Power Grid Market by Component (Cables, Variable Speed Drives, Transformers, Switchgear), Power Source (Oil, Natural Gas, Coal, Renewables), Application (Generation, Transmission, Distribution) and Region - Global Forecast to 2028

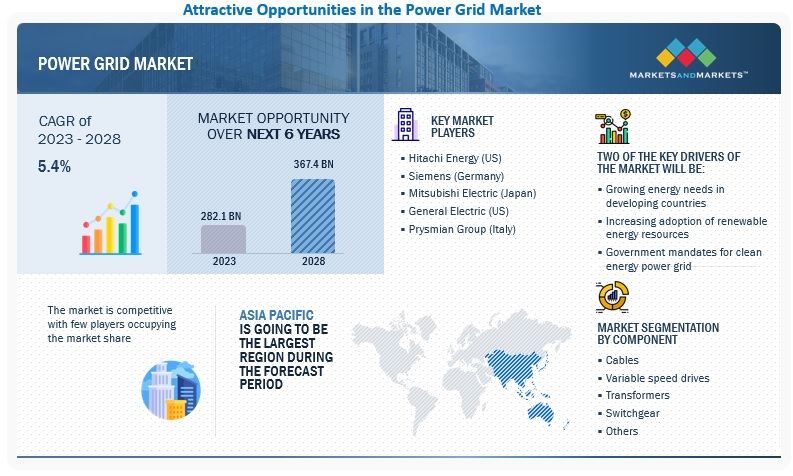

[215 Pages Report] The global power grid market in terms of revenue was estimated to be worth $282.1 billion in 2023 and is poised to reach $367.4 billion by 2028, growing at a CAGR of 5.4% from 2023 to 2028. Manufacturers feel the urgency of moving toward the electrification of industrial processes and are beginning to strategize accordingly. Regulations are likely to force commercial fleets and vehicles to go electric. This rise in the electrification of industrial processes and the transport sector will eventually increase the electricity demand, leading to the growth of the power grid market.

To know about the assumptions considered for the study, Request for Free Sample Report

Power Grid Market Dynamics

Driver: Investments in upgrading and expanding transmission and distribution infrastructure

The increasing energy demand has resulted in the need for stable and reliable transmission and distribution networks. Uninterrupted power can only be assured through a system capable of handling sudden power shorts and drops. Substations in developed nations are being modernized to ensure an uninterrupted power supply with minimum losses. This is achieved by replacing the old components with modern and more efficient ones. These upgrades are smart and more protective from overcurrent situations. The rising demand for renewable energy sources and the increasing number of power generation plants drive investments in transmission and distribution (T&D) infrastructure, making the T&D system capable of handling long-distance power flow and minimizing energy losses caused by strong currents. Many countries, such as the US, the UK, China, and India, are significantly investing in modernizing their substations and developing a reliable supply network. This drive for the transition and modernization of power grid infrastructure drives the power grid market in the near future.

Restraint: High installation cost of HVDC transmission systems and high-end monitoring devices

Renewable energy can be harnessed effectively with the help of sound transmission infrastructure through which energy is carried from long distances to load centres. However, HVDC transmission systems require high initial investments for setting up converter stations for reliable and secure power transmission. An aging power grid infrastructure and lack of transmission capacities require substantial investments. Similarly, a power monitoring system helps in tracking harmonics, frequency stability, voltage regulations, and other conditions that help avoid power grid operational downtime and maintain high power quality. Low-end monitoring devices provide basic functionalities in the power grid, such as measuring voltage, power factor, and energy use.

On the other hand, high-end monitoring devices such as data loggers, power quality analysers, and data recorders include various features, such as disturbance detection and location, harmonic distortion analysis, and flicker detection. These devices are more complex and costlier than low-end monitoring and other energy management devices. Thus, the high initial cost of HVDC transmission and high-end monitoring devices restricts their deployment in utilities, hindering market growth.

