Protein Hydrolysis Enzymes Market by Source (Microorganisms, Animals, Plants), Method of Production (Fermentation and Extraction), Product, Application (Detergent, Pharmaceuticals, Food, Textiles & Leather) and Region - Global Forecast to 2027

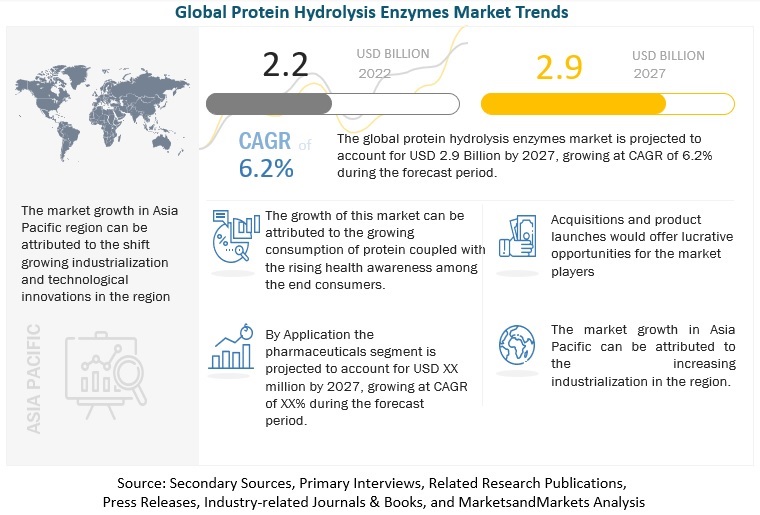

The protein hydrolysis enzymes market is predicted to grow at a 6.2% CAGR from 2022 to 2027, from USD 2.2 billion in 2022 to USD 2.9 billion in 2027. Protein hydrolysis Enzymes are used in various industrial applications such as detergents, pharmaceuticals, food, textiles & leather and other applications (feed industry, silver recovery, photography, chemical industries, and waste management). Protein hydrolysis enzymes are used for the extraction of valuable pharmaceuticals, the production of savory flavors, the production of functional peptides, meat tenderization, and protein solubilization, among others. The varied application of protein hydrolysis enzymes in multiple sectors is boosting the growth of the market.

Current trends in the protein hydrolysis enzymes market:

- Increasing demand for protein hydrolysis enzymes in food and beverage industries due to their ability to improve nutritional profile and functionality of food products.

- Rising use of protein hydrolysis enzymes in pharmaceuticals for the production of biologically active peptides.

- Growing interest in personalized medicine is expected to drive the use of protein hydrolysis enzymes in pharmaceutical industry. Increasing research and development activities to improve the efficiency and specificity of protein hydrolysis enzymes.

- The use of protein hydrolysis enzymes in animal feed is expected to increase due to their ability to improve digestibility and nutritional value of feed.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increase in Prevalence of Chronic Diseases and adoption of protein hydrolysis enzymes in the treatment of such diseases

The world is witnessing a rise in chronic diseases and conditions driven by the aging population and sedentary lifestyle. According to the World Health Organization (WHO), in 2019, chronic diseases contribute to 71% of the global deaths, of which 17.9 million are caused due to cardiovascular diseases, followed by cancer with 9.3 million, 4.1 million respiratory diseases, and diabetes with 1.5 million deaths. Protein hydrolysis enzymes in some food, such as papaya, bind cancer-causing toxins in the colon and separate them from the healthy colon cells. In the recent year, according to a study published by the World Journal of Gastroenterology, protein hydrolysis enzymes are involved in the destruction of cancer invasion and metastasis. Protein hydrolysis enzymes can potentially be used as therapeutic agents in the treatment of colorectal cancer.

Restraints: High Entry Barriers for the New Companies

Manufacturing enzymes require specialized knowledge and huge investments. One of the most prominent factors hindering the growth of new companies entering the market is to offer continuous and differentiated products according to the client’s requirements as these customized demands require real-time research and development capabilities and manufacturing flexibility. The other factors discouraging the entry of new players in the market are the highly technical nature of the business, reliance on R&D, and the dearth of skilled professionals with hands-on experience in the enzyme and biotechnology industry. The large companies such as Novozymes and DSM have proven capabilities, and their dominance discourages new players from entering the market.

Opportunities: Rise in Demand for Natural and Environment-friendly Products

The demand for natural and healthy food ingredients is flourishing, coupled with the growing awareness regarding health diseases associated with consuming artificial food additives. Using protein hydrolysis enzymes as alternatives to chemicals has proven to improve product quality and reduce environmental pollution. Advancements in protein hydrolysis enzymes will continue to facilitate their applications to provide a sustainable environment and improve the quality of human life. Besides sustainability, protein hydrolysis enzymes have hypo-allergenic properties, which is an additional health advantage. Protease is used in dairy to produce low-allergic products, makes yogurt products creamier, and hydrolyzes whey proteins, thus lowering the chances of allergic reactions. It is primarily used to reduce the allergic properties of cow milk products for infants. Brands in the food & beverage and pharmaceutical industries are looking for natural alternatives for use in their products. These companies are reformulating their products with natural ingredients to respond to the rising consumer needs. The EU Commission and the Food and Agriculture Organization of the United States (FAO) consider natural food additives safe to be used, raising the product’s credibility. Protein hydrolysis enzymes are derived from plants, animals, and microorganisms, providing lucrative growth opportunities.

