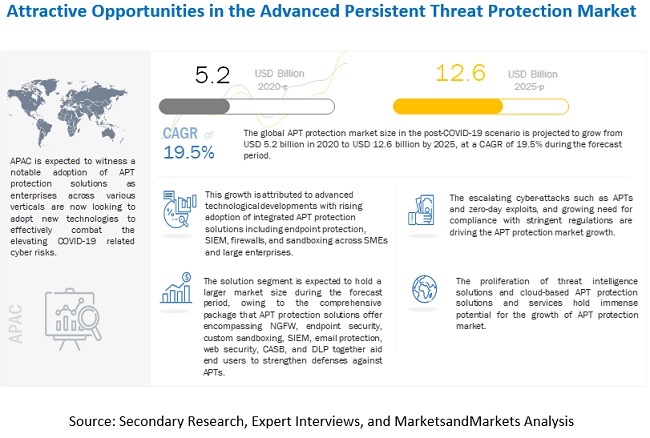

[287 Pages Report] The global Advanced Persistent Threat Protection Market size is estimated to register a CAGR of 19.5%, reaching a valuation of $12.6 billion by the end of 2025. The global APT Protection industry was valued $5.2 billion in 2020. The base year for estimation is 2019 and the historical data spans from 2020 to 2025

The major factors driving the market include the increasing number of security breaches and advanced cyberattacks such as zero-day exploits, persistent threats, malware, and ransomware; stringent government regulations towards adoption of APT protection policies; and proliferation of cloud based APT protection solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

Advanced Persistent Threat Protection Market Growth Dynamics

Driver: Rising security breaches and cyberattacks due to the pandemic

Cyber threats are not only hampering the productivity of businesses but also damaging critical IT infrastructure and sensitive data of organizations. Due to the rapid rise in digital transactions across industry verticals, there is an increase in the frequency of cybercrimes. The increase in enterprise data breaches or data leakages is fueling the market for cybersecurity products and services. This rise is attributed to technologies, such as ML, which helps attackers create several different versions of malicious codes each day. Furthermore, organized crime groups have been building out attack infrastructure since mid-January. Mark Monitor reports that over 100,000 COVID-19-related domains have been registered since mid-January, with the greatest rate during the period 11-18 March. Additionally, Malwarebytes reports that cyber criminals and state APT groups have moved to use COVID-19 lures. Attacks include lure documents with links to malicious Microsoft Office templates, malicious macros, RTF exploits using OLEI-related vulnerabilities, and malicious LNK files.

Restraint: Lack of knowledge across enterprises regarding APTs

Advanced persistent threats are highly targeted, long time persistent and are diverse in nature. With changes in the business environment, the security requirements are also showing signs of transformation, as dozens of new zero day threats have emerged. This lack of awareness about advanced security threats is putting businesses at risk and is restraining the growth of the advanced persistent threat protection market. There lies a big knowledge gap across enterprises to understand the APTs and how to defend against them.

Opportunity: Proliferation of cloud-based APT protection solutions and services

With the rising spree of a gazillion terabytes of confidential data moving to the cloud, the concerns related to security have skyrocketed, as cyberattackers have become a real danger. Companies that are too clinging on cloud-based models are now susceptible to numerous cyber threats like never before.

Security is an ongoing and continuous process, which aims at real-time assessment of risks and uncertainties. With a tremendous amount of data being generated by IoT devices, data loss prevention tools, and security information (security solutions) in industry 4.0; data breaches have become extremely mainstream. Thereupon, organizations are opting for advanced analytics, strong access policies, and technologies to deal with these data breaches.

Challenge: Difficulties in addressing complexity of advanced threats

Cyberattackers around the world are trying new ways to attack mobile devices. They are becoming more sophisticated; every month, several new variants of malware are found attacking mobile phones. Over the last five years, APTs and targeted threats have significantly increased in volume, breadth, and complexity, becoming the most important security challenge for any organization. Cybercriminals use advanced attack techniques to infiltrate organizations’ networks and steal data, which can make organizations vulnerable. Due to the diverse nature of threats, it has become a challenge to understand the types of cyberattacks. Addressing the complexity of advanced threats represents a significant challenge to the APT protection market.

