Levulinic Acid Market by Application (Plasticizers, Pharmaceuticals & Cosmetics), Technology (Acid Hydrolysis, Biofine), and Region (North America, Europe, Asia-Pacific and Rest of the World) - Global Forecast to 2021

[113 Pages Report] The levulinic acid market is projected to reach USD 32.5 Million by 2021, at a CAGR of 14.0% between 2016 and 2021.

The objectives of this study are:

- To define, describe, and forecast the levulinic acid market on the basis of application and region

- To estimate and forecast the levulinic acid market size, in terms of value (USD million) and volume (tons)

- To estimate and forecast the levulinic acid market on the basis of application in different regions, namely, North America, Europe, Asia-Pacific, and Rest of the World

- To identify and analyze drivers, restraints, opportunities, and challenges influencing the levulinic acid market

- To analyze region-specific trends in North America, Europe, Asia-Pacific, and Rest of the World

- To strategically profile key market players and analyze their core competencies

- To track and analyze recent market developments and competitive strategies in the levulinic acid market, such as partnerships, agreements, collaborations, mergers & acquisitions, new product developments, and expansions

Years considered for the study are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2021

- Forecast Period – 2016 to 2021

For company profiles, 2015 has been considered as the base year. In cases where information was not available for the base year, the years prior to it have been considered.

Research Methodology

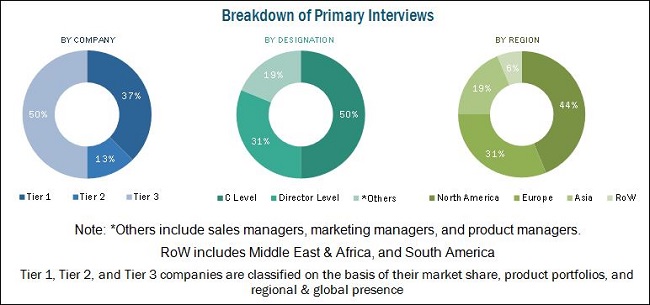

This study aims to estimate the levulinic acid market size for 2016 and projects its demand till 2021. It also provides a detailed qualitative and quantitative analysis of the levulinic acid market. Various secondary sources that include directories, industry journals, various associations (such as, ICTA International Chemical Trade Association, European Renewable Resources and Materials Association), and databases have been used to identify and collect information useful for this extensive commercial study of the levulinic acid market. Primary sources, such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess future prospects of the levulinic acid market. Breakdown of profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the levulinic acid market includes raw material manufacturers and levulinic acid manufacturers. Leading players operating in the levulinic acid market include Biofine International Inc. (U.S.), Avantium (Netherlands), GF Biochemicals Ltd. (Italy), Langfang Triple Well Chemicals Co. Ltd (China), Simagchem Corporation (China), Hefei TNJ Chemical Industry Co., Ltd. (China), Great Chemicals Co. Ltd. (China), and Anhui Herman Impex Co Ltd (China), among others. In addition, companies that may be potential end users of levulinic acid include Akzonobel (N.L.), PPG Industries (U.S.), Sherwin-Williams (U.S.), Axalta (U.S.), BASF (Germany), and others, for paints and coating, and Merck & Co (U.S.), Johnson & Johnson (U.S.), and others, for pharmaceuticals and cosmetics.

Key Target Audience

- Manufacturers of Levulinic Acid

- Traders, Distributors, and Suppliers of Levulinic Acid

- End-Use Industries Operating in Levulinic Acid Supply Chain

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Scope of the Report: This research report categorizes the levulinic acid market on the basis of application and region. The report forecasts revenues as well as analyzes trends in each of these submarkets.

On the basis of Application:

- Plasticizers

- Pharmaceuticals & Cosmetics

- Others

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Applications Industry Analysis

- Further breakdown of the application industry into different areas, such as solvents, anti-inflammatories, and others for four regions

- Company Information

- Detailed analysis and profiling of additional market players (up to five)

The levulinic acid market is projected to reach USD 32.5 Million by 2021, at a CAGR of 14.0% between 2016 and 2021. The key factor fueling the growth of the levulinic acid market is the increasing demand for levulinic acid from plasticizers, pharmaceuticals, and cosmetic industries. Levulinic acid is used in anti–inflammatory medication, and mineral supplements in pharmaceutical applications.

