Prebiotic Ingredients Market by Type (Oligosaccharides, Inulin, & Polydextrose), Application (Food & Beverage, Dietary Supplements, & Animal Feed), Source, Brand, Functionality, Bacterial Activity and Region - Global Forecast to 2027

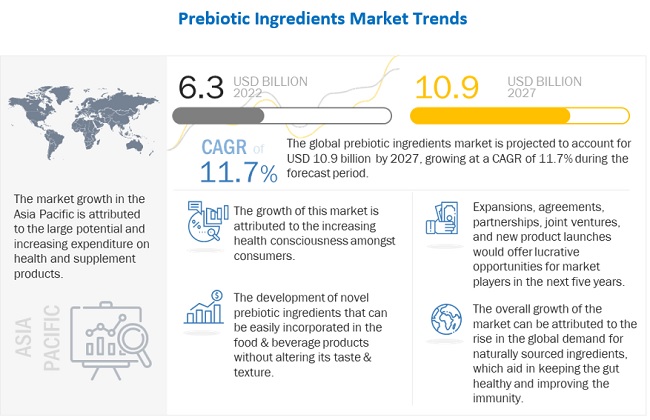

[261 Pages Report] The prebiotic ingredients market size is projected to grow from USD 6.3 billion in 2022 to USD 10.9 billion by 2027, recording a compound annual growth rate (CAGR) of 11.7% during the forecast period. The rise in the global population, wide use of prebiotics as nutraceutical ingredients, and increased awareness for prebiotics are the key factors that are projected to drive the growth of the prebiotic ingredients market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: The increasing number of product launches within the dairy subsegment

Looking at the various subsegments within the food segment, which largely supports the consumption of the prebiotic ingredient, the dairy and dairy products industry is growing at a CAGR of 6-8% (FAO) that, which is supporting the market growth. Food & beverage manufacturers have indicated a significant opportunity in the frozen dessert subsegment.

Dairy manufacturers are increasingly incorporating prebiotics as a key ingredient, which has led to higher demand in the global market. It has paved the way for a range of prebiotic-infused dairy products on retail shelves. For instance, many packaged product manufacturers in Latin America are complementing the supply-side push for inulin with new product launches. Companies such as Laticinios Bela Vista Ltda., Verde Campo, and 3arroyos provide inulin through fiber milk and snack bars. Other examples include Dos Pinos Strawberry yogurt ice cream, Brownes Dairy Wiggles, and prebiotic RTD coffee. Shifting consumer trends towards healthier and better-for-you indulgences while using minimal artificial ingredients are also augmenting the market's growth in the dairy segment.

Health claims are fostering growth in the dietary supplements category

The growing demand for prebiotics in dietary supplements due to its extensive clinical evidence for bowel health (Registered Dietician Survey, Global Prebiotic Association) is further boosting the growth of the prebiotic ingredients market. Private-label supplement manufacturers have reported a consistent demand for inulin in the digestive health supplement category over the past five years.

The availability of a wealth of scientific studies is enabling manufacturers to promote prebiotic ingredients under exclusive claims. For instance, Beneo has an exclusive EU health claim – ‘Chicory inulin promotes digestive health’ and ‘chicory root fiber supports a healthy and balanced digestive system.’ These claims have grown in influence over the geriatric population, with consumers seeking out products that have claims supporting self-health strategies. Also, these claims further support the supplementation of prebiotic ingredients in infant formula.

The post-COVID era is encouraging market growth for the prebiotic ingredients market

Covid-19 has impacted the prebiotics market by increasing the consumption of health supplements due to their health benefits. Quarantine and the extended lockdown have impacted considerably all over the world. However, the pandemic has created an opportunity due to the increased demand for prebiotics. This is mainly due to the raised awareness regarding health and increased concern for maintaining immunity and, thereby wellbeing of health.

There is heightened awareness of the proven health benefits of prebiotic ingredients, such as promoting gut health, weight management, mineral absorption, and maintaining blood cholesterol levels. About 5 g–10 g per day of inulin is recommended for people with healthy digestive function; it is safe to maintain the range between 10 g–15 g per day. The post-COVID era fosters increased prebiotic consumption in the geriatric, adult, and pediatric populations.

Challenges: Manufacturing hurdles: Formulating formats that cater to all consumer needs is the biggest challenge

Currently, enabling innovation in convenient supplement solutions is proving to be challenging for the industry. Convenience is expected to become the key priority in developing new products as consumers prioritize gut health. Currently, R&D experts in the industry are struggling to help food and supplement manufacturers to innovate new products owing to technical limitations. Depending on the prebiotics’ delivery format, successful formulation involves challenges ranging from ingredient stability & flavor to maintaining the right texture. These include-

- Manufacturers call for the need for acid and heat-stable, tasteless ingredients which can be easily applied to an array of applications, including powders, frozen snacks, beverages, gummies, and snack bars. Formulating products that respond to consumer needs for taste, texture, and convenience and simultaneously deliver health benefits has proven to hinder product innovation.

- Another challenge is prebiotics formulation with additional ingredients such as protein for added benefits. Presently, not all prebiotic fibers are heat or acid-stable, and their fibers break during processing, impacting their functionality and efficacy.

- The challenge of formulating prebiotics in smaller formats so that each product contains the right amount of prebiotic ingredients currently possesses the profound interest of formulators.

- Another concern is shelf-life stability which usually narrows the list of ingredients that manufacturers can use. Currently, the manufacturing process is expensive and time-consuming, and prebiotic companies are continuously tweaking their formulations and production process to attain the right product mix.

Opportunity : Small, innovative formats are a lucrative area for manufacturers

Increasingly, consumers expect to see supplement options on shelves that are positioned to help them in their health and wellness goals. Smaller formats such as shots, gummies, and pills and capsules are a lucrative area for prebiotic ingredient innovation. These smaller formats should also be functional, effective, and savory.

Unique formulations are creating an opportunity for companies to innovate prebiotics in smaller formats. Smaller formats such as gummies, tablets and capsules are a fast-growing form of supplements for millennial and Gen Z consumers. These formats also have the potential to lower the doses of prebiotic ingredients but have a higher impact on gut health.

There is an increasing need for synergy between formulators, consumers, and marketing experts to bring the right formats, which is deemed vital to ensure success in launching new formats. An emerging concept expected to gain traction in the industry is having a co-manufacturing network that connects consumers with companies that help them produce new formats based on their demands and feedback. The customer can choose their own flavors, vitamins and minerals, and even the prebiotic dosing for the supplement.

