Thin Film and Printed Battery Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Thin Film, Printed), Voltage (Below 1.5 V, 1.5 to 3 V, Above 3 V), Capacity (Below 10 mAh, 10 to 100 mAh, Above 100 mAh), Battery Type (Primary, Secondary), Application, Region - Global Forecast to 2028

Updated on : October 22, 2024

Thin Film and Printed Battery Market Size & Growth

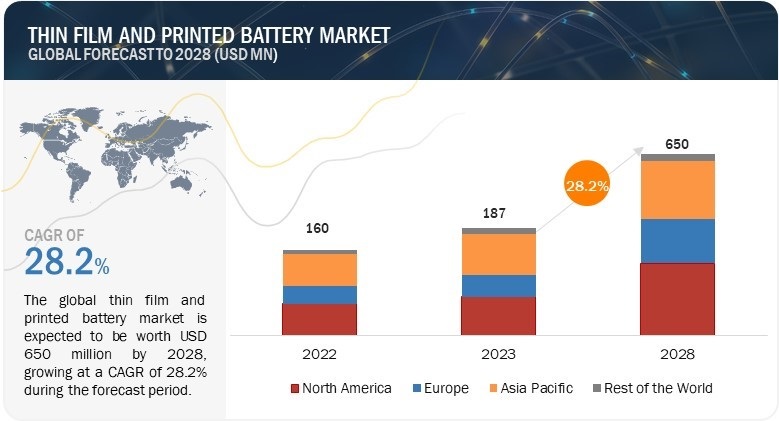

Global Thin Film and Printed Battery Market Size is expected to grow from USD 187 Million in 2023 to USD 650 Million by 2028, growing at a CAGR of 28.2% during the forecast period from 2023 to 2028.

Thin film and printed batteries are designed to complement the characteristics of thin and lightweight products with limited internal space. Unlike traditional batteries that are rigid and have predefined shapes, these batteries offer thin, flexible, light, and portable features.

Thin Film and Printed Battery Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Thin Film and Printed Battery Market Trends:

DRIVERS: Rising proliferation of thin, flexible, and printed batteries in medical devices

In recent years, there have been advancements in medical devices, which require thin and flexible batteries. These batteries provide ease in designing miniature medical devices with reliable power sources. The increasing use of thin, flexible, and printed batteries significantly impacts healthcare research and development. These batteries are finding extensive application in devices worn or implanted in the human body, where minimizing their shape and size is crucial. This advancement in battery technology enables the development of more compact and lightweight medical devices, thus improving patient comfort and mobility.

RESTRAINTS: High initial investments

Manufacturing printed batteries imposes specialized equipment distinct from those used to print other products like electronics, chips, paper, and textiles. The development of printed flexible batteries requires high initial investments, especially to carry out research and development activities related to them and their manufacturing. It involves the implementation of advanced and expensive machinery, along with the required manufacturing technologies. The printing process for batteries demands high precision to ensure their functionality. As a result, manufacturers must invest in top-notch equipment and employ skilled workers with expertise in controlling the printing parameters. These factors increase the overall manufacturing cost.

OPPORTUNITIES: Advancements in next-generation thin film and printed lithium-air batteries

The demand for glucose-sensing armbands, heart-monitoring patches, and other wearable fitness devices is increasing globally. Battery researchers use thin, lightweight, printed, flexible, and stretchable batteries to power such electronic gadgets. However, most of these batteries are not durable. This has led to the development of next-generation thin film and printed flexible lithium-air batteries, which are reliable, thin, lightweight, and flexible. These next-generation batteries are currently in the initial years of development but are expected to power products ranging from clothing to roll-up tablets and prosthetic hands. Thin film and printed flexible lithium-air batteries are expected to store ten times more energy than current commercial lithium-ion cells.

CHALLENGES: Selection of raw materials and their high costs

Thin film and printed batteries offer limited power, unlike traditional batteries. Different types of thin film batteries that are available in the market are flexible alkaline batteries, plastic batteries, polymer lithium-metal batteries, and thin film lithium-ion batteries. Among these, thin film lithium-ion batteries are widely used owing to their increased flexibility, high-energy density, lightweight, and long lifespan. Despite these advantages, printed flexible lithium-ion batteries may be flammable and may lead to environmental problems. Zinc-based flexible batteries are cheaper than lithium-ion batteries and have no toxic material in them. However, zinc-based flexible batteries cannot effectively cater to every device's power requirements. Raw material costs and the required specifications and voltages of flexible batteries are among the key factors considered while selecting materials for their development. Thus, the selection of suitable materials to manufacture thin film and printed batteries with required specifications and voltage while keeping their costs low acts as a challenge for manufacturers of thin film and printed batteries.

