Quantum Cascade Laser Market by Fabrication Technology (Fabry–Perot, Distributed Feedback), Packaging Type, Operation Mode, End-User Industry (Medical, Military & Defense, Telecommunications, Industrial) and Region - Global Forecast to 2028

Updated on : Sep 12, 2024

Quantum Cascade Laser Market Size & Growth

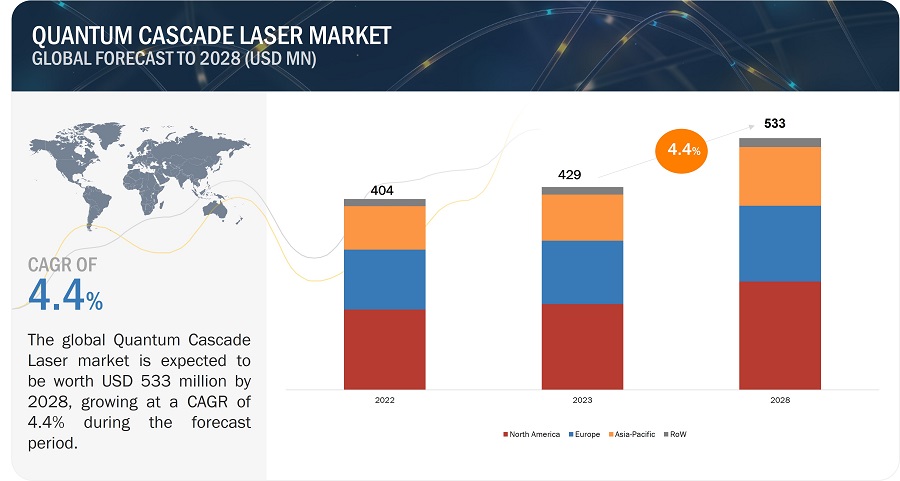

The quantum cascade laser market is projected to grow from USD 429 million in 2023 to USD 533 million by 2028; it is expected to grow at a CAGR of 4.4% from 2023 to 2028. The increasing use of quantum cascade lasers in gas sensing and chemical detection applications and the growing demand for QCLs in healthcare and medical diagnostics are among the factors driving the growth of the quantum cascade laser industry.

Quantum Cascade Laser Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Quantum Cascade Laser Market Trends & Dynamics

Driver: Growing demand for quantum cascade lasers in healthcare and medical diagnostics

Quantum Cascade Lasers are rapidly being used in medical diagnostics for non-invasive spectroscopy, breath analysis, and disease diagnosis. They provide precise and accurate measurements, making them useful in fields like breath analysis for disease diagnosis, blood glucose monitoring, and cancer biomarker detection. QCLs have transformed non-invasive spectroscopic analysis in healthcare. They produce light in the mid-infrared region, which correlates to the absorption bands of numerous compounds in biological samples. Identifying and quantifying biomarkers and analytes in biological fluids, tissues, and breath samples is possible with QCL-based spectroscopy, enabling early identification of diseases and monitoring.

Restraint: High costs of QCL-based devices

QCLs are currently more expensive than other laser technologies. The complicated manufacturing process, specific materials, and developing design factors contribute to its increased cost. This cost aspect may limit their broad use, particularly in price-sensitive applications or industries. QCL-based devices use expensive wafers and complicated circuitry, which results in significant development costs, making them pricey. Furthermore, developing custom QCL-based devices is expensive, resulting in high device costs as firms are required to create QCLs for a specific wavelength within the mid-infrared range. Compared to other laser technologies, QCLs are frequently produced in lesser numbers, and modifications may be necessary to fulfill specific application needs. Additionally, the requirement for particular manufacturing setups, individualized testing, lesser economies of scale, customization, and low-volume production might result in higher prices.

Opportunity: Use of quantum cascade lasers in industrial and environmental monitoring

QCLs are suitable for industrial and environmental monitoring. They are useful for detecting and analyzing trace gases and contaminants due to their great sensitivity, precision, and selectivity. Opportunities exist in areas where QCL-based sensors and systems can increase efficiency, compliance, and environmental sustainability, such as gas sensing, emissions monitoring, industrial process control, and air quality monitoring. QCLs monitor air quality in cities, industrial zones, and indoor spaces. QCL-based sensors can detect and measure a variety of air pollutants, including particulate matter, ozone, carbon monoxide, nitrogen dioxide, and volatile organic compounds. These sensors give continuous, real-time data that can be used to analyze air quality, identify pollution sources, and perform targeted mitigation actions.

Challenge: Manufacturing complexities of quantum cascade lasers

QCLs require complex manufacturing processes such as molecular beam epitaxy (MBE). MBE is an accurate and controlled deposition process that involves the growth of multiple layers of semiconductor materials with specific compositions and thicknesses, resulting in the precise layer structures required for QCL operation. The manufacturing process is complex and time-consuming, which raises production costs. Furthermore, QCLs’ sensitivity to material flaws and faults can reduce production yields, restricting their availability and increasing costs. The manufacturing complexity of QCL devices comes from the requirement to achieve exact control over material properties, layer architectures, and device shape. Each phase necessitates specialized equipment, experience, and tight quality control procedures. Manufacturing techniques, equipment, and process optimization are constantly being improved to meet these challenges and improve the scalability, yield, and cost-effectiveness of QCL devices.