Product Opportunities through novel ingredient development

Presently, the research on the health-promoting mechanism, interaction with other ingredients within the body, side effects, and bioavailability of prebiotic ingredients are continuously expanding. Such research has the opportunity to contribute to the development of novel prebiotics in food and dietary supplement segments. The potential to create a new generation of prebiotic products is paving the way for investigating protein-based prebiotics' complex functions and properties. Research on the synergistic effect of protein-prebiotic conjugation is projected to develop promising ingredients with enhanced bioavailability, longer shelf life, and higher nutritional value.

As the awareness around the gut-brain axis is becoming mainstream, clinical studies also highlight how prebiotic ingredients can support normal stress levels and promote overall mental wellbeing. Other research areas that are important to the scientific community are muscle strength, bone health, nutrient uptake, and resilience to circadian disruption. The protein-based prebiotic study has emerged as a promising branch allowing formulators to create prebiotics with enhanced efficacy, which simultaneously addresses the deepening interest in supporting overall health. Evolving research and education could further help formulators develop and expand innovations for a specific benefit area for consumers.

Expansion in the RTD and RTE segments

The versatility of prebiotic ingredients has made them ideal for food applications. A growing interest in gut health and consumers’ shifting preferences towards carbohydrate-based diets, where fibers are being calculatedly consumed, have created a significant runway for prebiotics over the forecast period. As consumer priorities are being aligned with a focus on ready-to-eat products, bars and gels are perceived as key growth pockets for prebiotic ingredients in the food & beverage segment. Derivatives of cassava and chicory root are the key ingredients supporting the development of new products in this category.

Furthermore, recent regulations have also allowed the widespread incorporation of prebiotic ingredients as sweeteners. Prebiotics are perceived as ingredients having the additional benefit of flavoring products where manufacturers can also add no-sugar labels.

Another category contributing to the market growth is shelf-stable tonics and sodas, an emerging area of innovation for prebiotic formulators. According to primary sources, this area is projected to grow at a rate of 55% yearly, which should further augment market growth.

Restraint : Side effects have triggered caution among consumers

A difference in anecdotal evidence and science has led to many consumers turning away from prebiotics. As opposed to the claims made by the prebiotic ingredient brands, reports published in the National Center for Biotechnology Information highlight some of the adverse effects of prebiotics. Consumers increasingly relying on scientific evidence before buying have grown sensitive to the side effects brought about by prebiotics. Some of these include-

- Prebiotics increase the number of good bacteria but do not support the diversity of these bacteria. Having diverse bacteria in the body has been perceived as important owing to their multiple functions during metabolism.

- Overdose of prebiotic ingredients is known to have major side effects such as bloating and flatulence

- Prebiotics are known to impact the GI negatively and worsen symptoms of Irritable Bowel Syndrome owing to rapid fermentation leading to gas, bloating, diarrhea, or constipation in sensitive patients.

This awareness among consumers has slightly hindered the market expansion targeting a broader demo graph.

To know about the assumptions considered for the study, download the pdf brochure

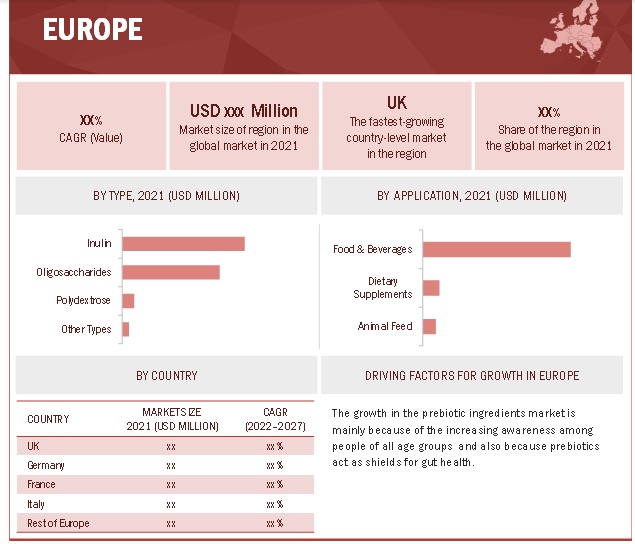

Europe is projected to account for the largest share of the prebiotic market during the forecast period.

Europe dominated the market for prebiotic ingredients, with a value of USD 2,120.1 million in 2021. This growth is mainly due to the ban on antibiotic growth promoters imposed by the European Union back in 2006. Since then, feed manufacturers have used prebiotics as additives for animal growth and nutrition. Some companies, such as FrieslandCampina (Netherlands) and Nexira (France), offer prebiotic ingredients for animal feed and human consumption.

Currently, the EU is offering funding for the R&D of food products to SMEs to fulfill the nutritional demand from consumers. Various organizations such as the USFDA, EFSA, and FAO have given results regarding the benefits of prebiotic ingredients on human and animal health, thereby leading to the growth of the prebiotic ingredients market in Europe.

Gut health products promoting overall mental health are a hot trend in the European market. Other trends such as clean-label, free-from, and naturally sourced ingredients are paving the way for the growth of the European prebiotic ingredients market.

Key Market Players

Key players in this market include Beno (Germany), ADM (US), DuPont (US), Friesland Campina (Netherlands), Ingredion (US), Samyang Corp (South Korea), Beghin Meiji (France), Tate & Lyle PLC (UK), Yakult (Japan), Kerry PLC (Ireland), Fronterra Ltd. (New Zealand), Royal Cosun (Netherlands), Roquette Frères (France), Cosucra Groupe Warcoing SA (Belgium), Taiyo International Inc. (US), Alland & Robert (France), Nexira (France), Prenexus Health (US), Vitalus Nutrition Inc. (Canada), and Clasado Ltd. (UK). These companies use strategies, such as expansions & investments, new product launches, agreements, and acquisitions to strengthen their market position.