Challenges: Side Effects Associated with Certain Protein Hydrolysis Enzymes

Some of the protein hydrolysis enzymes are found to have side effects on humans. High doses of bromelain lead to diarrhea, vomiting, nausea, and heavier than normal menstrual bleeding. Bromelain is found to have an antiplatelet effect on blood, leading to excessive bleeding. Excessive consumption or high dosage of papain are found to cause esophageal perforation, throat irritation or damage, stomach irritation, and allergic reaction. Moreover, trypsin can lead to side effects such as pain and burning sensation while used in wound healing. Various side effects associated with the consumption of protein hydrolysis enzymes are anticipated to challenge the market growth.

The microbial segment, by product dominates the market in terms of value.

The microbial segment held the largest share in 2021 and is anticipated to grow with the CAGR of 6.3% by 2027 as microbial protein hydrolysis enzymes are used in a wide range of applications such as industrial processes and products, and prominently in the food industry. Microbial protease enzymes are majorly used in the baking industry for the production bread, baked foods, crackers and waffles to reduce the mixing time, decrease dough consistency and uniformity, regulate the gluten strength in bread and to improve the texture and flavor. Moreover, it can also use to improve extensibility and strength of the dough. These various applications in the food industry, dominated the microbial segment in the protein hydrolysis enzymes market.

The alkaline proteases, by microbial product segment to hold the largest share by 2027

The alkaline protease segment is expected to account for the largest share during the forecast period, because of diverse range of applications in detergents, pharmaceutical, food and textile industry. They also have applications in silver recovery from X-rays, and feed industry. Due to widespread applications many players have increased the production at commercial levels. Bacillus Species are most widely used in many industries. Moreover, discovering new strains with unique properties and substantial activity are holding the largest share in the market.

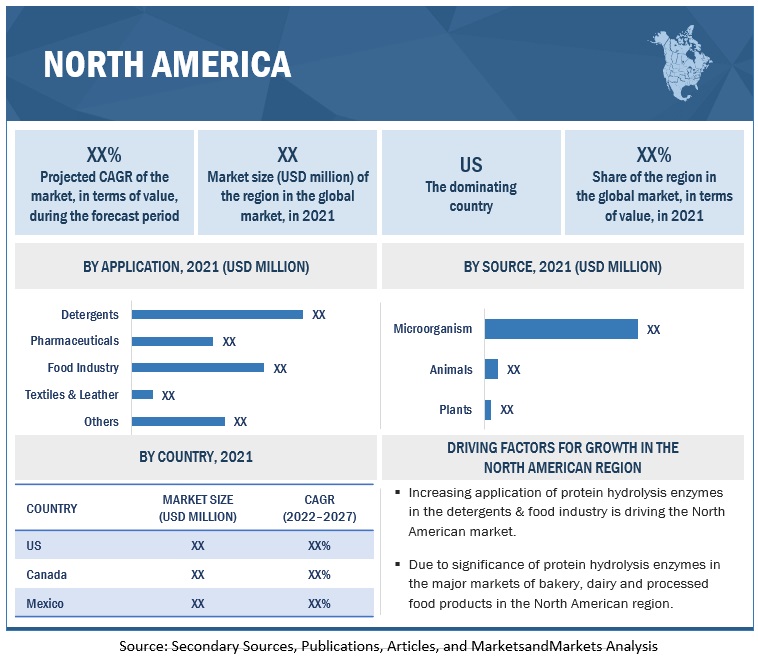

North America: Enzyme Market Snapshot

To know about the assumptions considered for the study, download the pdf brochure

North America dominated the protein hydrolysis enzymes market, and is projected to grow with a CAGR of 5.07% during the forecast period (2022 - 2027)

The North American protein hydrolysis enzymes market is led by their wide industrial applications. Technological advancements have made protease enzymes available for a wide range of applications such as in detergents, pharmaceuticals, food, textiles & leather, and other applications.

North America is the leading market for the protein hydrolysis enzymes. The market for protein hydrolysis enzymes has grown in response to the rising demand for meat and fortified foods, particularly in the region. The US pharmaceutical industry is the largest in the world in drug development and production. In 2019, the US pharmaceutical market accounted for 48% of the global market. The presence of growing application markets drives the demand for various enzymes, including protein hydrolysis enzymes. DuPont (US) and other important regional players including Creative Enzymes (US), Specialty Enzymes & Biotechnologies (US), ENMEX (Mexico) have contributed to the expansion of the market.

Moreover, companies from developed regions such as North America have largely invested in enzyme-related technologies to increase their production and productivity. For instance, in 2019, Dyadic International Inc. collaborated with an animal health company. This collaboration helped in demonstrating the C1 technology for the expression and production of therapeutic proteins for dealing with companion and farm animal health diseases.