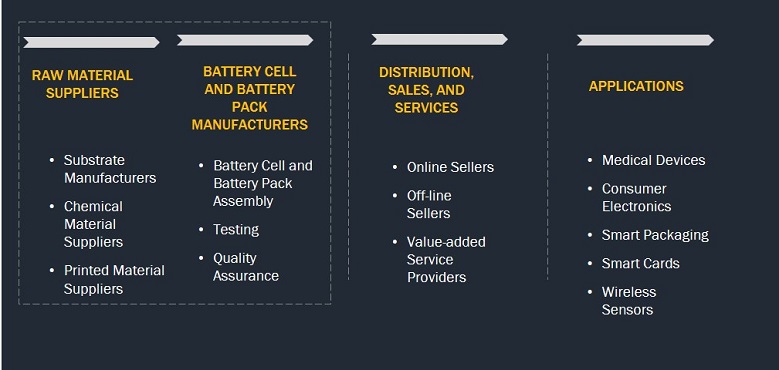

Thin Film and Printed Battery Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers, along with many startups and smaller companies. The thin film and printed battery market is still in emerging phase which presents huge growth opportunities for both large players and new startups. Some of the major players in this market include Samsung SDI Co., Ltd. (South Korea), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), NGK Insulators, Ltd. (Japan), Cymbet Corporation (US), Ilika plc (UK), and Jenax Inc. (South Korea). These companies have been focusing on new product developments, acquisitions, and partnerships to strengthen their market position.

Thin Film and Printed Battery Market Segmentation

Above 3 V voltage segment is expected to grow at a substantial CAGR during the forecast period.

Thin film and printed batteries with 3 V voltage offer higher power, longer life, and more safety than other flexible batteries. These batteries will likely witness a considerable global demand during the forecast period. Applications of thin film and printed batteries of 3 V have increased recently due to the development of many compact electronic devices. These batteries are expected to have applications in consumer electronics and wearables.

The market for 10 to 100 mAh capacity is projected to gain the largest market share during the forecast period

Thin film and printed batteries ranging from 10 to 100 mAh are comparatively large. These batteries are used for products requiring moderate to high energy. These thin film and printed batteries can be used in wearable devices, medical devices, energy harvesting systems, and wireless sensors. They can act as an integral part of these devices as their efficiency depends on the properties and shelf life of the batteries used. Thin film and printed batteries with a capacity of 10 to 100 mAh are expected to be the ideal energy sources for portable devices in the future.

Thin Film and Printed Battery Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Thin Film and Printed Battery Industry Regional Analysis

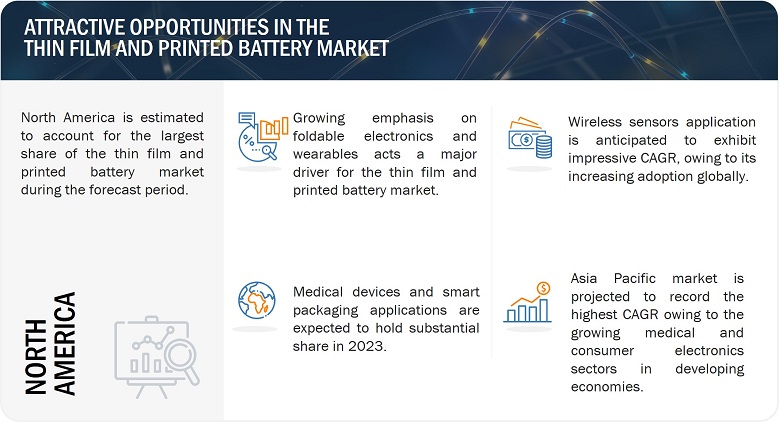

Thin film and printed battery market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028.