By organization size, the large enterprise segment to lead the market in 2020

Large enterprises are organizations that have more than 1,000 employees. These organizations invest heavily in advanced technologies for increasing overall productivity and efficiency. Large enterprises are widely opting APT protection solutions and are expected to invest significantly in advanced APT protection solutions to provide optimum security to their enterprises’ intense competitive environment. Organizations and businesses that possess large amount of sensitive and personal information such as BFSI, government, healthcare, telecom, and education institutions run the highest risks of being targeted by APTs. Large enterprises have adopted APT protection solutions, as they use a large number of cloud and Internet of Things (IoT)-based applications that are highly susceptible to cyberattacks. Moreover, stringent regulatory pressure is driving cyber risk awareness with the need for APT protection solutions. For example, in the US, CCPA is one of the toughest data privacy law.

To know about the assumptions considered for the study, download the pdf brochure

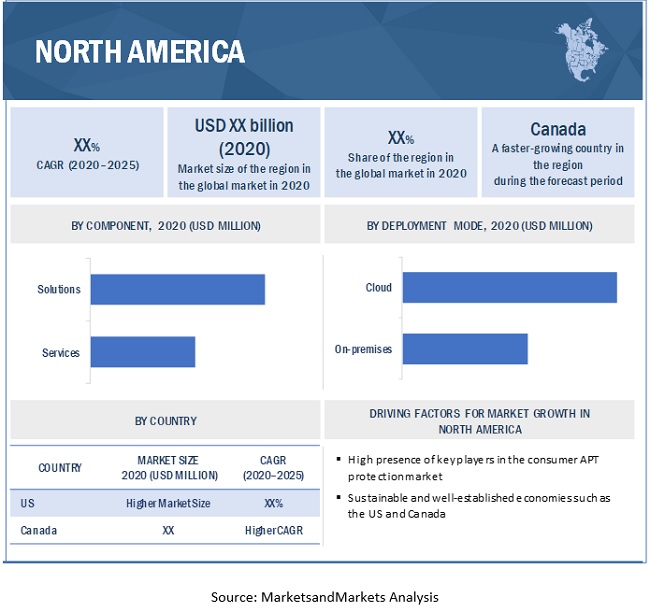

North America is expected to hold the largest market size during the forecast period.

North American has sustainable and well-established economies, which empower it to invest significantly in Research and Development (R&D) activities, thereby contributing to the development of new technologies in the APT protection market. The presence of majority of key players in the APT protection market is expected to be the major factor driving the growth of the market in this region. The key top APT protection market vendors functioning in the region are Broadcom, McAfee, Fortinet, FireEye, Raytheon Technologies, Palo Alto Neworks, VMware Carbon Black, Microsoft, Cisco, Webroot, and CyberArk. The dominance of APT protection market players in North America is expected to drive the overall market growth.

Market Players:

The technology vendors covered in the APT protection market report include Broadcom (US), McAfee (US), Kaspersky (Russia), Fortinet (US), FireEye (US), Raytheon Technologies (US), Sophos (UK), ESET (Slovakia), Palo Alto Networks (US), VMware Carbon Black (US), Microsoft (US), Cisco (US), Webroot (US), F-Secure (Finland), Trend Micro (Japan), and CyberArk (US). The start-up vendors covered in the APT protection market report are RevBits (US), Wijungle (India), BluVector (US), Aristi Labs (India), Securden (US), Red Sift (England), ZecOps (US), XM Cyber (Israel). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the APT protection market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2014-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Offering, Solutions, Services, Deployment Mode, Organization Size, Vertical, and Region. |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Technology Vendors - Broadcom (US), McAfee (US), Kaspersky (Russia), Fortinet (US), FireEye (US), Raytheon Technologies (US), Sophos (UK), ESET (Slovakia), Palo Alto Networks (US), VMware Carbon Black (US), Microsoft (US), Cisco (US), Webroot (US), F-Secure (Finland), Trend Micro (Japan), and CyberArk (US). |