Key Market Players

The key players in this market include Novozymes (Denmark), Associated British Foods (UK), DSM (Netherlands), DuPont (US), BASF (Germany), Advanced Enzymes Technologies (India), Dyadic International (US), and Chr. Hansen (Denmark) among others.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 2.2 billion |

|

Revenue forecast in 2027 |

USD 2.9 billion |

|

Growth rate |

CAGR of 6.2% from 2022-2027 |

|

Market size available for years |

2022-2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Application, Region, Product, Source |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Key companies profiled |

Novozymes (Denmark), Associated British Foods (UK), DSM (Netherlands), DuPont (US), BASF (Germany), Advanced Enzymes Technologies (India), Dyadic International (US), and Chr. Hansen (Denmark) |

|

Major Drivers |

|

Target Audience:

- Enzyme manufacturing companies

- Intermediate suppliers such as traders and distributors of enzymes

- Government and research organizations

- Research officers

- Associations, regulatory bodies, and other industry-related bodies

Report Scope:

Protein Hydrolysis Enzymes market:

Protein Hydrolysis Enzymes Market, By Source

- Microorganisms

- Animals

- Plants

Protein Hydrolysis Enzymes Market, By Method of Production

- Extraction

- Fermentation

Protein Hydrolysis Enzymes Market, By product

-

Animal Product

- Trypsin

- Pepsin

- Renin

- Others

-

Plant Product

- Papain

- Bromelain

- Others (Keratinases and Ficin)

-

Microbial Product

- Alkaline Protease

- Acid Protease

- Neutral Protease

- Others

Protein Hydrolysis Enzymes Market, By Application

- Detergents

- Pharmaceuticals

- Food

- Textiles & Leather

- Other Applications

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In April 2021, Biocatalysts launched a new enzyme product to extend the range in dairy protein market. The enzyme is used for Casein Hydrolysis.

- In November 2021, Biocatalysts launched a new product named “Promod 324L” for the pet food industry.

- In April 2019, Chr. Hansen launched an innovative coagulant product named CHY-MAX Supreme. This product enables modern cheesemakers to meet customer demand for better functionality and convenient cheese formats.

Frequently Asked Questions (FAQ):

What is the expected market size for the global protein hydrolysis enzymes market in the coming years?

The protein hydrolysis enzymes market is poised for sustained growth over the next few years, with a projected CAGR of 6.2% from 2022 to 2027. This anticipated expansion is forecast to elevate the market value to USD 2.9 billion by 2027, marking a substantial increase from the USD 2.2 billion recorded in 2022.

What is the estimated growth rate (CAGR) of the global protein hydrolysis enzymes market for the next five years?

The global protein hydrolysis enzymes market is set to grow at a moderate rate, representing a CAGR of 6.2% during the forecast period.

What are the major revenue pockets in the protein hydrolysis enzymes market currently?

North America dominated the protein hydrolysis enzymes market, and is projected to grow with a CAGR of 5.07% during the forecast period (2022 - 2027)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

FIGURE 2 REGION SEGMENTATION

1.5 YEARS CONSIDERED

FIGURE 3 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 4 PROTEIN HYDROLYSIS ENZYMES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE ANALYSIS

FIGURE 6 KEY ECONOMIES BASED ON GDP, 2019–2021 (USD TRILLION)

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Research & development of protein hydrolysis enzymes

2.3 MARKET SIZE ESTIMATION

2.3.1 APPROACH ONE (BASED ON APPLICATIONS, BY REGION)

FIGURE 7 APPROACH ONE (BASED ON APPLICATIONS, BY REGION)

2.3.2 APPROACH TWO (BASED ON GLOBAL MARKET)

FIGURE 8 APPROACH TWO (BASED ON GLOBAL MARKET)

2.4 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

TABLE 2 PROTEIN HYDROLYSIS ENZYMES MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 10 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 PROTEIN HYDROLYSIS ENZYMES MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES FOR PROTEIN HYDROLYSIS ENZYMES MARKET PLAYERS

FIGURE 13 GROWING CONSUMPTION OF PROTEIN COUPLED WITH RISING HEALTH AWARENESS AMONG END CONSUMERS TO DRIVE MARKET

4.2 PROTEIN HYDROLYSIS ENZYMES MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

FIGURE 14 US WAS LARGEST MARKET GLOBALLY FOR PROTEIN HYDROLYSIS ENZYMES IN 2021

4.3 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION & COUNTRY

FIGURE 15 CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2022

4.4 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION

FIGURE 16 PHARMACEUTICALS TO DOMINATE PROTEIN HYDROLYSIS ENZYMES MARKET

4.5 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE

FIGURE 17 MICROORGANISM-BASED ENZYMES TO DOMINATE PROTEIN HYDROLYSIS ENZYMES MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MARKET DYNAMICS: PROTEIN HYDROLYSIS ENZYMES MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in consumption of protein, coupled with rise in health awareness among end consumers

FIGURE 19 GLOBAL PER CAPITA PROTEIN CONSUMPTION, BY REGION, 2000–2019 (GRAM/CAPITA)

5.2.1.2 Multiple applications in food sector

FIGURE 20 GLOBAL PER CAPITA MEAT CONSUMPTION, BY COUNTRY, 2021 (KILOGRAM/CAPITA)