Scope of the report

|

Report Metric |

Details |

|

Market size value in 2021: USD MN |

5,426.7 |

|

Market size value in 2022: USD MN |

6,312.8 |

|

Market size value in 2023: USD MN |

7,227.5 |

|

(CAGR) Growth Rate: |

11.70% |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Study Period |

2017-2027 |

|

Units considered |

Value (USD Million), Volume (KT) |

|

Segments covered |

Type, Application, Source, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Largest Market |

Europe |

|

Fastest Growing Market |

Asia Pacific |

|

Companies studied |

Beneo (Germany), ADM (US), DuPont (US), Friesland Campina (Netherlands), Ingredion (US), Samyang Corp (South Korea), Beghin Meiji (France), Tate & Lyle PLC (UK), Yakult (Japan), Kerry PLC (Ireland), Fronterra Ltd. (New Zealand), Royal Cosun (Netherlands), Roquette Frères (France), Cosucra Groupe Warcoing SA (Belgium), Taiyo International Inc. (US), Alland & Robert (France), Nexira (France), Prenexus Health (US), Vitalus Nutrition Inc. (Canada), and Clasado Ltd. (UK), Amway |

This research report categorizes the prebiotic ingredients market based on type, application, source, and region.

Based on type, the market has been segmented as follows:

- Oligosaccharide

- Inulin

- Polydextrose

- Other Types

Based on application, the market has been segmented as follows:

- Food & Beverage

- Dietary Supplements

- Animal Feed

Based on the source, the market has been segmented as follows:

- Roots

- Grains

- Vegetables

- Other sources

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW

Recent Developments

- In November 2021, ADM completed its acquisition of Georgia, US-based Deerland Probiotics and Enzymes. Deerland Probiotics and Enzymes provides probiotic and dietary supplements using probiotic, prebiotic, and enzyme technology. It operates five manufacturing facilities, one fermentation facility, and eight global R&D and quality control laboratories.

- In December 2019, DuPont merged with IFF; this merger would help DuPont become a global leader in high-value ingredients and solutions for global food & beverage, home & personal care, and health & wellness industries.

- In February 2021, GrupoArcor and Ingredion Incorporated entered into a joint venture to integrate the combined operations to market, sell, and manufacture ingredients within Argentina, Chile, and Uruguay. The manufacturing facilities will produce value-added ingredients such as glucose syrups, maltose, fructose, starch, and maltodextrins. Maltodextrins are prebiotics with proven health properties.

- In November 2020, Nexira acquired Swiss-based Unipektin Ingredients AG, which manufactures ‘Vidofibers,’ which are plant fibers. Vidofiber GF 25A is a soluble dietary fiber made from de-polymerized guar gum. This powder can be easily added to various foods, beverages, and supplements.

- In November 2021, Kerry PLC launched Emugold Fiber for the fortified white bread manufacturer. This will promote a high fiber claim in the white bread without affecting the taste, texture, and other sensory aspects.

- In July 2020, Roquette launched Nutriose soluble fiber sourced from yellow peas in the US market. The product offers the same functional benefits as the fibers sourced from wheat and corn. It also includes stronger and more consumer-friendly labeling because pea is not an allergen.

- In March 2020, Taiyo International expanded its Sunfiber product portfolio by launching Sunfiber GI, a synbiotic manufactured by combining probiotic and prebiotic properties. It targeted the women's demo graph suffering from gut health issues.

- In October 2021, Prenexus Health announced a partnership with Aloha Medicinals, a cultivator of bulk medicinal mushrooms and mushroom grain spawn ingredients, to bring the novel mushroom-based prebiotic, MyceliaGI to market.

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the prebiotic ingredients market, and how intense is the competition?

Key players in this market include Beneo (Germany), ADM (US), DuPont (US), Friesland Campina (Netherlands), Ingredion (US), Samyang Corp (South Korea), Beghin Meiji (France), Tate & Lyle PLC (UK), Yakult (Japan), Kerry PLC (Ireland), Fronterra Ltd. (New Zealand), Royal Cosun (Netherlands), Roquette Frères (France), Cosucra Groupe Warcoing SA (Belgium), Taiyo International Inc. (US), and Alland & Robert (France). Companies such as Nexira(France) have done exceedingly well in their product portfolio and business strategy. Companies such as Clasado(UK) are constantly seeking to tap opportunities in this market.

What kind of stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

The key stakeholders in the prebiotics market would be

- Prebiotic ingredient manufacturers, formulators, and blenders

- Prebiotic ingredient traders, suppliers, distributors, importers, and exporters

- Oligosaccharides manufacturing companies(such as infant milk powder, confectionery and dairy desserts)

- Agricultural co-operative societies

- Commercial research & development (R&D) organizations and financial institutions

- Other related associations and industry bodies: The Food and Agriculture Organization(FAO), the US Food & Drug Administration (FDA), Global Prebiotic Association

What are the potential challenges to the prebiotic ingredients market?

Consumers are often confused between these two ingredients due to the similarity of names and lack of information about prebiotics. The market for prebiotic ingredients as a dietary supplement in food & beverage is still to flourish, and there is less awareness regarding incorporating prebiotic ingredients in food & beverage items. However, these ingredients are growing gradually in the nutraceutical and pharmaceutical industries.

What are the key market trends in the prebiotic ingredients market?

A shift in lifestyle toward the work-from-home regime has increased the snacking trend. It has further encouraged the retail sales of healthy packaged food products, supporting the growth of prebiotic ingredients.

Today’s well-informed consumers prefer products that have science-backed benefits. They increasingly prefer solutions, such as prebiotics, that support a holistic approach to health and gut-related concerns. As a result, the demand for chicory root fiber was already high, which has accelerated, meaning supply can be tight.

What companies in the prebiotic ingredients market undertake key development strategies?

Strategies such as new product launches, investments into expansion and development, and research initiatives are the key strategies used by large players to achieve differential positioning in the global market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONS COVERED

1.3.3 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.5 VOLUME UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

1.7.1 PREBIOTIC INGREDIENTS MARKET – GLOBAL FORECAST TO 2027

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.2 MARKET GROWTH ASSUMPTIONS FOR STUDY

2.2.1 PRIMARY DATA

2.2.1.1 Key data from primary sources

2.2.1.2 Breakdown of primaries

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKETSANDMARKETS ANALYSIS DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS & LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

2.6 MARKET SCENARIOS CONSIDERED FOR COVID-19 IMPACT

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 6 COVID-19: THE GLOBAL PROPAGATION

FIGURE 7 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 8 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 2 PREBIOTIC INGREDIENTS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 11 IMPACT OF COVID-19 ON PREBIOTIC INGREDIENTS MARKET SIZE, BY SCENARIO, 2021–2022 (USD BILLION)

FIGURE 12 PREBIOTIC INGREDIENTS MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 16 GROWING CONCERN AROUND GUT HEALTH AND IMMUNITY TO SUPPORT MARKET GROWTH