This research report categorizes the Advanced Persistent Threat Protection Market to forecast revenues and analyze trends in each of the following submarkets:

Based on offering:

- Solutions

- Services

Based on solutions:

- Security Information and Event Management (SIEM)

- Endpoint Protection

- Intrusion Detection System/ Intrusion Prevention System (IDS/ IPS)

- Sandboxing

- Next-Generation Firewall (NGFW)

- Forensic Analysis

- Other solutions (encrypted traffic management, and content security and administration)

Based on the services:

- Integration and deployment

- Support and maintenance

- Consulting

Based on the deployment mode:

- Cloud

- On-premise

Based on the organization size:

- Large Enterprises

- SMEs

Based on the vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Construction and Engineering

- Healthcare

- Retail and ecommerce

- Energy and utilities

- Media and entertainment

- Government and defense

- IT

- Telecommunications

- Other verticals (education, automotive, and transportation)

Based on the region:

-

North America

- United States (US)

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe (Netherlands, Spain, Italy, and Switzerland)

-

APAC

- China

- Japan

- Australia

- India

- Rest of APAC (Hong Kong, Thailand, Indonesia, New Zealand, Singapore, and South Korea)

-

MEA

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America (Argentina and Chile)

Recent Developments

- In October 2020, Symantec released a new version of Symantec Content Analysis. The new version, Symantec Content Analysis 3.0, features malware and antivirus scanning, predictive analysis, file reputation service, manual file blacklist and whitelist, sandbox integration, endpoint integration, cached response, and Symantec Global Intelligence Network (GIN).

- In November 2020, Kaspersky Threat Intelligence Portal introduced API integration. With rise in cyber schemes due to COVID-19, free access will be provided to the Kaspersky Threat Intelligence Portal that gathers actionable threat insight data. Users will be able to connect their applications through API and monitor limited URLs and files in Kaspersky Cloud Sandbox to detect advanced threats and APTs.

- In February 2020, Fortinet released FortiOS 6.4, powering the Fortinet Security Fabric with over 350 new features. The FortiOS version 6.4 adds new features to support digital innovation goals across Fortinet Security Fabric and FortiGuard Labs. The new version adds advanced threat detection and ML-based Next-Gen Anti-Virus (NGAV) capabilities complementing endpoint-securing of FortiClient with ransomware and threat detection in FortiEDR.

- In February 2020, Forcepoint offers security solutions through Amazon Web Services (AWS) Security Hub. Forcepoint integrated Forcepoint DLP, Forcepoint CASB, and Forcepoint NGFW on the AWS Security Hub to provide 40,000 enterprises with a holistic view of security alerts generated by Forcepoint’s risk-adaptive security solutions. The Forcepoint AWS Security Hub integration helps users to manage their compliance status and security alerts across their AWS accounts.

- In February 2020, Sophos unveiled a new ‘Xstream’ version of Sophos XG Firewall. The ‘Xstream’ architecture of Sophos XG Firewall eradicates security risks associated with encrypted network traffic with high performance Transport Layer Security (TLS) crypto operation and SophosLabs AI-enhanced threat analysis.

Frequently Asked Questions (FAQ):

What is the Advanced Persistent Threat Protection (APT)?

APT solutions are a set of integrated solutions for detection, prevention, and mitigation of sophisticated threats, such as zero-day threats and advanced persistent malicious attacks.

Capabilities/Features:

APT solutions are designed to sidestep any security provision you have in place and cause as much damage and disruption as possible.

APT solutions provide full life-cycle protection against zero-day and advanced persistent threats with a comprehensive in-depth network defense framework.

What is the APT protection market size?

The global APT protection market size in the post-COVID-19 scenario is projected to grow from USD 5.2 billion in 2020 to USD 12.6 billion by 2025, at a CAGR of 19.5% during the forecast period.

What are the major drivers in the APT protection market?

The major factors driving the market include the increasing number of security breaches and advanced cyberattacks such as zero-day exploits, persistent threats, malware, and ransomware; stringent government regulations towards adoption of APT protection policies; and proliferation of cloud based APT protection solutions and services.

Who are the key players operating in the APT protection market?

