Production Printer Market by Type (Monochrome, Color), Technology (Inkjet, Toner), Production Method (Cut Sheet, Continuous Feed, Sheet Fed, and Web Based), Application and Geography - Global Trends & Forecast to 2022

The production printer market is expected to grow from USD 5.22 billion in 2015 to USD 7.74 billion by 2022, at a CAGR of 5.5% between 2016 and 2022. Production printers are high-speed printers, with speed of 60 ppm and more, used for high-volume printing applications. They offer superior quality printing at low cost. These printers can be divided into two basic types, namely, monochrome and color production printers. These printers are largely used in different applications such as publishing, commercial, and label & package among others. The base year considered for this report is 2015, and the forecast period for the production printer market has been considered between 2016 and 2022.

Market Dynamics

Drivers

- Increased usage in publishing industry

- High demand from media and advertising industry

Restraints

- High initial investment cost

- Competition from substitute technology

Opportunities

- Demand from label and packaging printing

- Availability of a wide range of options

- Demand from in-plant markets

Challenges

- Rising demand for digital advertisements and e-books

High demand from media and advertising industry

Nowadays, there is rising competition among all companies in the production printer market as they seek to attract consumers toward their products in various ways. Powerful and fascinating marketing materials increase the brand affinity and also help boost sales. Companies all over the world advertise their products on banners, posters, signages, billboards, and hoardings. Banners and billboards must consist of images of very high detail, clarity, and excellent quality to attract the attention and retain the interest of customers. Production printers offer many advantages over their traditional counterparts such as fast turnaround time, lower printing costs, and flexibility in terms of printing any type of media. Thus, production printers can be considered as a one stop shop for the advertising industry. Therefore, advertisers now make use of production printers to print messages on billboards, banners, and posters instead of traditional printers.

The following are the major objectives of the study.

- To define, describe, and forecast the global production printer market on the basis of type, technology, application production method, and geography

- To provide market statistics with detailed classifications along with the respective market sizes for the segmentations

- To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and detail the competitive landscape of the market leaders

- To forecast the market segments with respect to four main geographies, namely, North America, Europe, Asia-Pacific, and Rest of the World

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- To provide detailed information regarding the major factors influencing the growth of the production printer market (drivers, restraints, opportunities, and challenges)

- To provide a detailed Porter's analysis and market life cycle analysis along with the technology and market roadmap for the production printer market

- To analyze the competitive developments such as contracts, joint ventures, mergers and acquisitions, new product developments, and research and developments in the production printer market

- To map the competitive intelligence based on the company profiles, key player strategies, and game-changing developments such as contracts, product launches, collaborations, and acquisitions

The global production printer market is expected to grow from USD 5.63 billion in 2016 to USD 7.74 billion by 2022, at a CAGR of 5.5% between 2016 and 2022. The production printers are used for high-volume printing applications offering superior quality printing with low cost. They use different production methods such as cut sheet and continuous feed among others.

Production printer is a high-speed printer—with speed of 60 ppm and above—which is used for volume printing, manuals, and booklets among others. . These printers perform at top speeds both in color as well as black & white. Using traditional printers, it is difficult to print papers in high volume with reduced time and cost. Therefore, to meet the growing demand for high-volume printing, several printing companies are developing different high-volume printers to stabilize their business and increase their profitability.

Color type production printers are extensively used in the production printer market owing to the demand for color printing in trans-promo pages, advertisements, banners, brochures, and newsletters among others. These printers are used in commercial, label & package, and transactional applications. The inkjet technology is highly preferred for color printing.