The thin film and printed battery industry in Asia Pacific has been studied for China, India, Japan, and the Rest of Asia Pacific. The growing demand for IoT-enabled devices and the increasing proliferation of portable consumer electronics in countries such as China and India are driving the thin film and printed battery market growth. Given its large-scale industrial development, increased mobile and internet penetration, skilled workforce, and stable political conditions, India presents significant growth opportunities for the IoT market. Moreover, the country is also one of the leading adopters of technologies and related products. In addition, factors such as a growing number of infrastructural activities, rising population and per capita income, increasing penetration of high-end technologies, and a rising economy are also driving the market. Furthermore, the usage of compact electronics and medical devices in other countries such as China, Japan, and Malaysia contributes to the growth of the region's thin film and printed battery market.

Top Thin Film and Printed Battery Companies - Key Market Players

- Samsung SDI Co., Ltd. (South Korea),

- Enfucell (Finland),

- Ultralife Corporation (US),

- Molex, LLC (US),

- NGK Insulators, Ltd. (Japan),

- Cymbet Corporation (US),

- Ilika plc (UK),

- Jenax Inc. (South Korea),

- ProLogium Technology Co., Ltd. (Taiwan),

- Renata SA (Switzerland),

- VARTA AG (Germany), are among a few top players in thin film and printed battery companies.

Thin Film and Printed Battery Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 187 Million in 2023 |

|

Projected Market Size in 2028 |

USD 650 Million by 2028 |

|

Growth Rate |

CAGR of 28.2% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, Voltage, Capacity, Battery Type, and Application |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: Samsung SDI Co., Ltd. (South Korea), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), NGK Insulators, Ltd. (Japan), Cymbet Corporation (US), Ilika plc (UK), Jenax Inc. (South Korea), ProLogium Technology Co., Ltd. (Taiwan), Renata SA (Switzerland), VARTA AG (Germany) and Others- (Total 20 players have been covered) |

Thin Film and Printed Battery Market Highlights

This research report categorizes the thin film and printed battery market share by component, material, type, voltage, capacity, battery type, application, and region.

|

Segment |

Subsegment |

|

By Component: |

|

|

By Material: |

|

|

By Type: |

|

|

By Voltage: |

|

|

By Capacity: |

|

|

By Battery Type: |

|

|

By Application: |

|

|

By Region |

|

Recent Developments in Thin Film and Printed Battery Industry

- In May 2023, Ilika plc rolled out the first shipment of the solid-state Stereax M300 batteries to its customers.

- In December 2021, Ultralife Corporation acquired Excell Battery Co. to strengthen its capabilities in mission-critical applications, such as downhole drilling, medical devices, OEM industrial devices, automated meters, and more. This acquisition will help scale up Battery & Energy Products business and expand key underserved market segments for the company.

- In May 2020, Enfucell launched the WithMe app for detecting temperatures. The app can be installed on a mobile or tablet with an NFC function, where the user can read the data on the Wearable Temperature Tag produced by Enfucell.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the thin film and printed battery market size during 2023-2028?

The global thin film and printed battery market is expected to record a CAGR of 28.2% from 2023–2028.

What are the driving factors for the thin film and printed battery market share?

The growing interest in foldable electronics and wearables is the key driving factor for the thin film and printed battery market.

Which application will grow at a fast rate in the future?

The consumer electronics application is expected to grow at a substantial CAGR during the forecast period. Wearable devices require thin power sources, which can maintain their characteristics even when bent and twisted. This factor is expected to increase the use of thin film and printed batteries in wearable devices.

Which are the significant players operating in the thin film and printed battery market share?

Samsung SDI Co., Ltd. (South Korea), Enfucell (Finland), Molex, LLC (US), NGK Insulators, Ltd. (Japan), and Ultralife Corporation (US) are among a few top players in the thin film and printed battery market.

Which region will grow at a fast rate in the future?

The thin film and printed battery market in Asia Pacific is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for foldable electronics and wearables- Adoption of thin, flexible, and printed batteries in wearable medical devices- Rising trend of miniaturization across sectors- Extensive use of IoT devicesRESTRAINTS- High initial investments required for manufacturing printed batteries- Lack of standardization in battery manufacturing processesOPPORTUNITIES- Increasing adoption of wireless sensors- Development of next-generation thin film lithium-air batteriesCHALLENGES- Fabrication challenges associated with thin film batteries- High cost of raw materials

- 5.3 EVOLUTION OF THIN FILM AND PRINTED BATTERIES

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM MAPPING

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TRENDAVERAGE SELLING PRICE TREND, BY TYPEAVERAGE SELLING PRICE TREND, BY KEY PLAYER