Major application industries using levulinic acid are plasticizers, pharmaceuticals & cosmetics, and others. The demand from these industries for levulinic acid is projected to grow in the coming years, as these acids are bio-based and renewable. With fluctuations in crude oil prices, these industries are compelled to use renewable feedstock instead of petrochemical-based feedstock. Use of levulinic acid would not only bring economic benefits, but also help in addressing rising concerns of greenhouse gas emissions.

Based on application, the levulinic acid market has been segmented into plasticizers, pharmaceuticals & cosmetics, and others. The plasticizers segment accounted for the largest share of the levulinic acid market in 2015. The pharmaceuticals & cosmetics segment is expected to grow at the fastest rate during the forecast period. Levulinic acid are widely preferred in cosmetic products for its broad compatibility and biodegradable properties.

Based on technology, the levulinic acid market has been segmented into acid hydrolysis and biofine process. Acid hydrolysis production process is a technology used by most Chinese manufacturers, in which the feedstock used is paper mill sludge, energy crops, among others. The by-product in this technology is tar, which can be used for energy and power generation. Biofine process is one of the key processes used in the European levulinic acid market, which are designed by the BioFine Company.

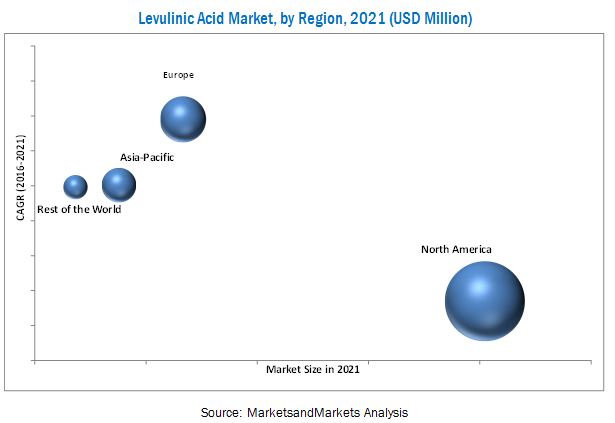

The levulinic acid market in Europe is anticipated to grow at the highest CAGR between 2016 and 2021. Development of cost competitive levulinic acid, combined with high chemical functionality, is expected to increase the demand for levulinic acid as a platform chemical.

The market study demonstrates that levulinic acid and its derivatives, such as MTHF, DALA, and DPA will be far less expensive than petrochemicals, making its use possible for commercial purposes. In addition, if levulinic acid is used as a base material, the entire suite of chemicals is derived from renewable feedstock.

Leading players operating in the levulinic acid market are Biofine International Inc. (U.S.), Avantium (Netherlands), GF Biochemicals Ltd. (Italy), Langfang Triple Well Chemicals Co. Ltd. (China), Simagchem Corporation (China), Hefei TNJ Chemical Industry Co., Ltd. (China), Great Chemicals Co. Ltd. (China), and Anhui Herman Impex Co Ltd (China), among others.

Renewable chemicals have generated considerable interest in consumers. However, consumers are unwilling to pay more for them, as besides high initial cost, use of renewable chemicals also involves modification costs, such as alterations in production processes.

GF Biochemical (Italy) is a leading player in the levulinic acid market. Other key players operational in the levulinic acid market are Biofine Inc. (U.S.), Avantium (Netherlands), Langfang Triple Well Chemicals Co. Ltd. (China), Simagchem Corporation (China), and Anhui Herman Impex Co. Ltd. (China), among others. These players are most active in the levulinic acid market and have an established distribution network. These players are investing more in research & development activities and expansion of capacities. They also have strong technical and market development capabilities, which enable them to upgrade their existing products for new applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Product Analysis

1.2.1 Product Definition

1.2.2 Product Properties

1.3 Markets Covered

1.4 Stakeholders

1.5 Currency & Years Considered for the Study

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Market Size Estimation

2.2.1 Top Down

2.2.2 Bottom Up

2.3 Data Triangulation

2.4 General Assumptions

3 Executive Summary (Page No. - 24)

3.1 Introduction

3.2 Market Developments

3.3 Market Analysis

3.4 Conclusion

4 Market Overview (Page No. - 30)

4.1 Introduction

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.2.4 Impact Analysis of Drivers & Restraints

