Probiotics Food & Cosmetics Market Size, Share, Trends Analysis Report by Product Type (Probiotics Food and Beverages, Dietary Supplements, Cosmetics), Ingredient (Bacteria, Yeast), Distribution Channel (Hypermarkets/Supermarkets, Pharmacies/Drugstores, Specialty Stores, Online) & Region - Global Industry Forecast to 2026

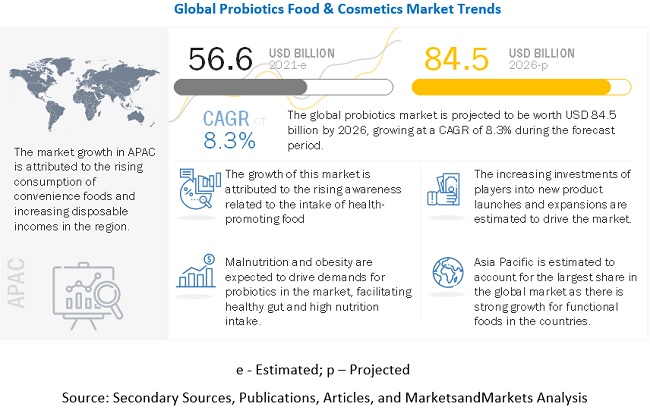

The global probiotics food & cosmetics market size is estimated to reach $84.5 billion by 2026, growing at a 8.3% compound annual growth rate (CAGR). The global market size was valued $56.6 billion in 2021. The best probiotics skin care products promote a healthier, stronger, and calmer skin barrier, which consists of a layer of natural bacteria, making them great for combating dryness, irritation, inflammation, and damage caused by free radical exposure. Today, probiotic supplements are consumed with increasing regularity and record a rapidly growing economic value.

To know about the assumptions considered for the study, Request for Free Sample Report

Probiotic Food and Cosmetics Market Growth Insights

Drivers: Increasing popularity of probiotic dietary supplements

Dietary supplements include tablets, capsules, powders, liquids, and pills, which are convenient forms of meeting the daily nutritional requirements of the body. Probiotic dietary supplements are not as popular as probiotic foods, especially in Asia Pacific, but have started gaining popularity over the past few years. North America is a huge market for probiotic dietary supplements due to the natural predisposition of consumers for taking supplements. Compared to European countries, people in the US are more willing to consume oral supplements. In the US, the FDA does not require pre-market approval of the health claims made by manufacturers of probiotic dietary supplements, which allows them to launch innovative products to cater to the increasing demand.

Restraints: International quality standards and regulations for probiotic products

International bodies, such as the National Food Safety and Quality Service, Canadian Food Inspection Agency, US FDA, WHO, and European Parliament Committee on the ENVI (Environment, Public Health and Food Safety) of the EU are associated with food safety regulations. These organizations have control over the use of different chemicals and materials during food processing, directly or indirectly. In 2001, the joint FAO of the UN/WHO Expert Consultation on Evaluation of Health and Nutritional Properties of Probiotics developed guidelines for evaluating probiotics in food that could lead to the substantiation of health claims. This was to standardize the requirements needed to make health claims related to probiotic agents. The inclusion of probiotics in cosmetics will provide regulatory challenges as it brings cosmetic products into the health realm. The products are focused on safety, clinical verification, and proof of using high standards for handling, storing, and applying products containing microbes and their metabolites or cell walls.

Opportunities: Probiotics can replace pharmaceutical agents

The increasing demand for probiotics has shown that customers prefer products with proven health benefits. The increasing evidence of health benefits associated with probiotics for health restoration has increased the customer expectations related to probiotics. This inclination toward a safe, natural, and cost-effective substitute for drugs has led to the application of probiotics as pharmaceutical agents. Beneficial effects of probiotics as pharmaceutical agents seem to be strain- and dose-dependent. Clinical trials have displayed that probiotics may cure certain disorders or diseases in humans, especially those related to the GI tract. The consumption of fermented dairy products containing probiotic cultures may provide health benefits in certain clinical conditions, such as antibiotic-associated diarrhea, rotavirus-associated diarrhea, inflammatory bowel disease, irritable bowel syndrome (IBS), allergenic diseases, cancer, Helicobacter pylori infection, and lactose-intolerance