Opportunities: Rapid urbanization and digitalization

Digital technologies are set to transform the global energy system in the coming decades, making it more connected, reliable, and sustainable. With the help of smart thermostats, the International Energy Agency (IEA) report finds that smart lighting and other digital tools help buildings reduce energy consumption by 10% by using real-time data to improve operational efficiency. Meanwhile, massive volumes of data, ubiquitous connectivity, and rapid progress in artificial intelligence and machine learning technologies led to newer applications and business models across the energy system, from autonomous cars and shared mobility to 3D printing and connected appliances. More than 1 billion households and 11 billion smart appliances could be part of interconnected electricity systems by 2040, which is possible through smart meters and connected devices. This would allow homes to alter when and how much electricity to draw from the grid.

Rapid urbanization leads to high energy consumption, pollution growth, increased need for toxic waste disposal, resource depletion, inefficient urban infrastructure management, ineffective planning processes and decision-making systems, saturated transport networks, and social inequality and socio-economic disparity. These issues are resolved by adopting IoT and big data technologies in smart cities. Thus, the constant increase in several connected devices deployed across urban environments will result in exponential growth in data volumes and high demand for energy management systems, which is expected to create opportunities for the providers of smart grid systems

Challenges: Delays in grid expansion projects due to unclear regulations and lengthy approval processes

Planning and designing equipment for a power supply network requires a massive volume of data. Factors such as government interventions, lack of coordinated efforts, unclear regulations, and lengthy governmental approval and environmental clearance processes result in delays in implementing grid expansion projects. According to Europe’s 10-year network development plan 2020 edition, five transmission projects for interconnection between Portugal and Spain were expected to be commissioned by 2024. However, these projects are still in the design and approval phases. These delays extend the implementation of grid expansion projects and increase gas-insulated switchgear (GIS) procurement time. The delays in grid expansion projects make production planning highly challenging for power grid component manufacturers as most extra-high-voltage substations are manufactured according to the personalized demands of the buyers

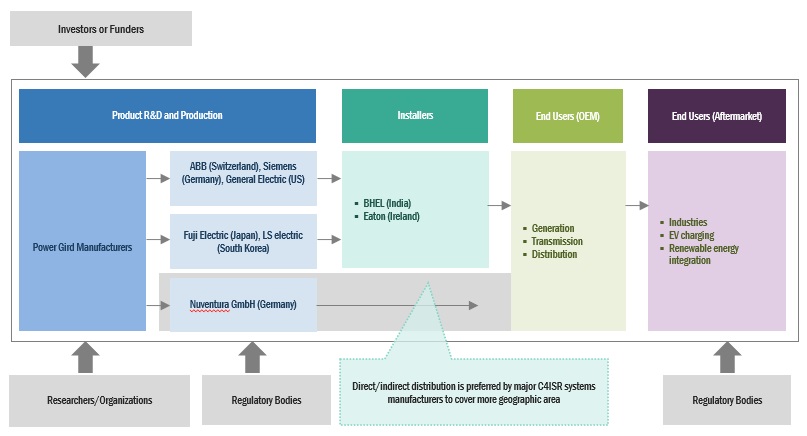

Power Grid Market Ecosystem

Prominent power grid companies in this market include well-established, financially stable manufacturers of power grid system market and components. These electric grid infrastructure companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include ABB (Switzerland), Siemens (Germany), General Electric (US), Prysmian Group (Italy), Nexans (France), and Schneider Electric (France)

To know about the assumptions considered for the study, download the pdf brochure

The cables segment, by component, is expected to be the largest market during the forecast period.

This report segments the power grid system market based on components into five types: cables, variable speed drives, transformers, switchgear, and others. The cables segment is expected to be the largest market during the forecast period. These cables maintain the stability and reliability of the grid by ensuring that power flows smoothly and efficiently. Cables can be used to balance the load on different parts of the grid, prevent voltage fluctuations, and reduce the risk of power outages

By Application, the distribution segment is expected to be the largest during the forecast period

This report segments the power grid industry based on components into three segments: generation, transmission, and distribution. The distribution segment is expected to be the largest segment during the forecast period. Power distribution is a critical component of the power grid infrastructure as it is responsible for delivering electrical energy from the transmission network to homes, businesses, and industries