The technology vendors covered in the APT protection market report include Broadcom (US), McAfee (US), Kaspersky (Russia), Fortinet (US), FireEye (US), Raytheon Technologies (US), Sophos (UK), ESET (Slovakia), Palo Alto Networks (US), VMware Carbon Black (US), Microsoft (US), Cisco (US), Webroot (US), F-Secure (Finland), Trend Micro (Japan), and CyberArk (US). The start-up vendors covered in the APT protection market report are RevBits (US), Wijungle (India), BluVector (US), Aristi Labs (India), Securden (US), Red Sift (England), ZecOps (US), XM Cyber (Israel). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the APT protection market.

What are the opportunities for new market entrants in the APT protection market?

The opportunities in the APT protection market are growing inclination towards industry-specific solutions, increasing government initiatives, developing partnerships, penetration of advanced technologies, and increasing APT protection related policies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 STUDY OBJECTIVES

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2014–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 6 APT PROTECTION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

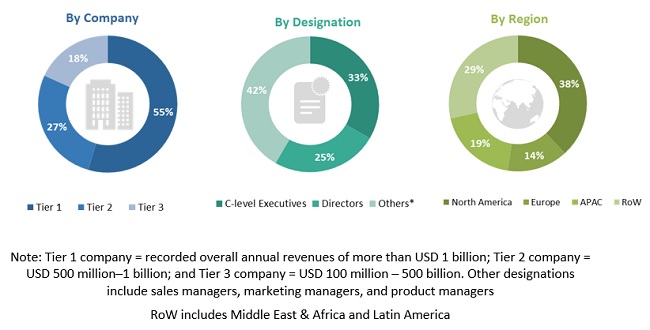

2.1.2.1 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP-DOWN (DEMAND SIDE)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 10 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 11 STARTUP/SME COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 STUDY ASSUMPTIONS

2.8 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 60)

FIGURE 12 GLOBAL ADVANCED PERSISTENT THREAT PROTECTION MARKET TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

FIGURE 13 LEADING SEGMENTS IN THE MARKET IN 2020

FIGURE 14 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ADVANCED PERSISTENT THREAT PROTECTION MARKET

FIGURE 15 RISE IN NUMBER OF ADVANCED AND TARGETED THREATS TO PROPEL

THE MARKET 63

4.2 MARKET, BY OFFERING AND DEPLOYMENT MODE

FIGURE 16 SOLUTIONS AND CLOUD SEGMENTS TO HOLD HIGH MARKET SHARES IN 2020

4.3 MARKET, BY REGION

FIGURE 17 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.4 MARKET: INVESTMENT SCENARIO

FIGURE 18 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS OVER THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ADVANCED PERSISTENT THREAT PROTECTION MARKET

5.2.1 DRIVERS

5.2.1.1 Rising security breaches and cyberattacks due to the pandemic

5.2.1.2 Strict government regulation for cybersecurity

5.2.1.3 Work from home lures new security challenges

5.2.1.4 Expanding cybersecurity funding following COVID-19 pandemic

5.2.1.5 Rise in cloud adoption across enterprises

5.2.2 RESTRAINTS

5.2.2.1 Lack of knowledge across enterprises regarding APTs

5.2.2.2 Shortage of cybersecurity talent

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of threat intelligence solutions to mitigate APTs

5.2.3.2 Proliferation of cloud-based APT protection solutions and services

5.2.4 CHALLENGES

5.2.4.1 Scarcity of skilled cybersecurity professionals among enterprises

5.2.4.2 Difficulties in addressing complexity of advanced threats

5.2.4.3 Diverse nature of sophisticated threats

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

TABLE 3 COVID-19 IMPACT: ADVANCED PERSISTENT THREAT PROTECTION MARKET

5.4 VALUE CHAIN

FIGURE 20 VALUE CHAIN OF MARKET

5.5 ECOSYSTEM: ADVANCED PERSISTENT THREAT PROTECTION

5.6 AVERAGE SELLING PRICE/PRICING MODEL OF ADVANCED PERSISTENT THREAT PROTECTION SOLUTIONS

5.7 TECHNOLOGY ANALYSIS

5.7.1 BLOCKCHAIN

5.7.2 BIG DATA AND ANALYTICS

5.8 REGULATORY IMPLICATIONS

5.8.1 GENERAL DATA PROTECTION REGULATION

5.8.2 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

5.8.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.8.4 SARBANES-OXLEY ACT (SOX)

