Predictive Vehicle Technology Market by Application (Proactive alerts, Safety & Security), Hardware (ADAS component, OBD and Telematics), Deployment (On premise and Cloud), End User, Vehicle, and Region - Global Forecast to 2027

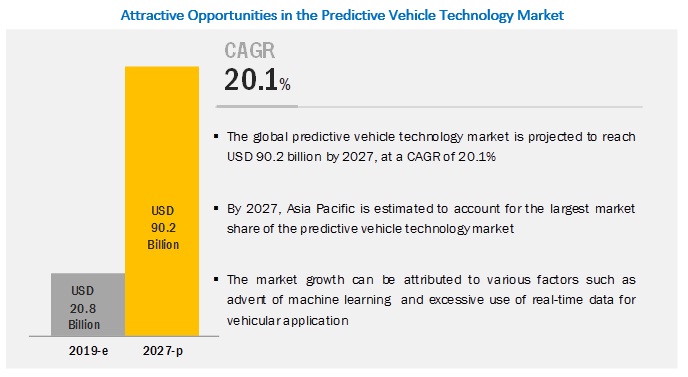

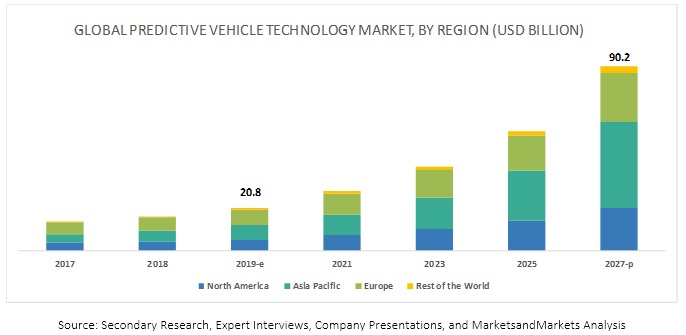

The global predictive vehicle technology market size was valued at USD 20.8 billion in 2019 and is projected to reach USD 90.2 billion by 2026 at a CAGR of 20.1% during the forecast period 2019-2027. Predictive vehicle technology is a set of vehicle technologies that incorporates predictive analytics with the use of both real-time and historical data that forecast activity, behavior, and faults that might hamper vehicles if not corrected in real time.

By Hardware: ADAS component is expected to be the largest segment in the predictive vehicle technology market

The ADAS component is anticipated to be the largest market during the forecast period. ADAS components include various sensors like radar, LiDAR, ultrasonic sensors, and cameras. These sensors are used to sense the data and send it for further processing. These sensors can be used in isolation or with a combination in various ADAS applications. Leading automakers across the world are integrating advanced features in passenger and commercial vehicles to enhance vehicle safety performance.

By Application: Safety & security segment is expected to dominate the predictive vehicle technology market

Safety and security, in the coming years is likely to be integrated as an ADAS function by automakers globally. These functions are mainly intended to assist the driver by offering predictive signals. Vehicle occupants in developed countries are demanding such features in their vehicles. On the other hand, OEMs are offering these features in their vehicles in developing regions. The growth of the safety & security segment is supported by government mandates as traffic congestion is a huge issue in every region, thereby driving the growth of the segment.

By Vehicle Type: Commercial vehicle segment is estimated to be the fastest market during the forecast period

The commercial vehicle segment is expected to dominate the predictive vehicle technology market during the forecast period. The use of telematics in commercial vehicles is rising as it contributes to fleet safety. It mainly provides satellite navigation, GPS location tracking, and infotainment options. The option to monitor the location of a vehicle in real time is useful for informing drivers about the incoming traffic, vehicle accidents, weather issues, and congested routes. Government regulations in developed countries are supportive of and often mandate the inclusion of commercial telematics in new vehicles, helping the global commercial telematics market. These factors have fueled the fastest growth of the commercial vehicle market.