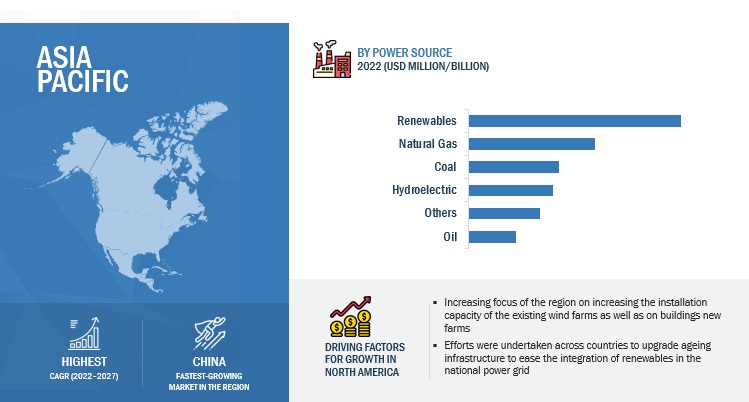

“Asia Pacific”: The fastest in the power grid market”

Asia Pacific is expected to fastest growing region in the power grid market between 2022–2027, followed by the Middle East and Africa, and North America. Rising investments in the aging infrastructure to ease the integration of renewable energy in the national grid are one of the key factors fostering the growth of the electrical grid market in the Asia Pacific

Key Market Players

The market is dominated by a few major players that have a wide regional presence. The major players in the power grid market are ABB (Switzerland), Siemens (Germany), Schneider Electric (France), and General Electric (US). Between 2018 and 2022, Strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these grid infrastructure companies to capture a larger share of the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billiona) |

|

Segments covered |

Power grid market by component, power source, application, and region. |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies covered |

ABB(Switzerland), Siemens(Germany), General Electric(US), Prysmian Group (Italy), Nexans(France), Schneider Electric(France), Mitsubishi Electric(Japan), Eaton(Ireland), Hitachi Energy(Switzerland), Powell Industries(US), Havells(India), LS Elctric(South Korea), Hubbell(India), Toshiba Energy Systems & Solutions Corporation(Japan), Fuji Electric(Japan), Sumitomo Electric(Japan), NKT(Denmark), Hyundai Electric & Energy Systems Co, Ltd(South Korea), Secheron(Switzerland), and Southwire Company(US). |

This research report categorizes the power grid industry by component, power source, application, and region.

On the basis of by component, the power grid market has been segmented as follows:

- Cables

- Varaible Speed Drives

- Transformers

- Switchgear

- Others

On the basis of power source, the power grid market has been segmented as follows:

- Oil

- Natural Gas

- Coal

- Hydro Electric

- Renewables

- Others

On the basis of application, the power grid system market has been segmented as follows:

- Generation

- Transmission

- Distribution

On the basis of region, the power grid system market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In November 2022, GE Renewable Energy launched HYpact switchgear. It can be used in several applications such as mobile (truck-mounted) substations and onshore wind substations. It makes the electrical network more predictable also reduces the customer’s operational costs, as well as their impact on the environment.

- In October 2022, Siemens and Eplan have formed a strategic alliance to expand their collaboration in software solutions for the industrial and infrastructure markets. Siemens' Electrical Products business unit will join the Eplan Partner Network as a strategic partner as part of this agreement. The goal is to better coordinate the products of both companies in order to provide optimised solutions for switchgear manufacturers and electrical planners.

- In February 2022, ABB entered into an agreement with OneSubsea to support its subsea multiphase compression system for Shell’s Ormen Lange field. ABB supplied variable-speed drives and subsea transformers to power subsea compressors.

- In March 2021, Nexans and Empire Offshore Wind LLC signed a preferred supplier agreement (PSA) to connect the Empire Wind offshore projects to the onshore grid. The turnkey projects include complete design and manufacturing, as well as the installation and protection of over 300 kilometres of export cables.

Frequently Asked Questions (FAQ):

What is the current size of the power grid market?

The current market size of the power grid market is USD 255.5 billion in 2021.

What are the major drivers for the power grid market?

Electrification of industrial processes and fleets and Investments in upgrading and expanding transmission and distribution infrastructure is the major driving factor for the power grid market.

Which is the largest region during the forecasted period in the power grid market?

