Purpose-built Backup Appliance (PBBA) Market by Component (Hardware, Software), System (Mainframe, Open), Enterprise (Large, Small and Mid-level), Vertical (Telecom & IT, BFSI, Manufacturing, Retail, Healthcare), and Geography - Global Forecast to 2024

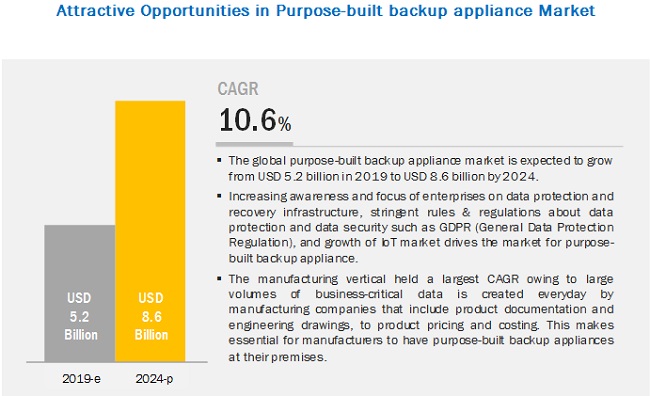

The purpose-built backup appliance market is expected to reach USD 8.6 billion by 2024 from USD 5.2 billion in 2019, at a CAGR of 10.6%. The growth of this market lies in the data protection and security policy introduced by EU, i.e., GDPR (General Data Protection Regulation), increasing focus and awareness of the enterprise on data protection & recovery infrastructure, and the drastic growth in the IoT market.

The hardware component is expected to be the more significant contributor in purpose-built backup appliance during the forecast period

The hardware component of the purpose-built backup appliance market is either replaced or repaired in case of repairable damage whereas the software of the purpose-built backup appliances is upgraded. The cost of the hardware lies in the capacity of the storage, the form factor of the appliance, and whether the appliance is a mainframe system supporting or open system supporting. Higher the capacity of the appliances, higher will be the cost of it. In the case of software, the features such as deduplication, snapshot hardly changes if the storage capacity of the product increases. Hence, the hardware component has a higher market share than the software component of the market.

Open system to have higher market share in purpose-built backup appliance market during the forecast period

An open system is the computing platforms build by a variety of vendors in the market with open hardware and software standards. Open system supporting purpose-built backup appliances are easy to adapt to any IT environment. While mainframe systems are mature storage management environment, but the usage of the mainframe is exclusive. An open system is priced cheaper and is flexible to adapt to any IT environment of the enterprises drives the market for the open system in purpose-built backup appliances.

Small and mid-level enterprises to hold a higher growth rate as compared to large enterprises during the forecast period

Small and mid-level enterprises (SMEs) are getting a boost in many countries in terms of policies and initiatives that would help SMEs to grow. Initiatives such as a reduction in corporate tax, and providing loans to SMEs for initial few years on less interest rate, helps SME to set up their business, thereby driving the growth of SMEs. Owing to initiatives taken by various countries, the small and mid-level enterprises are expected to hold a higher growth rate as compared to large enterprises.

Telecom & IT held the largest market share in purpose-built backup appliances in 2018

There are many big companies in telecom & IT sector such as AT&T, Sprint, Airtel, Cognizant, Accenture, TCS, Infosys who has huge turnover. Their businesses and presence are spread across the globe. But there is intense competition, and market dynamics are forcing telecom companies to change or evolve continuously.

With plans for rolling out of 5G network in some countries, the data generated in the 5G spectrum will be huge, which would be business critical and hence, the need to take a backup. With the increasing size of the large telecom & IT, companies and various emerging trends in data analytics in these verticals, the telecom & IT held the largest market share of the purpose-built backup appliance in 2018.

