Protein Stability Analysis Market by Product (Assay and Reagent, Instrument), Technique (Chromatography, Spectroscopy (DLS, Fluorescence Spectroscopy), SPR, DSF), End User (Pharmaceutical & Biotech Companies, Research Institute) - Global Forecast to 2024

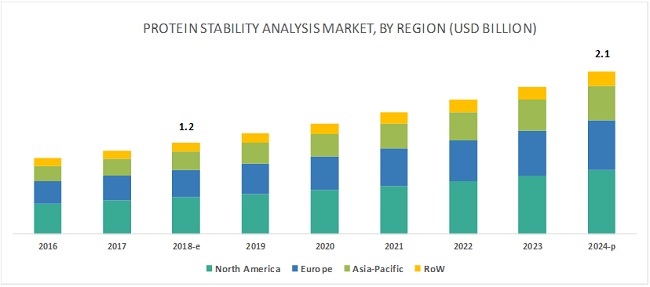

[111 Pages Report] The market for protein stability analysis is expected to grow from USD 1.2 billion in 2018 to USD 2.1 billion by 2024, at a CAGR of 10.0 % during the forecast period. The growth of the protein stability analysis market is primarily driven by the growing adoption of open innovation models in pharmaceutical & biotechnology companies and increasing pharmaceutical outsourcing. Emerging economies will provide new growth opportunities for players in the market. However, the high cost of protein stability analysis systems is expected to restrain the growth of this market to a certain extent.

The reagents & assay kits segment held the largest share of the market in 2018.

On the basis of products, the protein stability analysis market is divided into reagents & assay kits, instruments, consumables & accessories, and software. Reagents and assay kits accounted for the largest share of the market in 2018. The large share of this market segment can be attributed to the high consumption of reagents and assay kits in protein stability analysis techniques, increasing protein pharmaceutical R&D, and increased government funding for life science research.

The extensive use of protein stability analysis in pharmaceutical & biotechnology companies for drug discovery applications will drive the market during the forecast period.

By end user, the protein stability analysis market is segmented into pharmaceutical and biotechnology companies, contract research organization, and academic & research institutes. Pharmaceutical & biotechnology companies accounted for the largest share of the market in 2018. The large share of this segment is primarily due to the extensive use of protein stability analysis in pharmaceutical & biotechnology companies for drug discovery applications. Stringent regulations for pharmaceutical drug development and manufacturing are also supporting the adoption of protein stability analysis instruments in this end-user segment.

North America is expected to account for the largest market share during the forecast period.

The protein stability analysis market is segmented into four major regions, namely, North America, Europe, the Asia Pacific, and the rest of the World. The North American market is further divided into the US and Canada. In 2018, North America accounted for the largest share of the market, followed by Europe. The availability of funds for research from various public and private sector organizations and increasing research activities for drug development are the major factors driving the North American market for protein stability analysis.

Key Market Players

The major protein stability analysis vendors include PerkinElmer (US), Thermo Fisher Scientific, Inc. (US), Unchained Labs (US), NanoTemper Technologies (US), Waters Corporation (US), Agilent Technologies, Inc. (US), Shimadzu Corporation (Japan), GE Healthcare (US), Malvern Panalytical Ltd (Spectris company) (US), Enzo Life Sciences, Inc. (US), and Horiba, Ltd (Japan).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016-2024 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2024 |

|

Forecast units |

Values (USD Million) |

|

Segments covered |

By Product, Technique, End User and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Thermo Fisher Scientific, Inc. (US), Waters Corporation (US), Agilent Technologies, Inc. (US), PerkinElmer (US), Shimadzu Corporation (Japan), and GE Healthcare (US) 11 major players covered, in total |

This research report categorizes the protein stability analysis market based on Product, Technique, End User, and Region.

On the basis of Product, the protein stability analysis market is segmented as follows:

- Reagents and Assay Kits

- Instruments

- Consumable and Accessories

- Software

On the basis of technique, the protein stability analysis market is segmented as follows:

- Chromatography

- Spectroscopy

- Surface Plasma Resonance Imaging (SPRI)

- Differential Scanning Calorimetry (DSC)

- Differential Scanning Fluorimetry (DSF)

- Others

On the basis of end users, the protein stability analysis market is segmented as follows:

- Pharmaceutical & Biotechnology Companies

- Contract Research Organization

- Academic & Research Institutes

On the basis of region, the protein stability analysis market is segmented as follows:

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- RoE

- Asia Pacific

- RoW

Recent Developments:

- In 2019, Thermo Fisher Scientific collaborated with Genovis, for biological drug development to develop advanced workflows for the preparation, characterization, and monitoring of complex biotherapeutics using liquid chromatography-mass spectrometry (LC-MS).