5.8.5 SOC2

5.9 USE CASES

5.9.1 USE CASE: TREND MICRO

5.9.2 USE CASE: KASPERSKY LAB

5.9.3 USE CASE: MCAFEE

5.9.4 USE CASE: CHECK POINT

5.9.5 USE CASE: PROOFPOINT

6 ADVANCED PERSISTENT THREAT PROTECTION MARKET: COVID-19 IMPACT (Page No. - 80)

6.1 COVID-19 IMPACT

7 ADVANCED PERSISTENT THREAT PROTECTION MARKET, BY OFFERING (Page No. - 81)

7.1 INTRODUCTION

7.1.1 OFFERING: MARKET DRIVERS

7.1.2 OFFERING: MARKET COVID-19 IMPACT

7.1.3 OFFERING: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 21 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 4 MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 5 MARKET SIZE, BY OFFERING, 2019-2025 (USD MILLION)

7.2 SOLUTIONS

TABLE 6 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 7 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 SERVICES

TABLE 8 SERVICES: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 9 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 ADVANCED PERSISTENT THREAT PROTECTION MARKET, BY SOLUTION (Page No. - 86)

8.1 INTRODUCTION

8.1.1 SOLUTIONS: MARKET DRIVERS

8.1.2 SOLUTIONS: MARKET COVID-19 IMPACT

8.1.3 SOLUTIONS: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 22 FORENSIC ANALYSIS SEGMENT TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 10 SOLUTIONS: MARKET SIZE, BY TYPE, 2014-2019 (USD MILLION)

TABLE 11 SOLUTIONS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

8.2 SECURITY INFORMATION AND EVENT MANAGEMENT

TABLE 12 SECURITY INFORMATION AND EVENT MANAGEMENT: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 13 SECURITY INFORMATION AND EVENT MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 ENDPOINT PROTECTION

TABLE 14 ENDPOINT PROTECTION: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 15 ENDPOINT PROTECTION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.4 INTRUSION DETECTION SYSTEM/INTRUSION PREVENTION SYSTEM

TABLE 16 INTRUSION DETECTION SYSTEM/INTRUSION PREVENTION SYSTEM: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 17 INTRUSION DETECTION SYSTEM/INTRUSION PREVENTION SYSTEM: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.5 SANDBOXING

TABLE 18 SANDBOXING: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 19 SANDBOXING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.6 NEXT-GENERATION FIREWALL

TABLE 20 NEXT-GENERATION FIREWALL: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 21 NEXT-GENERATION FIREWALL: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.7 FORENSIC ANALYSIS

TABLE 22 FORENSIC ANALYSIS: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 23 FORENSIC ANALYSIS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.8 OTHER SOLUTIONS

TABLE 24 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 25 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 ADVANCED PERSISTENT THREAT PROTECTION MARKET, BY SERVICE (Page No. - 99)

9.1 INTRODUCTION

9.1.1 SERVICES: MARKET DRIVERS

9.1.2 SERVICES: MARKET COVID-19 IMPACT

9.1.3 SERVICES: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 23 MARKET FOR SUPPORT AND MAINTENANCE TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 26 SERVICES: MARKET SIZE, BY TYPE, 2014-2019 (USD MILLION)

TABLE 27 SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

9.2 INTEGRATION AND DEPLOYMENT

TABLE 28 INTEGRATION AND DEPLOYMENT: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 29 INTEGRATION AND DEPLOYMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 SUPPORT AND MAINTENANCE

TABLE 30 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 31 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.4 CONSULTING

TABLE 32 CONSULTING: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 33 CONSULTING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 ADVANCED PERSISTENT THREAT PROTECTION MARKET, BY DEPLOYMENT MODE (Page No. - 107)