4.2.5 Evolution of Renewable Fuels & Chemicals

4.3 Platform Chemicals - Sources and Feedstock

4.4 Market Estimates (Comparison of Platform Chemicals With Peer Markets)

4.5 Chemical Initiatives and Regulations Supporting Bio-Based Chemicals

4.6 Current Policy Status for Biochemicals in Five Major Regions

5 Industry Trends (Page No. - 42)

5.1 Value Chain Analysis

5.2 Biobased Chemicals : Commercialization and Growth Prospects

5.3 Patent Analysis

5.4 New Markets and Applications Already Validated

5.5 Levulinic Acid Production Routes

6 Levulinic Acid Market, By Technology (Page No. - 48)

6.1 Introduction

6.2 Acid Hydrolysis Production Process

6.3 Biofine Production Process

6.4 Levulinic Acid as A Part of Green Technology

6.5 Levulinic Acid Derivatives and Applications

6.6 Existing and Potential Applications

6.7 Market Dynamics of Target Market

7 Levulinic Acid Market, By Region (Page No. - 58)

7.1 Introduction

7.2 Levulinic Acid Market, By Region 2014-2021

7.3 North America Levulinic Acid Market

7.4 Europe Levulinic Acid Market

7.5 Asia-Pacific Levulinic Acid Market

7.6 RoW Levulinic Acid Market

8 Levulinic Acid Market, By Application (Page No. - 70)

8.1 Introduction

8.2 Estimated Size of Major Addressable Markets By 2021

8.3 Levulinic Acid Market, By Application 2014-2021

8.4 Plasticizers

8.5 Pharmaceuticals & Cosmetics

8.6 Other Applications

9 Company Profile (Page No. - 81)

9.1 Company Analysis

9.2 Biofine International Inc.

9.3 Avantium Inc.

9.4 GF Biochemicals Ltd.

9.5 Langfang Triple Well Chemicals Co Ltd

9.6 Simagchem Corporation

9.7 Hefei TNJ Chemical Industry Co Ltd.

9.8 Great Chemicals Co Ltd.

10 Appendix (Page No. - 110)

10.1 RT: Real Time Market Intelligence

10.2 Knowledge Store

List of Tables (27 Tables)

Table 1 Levulinic Acid Properties

Table 2 Levulinic Acid Identifiers

Table 3 General Assumptions

Table 4 Yearwise Forecast and Assumptions

Table 5 Building Block Chemicals for Bio-Refineries

Table 6 Chemical Initiatives and Regulations for Bio-Based Chemicals

Table 7 Policy Status for Biochemicals in Five Major Regions

Table 8 Levulinic Acid: Region Wise Patent Analysis

Table 9 Levulinic Acid Market, By Region, 2014-2021 (USD Million)

Table 10 Levulinic Acid Market, By Region, 2014-2021 (Tons)

Table 11 North America Levulinic Acid Market, By Country, 2014-2021 (USD Million)

Table 12 North America Levulinic Acid Market, By Country, 2014-2021 (Tons)

Table 13 Europe Levulinic Acid Market, By Country, 2014-2021 (USD Million)

Table 14 Europe Levulinic Acid Market, By Country, 2014-2021 (Tons)

Table 15 Asia-Pacific Levulinic Acid Market, By Country, 2014-2021 (USD Million)

Table 16 Asia-Pacific Levulinic Acid Market, By Country, 2014-2021 (Tons)

Table 17 Rest of World Levulinic Acid Market, By Region, 2014-2021 (USD Million)

Table 18 Rest of World Levulinic Acid Market, By Region, 2014-2021 (Tons)

Table 19 Levulinic Acid Market, By Application, 2014-2021 (USD Million)

Table 20 Levulinic Acid Market, By Application, 2014-2021 (Tons)

Table 21 Levulinic Acid Market in Plasticizers, By Region, 2014-2021 (USD Million)

Table 22 Levulinic Acid Market in Plasticizers, By Region, 2014-2021 (Tons)

Table 23 Levulinic Acid Market in Pharmaceuticals & Cosmetics, By Region, 2014-2021 (USD Million)

Table 24 Levulinic Acid Market in Pharmaceuticals & Cosmetics, By Region, 2014-2021 (Tons)