Quantum Cascade Laser Market Ecosystem

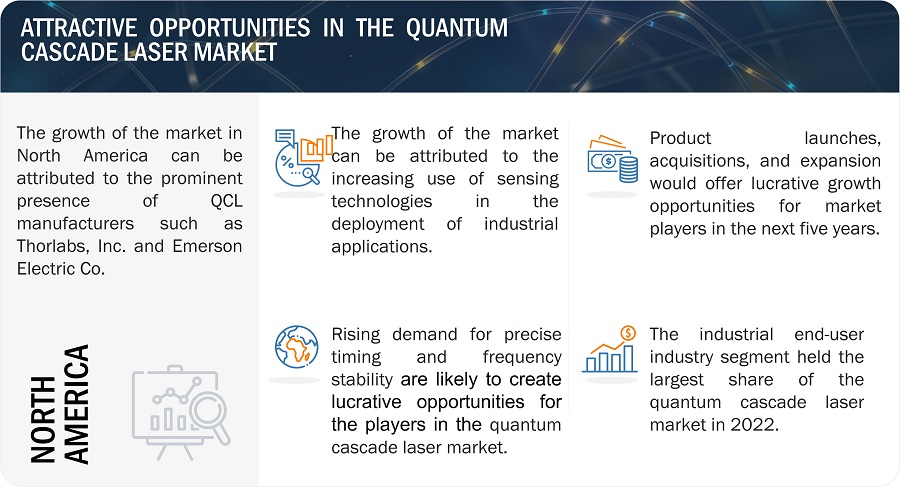

The prominent players in the Quantum Cascade Laser market are Thorlabs, Inc. (US), Hamamatsu Photonics K.K. (Japan), MirSense (France), Emerson Electric Co. (US), and Block Engineering. (US). These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

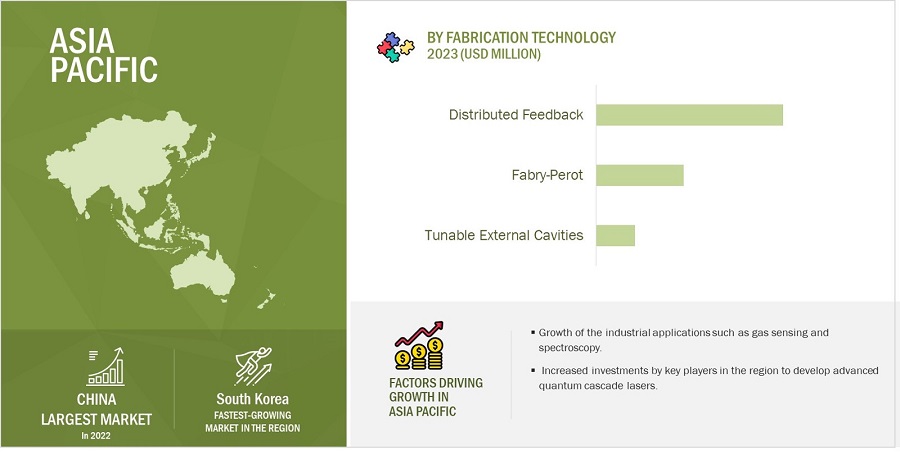

Distributed Feedback QCLs accounted for the largest market share during forecast period.

Distributed feedback (DFB) technology is widely used in QCLs due to its advantages, including single-mode operation, narrow linewidth, stable and reliable performance, single-frequency emission, and compact design. DFB-QCLs offer precise and selective wavelength emission, making them suitable for applications like spectroscopy and telecommunications. Their narrow linewidth enables high spectral purity and coherent beam propagation. The inherent stability of DFB-QCLs ensures consistent operation, which is crucial for applications such as industrial process control and defense systems. The compact design and integration-friendly nature of DFB-QCLs make them ideal for portable devices and facilitate their adoption in various fields, including environmental sensing and medical diagnostics.

Continuous wave operation mode accounted for the largest market share during the forecast period.

Continuous wave (CW) technology is widely used in the QCL market because it provides a constant and stable output of laser light, ensuring reliable performance in applications such as spectroscopy and process monitoring. CW operation also enables longer integration times, resulting in improved sensitivity and accuracy for applications like gas sensing and molecular spectroscopy. The simplified system design of CW-QCLs reduces complexity. It enhances reliability, while their high wall-plug efficiencies contribute to efficient power consumption, making them suitable for portable and battery-operated devices. Overall, the benefits of CW technology drive its widespread adoption in industrial QCL applications.

Industrial Applications accounted for the largest market share during the forecast period.

QCLs are extensively used in industrial applications due to their high power and brightness, wide wavelength coverage, rapid pulse generation, long-term stability, compactness, solid-state nature, and high sensitivity and selectivity for gas sensing. These characteristics enable QCLs to be employed in laser material processing, spectroscopy, gas sensing, industrial process monitoring, and environmental sensing. QCLs offer efficient and reliable performance, precise control over emitted wavelengths, and robustness in demanding industrial environments. Their versatility and compatibility with industrial systems have made QCLs a preferred choice for various industrial sectors, facilitating process optimization, quality control, and advanced analytical capabilities.

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period.