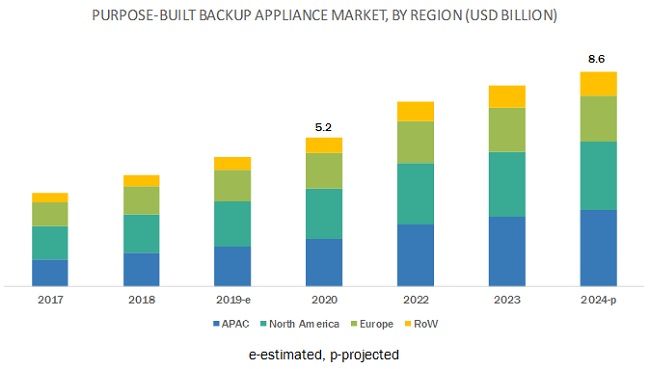

APAC to be the largest purpose-built backup appliance market for purpose-built backup appliances by 2024

APAC region is led by developed countries such as Japan and developing countries such as India, China, among others. APAC is a promising market for purpose-built backup appliance owing to factors such as growing economies, growth of small and mid-level enterprises, among others. The economic infrastructure of the APAC is on the rise, which will directly have an impact on the market of purpose-built backup appliances. Presence of all the major companies, strong industrial development demand, strong supply side, and capability drives the market for APAC region.

Key Market Players

Major players operating in the purpose-built backup appliance market are Dell Inc. (US), NetApp, Inc. (US), IBM Corporation (US), Oracle Corporation (US), Fujitsu Limited (Japan), Commvault Systems, Inc. (US), Veritas Technologies LLC (US), Hewlett Packard Enterprise Company (US), Quantum Corporation (US), Barracuda Networks, Inc. (US), Hitachi Vantara Corporation (US), and Arcserve LLC (US) among others

Dell (US) is among the worlds largest information technology company that is held privately. In September 2016, Dell acquired EMC (US), a leading company in storage infrastructure and converged systems. The acquisition aims to address the challenges faced by the companies in technology shifts for servers and storage. With this acquisition, Dell plans to grow its business in next-generation data storage products and solutions with the expertise and extended portfolio of EMC, which include world-class flash storage, converged systems, cloud infrastructure, as well as enterprise backup solutions such as purpose-built backup appliances.

Veritas (US) develops and delivers backup and recovery, business continuity, information governance, and software-defined storage products to its global clientele. The company specializes in information management, data management, information governance, cloud, backup and recovery, business continuity, software-defined storage, open stack, and data privacy. Data insight provides analytics, tracking, and reporting of the unstructured data, thus providing necessary information to organizations to help them deliver organizational accountability related to file use and security. Data insight integrates archiving and security solutions to prevent data loss and ensure policy-based data retention. The company has an extensive product portfolio in the market. Veritas Technologies has a significant presence across the world, with its customers mainly concentrated in the Americas, Asia Pacific, Europe, and Africa.

HPE (US) is one of the major players in the purpose-built backup appliance market. The company is a globally leading technology solution provider to optimize traditional information technology. HPE Company offers purpose-built backup appliances for backup and storage for enterprises and small- and medium-scale business environments. The company provides backup solutions for small and mid-level businesses as well as for large enterprises too.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value(USD) |

|

Segments covered |

Component, System, Enterprise, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe and RoW |

|

Companies covered |

Dell Inc. (US), NetApp, Inc. (US), IBM Corporation (US), Oracle Corporation (US), Fujitsu Limited (Japan), Commvault Systems, Inc. (US), Veritas Technologies LLC (US), Hewlett Packard Enterprise Company (US), Quantum Corporation (US), Barracuda Networks, Inc. (US), Hitachi Vantara Corporation (US), and Arcserve LLC (US). |

In this report, the overall purpose-built backup appliance market has been segmented based on component, system, enterprise, vertical, and geography.

Purpose-built backup appliance market, by Component:

- Hardware

- Software

Purpose-built backup appliance market, by System:

- Mainframe

- Open

Purpose-built backup appliance market, by Enterprise:

- Large Enterprise

- Small and Mid-level Enterprise

Purpose-built backup appliance market, by Vertical:

- Telecom & IT

- BFSI

- Manufacturing

- Retail

- Healthcare

- Media & Entertainment

- Government

- Others (Travel & Hospitality, Power & Utility)

Purpose-built backup appliance market, by Region:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- South Korea

- India

- Rest of APAC

- Rest of the World (RoW)

- South America

- Middle East & Africa

Following are few of the recent developments in the purpose-built backup appliance market:

- In February 2019, Fujitsu introduced a new licensing option for its all-in-one backup solution Fujitsu Storage ETERNUS CS200c. This will benefit the customers in terms of easier integration of the backup appliance, besides offering maximum licensing flexibility and investment protection.