TABLE 3 IMPORT AND EXPORT OF BAKERY PRODUCTS, BY COUNTRY, 2020 (USD BILLION)

5.2.1.3 Increase in prevalence of chronic diseases

FIGURE 21 NEW CANCER CASES, BY CANCER TYPE, 2020 (MILLION)

5.2.2 RESTRAINTS

5.2.2.1 Varying government regulations and standards

5.2.2.2 High entry barriers for new companies

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand for natural and environment-friendly products

5.2.4 CHALLENGES

5.2.4.1 Side effects associated with certain proteases

6 INDUSTRY TRENDS (Page No. - 64)

6.1 INTRODUCTION

6.2 TRENDS IMPACTING CUSTOMERS’ BUSINESSES

6.3 VALUE CHAIN ANALYSIS

FIGURE 22 RESEARCH AND ENZYME DEVELOPMENT CONTRIBUTES MAXIMUM VALUE TO OVERALL WORTH OF PROTEIN HYDROLYSIS ENZYMES

6.4 TRADE ANALYSIS

6.4.1 ENZYMES

TABLE 4 TOP 10 EXPORTERS AND IMPORTERS OF ENZYMES, 2021 (USD THOUSAND)

6.5 TECHNOLOGY ANALYSIS

6.6 PATENT ANALYSIS

TABLE 5 LIST OF IMPORTANT PATENTS FOR PROTEIN HYDROLYSIS ENZYMES MARKET, 2019–2022

6.7 ECOSYSTEM MAP & SUPPLY CHAIN ANALYSIS

FIGURE 23 ENZYME DEVELOPMENT AND PRODUCTION PLAY A VITAL ROLE IN SUPPLY CHAIN

6.7.1 PROTEIN HYDROLYSIS ENZYMES: MARKET MAP

FIGURE 24 PROTEIN HYDROLYSIS ENZYMES ECOSYSTEM MAP

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PROTEIN HYDROLYSIS ENZYMES MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PROTEIN HYDROLYSIS ENZYMES MARKET: PORTER’S FIVE FORCES ANALYSIS

6.8.1 THREAT FROM NEW ENTRANTS

6.8.2 THREAT FROM SUBSTITUTES

6.8.3 BARGAINING POWER OF SUPPLIERS

6.8.4 BARGAINING POWER OF BUYERS

6.8.5 INTENSITY OF COMPETITIVE RIVALRY

6.9 CASE STUDIES

6.9.1 DSM AND NOVOZYMES COLLABORATED TO ADDRESS GROWING FEED RAW MATERIAL PRICES

6.10 PRICING ANALYSIS

TABLE 7 AVERAGE SELLING PRICES OF PROTEIN HYDROLYSIS ENZYMES, BY APPLICATION, 2018–2022 (USD/KG)

TABLE 8 AVERAGE SELLING PRICES OF PROTEIN HYDROLYSIS ENZYMES, BY REGION, 2018–2022 (USD/KG)

6.11 TARIFF AND REGULATORY LANDSCAPE

6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.11.2 NORTH AMERICA

6.11.2.1 US

TABLE 10 PROTEASE PREPARATIONS APPROVED AS FOOD ADDITIVES LISTED IN 21 CFR 173 AND AFFIRMED AS GRAS IN 21 CFR 184

6.11.2.2 Canada

TABLE 11 CANADA: LIST OF PERMITTED FOOD ENZYMES

6.11.3 EUROPE

6.11.4 ASIA PACIFIC

6.11.4.1 China

6.11.4.2 India

6.11.4.3 Australia & New Zealand

6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING MICROBIAL PRODUCTS

TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MICROBIAL PRODUCTS

6.12.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 13 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

6.13 KEY CONFERENCES & EVENTS

TABLE 14 PROTEIN HYDROLYSIS ENZYMES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

7 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE (Page No. - 80)

7.1 INTRODUCTION

TABLE 15 TYPES OF PROTEASES ALONG WITH FUNCTIONAL GROUPS AND THEIR SOURCES

FIGURE 28 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2021 VS. 2027 (USD MILLION)

TABLE 16 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 17 PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

7.2 MICROORGANISMS

7.2.1 SUSTAINABILITY OFFERED TO DRIVE DEMAND FOR MICROORGANISM-BASED ENZYMES

TABLE 18 MICROORGANISM-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 MICROORGANISM-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ANIMALS

7.3.1 TRYPSIN

7.3.1.1 Significance in hydrolysis of food proteins to fuel demand

7.3.2 CHYMOTRYPSIN

7.3.2.1 Applications in pharmaceutical sector to drive demand

7.3.3 PEPSIN

7.3.3.1 Rise in demand from food, pharmaceutical, and leather industries

7.3.4 PANCREATIN

7.3.4.1 Demand in treating pancreatic deficiencies to propel growth

TABLE 20 ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 PLANTS

7.4.1 PAPAIN

7.4.1.1 Wide range of industrial applications to boost market traction

7.4.2 BROMELAIN

7.4.2.1 Extensive application in food industry to drive segment

7.4.3 OTHER PLANT PRODUCTS

TABLE 22 PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2022–2027 (USD MILLION)

