Process Analytics Market by Process Mining Type (Process Discovery, Process Conformance & Process Enhancement), Deployment Type, Organization Size, Application (Business Process, It Process, & Customer Interaction), and Region - Global Forecast to 2023

[126 Pages Report] The process analytics market size expected to grow from USD 125.6 Million in 2017 to USD 1,421.7 Million by 2023, at a Compound Annual Growth Rate (CAGR) of 50.3% during the forecast period. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

Objectives of the Study

The major objective of the report is to define, describe, and forecast the process analytics market size by process mining type, deployment type, organization size, application, and region. The report provides detailed information on the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market. The report attempts to forecast the market size with respect to the 5 key regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report strategically profiles the key market players and comprehensively analyzes their core competencies. It also tracks and analyzes the competitive developments, such as joint ventures, mergers and acquisitions, and new product developments, in the market.

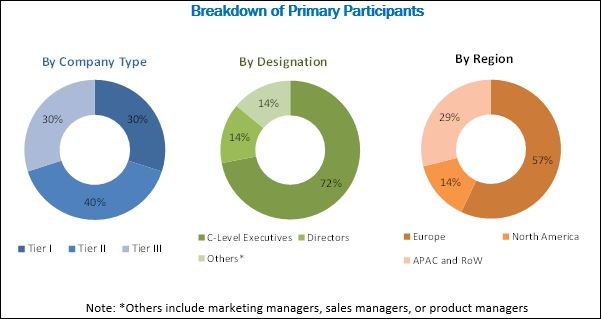

The research methodology used to estimate and forecast the process analytics market size began with the collection and analysis of data on the key vendor revenues through secondary sources, including the annual reports and press releases, investor presentations, conferences and associations (IEEE International Conference on Data Mining (ICDM) 2017, Strata Data Conference, TDWI Chicago Conference, NIPS 2017, and The Data Science Conference 2017), technology journals, certified publications, articles from recognized authors, directories, and databases. The vendor offerings were also taken into consideration to determine the market segmentations. The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of the key players and their market shares. The process analytics market spending across all regions, along with the geographic split in various verticals, was considered to arrive at the overall market size. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of the primary participants is depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The process analytics market includes various vendors providing process analytics solutions and services to commercial clients across the globe. The major vendors, such as Celonis (Germany), Fluxicon (Netherlands), Icaro Tech (Brazil), Kofax (US), Lana Labs (Germany), Minit (Slovakia), Logpickr (France), TimelinePI (US), Scheer (Germany), Monkey Mining (Netherlands), Worksoft (US), Puzzle Data (South Korea), QPR Software (Finland), Cognitive Technology (Malta), Signavio (Germany), SNP (US), Your Data (France), Process Mining Group (Open-Source), Software AG (Germany), Fujitsu (Japan), CA Technologies (US), Process Analytics Factory (Germany), StereoLOGIC (Ontario), Intellera (Canada), and ProcessGold (Netherlands), have adopted partnerships, agreements, and collaborations as the key strategies to expand their market reach.

Key Target Audience

- Process analytics vendors

- Data scientists

- Integration services providers

- Cloud services providers

- Big data analytics vendors

- Business process management vendors

- Consultancy firms and advisory firms

- Regulatory agencies

- Technology consultants

- Governments

The study answers several questions for stakeholders, primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Report

The research report segments the process analytics market into the following submarkets:

By Process Mining Type:

- Process discovery

- Process conformance

- Process enhancement

Process Analytics Market By Deployment Type:

- On-premises

- Cloud

By Organization Size:

- SMEs

- Large enterprises

Process Analytics Market By Application:

- Business process

- Information technology process

- Customer interaction

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the process analytics market in the US and Canada into process mining type, organization size, deployment type, and application.

- Further breakdown of the market in the Netherlands, Germany, and UK into process mining type, organization size, deployment type, and application.

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets expects the global process analytics market size to grow from USD 185.3 Million in 2018 to USD 1,421.7 Million by 2023, at a Compound Annual Growth Rate (CAGR) of 50.3% during the forecast period. The major growth factors for the market include the implementation of digital transformation that is driving users’ awareness for analyzing and understanding business processes, and the advent of the algorithmic business. Moreover, collaborations between process analytics and Enterprise Resource Planning (ERP) vendors, and the rise in the implementation of the task level automation are also driving the market growth. The process analytics market is segmented on the basis of process mining types, organization size, deployment types, applications, and regions.