Challenges:Intolerance of probiotics to stomach acid and bile

Probiotics is exposed to harsh conditions prevailing in the stomach and small intestine after they survive the manufacturing process and degradation with time on the shelf. According to the UK food microbiologist, only a few highly resistant bacteria such as lactobacillus and bifidobacteria can survive stomach acid. The other probiotic bacteria are expected to get destroyed by stomach acid. Mostly, the intolerance level to survive the harsh acidity in the stomach is below pH 2. For instance, Lactobacilli spp. has been observed to survive only between 30 seconds to a few minutes under such conditions. Generally, the acid is useful in killing harmful bacteria, which might be ingested with food or while drinking, but good bacteria are also killed in the process that is in the form of probiotics. However, the stomach of humans has a mucous lining, which can resist the stomach acid from digesting the food.

Bacteria plays a major role in building immunity among people

The most widely consumed bacteria strains are Lactobacilli, Bifidobacteria, and Streptococcus Thermophilusthermophilus, among others (Enterococcus, Bacillus, and Pediococcus). The primary benefit of incorporating scientifically derived bacterial strains in probiotic foods is the balance in the host’s intestinal microbiota and the subsequent enhancement of the immune system. The other advantages include balancing the pH of the large intestine, cholesterol reduction, prevention of diseases, treatment of tooth decay, and improvement in women’s health.

The probiotics food & cosmetics segment, by product type is projected to be the fastest-growing during the forecast period.

Probiotics are categorized as foods & beverages based on their intended uses and benefits, which, in turn, depends on probiotic microbes. The products under this category include foods & beverages that offer distinct health benefits beyond fundamental nutrition due to their specific ingredients. Probiotic ingredients are incorporated in a wide range of food & beverage applications such as dairy products, non-dairy beverages, cereals, and infant formula. The increasing consumer awareness related to probiotics is gradually gaining pace, which is expected to drive the investments in R&D for developing new products that contain probiotic ingredients.

Probiotic Food and Cosmetics Market Regional Insight

High-growth prospects for probiotic manufacturers in Asia Pacific

The expansion of supermarkets, especially in Asia Pacific, is expected to create high-growth prospects for probiotic manufacturers in the coming years. China is expected to create lucrative opportunities for the US yogurt manufacturers amid the rise in the demand for yogurt in the country, exceeding domestic production. Companies such as General Mills (US) and Chobani (US) can penetrate the yogurt market in the country with the launch of their product line. Consumers are willing to visit supermarkets and pay premium prices for products with nutritional benefits. The trend of leading a healthy lifestyle attracts youngsters in the country to shop in supermarkets even if it is expensive. The growing popularity of online mode of distribution channels has urged supermarkets to adopt different strategies. For instance, in-store promotions and on-site demonstrations are some of the strategies adopted by supermarkets.

The Asia Pacific region dominated the probiotic food & cosmetics market

Probiotics are becoming one of the essential ingredients for various health and nutritional applications. Awareness regarding the benefits of ‘good bacteria’ has always been high in the European and Asia Pacific markets due to bacterially fermented milk products available in the regions. With the increase in diseases such as obesity, high blood pressure, and osteoporosis, consumers tend to maintain a healthy diet with the increased consumption of fortified foods, beverages, and dietary supplements.

Key Players in Probiotics Food & Cosmetics Market

Key players in this market include Probi AB (Sweden), Nestlé (Switzerland), ADM (US), Danone (France), DuPont (US), Yakult Honsha (Japan), Kerry (Ireland), BioGaia (Sweden), Esse Skincare (South Africa), and L’Oréal (France).

