Managed Print Services Market by Deployment Mode (On Premise, Cloud based, and Hybrid), Channel Type (Printer/Copier Manufacturers, System Integrators/Resellers, and ISVs), Application, Organization Size, and Geography - Global Forecast to 2023

The managed print services market is expected to grow from USD 28.40 billion in 2016 to USD 50.78 billion by 2023, at a CAGR of 8.5% between 2017 and 2023. Managed print services (MPS) are services offered by an external provider to optimize or manage a company’s document output. Outsourcing helps companies reduce the cost incurred on network and IT spending by eliminating Capex and Opex. More than a cost control tool, it also helps organizations to gain a competitive advantage by improving efficiency and providing business differentiation. The rapid and exponential growth in the digitalization of various enterprises, businesses, and organizations has resulted in increasing demand for managed print services. The base year considered for the study is 2016, and the market size forecast is provided for the period between 2017 and 2023.

Market Dynamics

Drivers

- Reduced cost of operation and flexibility to match custom requirements

- Persistent rise in the complexity of technological solutions

- Continuous upsurge in dependency on heterogeneous networks of applications and infrastructure

- Steep increase in the adoption of big data solutions

- Initiatives from organisations to reduce paper wastage

- Competent technical support by managed print service providers

Restraints

- Doubt in efficiency and effectiveness of managed print services

- Long-term recurring expenditure

Opportunities<

- Optimizing the use of analytics and cloud computing

- New business propositions

- Greater networking opportunities

Challenges

- Privacy and security concerns

- New and strategic partnerships

MPS in BFSI application are expected to drive the global managed print services market

The banking, financial services, and insurance (BFSI) industry is heavily dependent on record-keeping to function. Papers are being widely used in banking and financial institutions for loan applications, new account opening, mortgages, and several other purposes, which leads to high investment cost in resources. Financial services and insurance firms face challenges with regulatory requirements and time-consuming record-keeping tasks. There is a strong need for technology and automation to control these extra costs and rationalize the overall printing process in the BFSI industry. MPS help in assessing the actual cost incurred for different print applications to keep track of printing environment and reducing wastage. The BFSI application has high printing demands to provide secure data access benefits, thereby creating huge growth opportunities for MPS.

The prime objectives of this report can be summarized in the following points.

- To define, describe, and forecast the global managed print services market on the basis of deployment mode, channel type, applications, organization size, and geography

- To strategically analyze micro markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders

- To forecast the market size for various segments with respect to the following regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To strategically profile the key players and comprehensively analyze their market rankings and core competencies

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze competitive strategies such as contracts, joint ventures, mergers and acquisitions, product developments, and R&D in the managed print services market

- To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments such as contracts, product launches, collaborations, and acquisitions

The managed print services market, in terms of value, is expected to grow from USD 28.40 billion in 2016 to USD 50.78 billion by 2023, at a CAGR of 8.5% between 2017 and 2023. The major drivers for the market are reduced cost of operation and flexibility to match custom requirements, persistent rise in complexity of technological solutions, continuous upsurge in the dependency over heterogeneous network of applications and infrastructure, steep increase in the adoption of big data solutions, and competent technical support by managed print service providers among others.

Managed print services (MPS) are services offered by an external provider to optimize or manage a company’s document output. Outsourcing helps companies reduce the cost incurred on network and IT spending by eliminating Capex and Opex. More than a cost control tool, it also helps organizations to gain a competitive advantage by improving efficiency and providing business differentiation.