Asia Pacific is expected to dominate the power grid market between 2022–2027, followed by North America and Europe. Rising urbanization and power demand with increased renewable energy capacity are driving the market for this region.

Which is the largest segment, by component during the forecasted period in the power grid market?

The cables segment is expected to be the largest market during the forecast period. These cables carry power from one country to another, as well as from one platform to another, and transfer power from renewable energy generation plants, which use wind, wave, and tidal energy, to generate electricity; regional electrical transmission networks; etc.

Which is the fastest segment, by the application during the forecasted period in the power grid market?

The transmission segment is expected to be the fastest market during the forecast period. The transmission network must be upgraded and operated to maintain a stable frequency and voltage, even during periods of high demand or unexpected events such as equipment failure or severe weather.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Electrification of industrial processes and fleets- Investments in upgrading and expanding transmission and distribution infrastructure- Transition from traditional to electric two-way power flowing gridsRESTRAINTS- High installation cost of HVDC transmission systems and high-end monitoring devices- Lack of common standards for EV charging and integration of renewable energy into power gridOPPORTUNITIES- Rapid urbanization and digitalization- Focus of governments worldwide on reducing AT&C losses of power distribution utilities- Rising use of power grids by EV and HV users to charge vehiclesCHALLENGES- Delays in grid expansion projects due to unclear regulations and lengthy approval processes- High adoption of energy-efficient equipment and processes by industrial and residential users

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSNEW REVENUE POCKETS FOR POWERGRID PROVIDERS

-

5.4 ECOSYSTEM MAPPING

-

5.5 VALUE/SUPPLY CHAIN ANALYSISGRID MANUFACTURERSGRID INFRASTRUCTURE INSTALLERSEND USERS

-

5.6 TECHNOLOGY ANALYSISDIFFERENT TECHNOLOGIES INTEGRATED INTO POWER GRID SYSTEMS

- 5.7 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.8 TARIFF AND REGULATORY LANDSCAPETARIFF DATA FOR LOW- AND HIGH-VOLTAGE PROTECTION EQUIPMENT IMPORTED BY COUNTRIES

- 5.9 POWER GRID: REGULATORY LANDSCAPE

-

5.10 TRADE ANALYSISTRADE ANALYSIS OF POWERGRID APPARATUS EXCEEDING 1,000 VOLTS USED IN SWITCHING OR PROTECTING ELECTRICAL CIRCUITSIMPORT SCENARIOEXPORT SCENARIOTRADE ANALYSIS FOR POWERGRID APPARATUS NOT EXCEEDING 1,000 VOLTS USED IN SWITCHING OR PROTECTING ELECTRICAL CIRCUITSIMPORT SCENARIOEXPORT SCENARIO

-

5.11 PATENT ANALYSIS

-

5.12 CASE STUDY ANALYSISVOLTAGE AND POWER OPTIMIZATION HELP SAVE ENERGY AND REDUCE PEAK POWERWIND POWER DEVELOPMENTS ADDRESS GRID INTEGRATION ISSUESEXPANSION OF SMART ENERGY CORRIDOR WITH IMPROVED CYBERSECURITY

-

5.13 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS ON BUYING PROCESSBUYING CRITERIA