8 PROTEIN HYDROLYSIS ENZYMES MARKET, BY METHOD OF PRODUCTION (Page No. - 88)

8.1 INTRODUCTION

8.2 FERMENTATION

8.2.1 INCREASED PRODUCTION IN SHORTER PERIOD TO BOOST FERMENTATION METHOD

FIGURE 29 PRODUCTION OF ENZYMES BY FERMENTATION

TABLE 24 USE OF PROTEASES IN BREWING

8.3 EXTRACTION

8.3.1 APPLICATION PRODUCING ENZYMES FROM ANIMAL AND PLANTS TO DRIVE SEGMENT

9 PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT (Page No. - 91)

9.1 INTRODUCTION

FIGURE 30 PROTEIN HYDROLYSIS ENZYMES MARKET, BY MICROBIAL PRODUCTS, 2021 VS. 2027 (USD MILLION)

TABLE 25 ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 26 ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 27 PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 28 PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 29 MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 30 PROTEIN HYDROLYSIS ENZYMES MARKET, BY MICROBIAL PRODUCTS, 2022–2027 (USD MILLION)

9.2 ANIMAL PRODUCTS

9.2.1 TRYPSIN

9.2.1.1 Higher demand from leather industry to drive segment growth

TABLE 31 TRYPSIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 TRYPSIN MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2.2 PEPSIN

9.2.2.1 Use as supplement in treating anemic conditions to drive segment

TABLE 33 PEPSIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 PEPSIN MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2.3 RENIN

9.2.3.1 Applications in cheese making to drive segment growth

TABLE 35 RENIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 RENIN MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2.4 OTHER ANIMAL PRODUCTS

TABLE 37 APPLICATIONS OF DIFFERENT PROTEIN HYDROLYSIS ENZYMES IN ANIMALS

TABLE 38 OTHER ANIMAL PRODUCTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 OTHER ANIMAL PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 PLANT PRODUCTS

9.3.1 PAPAIN

9.3.1.1 Use in cell isolation procedures across industries to drive segment

TABLE 40 PAPAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 PAPAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3.2 BROMELAIN

9.3.2.1 Growth in research and innovation for applications in pharmaceutical sector

TABLE 42 BROMELAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 BROMELAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3.3 OTHER PLANT PRODUCTS

TABLE 44 OTHER PLANT PRODUCTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 OTHER PLANT PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 MICROBIAL PRODUCTS

9.4.1 ALKALINE PROTEASES

9.4.1.1 Growth in R&D on alkaline proteases to boost segment growth

TABLE 46 ALKALINE PROTEASES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 ALKALINE PROTEASES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4.2 ACID PROTEASES

9.4.2.1 Acid proteases used to enhance bioethanol yields

TABLE 48 ACID PROTEASES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 ACID PROTEASES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4.3 NEUTRAL PROTEASES

9.4.3.1 Neutral proteases offer broad range of substrate specificity and variety

TABLE 50 NEUTRAL PROTEASES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 NEUTRAL PROTEASES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4.4 OTHER MICROBIAL PRODUCTS

TABLE 52 OTHER MICROBIAL PRODUCTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 OTHER MICROBIAL PRODUCTS MARKET, BY REGION, 2022–2027 (USD MILLION)

10 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION (Page No. - 106)

10.1 INTRODUCTION

FIGURE 31 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2021 VS. 2027 (USD MILLION)

FIGURE 32 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2021 VS. 2027 (METRIC TON)

TABLE 54 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 55 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 56 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (METRIC TON)

TABLE 57 PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

10.2 DETERGENTS

10.2.1 HIGH ACTIVITY AND STABILITY OVER A WIDE RANGE OF TEMPERATURES TO BOOST APPLICATIONS IN DETERGENTS

TABLE 58 DETERGENT APPLICATIONS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 DETERGENT APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 60 DETERGENT APPLICATIONS MARKET, BY REGION, 2018–2021 (METRIC TON)

TABLE 61 DETERGENT APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.3 PHARMACEUTICALS

10.3.1 DEMAND FOR ALTERNATIVES TO TRADITIONAL ANTIBIOTICS TO BOOST SEGMENT

TABLE 62 PHARMACEUTICAL APPLICATIONS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 PHARMACEUTICAL APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 64 PHARMACEUTICAL APPLICATIONS MARKET, BY REGION, 2018–2021 (METRIC TON)

TABLE 65 PHARMACEUTICAL APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.4 FOOD

10.4.1 DEMAND FOR IMPROVED FLAVOR AND TEXTURE OF FOOD TO FUEL SEGMENT GROWTH

TABLE 66 APPLICATIONS OF VARIOUS PROTEASES IN FOOD

TABLE 67 FOOD APPLICATIONS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 FOOD APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 69 FOOD APPLICATIONS MARKET, BY REGION, 2018–2021 (METRIC TON)

TABLE 70 FOOD APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.5 TEXTILES & LEATHER

10.5.1 NEED FOR DECREASED PROCESSING TIME AND ENHANCED MATERIAL QUALITY TO PROPEL SEGMENT

TABLE 71 TEXTILES & LEATHER APPLICATIONS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 TEXTILES & LEATHER APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 73 TEXTILES & LEATHER APPLICATIONS MARKET, BY REGION, 2018–2021 (METRIC TON)