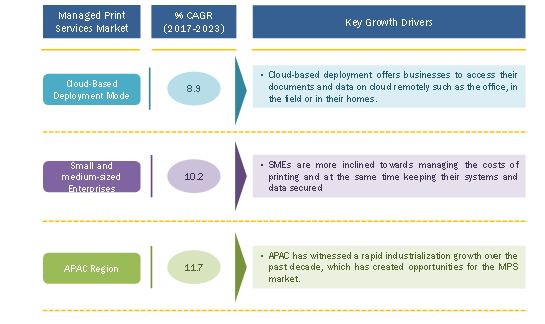

This report covers the managed print services market based on deployment mode, into on-premises, cloud based, and hybrid. Hybrid deployment is expected to be the fastest-growing deployment mode in market as it offers together benefits of cloud-based and on-premise deployment. In this deployment type, a user can have services that are hosted locally or on premises and some services managed by cloud service providers.

Managed print services market has different channels such as printer/copier manufacturers, system integrators/resellers, independent software vendors (ISVs). Organizations realizing the importance of MPS in efficient printing techniques are driving the growth of this market worldwide. Additionally, the increasing use of analytics and cloud computing technologies in printing is expected to increase the requirement for managed print services.

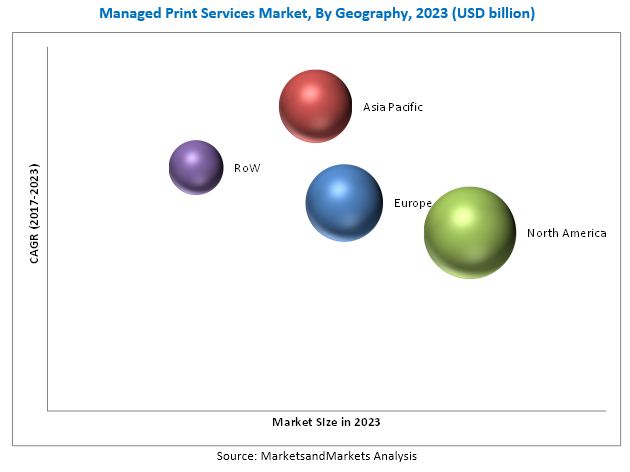

The managed print services market in APAC is expected to grow at the highest rate between 2017 and 2023. APAC has witnessed a rapid growth in industrialization over the past decade, which has created a lot of opportunities for MPS. The MPS market in APAC has potential to grow in the near future. The increasing industrialization and high-end technological requirements of businesses are expected to drive the cloud-based MPS market in APAC.

Application of MPS in BFSI, government, telecom and IT, and industrial manufacturing drive the growth of managed print services market

Banking, Financial Services, and Insurance (BFSI)

The banking, financial services, and insurance (BFSI) industry is heavily dependent on record-keeping to function. Papers are being widely used in banking and financial institutions for loan applications, new account opening, mortgages, and several other purposes, which leads to high investment cost in resources. There is a strong need for technology and automation to control these extra costs and rationalize the overall printing process in the BFSI industry. BFSI is one of the most sensitive industries in terms of customer information, and MPS secured printing is the integral requirement of this industry. MPS help in assessing the actual cost incurred for different print applications to keep track of printing environment and reducing wastage.

Government

Shrinking budgets and rising demand for government services are forcing the government agencies and departments to modernize their storage infrastructure and enable vast service delivery. Also, paper-based processes add workload and cause delayed responses. Government organizations waste lots of money on documentation, that is, on paper, printer ink, toner, and so on; sometimes print commands are sent to the wrong printer, thereby causing reprinting. MPS in government organizations provide advantages such as secured printing, reduced printing cost, centralized print management, and customization in reporting.

Telecom and IT

Telecom and IT is one of the fastest-growing industries worldwide. IT industry deals with the information that is available, adaptable, searchable, portable, and reusable. Heavy printing is usually exercised in this vertical and is a major source of increased cost to companies. Printed documentation is a critical part of maintaining information. MPS help in optimized printing through print environment analysis and user printing pattern. These services also provide optimized solutions to reduce the overall printing cost. MPS help businesses to buy printers and provide maintenance and support services that reduce large capital investment requirements through classified operational expenditure in an ongoing MPS contract.