- 5.15 PRICING ANALYSIS

- 6.1 INTRODUCTION

-

6.2 CABLESUSED TO TRANSMIT AND DISTRIBUTE POWER OVER LONG DISTANCES

-

6.3 VARIABLE SPEED DRIVESUTILIZED FOR EFFICIENT CONTROL OVER SPEED AND TORQUE OF ELECTRIC MOTORS

-

6.4 TRANSFORMERSNEED TO MAINTAIN STABILITY AND RELIABILITY IN GRID INFRASTRUCTURE TO DRIVE SEGMENT

-

6.5 SWITCHGEARNEED TO PROTECT GRID FROM POWER FLOW FAULTS TO PROPEL SEGMENT

-

6.6 OTHERSNEED FOR RELIABLE, EFFICIENT, AND SAFE OPERATION OF EQUIPMENT IN GRID INFRASTRUCTURE TO FUEL MARKET

- 7.1 INTRODUCTION

-

7.2 OILADVANTAGES SUCH AS HIGH ENERGY DENSITY OF OIL TO DRIVE SEGMENT

-

7.3 NATURAL GASABUNDANCY OF AND CLEAN SUBSTITUTION OF FOSSIL FUELS BY NATURAL GAS TO DRIVE SEGMENT

-

7.4 COALLOW COST OF COAL AS FUEL TO DRIVE SEGMENT

-

7.5 HYDROELECTRICSUSTAINABILITY OF HYDROELECTRIC SOURCE FOR POWER GENERATION TO DRIVE SEGMENT

-

7.6 RENEWABLESNEED TO REDUCE CO2 EMISSIONS TO DRIVE RENEWABLES SEGMENT

-

7.7 OTHERSRELIANCE ON DIFFERENT ENERGY SOURCES FOR POWER GENERATION TO DRIVE SEGMENT

- 8.1 INTRODUCTION

-

8.2 GENERATIONNEED TO MEET ELECTRICITY DEMAND OF GROWING POPULATION TO DRIVE SEGMENT

-

8.3 TRANSMISSIONNEED TO MAINTAIN STABLE FREQUENCY AND VOLTAGE TO FUEL SEGMENT GROWTH

-

8.4 DISTRIBUTIONNEED TO DELIVER GENERATED ENERGY EFFICIENTLY TO PROPEL SEGMENT

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICASIA PACIFIC MARKET: RECESSION IMPACT- China- India- Australia- Japan- South Korea- Rest of Asia Pacific

-

9.3 EUROPEEUROPEAN MARKET: RECESSION IMPACTBY COUNTRY- Germany- UK- France- Italy- Spain- Rest of Europe

-

9.4 NORTH AMERICANORTH AMERICAN MARKET: RECESSION IMPACT- US- Canada- Mexico

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICAN MARKET: RECESSION IMPACT- Saudi Arabia- South Africa- Egypt- Turkey- Rest of Middle East & Africa

-

9.6 SOUTH AMERICASOUTH AMERICAN MARKET: RECESSION IMPACT- Brazil- Argentina- Rest of South America

- 10.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- 10.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

-

10.4 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.5 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.6 COMPETITIVE BENCHMARKING

- 10.7 MARKET: COMPANY FOOTPRINT

- 10.8 COMPETITIVE SCENARIO

-

11.1 KEY PLAYERSHITACHI ENERGY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSIEMENS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGENERAL ELECTRIC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewPRYSMIAN GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNEXANS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSCHNEIDER ELECTRIC- Business overview- Products/Services/Solutions offered- Recent developmentsMITSUBISHI ELECTRIC- Business overview- Products/Services/Solutions offered- Recent developmentsEATON- Business overview- Products/Services/Solutions offered- Recent developmentsABB- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewPOWELL INDUSTRIES- Business overview- Products/Services/Solutions offeredHAVELLS- Business overview- Products/Services/Solutions offeredLS ELECTRIC- Business overview- Products/Services/Solutions offered- Recent developmentsHUBBELL- Business overview- Products/Services/Solutions offeredTOSHIBA ENERGY SYSTEM & SOLUTIONS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsFUJI ELECTRIC- Business overview- Products/Services/Solutions offered

-

11.2 OTHER PLAYERSSUMITOMO ELECTRICNKTHYUNDAI ELECTRIC & ENERGY SYSTEMS CO., LTD.SECHERONSOUTHWIRE COMPANY

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 GLOBAL T&D INFRASTRUCTURE EXPANSION AND REFURBISHMENT PLANS

- TABLE 2 KEY COMPANIES AND THEIR ROLE IN POWERGRID ECOSYSTEM

- TABLE 3 KEY CONFERENCES AND EVENTS

- TABLE 4 IMPORT TARIFF FOR LOW-VOLTAGE PROTECTION EQUIPMENT, BY COUNTRY, 2019

- TABLE 5 IMPORT TARIFF FOR HIGH-VOLTAGE PROTECTION EQUIPMENT, BY COUNTRY, 2019

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 IMPORT SCENARIO FOR PRODUCTS COVERED UNDER HS CODE 853590, BY COUNTRY, 2019–2021 (USD)