Probiotics Food & Cosmetics Market Report Scope

|

Report Metric |

Details |

|

Market value in 2021 |

USD 56.6 billion |

|

Revenue prediction in 2026 |

USD 84.5 billion |

|

Growth Rate |

CAGR of 8.3% |

|

Base year considered |

2020 |

|

Forecast period considered |

2021–2026 |

|

Units considered |

Value (USD) |

|

Segments covered |

By distribution channel, ingredients, product type, and region |

|

Regions covered |

North America, Asia Pacific, Europe, South America and RoW |

|

Companies studied |

|

This research report categorizes the probiotics food & cosmetics market, based on distribution channel, ingredients, product type, and region

Probiotics Food & Cosmetics Market Segmentation

By Distribution Channel

- Hypermarkets/ Supermarkets

- Pharmacies/ Drugstores

- Specialty stores

- Online

By Ingredients

- Bacteria

- Yeast

By Product Type

- Probiotics food & beverages

- Dietary Supplements

- Cosmetics

By Product Type

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In February 2021, BioGia aims at developing next-generation probiotic products focusing on metabolic conditions with a special emphasis on diabetes and related diseases.

- In December 2020, Danone launched a probiotic product for preventing lactation mastitis in breastfeeding mothers. It is sold exclusively in China.

- In November 2020, Kerry acquired Bio-K Plus International, which provides a range of clinically supported probiotic beverage and supplement applications.

- In May 2020, Probi AB signed a long-term R&D collaboration agreement with Competence Centre on Health Technologies (CCHT). It aims at developing novel products based on probiotics lactobacilli strains for women’s health.

Frequently Asked Questions (FAQ):

How big is the probiotics food & cosmetics market?

The global market for probiotics food & cosmetics is expected to increase at a compound annual growth rate of 8.3%, reaching $56.6 billion in 2021 and $84.5 billion by the end of 2026.

Which players are involved in the manufacturing of probiotics food & cosmetics market?

Key players in this market include Probi AB, Nestle, ADM, Loreal, and DuPont. Organizations are focusing on expanding their production facilities, entering into partnerships and agreements, and launching new products to grow their businesses and, in turn, their market share.

Which region is projected to account for the largest share in the probiotics food & cosmetics market?

Asia Pacific account largest share in the probiotics food & cosmetics market. In the probiotic dietary supplements space, demand is expected to be large in Japan, where the older population is large in number.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 15)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 PROBIOTIC FOOD & COSMETIC MARKET SEGMENTATION

1.4 INCLUSIONS AND EXCLUSIONS

FIGURE 2 PROBIOTIC FOOD & COSMETICS MARKET: GEOGRAPHIC SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2020

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

FIGURE 3 PROBIOTICS FOOD & COSMETICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary profiles

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN

2.2.2 BOTTOM-UP

2.3 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.3.1 SUPPLY SIDE

2.3.2 DEMAND SIDE

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 5 COVID-19: GLOBAL PROPAGATION

FIGURE 6 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 7 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 8 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 9 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 10 FOOD & BEVERAGES SEGMENT TO DOMINATE THE PROBIOTIC FOOD & COSMETICS MARKET, 2021 VS. 2026 (USD BILLION)

FIGURE 11 ASIA PACIFIC TO BE THE LARGEST REGION IN THE PROBIOTIC FOOD & COSMETICS MARKET, 2021–2026

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 BRIEF OVERVIEW OF THE PROBIOTIC FOOD & COSMETICS MARKET

FIGURE 12 BENEFITS ASSOCIATED WITH PROBIOTICS FUEL THE MARKET DEMAND

4.2 PROBIOTIC FOOD & COSMETICS MARKET SIZE, BY REGION

FIGURE 13 PROBIOTIC FOOD & COSMETICS MARKET SIZE, BY REGION, 2021 VS. 2026 (USD BILLION)

4.3 COVID-19 IMPACT ON THE PROBIOTIC FOOD & COSMETICS MARKET

FIGURE 14 PRE- & POST-COVID SCENARIOS IN THE PROBIOTIC FOOD & COSMETICS MARKET

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 PROBIOTICS FOOD & COSMETICS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing popularity of probiotic dietary supplements