Industrial Manufacturing

Printing is an integral part of business processes for manufacturing organizations, that is, from product order to shipping and delivery of finished goods. Manufacturing companies are continuously looking to maintain vital information and output in a secured format. Usually, manual paperwork creates tailbacks in the work processes and proves to be inefficient and costly. Manufacturing businesses need help in reducing office and production printing costs and improve production efficiency. MPS for manufacturing simplifies many industry challenges related to printing. Paper-intensive processes such as digitized bills, document control processes, namely conversion, compression, and profiling are stored in the form of digital files, and user authentication processes are highly secured with MPS. Also, consolidation of vendors could be done for printing and imaging cost reduction and fax over IP helps in reducing print costs and print device reliance.

Critical questions the report answers:

- What are the key strategies of the MPS providers in the mid to long term?

- What are the upcoming industry where MPS applications is growing?

Doubt about the efficiency and effectiveness of managed print services is a major factor restraining the growth of the market. When companies transition from in-house functions to MPS, they always face significant barriers in terms of maintaining operations and efficiency. Various critical processes such as remote monitoring and unified communications are involved in IT services; hence, companies require higher bandwidth to manage them and to avoid latency issues. The possibility of lack of efficiency in the cloud model of managed print services is detrimental to its quicker adoption. The failure of the systems due to technical difficulties can prove

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Managed Print Services Market

4.2 Market in APAC

4.3 Market, By Deployment Mode

4.4 Country-Wise Analysis of the Market

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Reduced Cost of Operation and Flexibility to Match Custom Requirements

5.2.1.2 Persistent Rise in the Complexity of Technological Solutions

5.2.1.3 Continuous Upsurge in Dependency on Heterogeneous Networks of Applications and Infrastructure

5.2.1.4 Steep Increase in the Adoption of Big Data Solutions

5.2.1.5 Initiatives From Organisations to Reduce Paper Wastage

5.2.1.6 Competent Technical Support By Managed Print Service Providers

5.2.2 Restraints

5.2.2.1 Doubt in Efficiency and Effectiveness of Managed Print Services

5.2.2.2 Long-Term Recurring Expenditure

5.2.3 Opportunities

5.2.3.1 Optimizing the Use of Analytics and Cloud Computing

5.2.3.2 New Business Propositions

5.2.3.3 Greater Networking Opportunities

5.2.4 Challenges

5.2.4.1 Privacy and Security Concerns

5.2.4.2 New and Strategic Partnerships

5.3 Value Chain Analysis

6 Managed Print Services Market, By Channel Type (Page No. - 42)

6.1 Introduction

6.2 Printer/Copier Manufacturers

6.3 System Integrators/Resellers

6.4 Independent Software Vendors (ISVS)

7 Managed Print Services Market, By Deployment Mode (Page No. - 47)

7.1 Introduction

7.2 On-Premises

7.3 Cloud Based

7.4 Hybrid

8 Managed Print Services Market, By Application (Page No. - 56)

8.1 Introduction

8.2 BFSI

8.3 Government

8.4 Education

8.5 Healthcare

8.6 Telecom and IT

8.7 Industrial Manufacturing

8.8 Retail

8.9 Others

9 Managed Print Services Market, By Organization Size (Page No. - 77)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises (SMES)

9.3 Large Enterprises

10 Geographic Analysis (Page No. - 82)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 Australia

10.4.4 India

10.4.5 South Korea

10.4.6 Rest of APAC

10.5 Rest of the World

10.5.1 South America

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 106)