Asia Pacific is expected to account for the largest market size during the forecast period

The Asia Pacific region is estimated to be the largest market by 2027. The region comprises some of the fastest developing economies of the world such as China and India. Also, the Asia Pacific region is the largest market for automotive as the growing purchasing power of consumers has triggered the demand for automobiles in the region. Also, the increasing sales of commercial vehicles and passenger cars in the region are driving the growth of the market. The countries in the region are supporting the inclusion of commercial telematics in new vehicles, helping the global commercial telematics market. Many European and North American OEMs are entering the sub-continental markets to cater to the demand for advanced telematics solutions in the region. Hence, Asia Pacific is expected to show incremental growth during the forecast period.

Europe is home to leading automotive manufacturers and has been at the forefront of early adoption of electrification in vehicles. Thus, the predictive technology features in Europe are expected to gain traction during the forecast period.

Key Market Players

The major predictive vehicle technology market players include Bosch (Germany), Continental (Germany), Garrett Motion (Switzerland), Aptiv (UK), Aisin Seiki (Japan), ZF (Germany), NXP (The Netherlands), and Valeo (France) among others. These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Application, Hardware, Deployment, Vehicle Type, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and Rest of the World |

|

Companies covered |

Bosch (Germany), Continental (Germany), Valeo (France), Garrett Motion (Switzerland), Aisin Seiki (Japan), Aptiv (UK), and others |

This research report categorizes the market based on application, hardware, deployment, vehicle type, and region.

On the basis of application, the market has been segmented as follows:

- Pro-active Alerts

- Safety & Security

On the basis of hardware, the market has been segmented as follows:

- ADAS

- Telematics

- OBD

On the basis of deployment, the market has been segmented as follows:

- On-premise

- Cloud

On the basis of vehicle type, the market has been segmented as follows:

- Passenger Vehicle

- Commercial Vehicle

On the basis of region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

Europe

- France

- Germany

- Russia

- Spain

- Turkey

- UK

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- Iran

- Rest of RoW

Critical Questions:

- With the growth of predictive vehicle technology, data is becoming the new money. What should be the go-to-market strategies for predictive vehicle technology suppliers to enter the developing regions?

- How will the implementation of safety mandates impact the overall market?

- Who is responsible for the ownership of data generated through predictive vehicle technology? How is it commercialized?

- Predictive vehicle technology will be collecting huge amount of data. What are data security solution providers doing to protect this critical data?

Frequently Asked Questions (FAQ):

What are the hardware components required in the predictive vehicle technology in the vehicle?

Hardware components used for predictive vehicle technology are ADAS components, telematics and on-board diagnostics (OBD) port.

What are the main enabler of the use of predictive vehicle technology in the vehicle?

The rapid incorporation of vehicle connectivity and cloud technology is enabling innovations and developments in the field of vehicle diagnostics and prognostics. Device integration features in connected vehicles are considered as the main enabler for predictive vehicle technology.

Who are the frontrunners in the predictive vehicle technology market, and what strategies have been adopted by them?

The global predictive vehicle technology market is dominated by major players such Bosch (Germany), Continental (Germany), Valeo (France), Garrett Motion (Switzerland), Aisin Seiki (Japan), Aptiv (UK). These companies have adopted strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Which are the areas in which OEMs are investing in the context of predictive vehicle technology market?

Machine learning has witnessed a drastic rise in its adoption in the automotive industry because of its high potential to improve various vehicle driving functions. Due to this, many major vehicle manufacturers are investing heavily in trying and using deep learning technologies to offer high level performance of vehicles to consumers.

What region is the dominating region in predictive vehicle technology market?

Asia Pacific is expected to account for the largest market size. The countries in the region are supporting the inclusion of commercial telematics in new vehicles, helping the global commercial telematics market. Many European and North American OEMs are entering the sub-continental markets to cater to the demand for advanced telematics solutions in the region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Product and Market Definition

1.3 Predictive Vehicle Technology Market Scope

1.3.1 Years Considered for the Study

1.4 Currency Exchange Rates

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Predictive Vehicle Technology Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Predictive Vehicle Technology Market