- In February 2019, Dell EMC, subsidiary of Dell, launched backup storage appliances with enhanced capabilities in the Dell EMC Data Domain and Integrated Data Protection Appliance (IDPA) portfolio that will offer flexibility, multiple cloud capability, and improved performance in enterprise backup storage that includes purpose-built backup appliance.

- In May 2019, Fujitsu partnered with Veeam Software to offer simplified backup and recovery for customers for virtual machines in the data centers. This will help enterprises to increase the availability of data and faster recovery of data in case of disasters or unplanned system downtime.

Key Questions addressed by the report:

- Which system of purpose-built backup appliances to have the highest demand in the future?

- What are the opportunities and challenges for the purpose-built backup appliance?

- Which region will have the highest demand for the purpose-built backup appliance market?

- Which company is leading in conveyor belt monitoring?

- Which vertical has most adoption of the purpose-built backup appliance?

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for purpose-built backup appliance market during 20192024?

The purpose-built backup appliance market is expected to record the CAGR of 10.6% during 20192024

What are the driving factors for purpose-built backup appliance market?

Data protection and security policy introduced by EU, i.e., GDPR (General Data Protection Regulation), increasing focus and awareness of the enterprise on data protection & recovery infrastructure, and the drastic growth in the IoT market

Which industry accounted for the largest share of market in 2019?

The telecom and IT industry accounted for the largest share of market in 2019.

Which are the significant players operating in purpose-built backup appliance market?

Dell Inc. (US), NetApp, Inc. (US), IBM Corporation (US), Oracle Corporation (US), Fujitsu Limited (Japan), Commvault Systems, Inc. (US), Veritas Technologies LLC (US) are some of the significant players in the purpose-built backup appliance market.

How is the purpose-built backup appliance market segmented?

The purpose-built backup appliance market has been segmented based on component, system, enterprise, vertical, and geography.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Introduction

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 List of Major Secondary Sources

2.1.2.2 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.3.1 Breakdown of Primaries

2.1.3.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Arriving at Market Size Using Bottom-Up Analysis

2.2.2 Top-Down Approach

2.2.2.1 Approach for Arriving at Market Size Using Bottom-Up Analysis

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 36)

4.1 Purpose-Built Backup Appliance Market

4.2 Market, By System (20192024)

4.3 Market, By Enterprise (2019 & 2024)

4.4 Market, By Vertical (2018 & 2024)

4.5 Market, By Region (20192024)

5 Market Overview (Page No. - 40)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing Awareness and Focus of Enterprises on Data Protection and Recovery Infrastructure