The Asia Pacific region is witnessing rapid industrialization and significant investments in research and development. This, coupled with the emerging defense and security applications, large consumer electronics market, and government support, is expected to drive the growth of the Quantum cascade laser (QCL) market in the region. The demand for advanced sensing technologies, laser-based applications, and solutions offered by QCLs in industries such as automotive, electronics, healthcare, and telecommunications will contribute to the market’s expansion. The Asia Pacific region’s focus on innovation, defense capabilities, and government initiatives positions it as a key player in the growing QCL industry.

Quantum Cascade Laser Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Quantum Cascade Laser Companies - Key Market Players

The major players in the Quantum Cascade Laser companies include Thorlabs, Inc. (US), Hamamatsu Photonics K.K. (Japan), MirSense (France), Emerson Electric Co. (US), Block Engineering. (US), Wavelength Electronics, Inc. (US), Daylight Solutions. (US), Alpes Lasers (Switzerland), nanoplus Nanosystems and Technologies GmbH (Germany), and Akela Laser Corporation (US). These companies have used organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships, to strengthen their position in the market.

Scope of the Report

|

Report Metric |

Details |

| Estimated Value | USD 429 million in 2023 |

| Projected Value | USD 533 million by 2028 |

| Growth Rate | CAGR of 4.4% |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Fabrication Technology, By Operation Mode, By Packaging Type, By End-User Industry, By Region |

|

Geographies Covered |

South America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Thorlabs, Inc. (US), Hamamatsu Photonics K.K. (Japan), MirSense (France), Emerson Electric Co. (US), Block Engineering. (US), Wavelength Electronics, Inc. (US), Daylight Solutions. (US), Alpes Lasers (Switzerland), nanoplus Nanosystems and Technologies GmbH (Germany), Akela Laser Corporation (US), LaserMaxDefense (US), Picarro, Inc. (US), Aerodyne Research Inc. (US), Power Technologies. (US), MG Optical Solutions GmbH (Germany), Sacher Lasertechnik GmbH (Germany), AdTech Optics (US), LongWave Photonics LLC (US), and ELUXI Ltd (UK) |

Quantum Cascade Laser Market Highlights

This research report categorizes the Quantum Cascade Laser Market based on by fabrication technology, operation mode, packaging type, end-user industry, and region.

|

Segment |

Subsegment |

|

By Fabrication Technology |

|

|

By Operation Mode |

|

|

By Packaging Type |

|

|

By End-User Industry |

|

|

By Region |

|

Recent Developments

- In April 2023, Thorlabs, Inc. launched QD8912HH, which is the ideal laser for Ammonia (NH3) sensing as it includes a collimated output, a standard HHL connector for electrical and temperature control, and a tuning range of 8912 nm for the lasing wavelength.

- In March 2023, Wavelength Electronics, Inc. launched QCL2000 LAB can accurately send up to 2 A to the laser and has good stability and minimal noise. With an average current noise density of 4 nA/Hz, this tabletop instrument demonstrates a noise performance of 1.3 A RMS up to 100 kHz. The QCL driver from Wavelength Electronics allows reliable laser output and low-noise high-definition video streaming at a data rate of 1.485 Gbit/s. As a result, the created QCL system is a reliable tool for actual field uses in free-space communication.

- In March 2022, Hamamatsu Photonics K.K. announced the world’s first QCL module with an adjustable frequency range of 0.42 to 2 THz. Hamamatsu’s innovation was made possible by employing cutting-edge optical design technology to analyze the terahertz wave generating principle, which increases the output power of the QCL, and the arrangement of the highly effective external cavity.

Frequently Asked Questions (FAQ):

What is the current size of the Global Quantum Cascade Laser Market?

The Quantum Cascade Laser market is projected to grow from USD 429 million in 2023 to USD 533 million by 2028; it is expected to grow at a CAGR of 4.4% from 2023 to 2028.

Who are the winners in the Global Quantum Cascade Laser Market?

Companies such as Thorlabs, Inc. (US), Hamamatsu Photonics K.K. (Japan), MirSense (France), Emerson Electric Co. (US), and Block Engineering. (US).

Which region is expected to hold the highest market share?

North America is expected to dominate the Quantum Cascade Laser market during the forecast period. Growing demand for industrial applications and the presence of established QCL manufacturers are the major factors contributing to the market growth in North America.

What are the major drivers and opportunities related to the Quantum Cascade Laser market?

The increasing use of quantum cascade lasers in gas sensing and chemical detection applications and the growing demand for QCLs in healthcare and medical diagnostics, Use of quantum cascade lasers in industrial and environmental monitoring are some of the major drivers and opportunities related to the Quantum Cascade Laser market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the Quantum Cascade Laser market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing adoption of advanced techniques in healthcare and medical diagnostics- Increasing use of quantum cascade lasers in gas sensing and chemical detection- Growing demand in automotive industryRESTRAINTS- High cost associated with quantum cascade lasersOPPORTUNITIES- Increasing use in industrial and environmental monitoring- Widening application scope in military sector- Innovations in spectroscopy and imagingCHALLENGES- Manufacturing complexities associated with quantum cascade lasers