4.2 Global Predictive Vehicle Technology Market Share, By Region

4.3 Global Market, By Application

4.4 Global Market, By Hardware

4.5 Global Market, By Deployment

4.6 Global Market, By Vehicle

5 Predictive Vehicle Technology Market Overview (Page No. - 34)

5.1 Introduction

5.2 Predictive Vehicle Technology Market Dynamics

5.2.1 Drivers

5.2.1.1 Advent of Machine Learning in Automotive Industry

5.2.1.2 Excessive Usage of Real-Time Data for Vehicular Applications

5.2.2 Restraints

5.2.2.1 Issues Associated With Data Security and Its Integration With Existing Software Platforms

5.2.3 Opportunities

5.2.3.1 Predictive Vehicle Technology is Key to Fleet Management in Emerging Countries

5.2.3.2 Ensuring Appropriate Insurance Premiums With Telematics

5.2.4 Challenges

5.2.4.1 Extracting Useful Data From the Telematics

5.2.4.2 Time Lag of Cybersecurity Updates for Maintenance and Troubleshooting

6 Industry Trends (Page No. - 39)

6.1 Predictive Vehicle Technology: Trends

6.1.1 Artificial Intelligence in Automotive

6.1.2 Use of Data Analytics Software for Predictive Vehicle Technology

6.1.3 Changing Automotive Industry With Application Program Interface (API)

6.2 Regulatory Overview

6.2.1 ADAS Regulations

6.3 Porter’s Five Forces

7 Global Predictive Vehicle Technology Market, By Application (Page No. - 43)

7.1 Introduction

7.2 Research Methodology

7.3 Proactive Alerts

7.3.1 Increasing Awareness About Vehicle Health Management to Drive the Market for Proactive Alerts

7.4 Safety & Security

7.4.1 Increasing Adoption of Safety & Security Automotive Services to Drive the Safety & Security Market

7.5 Key Industry Insights

8 Global Predictive Vehicle Technology Market, By Hardware (Page No. - 48)

8.1 Introduction

8.2 ADAS Component

8.2.1 Government Mandates Related to ADAS Functions to Drive the ADAS Component Market

8.3 Telematics

8.3.1 Increasing Adoption of Cloud-Based Automotive Services to Drive Telematics Market

8.4 On-Board Diagnostics

8.4.1 Current and Upcoming Government Mandates to Drive the On-Board Diagnostics Market

9 Global Market, By Deployment (Page No. - 53)

9.1 Introduction

9.2 Research Methodology

9.3 On-Premise

9.3.1 Increasing Use of Connected Vehicle Devices to Drive this Market

9.4 Cloud

9.4.1 Increasing Adoption of Cloud Based Automotive Services to Drive this Market

9.5 Key Industry Insights

10 Global Predictive Vehicle Technology Market, By Vehicle Type (Page No. - 57)

10.1 Introduction

10.2 Research Methodology

10.3 Passenger Vehicle

10.3.1 Increasing Passenger Vehicle and Connected Car Production is Expected to Drive the Global Market

10.4 Commercial Vehicle

10.4.1 Increasing Communication System and ADAS Functions are Expected to Drive the Commercial Vehicles Software Market

10.5 Key Industry Insights

11 Global Predictive Vehicle Technology Market, By End User (Page No. - 62)

11.1 Fleet Owners

11.2 Insurers

11.2.1 Driving Pattern Analysis

11.3 OEMs and Service Providers

12 Global Predictive Vehicle Technology Market, By Region (Page No. - 64)

12.1 Introduction

12.2 Research Methodology

12.3 Asia Pacific

12.3.1 China

12.3.1.1 Rise in Vehicle Production to Drive the Chinese Market

12.3.2 India

12.3.2.1 Increasing Vehicle Sales to Drive the Indian Market

12.3.3 Japan

12.3.3.1 Significant Technology Adoption in Vehicles to Drive the Japanese Market

12.3.4 South Korea