In the process mining type segment, the process discovery subsegment is expected to account for the largest market share. In the process discovery subsegment, the process data from logs are extracted, cleaned, and formatted for analysis. The data mining software, along with Artificial Intelligence (AI) and machine learning algorithms are used to mine the extracted and cleaned data to create data-driven process models. Moreover, in the process mining type segment, the process conformance subsegment is expected to show the highest growth rate. In the process conformance subsegment, the data mining software is used for process conformance checks, wherein the event logs are checked against ideal processes. The process mining software converts the event logs into a process model and checks them against ideal and pre-defined processes. Hence, deviations between the derived business process model and ideal processes can be diagnosed, and non-conformance can be highlighted and visualized.

The large enterprises segment is expected to account for a larger market share in the process analytics market by organization size. This growth is attributed to the fact that process analytics solutions enable enterprises to monitor and regulate complex business and Information Technology (IT) processes. In the deployment type segment, the cloud subsegment is expected to grow at a higher CAGR during the forecast period. This growth is attributed to the fact that the cloud subsegment enables organizations to manage their costs and helps them ensure improved business agility.

The business process segment is expected to account for the largest market share in the process analytics market. The process mining software provides data scientists and analyst’s with enhanced situational awareness for the daily business processes of enterprises. Moreover, the software provides intuitive, graphical, and visual representations of the enterprise’s business processes. Furthermore, data-based process discovery enables enterprises to represent their business transactions as a process diagram. Besides, the customer interaction segment is expected to grow at the highest CAGR during the forecast period. The process analytics software enables enterprises to trace the entire customer journey and provides insights into the consumer purchasing patterns. Moreover, it enables enterprises to estimate the stage where consumers are on their journey, which helps the marketing team take more effective and efficient marketing decisions.

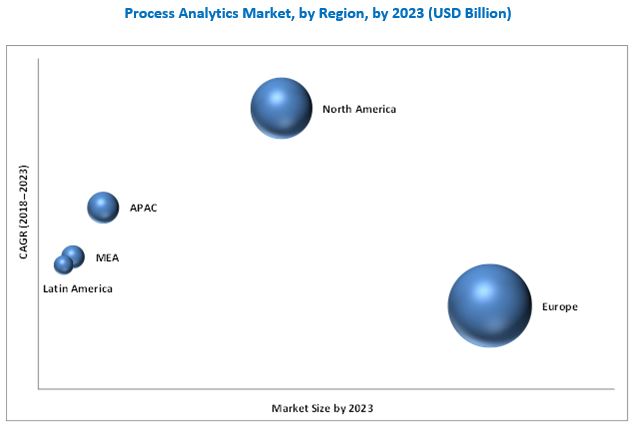

Europe is the largest contributor to the process analytics market, due to the widespread acceptance of innovations and the upcoming analytics technology among the large numbers of vendors operating in the region. Germany and the Netherlands are the top countries contributing to the market in Europe. Along with these countries, several other European countries are also incorporating the process analytics software into their existing analytics portfolio to receive quick and actionable executive insights to keep pace with their analytics-driven competitors in the other regions. Enterprises in the European region are adopting the advanced process analytics software to fulfill the growing needs for data-driven decision-making across all verticals.

North America holds the largest opportunity in the process analytics market. The region is expected to offer a huge market scope for the adoption of the process analytics software during the forecast period. Commercial entities and government organizations have expressed an interest in implementing process analytics solutions over the traditional Business Process Management (BPM) solutions. The US is expected to register the higher adoption of the process analytics software during the forecast period.

Availability of the open-source software is expected to be the major restraining factor for the growth of the process analytics market. However, the recent developments, new product launches, and acquisitions undertaken by the major market players are expected to boost the market growth.