10.1 INTRODUCTION

10.1.1 DEPLOYMENT MODE: MARKET DRIVERS

10.1.2 DEPLOYMENT MODE: MARKET COVID-19 IMPACT

10.1.3 DEPLOYMENT MODE: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 24 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 34 MARKET SIZE, BY DEPLOYMENT MODE, 2014-2019 (USD MILLION)

TABLE 35 MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

10.2 CLOUD

TABLE 36 CLOUD: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 37 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.3 ON-PREMISES

TABLE 38 ON-PREMISES: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 39 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11 ADVANCED PERSISTENT THREAT PROTECTION MARKET, BY ORGANIZATION SIZE (Page No. - 114)

11.1 INTRODUCTION

11.1.1 ORGANIZATION SIZE: MARKET DRIVERS

11.1.2 ORGANIZATION SIZE: ADVANCED PERSISTENT THREAT PROTECTION COVID-19 IMPACT

11.1.3 ORGANIZATION SIZE: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 25 SMALL AND MEDIUM ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 40 MARKET SIZE, BY ORGANIZATION SIZE, 2014-2019 (USD MILLION)

TABLE 41 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

11.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.3 LARGE ENTERPRISES

TABLE 44 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 45 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12 ADVANCED PERSISTENT THREAT PROTECTION MARKET, BY VERTICAL (Page No. - 119)

12.1 INTRODUCTION

12.1.1 VERTICAL: MARKET DRIVERS

12.1.2 VERTICAL: ADVANCED PERSISTENT THREAT PROTECTION MARKE COVID-19 IMPACT

12.1.3 VERTICAL: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 26 MEDIA AND ENTERTAINMENT ENTERPRISES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 46 VERTICAL: MARKET SIZE, 2014-2019 (USD MILLION)

TABLE 47 VERTICAL: MARKET SIZE, 2019–2025 (USD MILLION)

12.2 BANKING, FINANCIAL SERVICES AND INSURANCE

TABLE 48 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 49 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.3 CONSTRUCTION AND ENGINEERING

TABLE 50 CONSTRUCTION AND ENGINEERING: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 51 CONSTRUCTION AND ENGINEERING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.4 HEALTHCARE

TABLE 52 HEALTHCARE: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 53 HEALTHCARE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.5 RETAIL AND ECOMMERCE

TABLE 54 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 55 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.6 ENERGY AND UTILITIES

TABLE 56 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 57 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.7 MEDIA AND ENTERTAINMENT

TABLE 58 MEDIA AND ENTERTAINMENT: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 59 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.8 GOVERNMENT AND DEFENSE

TABLE 60 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 61 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.9 INFORMATION TECHNOLOGY

TABLE 62 INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 63 INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.10 TELECOMMUNICATIONS

TABLE 64 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 65 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.11 OTHER VERTICALS

TABLE 66 OTHER VERTICALS: MARKET SIZE, BY REGION, 2014-2019 (USD MILLION)

TABLE 67 OTHER VERTICALS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13 ADVANCED PERSISTENT THREAT PROTECTION MARKET, BY REGION (Page No. - 137)

13.1 INTRODUCTION

FIGURE 27 NORTH AMERICA TO HAVE LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 68 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 69 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: MARKET DRIVERS

13.2.2 NORTH AMERICA: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

13.2.3 NORTH AMERICA: COVID-19 IMPACT

13.2.4 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

TABLE 70 NORTH AMERICA: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.2.5 UNITED STATES

TABLE 84 UNITED STATES: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 85 UNITED STATES: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 86 UNITED STATES: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 87 UNITED STATES: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 88 UNITED STATES: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 89 UNITED STATES: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 90 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 91 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 92 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 93 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

13.2.6 CANADA

13.3 EUROPE

13.3.1 EUROPE: ADVANCED PERSISTENT THREAT PROTECTION MARKET DRIVERS

13.3.2 EUROPE: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

13.3.3 EUROPE: COVID-19 IMPACT

13.3.4 EUROPE: REGULATORY LANDSCAPE

TABLE 96 EUROPE: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.3.5 UNITED KINGDOM

TABLE 110 UNITED KINGDOM: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 111 UNITED KINGDOM: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 112 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 113 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 114 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 115 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 116 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 117 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 118 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 119 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 120 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 121 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