5.2.1.2 Participation of international bodies in the R&D of probiotic products

5.2.1.3 Market competitiveness in the probiotics market

5.2.2 RESTRAINTS

5.2.2.1 International quality standards and regulations for probiotic products

5.2.2.2 High R&D costs for developing new probiotic strains

5.2.2.3 Instances of allergies to some probiotic supplements

5.2.3 OPPORTUNITIES

5.2.3.1 Probiotics can replace pharmaceutical agents

5.2.3.2 Increase in demand for probiotics in developed economies

5.2.4 CHALLENGES

5.2.4.1 Intolerance of probiotics to stomach acid and bile

6 INDUSTRY TRENDS (Page No. - 45)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN

FIGURE 15 THE STRAIN DEVELOPMENT AND DISTRIBUTION PHASE PLAYS A VITAL ROLE IN THE VALUE ADDITION OF THE SUPPLY CHAIN FOR PROBIOTICS

6.3 TECHNOLOGY ANALYSIS

6.3.1 INDICATION-SPECIFIC FORMULATIONS TO IMPROVE THE METABOLIC ACTIVITY OF MICROBES

6.3.2 MICROENCAPSULATION TO ENHANCE THE VIABILITY OF PROBIOTICS

6.3.3 PROBIOTICS AND ARTIFICIAL INTELLIGENCE

6.4 PRICING ANALYSIS: PROBIOTIC FOOD & COSMETICS MARKET

6.5 ECOSYSTEM OF PROBIOTICS

6.5.1 PROBIOTIC FOOD & COSMETICS MARKET: ECOSYSTEM MAP

TABLE 2 PROBIOTIC FOOD & COSMETICS MARKET: ECOSYSTEM

6.6 YC-YCC SHIFT: TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 16 REVENUE SHIFT FOR THE PROBIOTIC FOOD & COSMETICS MARKET