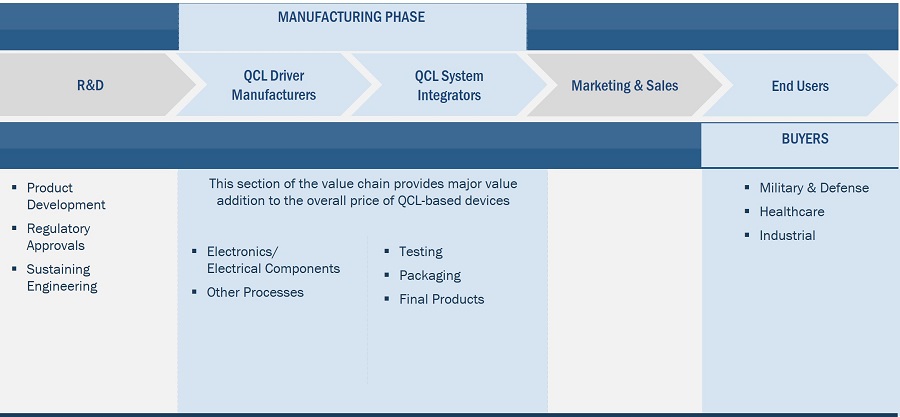

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.7 PATENT ANALYSIS

-

5.8 TECHNOLOGY ANALYSISFABRY–PEROTDISTRIBUTED FEEDBACK (DFB)TUNABLE EXTERNAL CAVITY

-

5.9 CASE STUDY ANALYSISBLOCK MEMS LLC DEVELOPED MID-IR (MIR) SPECTROSCOPY-BASED STANDOFF-DETECTING DEVICES TO DETECT CHEMICAL AND BIOLOGICAL THREATSWAVELENGTH ELECTRONICS WITH PRINCETON UNIVERSITY DEVELOPED QCL-BASED SENSOR FOR PRECISION GAS DETECTION AND MEASUREMENTDAYLIGHT SOLUTIONS DEVELOPED SPERO (QCL-BASED INFRARED MICROSCOPY DEVICE) FOR BREATH ANALYSIS IN MEDICAL DIAGNOSTICSINSTALLATION OF DIRCM SYSTEMS TO DEFEND AIRPLANES AGAINST HEAT-SEEKING MISSILESBLOCK ENGINEERING HELPED SCIENCE AND TECHNOLOGY DIRECTORATE (S&T) OF US DEPARTMENT OF HOMELAND SECURITY FIND VEHICLE-BORNE IMPROVISED EXPLOSIVE DEVICES

- 5.10 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 TARIFF AND REGULATORY LANDSCAPESTANDARDS- International Electrotechnical Commission (IEC)- Center for Devices and Radiological Health (CDRH)REGIONAL STANDARDS- US- EuropeREGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.13 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) OF QUANTUM CASCADE LASERS, BY FABRICATION TECHNOLOGY

- 6.1 INTRODUCTION

-

6.2 FABRY–PEROTOPERATES IN MULTI-MODE LIGHT AT HIGH OPERATING CURRENT

-

6.3 DISTRIBUTED FEEDBACK (DFB)OPERATES IN CONTINUOUS AND PULSE OPERATION MODES

-

6.4 TUNABLE EXTERNAL CAVITYFEATURES HIGHER SPECTRAL TUNING RANGE THAN DFB QUANTUM CASCADE LASERS

- 7.1 INTRODUCTION

-

7.2 CONTINUOUS WAVEPROVIDES UNINTERRUPTED LASER BEAM WITH CONSTANT AMPLITUDE AND WAVE FREQUENCY

-

7.3 PULSEDCONSUMES LESS POWER TO OBTAIN LOW-DUTY CYCLE

- 8.1 INTRODUCTION

-

8.2 C-MOUNT PACKAGEUSED IN DEVICES WITH OPERATING WAVELENGTH RANGE OF 680–980 NM

-

8.3 HHL & VHL PACKAGEWIDELY ADOPTED IN INDUSTRIAL SECTOR

-

8.4 TO3 PACKAGECOMMONLY USED IN SILICON-CONTROLLED RECTIFIERS (SCRS), POWER TRANSISTORS, AND HIGH-OUTPUT SEMICONDUCTOR DEVICES

- 9.1 INTRODUCTION

-

9.2 INDUSTRIALGROWING ADOPTION OF QUANTUM CASCADE LASER-BASED ANALYZERS IN GAS-SENSING AND MEASUREMENT APPLICATIONS

-

9.3 MEDICALRISING DEPLOYMENT OF QUANTUM CASCADE LASER-BASED BREATH ANALYZERS OVER TRADITIONAL LEAD–SALT DIODE-BASED BREATH ANALYZERS

-

9.4 TELECOMMUNICATIONSINCREASING USE OF QUANTUM CASCADE LASERS IN FREE-SPACE OPTICAL COMMUNICATION

-

9.5 MILITARY & DEFENSEINSTALLATION OF FABRY–PEROT QUANTUM CASCADE LASERS IN INFRARED COUNTERMEASURES (IRCMS) TO DETECT EXPLOSIVES AND DRUGS

- 9.6 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Rising deployment of laser-based weapons in defense sector and use of lasers in healthcare proceduresCANADA- Increasing focus on R&D for quantum cascade laser technologyMEXICO- Increasing adoption in industrial sectorNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEUK- Development of energy-efficient and low carbon-emitting devices using laser technologyGERMANY- Increasing bandwidth requirements from mobile and data center network operatorsFRANCE- Increasing adoption of laser technology in healthcare sectorREST OF EUROPEEUROPE: RECESSION IMPACT