13.3.6 GERMANY

13.3.7 FRANCE

13.3.8 REST OF EUROPE

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: ADVANCED PERSISTENT THREAT PROTECTION MARKET DRIVERS

13.4.2 ASIA PACIFIC: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

13.4.3 ASIA PACIFIC: COVID-19 IMPACT

13.4.4 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.4.5 CHINA

TABLE 136 CHINA: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 137 CHINA: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 138 CHINA: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 139 CHINA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 140 CHINA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 141 CHINA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 142 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 143 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 144 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 145 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 146 CHINA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 147 CHINA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

13.4.6 JAPAN

13.4.7 AUSTRALIA

13.4.8 INDIA

13.4.9 REST OF ASIA PACIFIC

13.5 MIDDLE EAST AND AFRICA

13.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

13.5.2 MIDDLE EAST AND AFRICA: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

13.5.3 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

13.5.4 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 148 MIDDLE EAST AND AFRICA: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 149 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 150 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 151 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 152 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.5.5 MIDDLE EAST

TABLE 162 MIDDLE EAST: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 163 MIDDLE EAST: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 164 MIDDLE EAST: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 165 MIDDLE EAST: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 166 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 167 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 168 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 169 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 170 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 171 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 172 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 173 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

13.5.6 AFRICA

13.6 LATIN AMERICA

13.6.1 LATIN AMERICA: MARKET DRIVERS

13.6.2 LATIN AMERICA: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

13.6.3 LATIN AMERICA: COVID-19 IMPACT

13.6.4 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 174 LATIN AMERICA: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.6.5 BRAZIL

TABLE 188 BRAZIL: ADVANCED PERSISTENT THREAT PROTECTION MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 189 BRAZIL: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 190 BRAZIL: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 191 BRAZIL: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 192 BRAZIL: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 193 BRAZIL: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 194 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 195 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 196 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 197 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 198 BRAZIL: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 199 BRAZIL: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

13.6.6 MEXICO

13.6.7 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE (Page No. - 217)

14.1 INTRODUCTION

14.2 MARKET EVALUATION FRAMEWORK

FIGURE 30 MARKET EVALUATION FRAMEWORK, ADVANCED PERSISTENT THREAT PROTECTION FRAMEWORK

14.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 31 ADVANCED PERSISTENT THREAT PROTECTION, REVENUE ANALYSIS

14.4 HISTORICAL REVENUE ANALYSIS

FIGURE 32 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

14.5 RANKING OF KEY PLAYERS IN THE ADVANCED PERSISTENT THREAT PROTECTION MARKET, 2020

FIGURE 33 MARKET, KEY PLAYER RANKING

15 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 221)

15.1 COMPANY EVALUATION MATRIX

15.1.1 COMPETITIVE EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 200 EVALUATION CRITERIA

15.1.2 STAR

15.1.3 PERVASIVE PLAYERS

15.1.4 EMERGING LEADERS

15.1.5 PARTICIPANTS

FIGURE 34 ADVANCED PERSISTENT THREAT PROTECTION MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

15.2 COMPANY PROFILES

(Business overview, Solutions offered, Recent developments, COVID-19 Related developments, MnM view, Key strengths/right to win, Strategic choices, Weaknesses and competitive threats)*

15.2.1 BROADCOM

FIGURE 35 BROADCOM: COMPANY SNAPSHOT

15.2.2 MCAFEE

15.2.3 KASPERSKY

15.2.4 FORTINET

FIGURE 36 FORTINET: COMPANY SNAPSHOT

15.2.5 FIREEYE

FIGURE 37 FIREEYE: COMPANY SNAPSHOT

15.2.6 RAYTHEON TECHNOLOGIES

FIGURE 38 RAYTHEON: COMPANY SNAPSHOT

15.2.7 SOPHOS

FIGURE 39 SOPHOS: COMPANY SNAPSHOT

15.2.8 ESET

15.2.9 PALTO ALTO NETWORKS

FIGURE 40 PALO ALTO NETWORKS: COMPANY SNAPSHOT

15.2.10 VMWARE CARBON BLACK

15.2.11 MICROSOFT

15.2.12 CISCO

15.2.13 WEBROOT

15.2.14 F-SECURE

15.2.15 TREND MICRO

15.2.16 CYBERARK

*Business overview, Solutions offered, Recent developments, COVID-19 Related developments, MnM view, Key strengths/right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15.3 STARTUP/SME EVALUATION MATRIX, 2020