6.7 PORTER’S FIVE FORCES ANALYSIS

6.7.1 PROBIOTIC FOOD & COSMETICS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.7.2 THREAT OF NEW ENTRANTS

6.7.3 THREAT OF SUBSTITUTES

6.7.4 BARGAINING POWER OF SUPPLIERS

6.7.5 BARGAINING POWER OF BUYERS

6.7.6 INTENSITY OF COMPETITIVE RIVALRY

6.8 PATENT ANALYSIS

FIGURE 17 TOP PUBLICATION YEAR

FIGURE 18 TOP TEN APPLICANTS IN THE LAST TEN YEARS

TABLE 3 SOME PATENTS PERTAINING TO PROBIOTICS, 2019–2021

6.9 CASE STUDIES

TABLE 4 INCREASING ISSUES OF OBESITY CREATE A MARKET FOR INNOVATIVE SOLUTIONS

TABLE 5 SAFETY ASSESSMENT AND CERTIFICATION DEMAND BY INDUSTRY PLAYERS TO ENSURE TRANSPARENCY

6.10 COVID-19 IMPACT ANALYSIS

6.11 REGULATORY FRAMEWORK

6.11.1 NORTH AMERICA

6.11.1.1 United States

6.11.1.2 Canada

6.11.2 EUROPE

6.11.3 ASIA PACIFIC

6.11.3.1 Japan

6.11.3.2 Australia & New Zealand

6.11.3.3 India

6.11.4 SOUTH AMERICA

6.11.4.1 Brazil

7 PROBIOTIC FOOD & COSMETICS MARKET, BY INGREDIENT (Page No. - 59)

7.1 INTRODUCTION

TABLE 6 DIVERSITY OF PROBIOTICS

TABLE 7 HEALTH BENEFITS OF PROBIOTIC MICROORGANISMS

7.2 BACTERIA

7.2.1 BACTERIA PLAYS A MAJOR ROLE IN BUILDING IMMUNITY AMONG PEOPLE

7.2.2 LACTOBACILLI

7.2.2.1 Lactobacillus acidophilus

7.2.2.2 Lactobacillus rhamnosus

7.2.2.3 Lactobacillus casei

7.2.2.4 Lactobacillus reuteri

7.2.3 BIFIDOBACTERIUM

7.2.4 STREPTOCOCCUS THERMOPHILUS

7.3 YEAST

7.3.1 PROBIOTICS ARE WIDELY USED FOR SEVERAL THERAPEUTIC PURPOSES

TABLE 8 BENEFICIAL EFFECTS OF YEAST

7.3.2 SACCHAROMYCES BOULARDII

8 PROBIOTIC FOOD & COSMETICS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 67)

8.1 INTRODUCTION

8.1.1 HYPERMARKETS/SUPERMARKETS

8.1.1.1 High-growth prospects for probiotic manufacturers in Asia Pacific

8.1.2 PHARMACIES/DRUGSTORES

8.1.2.1 In the US, the demand for dietary supplements will increase amid the rise in the geriatric population

8.1.3 SPECIALTY STORES

8.1.3.1 Specialty stores provide a variety of probiotic dietary supplements to various categories of people

8.1.4 ONLINE

8.1.4.1 Online shopping to gain consumer interest in the coming years

9 PROBIOTIC FOOD & COSMETICS MARKET, BY PRODUCT TYPE (Page No. - 69)

9.1 INTRODUCTION

TABLE 9 PROBIOTICS FOOD and COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 10 PROBIOTIC FOOD & COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

9.2 PROBIOTIC FOOD & BEVERAGES

TABLE 11 PROBIOTIC FOOD and BEVERAGES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 12 PROBIOTIC FOOD and BEVERAGES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 PROBIOTICS DIETARY SUPPLEMENTS

9.3.1 DIETARY SUPPLEMENTS ARE AN ALTERNATIVE TO FULFILL DIET DEFICIENCIES

TABLE 13 PROBIOTIC DIETARY SUPPLEMENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 PROBIOTIC DIETARY SUPPLEMENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 PROBIOTIC COSMETICS

9.4.1 DUE TO THIS RISING INCLINATION, THE PERSONAL CARE INDUSTRY IS CONSISTENTLY WITNESSING SUBSTANTIAL GROWTH

TABLE 15 PROBIOTIC COSMETICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 PROBIOTIC COSMETICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 PROBIOTIC FOOD & COSMETICS MARKET, BY REGION (Page No. - 74)

10.1 INTRODUCTION

TABLE 17 PROBIOTIC FOOD & COSMETICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 PROBIOTIC FOOD and COSMETICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

TABLE 19 NORTH AMERICA: PROBIOTIC FOOD & COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 20 NORTH AMERICA: PROBIOTIC FOOD and COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Aim to improve digestive health and immunity fuels the growth of probiotics in the US

10.2.2 CANADA

10.2.2.1 Probiotic companies offer improved and innovative products to facilitate the demand for high-quality products

10.2.3 MEXICO

10.2.3.1 Lack of awareness about the health benefits of probiotics to restrict the growth of the market

10.3 EUROPE

TABLE 21 EUROPE: PROBIOTIC FOOD & COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 22 EUROPE: PROBIOTIC FOOD and COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

10.3.1 FRANCE

10.3.1.1 Traditional drinks such as kefir to contribute to the growth of the probiotics market in Russia

10.3.2 UK

10.3.2.1 Probiotics usage to be extended to various food applications such as snack bars

10.3.3 ITALY

10.3.3.1 Italy has a huge market in Europe owing to the awareness about the health benefits of probiotics

10.3.4 GERMANY

10.3.4.1 Ban on antibiotics to promote growth in the probiotic food & cosmetics market

10.3.5 SPAIN

10.3.5.1 Companies invest in Spain to produce value-added probiotic products

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

TABLE 23 ASIA PACIFIC: PROBIOTIC FOOD & COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 24 ASIA PACIFIC: PROBIOTIC FOOD and COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China is one of the major markets for probiotics in Asia Pacific

10.4.2 JAPAN

10.4.2.1 Yakult Japan adopts various innovative strategies to strengthen the probiotic food & cosmetics market in the country

10.4.3 SOUTH KOREA

10.4.3.1 Multinational players’ penetration in the probiotics industry to boost the market growth

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.4.1 Probiotic products are mainly designed for women and children in this region

10.4.5 REST OF ASIA PACIFIC

10.5 SOUTH AMERICA

TABLE 25 SOUTH AMERICA: PROBIOTICS FOOD & COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 26 SOUTH AMERICA: PROBIOTIC FOOD and COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