- TABLE 11 EXPORT SCENARIO FOR PRODUCTS COVERED UNDER HS CODE 853590, BY COUNTRY, 2019–2021 (USD)

- TABLE 12 IMPORT SCENARIO FOR PRODUCTS COVERED UNDER HS CODE 853690, BY COUNTRY, 2019–2021 (USD)

- TABLE 13 EXPORT SCENARIO FOR PRODUCTS COVERED UNDER HS CODE 853690, BY COUNTRY, 2019–2021 (USD)

- TABLE 14 POWERGRID-RELATED INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 15 POWER GRID MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 17 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 18 AVERAGE SELLING PRICE OF DIFFERENT POWERGRID COMPONENTS OFFERED BY KEY PLAYERS (USD)

- TABLE 19 PRICING ANALYSIS, BY REGION, 2022 (USD THOUSAND)

- TABLE 20 POWER GRID MARKET, BY COMPONENT, 2021–2028 (USD BILLION)

- TABLE 21 CABLES: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 22 VARIABLE SPEED DRIVES: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 23 TRANSFORMERS: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 24 SWITCHGEAR: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 25 OTHERS: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 26 POWER GRID MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 27 OIL: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 28 NATURAL GAS: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 29 COAL: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 30 HYDROELECTRIC: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 31 RENEWABLES: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 32 OTHERS: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 33 POWER GRID MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 34 GENERATION: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 35 TRANSMISSION: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 36 DISTRIBUTION: POWER GRIDS MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 37 POWER GRID MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 38 POWER GRIDS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 39 ASIA PACIFIC: POWER GRID MARKET, BY COMPONENT, 2021–2028 (USD BILLION)

- TABLE 40 ASIA PACIFIC: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 41 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 42 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 43 CHINA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 44 INDIA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 45 AUSTRALIA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 46 JAPAN: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 47 SOUTH KOREA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 48 REST OF ASIA PACIFIC: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 49 EUROPE: POWER GRID MARKET, BY COMPONENT, 2021–2028 (USD BILLION)

- TABLE 50 EUROPE: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 51 EUROPE: MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 52 EUROPE: MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 53 GERMANY: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 54 UK: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 55 FRANCE: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 56 ITALY: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 57 SPAIN: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 58 REST OF EUROPE: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 59 NORTH AMERICA: POWER GRID MARKET, BY COMPONENT, 2021–2028 (USD BILLION)

- TABLE 60 NORTH AMERICA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 61 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 63 US: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 64 CANADA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 65 MEXICO: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 66 MIDDLE EAST & AFRICA: POWER GRID MARKET, BY COMPONENT, 2021–2028 (USD BILLION)

- TABLE 67 MIDDLE EAST & AFRICA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 68 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 69 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 70 SAUDI ARABIA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 71 SOUTH AFRICA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 72 EGYPT: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 73 TURKEY: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 74 REST OF MIDDLE EAST & AFRICA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 75 SOUTH AMERICA: POWER GRID MARKET, BY COMPONENT, 2021–2028 (USD BILLION)

- TABLE 76 SOUTH AMERICA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 77 SOUTH AMERICA: MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 78 SOUTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 79 BRAZIL: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 80 ARGENTINA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 81 REST OF SOUTH AMERICA: MARKET, BY POWER SOURCE, 2021–2028 (USD BILLION)

- TABLE 82 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2022

- TABLE 83 POWER GRID MARKET: DEGREE OF COMPETITION

- TABLE 84 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 85 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 86 COMPANY FOOTPRINT, BY COMPONENT

- TABLE 87 COMPANY FOOTPRINT, BY POWER SOURCE

- TABLE 88 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 89 COMPANY FOOTPRINT, BY REGION

- TABLE 90 COMPANY FOOTPRINT

- TABLE 91 MARKET: PRODUCT LAUNCHES, JANUARY 2019–FEBRUARY 2023

- TABLE 92 MARKET: DEALS, JANUARY 2019–FEBRUARY 2023

- TABLE 93 MARKET: OTHERS, JANUARY 2019–FEBRUARY 2023

- TABLE 94 HITACHI ENERGY: BUSINESS OVERVIEW

- TABLE 95 HITACHI ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 96 HITACHI ENERGY: DEALS