- In 2018, Thermo Fisher Scientific opened its first Bioprocess Design Center in Shanghai, China to connect and collaborate with biologic developers to design bioprocessing solutions.

- PerkinElmer and the Genome Institute of Singapore opened a joint laboratory in Singapore to develop a state-of-the-art high-throughput screening (HTS) platform. This platform is used to predict therapeutic sensitivity in next-generation patient-derived tumor models with the goal of bringing precision oncology research results into the clinic.

Key questions addressed by the report:

- Who are the major market players in protein stability analysis market?

- What are the regional growth trends and the largest revenue-generating region for protein stability analysis market?

- What are the major drivers and opportunities of the protein stability analysis market?

- What are the major techniques used for protein stability analysis?

- What is the major end user for protein stability analysis?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Sources

2.1.2 Key Data From Secondary Sources

2.1.3 Primary Sources

2.1.3.1 Key Industry Insights

2.1.3.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Protein Stability Analysis: Market Overview

4.2 North America: Protein Stability Analysis Market, By Product (2018)

4.3 Regional Split: Protein Stability Analysis Market, By Country (2018)

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Adoption of Open Innovation Models in Pharmaceutical and Biotechnology Companies

5.2.1.2 Increasing Pharmaceutical Outsourcing

5.2.2 Restraints

5.2.2.1 High Cost of Protein Stability Analysis Instruments

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.4 Challenges

5.2.4.1 Shortage of Skilled Professionals

6 Protein Stability Analysis Market, By Product (Page No. - 33)

6.1 Introduction

6.2 Reagents and Assay Kits

6.2.1 Reagents and Assay Kits Play A Major Role in Protein Stability Analysis and Hold the Largest Market Share

6.3 Instruments

6.3.1 Demand for High-Throughput Systems is Increasing in Laboratories

6.4 Consumables and Accessories

6.4.1 Development of High-Quality Consumables and Accessories is Driving Market Growth

6.5 Software

6.5.1 Advancements in Software Likely to Drive Market

7 Protein Stability Analysis Market, By Technique (Page No. - 40)

7.1 Introduction

7.2 Chromatography

7.2.1 High Usage of HPLC and Size-Exclusion Chromatography for Protein Stability and Aggregate Analysis to Drive the Growth of This Segment

7.3 Spectroscopy

7.3.1 Advantages of Spectroscopic Methods to Drive Their Demand in Protein Stability Analysis

7.3.1.1 Mass Spectrometry

7.3.1.2 Dynamic Light Scattering

7.3.1.3 Circular Dichroism

7.3.1.4 Other Spectrometry Techniques

7.4 Surface Plasmon Resonance

7.4.1 Spr is Used for Getting Key Insights Into Biological Processes and Molecular Binding Mechanisms

7.5 Differential Scanning Calorimetry

7.5.1 Dsc is Widely Used in Drug Discovery and Development for the Characterization of Proteins

7.6 Differential Scanning Fluorimetry

7.6.1 Dsc is A Rapid and Inexpensive Screening Method to Identify Low-Molecular-Weight Ligands That Bind and Stabilize Purified Proteins

7.7 Other Techniques

8 Protein Stability Analysis Market, By End User (Page No. - 50)

8.1 Introduction

8.2 Pharmaceutical & Biotechnology Companies

8.2.1 Pharmaceutical & Biotechnology Companies are the Largest End Users of Protein Stability Analysis

8.3 Contract Research Organizations

8.3.1 Outsourcing of Analytical and Clinical Services Helps Pharma & Biopharma Companies to Mitigate RiskA Major Driver for Contract Research Organizations

8.4 Academic & Government Institutes

8.4.1 Government Support in the Form of Funding and Rising Number of Industry-Academia Collaborations Drives Market Growth in This End-User Segment

9 Protein Stability Analysis Market, By Region (Page No. - 56)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Growing R&D Investments in the US to Drive Market Growth

9.2.2 Canada

9.2.2.1 Increasing Government Fund for Research Activities Will Drive Market Growth

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Holds the Largest Share of the European Protein Stability Analysis Market

9.3.2 France

9.3.2.1 Availability of Funds for Research From Government and Private Organizations is Driving the Growth of This Market

9.3.3 UK

9.3.3.1 Over One-Third of the UKs Medical Biotech Sector is Engaged in Drug Discovery & Development

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 High Focus on Healthcare Modernization Will Create Growth Opportunities

9.5 Rest of the World

10 Competitive Landscape (Page No. - 79)

10.1 Introduction

10.2 Market Ranking Analysis, 2018

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Players

10.4 Competitive Situation and Trends

10.4.1 Product Launches

10.4.2 Collaborations, Partnerships, and Agreements

10.4.3 Expansion

10.4.4 Acquisition

11 Company Profiles (Page No. - 84)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Thermo Fisher Scientific

11.2 Agilent Technologies, Inc.

11.3 Perkinelmer, Inc.

11.4 Waters Corporation

11.5 Shimadzu Corporation

11.6 General Electric

11.7 Horiba, Ltd

11.8 Spectris PLC

11.9 Enzo Biochem, Inc.

11.10 Setaram Instrumentation

11.11 Unchained Labs

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 105)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (68 Tables)