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.8 TECHNOLOGY ANALYSISSOLID-STATE BATTERIESMETAL-AIR BATTERIESLIQUID-METAL BATTERIESZINC-MANGANESE BATTERIESVANADIUM-FLOW BATTERIESLITHIUM-SILICON BATTERIESLITHIUM-COBALT OXIDE BATTERIESNICKEL-MANGANESE-COBALT BATTERIESLITHIUM-NICKEL-COBALT-ALUMINUM OXIDE BATTERIESLITHIUM-SULFUR BATTERIES

-

5.9 PORTER’S FIVE FORCE ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.10 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.12 TRADE ANALYSIS

-

5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES & EVENTS, 2023–2024

-

5.15 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

- 6.1 INTRODUCTION

-

6.2 ELECTRODESCATHODEANODE

- 6.3 SUBSTRATES

- 6.4 ELECTROLYTES

- 6.5 OTHER COMPONENTS

- 7.1 INTRODUCTION

- 7.2 LITHIUM-ION

- 7.3 LITHIUM POLYMER

- 7.4 ZINC

- 8.1 INTRODUCTION

-

8.2 THIN FILM BATTERIESSAFETY CONCERNS IN COMPACT DEVICES TO BOOST DEMAND FOR THIN FILM BATTERIES

-

8.3 PRINTED BATTERIESNON-TOXIC, NON-VOLATILE, AND MODERATE POWER CAPACITY FEATURES OF PRINTED BATTERIES TO DRIVE SEGMENTAL GROWTH

- 9.1 INTRODUCTION

-

9.2 BELOW 1.5 VIDEAL FOR LOW-POWER SINGLE-USE APPLICATIONS

-

9.3 1.5 TO 3 VSUITABLE FOR USAGE IN MEDICAL DEVICES

-

9.4 ABOVE 3 VUSED IN CONSUMER ELECTRONICS AND WEARABLES DUE TO THEIR LIGHT WEIGHT AND COMPACT DESIGN

- 10.1 INTRODUCTION

-

10.2 BELOW 10 MAHINCREASING DEMAND FOR LIGHTWEIGHT AND COMPACT BATTERIES TO DRIVE SEGMENTAL GROWTH

-

10.3 10 TO 100 MAHGROWING TREND OF PORTABLE ELECTRONICS TO BOOST DEMAND FOR BATTERIES WITH CAPACITY OF 10 TO 100 MAH

-

10.4 ABOVE 100 MAHBOOMING MARKET FOR CONSUMER ELECTRONICS TO ACCELERATE DEMAND FOR ABOVE 100 MAH BATTERIES

- 11.1 INTRODUCTION

-

11.2 PRIMARYRISING DEMAND FOR LOW-COST AND ECO-FRIENDLY BATTERIES ACROSS APPLICATIONS TO DRIVE SEGMENTAL GROWTH

-

11.3 SECONDARYADOPTION OF WEARABLES AND MEDICAL DEVICES TO BOOST DEMAND FOR SECONDARY BATTERIES

- 12.1 INTRODUCTION

-

12.2 CONSUMER ELECTRONICSTHRIVING CONSUMER ELECTRONICS INDUSTRY TO BOOST DEMAND FOR THIN FILM AND PRINTED BATTERIESSMARTPHONES/TABLETSWEARABLE DEVICES

-

12.3 MEDICAL DEVICESINTEGRATION OF FLEXIBLE BATTERIES INTO MEDICAL DEVICES OWING TO THEIR RELIABILITY TO DRIVE MARKETCOSMETIC AND MEDICAL PATCHESPACEMAKERSHEARING AIDSMEDICAL IMPLANTS

-

12.4 SMART PACKAGINGRISING INCLINATION TOWARD SMART PACKAGING PRODUCTS TO BOOST DEMAND FOR THIN FILM AND PRINTED BATTERIESSMART LABELS

-

12.5 SMART CARDSGROWING USE OF SELF-POWERED CREDIT, GIFT, AND ACCESS CARDS TO FUEL DEMAND FOR THIN FILM AND PRINTED BATTERIES

-

12.6 WIRELESS SENSORSSPACE CONSTRAINTS OF WIRELESS SENSORS TO PROMOTE USE OF THIN FILM AND PRINTED BATTERIES

- 12.7 OTHERS

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- Demand for smart packaging to fuel need for thin film and printed batteriesCANADA- Adoption of IoT in medical devices and wireless sensors to create opportunities for market playersMEXICO- Growing popularity of wearables to boost demand for thin film and printed batteries