TABLE 74 TEXTILES & LEATHER APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.6 OTHER APPLICATIONS

10.6.1 FEED

10.6.2 SILVER RECOVERY

TABLE 75 OTHER APPLICATIONS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 OTHER APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 77 OTHER APPLICATIONS MARKET, BY REGION, 2018–2021 (METRIC TON)

TABLE 78 OTHER APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

11 PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION (Page No. - 119)

11.1 INTRODUCTION

TABLE 79 PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 81 PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2018–2021 (METRIC TON)

TABLE 82 PROTEIN HYDROLYSIS ENZYMES MARKET, BY REGION, 2022–2027 (METRIC TON)

FIGURE 33 PROTEIN HYDROLYSIS ENZYMES MARKET, BY KEY COUNTRY, CAGR (2022–2027)

11.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: ENZYMES MARKET SNAPSHOT

TABLE 83 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018–2021 (METRIC TON)

TABLE 86 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022–2027 (METRIC TON)

TABLE 87 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 90 NORTH AMERICA: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 94 NORTH AMERICA: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (METRIC TON)

TABLE 98 NORTH AMERICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

11.2.1 US

11.2.1.1 High demand from textile and pharmaceutical sectors to boost market

TABLE 99 US: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 100 US: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 101 US: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 102 US: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Regulatory approval of proteases from Bacillus species in food applications to augment market growth

TABLE 103 CANADA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 104 CANADA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 105 CANADA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 106 CANADA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Growing demand from food industry to boost market

TABLE 107 MEXICO: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 108 MEXICO: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 109 MEXICO: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 110 MEXICO: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3 EUROPE

TABLE 111 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 112 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 113 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018–2021 (METRIC TON)

TABLE 114 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022–2027 (METRIC TON)

TABLE 115 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 116 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 117 EUROPE: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 118 EUROPE: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 120 EUROPE: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 121 EUROPE: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 122 EUROPE: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 123 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 124 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 125 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (METRIC TON)

TABLE 126 EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

11.3.1 GERMANY

11.3.1.1 Rise in demand from baking industry in Germany

TABLE 127 GERMANY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 128 GERMANY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 129 GERMANY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 130 GERMANY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Extensive application of proteases in French clothing industry

TABLE 131 FRANCE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 132 FRANCE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 133 FRANCE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 134 FRANCE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.3 UK

11.3.3.1 Varied applications in food industry to influence market growth

TABLE 135 UK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 136 UK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 137 UK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 138 UK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.4 SPAIN

11.3.4.1 Rise in demand for meat and meat products to boost demand

TABLE 139 SPAIN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 140 SPAIN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 141 SPAIN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 142 SPAIN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.5 ITALY

11.3.5.1 Multifunctionality of proteases to boost applications in Italian textile & leather industry

TABLE 143 ITALY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 144 ITALY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 145 ITALY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 146 ITALY: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.6 DENMARK

11.3.6.1 Increased demand from food processing industries to drive market

TABLE 147 DENMARK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 148 DENMARK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 149 DENMARK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 150 DENMARK: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 151 REST OF EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 152 REST OF EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 153 REST OF EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 154 REST OF EUROPE: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 155 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018–2021 (METRIC TON)

TABLE 158 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022–2027 (METRIC TON)

TABLE 159 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 161 ASIA PACIFIC: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 162 ASIA PACIFIC: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 163 ASIA PACIFIC: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 164 ASIA PACIFIC: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 165 ASIA PACIFIC: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 166 ASIA PACIFIC: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 167 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 168 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 169 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (METRIC TON)

TABLE 170 ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

11.4.1 CHINA

11.4.1.1 Rise in investments in R&D to drive Chinese market growth

TABLE 171 CHINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 172 CHINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 173 CHINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 174 CHINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Demand from pharmaceutical sector to drive Indian market

TABLE 175 INDIA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 176 INDIA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 177 INDIA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 178 INDIA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Advancements in pharmaceutical sector to boost market growth

TABLE 179 JAPAN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 180 JAPAN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 181 JAPAN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 182 JAPAN: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Innovations in healthcare with incorporation of proteases to drive market growth

TABLE 183 SOUTH KOREA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 184 SOUTH KOREA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 185 SOUTH KOREA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 186 SOUTH KOREA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.5 AUSTRALIA & NEW ZEALAND

11.4.5.1 Increase in demand for alcohol and winemaking to propel market demand

TABLE 187 AUSTRALIA & NEW ZEALAND: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 188 AUSTRALIA & NEW ZEALAND: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 189 AUSTRALIA & NEW ZEALAND: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 190 AUSTRALIA & NEW ZEALAND: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 191 REST OF ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 192 REST OF ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 193 REST OF ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 194 REST OF ASIA PACIFIC: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.5 REST OF THE WORLD (ROW)

TABLE 195 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 196 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 197 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2018–2021 (METRIC TON)

TABLE 198 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY COUNTRY, 2022–2027 (METRIC TON)