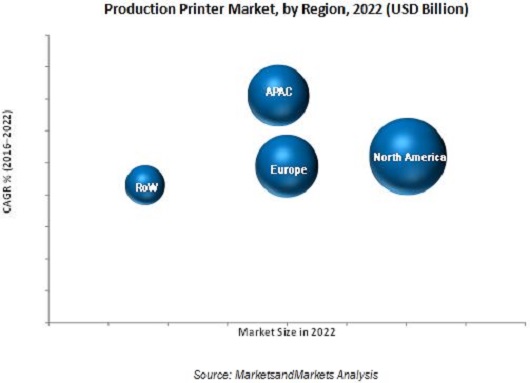

North America is expected to hold the largest share of the production market, while the market in the APAC is expected to grow at the highest CAGR during the forecast period. This growth of the market in APAC may be attributed to the high demand in Japan and other countries. The ongoing development in this region makes it a lucrative and high-potential market for production printers.

Production printer applications for transactional, commercial, and label & package drive the growth of reed sensor market

Transactional

The transactional application of production printers includes the production of bills, statements, invoices, checks, insurance policies, and other informational documents with unique content for each recipient. These play a crucial role in businesses as they keep the company in touch with customers and suppliers. Production printers are widely used for printing transactional documents with low cost. Trans-promo refers to full-color variable content printed on the informational document to promote a product or service, combining marketing with transactional content. Color production printers are most widely used for this application. Both inkjet and toner technologies are used for the transactional application, while continuous feed is the most widely adopted production method.

Commercial

The commercial application includes advertising and promotional material, in-plant printing, banners, print for pay, direct mail, and others. It encompasses brochures, stationery, business cards, catalogs, postcards, booklets, mailing labels, invitations, calendars, newsletters, announcements, coupons, banners, posters, signage, billboards, and hoardings among others. Advertising is a form of communication that encourages, influences, and seeks to persuade the audience to take some action, which normally includes buying a product or a service. Besides, ideological and political advertising are also common. Since the past decade, the advertising industry has seen tremendous growth. Earlier, advertising was hand painted and banners were also written by hand. Now, however, these are printed with the help of production printers, which has brought about a revolution in the advertising industry.

Label & Package

The label & package application includes the printing of packages, boxes, cartons, bags, tags, and labels. High quality, low cost, and fast turnaround are the key factors driving the production printer market for the label & package application and color production printers are highly preferred in this application.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for production printer?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The costs associated with the production printer in the initial investments, installation and maintenance is high which acts as a major restraint for production printer market. One of the main factors responsible for this high cost is the complexity of design of the printers.

The major players in the market are Xerox Corporation (U.S.), Hewlett-Packard (U.S.), Ricoh Company Ltd. (Japan), Konica-Minolta Inc. (Japan), and Canon Inc. (Japan), These players adopted various strategies such as new product developments, partnership, acquisition, collaborations, and business expansions to enhance their presence in the production printer market. Since the last three years the new product development strategy was found to be the key strategy among the market players to enhance their leadership in the production printer ecosystem.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 32)

4.1 Growth Opportunities in the Production Printer Market

4.2 Market, By Type

4.3 Transactional Application to Hold the Largest Share of the Market

4.4 APAC Market Expected to Grow at the Highest Rate for Production Printer During the Forecast Period

4.5 Market, By Geography

4.6 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Type

5.2.2 Market, By Production Method

5.2.3 Market, By Application

5.2.4 Market, By Technology

5.2.5 Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Usage in Publishing Industry