5.1.1.2 Stringent Rules and Regulations About Data Protection and Data Security

5.1.1.3 Growth of the IoT Market

5.1.2 Restraints

5.1.2.1 High Cost Associated With Storage and Backup Technology and Availability of Cost-Effective Substitutes

5.1.3 Opportunities

5.1.3.1 Virtualized Pbbas

5.1.3.2 Increasing Need for Data Analytics

5.1.4 Challenges

5.1.4.1 Convenient Cloud Storage Solutions Threaten the Purpose-Built Backup Appliance Market

6 Market, By Component (Page No. - 44)

6.1 Introduction

6.2 Hardware

6.3 Software

7 Market, By System (Page No. - 51)

7.1 Introduction

7.2 Mainframe Systems

7.3 Open Systems

8 Market, By Enterprise (Page No. - 57)

8.1 Introduction

8.2 Small and Mid-Level Enterprises

8.3 Large Enterprise

9 Market, By Vertical (Page No. - 63)

9.1 Introduction

9.2 Telecom and It

9.3 Manufacturing

9.4 BFSI

9.5 Healthcare

9.6 Retail

9.7 Media and Entertainment

9.8 Government

9.9 Others

10 Market, By Geography (Page No. - 76)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia Pacific (APAC)

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Rest of APAC

10.5 Rest of the World (RoW)

10.5.1 Middle East and Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 90)

11.1 Overview

11.2 Ranking Analysis of Market Players

11.3 Purpose-Built Backup Appliance Market (Global) Competitive Leadership Mapping, 2018

11.3.1 Introduction

11.3.1.1 Visionary Leaders

11.3.1.2 Dynamic Differentiators

11.3.1.3 Innovators

11.3.1.4 Emerging Companies

11.3.2 Competitive Leadership Mapping

11.4 Purpose-Built Backup Appliance Market (Global) Competitive Scenario

11.4.1 Product Launches

11.4.2 Partnerships

12 Company Profiles (Page No. - 95)

12.1 Key Players

12.1.1 Dell

12.1.1.1 Business Overview

12.1.1.2 Products & Services Offered

12.1.1.3 Recent Developments

12.1.1.4 MnM View

12.1.1.5 SWOT Analysis

12.1.2 Hewlett Packard Enterprise (HPE) Company

12.1.2.1 Business Overview

12.1.2.2 Products & Services Offered

12.1.2.3 MnM View

12.1.2.4 SWOT Analysis

12.1.3 IBM

12.1.3.1 Business Overview

12.1.3.2 Products & Services Offered

12.1.3.3 MnM View

12.1.3.4 SWOT Analysis

12.1.4 Oracle

12.1.4.1 Business Overview

12.1.4.2 Products & Services Offered

12.1.4.3 MnM View

12.1.5 Hitachi Vantara Corporation

12.1.5.1 Business Overview

12.1.5.2 Products & Services Offered

12.1.5.3 MnM View

12.1.5.4 SWOT Analysis

12.1.6 Netapp

12.1.6.1 Business Overview

12.1.6.2 Products & Services Offered

12.1.6.3 MnM View

12.1.6.4 SWOT Analysis

12.1.7 Fujitsu

12.1.7.1 Business Overview

12.1.7.2 Products & Services Offered

12.1.7.3 Recent Developments

12.1.7.4 MnM View

12.1.8 Quantum

12.1.8.1 Business Overview

12.1.8.2 Products Offered

12.1.8.3 MnM View

12.1.9 Veritas

12.1.9.1 Business Overview

12.1.9.2 Products Offered

12.1.9.3 MnM View

12.1.10 Commvault

12.1.10.1 Business Overview

12.1.10.2 Products Offered

12.1.10.3 MnM View

12.2 Other Key Players

12.2.1 Barracuda Networks

12.2.2 Veeam

12.2.3 Rubrik

12.2.4 Storserver

12.2.5 Cohesity

13 Appendix (Page No. - 120)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Available Customizations

13.4 Related Reports

List of Tables (65 Tables)

Table 1 IoT Connections (Billion)

Table 2 PBBA Market, By Component, 20152024 (USD Million)

Table 3 PBBA Market for Hardware, By System, 20152024 (USD Million)

Table 4 Market for Hardware, By Enterprise, 20152024 (USD Million)

Table 5 Market for Hardware, By Geography, 20152024 (USD Million)

Table 6 Market for Hardware, By Vertical, 20152024 (USD Million)

Table 7 Market for Software, By System, 20152024 (USD Million)

Table 8 Market for Software, By Enterprise, 20152024 (USD Million)

Table 9 Market for Software, By Geography, 20152024 (USD Million)

Table 10 Market for Software, By Vertical, 20152024 (USD Million)

Table 11 PBBA Market, By System, 20152024 (USD Million)

Table 12 PBBA Market for Mainframe System, By Component, 20152024 (USD Million)

Table 13 Market for Mainframe System, By Enterprise, 20152024 (USD Million)

Table 14 Market for Mainframe System, By Vertical, 20152024 (USD Million)

Table 15 Market for Open System, By Component, 20152024 (USD Million)

Table 16 Market for Open System, By Enterprise, 20152024 (USD Million)

Table 17 Market for Open System, By Vertical, 20152024 (USD Million)

Table 18 PBBA Market, By Enterprise, 20152024 (USD Million)

Table 19 Market for Small and Mid-Level Enterprise, By System, 20152024 (USD Million)