4.2 ASIA PACIFIC: PREBIOTIC INGREDIENTS MARKET, BY TYPE & COUNTRY

FIGURE 17 INULIN AND CHINA TO ACCOUNT FOR LARGEST SHARES IN ASIA PACIFIC MARKET IN 2022

4.3 PREBIOTIC INGREDIENTS MARKET, BY TYPE

FIGURE 18 INULIN TO DOMINATE THE GLOBAL MARKET DURING FORECAST PERIOD

4.4 PREBIOTIC INGREDIENTS MARKET, BY APPLICATION & REGION

FIGURE 19 FOOD & BEVERAGE SEGMENT TO DOMINATE EUROPEAN MARKET DURING FORECAST PERIOD

4.5 PREBIOTIC INGREDIENTS MARKET, BY SOURCE

FIGURE 20 ROOTS SEGMENT TO DOMINATE THE GLOBAL MARKET DURING FORECAST PERIOD

4.6 PREBIOTIC INGREDIENTS: MAJOR REGIONAL SUBMARKETS

FIGURE 21 INDIA TO BE FASTEST-GROWING COUNTRY IN PREBIOTIC INGREDIENTS MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 PREBIOTIC INGREDIENTS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing awareness among consumers regarding health and wellness

FIGURE 23 FACTORS IMPACTING SHOPPING (%) BETWEEN 2010-2020

FIGURE 24 ADULT OBESITY RATES IN KEY COUNTRIES, 2017

5.2.1.2 Healthiness determines what to eat in low and lower middle income countries

FIGURE 25 FACTORS IMPACTING CHOICE OF FOODS, GLOBALLY (%) IN 2019

5.2.2 RESTRAINTS

5.2.2.1 High manufacturing and R&D cost

5.2.2.2 Stringent trade regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Rapid increase in research activities for various applications of prebiotics

5.2.3.2 Growth in demand for prebiotic ingredients in China, India, and Brazil

5.2.4 CHALLENGES

5.2.4.1 Low awareness regarding difference between probiotics and prebiotic

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS (YC-YCC SHIFT)

FIGURE 26 REVENUE SHIFT FOR PREBIOTIC INGREDIENTS MARKET

5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.4.1 COVID-19 TO BOOST DEMAND FOR PREBIOTIC PRODUCTS

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY TYPE

FIGURE 27 AVERAGE SELLING PRICES OF KEY PLAYERS FOR PREBIOTIC INGREDIENT TYPES

TABLE 3 AVERAGE SELLING PRICES OF KEY PLAYERS FOR PREBIOTIC INGREDIENTS TYPES (USD/TON)

5.5.2 AVERAGE SELLING PRICE TREND

5.5.3 MAJOR PLAYERS OFFERING NEW PRODUCTS

5.6 MACROECONOMIC INDICATORS

5.6.1 DEVELOPMENT IN RETAIL INDUSTRY

5.6.2 RISE IN DUAL-INCOME HOUSEHOLDS

5.7 VALUE CHAIN ANALYSIS

FIGURE 28 PREBIOTIC INGREDIENTS MARKET: VALUE CHAIN

5.7.1 SOURCING OF RAW MATERIALS

5.7.2 PRODUCTION & PROCESSING

5.7.3 DISTRIBUTION, MARKETING, AND SALES

5.8 MARKET ECOSYSTEM

FIGURE 29 PREBIOTIC FOOD INGREDIENTS: MARKET MAP

5.8.1 DEMAND SIDE

5.8.1.1 Prebiotic Ingredient Manufacturers

5.8.2 SUPPLY SIDE

TABLE 4 PREBIOTIC INGREDIENTS MARKET: ECOSYSTEM

5.9 TECHNOLOGY ANALYSIS

5.9.1 SSMB TECHNOLOGY FOR SEPARATION

5.9.2 PREBIOTIC INGREDIENTS AND COENCAPSULATION

5.10 PATENT ANALYSIS

FIGURE 30 TOP APPLICANTS FOR PREBIOTIC INGREDIENTS PATENTS

FIGURE 31 TOP 10 INVENTORS FOR THE PREBIOTIC INGREDIENTS

TABLE 5 KEY PATENTS PERTAINING TO PREBIOTIC INGREDIENTS, 2019–2021

5.11 TRADE ANALYSIS

TABLE 6 EXPORT VALUE OF INULIN FOR KEY COUNTRIES, 2020 (USD MILLION)

TABLE 7 IMPORT VALUE OF INULIN FOR KEY COUNTRIES, 2020 (USD MILLION)

5.12 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 8 PREBIOTIC INGREDIENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 TARIFF & REGULATORY LANDSCAPE

5.13.1 INTRODUCTION

TABLE 9 INULIN AS DIETARY FIBER TO BE ACCEPTED IN FOLLOWING EUROPEAN COUNTRIES

5.14 JAPAN

5.15 CANADA

TABLE 10 LIST OF ACCEPTED DIETARY FIBERS BY CANADIAN REGULATORY AUTHORITIES & THEIR SOURCES

5.16 US

TABLE 11 LIST OF FDA-APPROVED PREBIOTIC INGREDIENTS

5.17 EUROPEAN UNION

5.18 AUSTRALIA & NEW ZEALAND

5.19 SOUTH KOREA

5.20 INDIA

TABLE 12 SCHEDULE – XI OF FOOD SAFETY AND STANDARDS REGULATIONS, 2015, FOR LIST OF APPROVED PREBIOTIC INGREDIENTS

5.20.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.21 PORTER’S FIVE FORCES ANALYSIS

TABLE 16 PREBIOTIC INGREDIENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.21.1 INTENSITY OF COMPETITIVE RIVALRY

5.21.2 BARGAINING POWER OF SUPPLIERS

5.21.3 BARGAINING POWER OF BUYERS

5.21.4 THREAT OF NEW ENTRANTS

5.21.5 THREAT OF SUBSTITUTES

5.22 KEY STAKEHOLDERS & BUYING CRITERIA

5.22.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

5.22.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.23 CASE STUDY

TABLE 19 ENSURING SUSTAINABILITY BY LAUNCHING ORGANIC INGREDIENTS IN US

TABLE 20 RISING CONSUMER DEMAND FOR SYNBIOTICS

6 PREBIOTIC INGREDIENTS MARKET, BY TYPE (Page No. - 84)

6.1 INTRODUCTION

FIGURE 34 PREBIOTIC INGREDIENTS MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 21 MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 22 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 23 MARKET, BY TYPE, 2017–2021 (KT)