12.3.4.1 Developments in the Field of Autonomous Vehicles to Drive the South Korean Market

12.3.5 Thailand

12.3.5.1 Thailand has the Largest Automotive Production Capacity Among Southeast Asian Countries

12.3.6 Rest of Asia Pacific

12.3.6.1 Increasing Sales of Premium Vehicle to Drive the Rest of Asia Pacific Market

12.4 Europe

12.4.1 Germany

12.4.1.1 Rising Adoption of Modern Technologies to Drive the German Market

12.4.2 France

12.4.2.1 Rising Safety Concerns Among Vehicle Occupants to Drive the French Market

12.4.3 UK

12.4.3.1 Heavy Investments By OEMs are Expected to Drive the UK Market

12.4.4 Spain

12.4.4.1 Increasing Production of D, E, and F Passenger Vehicles to Drive the Spanish Market

12.4.5 Russia

12.4.5.1 Continuous Rise in Vehicle Sales to Drive the Market for Predictive Vehicle Technology in Russia

12.4.6 Turkey

12.4.6.1 Increasing Automotive Investments in Recent Years to Drive the Turkish Market

12.4.7 Rest of Europe

12.4.7.1 Continuous Growth of Automotive Industry in Eastern Europe to Drive the Rest of Europe Market

12.5 North America

12.5.1 Canada

12.5.1.1 Increasing Use of Lcvs Equipped With Modern Electronic Architecture to Drive the Canadian Market

12.5.2 Mexico

12.5.2.1 Growth of Us-Mexico Trade to Drive the Mexican Market

12.5.3 US

12.5.3.1 Developments in the Field of Connected Cars and Nhtsa Mandates Related to Vehicle Safety to Drive the US Market

12.6 Rest of the World (RoW)

12.6.1 Brazil

12.6.1.1 Increasing Demand for Light Vehicles to Drive the Brazilian Market

12.6.2 Iran

12.6.2.1 Increasing Sales of Luxury Vehicles to Drive the Iranian Market

12.6.3 Rest of RoW

12.6.3.1 Adoption of Modern Safety Technologies Inside Vehicles to Drive the Rest of RoW Market

12.7 Key Industry Insights

13 Competitive Landscape (Page No. - 83)

13.1 Overview

13.2 Market Ranking Analysis

13.3 Competitive Situations & Trends

13.3.1 New Product Developments

13.3.2 Expansions

13.3.3 Partnerships/Supply Contracts/Collaborations/Joint Ventures/Agreements/Mergers & Acquisitions

13.4 Competitive Leadership Mapping

13.4.1 Visionary Leaders

13.4.2 Innovators

13.4.3 Dynamic Differentiators

13.4.4 Emerging Companies

14 Company Profiles (Page No. - 90)

(Business Overview, Products Offered, Recent Developments, and SWOT Analysis)*

14.1 Continental

14.2 Robert Bosch

14.3 Aptiv

14.4 Aisin Seiki

14.5 Garrett Motion

14.6 Harman (Samsung)

14.7 Visteon

14.8 ZF

14.9 Valeo

14.10 NXP

14.11 Other Key Regional Players

14.11.1 Asia Pacific

14.11.1.1 Cohda Wireless

14.11.1.2 Kpit

14.11.1.3 Embitel

14.11.2 Europe

14.11.2.1 Autoliv

14.11.2.2 Hella

14.11.3 North America

14.11.3.1 Airbiquity

14.11.3.2 Infineon

14.11.3.3 Qualcomm

14.11.3.4 Cisco (Jasper)

14.11.3.5 Verizon

14.11.3.6 At&T

14.11.3.7 Sierra Wireless

14.11.3.8 Cloudmade

*Details on Business Overview, Products Offered, Recent Developments, and SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 122)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (42 Tables)

Table 1 Currency Exchange Rates (WRT USD)

Table 2 Regulations for ADAS

Table 3 Global Predictive Vehicle Technology Market, By Application, 2017–2027 (USD Million)

Table 4 Proactive Alerts: Market, By Region, 2017–2027 (USD Million)

Table 5 Safety & Security: Market, By Region, 2017–2027 (USD Million)

Table 6 Global Market, By Hardware, 2017–2027 (USD Million)

Table 7 ADAS Component: Market, By Region, 2017–2027 (USD Million)