-

10.4 ASIA PACIFICCHINA- Increasing applications in spectroscopy, breathe analyzers, and free-space optical communicationJAPAN- Increasing R&D investments and presence of major market playersSOUTH KOREA- Growing use in real-time monitoring of gases and contaminants in industrial sectorINDIA- Massive deployment of networks to enable high-speed connectivityREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

10.5 ROWMIDDLE EAST & AFRICA- Increasing biological and chemical warfare threatsSOUTH AMERICA- Increasing demand in gas spectroscopy and monitoringROW: RECESSION IMPACT

- 11.1 OVERVIEW

-

11.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 MARKET SHARE ANALYSIS, 2022

- 11.4 REVENUE ANALYSIS, 2018–2022

-

11.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 KEY STARTUPS/SMES

-

11.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSTHORLABS, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHAMAMATSU PHOTONICS K.K.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMIRSENSE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBLOCK ENGINEERING- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewWAVELENGTH ELECTRONICS, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsDAYLIGHT SOLUTIONS- Business overview- Product/Solutions/Services offered- Recent developmentsALPES LASERS- Business overview- Products/Solutions/Services offeredNANOPLUS NANOSYSTEMS AND TECHNOLOGIES GMBH- Business overview- Product/Solutions/Services offeredAKELA LASER CORPORATION- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSLASERMAXDEFENSEPICARRO, INC.AERODYNE RESEARCH, INC.POWER TECHNOLOGIESMG OPTICAL SOLUTIONS GMBHSACHER LASERTECHNIKADTECH OPTICSLONGWAVE PHOTONICS LLCELUXI LTDPRANALYTICAFRANKFURT LASER COMPANY

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 LIST OF SECONDARY SOURCES

- TABLE 2 RISK ASSESSMENT

- TABLE 3 QUANTUM CASCADE LASER MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 5 QUANTUM CASCADE LASER MARKET: PATENT ANALYSIS, 2021–2023

- TABLE 6 QUANTUM CASCADE LASER MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 7 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 8 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 9 INTERNATIONAL ELECTROTECHNICAL COMMISSION (IEC) LASER CLASSIFICATIONS

- TABLE 10 AMERICAN NATIONAL STANDARDS INSTITUTE (ANSI) LASER STANDARDS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 15 QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 16 QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (THOUSAND UNITS)

- TABLE 17 QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (THOUSAND UNITS)

- TABLE 18 FABRY–PEROT: QUANTUM CASCADE LASER MARKET, BY PACKAGING TYPE, 2019–2022 (USD MILLION)

- TABLE 19 FABRY–PEROT: QUANTUM CASCADE LASER MARKET, BY PACKAGING TYPE, 2023–2028 (USD MILLION)

- TABLE 20 FABRY–PEROT: QUANTUM CASCADE LASER MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 21 FABRY–PEROT: QUANTUM CASCADE LASER MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 22 FABRY–PEROT: QUANTUM CASCADE LASER MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 23 FABRY–PEROT: QUANTUM CASCADE LASER MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 24 FABRY–PEROT: QUANTUM CASCADE LASER MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 25 FABRY–PEROT: QUANTUM CASCADE LASER MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 26 FABRY–PEROT: NORTH AMERICA QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 27 FABRY–PEROT: NORTH AMERICA QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 28 FABRY–PEROT: EUROPE QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 29 FABRY–PEROT: EUROPE QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 30 FABRY–PEROT: ASIA PACIFIC QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 31 FABRY–PEROT: ASIA PACIFIC QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 32 FABRY–PEROT: ROW QUANTUM CASCADE LASER MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 33 FABRY–PEROT: ROW QUANTUM CASCADE LASER MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 34 DISTRIBUTED FEEDBACK: QUANTUM CASCADE LASER MARKET, BY PACKAGING TYPE, 2019–2022 (USD MILLION)

- TABLE 35 DISTRIBUTED FEEDBACK: QUANTUM CASCADE LASER MARKET, BY PACKAGING TYPE, 2023–2028 (USD MILLION)

- TABLE 36 DISTRIBUTED FEEDBACK: QUANTUM CASCADE LASER MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 37 DISTRIBUTED FEEDBACK: QUANTUM CASCADE LASER MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 38 DISTRIBUTED FEEDBACK: QUANTUM CASCADE LASER MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 39 DISTRIBUTED FEEDBACK: QUANTUM CASCADE LASER MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 40 DISTRIBUTED FEEDBACK: QUANTUM CASCADE LASER MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 41 DISTRIBUTED FEEDBACK: QUANTUM CASCADE LASER MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 42 DISTRIBUTED FEEDBACK: NORTH AMERICA QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 43 DISTRIBUTED FEEDBACK: NORTH AMERICA QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 44 DISTRIBUTED FEEDBACK: EUROPE QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 45 DISTRIBUTED FEEDBACK: EUROPE QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 46 DISTRIBUTED FEEDBACK: ASIA PACIFIC QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 47 DISTRIBUTED FEEDBACK: ASIA PACIFIC QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 48 DISTRIBUTED FEEDBACK: ROW QUANTUM CASCADE LASER MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 49 DISTRIBUTED FEEDBACK: ROW QUANTUM CASCADE LASER MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 50 TUNABLE EXTERNAL CAVITY: QUANTUM CASCADE LASER MARKET, BY PACKAGING TYPE, 2019–2022 (USD MILLION)