TABLE 24 MARKET, BY TYPE, 2022–2027 (KT)

6.1.1 COVID-19 IMPACT ON PREBIOTIC INGREDIENTS MARKET, BY TYPE

6.1.1.1 Optimistic Scenario

TABLE 25 OPTIMISTIC SCENARIO: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

6.1.1.2 Realistic Scenario

TABLE 26 REALISTIC SCENARIO: MARKET, BY TYPE, 2019–2022 (USD MILLION)

6.1.1.3 Pessimistic Scenario

TABLE 27 PESSIMISTIC SCENARIO: MARKET, BY TYPE, 2019–2022 (USD MILLION)

6.2 OLIGOSACCHARIDES

6.2.1 MOS

6.2.2 GOS

6.2.3 FOS

TABLE 28 OLIGOSACCHARIDES: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 OLIGOSACCHARIDES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 30 OLIGGOSACCHARIDES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 31 OLIGOSACCHARIDES: MARKET, BY REGION, 2022–2027 (KT)

6.3 INULIN

TABLE 32 INULIN: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 INULIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 INULIN: MARKET, BY REGION, 2017–2021 (KT)

TABLE 35 INULIN: MARKET, BY REGION, 2022–2027 (KT)

6.4 POLYDEXTROSE

TABLE 36 POLYDEXTROSE: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 POLYDEXTROSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 POLYDEXTROSE: MARKET, BY REGION, 2017–2021 (KT)

TABLE 39 POLYDEXTROSE: MARKET, BY REGION, 2022–2027 (KT)

6.5 OTHER TYPES

TABLE 40 OTHER TYPES: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 OTHER TYPES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 OTHER TYPES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 43 OTHER TYPES: MARKET, BY REGION, 2022–2027 (KT)

7 PREBIOTIC INGREDIENTS MARKET, BY APPLICATION (Page No. - 96)

7.1 INTRODUCTION

FIGURE 35 PREBIOTIC INGREDIENTS MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 44 PREBIOTIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 45 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 46 MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 47 MARKET, BY APPLICATION, 2022–2027 (KT)

7.1.1 COVID-19 IMPACT ON PREBIOTIC INGREDIENTS MARKET, BY APPLICATION

7.1.1.1 Optimistic Scenario

TABLE 48 OPTIMISTIC SCENARIO: PREBIOTIC INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

7.1.1.2 Realistic Scenario

TABLE 49 REALISTIC SCENARIO: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

7.1.1.3 Pessimistic Scenario

TABLE 50 PESSIMISTIC SCENARIO: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

7.2 FOOD & BEVERAGE

TABLE 51 FOOD & BEVERAGE: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 FOOD & BEVERAGE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 FOOD & BEVERAGE: MARKET, BY REGION, 2017–2021 (KT)

TABLE 54 FOOD & BEVERAGE: MARKET, BY REGION, 2022–2027 (KT)

7.3 DIETARY SUPPLEMENTS

TABLE 55 DIETARY SUPPLEMENTS: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 56 DIETARY SUPPLEMENTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 DIETARY SUPPLEMENTS: MARKET, BY REGION, 2017–2021 (KT)

TABLE 58 DIETARY SUPPLEMENTS: MARKET, BY REGION, 2022–2027 (KT)

7.4 ANIMAL FEED

TABLE 59 ANIMAL FEED: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 ANIMAL FEED: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 ANIMAL FEED: MARKET, BY REGION, 2017–2021 (KT)

TABLE 62 ANIMAL FEED: MARKET, BY REGION, 2022–2027 (KT)

8 PREBIOTIC INGREDIENTS MARKET, BY SOURCE (Page No. - 106)

8.1 INTRODUCTION

FIGURE 36 PREBIOTIC INGREDIENTS MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 63 MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 64 MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 65 MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 66 MARKET, BY SOURCE, 2022–2027 (KT)

8.1.1 COVID-19 IMPACT ON PREBIOTIC INGREDIENTS MARKET, BY SOURCE

8.1.1.1 Optimistic Scenario

TABLE 67 OPTIMISTIC SCENARIO: PREBIOTIC INGREDIENTS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

8.1.1.2 Realistic Scenario

TABLE 68 REALISTIC SCENARIO: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

8.1.1.3 Pessimistic Scenario

TABLE 69 PESSIMISTIC SCENARIO: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

8.2 ROOTS

TABLE 70 ROOTS: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 71 ROOTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 ROOTS: MARKET, BY REGION, 2017–2021 (KT)

TABLE 73 ROOTS: MARKET, BY REGION, 2022–2027 (KT)

8.3 GRAINS

TABLE 74 GRAINS: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 75 GRAINS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 76 GRAINS: MARKET, BY REGION, 2017–2021 (KT)

TABLE 77 GRAINS: MARKET, BY REGION, 2022–2027 (KT)

8.4 VEGETABLES

TABLE 78 VEGETABLES: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 79 VEGETABLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 80 VEGETABLES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 81 VEGETABLES: MARKET, BY REGION, 2022–2027 (KT)

8.5 OTHER SOURCES

TABLE 82 OTHER SOURCES: PREBIOTIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 83 OTHER SOURCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 84 OTHER SOURCES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 85 OTHER SOURCES: MARKET, BY REGION, 2022–2027 (KT)

9 PREBIOTIC INGREDIENTS MARKET, BY BRAND (Page No. - 116)

9.1 INTRODUCTION

9.2 ORAFTI HPX

9.3 OSMOAID

9.4 FIBERSOL-2

9.5 NUTRAFLORA

9.6 DOMO VIVINAL GOS

9.7 FIBREGUM

9.8 STA-LITE

9.9 OLIGOMATE

10 PREBIOTIC INGREDIENTS MARKET, BY FUNCTIONALITY (Page No. - 118)

10.1 INTRODUCTION

10.1.1 GUT HEALTH

10.1.2 CARDIOVASCULAR HEALTH

10.1.3 BONE HEALTH

10.1.4 IMMUNITY

10.1.5 WEIGHT MANAGEMENT

10.1.6 COVID-19 IMPACT ON PREBIOTIC INGREDIENTS MARKET, BY FUNCTIONALITY

11 PREBIOTIC INGREDIENTS MARKET, BY BACTERIAL ACTIVITY (Page No. - 120)

11.1 INTRODUCTION

11.1.1 BIFIDOBACTERIA

11.1.2 LACTIC ACID BACTERIA

11.1.3 OTHERS

11.1.4 COVID-19 IMPACT ON PREBIOTIC INGREDIENTS MARKET, BY BACTERIAL ACTIVITY

12 PREBIOTIC INGREDIENTS MARKET, BY REGION (Page No. - 123)

12.1 INTRODUCTION

FIGURE 37 GEOGRAPHICAL SNAPSHOT (2022–2027): ASIAN COUNTRIES TO GROW AT HIGHEST RATE IN PREBIOTIC INGREDIENTS MARKET

TABLE 86 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 87 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 88 MARKET, BY REGION, 2017–2021 (KT)