10.5.1 ARGENTINA

10.5.1.1 Probiotic yogurt benefits increase its sales in Argentina

10.5.2 BRAZIL

10.5.2.1 Dietary supplement consumption to increase with health awareness

10.5.3 REST OF SOUTH AMERICA

10.5.3.1 Startups to boost the probiotic food & cosmetics market without hampering the taste element in foods

10.6 REST OF THE WORLD

TABLE 27 ROW: PROBIOTIC FOOD & COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 28 ROW: PROBIOTIC FOOD and COSMETICS MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

10.6.1 MIDDLE EAST

10.6.1.1 Use of probiotics for proper functioning of GIT

10.6.2 AFRICA

10.6.2.1 Investments to increase in pharmaceutical companies with intra-African trade

11 COMPETITIVE LANDSCAPE (Page No. - 87)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS, 2020

TABLE 29 PROBIOTIC FOOD AND COSMETICS MARKET: DEGREE OF COMPETITION

11.3 KEY PLAYER STRATEGIES

11.4 REVENUE ANALYSIS OF PROBIOTIC FOOD & COSMETICS COMPANIES, 2018-2020

FIGURE 19 REVENUE ANALYSIS OF PROBIOTIC FOOD & COSMETICS COMPANIES IN THE MARKET, 2018–2020 (USD BILLION)

11.5 COVID-19-SPECIFIC COMPANY RESPONSES

11.5.1 ADM

11.5.2 DUPONT

11.5.3 KERRY GROUP

11.5.4 NESTLE

11.6 COMPANY EVALUATION QUADRANT (FOOD AND BEVERAGES COMPANIES)

11.6.1 STAR

11.6.2 PERVASIVE

11.6.3 EMERGING LEADERS

11.6.4 PARTICIPANTS

FIGURE 20 PROBIOTICS FOOD AND COSMETICS MARKET: COMPANY EVALUATION QUADRANT, 2020 (FOOD AND BEVERAGES COMPANIES)

11.6.5 PRODUCT FOOTPRINT

TABLE 30 COMPANY, BY APPLICATION FOOTPRINT

TABLE 31 COMPANY, BY REGIONAL FOOTPRINT

TABLE 32 OVERALL COMPANY FOOTPRINT

11.7 COSMETIC COMPANIES EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 21 PROBIOTIC FOOD AND COSMETICS MARKET: COSMETIC COMPANIES EVALUATION QUADRANT, 2020

11.8 COMPETITIVE SCENARIO AND TRENDS

11.8.1 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

TABLE 33 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS, JUNE 2018–MAY 2021