- TABLE 51 TUNABLE EXTERNAL CAVITY: QUANTUM CASCADE LASER MARKET, BY PACKAGING TYPE, 2023–2028 (USD MILLION)

- TABLE 52 TUNABLE EXTERNAL CAVITY: QUANTUM CASCADE LASER MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 53 TUNABLE EXTERNAL CAVITY: QUANTUM CASCADE LASER MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 54 TUNABLE EXTERNAL CAVITY: QUANTUM CASCADE LASER MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 55 TUNABLE EXTERNAL CAVITY: QUANTUM CASCADE LASER MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 56 TUNABLE EXTERNAL CAVITY: QUANTUM CASCADE LASER MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 57 TUNABLE EXTERNAL CAVITY: QUANTUM CASCADE LASER MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 58 TUNABLE EXTERNAL CAVITY: NORTH AMERICA QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 59 TUNABLE EXTERNAL CAVITY: NORTH AMERICA QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 60 TUNABLE EXTERNAL CAVITY: EUROPE QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 61 TUNABLE EXTERNAL CAVITY: EUROPE QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 62 TUNABLE EXTERNAL CAVITY: ASIA PACIFIC QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 63 TUNABLE EXTERNAL CAVITY: ASIA PACIFIC QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 64 TUNABLE EXTERNAL CAVITY: ROW QUANTUM CASCADE LASER MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 65 TUNABLE EXTERNAL CAVITY: ROW QUANTUM CASCADE LASER MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 66 QUANTUM CASCADE LASER MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 67 QUANTUM CASCADE LASER MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 68 CONTINUOUS WAVE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 69 CONTINUOUS WAVE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 70 PULSED: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 71 PULSED: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 72 QUANTUM CASCADE LASER MARKET, BY PACKAGING TYPE, 2019–2022 (USD MILLION)

- TABLE 73 QUANTUM CASCADE LASER MARKET, BY PACKAGING TYPE, 2023–2028 (USD MILLION)

- TABLE 74 C-MOUNT PACKAGE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 75 C-MOUNT PACKAGE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 76 HHL & VHL PACKAGE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 77 HHL & VHL PACKAGE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 78 TO3 PACKAGE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 79 TO3 PACKAGE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 80 QUANTUM CASCADE LASER MARKET FOR FABRY PEROT TECHNOLOGY, BY END USER, 2019–2022 (USD MILLION)

- TABLE 81 QUANTUM CASCADE LASER MARKET FOR FABRY PEROT TECHNOLOGY, BY END USER, 2023–2028 (USD MILLION)

- TABLE 82 INDUSTRIAL: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 83 INDUSTRIAL: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 84 MEDICAL: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 85 MEDICAL: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 86 TELECOMMUNICATIONS: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 87 TELECOMMUNICATIONS: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 88 MILITARY & DEFENSE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 89 MILITARY & DEFENSE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 90 OTHERS: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 91 OTHERS: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 92 QUANTUM CASCADE LASER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 QUANTUM CASCADE LASER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: QUANTUM CASCADE LASER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 106 ROW: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 107 ROW: QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 108 ROW: QUANTUM CASCADE LASER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 109 ROW: QUANTUM CASCADE LASER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 110 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP QUANTUM CASCADE LASER MANUFACTURERS

- TABLE 111 DEGREE OF COMPETITION

- TABLE 112 COMPANY FOOTPRINT

- TABLE 113 FABRICATION TECHNOLOGY: COMPANY FOOTPRINT

- TABLE 114 END USER: COMPANY FOOTPRINT

- TABLE 115 REGION: COMPANY FOOTPRINT

- TABLE 116 QUANTUM CASCADE LASER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 117 QUANTUM CASCADE LASER MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 118 QUANTUM CASCADE LASER MARKET: DEALS, 2020–2023

- TABLE 119 THORLABS, INC.: COMPANY OVERVIEW

- TABLE 120 THORLABS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 121 THORLABS, INC.: PRODUCT LAUNCHES

- TABLE 122 THORLABS, INC.: DEALS

- TABLE 123 HAMAMATSU PHOTONICS K.K.: COMPANY OVERVIEW

- TABLE 124 HAMAMATSU PHOTONICS K.K.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 125 HAMAMATSU PHOTONICS K.K.: PRODUCT LAUNCHES

- TABLE 126 MIRSENSE: COMPANY OVERVIEW

- TABLE 127 MIRSENSE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 128 MIRSENSE: PRODUCT LAUNCHES

- TABLE 129 MIRSENSE: DEALS

- TABLE 130 BLOCK ENGINEERING: COMPANY OVERVIEW

- TABLE 131 BLOCK ENGINEERING: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 132 BLOCK ENGINEERING: DEALS

- TABLE 133 WAVELENGTH ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 134 WAVELENGTH ELECTRONICS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 135 WAVELENGTH ELECTRONICS, INC.: PRODUCT LAUNCHES