5.3.1.2 High Demand From Media and Advertising Industry

5.3.2 Restraints

5.3.2.1 High Initial Investment Cost

5.3.2.2 Competition From Substitute Technology

5.3.3 Opportunities

5.3.3.1 Demand From Label and Package Printing

5.3.3.2 Availability of A Wide Range of Options

5.3.3.3 Demand From In-Plant Markets

5.3.4 Challenges

5.3.4.1 Rising Demand for Digital Advertisements and E-Books

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis, 2015

6.3.1 Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

7 Market, By Type (Page No. - 52)

7.1 Introduction

7.2 Monochrome

7.3 Color

8 Market, By Production Method (Page No. - 57)

8.1 Introduction

8.2 Cut Sheet

8.3 Continuous Feed

8.4 Sheet Feed

8.5 Web Based

9 Market, By Technology (Page No. - 69)

9.1 Introduction

9.2 Inkjet

9.3 Toner

10 Market, By Application (Page No. - 76)

10.1 Introduction

10.2 Transactional

10.3 Commercial

10.4 Publishing

10.5 Label & Package

10.6 Other

11 Market, By Geography (Page No. - 92)

11.1 Introduction

11.2 North America

11.2.1 The U.S. to Hold the Largest Share of North American Market

11.2.2 U.S.

11.2.2.1 The Transactional Application in the U.S. Held the Largest Market Size in 2015

11.2.3 Canada

11.3 Europe

11.3.1 The French Market is Expected to Witness High Growth Rate in the European Market During the Forecast Period

11.3.2 U.K.

11.3.2.1 High Quality and Mass Print Production Expected to Drive the U.K. Market

11.3.3 Germany

11.3.3.1 Increased Demand for Printing in the Commercial Application is Expected to Drive the Market

11.3.4 France

11.3.5 Rest of Europe

11.4 APAC

11.4.1 Japan is Expected to Dominate the APAC Market During the Forecast Period

11.4.2 China

11.4.2.1 High Demand for Transactional and Publishing Application is Expected to Propel the Growth of the Market in China

11.4.3 Japan

11.4.3.1 Highest Usage in Publishing Application is Driving the Market in Japan

11.4.4 India

11.4.5 Rest of APAC

11.5 RoW

11.5.1 Increased Usage in the Middle East & Africa is Expected to Drive the Market

12 Competitive Landscape (Page No. - 109)

12.1 Overview

12.2 Companies and Their Market Share in the Market, 2015

12.3 Competitive Situation

12.4 Recent Developments

12.4.1 New Product Developments

12.4.2 Partnerships & Agreements

12.4.3 Mergers & Acquisitions

12.4.4 Expansions

13 Company Profiles (Page No. - 115)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 Introduction

13.2 Xerox Corporation

13.3 Hewlett-Packard Development Company, L.P.

13.4 Ricoh Company Ltd

13.5 Canon Inc.

13.6 Konica Minolta, Inc.

13.7 Agfa-Gevaert N.V.

13.8 Eastman Kodak Company

13.9 EFI Elecronics Corporation

13.10 Inca Digital Printers Ltd.

13.11 Miyakoshi Co., Ltd.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 140)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (75 Tables)

Table 1 Production Printer Market Segmentation, By Type

Table 2 Market Segmentation, By Production Method

Table 3 Market Segmentation, By Application

Table 4 Market Segmentation, By Technology

Table 5 Increased Usage in Publishing Industry to Propel the Growth of the Market During the Forecast Period

Table 6 High Investment Cost Restrains the Market Growth

Table 7 Growing Demand for Label & Package is an Opportunity for the Production Printing Market

Table 8 Porter’s Five Forces Analysis: Threat of New Entrants to Have Medium Impact on the Overall Market

Table 9 Market, By Type, 2013–2022 (USD Million)

Table 10 Monochrome Market, By Production Method, 2013–2022 (USD Million)

Table 11 Monochrome Market, By Application, 2013–2022 (USD Million)

Table 12 Color Market, By Production Method, 2013–2022 (USD Million)

Table 13 Color Market, By Application, 2013–2022 (USD Million)

Table 14 Market, By Production Method, 2013–2022 (USD Million)

Table 15 Cut Sheet Production Printer Market, By Type, 2013–2022 (USD Million)

Table 16 Cut Sheet Market, By Application, 2013–2022 (USD Million)

Table 17 Cut Sheet Market, By Technology, 2013–2022 (USD Million)

Table 18 Cut Sheet Market, By Region, 2013–2022 (USD Million)

Table 19 Continuous Feed Production Printer Market, By Type, 2013–2022 (USD Million)

Table 20 Continuous Feed Market, By Application, 2013–2022 (USD Million)

Table 21 Continuous Feed Market, By Technology, 2013–2022 (USD Million)