TABLE 89 MARKET, BY REGION, 2022–2027 (KT)

12.2 NORTH AMERICA

TABLE 90 NORTH AMERICA: PREBIOTIC INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (KT)

TABLE 93 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 94 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (KT)

TABLE 97 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 98 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 101 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 102 NORTH AMERICA: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 105 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (KT)

12.2.1 US

12.2.1.1 Increase in health awareness to drive prebiotic ingredients market growth

TABLE 106 US: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 107 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 108 US: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 109 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 110 US: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 111 US: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Strategic efforts to boost prebiotics by government to enhance market growth in Canada

TABLE 112 CANADA: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 113 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 114 CANADA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 115 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 116 CANADA: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 117 CANADA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 High consumer awareness and interest in gut health to create opportunities for prebiotics

TABLE 118 MEXICO: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 119 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 120 MEXICO: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 121 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 122 MEXICO: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 123 MEXICO: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.3 EUROPE

FIGURE 38 EUROPEAN PREBIOTIC INGREDIENTS MARKET SNAPSHOT: UK TO BE A GLOBAL LEADER DURING FORECAST PERIOD

TABLE 124 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY COUNTRY, 2017–2021 (KT)

TABLE 127 EUROPE: MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 128 EUROPE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 129 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 130 EUROPE: MARKET, BY TYPE, 2017–2021 (KT)

TABLE 131 EUROPE: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 132 EUROPE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 135 EUROPE: MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 136 EUROPE: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 137 EUROPE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 138 EUROPE: MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 139 EUROPE: MARKET, BY SOURCE, 2022–2027 (KT)

12.3.1 UK

12.3.1.1 Increase in health awareness to drive prebiotic ingredients market growth

TABLE 140 UK: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 141 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 142 UK: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 143 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 144 UK: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 145 UK: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Growth in functional food ingredients industry to drive growth in prebiotic ingredients market

TABLE 146 GERMANY: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 147 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 148 GERMANY: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 149 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 150 GERMANY: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 151 GERMANY: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 High consumer awareness in gut health to create opportunities for prebiotics

TABLE 152 FRANCE: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 153 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 154 FRANCE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 155 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 156 FRANCE: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 157 FRANCE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.3.4 ITALY

12.3.4.1 Increasing trend of using nutrition-enriched ingredients to drive prebiotic ingredients market growth

TABLE 158 ITALY: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 159 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 160 ITALY: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 161 ITALY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 162 ITALY: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 163 ITALY: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.3.5 REST OF EUROPE

TABLE 164 REST OF EUROPE: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 165 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 166 REST OF EUROPE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 167 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 168 REST OF EUROPE: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 169 REST OF EUROPE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC PREBIOTIC INGREDIENTS MARKET SNAPSHOT: CHINA TO BE A GLOBAL LEADER DURING FORECAST PERIOD

TABLE 170 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (KT)

TABLE 173 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 174 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (KT)

TABLE 177 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 178 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 181 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 182 ASIA PACIFIC: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 185 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (KT)

12.4.1 CHINA

12.4.1.1 Ease of incorporation of prebiotics in food & beverage industry to increase consumption of prebiotics

TABLE 186 CHINA: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 187 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 188 CHINA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 189 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 190 CHINA: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 191 CHINA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Increase in demand for functional foods to lead prebiotics industry growth

TABLE 192 JAPAN: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 193 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 194 JAPAN: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 195 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 196 JAPAN: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 197 JAPAN: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Growing interest in digestive health ingredients to lead prebiotic ingredients market growth

TABLE 198 INDIA: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 199 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 200 INDIA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 201 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 202 INDIA: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 203 INDIA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.4.4 REST OF ASIA PACIFIC

TABLE 204 REST OF ASIA PACIFIC: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 205 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 206 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 207 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 208 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 209 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.5 SOUTH AMERICA

TABLE 210 SOUTH AMERICA: PREBIOTIC INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 211 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 212 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (KT)

TABLE 213 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 214 SOUTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 215 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 216 SOUTH AMERICA: MARKET, BY TYPE, 2017–2021 (KT)

TABLE 217 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 218 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 219 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 220 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 221 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 222 SOUTH AMERICA: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 223 SOUTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 224 SOUTH AMERICA: MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 225 SOUTH AMERICA: MARKET, BY SOURCE, 2022–2027 (KT)

12.5.1 BRAZIL

12.5.1.1 Demand for gut-healthy products to drive prebiotic ingredients’ demand in Brazil

TABLE 226 BRAZIL: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 227 BRAZIL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 228 BRAZIL: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 229 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 230 BRAZIL: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 231 BRAZIL: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.5.2 ARGENTINA

12.5.2.1 Increasing demand for plant-based fibers to drive market growth in Argentina

TABLE 232 ARGENTINA: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 233 ARGENTINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 234 ARGENTINA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 235 ARGENTINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 236 ARGENTINA: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 237 ARGENTINA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.5.3 REST OF SOUTH AMERICA

TABLE 238 REST OF SOUTH AMERICA: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 239 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 240 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 241 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 242 REST OF SOUTH AMERICA: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 243 REST OF SOUTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.6 ROW

FIGURE 40 ASIA PACIFIC PREBIOTIC INGREDIENTS MARKET SNAPSHOT: MIDDLE EAST TO BE A GLOBAL LEADER DURING FORECAST PERIOD

TABLE 244 ROW: PREBIOTIC INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 245 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 246 ROW: MARKET, BY COUNTRY, 2017–2021 (KT)

TABLE 247 ROW: MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 248 ROW: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 249 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 250 ROW: MARKET, BY TYPE, 2017–2021 (KT)