TABLE 199 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 200 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 201 ROW: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 202 ROW: ANIMAL-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 203 ROW: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 204 ROW: PLANT-BASED PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 205 ROW: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 206 ROW: MICROBIAL PROTEIN HYDROLYSIS ENZYMES MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 207 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 208 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 209 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (METRIC TON)

TABLE 210 ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

11.5.1 BRAZIL

11.5.1.1 Government policies for biofuel production to drive demand

TABLE 211 BRAZIL: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 212 BRAZIL: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 213 BRAZIL: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 214 BRAZIL: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Rise in demand from dairy industry to propel market growth

TABLE 215 ARGENTINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 216 ARGENTINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 217 ARGENTINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 218 ARGENTINA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.3 SOUTH AFRICA

11.5.3.1 Growth potential of South African pharmaceutical and detergent industry to drive market

TABLE 219 SOUTH AFRICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 220 SOUTH AFRICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 221 SOUTH AFRICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 222 SOUTH AFRICA: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.4 OTHERS IN ROW

TABLE 223 OTHERS IN ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 224 OTHERS IN ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 225 OTHERS IN ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 226 OTHERS IN ROW: PROTEIN HYDROLYSIS ENZYMES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 179)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 35 MARKET EVALUATION FRAMEWORK, JANUARY 2019–SEPTEMBER 2022

12.3 MARKET SHARE ANALYSIS

TABLE 227 PROTEIN HYDROLYSIS ENZYMES MARKET SHARE ANALYSIS, 2021

12.4 RANKING OF KEY PLAYERS

12.5 REVENUE ANALYSIS OF MAJOR MARKET PLAYERS

FIGURE 36 REVENUE ANALYSIS OF MAJOR MARKET PLAYERS, 2019–2021 (USD BILLION)

12.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 37 KEY PLAYERS COMPANY EVALUATION QUADRANT, 2022

12.6.4.1 COMPETITIVE BENCHMARKING

TABLE 228 PROTEIN HYDROLYSIS ENZYMES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY SOURCE

TABLE 229 PROTEIN HYDROLYSIS ENZYMES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY PRODUCT

TABLE 230 PROTEIN HYDROLYSIS ENZYMES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY APPLICATION

TABLE 231 PROTEIN HYDROLYSIS ENZYMES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

TABLE 232 PROTEIN HYDROLYSIS ENZYMES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, OVERALL FOOTPRINT

12.7 STARTUP EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 STARTING BLOCKS

12.7.3 RESPONSIVE COMPANIES

12.7.4 DYNAMIC COMPANIES

FIGURE 38 SME/STARTUP EVALUATION QUADRANT, 2022

12.7.4.1 COMPETITIVE BENCHMARKING

TABLE 233 PROTEIN HYDROLYSIS ENZYMES MARKET: DETAILED LIST OF SMES

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 234 PROTEIN HYDROLYSIS ENZYMES MARKET: PRODUCT LAUNCHES, 2019–2021

12.8.2 DEALS

TABLE 235 PROTEIN HYDROLYSIS ENZYMES MARKET: DEALS, 2019–2022

12.8.3 OTHER DEVELOPMENTS

TABLE 236 PROTEIN HYDROLYSIS ENZYMES MARKET: OTHER DEVELOPMENTS, 2020

13 COMPANY PROFILES (Page No. - 194)

(Business overview, Products offered, Recent Developments, MNM view)*

13.1 KEY PLAYERS

13.1.1 NOVOZYMES

TABLE 237 NOVOZYMES: BUSINESS OVERVIEW

FIGURE 39 NOVOZYMES: COMPANY SNAPSHOT

TABLE 238 NOVOZYMES: PRODUCTS OFFERED

TABLE 239 NOVOZYMES: PRODUCT LAUNCHES

TABLE 240 NOVOZYMES: DEALS

13.1.2 ASSOCIATED BRITISH FOODS

TABLE 241 ASSOCIATED BRITISH FOODS: BUSINESS OVERVIEW

FIGURE 40 ASSOCIATED BRITISH FOODS: COMPANY SNAPSHOT

TABLE 242 ASSOCIATED BRITISH FOODS: PRODUCTS OFFERED

TABLE 243 ASSOCIATED BRITISH FOODS: PRODUCT LAUNCHES

TABLE 244 ASSOCIATED BRITISH FOODS: DEALS

13.1.3 DSM

TABLE 245 DSM: BUSINESS OVERVIEW

FIGURE 41 DSM: COMPANY SNAPSHOT

TABLE 246 DSM: PRODUCTS OFFERED

TABLE 247 DSM: DEALS

13.1.4 DUPONT

TABLE 248 DUPONT: BUSINESS OVERVIEW

FIGURE 42 DUPONT: COMPANY SNAPSHOT

TABLE 249 DUPONT: PRODUCTS OFFERED

13.1.5 BASF SE

TABLE 250 BASF SE: BUSINESS OVERVIEW

FIGURE 43 BASF SE: COMPANY SNAPSHOT

TABLE 251 BASF SE: PRODUCTS OFFERED

TABLE 252 BASF SE: DEALS

TABLE 253 BASF SE: OTHER DEVELOPMENTS

13.1.6 ADVANCED ENZYME TECHNOLOGIES

TABLE 254 ADVANCED ENZYME TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 44 ADVANCED ENZYME TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 255 ADVANCED ENZYME TECHNOLOGIES: PRODUCTS OFFERED