Table 22 Continuous Feed Market, By Region, 2013–2022 (USD Million)

Table 23 Sheet-Fed Production Printer Market, By Type, 2013–2022 (USD Million)

Table 24 Sheet-Fed Market, By Application, 2013–2022 (USD Million)

Table 25 Sheet-Fed Market, By Technology, 2013–2022 (USD Million)

Table 26 Sheet-Fed Market, By Region, 2013–2022 (USD Million)

Table 27 Web-Based Production Printer Market, By Type, 2013–2022 (USD Million)

Table 28 Web-Based Market, By Application, 2013–2022 (USD Million)

Table 29 Web-Based Market, By Technology, 2013–2022 (USD Million)

Table 30 Web-Based Market, By Region, 2013–2022 (USD Million)

Table 31 Market, By Technology, 2013–2022 (USD Million)

Table 32 Market, By Printing Technology, 2013–2022 (Thousand Units)

Table 33 Inkjet-Based Production Printer Market, By Production Method, 2013–2022 (USD Million)

Table 34 Inkjet-Based Market, By Application, 2013–2022 (USD Million)

Table 35 Toner-Based Market, By Production Method, 2013–2022 (USD Million)

Table 36 Toner-Based Market, By Application, 2013–2022 (USD Million)

Table 37 Market, By Application, 2013–2022 (USD Million)

Table 38 Market for Transactional Application, By Type, 2013–2022 (USD Million)

Table 39 Market for Transactional Application, By Technology, 2013–2022 (USD Million)

Table 40 Market for Transactional Application, By Production Method, 2013–2022 (USD Million)

Table 41 Market for Transactional Application, By Region, 2013–2022 (USD Million)

Table 42 Market for Commercial Application, By Type, 2013–2022 (USD Million)

Table 43 Market for Commercial Application, By Technology, 2013–2022 (USD Million)

Table 44 Market for Commercial Application, By Production Method, 2013–2022 (USD Million)

Table 45 Market for Commercial Application, By Region, 2013–2022 (USD Million)

Table 46 Market for Publishing Application, By Type, 2013–2022 (USD Million)

Table 47 Market for Publishing Application, By Technology, 2013–2022 (USD Million)

Table 48 Market for Publishing Application, By Production Method, 2013–2022 (USD Million)

Table 49 Market for Publishing Application, By Region, 2013–2022 (USD Million)

Table 50 Market for Label & Package Application, By Type, 2013–2022 (USD Million)

Table 51 Market for Label & Package Application, By Technology, 2013–2022 (USD Million)

Table 52 Market for Label & Package Application, By Production Method, 2013–2022 (USD Million)

Table 53 Market for Label & Package Application, By Region, 2013–2022 (USD Million)

Table 54 Market for Other Application, By Type, 2013–2022 (USD Million)

Table 55 Market for Other Application, By Technology, 2013–2022 (USD Million)

Table 56 Market for Other Application, By Production Method, 2013–2022 (USD Million)

Table 57 Market for Other Application, By Region, 2013–2022 (USD Million)

Table 58 Market, By Region, 2013–2022 (USD Million)

Table 59 Market, By Region, 2013–2022 (Thousand Units)

Table 60 Market in North America, By Application, 2013–2022 (USD Million)

Table 61 Market in North America, By Production Method, 2013–2022 (USD Million)

Table 62 Market in North America, By Country, 2013–2022 (USD Million)

Table 63 Market in Europe, By Application, 2013–2022 (USD Million)

Table 64 Market in Europe, By Production Method, 2013–2022 (USD Million)

Table 65 Market in Europe, By Geography, 2013–2022 (USD Million)

Table 66 Market in APAC, By Application, 2013–2022 (USD Million)

Table 67 Market in APAC, By Production Method, 2013–2022 (USD Million)

Table 68 Market in APAC, By Geography, 2013–2022 (USD Million)

Table 69 Market in RoW, By Application, 2013–2022 (USD Million)