Table 1 Protein Stability Analysis: Market, By Product, 20162024 (USD Million)

Table 2 Protein Stability Analysis: Market for Reagents and Assay Kits, By Region, 20162024 (USD Million)

Table 3 North America: Protein Stability Analysis: Market for Reagents and Assay Kits, By Country, 20162024 (USD Million)

Table 4 Protein Stability Analysis: Market for Instruments, By Region, 20162024 (USD Million)

Table 5 North America: Protein Stability Analysis: Market for Instrument, By Country, 20162024 (USD Million)

Table 6 Protein Stability Analysis: Market for Consumables and Accessories, By Region, 20162024 (USD Million)

Table 7 North America: Protein Stability Analysis: Market for Consumables and Accessories, By Country, 20162024 (USD Million)

Table 8 Market for Software, By Region, 20162024 (USD Million)

Table 9 North America: Market for Software Companies, By Country, 20162024 (USD Million)

Table 10 Market, By Technique, 20162024 (USD Million)

Table 11 Market for Chromatography, By Region, 20162024 (USD Million)

Table 12 North America: Market for Chromatography, By Country, 20162024 (USD Million)

Table 13 Market for Spectrometry, By Type, 20162024 (USD Million)

Table 14 Market for Spectrometry, By Region, 20162024 (USD Million)

Table 15 North America: Market for Spectrometry, By Country, 20162024 (USD Million)

Table 16 Market for Surface Plasmon Resonance, By Region, 20162024 (USD Million)

Table 17 North America: Market for Surface Plasmon Resonance, By Country, 20162024 (USD Million)

Table 18 Market for Differential Scanning Calorimetry, By Region, 20162024 (USD Million)

Table 19 North America: Market for Differential Scanning Calorimetry, By Country, 20162024 (USD Million)

Table 20 Market for Differential Scanning Fluorimetry, By Region, 20162024 (USD Million)

Table 21 North America: Market for Differential Scanning Fluorimetry, By Country, 20162024 (USD Million)

Table 22 Market for Other Techniques, By Region, 20162024 (USD Million)

Table 23 North America: Market for Other Techniques, By Country, 20162024 (USD Million)

Table 24 Market, By End User, 20162024 (USD Million)

Table 25 Market for Pharmaceutical & Biotechnology Companies, By Region, 20162024 (USD Million)

Table 26 North America: Market for Pharmaceutical & Biotechnology Companies, By Country, 20162024 (USD Million)

Table 27 Market for Contract Research Organizations, By Region, 20162024 (USD Million)

Table 28 North America: Market for Contract Research Organizations, By Country, 20162024 (USD Million)

Table 29 Market for Academic & Government Institutes, By Region, 20162024 (USD Million)

Table 30 North America: Market for Academic & Government Institutes, By Country, 20162024 (USD Million)

Table 31 Market, By Region, 20162024 (USD Million)

Table 32 North America: Market, By Country, 20162024 (USD Million)

Table 33 North America: Market, By Product, 20162024 (USD Million)

Table 34 North America: Market, By Technique, 20162024 (USD Million)

Table 35 North America: Market, By End User, 20162024 (USD Million)

Table 36 US: Market, By Product, 20162024 (USD Million)

Table 37 US: Market, By Technique, 20162024 (USD Million)

Table 38 US: Market, By End User, 20162024 (USD Million)

Table 39 Canada: Market, By Product, 20162024 (USD Million)

Table 40 Canada: Market, By Technique, 20162024 (USD Million)

Table 41 Canada: Market, By End User, 20162024 (USD Million)

Table 42 Europe: Market, By Country/Region, 20162024 (USD Million)

Table 43 Europe: Market, By Product, 20162024 (USD Million)

Table 44 Europe: Market, By Technique, 20162024 (USD Million)

Table 45 Europe: Market, By End User, 20162024 (USD Million)

Table 46 Germany: Market, By Product, 20162024 (USD Million)

Table 47 Germany: Market, By Technique, 20162024 (USD Million)

Table 48 Germany: Market, By End User, 20162024 (USD Million)

Table 49 France: Market, By Product, 20162024 (USD Million)

Table 50 France: Market, By Technique, 20162024 (USD Million)

Table 51 France: Market, By End User, 20162024 (USD Million)

Table 52 UK: Market, By Product, 20162024 (USD Million)

Table 53 UK: Market, By Technique, 20162024 (USD Million)

Table 54 UK: Market, By End User, 20162024 (USD Million)