The study measures and evaluates the major offerings and the key strategies of the major market vendors, including Celonis (Germany), Fluxicon (Netherlands), Icaro Tech (Brazil), Kofax (US), Lana Labs (Germany), Minit (Slovakia), Logpickr (France), TimelinePI (US), Scheer (Germany), Monkey Mining (Netherlands), Worksoft (US), Puzzle Data (South Korea), QPR Software (Finland), Cognitive Technology (Malta), Signavio (Germany), SNP (US), Your Data (France), Process Mining Group (Open-Source), Software AG (Germany), Fujitsu (Japan), CA Technologies (US), Process Analytics Factory (Germany), StereoLOGIC (Ontario), Intellera (Canada), and ProcessGold (Netherlands). These companies have been at the forefront in offering reliable process analytics software to commercial clients across diverse locations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Process Analytics Market

4.2 Market By Application and Top 3 Regions

4.3 Market By Region

4.4 Market Investment Scenario

5 Process Analytics Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Digital Transformation Driving Users’ Awareness for Analyzing and Understanding Business Processes

5.2.1.2 Advent of Algorithmic Business

5.2.1.3 Rise in the Implementation of Task-Level Automation

5.2.1.4 Generation of Humongous Volumes of Process Log Data Across Business Functions

5.2.1.5 The Need to Enhance Process Auditing and Compliance

5.2.1.6 Collaborations Between Process Analytics and ERP Vendors

5.2.2 Restraints

5.2.2.1 Competition From Open-Source Alternatives Hampering the Demand for Commercial Solutions

5.2.3 Opportunities

5.2.3.1 The Need to Focus on Enhancing the Customer Experience

5.2.3.2 Investments From Leading Analytics Vendors

5.2.4 Challenges

5.2.4.1 Integration of Process Analytics Software With Legacy ERP Software

5.2.4.2 Lack of Skills and Expertise

6 Process Analytics Market, By Process Mining Type (Page No. - 37)

6.1 Introduction

6.2 Process Discovery

6.3 Process Conformance

6.4 Process Enhancement

7 Market By Deployment Type (Page No. - 42)

7.1 Introduction

7.2 On-Premises

7.3 Cloud

8 Process Analytics Market, By Organization Size (Page No. - 46)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Market By Application (Page No. - 50)

9.1 Introduction

9.2 Business Process

9.3 Information Technology Process

9.4 Customer Interaction

10 Process Analytics Market, By Region (Page No. - 55)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 69)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 New Product Launches and Product Enhancements

11.3.2 Business Expansions

11.3.3 Mergers and Acquisitions

11.3.4 Partnerships, Agreements, and Collaborations

12 Company Profiles (Page No. - 73)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Celonis

12.2 Fluxicon

12.3 Icaro Tech

12.4 Kofax

12.5 Lana Labs

12.6 Minit

12.7 Logpickr

12.8 Timelinepi

12.9 Scheer

12.10 Monkey Mining

12.11 Worksoft

12.12 Puzzle Data

12.13 QPR Software

12.14 Cognitive Technology

12.15 Signavio

12.16 SNP

12.17 Your Data

12.18 Process Mining Group

12.19 Software AG

12.20 Fujitsu

12.21 CA Technologies

12.22 Process Analytics Factory (PAF)

12.23 Stereologic

12.24 Intellera

12.25 Processgold

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 116)

13.1 Industry Excerpts

13.2 Interview With Professor Wil Van Der Aalst

13.3 Discussion Guide

13.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.5 Introducing RT: Real-Time Market Intelligence

13.6 Available Customizations

13.7 Related Reports

13.8 Author Details

List of Tables (41 Tables)

Table 1 Process Analytics Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Market Size By Process Mining Type, 2016–2023 (USD Million)

Table 3 Process Discovery: Market Size By Region, 2016–2023 (USD Million)

Table 4 Process Conformance: Market Size By Region, 2016–2023 (USD Million)

Table 5 Process Enhancement: Market Size By Region, 2016–2023 (USD Million)

Table 6Process Analytics Market Size By Deployment Type, 2016–2023 (USD Million)

Table 7 On-Premises: Market Size By Region, 2016–2023 (USD Million)

Table 8 Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 9 Process Analytics Market Size, By Organization Size, 2016–2023 (USD Million)

Table 10 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 11 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 12 Market Size By Application, 2016–2023 (USD Million)