11.1 Introduction

11.2 Market Ranking of Top 5 Players in the Market, 2016

11.3 Competitive Scenario and Trends

11.4 Managed Print Services Market (Global) Competitive Leadership Mapping, 2017

11.4.1 Visionary Leaders

11.4.2 Dynamic Differentiators

11.4.3 Innovators

11.4.4 Emerging Companies

11.5 Business Strategy Excellence (25 Companies)

11.6 Strength of Service Portfolio (25 Companies)

*

Top 25 Companies Analyzed for This Study are - Xerox Corporation (US), Ricoh Company (Japan), HP Development Company L.P. (US), Lexmark International, Inc. (US), Canon, Inc. (Japan), Konica Minolta, Inc. (Japan), Samsung Electronics Co. Ltd. (South Korea), Kyocera Corporation (Japan), Sharp Corporation (Japan), Toshiba Corporation (Japan), ARC Document Solutions, Inc. (US), Dell Technologies (US), Fujitsu (Japan), Epson (Japan), HCL Technologies (India), SCC Technology (UK), Wipro Technologies (India), Pitney Bowes (UK), Print Audit (Canada), Ingram Micro Inc. (US), Smart Print (Canada), All Copy Products (US), Laser Cycle USA (US), Fleet MPS (UK), Capital Document Solutions (Scotland)

12 Company Profiles (Page No. - 113)

(Business Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Key Relationships)*

12.1 Introduction

12.2 Xerox Corporation

12.3 Ricoh Company, Ltd.

12.4 HP Development Company, L.P.

12.5 Konica Minolta, Inc.

12.6 Canon, Inc.

12.7 Lexmark International, Inc.

12.8 Kyocera Corporation

12.9 Samsung Electronics Co., Ltd.

12.1 Sharp Corporation

12.11 Toshiba Corporation

12.12 ARC Document Solutions, Inc.

12.13 Key Innovators

12.13.1 Pitney Bowes

12.13.2 Wipro Limited

12.13.3 Print Audit

12.13.4 Ingram Micro Inc.

*Details on Business Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 157)

13.1 Introduction

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customization

13.6 Related Reports

13.7 Author Details

List of Tables (61 Tables)

Table 1 MPS Market, By Channel Type, 2014–2023 (USD Billion)

Table 2 MPS Market for Printer/Copier Manufacturers, By Region, 2014–2023 (USD Billion)

Table 3 MPS Market for System Integrators/Resellers, By Region, 2014–2023 (USD Billion)

Table 4 MPS Market for ISVS, By Region, 2014–2023 (USD Billion)

Table 5 Market, By Deployment Mode, 2014–2023 (USD Billion)

Table 6 Market, By On-Premises Deployment Mode, 2014–2023 (USD Billion)

Table 7 Market for On-Premises Deployment Mode, By Application, 2014–2023 (USD Billion)

Table 8 Market, By Cloud Based Deployment Mode, 2014–2023 (USD Billion)

Table 9 Managed Print Services Market for Cloud Based Deployment Mode, By Application, 2014–2023 (USD Billion)

Table 10 Market, By Hybrid Deployment Mode, 2014–2023 (USD Billion)

Table 11 Market for Hybrid Deployment Mode, By Application, 2014–2023 (USD Billion)

Table 12 MPS Market, By Application, 2014–2023 (USD Billion)

Table 13 MPS Market for BFSI Application, By Region, 2014–2023 (USD Billion)

Table 14 MPS Market for BFSI Application, By Deployment Mode, 2014–2023 (USD Billion)

Table 15 MPS Market for BFSI Application, By Channel Type, 2014–2023 (USD Billion)

Table 16 MPS Market for Government Application, By Region, 2014–2023 (USD Billion)

Table 17 MPS Market for Government Application, By Deployment Mode, 2014–2023 (USD Billion)

Table 18 MPS Market for Government Application, By Channel Type, 2014–2023 (USD Billion)

Table 19 MPS Market for Education Application, By Region, 2014–2023 (USD Billion)

Table 20 MPS Market for Education Application, By Deployment Mode, 2014–2023 (USD Billion)

Table 21 MPS Market for Education Application, By Channel Type, 2014–2023 (USD Billion)

Table 22 MPS Market for Healthcare Application, By Region, 2014–2023 (USD Billion)