-

13.3 EUROPEEUROPE: IMPACT OF RECESSIONGERMANY- Government emphasis on R&D activities to revolutionize medical devices to support market growthUK- Growth of wearables market to induce demand for thin film and printed batteriesFRANCE- Increasing use of smart cards to present opportunities for market playersREST OF EUROPE

-

13.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONCHINA- Strong industrial and battery manufacturing sectors to favor market growthJAPAN- High adoption of consumer electronics to drive marketINDIA- Growing economy, digitalization, and industrial development to boost market growthREST OF ASIA PACIFIC

-

13.5 REST OF THE WORLD (ROW)REST OF THE WORLD: IMPACT OF RECESSIONMIDDLE EAST & AFRICA- Rising demand for consumer electronics and wearables to accelerate market growthSOUTH AMERICA- Growing demand for consumer electronics devices to foster market growth

- 14.1 INTRODUCTION

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 TOP FIVE COMPANY REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS, 2022

-

14.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.6 COMPANY EVALUATION MATRIX FOR SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 14.7 MARKET: COMPANY FOOTPRINT

- 14.8 COMPETITIVE BENCHMARKING

-

14.9 COMPETITIVE SCENARIOS AND TRENDSMARKET: PRODUCT LAUNCHESTHIN FILM AND PRINTED BATTERY MARKET: DEALS

-

15.1 KEY PLAYERSSAMSUNG SDI CO., LTD.- Business overview- Products offered- Recent developments- MnM viewENFUCELL- Business overview- Products offered- Recent developments- MnM viewMOLEX, LLC- Business overview- Products offered- MnM viewNGK INSULATORS, LTD.- Business overview- Products offered- MnM viewULTRALIFE CORPORATION- Business overview- Products offered- Recent developments- MnM viewCYMBET CORPORATION- Business overview- Products offered- Recent developmentsILIKA PLC- Business overview- Products offered- Recent developmentsJENAX INC.- Business overview- Products offered- Recent developmentsPROLOGIUM TECHNOLOGY CO., LTD.- Business overview- Products offeredRENATA SA- Business overview- Products offered- Recent developmentsVARTA AG- Business overview- Products offered- Recent developments

-

15.2 OTHER PLAYERSCENTRAL MIDORI INT’L PTE LTD.ENERGY DIAGNOSTICSGMB CO., LTD.IMPRINT ENERGYPRELONIC TECHNOLOGIESPRINTED ENERGY PTY LTD.ROCKET POLAND SP. Z O.O.SHENZHEN GREPOW BATTERY CO., LTD.ZINERGY

- 16.1 INTRODUCTION

-

16.2 FLOW BATTERY MARKET, BY APPLICATIONINTRODUCTIONUTILITIES- Growing adoption of flow batteries by utilities to boost market growthCOMMERCIAL & INDUSTRIAL- Commercial & industrial segment to hold significant market share during forecast periodEV CHARGING STATION- Growing need for fast recharging of vehicles to fuel adoption of flow batteries in charging stationsOTHERS

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

- TABLE 1 RISK ANALYSIS

- TABLE 2 THIN FILM AND BATTERY MARKET: ROLE OF KEY COMPANIES IN ECOSYSTEM

- TABLE 3 THIN FILM AND PRINTED BATTERY MARKET: AVERAGE SELLING PRICE AND VOLUME

- TABLE 4 AVERAGE SELLING PRICE OF THIN FILM BATTERIES OFFERED BY KEY PLAYER

- TABLE 5 AVERAGE SELLING PRICE OF THIN FILM AND PRINTED BATTERIES, BY REGION

- TABLE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 9 THIN FILM BATTERIES USED IN SPORTS APPLICATIONS

- TABLE 10 THIN FILM BATTERIES USED IN POWER SKIN PATCHES

- TABLE 11 SAFE BED-EXIT SENSORS DEVELOPED USING THIN FILM BATTERIES

- TABLE 12 NGK INSULATORS, LTD. AND INNOLUX CORPORATION DEVELOPED FLEXIBLE SENSOR TAG EQUIPPED WITH THIN FILM BATTERIES TO TRACK SHIPMENTS