Table 70 Market in RoW, By Production Method, 2013–2022 (USD Million)

Table 71 Market in RoW, By Region, 2013–2022 (USD Million)

Table 72 New Product Developments, 2014–2015

Table 73 Partnerships & Agreements, 2014–2015

Table 74 Acquisition,2013-2014

Table 75 Market Expansion, 2013–2015

List of Figures (69 Figures)

Figure 1 Production Printer Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Global Market Size, (2013-2022)

Figure 6 Market for Color Production Printer Expected to Grow at the Highest Rate During the Forecast Period

Figure 7 Cut Sheet Production Method is Expected to Grow at Highest Rate in the Market

Figure 8 Inkjet Technology is Expected to Grow at Highest Rate During the Forecast Period

Figure 9 Transactional Application Market Estimated to Hold the Largest Share of the Market

Figure 10 APAC Market Expected to Witness Highest Growth During the Forecast Period

Figure 11 Demand for Production Printers to Increase Significantly During the Forecast Period

Figure 12 Market for Color Type Production Printer to Grow at A High Rate During the Forecast Period

Figure 13 Japan Held the Largest Share of the APAC Market in 2015

Figure 14 Market in India Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 APAC Market for Production Printer to Grow at the Highest Rate During the Forecast Period

Figure 16 North America Held the Largest Share of the Market in 2015

Figure 17 Market : Segmentation

Figure 18 Market Segmentation, By Geography

Figure 19 Increasing Usage in Publishing Industry Expected to Spur the Demand for Production Printer

Figure 20 Largest Book Market Across the World in 2012

Figure 21 Value Chain Analysis: Major Value Added During Manufacturing

Figure 22 Porter’s Five Forces Analysis:

Figure 23 Market: Porter’s Five Forces Analysis

Figure 24 Competitive Rivalry: High Degree of Competition in the Market Due to the Presence of Several Players

Figure 25 Threat of Substitutes in Market, 2015

Figure 26 Bargaining Power of Buyers in Market, 2015

Figure 27 Bargaining Power of Suppliers in Market, 2015

Figure 28 Threat of New Entrants in Market, 2015

Figure 29 Market Segmentation: By Type

Figure 30 Color Production Printer to Grow at High CAGR During the Forecast Period

Figure 31 Market Segmentation: By Production Method

Figure 32 Cut Sheet Production Printers Expected to Grow at the Highest Rate During the Forecast Period

Figure 33 Market for Continuous Feed Production Printer Based on Inkjet Technology Expected to Grow at the Highest Rate During the Forecast Period

Figure 34 Market for Web-Based Production Printer Based on Inkjet Technology Expected to Grow at the Highest Rate During the Forecast Period

Figure 35 Market Segmentation: By Technology

Figure 36 Inkjet Technology Market to Grow at the Highest Rate During the Forecast Period

Figure 37 Transactional Printing Expected to Remain Largest Market for Toner Based Production Printing

Figure 38 Market Segmentation: By Application

Figure 39 Market for Label and Packages Printing Application Expected to Grow at the Highest Rate During the Forecast Period

Figure 40 Inkjet-Based Market to Grow at the Highest Rate for Commercial Application

Figure 41 Color Type Market for Publishing Application Expected to Grow at the Highest Rate During the Forecast Period

Figure 42 APAC Market to Grow at the Highest Rate for Other Application

Figure 43 Market Segmentation: By Geography

Figure 44 Geographic Snapshot: APAC Expected to Register Highest Growth Rate During the Forecast Period

Figure 45 Market in North America: By Country

Figure 46 North America: Snapshot of Market

Figure 47 Market in Europe: By Geography

Figure 48 Europe: Market Snapshot

Figure 49 Market in APAC: By Geography

Figure 50 APAC: Market Snapshot

Figure 51 Market in RoW: By Region

Figure 52 Key Growth Strategies Adopted By Top Companies Over the Past Three Years, 2013–2015