- TABLE 97 HITACHI ENERGY: OTHERS

- TABLE 98 SIEMENS: BUSINESS OVERVIEW

- TABLE 99 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 100 SIEMENS: DEALS

- TABLE 101 SIEMENS: OTHERS

- TABLE 102 GENERAL ELECTRIC: BUSINESS OVERVIEW

- TABLE 103 GENERAL ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 104 GENERAL ELECTRIC: PRODUCT LAUNCHES

- TABLE 105 GENERAL ELECTRIC: DEALS

- TABLE 106 GENERAL ELECTRIC: OTHERS

- TABLE 107 PRYSMIAN GROUP: BUSINESS OVERVIEW

- TABLE 108 PRYSMIAN GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 109 PRYSMIAN GROUP: DEALS

- TABLE 110 PRYSMIAN GROUP: OTHERS

- TABLE 111 NEXANS: BUSINESS OVERVIEW

- TABLE 112 NEXANS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 113 NEXANS: DEALS

- TABLE 114 NEXANS: OTHERS

- TABLE 115 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 116 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 117 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 118 SCHNEIDER ELECTRIC: DEALS

- TABLE 119 SCHNEIDER ELECTRIC: OTHERS

- TABLE 120 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

- TABLE 121 MITSUBISHI ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 122 MITSUBISHI ELECTRIC: DEALS

- TABLE 123 EATON: COMPANY OVERVIEW

- TABLE 124 EATON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 125 EATON: DEALS

- TABLE 126 EATON: OTHERS

- TABLE 127 ABB: BUSINESS OVERVIEW

- TABLE 128 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 129 ABB: PRODUCT LAUNCHES

- TABLE 130 ABB: DEALS

- TABLE 131 ABB: OTHERS

- TABLE 132 POWELL INDUSTRIES: COMPANY OVERVIEW

- TABLE 133 POWELL INDUSTRIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 134 HAVELLS: COMPANY OVERVIEW

- TABLE 135 HAVELLS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 136 LS ELECTRIC CO LTD: COMPANY OVERVIEW

- TABLE 137 LS ELECTRIC CO LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 138 LS ELECTRIC: OTHERS

- TABLE 139 HUBBELL: COMPANY OVERVIEW

- TABLE 140 HUBBELL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 141 TOSHIBA ENERGY SYSTEM & SOLUTIONS CORPORATION: COMPANY OVERVIEW

- TABLE 142 TOSHIBA ENERGY SYSTEM & SOLUTIONS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 143 TOSHIBA ENERGY SYSTEM & SOLUTIONS CORPORATION: DEALS

- TABLE 144 TOSHIBA ENERGY SYSTEM & SOLUTIONS CORPORATION: OTHERS

- TABLE 145 FUJI ELECTRIC: COMPANY OVERVIEW

- TABLE 146 FUJI ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 POWER GRID MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR POWER GRIDS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 REGIONAL ANALYSIS

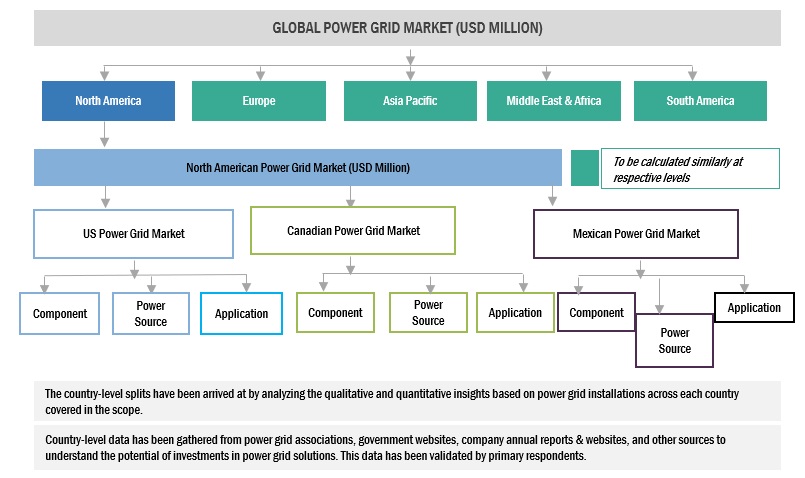

- FIGURE 8 COUNTRY-LEVEL ANALYSIS

- FIGURE 9 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF POWER GRID SOLUTIONS