11.8.2 DEALS

TABLE 34 ACQUISITIONS AND PARTNERSHIPS, JUNE 2018 – MAY 2021

11.8.3 OTHERS

TABLE 35 EXPANSIONS AND INVESTMENTS, JUNE 2019 – JUNE 2021

12 COMPANY PROFILES (Page No. - 101)

12.1 KEY COMPANIES

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 PROBI AB

TABLE 36 PROBI AB: BUSINESS OVERVIEW

FIGURE 22 PROBI AB: COMPANY SNAPSHOT

TABLE 37 PROBIOTIC FOOD & COSMETICS MARKET: PARTNERSHIP AND AGREEMENT BY PROBI AG

12.1.2 NESTLE

TABLE 38 NESTLE: PROBIOTICS FOOD & COSMETICS MARKET BUSINESS OVERVIEW

FIGURE 23 NESTLE: COMPANY SNAPSHOT

TABLE 39 PROBIOTIC FOOD & COSMETICS MARKET: PARTNERSHIP BY NESTLE

12.1.3 ARCHER DANIELS MIDLAND COMPANY

TABLE 40 ADM: BUSINESS OVERVIEW

FIGURE 24 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

TABLE 41 PROBIOTIC FOOD & COSMETICS MARKET: EXPANSION AND INVESTMENT BY ADM

TABLE 42 PROBIOTIC FOOD & COSMETICS MARKET: ACQUISITION

12.1.4 DANONE

TABLE 43 DANONE: BUSINESS OVERVIEW

FIGURE 25 DANONE: COMPANY SNAPSHOT

TABLE 44 PROBIOTIC FOOD & COSMETICS MARKET: NEW PRODUCT LAUNCHES BY DANONE

TABLE 45 PROBIOTIC FOOD & COSMETICS MARKET: EXPANSION BY DANONE

12.1.5 DUPONT

TABLE 46 DUPONT: BUSINESS OVERVIEW

FIGURE 26 DUPONT: COMPANY SNAPSHOT

TABLE 47 PROBIOTIC FOOD & COSMETICS MARKET: NEW PRODUCT LAUNCHES BY DANISCO

12.1.6 YAKULT HONSHA

TABLE 48 YAKULT HONSHA: BUSINESS OVERVIEW

FIGURE 27 YAKULT HONSHA: COMPANY SNAPSHOT

TABLE 49 PROBIOTIC FOOD & COSMETICS MARKET: EXPANSION BY YAKULT HONSHA

12.1.7 GENERAL MILLS

TABLE 50 GENERAL MILLS: BUSINESS OVERVIEW

FIGURE 28 GENERAL MILLS: COMPANY SNAPSHOT

TABLE 51 PROBIOTIC FOOD & COSMETICS MARKET: PARTNERSHIP BY GENERAL MILLS

TABLE 52 PROBIOTIC FOOD & COSMETICS MARKET: INVESTMENT BY GENERAL MILLS

12.1.8 KERRY

TABLE 53 KERRY: BUSINESS OVERVIEW

FIGURE 29 KERRY: COMPANY SNAPSHOT

TABLE 54 PROBIOTIC FOOD & COSMETICS MARKET: ACQUISITION BY KERRY

TABLE 55 PROBIOTIC FOOD & COSMETICS MARKET: EXPANSION BY KERRY

12.1.9 BIOGAIA

TABLE 56 BIOGAIA: BUSINESS OVERVIEW

FIGURE 30 BIOGAIA: COMPANY SNAPSHOT

TABLE 57 PROBIOTIC FOOD & COSMETICS MARKET: NEW PRODUCT LAUNCHES BY BIOGAIA

TABLE 58 PROBIOTIC FOOD & COSMETICS MARKET: EXPANSION BY BIOGAIA

TABLE 59 PROBIOTIC FOOD & COSMETICS MARKET: AGREEMENT AND PARTNERSHIP BY BIOGAIA

12.1.10 MORINAGA MILK INDUSTRY CO., LTD.

TABLE 60 MORINAGA MILK INDUSTRY CO., LTD.: BUSINESS OVERVIEW

FIGURE 31 MORINAGA MILK INDUSTRY CO., LTD.: COMPANY SNAPSHOT

TABLE 61 PROBIOTIC FOOD & COSMETICS MARKET: NEW PRODUCT LAUNCHES BY MORINAGA

TABLE 62 PROBIOTIC FOOD & COSMETICS MARKET: EXPANSION BY MORINAGA

12.1.11 GLOWBIOTICS LLC

TABLE 63 GLOWBIOTICS LLC: COMPANY OVERVIEW

12.1.12 EMINENCE ORGANIC SKIN CARE

TABLE 64 EMINENCE ORGANIC SKIN CARE: COMPANY OVERVIEW

12.1.13 ESSE SKIN CARE

TABLE 65 ESSE SKIN CARE: COMPANY OVERVIEW

12.1.14 L'ORÉAL

TABLE 66 L'ORÉAL: COMPANY OVERVIEW

12.1.15 ESTÉE LAUDER

TABLE 67 ESTÉE LAUDER: COMPANY OVERVIEW

12.1.16 TULA SKINCARE

TABLE 68 TULA SKINCARE: COMPANY OVERVIEW

12.1.17 AURELIA LONDON

TABLE 69 AURELIA LONDON: COMPANY OVERVIEW

12.1.18 LAFLORE PROBIOTIC SKINCARE

TABLE 70 LAFLORE PROBIOTIC SKINCARE: COMPANY OVERVIEW

12.1.19 GALLINÉE MICROBIOME SKINCARE

TABLE 71 GALLINÉE MICROBIOME SKINCARE: COMPANY OVERVIEW

12.1.20 BIOMILK SKINCARE

TABLE 72 BIOMILK SKINCARE: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 145)