TABLE 251 ROW: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 252 ROW: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 253 ROW: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 254 ROW: MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 255 ROW: MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 256 ROW: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 257 ROW: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 258 ROW: MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 259 ROW: MARKET, BY SOURCE, 2022–2027 (KT)

12.6.1 AFRICA

12.6.1.1 Large consumer base and low-cost labor to propel prebiotic ingredients market growth

TABLE 260 AFRICA: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 261 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 262 AFRICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 263 AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 264 AFRICA: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 265 AFRICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

12.6.2 MIDDLE EAST

12.6.2.1 Increase in health awareness to lead to prebiotics industry growth

TABLE 266 MIDDLE EAST: PREBIOTIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 267 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 268 MIDDLE EAST: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 269 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 270 MIDDLE EAST: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 271 MIDDLE EAST: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 190)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS, 2021

TABLE 272 PREBIOTIC INGREDIENTS MARKET SHARE ANALYSIS, 2021

13.3 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.3.1 STARS

13.3.2 PERVASIVE PLAYERS

13.3.3 EMERGING LEADERS

13.3.4 PARTICIPANTS

FIGURE 41 PREBIOTIC INGREDIENTS MARKET, COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

13.4 COMPETITION BENCHMARKING

TABLE 273 PREBIOTIC INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

13.5 PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 274 COMPANY FOOTPRINT (KEY PLAYERS), BY APPLICATION

TABLE 275 COMPANY FOOTPRINT (KEY PLAYERS), BY TYPE

TABLE 276 COMPANY FOOTPRINT (KEY PLAYERS), BY REGION

TABLE 277 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

13.6 PREBIOTIC INGREDIENTS MARKET, STARTUP/SME EVALUATION QUADRANT, 2021

13.6.1 PROGRESSIVE COMPANIES

13.6.2 STARTING BLOCKS

13.6.3 RESPONSIVE COMPANIES

13.6.4 DYNAMIC COMPANIES

FIGURE 42 PREBIOTIC INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUP/SMES)

TABLE 278 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 279 MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SMES

13.7 PRODUCT FOOTPRINT (STARTUP/SMES)

TABLE 280 COMPANY FOOTPRINT (STARTUP/SMES), BY APPLICATION

TABLE 281 COMPANY FOOTPRINT (STARTUP/SMES), BY TYPE

TABLE 282 COMPANY FOOTPRINT (STARTUP/SMES), BY REGION

TABLE 283 OVERALL COMPANY FOOTPRINT (STARTUP/SMES)

13.8 COMPETITIVE SCENARIO

13.8.1 PRODUCT LAUNCHES

TABLE 284 PREBIOTIC INGREDIENTS MARKET: PRODUCT LAUNCHES, 2018-2022

13.8.2 EXPANSIONS

TABLE 285 MARKET: EXPANSIONS, 2020-2021

13.8.3 OTHERS

TABLE 286 MARKET: OTHERS, 2019-2021

14 COMPANY PROFILES (Page No. - 204)

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

14.1 KEY PLAYERS

14.1.1 BENEO

TABLE 287 BENEO: BUSINESS OVERVIEW

TABLE 288 BENEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 289 BENEO: EXPANSIONS

14.1.2 ADM

TABLE 290 ADM: BUSINESS OVERVIEW

FIGURE 43 ADM: COMPANY SNAPSHOT

TABLE 291 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 292 ADM: ACQUISITION & INVESTMENTS

14.1.3 DUPONT

TABLE 293 DUPONT: BUSINESS OVERVIEW

FIGURE 44 DUPONT: COMPANY SNAPSHOT

TABLE 294 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 295 DUPONT: MERGER

14.1.4 FRIESLANDCAMPINA

TABLE 296 FRIESLANDCAMPINA: BUSINESS OVERVIEW

FIGURE 45 FRIESLANDCAMPINA: COMPANY SNAPSHOT

TABLE 297 FRIESLANDCAMPINA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.5 INGREDION INCORPORATED

TABLE 298 INGREDION INCORPORATED: BUSINESS OVERVIEW

FIGURE 46 INGREDION INCORPORATED: COMPANY SNAPSHOT

TABLE 299 INGREDION INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 300 INGREDION INCORPORATED: JOINT VENTURE

14.1.6 SAMYANG CORP

TABLE 301 SAMYANG CORP: BUSINESS OVERVIEW

FIGURE 47 SAMYANG CORP: COMPANY SNAPSHOT

TABLE 302 SAMYANG CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.7 NEXIRA

TABLE 303 NEXIRA: BUSINESS OVERVIEW

TABLE 304 NEXIRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 305 NEXIRA: DEALS

TABLE 306 NEXIRA: PRODUCT LAUNCHES

14.1.8 BEGHIN MEIJI

TABLE 307 BEGHIN MEIJI: BUSINESS OVERVIEW

TABLE 308 BEGHIN MEIJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.9 TATE & LYLE PLC

TABLE 309 TATE & LYLE PLC: BUSINESS OVERVIEW

FIGURE 48 TATE & LYLE PLC: COMPANY SNAPSHOT

TABLE 310 TATE & LYLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.10 YAKULT PHARMACEUTICAL

TABLE 311 YAKULT PHARMACEUTICAL: BUSINESS OVERVIEW

FIGURE 49 YAKULT PHARMACEUTICAL: COMPANY SNAPSHOT

TABLE 312 YAKULT PHARMACEUTICAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 313 YAKULT PHARMACEUTICAL: PRODUCT LAUNCHES

14.1.11 KERRY PLC

TABLE 314 KERRY PLC: BUSINESS OVERVIEW

FIGURE 50 KERRY PLC: COMPANY SNAPSHOT

TABLE 315 KERRY PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 316 KERYY PLC: PRODUCT LAUNCHES

14.1.12 FONTERRA LTD

TABLE 317 FONTERRA LTD: BUSINESS OVERVIEW

FIGURE 51 FONTERRA LTD: COMPANY SNAPSHOT

TABLE 318 FONTERRA LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 319 FONTERRA LTD: PRODUCT LAUNCHES

14.1.13 ROYAL COSUN

TABLE 320 ROYAL COSUN: BUSINESS OVERVIEW

FIGURE 52 ROYAL COSUN: COMPANY SNAPSHOT

TABLE 321 ROYAL COSUN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 322 ROYAL COSUN: EXPANSIONS