Table 8 Telematics: Market, By Region, 2017–2027 (USD Million)

Table 9 On-Board Diagnostics: Market, By Region, 2017–2027 (USD Million)

Table 10 Global Market, By Deployment, 2017–2027 (USD Million)

Table 11 On-Premise: Market, By Region, 2017–2027 (USD Million)

Table 12 Cloud: Market, By Region, 2017–2027 (USD Million)

Table 13 Global Market, By Vehicle Type, 2017–2027 (USD Million)

Table 14 Passenger Vehicle: Market, By Region, 2017–2027 (USD Million)

Table 15 Commercial Vehicle: Market, By Region, 2017–2027 (USD Million)

Table 16 Predictive Vehicle Technology Market, By Region, 2017–2027 (USD Million)

Table 17 Asia Pacific: Market, By Country, 2017–2027 (USD Million)

Table 18 China: Market, By Application, 2017–2027 (USD Million)

Table 19 India: Market, By Application, 2017–2027 (USD Million)

Table 20 Japan: Market, By Application, 2017–2027 (USD Million)

Table 21 South Korea: Market, By Application, 2017–2027 (USD Million)

Table 22 Thailand: Market, By Application, 2017–2027 (USD Million)

Table 23 Rest of Asia Pacific: Market, By Application, 2017–2027 (USD Million)

Table 24 Europe: Market, By Country, 2017–2027 (USD Million)

Table 25 Germany: Market, By Application,2017–2027 (USD Million)

Table 26 France: Market, By Application, 2017–2027 (USD Million)

Table 27 UK: Market, By Application,2017–2027 (USD Million)

Table 28 Spain: Market, By Application, 2017–2027 (USD Million)

Table 29 Russia: Market, By Application, 2017–2027 (USD Million)

Table 30 Turkey: Market, By Application, 2017–2027 (USD Million)

Table 31 Rest of Europe: Market, By Application, 2017–2027 (USD Million)

Table 32 North America: Market, By Country, 2017–2027 (USD Million)

Table 33 Canada: Market, By Application, 2017–2027 (USD Million)

Table 34 Mexico: Market, By Application, 2017–2027 (USD Million)

Table 35 US: Market, By Application, 2017–2027 (USD Million)

Table 36 RoW: Market, By Country, 2017–2027 (USD Million)

Table 37 Brazil: Market, By Application, 2017–2027 (USD Million)

Table 38 Iran: Market, By Application, 2017–2027 (USD Million)

Table 39 Rest of RoW: Market, By Application, 2017–2027 (USD Million)

Table 40 New Product Developments, 2016–2019

Table 41 Expansions, 2016–2019

Table 42 Partnerships/Supply Contracts/Collaborations/Joint Ventures/Agreements/Mergers & Acquisitions, 2016–2019

List of Figures (44 Figures)

Figure 1 Global Market Segmentation

Figure 2 Global Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Global Market, By Application: Bottom-Up Approach

Figure 6 Global Market, By Deployment: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Predictive Vehicle Technology: Market Dynamics

Figure 9 Global Market, By Region, 2019–2027

Figure 10 Global Market, By Application, 2019 Vs.2027

Figure 11 Integration of Various Safety Applications and Increasing Adoption Rate of Connected Cars are Expected to Boost the Predictive Vehicle Technology Market From 2019 to 2027

Figure 12 Asia Pacific is Estimated to Be the Fastest Growing Region in PVT Market From 2019 to 2027

Figure 13 Safety & Security is Expected to Be the Largest Segment of PVT Market By 2027 (USD Million)

Figure 14 ADAS Component is Expected to Be the Largest Segment of PVT Market By 2027 (USD Billion)

Figure 15 On-Premise is Expected to Be the Largest PVT Market, 2019 vs. 2027 (USD Billion)

Figure 16 Passenger Vehicle Segment is Expected to Be the Largest PVT Market, 2019 vs. 2027 (USD Billion)

Figure 17 Predictive Vehicle Technology: Market Dynamics

Figure 18 Porter’s Five Forces: Predictive Vehicle Technology Market

Figure 19 Safety & Security Segment is Expected to Dominate this Market By 2027, 2019 vs. 2027 (USD Billion)