- TABLE 136 DAYLIGHT SOLUTIONS.: COMPANY OVERVIEW

- TABLE 137 DAYLIGHT SOLUTIONS.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 138 DAYLIGHT SOLUTIONS: DEALS

- TABLE 139 ALPES LASERS: COMPANY OVERVIEW

- TABLE 140 ALPES LASERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 NANOPLUS NANOSYSTEMS AND TECHNOLOGIES GMBH: COMPANY OVERVIEW

- TABLE 142 NANOPLUS NANOSYSTEMS AND TECHNOLOGIES GMBH: PRODUCTS OFFERED

- TABLE 143 AKELA LASER CORPORATION: COMPANY OVERVIEW

- TABLE 144 AKELA LASER CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 QUANTUM CASCADE LASER MARKET: SEGMENTATION

- FIGURE 2 QUANTUM CASCADE LASER MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 QUANTUM CASCADE LASER MARKET: SUPPLY-SIDE ANALYSIS (1/2)

- FIGURE 7 QUANTUM CASCADE LASER MARKET: SUPPLY-SIDE ANALYSIS (2/2)

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 ASSUMPTIONS

- FIGURE 10 QUANTUM CASCADE LASER MARKET: GROWTH PROJECTION, 2019–2028

- FIGURE 11 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF QUANTUM CASCADE LASER MARKET FROM 2023 TO 2028

- FIGURE 12 DISTRIBUTED FEEDBACK SEGMENT TO LEAD QUANTUM CASCADE LASER MARKET FROM 2023 TO 2028

- FIGURE 13 NORTH AMERICA TO HOLD LARGEST SHARE OF QUANTUM CASCADE LASER MARKET IN 2023

- FIGURE 14 INCREASING USE OF QUANTUM CASCADE LASERS IN GAS SENSING AND CHEMICAL DETECTION

- FIGURE 15 TO3 PACKAGE SEGMENT TO LEAD QUANTUM CASCADE LASER MARKET FROM 2023 TO 2028

- FIGURE 16 CONTINUOUS WAVE (CW) SEGMENT TO HOLD LARGEST SHARE OF QUANTUM CASCADE LASER MARKET IN 2023 AND 2028

- FIGURE 17 DISTRIBUTED FEEDBACK AND INDUSTRIAL SEGMENTS TO HOLD LARGEST SHARES OF QUANTUM CASCADE LASER MARKET IN 2023

- FIGURE 18 ASIA PACIFIC QUANTUM CASCADE LASER MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 QUANTUM CASCADE LASER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 QUANTUM CASCADE LASER MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 21 QUANTUM CASCADE LASER MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 22 QUANTUM CASCADE LASER MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 23 QUANTUM CASCADE LASER MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 24 QUANTUM CASCADE LASER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MARKET PLAYERS

- FIGURE 26 QUANTUM CASCADE LASER MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 29 NUMBER OF PATENTS GRANTED RELATED TO QUANTUM CASCADE LASERS, 2012–2022

- FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED FOR QUANTUM CASCADE LASERS, 2022

- FIGURE 31 AVERAGE SELLING PRICE (ASP) OF QUANTUM CASCADE LASERS, BY FABRICATION TECHNOLOGY

- FIGURE 32 QUANTUM CASCADE LASER MARKET, BY FABRICATION TECHNOLOGY

- FIGURE 33 FABRY–PEROT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 QUANTUM CASCADE LASER MARKET, BY OPERATION MODE

- FIGURE 35 CONTINUOUS WAVE SEGMENT TO HOLD LARGER SHARE OF QUANTUM CASCADE LASER MARKET IN 2028

- FIGURE 36 QUANTUM CASCADE LASER MARKET, BY PACKAGING TYPE

- FIGURE 37 TO3 PACKAGE SEGMENT TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2028

- FIGURE 38 QUANTUM CASCADE LASER MARKET, BY END USER

- FIGURE 39 INDUSTRIAL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 40 ASIA PACIFIC QUANTUM CASCADE LASER MARKET TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 41 NORTH AMERICA: QUANTUM CASCADE LASER MARKET SNAPSHOT

- FIGURE 42 EUROPE: QUANTUM CASCADE LASER MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: QUANTUM CASCADE LASER MARKET SNAPSHOT

- FIGURE 44 QUANTUM CASCADE LASER MARKET: REVENUE ANALYSIS, 2018–2022

- FIGURE 45 QUANTUM CASCADE LASER MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 46 QUANTUM CASCADE LASER MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 47 HAMAMATSU PHOTONICS K.K.: COMPANY SNAPSHOT

The study involved four major activities in estimating the size of the Quantum Cascade Laser market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering QCLs have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Secondary research has been mainly conducted to obtain critical information about the value chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market-and technology-oriented perspectives. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated by primary research.