Table 20 Market for Small and Mid-Level Enterprise, By Vertical, 20152024 (USD Million)

Table 21 PBBA Market for Small and Mid-Level Enterprise, By Geography, 20152024 (USD Million)

Table 22 Market for Large Enterprise, By System, 20152024 (USD Million)

Table 23 Market for Large Enterprise, By Vertical, 20152024 (USD Million)

Table 24 PBBA Market for Large Enterprise, By Geography, 20152024 (USD Million)

Table 25 PBBA Market, By Vertical, 20152024 (USD Million)

Table 26 PBBA Market for Telecom & It, By Geography, 20152024 (USD Million)

Table 27 Market for Telecom & It, By System, 20152024 (USD Million)

Table 28 Market for Telecom & It, By Component, 20152024 (USD Million)

Table 29 PBBA Market for Manufacturing, By Geography, 20152024 (USD Million)

Table 30 Market for Manufacturing, By System, 20152024 (USD Million)

Table 31 Market for Manufacturing, By Component, 20152024 (USD Million)

Table 32 PBBA Market for BFSI, By Geography, 20152024 (USD Million)

Table 33 Market for BFSI, By System, 20152024 (USD Million)

Table 34 Market for BFSI, By Component, 20152024 (USD Million)

Table 35 PBBA Market for Healthcare, By Geography, 20152024 (USD Million)

Table 36 Market for Healthcare, By System, 20152024 (USD Million)

Table 37 Market for Healthcare, By Component, 20152024 (USD Million)

Table 38 PBBA Market for Retail, By Geography, 20152024 (USD Million)

Table 39 PBBA Market for Retail, By System, 20152024 (USD Million)

Table 40 PBBA Market for Retail, By Component, 20152024 (USD Million)

Table 41 PBBA Market for Media & Entertainment, By Geography, 20152024 (USD Million)

Table 42 PBBA Market for Media & Entertainment, By System, 20152024 (USD Million)

Table 43 Market for Media & Entertainment, By Component, 20152024 (USD Million)

Table 44 Market for Government, By Geography, 20152024 (USD Million)

Table 45 Market for Government, By System, 20152024 (USD Million)

Table 46 Market for Government, By Component, 20152024 (USD Million)

Table 47 Market for Others, By Geography, 20152024 (USD Million)

Table 48 Market for Others, By System, 20152024 (USD Million)

Table 49 PBBA Market for Others, By Component, 20152024 (USD Million)

Table 50 PBBA Market, By Geography, 20152024 (USD Million)

Table 51 North America Market, By Vertical, 20152024 (USD Million)

Table 52 North America Market , By Enterprise, 20152024 (USD Million)

Table 53 North America Market, By Country, 20152024 (USD Million)

Table 54 Europe PBBA Market, By Vertical, 20152024 (USD Million)

Table 55 Europe PBBA Market, By Enterprise, 20152024 (USD Million)

Table 56 Europe Market, By Country, 20152024 (USD Million)

Table 57 APAC PBBA Market, By Vertical, 20152024 (USD Million)

Table 58 APAC Market, By Enterprise, 20152024 (USD Million)

Table 59 APAC Market, By Country, 20152024 (USD Million)

Table 60 RoW PBBA Market, By Vertical, 20152024 (USD Million)

Table 61 RoW Market, By Enterprise, 20152024 (USD Million)

Table 62 RoW Market, By Region, 20152024 (USD Million)

Table 63 Purpose-Built Backup Appliance Market Players, 2018

Table 64 Product Launches, 20182019

Table 65 Partnerships, 20182019

List of Figures (37 Figures)

Figure 1 Market Segmentation

Figure 2 Purpose-Built Backup Appliance Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Assumption for Research Study

Figure 7 PBBA Market Segmentation

Figure 8 Global Purpose-Built Backup Appliance Market, 2015 to 2024 (USD Million)

Figure 9 Software of Purpose-Built Backup Appliances to have Higher CAGR During the Forecast Period

Figure 10 Open System Purpose-Built Backup Appliances to Lead Market in Terms of Size During the Forecast Period

Figure 11 Small and Mid-Level Enterprises Expected to Grow at Higher CAGR in Market From 2019 to 2024