13.1 INTRODUCTION

TABLE 73 ADJACENT MARKETS TO PROBIOTICS

13.2 LIMITATIONS

13.3 NUTRACEUTICAL INGREDIENTS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 74 NUTRACEUTICAL INGREDIENTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 75 NUTRACEUTICAL INGREDIENTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

13.4 PREBIOTIC INGREDIENTS MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

TABLE 76 PREBIOTIC INGREDIENTS MARKET SIZE, BY TYPE, 2015–2023 (USD MILLION)

14 APPENDIX (Page No. - 149)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

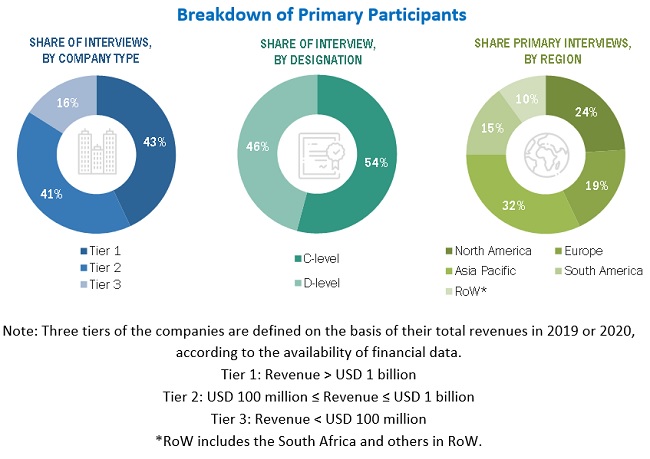

The study involved four major activities in estimating the market size for probiotics food & cosmetics. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as the Food and Drug Administration (FDA), European Food Safety Authority (EFSA), Food Standards Australia and New Zealand (FSANZ), and academic references pertaining to probiotics were referred to identify and collect information for this study. The secondary sources also include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was conducted to obtain critical information related to the industry’s supply chain, the total pool of key players, and market classification & segmentation, according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information related to the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, including technology suppliers, probiotics manufacturers, and end-use companies. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include probiotic manufacturers. The primary sources from the demand side include distributors, importers, exporters, and end-use sectors.

After the complete market engineering (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, key players, competitive landscape of probiotics supplied by different types of market players, and key market dynamics such as drivers, restraints, opportunities, industry trends, and key player strategies.

To know about the assumptions considered for the study, download the pdf brochure

Probiotics Food & Cosmetics Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the probiotics food & cosmetics market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- For the calculation of market shares of each market segment, the size of the most appropriate and immediate parent market has been considered for implementing the top-down procedure. The bottom-up procedure has also been implemented for data extracted from secondary research to validate the market size obtained for each segment.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent and each individual market have been determined and confirmed in this study. The data triangulation procedure implemented for this study is explained in the next section.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation & market breakdown procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for probiotics food & cosmetics on the basis of distribution channel, ingredients, product type, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the probiotics food & cosmetics market

Target Audience

- Manufacturers, importers and exporters, traders, distributors, and suppliers of probiotics

- Nutraceutical manufacturers

- Food processors and manufacturers

- Government and research organizations

- Trade associations and industry bodies

- Regulatory bodies and associations such as:

- Food Agriculture Organization (FAO)

- World Health Organization (WHO)

- International Dairy Federation (IDF)

- European Food & Feed Cultures Association (EFFCA)

- National Yogurt Association (NYA)

- International Scientific Association for Probiotics and Prebiotics (ISAPP)

- International Probiotics Association (IPA)

- Council for Responsible Nutrition (CRN)

- National Yogurt Association (NYA)

- International Frozen Yogurt Association (IFYA)

- American Nutrition Association (ANA)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe probiotics food & cosmetics market into the UK, and Greece

- Further breakdown of the Rest of Asia Pacific market for probiotics food & cosmetics into South Korea, Thailand, and Indonesia

- Further breakdown of the Rest of South America market for probiotics food & cosmetics into Chile, Peru, and Ecuador

- Further breakdown of other countries in the RoW market for probiotics food & cosmetics into Egypt, Israel, and Turkey

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Probiotics Food & Cosmetics Market