Primary Research

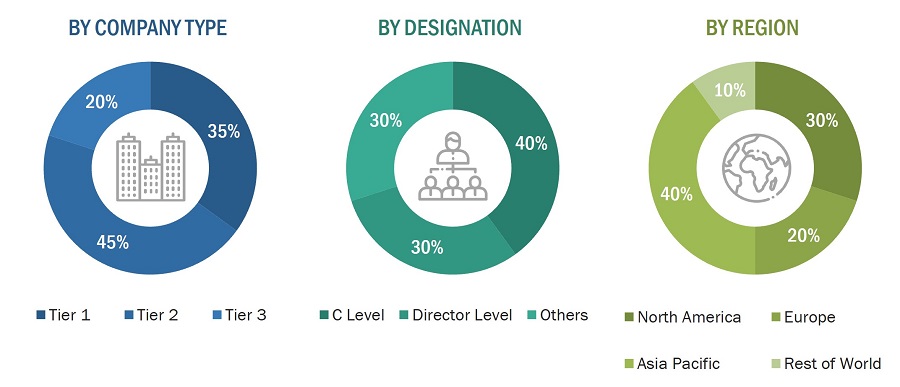

Extensive primary research has been conducted after understanding and analyzing the current scenario of the QCL market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across 4 major regions: Americas, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

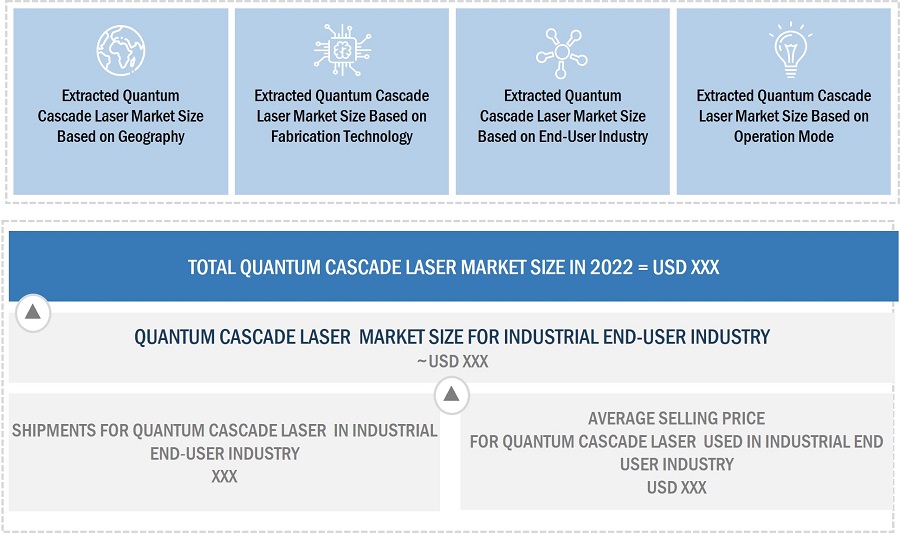

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the Quantum Cascade Laser Market.

- Identifying the types of QCLs and their penetration in different applications

- Analyzing the penetration of each type of QCL through secondary and primary research

- Identifying the ASP of different types of QCLs for the respective applications by conducting multiple discussion sessions with key opinion leaders to understand the detailed working of QCLs and their implementation in multiple applications; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, and operation managers, and finally with MarketsandMarkets’ domain experts

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

The top-down approach has been used to estimate and validate the total size of the Quantum Cascade Laser Market.

- Focusing on the expenditures being made in the ecosystem by QCL manufacturers

- Splitting the market by fabrication technology, operation mode, packaging type, end-user industry, and region, and listing the key developments

- Identifying all leading players and end users in the QCL market based on fabrication technology, operation mode, packaging type, and end-user industry through secondary research and verifying them through a brief discussion with industry experts

- Analyzing revenues, product mix, and geographic presence of all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with the industry experts to validate the information and identify the key growth pockets across all segments

- Breaking down the total market size based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall size of the Quantum Cascade Laser market from the estimation process explained earlier, the global market was split into several segments and subsegments. Where applicable, data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Quantum cascade lasers emit light in mid to far-infrared portions of the electromagnetic spectrum. They differ from other semiconductor diode lasers in their fundamental structure. These lasers are unipolar and rely only on electrons for their progression. Quantum cascade lasers are used in spectroscopy, free-space communication, breath analysis, and missile countermeasure applications. The market research study includes only QCL-based products, modules, and chips. It does not include any other type of semiconductor laser, fiber laser, and carbon dioxide (CO2) laser. The scope of the study includes different fabrication technologies, operation modes, packaging types, and end users of quantum cascade lasers as well as regions wherein they are used.

Key Stakeholders

- Brand Product Manufacturers/Original Equipment Manufacturers (OEMs)/Original Device Manufacturers (ODMs)

- Quantum Cascade Laser (QCL) Product Manufacturers

- Semiconductor Component Suppliers/Foundries

- Quantum Cascade Laser (QCL) Material and Component Suppliers

- Manufacturing Equipment Suppliers

- System Integrators

- Technology/IP Developers

- Consulting and Market Research Service Providers

- Quantum Cascade Laser (QCL) and Material-related Associations, Organizations, Forums, and Alliances

- Venture Capitalists and Startups

- Research and Educational Institutes

- Distributors and Resellers

- End Users

Report Objectives

- To define, describe, and forecast the size of the market, by fabrication technology, operation mode, packaging type, and end-user industry.

- To describe and forecast the market size, by region, for North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value.

- To analyze the emerging application/use cases in the QCL market.

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide Porter’s five forces analysis along with the technology and the market roadmaps for the QCL market

- To describe the ecosystem/value chain of the QCL market consisting of material and component suppliers, driver IC suppliers, manufacturing equipment suppliers, manufacturers, and brand product manufacturers.

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape for the market players.

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies.

- To analyze competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers and acquisitions, and product launches and developments in the market.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Growth opportunities and latent adjacency in Quantum Cascade Laser Market