Figure 12 Telecom & It to Hold Largest Market Share in Market From 2019 to 2024

Figure 13 APAC to Witness Highest CAGR in Global Market During Forecast Period

Figure 14 Attractive Growth Opportunities for the Market

Figure 15 Open System Market to Grow at A Higher CAGR During the Forecast Period

Figure 16 Large Enterprise to Hold A Larger Share of the Market During the Forecast Period

Figure 17 Telecom & It to Hold the Largest Share of the Market By 2024

Figure 18 Increasing Awareness and Focus of Enterprises on Data Protection and Recovery Infrastructure to Drive the Market for Purpose-Built Backup Appliances

Figure 19 Purpose-Built Backup Appliance Market, By Component

Figure 20 Market, By System

Figure 21 Market, By Enterprise

Figure 22 North America: Market Snapshot

Figure 23 APAC: Market Snapshot

Figure 24 Dell: Company Snapshot

Figure 25 SWOT Analysis

Figure 26 HPE Company: Company Snapshot

Figure 27 SWOT Analysis

Figure 28 IBM: Company Snapshot

Figure 29 SWOT Analysis

Figure 30 Oracle: Company Snapshot

Figure 31 Hitachi Vantara Corporation: Company Snapshot

Figure 32 SWOT Analysis

Figure 33 Netapp: Company Snapshot

Figure 34 SWOT Analysis

Figure 35 Fujitsu: Company Snapshot

Figure 36 Quantum: Company Snapshot

Figure 37 Commvault: Company Snapshot

The study involved four major activities in estimating the current market size for the purpose-built backup appliance market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data, triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva and Avention have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

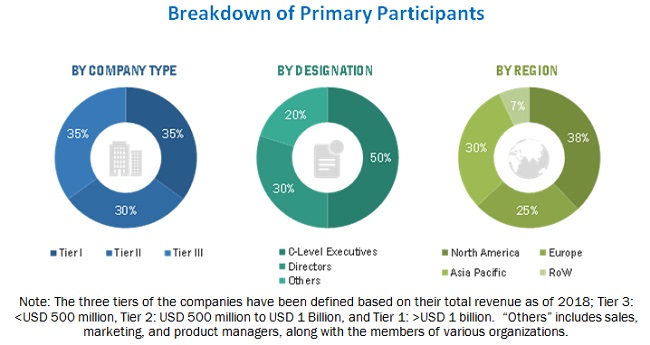

Extensive primary research has been conducted after gaining knowledge about the purpose-built backup appliance scenario through secondary research. Several primary interviews have been conducted with market experts from both demand and supply sides across four major regionsNorth America, Europe, APAC, and RoW. Approximately 30% and 70% primary interviews have been conducted with parties from the demand and supply sides, respectively. These primary data have been collected through questionnaires, e-mails, and telephonic interviews.

The following figure shows the breakdown of primaries based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global PBBA market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market rankings in the respective regions have been determined through primary and secondary research. This entire research methodology involves the study of financial reports of top players and interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the purpose-built backup appliance market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. These data have been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

The PBBA market was estimated at USD 5.2 billion in 2019 and is expected to reach USD 8.6 billion by 2024, at a CAGR of 10.6% from 2019 to 2024. The base year of the study is 2018, and the forecast period is from 2019 to 2024.

Study objectives are as follows:

- To define, describe, and forecast the purpose-built backup appliance, in terms of value, based on component, system, enterprise, and vertical

- To forecast the market size, in terms of value, for segments with respect to 4 main regions- North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To provide an overall view of the global market through illustrative segmentations, analyses, and market size estimations of the major geographic segments

- To analyze the competitive intelligence of players based on company profiles and key player strategies

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2, along with detailing the competitive landscape for the market leaders

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Purpose-built Backup Appliance (PBBA) Market

I need the market growth and demand analysis data for PBBA and drives specially in U.S with the latest market trends and major companies operating in this business.

Want to understand the major application and the major players into this industry? Have you provided a detailed study on this?

Interested in Tables about PBBA in Japan. What would be cost of procuring this level of information.

Would like to understand the market potential by hardware and software? Do you have such information qualitative or quantitative?