13.1.7 DYADIC INTERNATIONAL, INC.

TABLE 256 DYADIC INTERNATIONAL, INC.: BUSINESS OVERVIEW

FIGURE 45 DYADIC INTERNATIONAL, INC.: COMPANY SNAPSHOT

TABLE 257 DYADIC INTERNATIONAL, INC.: PRODUCTS OFFERED

TABLE 258 DYADIC INTERNATIONAL, INC.: DEALS

13.1.8 CHR. HANSEN HOLDING A/S

TABLE 259 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

FIGURE 46 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

TABLE 260 CHR. HANSEN HOLDING A/S: PRODUCTS OFFERED

TABLE 261 CHR. HANSEN HOLDING A/S: PRODUCT LAUNCHES

13.1.9 AMANO ENZYME

TABLE 262 AMANO ENZYME: BUSINESS OVERVIEW

TABLE 263 AMANO ENZYME: PRODUCTS OFFERED

TABLE 264 AMANO ENZYME: PRODUCT LAUNCHES

13.1.10 SPECIALTY ENZYMES & BIOTECHNOLOGIES

TABLE 265 SPECIALTY ENZYMES & BIOTECHNOLOGIES: BUSINESS OVERVIEW

TABLE 266 SPECIALTY ENZYMES & BIOTECHNOLOGIES: PRODUCTS OFFERED

13.1.11 CREATIVE ENZYMES

TABLE 267 CREATIVE ENZYMES: BUSINESS OVERVIEW

TABLE 268 CREATIVE ENZYMES: PRODUCTS OFFERED

13.1.12 JIANGSU BOLI BIOPRODUCTS CO., LTD

TABLE 269 JIANGSU BOLI BIOPRODUCTS CO., LTD: BUSINESS OVERVIEW

TABLE 270 JIANGSU BOLI BIOPRODUCTS CO., LTD: PRODUCTS OFFERED

13.1.13 BIOCATALYSTS

TABLE 271 BIOCATALYSTS: BUSINESS OVERVIEW

TABLE 272 BIOCATALYSTS: PRODUCTS OFFERED

TABLE 273 BIOCATALYSTS: PRODUCT LAUNCHES

13.1.14 AUMGENE BIOSCIENCES

TABLE 274 AUMGENE BIOSCIENCES: BUSINESS OVERVIEW

TABLE 275 AUMGENE BIOSCIENCES: PRODUCTS OFFERED

13.1.15 MERCK KGAA

TABLE 276 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 47 MERCK KGAA: COMPANY SNAPSHOT

TABLE 277 MERCK KGAA: PRODUCTS OFFERED

13.1.16 BIOSEUTICA

TABLE 278 BIOSEUTICA: BUSINESS OVERVIEW

TABLE 279 BIOSEUTICA: PRODUCTS OFFERED

13.1.17 ROSSARI BIOTECH LIMITED

TABLE 280 ROSSARI BIOTECH LIMITED: BUSINESS OVERVIEW

TABLE 281 ROSSARI BIOTECH LIMITED: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 231)

14.1 INTRODUCTION

TABLE 282 ADJACENT MARKETS TO THE PROTEIN HYDROLYSIS ENZYMES MARKET

14.2 ENZYMES MARKET

14.2.1 MARKET DEFINITION

14.2.2 MARKET OVERVIEW

TABLE 283 ENZYMES MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

14.3 FOOD ENZYMES MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 284 FOOD ENZYMES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 285 FOOD ENZYMES MARKET, BY TYPE, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 234)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

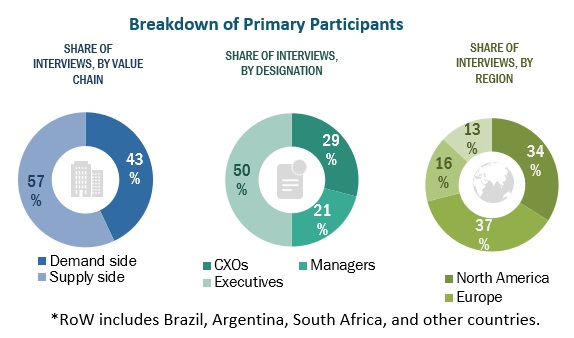

This research study involved the extensive use of secondary sources directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of protein hydrolysis enzymes market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the protein hydrolysis enzymes market.

To know about the assumptions considered for the study, download the pdf brochure

Report Objectives

- Determining and projecting the size of the protein hydrolysis enzymes market, with respect to source, method of production, product, application, and regional markets, over a five-year period, ranging from 2022 to 2027

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- Strategically identifying and profiling the key players and comprehensively analyzing their core competencies in each segment in the protein hydrolysis enzymes market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe includes Switzerland, Poland, Sweden, and Hungary.

- Further breakdown of the Rest of Asia Pacific into Philippines, Vietnam, Malaysia, Thailand, and Indonesia.

- Rest of the World (RoW) include Brazil, Argentina, South Africa and Other Countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Protein Hydrolysis Enzymes Market