15.3.1 PROGRESSIVE

15.3.2 RESPONSIVE

15.3.3 DYNAMIC

15.3.4 STARTING BLOCKS

FIGURE 41 ADVANCED PERSISTENT THREAT PROTECTION MARKET (GLOBAL), SME EVALUATION MATRIX, 2020

15.3.5 REVBITS

15.3.6 WIJUNGLE

15.3.7 BLUVECTOR

15.3.8 ARISTI LABS

15.3.9 SECURDEN

15.3.10 RED SIFT

15.3.11 ZECOPS

15.3.12 XM CYBER

16 ADJACENT/RELATED MARKETS (Page No. - 273)

16.1 INTRODUCTION

16.2 INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET

16.2.1 MARKET DEFINITION

TABLE 201 INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 202 PRE-COVID-19: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 203 POST-COVID-19: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 204 CLOUD: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 205 PRE-COVID-19: CLOUD MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 206 POST-COVID-19: CLOUD MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 207 ON-PREMISES: INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 208 PRE-COVID-19: ON-PREMISES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 209 POST-COVID-19: ON PREMISES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

16.3 ENDPOINT SECURITY MARKET

16.3.1 MARKET DEFINITION

TABLE 210 CLOUD-BASED ENDPOINT SECURITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 211 ON-PREMISES ENDPOINT SECURITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

16.4 NEXT-GENERATION FIREWALL MARKET

16.4.1 MARKET DEFINITION

TABLE 212 NEXT-GENERATION FIREWALL MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

TABLE 213 SMALL AND MEDIUM-SIZED ENTERPRISES: NEXT-GENERATION FIREWALL MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 214 LARGE ENTERPRISES: NEXT-GENERATION FIREWALL MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

17 APPENDIX (Page No. - 279)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The study involved 4 major activities in estimating the current size of the APT protection market. An exhaustive secondary research was done to collect information on the APT protection industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various sources were used to identify and collect information for this study. The research study involved the use of extensive secondary sources, directories, and databases, such as Factiva, D&B Hoovers, and Bloomberg, to identify and collect information useful for the comprehensive market research study on the APT protection market. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Data was also collected from secondary sources, such as the SANS Institute, Information Systems Security Association (ISSA), Information Security Forum (ISF), European Cyber Security Organization (ECSO), and European Union Agency for Cybersecurity (ENISA). Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players according to their offerings and industry trends related to technologies, applications, and regions and key developments from both market and technology oriented perspectives.

Primary Research

The APT protection market comprises several stakeholders, such as service providers, solution vendors, system integrators, technology partners, consulting firms, research organizations, Managed Service Providers (MSPs), government agencies, financial bodies, resellers and distributors, enterprise users, and technology providers. The demand side of the market consists of financial institutions, investors, and insurance companies. The supply side includes APT protection solutions providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the APT protection market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall APT protection market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the APT protection market by application, service model, security type, organization size, vertical, and region from 2020 to 2025, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall APT protection market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the APT protection market.

COVID-19 Impact

Amidst the COVID-19 pandemic crisis, various governments and regulatory authorities mandate both public and private organizations to embrace new practices for working remotely and maintaining social distancing. Since then, the digital ways of doing business became the new business continuity plan (BCP) for various organizations. With the widespread use of BYOD device, WFH trend, and internet penetration across the corners of the globe, individuals are progressively inclined towards the use of digital technologies, driving the need for APT protection measures. APT protection solutions enable organizations to ensure business continuity and maintain their security postures from the threat of cybercrimes and malicious threat actors.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the IDPS market report:

Geographic Analysis

- Further breakup of the APAC market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Advanced Persistent Threat (APT) Protection Market