Table 55 RoE: Market, By Product, 20162024 (USD Million)

Table 56 RoE: Market, By Technique, 20162024 (USD Million)

Table 57 RoE: Market, By End User, 20162024 (USD Million)

Table 58 APAC: Market, By Product, 20162024 (USD Million)

Table 59 APAC: Market, By Technique, 20162024 (USD Million)

Table 60 APAC: Market, By End User, 20162024 (USD Million)

Table 61 RoW: Market, By Product, 20162024 (USD Million)

Table 62 RoW: Market, By Technique, 20162024 (USD Million)

Table 63 RoW: Market, By End User, 20162024 (USD Million)

Table 64 Market Ranking, By Key Player (2018)

Table 65 Product Launches, 20162019

Table 66 Collaborations/Partnerships/Agreements, 20162019

Table 67 Expansion, 20162019

Table 68 Acquisition, 20162019

List of Figures (25 Figures)

Figure 1 Research Design

Figure 2 Primary Sources

Figure 3 Protein Stability Analysis Market: Top-Down Approach

Figure 4 Market: Bottom-Up Approach

Figure 5 Data Triangulation Methodology

Figure 6 Market, By Product, 2018 vs 2024 (USD Million)

Figure 7 Market Share, By Technique, 2018.

Figure 8 Market Share, By End User, 2018 vs 2024

Figure 9 Geographical Snapshot of the Protein Stability Analysis: Market

Figure 10 Growing Adoption of Open Innovation Models in Pharmaceutical and Biotechnology Companies is Driving the Market

Figure 11 Reagents and Assay Kits Segment Held the Largest Share of the Protein Stability Analysis: Market in North America

Figure 12 US Dominated the Protein Stability Analysis: Market in 2018

Figure 13 Protein Stability Analysis Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 North America: Protein Stability Analysis: Market Snapshot

Figure 15 Europe: Protein Stability Analysis: Market Snapshot

Figure 16 Competitive Leadership Mapping of the Protein Stability Analysis: Market

Figure 17 Thermo Fisher Scientific: Company Snapshot (2018)

Figure 18 Agilent Technologies, Inc.: Company Snapshot (2018)

Figure 19 Perkinelmer, Inc.: Company Snapshot (2018)

Figure 20 Waters Corporation: Company Snapshot (2018)

Figure 21 Shimadzu Corporation: Company Snapshot (2018)

Figure 22 General Electric: Company Snapshot (2018)

Figure 23 Horiba, Ltd: Company Snapshot (2017)

Figure 24 Spectris PLC: Company Snapshot (2018)

Figure 25 Enzo Biochem, Inc.: Company Snapshot (2018)

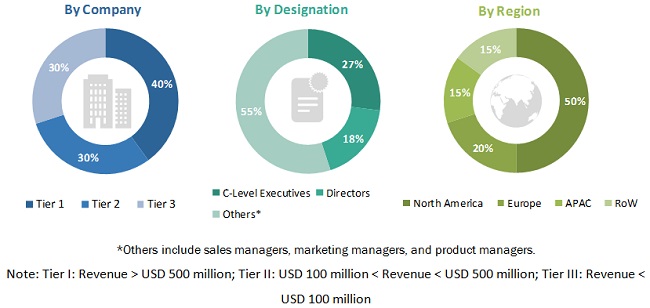

The study involved 4 major activities to estimate the current size of the protein stability analysis market. Exhaustive secondary research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, Forbes, and Dun & Bradstreet have been referred to, so as to identify and collect information useful for a technical, market-oriented, and commercial study of the protein stability analysis market. These secondary sources included annual reports, press releases & investor presentations of companies, World Health Organization (WHO), Food and Drug Administration (FDA), National Health Service (NHS), American Society for Clinical Laboratory Science (ASCLS), Centers for Disease Control and Prevention (CDC), National Center for Biotechnology Information (NCBI), and American Association for Clinical Chemistry (AACC). Secondary research was mainly used to obtain key information about the industrys supply chain, the total pool of key players, and market classification & segmentation, to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The protein stability analysis market includes several stakeholders such as raw material suppliers, manufacturers of protein stability analysis, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders from research institutes, pharma and biotech companies, and CROs. The primary sources from the supply side include key opinion leaders, distributors, and protein stability analysis manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the protein stability analysis market. These approaches were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- Key players have been identified through extensive secondary research.

- The protein stability analysis industrys value chain and market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes explained abovethe market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the protein stability analysis industry.

Report Objectives

- To define, describe, and forecast the protein stability analysis market by product, technique, end user, and region

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To forecast the size of the market segments in North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as product launches, acquisitions, collaborations, and expansions in the protein stability analysis market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of Asia Pacific protein stability analysis market, by key country

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Protein Stability Analysis Market