Table 23 MPS Market for Healthcare Application, By Deployment Mode, 2014–2023 (USD Billion)

Table 24 MPS Market for Healthcare Application, By Channel Type, 2014–2023 (USD Billion)

Table 25 MPS Market for Telecom and IT Application, By Region, 2014–2023 (USD Billion)

Table 26 MPS Market for Telecom and IT Application, By Deployment Mode, 2014–2023 (USD Billion)

Table 27 MPS Market for Telecom and IT Application, Channel Type, 2014–2023 (USD Billion)

Table 28 MPS Market for Industrial Manufacturing Application, By Region, 2014–2023 (USD Billion)

Table 29 MPS Market for Industrial Manufacturing Application, By Deployment Mode, 2014–2023 (USD Billion)

Table 30 MPS Market for Industrial Manufacturing Application, By Channel Type, 2014–2023 (USD Billion)

Table 31 MPS Market for Retail Application, By Region, 2014–2023 (USD Billion)

Table 32 MPS Market for Retail Application, By Deployment Mode, 2014–2023 (USD Billion)

Table 33 MPS Market for Retail Application, By Channel Type, 2014–2023 (USD Billion)

Table 34 MPS Market for Other Applications, By Region, 2014–2023 (USD Billion)

Table 35 MPS Market for Other Applications, By Deployment Mode, 2014–2023 (USD Billion)

Table 36 MPS Market for Other Applications, By Channel Type, 2014–2023 (USD Billion)

Table 37 MPS Market, By Organization Size, 2014–2023 (USD Billion)

Table 38 MPS Market for Small and Medium-Sized Enterprises (SMES), By Region, 2014–2023 (USD Billion)

Table 39 MPS Market for Large Enterprises, By Region, 2014–2023 (USD Billion)

Table 40 Managed Print Services Market, By Region, 2014–2023 (USD Billion)

Table 41 Market in North America, By Application, 2014–2023 (USD Billion)

Table 42 Market in North America, By Organization Size, 2014–2023 (USD Billion)

Table 43 Market in North America, By Deployment Mode, 2014–2023 (USD Billion)

Table 44 Market in North America, By Channel Type, 2014–2023 (USD Billion)

Table 45 Market in North America, By Country, 2014–2023 (USD Billion)

Table 46 Managed Print Services Market in Europe, By Application, 2014–2023 (USD Billion)

Table 47 Market in Europe, By Organization Size, 2014–2023 (USD Billion)

Table 48 Market in Europe, By Deployment Mode, 2014–2023 (USD Billion)

Table 49 Market in Europe, By Channel Type, 2014–2023 (USD Billion)

Table 50 Market in Europe, By Country, 2014–2023 (USD Billion)

Table 51 Managed Print Services Market in Asia Pacific, By Application, 2014–2023 (USD Billion)

Table 52 Market in Asia Pacific, By Organization Size, 2014–2023 (USD Billion)

Table 53 Market in Asia Pacific, By Deployment Mode, 2014–2023 (USD Billion)

Table 54 Market in Asia Pacific, By Channel Type, 2014–2023 (USD Billion)

Table 55 Market in Asia Pacific, By Country, 2014–2023 (USD Billion)

Table 56 Managed Print Services Market in RoW, By Application, 2014–2023 (USD Billion)

Table 57 Market in RoW, By Organization Size, 2014–2023 (USD Billion)

Table 58 Market in RoW, By Deployment Mode, 2014–2023 (USD Billion)

Table 59 Market in RoW, By Channel Type, 2014–2023 (USD Billion)

Table 60 Market in RoW, By Region, 2014–2023 (USD Billion)

Table 61 Market Ranking of Top 5 Players in the Market in 2016

List of Figures (60 Figures)

Figure 1 Managed Print Services Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Assumptions of the Research Study

Figure 6 Printer/Copier Manufacturers Expected to Dominate the MPS Market During the Forecast Period