- TABLE 13 NGK INSULATORS' ENERCERA THIN BATTERIES POWERED BITKEY'S COMPACT CARD-SIZED KEY

- TABLE 14 US: TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 15 MARKET: LIST OF PATENTS, 2019–2022

- TABLE 16 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 STANDARDS FOR THIN FILM AND PRINTED BATTERY MARKET

- TABLE 22 MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 23 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 24 THIN FILM BATTERIES: MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 25 THIN FILM BATTERIES: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 THIN FILM BATTERIES: MARKET, BY VOLTAGE, 2019–2022 (USD MILLION)

- TABLE 27 THIN FILM BATTERIES: MARKET, BY VOLTAGE, 2023–2028 (USD MILLION)

- TABLE 28 THIN FILM BATTERIES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 29 THIN FILM BATTERIES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 THIN FILM BATTERIES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 THIN FILM BATTERIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 PRINTED BATTERIES: MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 33 PRINTED BATTERIES: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 34 PRINTED BATTERIES: MARKET, BY VOLTAGE, 2019–2022 (USD MILLION)

- TABLE 35 PRINTED BATTERIES: MARKET, BY VOLTAGE, 2023–2028 (USD MILLION)

- TABLE 36 PRINTED BATTERIES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 PRINTED BATTERIES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 PRINTED BATTERIES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 PRINTED BATTERIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 THIN FILM AND PRINTED BATTERY MARKET, BY VOLTAGE, 2019–2022 (USD MILLION)

- TABLE 41 MARKET, BY VOLTAGE, 2023–2028 (USD MILLION)

- TABLE 42 MARKET, BY CAPACITY, 2019–2022 (USD MILLION)

- TABLE 43 MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 44 MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 45 MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 46 PRIMARY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 47 PRIMARY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 48 PRIMARY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 49 PRIMARY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 SECONDARY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 51 SECONDARY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 52 SECONDARY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 53 SECONDARY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 54 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 55 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 56 THIN FILM AND PRINTED BATTERY MARKET: APPLICATION ROADMAP

- TABLE 57 CONSUMER ELECTRONICS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 58 CONSUMER ELECTRONICS: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 CONSUMER ELECTRONICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MEDICAL DEVICES: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 61 MEDICAL DEVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 62 MEDICAL DEVICES: MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 63 MEDICAL DEVICES: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 64 MEDICAL DEVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 MEDICAL DEVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 SMART PACKAGING: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 67 SMART PACKAGING: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 68 SMART PACKAGING: MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 69 SMART PACKAGING: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 70 SMART PACKAGING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 SMART PACKAGING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 SMART CARDS: THIN FILM AND PRINTED BATTERY MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 73 SMART CARDS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 74 SMART CARDS: MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 75 SMART CARDS: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 76 SMART CARDS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 SMART CARDS: ARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 WIRELESS SENSORS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 79 WIRELESS SENSORS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 80 WIRELESS SENSORS: MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 81 WIRELESS SENSORS: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 82 WIRELESS SENSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 WIRELESS SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 OTHERS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 85 OTHERS: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 THIN FILM AND PRINTED BATTERY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 108 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 ROW: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 110 ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 112 ROW: THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 114 MARKET SHARE ANALYSIS (2022)

- TABLE 115 COMPANY FOOTPRINT

- TABLE 116 APPLICATION: COMPANY FOOTPRINT

- TABLE 117 REGION: COMPANY FOOTPRINT

- TABLE 118 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 119 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 120 PRODUCT LAUNCHES