Figure 53 Companies and Their Market Share in 2015

Figure 54 Market Evaluation Framework: New Product Developments Fuelled Growth and Innovation Between 2013 and 2015

Figure 55 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 56 Geographic Revenue Mix of Top 5 Market Players

Figure 57 Xerox Corporation.: Company Snapshot

Figure 58 Xerox Corporation: SWOT Analysis

Figure 59 HP Development Company, L.P.: Company Snapshot

Figure 60 Hewlett-Packard.: SWOT Analysis

Figure 61 Ricoh Group: Company Snapshot

Figure 62 Ricoh Company Ltd: SWOT Analysis

Figure 63 Canon Inc.: Company Snapshot

Figure 64 Canon Inc.: SWOT Analysis

Figure 65 Konika Minolta, Inc: Company Snapshot

Figure 66 Konica Minolta, Inc.: SWOT Analysis

Figure 67 Agfa-Gevaert N.V.: Company Snapshot

Figure 68 Eastman Kodak Company: Company Snapshot

Figure 69 EFI Electronics Corp.: Company Snapshot

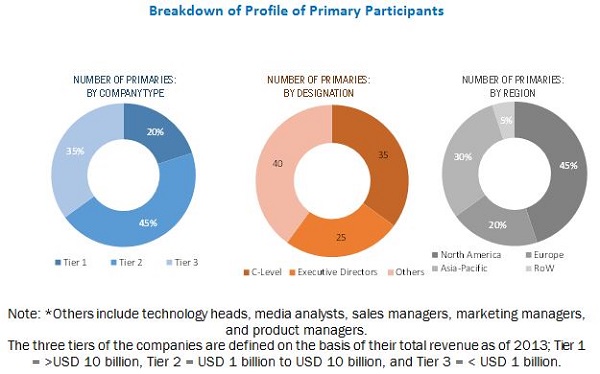

During this research study, major players operating in the production printer market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The production printer market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the reed sensor market are Xerox (US), Hewlett-Packard (US), Ricoh Company (Japan), Konica Minolta (Japan), and Canon (Japan), Agfa and Gevaert (Belgium), EFI Electronics (US), Eastman Kodak Company (US), Inca Digital Printers (UK), and Miyakoshi Co (Japan).

Major Market Developments

- In April 2015, Xerox partnered with Fotoba (US) to develop the industry’s fastest production of full-bleed and multi-up posters, banners, and signage at speeds as fast as five seconds per page.

- In March 2015, Xerox introduced its new digital color devices—the Versant 80 Press and the Color 800i/1000i Presses. The Versant 80 combines new features and functionality for high-end applications. The Color 800i/1000i Presses offers true Pantone metallic gold or silver specialty dry inks, which gives printers a creative and competitive edge.

- In February 2015, Ricoh started a new company in the Middle East as part of its strategy to more directly support customers and partners in key emerging markets globally as well as to meet local needs and the demand for new digital office solutions.

- In June 2014, Konica Minolta signed an agreement with Ergo Asia Pty Limited (Australia), a leading Asian marketing production management services provider, whereby it would acquire all the latter’s shares.

Target Audience

- Publication printing providers

- Label & packaging printing providers

- In-plant printing providers

- Advertisement & promotional print providers

- Security printing providers

- Research organizations and consulting companies

- Technology providers

- Electronic hardware equipment manufacturers

Report Scope:

Production Printer Market, by Type:

- Monochrome

- Color

Production Printer Market, by Technology:

- Inkjet

- Toner

Production Printer Market, b Production method:

- Cut Sheet Production method

- Continuous feed Production method

- Sheet Fed Production method

- Web based Production method

Production Printer Market, by Application Industries

- Transactional

- Commercial

- Publishing

- Label & Packaging

- Others

Production Printer Market, by Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographical Analysis

- Comprehensive coverage of regulations followed in each region (North America, APAC, Europe, RoW)

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Growth opportunities and latent adjacency in Production Printer Market