14.1.14 ROQUETTE FRÈRES

TABLE 323 ROQUETTE FRÈRES: BUSINESS OVERVIEW

TABLE 324 ROQUETTE FRÈRES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 325 ROQUETTE FRERÈS: PRODUCT LAUNCHES

14.1.15 COSUCRA GROUPE WARCOING SA

TABLE 326 COSUCRA GROUPE WARCOING SA: BUSINESS OVERVIEW

TABLE 327 COSUCRA GROUPE WARCOING SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 328 COSUCRA GROUPE WARCOING SA: EXPANSIONS

TABLE 329 COSUCRA GROUPE WARCOING SA: OTHERS

14.1.16 TAIYO INTERNATIONAL INC.

TABLE 330 TAIYO INTERNATIONAL INC.: BUSINESS OVERVIEW

TABLE 331 TAIYO INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 332 TAIYO INTERNATIONAL INC.: PRODUCT LAUNCHES

14.1.17 PRENEXUS HEALTH

TABLE 333 PRENEXUS HEALTH: BUSINESS OVERVIEW

TABLE 334 PRENEXUS HEALTH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 335 PRENEXUS HEALTH: OTHERS

14.1.18 VITALUS NUTRITION INC

TABLE 336 VITALUS NUTRITION INC.: BUSINESS OVERVIEW

TABLE 337 VITALUS NUTRITION INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 338 VITALUS NUTRITION INC.: PRODUCT LAUNCHES

TABLE 339 VITALUS NUTRITION INC.: OTHERS

14.1.19 CLASADO LTD.

TABLE 340 CLASADO LTD.: BUSINESS OVERVIEW

TABLE 341 CLASADO LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 342 CLASADO LTD.: EXPANSIONS

14.1.20 ALLAND & ROBERT

TABLE 343 ALLAND & ROBERT: BUSINESS OVERVIEW

TABLE 344 ALLAND & ROBERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 345 ALLAND & ROBERT: EXPANSIONS

TABLE 346 ALLAND & ROBERT: PRODUCT LAUNCHES

TABLE 347 ALLAND & ROBERT: OTHERS

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 251)

15.1 INTRODUCTION

TABLE 348 ADJACENT MARKETS TO PREBIOTIC INGREDIENTS

15.2 LIMITATIONS

15.3 FUNCTIONAL FOOD INGREDIENTS MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 349 FUNCTIONAL FOOD INGREDIENTS MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

15.4 DIETARY SUPPLEMENTS MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 350 DIETARY SUPPLEMENTS MARKET SIZE, BY MODE OF APPLICATION, 2018–2026 (USD MILLION)

15.5 NUTRACEUTICAL INGREDIENTS MARKET

15.5.1 MARKET DEFINITION

15.5.2 MARKET OVERVIEW

TABLE 351 NUTRACEUTICAL INGREDIENTS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

16 APPENDIX (Page No. - 255)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

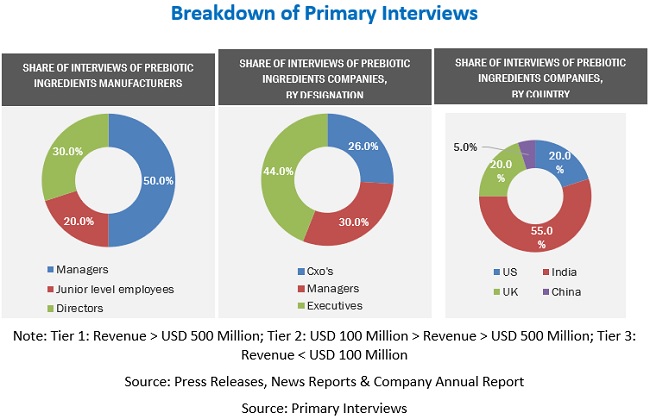

The study involved four major steps in estimating the size of the prebiotic ingredients market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments.

Secondary Research

In the secondary research process, various sources, such as Food & beverage manufacturers, prebiotic ingredient manufacturers, prebiotic ingredient suppliers, and traders, related associations, research organizations, and industry bodies: The Food and Agriculture Organization (FAO) and the US Food & Drug Administration (FDA), EU-Japan Centre for Industrial Cooperation, and Global Prebiotic Association were referred to identify and collect information for this study. The secondary sources also include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall prebiotic ingredients market comprises several stakeholders in the supply chain, which include global and regional level farmers supplying sources, dealers, food processing industries, as well as manufacturers of prebiotic ingredients. Primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, regional prebiotic ingredients dealers and manufacturers. The primary sources from the supply side include players involved in the extraction and blending of prebiotic ingredients, research institutions involved in R&D, and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

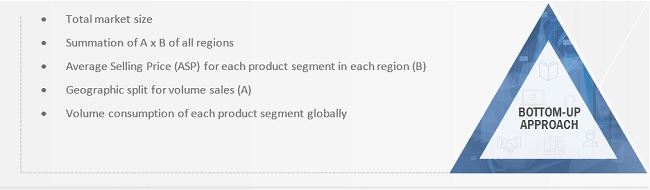

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-Down

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The parent market, that is, the global functional food ingredients market, was used to further validate the market details of prebiotic ingredients.

- The following figure represents the overall market size estimation process employed for the purpose of this study.

Bottom-Up

- Through the bottom-up approach, the data extracted from secondary research was utilized to validate the market segment sizes obtained. The approach was employed to arrive at the overall size of the prebiotic ingredients market in a particular region and its share in the market, validated through primary interviews conducted with prebiotic ingredient manufacturers, suppliers, dealers, and distributors.

- With the data triangulation procedure and validation of data through primaries, the overall size of the parent market size and the size of each individual market were determined.

Global Prebiotic ingredients Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the prebiotic ingredients market, with respect to their applications, types, sources, and regional markets, over a six-year period, ranging from 2022 to 2027

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors based on the following:

- Impact of macro and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Identifying and profiling prominent market players in the prebiotic ingredients market

- Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying key growth strategies adopted by the players across the key regions

- Analyzing the supply chain, value chain, and regulatory frameworks across regions and their impact on prominent market players

- Providing insights on key innovations, investments in technology, startups, and patent registrations

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market for prebiotic ingredients into Benelux and Nordic countries

- Further breakdown of the Rest of Asia Pacific market for prebiotic ingredients into Indonesia, Thailand, Vietnam, and South Korea

- Further breakdown of the Rest of South America market for prebiotic ingredients into Chile, Colombia, and Peru

- Further breakdown of other countries in the RoW market for prebiotic ingredients into Middle Eastern and African countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Prebiotic Ingredients Market