- TABLE 121 DEALS

- TABLE 122 SAMSUNG SDI CO., LTD.: COMPANY OVERVIEW

- TABLE 123 SAMSUNG SDI CO., LTD.: PRODUCTS OFFERED

- TABLE 124 SAMSUNG SDI CO., LTD.: OTHERS

- TABLE 125 ENFUCELL: COMPANY OVERVIEW

- TABLE 126 ENFUCELL: PRODUCTS OFFERED

- TABLE 127 ENFUCELL: PRODUCT LAUNCHES

- TABLE 128 MOLEX, LLC: COMPANY OVERVIEW

- TABLE 129 MOLEX, LLC: PRODUCTS OFFERED

- TABLE 130 NGK INSULATORS, LTD.: COMPANY OVERVIEW

- TABLE 131 NGK INSULATORS, LTD.: PRODUCTS OFFERED

- TABLE 132 ULTRALIFE CORPORATION: COMPANY OVERVIEW

- TABLE 133 ULTRALIFE CORPORATION: PRODUCTS OFFERED

- TABLE 134 ULTRALIFE CORPORATION: DEALS

- TABLE 135 CYMBET CORPORATION: COMPANY OVERVIEW

- TABLE 136 CYMBET CORPORATION: PRODUCTS OFFERED

- TABLE 137 CYMBET CORPORATION: PRODUCT LAUNCHES

- TABLE 138 CYMBET CORPORATION: DEALS

- TABLE 139 ILIKA PLC: COMPANY OVERVIEW

- TABLE 140 ILIKA PLC: PRODUCTS OFFERED

- TABLE 141 ILIKA PLC: DEALS

- TABLE 142 ILIKA PLC: OTHERS

- TABLE 143 JENAX INC.: COMPANY OVERVIEW

- TABLE 144 JENAX INC.: PRODUCTS OFFERED

- TABLE 145 JENAX INC.: DEALS

- TABLE 146 PROLOGIUM TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 147 PROLOGIUM TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 148 RENATA SA: COMPANY OVERVIEW

- TABLE 149 RENATA SA: PRODUCTS OFFERED

- TABLE 150 RENATA SA: PRODUCT LAUNCHES

- TABLE 151 VARTA AG: COMPANY OVERVIEW

- TABLE 152 VARTA AG: PRODUCTS OFFERED

- TABLE 153 VARTA AG: DEALS

- TABLE 154 VARTA AG: OTHERS

- TABLE 155 FLOW BATTERY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 156 FLOW BATTERY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 REGIONAL ANALYSIS

- FIGURE 3 THIN FILM AND PRINTED BATTERY MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET: RESEARCH APPROACH

- FIGURE 5 MARKET: BOTTOM-UP APPROACH

- FIGURE 6 MARKET: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 ASSUMPTIONS

- FIGURE 10 THIN FILM AND PRINTED BATTERY MARKET, 2019–2028 (USD MILLION)

- FIGURE 11 THIN FILM BATTERIES TYPE TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 12 10 TO 100 MAH SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2022

- FIGURE 13 MEDICAL DEVICES SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 GROWING DEMAND FOR FOLDABLE ELECTRONICS AND WEARABLES TO DRIVE MARKET

- FIGURE 16 THIN FILM BATTERIES SEGMENT TO CAPTURE LARGER MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 17 MEDICAL DEVICES SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 18 MEDICAL DEVICES AND US TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET MARKET IN 2028

- FIGURE 19 CHINA TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMPACT OF DRIVERS ON MARKET

- FIGURE 22 IMPACT OF RESTRAINTS ON MARKET

- FIGURE 23 IMPACT OF OPPORTUNITIES ON MARKET

- FIGURE 24 IMPACT OF CHALLENGES ON MARKET

- FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 THIN FILM AND PRINTED BATTERY MARKET: ECOSYSTEM MAPPING

- FIGURE 27 AVERAGE SELLING PRICE TREND FOR THIN FILM AND PRINTED BATTERIES, 2022–2028

- FIGURE 28 AVERAGE SELLING PRICE OF THIN FILM AND PRINTED BATTERY OFFERED BY KEY PLAYER

- FIGURE 29 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

- FIGURE 30 MARKET: PORTERS FIVE FORCES ANALYSIS, 2022

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 33 IMPORT DATA FOR LITHIUM CELLS AND BATTERIES, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 34 EXPORT DATA FOR LITHIUM CELLS AND BATTERIES, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 36 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2022

- FIGURE 37 MARKET, BY COMPONENT

- FIGURE 38 MARKET, BY MATERIAL

- FIGURE 39 MARKET, BY TYPE

- FIGURE 40 THIN FILM BATTERIES TO HOLD LARGER MARKET SHARE BY 2028

- FIGURE 41 THIN FILM AND PRINTED BATTERY, BY VOLTAGE

- FIGURE 42 1.5 TO 3 V SEGMENT TO CAPTURE LARGEST MARKET SHARE BY 2028

- FIGURE 43 THIN FILM AND PRINTED BATTERY, BY CAPACITY

- FIGURE 44 10 TO 100 MAH THIN FILM AND PRINTED BATTERIES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 45 MARKET, BY BATTERY TYPE

- FIGURE 46 SECONDARY BATTERIES TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 47 THIN FILM AND PRINTED BATTERY MARKET, BY APPLICATION