Figure 7 BFSI Sector is Expected to Account for Largest Share of MPS Market During Forecast Period

Figure 8 Cloud -Based Deployment Mode is Expected to Account for the Largest Market Share Between 2017 and 2023

Figure 9 Large Enterprises are Expected to Account for the Largest Share of the MPS Market By Organization Size During the Forecast Period

Figure 10 North America Held A Major Share of the MPS Market in 2016

Figure 11 Reduced Cost of Operation and Flexibility Acts as A Major Driver for the MPS Market During the Forecast Period

Figure 12 China Held the Largest Share of the MPS Market in APAC in 2016

Figure 13 MPS Market for Hybrid Deployment Mode is Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 14 The US Held the Largest Share of the Market in 2016

Figure 15 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Market: Value Chain Analysis

Figure 17 Market, By Channel Type

Figure 18 MPS Market, By Channel Type

Figure 19 Managed Print Services Market, By Deployment Mode

Figure 20 Cloud-Based Deployment Mode is Expected to Account for the Largest Market Share Between 2017 and 2023

Figure 21 Government Application is Expected to Account for the Largest Share in the MPS Market for On-Premises-Based Deployment Mode Between 2017 and 2023

Figure 22 Government Application is Expected to Grow at the Highest CAGR for Cloud-Based Deployment Mode Between 2017 and 2023

Figure 23 Government Application is Expected to Grow at the Highest CAGR for Hybrid Deployment Mode Between 2017 and 2023

Figure 24 MPS Market, By Application

Figure 25 MPS Market for Government Application Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 26 North America Expected to Hold the Largest Size of the MPS Market for BFSI Application During the Forecast Period

Figure 27 MPS Market in Asia Pacific for Government Application Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 28 North America to Dominate the MPS Market for Education Application Between 2017 and 2023

Figure 29 MPS Market in Asia Pacific for Healthcare Application Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 30 North America to Account for the Largest Size of the MPS Market By 2023

Figure 31 MPS Market in Asia Pacific for Industrial Manufacturing Application Expected to Grow at the Highest CAGR During 2017–2023

Figure 32 North America to Account for the Largest Size of the MPS Market for Retail Applications By 2023

Figure 33 MPS Market, By Organization Size

Figure 34 Large Enterprises Expected to Account for Largest Share of MPS Market Between 2017 and 2023

Figure 35 MPS Market for SMES in Asia Pacific Expected to Grow at Highest CAGR Between 2017 and 2023

Figure 36 North America Expected to Account for Largest Share of MPS Market for Large Enterprises Between 2017 and 2023

Figure 37 Managed Print Services Market, By Geography

Figure 38 Market, Geographic Snapshot

Figure 39 North America: Market Snapshot

Figure 40 The US Expected to Hold the Largest Market Share of the MPS Market in North America Between 2017 and 2022

Figure 41 Europe: Managed Print Services Market Snapshot

Figure 42 France Expected to Grow at the Highest CAGR for the MPS Market Between 2017 and 2022

Figure 43 Asia Pacific: Market Snapshot

Figure 44 MPS Market in India is Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 45 Middle East Expected to Hold the Largest Market Share in the RoW Region for MOS Market Between 2017 and 2023

Figure 46 Key Growth Strategies Adopted By the Top Companies Between 2015 and 2017

Figure 47 Battle for Market Share: New Product Launches Emerged as the Key Strategy Between 2015 and 2017