Table 25 Levulinic Acid Market in Other Applications, By Region, 2014-2021 (USD Million)

Table 26 Levulinic Acid Market in Other Applications, By Region, 2014-2021 (Tons)

Table 27 Levulinic Acid Market: Company and Technology Analysis

List of Figures (52 Figures)

Figure 1 Levulinic Acid Market Scope

Figure 2 Levulinic Acid Market : Research Methodology

Figure 3 Market Size Estimation : Top Down Approach

Figure 4 Market Size Estimation : Bottom Up Approach

Figure 5 Levulinic Acid Market : Data Triangulation

Figure 6 Levulinic Acid Market Value (USD Million) : 2014-2021

Figure 7 Levulinic Acid Market Share in 2015 : By Application

Figure 8 Europe to Register Highest CAGR Between 2016-2021

Figure 9 Levulinic Acid Market : Segmentation

Figure 10 Levulinic Acid : Market Dynamics

Figure 11 Levulinic Acid : Market Drivers

Figure 12 Levulinic Acid : Impact Analysis

Figure 13 Evolution of Renewable Fuels and Chemicals

Figure 14 Platform Chemicals : Sources and Feedstock

Figure 15 Comparison of Platform Chemicals With Peer Markets

Figure 16 Value Chain Analysis Bio Based Chemicals

Figure 17 Bio Based Chemicals : Commercialization and Growth Prospects

Figure 18 Levulinic Acid : Regionwise Patent Analysis

Figure 19 Levulinic Acid : Comparison of Market Potential and Price

Figure 20 Levulinic Acid : Production Routes

Figure 21 Acid Hydrolysis : Production Process

Figure 22 Biofine Production Process

Figure 23 Levulinic Acid : Part of Green Technology

Figure 24 Existing and Potential Applications of Levulinic Acid Derivatives

Figure 25 Levulinic Acid Market, By Region, 2015-2021 (USD Million)

Figure 26 Levulinic Acid Market, By Region, 2015-2021 (Tons)

Figure 27 North America Levulinic Acid Market, By Country, 2015-2021 (USD Million)

Figure 28 North America Levulinic Acid Market, By Country, 2015-2021 (Tons)

Figure 29 Europe Levulinic Acid Market, By Country, 2015-2021 (USD Million)

Figure 30 Europe Levulinic Acid Market, By Country, 2015-2021 (Tons)

Figure 31 Asia-Pacific Levulinic Acid Market, By Country, 2015-2021 (USD Million)

Figure 32 Asia-Pacific Levulinic Acid Market, By Country, 2015-2021 (Tons)

Figure 33 Rest of World Levulinic Acid Market, By Region, 2015-2021 (USD Million)

Figure 34 Rest of World Levulinic Acid Market, By Region, 2015-2021 (Tons)

Figure 35 Levulinic Acid : Estimated Addressable Market By 2021

Figure 36 Levulinic Acid Market, By Application , 2015-2021 (USD Million )

Figure 37 Levulinic Acid Market, By Application , 2015-2021 (Tons)

Figure 38 Levulinic Acid Market in Plasticizers, By Region, 2015-2021 (USD Million)

Figure 39 Levulinic Acid Market in Plasticizers, By Region, 2015-2021 (Tons)

Figure 40 Levulinic Acid Market in Pharmaceuticals & Cosmetics, By Region, 2015-2021 ( USD Million)

Figure 41 Levulinic Acid Market in Pharmaceuticals & Cosmetics, By Region, 2015-2021 (Tons)

Figure 42 Levulinic Acid Market in Other Applications, By Region, 2015-2021 (USD Million)

Figure 43 Levulinic Acid Market in Other Applications, By Region, 2015-2021 (Tons)

Figure 44 Levulinic Acid Market : Feedstock Analysis

Figure 45 Biofine Inc. Expected Commercialization

Figure 46 Avantium : Growth Strategies

Figure 47 Avantium : Feedstocks Used

Figure 48 Avantium : Target Market

Figure 49 Avantium : Expected Commercialization

Figure 50 GF Biochemical : Reactor Technology

Figure 51 GF Biochemical : Feedstock Used

Figure 52 GF Biochemical : Expected Commercialization

Growth opportunities and latent adjacency in Levulinic Acid Market