- FIGURE 48 MEDICAL DEVICES SEGMENT TO LEAD MARKET IN 2028

- FIGURE 49 MARKET, BY REGION

- FIGURE 50 MARKET IN CHINA TO WITNESS HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 51 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 52 US TO ACCOUNT FOR LARGEST SHARE OF MARKET IN NORTH AMERICA DURING FORECAST PERIOD

- FIGURE 53 EUROPE: MARKET SNAPSHOT

- FIGURE 54 GERMANY TO SECURE LARGEST SHARE OF MARKET IN EUROPE BY 2028

- FIGURE 55 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 56 CHINA TO RECORD HIGHEST CAGR IN MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 57 MIDDLE EAST AND AFRICA TO REGISTER HIGHER CAGR IN MARKET IN ROW FROM 2023 TO 2028

- FIGURE 58 THIN FILM AND PRINTED BATTERY MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2017–2021

- FIGURE 59 SHARE OF KEY PLAYERS IN MARKET, 2022

- FIGURE 60 MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 61 MARKET: COMPANY EVALUATION MATRIX FOR SMES, 2022

- FIGURE 62 SAMSUNG SDI CO., LTD.: COMPANY SNAPSHOT

- FIGURE 63 NGK INSULATORS, LTD.: COMPANY SNAPSHOT

- FIGURE 64 ULTRALIFE CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 ILIKA PLC: COMPANY SNAPSHOT

- FIGURE 66 VARTA AG: COMPANY SNAPSHOT

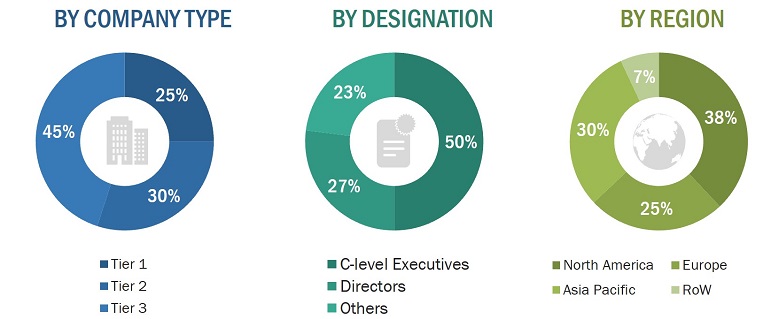

The study involved four major activities in estimating the current size of the thin film and printed battery market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the thin film and printed battery market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases. Secondary research helps in identifying the key players, their product offerings, and recent developments. It also assists in identifying the key drivers, restraints, opportunities, and challenges that are influencing market growth.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred thin film and printed battery providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from various thin film and printed battery providers, such as Samsung SDI Co., Ltd. (South Korea), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), and NGK Insulators, Ltd. (Japan); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the thin film and printed battery market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Thin Film and Printed Battery Market: Top-down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual market (mentioned in market segmentation) through percentage splits from secondary and primary research. For specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for data obtained from secondary research to validate the market size of various segments.

Thin Film and Printed Battery Market: Bottom-up Approach

The bottom-up approach has been used to arrive at the overall size of the thin film and printed battery market from the revenues of the key players and their market shares. Calculations based on revenues of key companies identified in the market led to the estimation of their overall market size.

Market Definition

Thin film and printed batteries are thin, lightweight, flexible, and compact and can be twisted or molded in various shapes according to the requirements of applications. They ensure the superior functionality of integrated products. Some thin film and printed batteries can retain their characteristics even when bent, twisted, or cut into parts. They are developed using different materials and can be of different sizes and shapes, depending on the applications wherein they are to be used to deliver optimum efficiency. Thin film and printed batteries differ from conventional batteries in features, size, form factor, shape, and flexibility.

Key Stakeholders

- Thin film and printed battery manufacturers

- Government Bodies and Policymakers

- Industry-standard Organizations, Forums, Alliances, and Associations

- Market Research and Consulting Firms

- Raw Material Suppliers and Distributors

- Research Institutes and Organizations

- Testing, Inspection, and Certification Providers

- Distributors and Resellers

- End Users

Report Objectives

- To define and forecast the thin film and printed battery market regarding the type, voltage, capacity, battery type, and application.

- To describe and forecast the market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain and allied industry segments of the thin film and printed battery market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the market

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Thin Film and Printed Battery Market