Figure 20 ADAS Component Segment is Expected to Dominate this Market By 2027, 2019 vs. 2027 (USD Billion)

Figure 21 Research Methodology

Figure 22 On-Premise Segment is Expected to Dominate this Market By 2027, 2019 vs. 2027 (USD Billion)

Figure 23 Passenger Vehicle Segment is Expected to Dominate this Market By 2027, 2019 vs. 2027 (USD Million)

Figure 24 PVT Market: Europe is Estimated to Grow at the Highest CAGR (2019–2027)

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Europe: Market Snapshot

Figure 27 Key Developments By Leading Players in this Market for 2015–2019

Figure 28 Aisin Seiki Led the Global Market in 2018

Figure 29 Global Market Competitive Leadership Mapping, 2019

Figure 30 Continental: Company Snapshot

Figure 31 Continental: SWOT Analysis

Figure 32 Robert Bosch: Company Snapshot

Figure 33 Robert Bosch: SWOT Analysis

Figure 34 Aptiv: Company Snapshot

Figure 35 Aptiv: SWOT Analysis

Figure 36 Aisin Seiki: Company Snapshot

Figure 37 Aisin Seiki: SWOT Analysis

Figure 38 Garrett Motion: Company Snapshot

Figure 39 Garrett Motion: SWOT Analysis

Figure 40 Samsung: Company Snapshot

Figure 41 Visteon: Company Snapshot

Figure 42 ZF: Company Snapshot

Figure 43 Valeo: Company Snapshot

Figure 44 NXP: Company Snapshot

The study involved four major activities in estimating the predictive vehicle technology market size for predictive vehicle technology. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been used in the secondary research process to identify and collect information useful for an extensive commercial study of the global predictive vehicle technology market. Secondary sources include company annual reports/presentations, press releases, industry association publications, India Electronics & Semiconductor Association, ARTEMIS Industry Association, European Automotive Research Partners Association (EARPA), International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), China Association Of Automoblie Manufacturers (CAAM), automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (Marklines and Factiva).

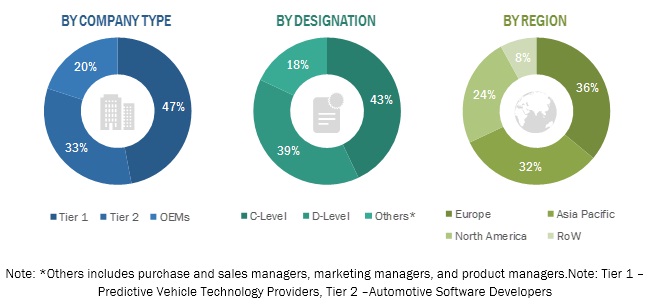

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the predictive vehicle technology market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs [(in terms of component supply), country-level government associations, and trade associations] and component manufacturers across four major regions—Asia Pacific, Europe, North America, and the Rest of the World. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter expert’s opinions, has led us to the findings as described in the remainder of this report.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the predictive vehicle technology market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. Data Triangulation

After arriving at the overall predictive vehicle technology market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides.

Report Objectives

- To analyze and forecast the predictive vehicle technology market, in terms of value (USD million), from 2019 to 2027

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market, by value, on the basis of region (Asia Pacific, Europe, North America, and Rest of the World)

- To segment and forecast the market, by value, on the basis of application (pro-active alerts and safety & security)

- To segment and forecast the market, by value, on the basis of hardware (ADAS, telematics, and OBD)

- To segment and forecast the market, by value, on the basis of deployment (on-premise and cloud)

- To segment and forecast the market, by value, on the basis of vehicle type (passenger vehicle and commercial vehicle)

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market share and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities undertaken by the key industry participants

Available Customizations

- Detailed analysis of predictive vehicle technology market, by EV type

-

Detailed analysis of predictive vehicle technology market, by vehicle type

- Buses

- Trucks

-

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Predictive Vehicle Technology Market