Table 13 Business Process: Market Size By Region, 2016–2023 (USD Million)

Table 14 Information Technology Process: Market Size By Region, 2016–2023 (USD Million)

Table 15 Customer Interaction: Market Size By Region, 2016–2023 (USD Million)

Table 16 Process Analytics Market Size, By Region, 2016–2023 (USD Million)

Table 17 North America: Market Size By Process Mining Type, 2016–2023 (USD Million)

Table 18 North America: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 19 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 20 North America: Market Size By Application, 2016–2023 (USD Million)

Table 21 Europe: Process Analytics Market Size, By Process Mining Type, 2016–2023 (USD Million)

Table 22 Europe: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 23 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 24 Europe: Market Size By Application, 2016–2023 (USD Million)

Table 25 Asia Pacific: Market Size, By Process Mining Type, 2016–2023 (USD Million)

Table 26 Asia Pacific: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 27 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 28 Asia Pacific: Market Size By Application, 2016–2023 (USD Million)

Table 29 Middle East and Africa: Process Analytics Market Size, By Process Mining Type, 2016–2023 (USD Million)

Table 30 Middle East and Africa: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 31 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 32 Middle East and Africa: Market Size By Application, 2016–2023 (USD Million)

Table 33 Latin America: Market Size, By Process Mining Type, 2016–2023 (USD Million)

Table 34 Latin America: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 35 Latin America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 36 Latin America: Market Size By Application, 2016–2023 (USD Million)

Table 37 Market Ranking for the Process Analytics Market, 2018

Table 38 New Product Launches and Product Enhancements, 2013–2018

Table 39 Business Expansions, 2013-2018

Table 40 Mergers and Acquisitions, 2013–2018

Table 41 Partnerships, Agreements, and Collaborations, 2013–2018

List of Figures (39 Figures)

Figure 1 Process Analytics Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Process Analytics Market: Research Assumptions

Figure 8 Market Top 3 Segments, 2018

Figure 9 Market By Organization Size, 2018–2023

Figure 10 Digital Transformation and the Advent of Algorithmic Business are Expected to Drive the Process Analytics Market Growth During the Forecast Period

Figure 11 Business Process Application and Europe are Estimated to Have the Largest Market Shares in 2018

Figure 12 Europe is Expected to Have the Largest Market Size During the Forecast Period

Figure 13 North America is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 14 Process Analytics Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Process Discovery Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 16 Europe is Expected to Have the Largest Market Share in the Process Discovery Segment During the Forecast Period

Figure 17 North America is Expected to Register the Highest CAGR in the Process Conformance Segment During the Forecast Period

Figure 18 North America is Expected to Register the Highest CAGR in the Process Enhancement Segment During the Forecast Period

Figure 19 On-Premises Deployment Type is Expected to Have the Larger Market Size During the Forecast Period

Figure 20 Large Enterprises Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 21 Customer Interaction Application is Expected to Register the Highest CAGR During the Forecast Period

Figure 22 Europe is Expected to Hold the Largest Market Size in the Business Process Application During the Forecast Period

Figure 23 North America is Expected to Register the Highest CAGR in the Information Technology Process Application During the Forecast Period

Figure 24 Europe is Expected to Hold the Largest Market Size in the Customer Interaction Application During the Forecast Period

Figure 25 Europe is Expected to Have the Largest Market Size During the Forecast Period

Figure 26 North America is Expected to Be A Major Investment Hub in the Process Analytics Market During the Forecast Period

Figure 27 North America: Market Snapshot

Figure 28 Europe: Market Snapshot

Figure 29 Key Development By the Leading Players in the Process Analytics Market for 2013–2018

Figure 30 QPR Software: Company Snapshot

Figure 31 QPR Software: SWOT Analysis

Figure 32 SNP: Company Snapshot

Figure 33 SNP: SWOT Analysis

Figure 34 Software AG: Company Snapshot

Figure 35 Software AG: SWOT Analysis

Figure 36 Fujitsu: Company Snapshot

Figure 37 Fujitsu: SWOT Analysis

Figure 38 CA Technologies: Company Snapshot

Figure 39 CA Technologies: SWOT Analysis

Growth opportunities and latent adjacency in Process Analytics Market