Figure 48 Competitive Leadership Mapping

Figure 49 Geographic Revenue Mix of Major Players in the Market, 2016

Figure 50 Xerox Corporation: Company Snapshot

Figure 51 Ricoh Company, Ltd.: Company Snapshot

Figure 52 HP Development Company, L.P.: Company Snapshot

Figure 53 Konica Minolta, Inc.: Company Snapshot

Figure 54 Canon, Inc.: Company Snapshot

Figure 55 Lexmark International, Inc.: Company Snapshot

Figure 56 Kyocera Corporation: Company Snapshot

Figure 57 Samsung Corporation: Company Snapshot

Figure 58 Sharp Corporation: Company Snapshot

Figure 59 Toshiba Corporation: Company Snapshot

Figure 60 ARC Document Solutions, Inc.: Company Snapshot

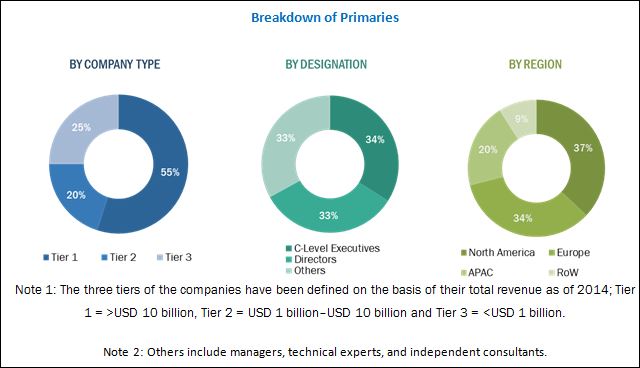

During this research study, major players operating in the managed print services market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The managed print services ecosystem includes manufacturers and resellers such as Xerox Corporation (US), HP Development Company, L.P. (US), Lexmark International Corporation (US), and ARC Document Solutions, Inc. (US), Kyocera Corporation (Japan), Sharp Corporation (Japan), Konica Minolta, Inc. (Japan), Ricoh Company, Ltd. (Japan), Toshiba Corporation (Japan), Samsung Electronics Co. Ltd. (South Korea) and other end users.

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Forecast period |

2017–2023 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Xerox Corporation (US), HP Development Company, L.P. (US), Lexmark International Corporation (US), and ARC Document Solutions, Inc. (US), Kyocera Corporation (Japan), Sharp Corporation (Japan), Konica Minolta, Inc. (Japan), Ricoh Company, Ltd. (Japan), Toshiba Corporation (Japan), Samsung Electronics Co. Ltd. (South Korea) |

Major Market Developments

- In March 2017, Xerox Corporation launched a “Xerox ConnectKey portfolio”, which has one-touch access to the cloud and multilayered security features. This is expected to create leverage for the company in technological innovations and enhance the product portfolio.

- In December 2016, HP redesigned its managed print services (MPS) to protect corporate print environments against cyber-attacks on network printers. The new features include advanced security professional services, software solutions, and expanded core delivery capabilities.

- In June 2017, Xeretec, the MPS reseller of Xerox, acquired the Landscape Group (UK), which is the HP MPS and solutions specialist. This acquisition will enable 2 major resellers to work together and create a revolutionary growth in the MPS market.

Key Target Audience

- Managed print services providers

- IT service providers

- Cloud service providers

- Printer suppliers

- Original equipment manufacturers (OEMs)

- System integrators and third-party vendors

- Software solution providers

- Government bodies

- Technology investors

- Enterprise data center professionals

- Research institutes and organizations

- Market research and consulting firms

Scope of the Report

The managed print services market has been covered in detail in this report. To provide a holistic picture, the current market demand and forecasts have also been included in the report. The market has been segmented as follows:

By Deployment Mode

- On-premise

- Cloud-based

- Hybrid

By Channel Type

- Printer/Copier Manufacturers

- System Integrators/Resellers

- Independent Software Vendors (ISVs)

By Application

- BFSI

- Government

- Education

- Healthcare

- Telecom and IT

- Manufacturing

- Legal

- Others

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

Critical questions which the report answers

- What are new application areas which the managed print service providers are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Deployment Mode Analysis

- Detailed analysis of on-premise, cloud-based, and hybrid deployment

Country-wise Information:

- Detailed analysis of each country

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Managed Print Services Market