- FIGURE 10 MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 11 COMPANY REVENUE ANALYSIS, 2021

- FIGURE 12 CABLES TO HOLD LARGEST SHARE OF POWER GRID MARKET, BY COMPONENT, DURING FORECAST PERIOD

- FIGURE 13 RENEWABLES SEGMENT TO LEAD POWER GRIDS MARKET DURING FORECAST PERIOD

- FIGURE 14 DISTRIBUTION APPLICATIONS TO CAPTURE LARGEST SHARE OF POWER GRIDS MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF POWER GRIDS MARKET IN 2022

- FIGURE 16 ADOPTION OF RENEWABLE ENERGY AND GOVERNMENT MANDATES FOR CLEAN POWER GRIDS TO CREATE OPPORTUNITIES FOR PLAYERS

- FIGURE 17 DISTRIBUTION APPLICATIONS AND CHINA TO HOLD LARGEST SHARES OF POWER GRIDS MARKET IN ASIA PACIFIC IN 2028

- FIGURE 18 CABLES SEGMENT TO DOMINATE POWER GRIDS MARKET, BY COMPONENT, IN 2028

- FIGURE 19 RENEWABLES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 20 DISTRIBUTION APPLICATIONS TO LEAD POWER GRIDS MARKET IN 2028

- FIGURE 21 POWER GRID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 INDUSTRY-WISE ELECTRIFICATION TRENDS, 2020 VS. 2050

- FIGURE 23 GROWTH IN URBAN POPULATION WORLDWIDE, 2010–2020

- FIGURE 24 GLOBAL INVESTMENTS IN ELECTRICITY NETWORKS, BY GEOGRAPHY, 2016–2021

- FIGURE 25 GLOBAL EV CAR STOCKS, 2016–2020, MILLION UNITS

- FIGURE 26 CO2 EMISSIONS FROM ELECTRICITY GENERATION, 1990–2019

- FIGURE 27 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

- FIGURE 28 MARKET MAP/ECOSYSTEM

- FIGURE 29 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED BY GRID INFRASTRUCTURE INSTALLERS

- FIGURE 30 POWERGRID MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 32 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 33 AVERAGE SELLING PRICE OF DIFFERENT TYPES OF POWERGRID COMPONENTS OFFERED BY KEY PLAYERS

- FIGURE 34 PRICING ANALYSIS OF TRANSFORMERS, BY REGION (2022)

- FIGURE 35 POWER GRID MARKET, BY COMPONENT, 2022

- FIGURE 36 POWER GRIDS MARKET, BY POWER SOURCE, 2022

- FIGURE 37 POWER GRIDS MARKET, BY APPLICATION, 2022

- FIGURE 38 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC: POWER GRID MARKET SNAPSHOT

- FIGURE 40 EUROPE: POWER GRIDS MARKET SNAPSHOT

- FIGURE 41 POWER GRID MARKET SHARE ANALYSIS, 2021

- FIGURE 42 TOP PLAYERS IN POWER GRIDS MARKET FROM 2017 TO 2021

- FIGURE 43 POWER GRID MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

- FIGURE 44 POWER GRIDS MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

- FIGURE 45 SIEMENS: COMPANY SNAPSHOT

- FIGURE 46 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 47 PRYSMIAN GROUP: COMPANY SNAPSHOT

- FIGURE 48 NEXANS: COMPANY SNAPSHOT

- FIGURE 49 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 50 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT, 2022

- FIGURE 51 EATON: COMPANY SNAPSHOT

- FIGURE 52 ABB: COMPANY SNAPSHOT

- FIGURE 53 POWELL INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 54 HAVELLS: COMPANY SNAPSHOT

- FIGURE 55 LS ELECTRIC CO LTD: COMPANY SNAPSHOT

- FIGURE 56 HUBBELL: COMPANY SNAPSHOT

- FIGURE 57 FUJI ELECTRIC: COMPANY SNAPSHOT

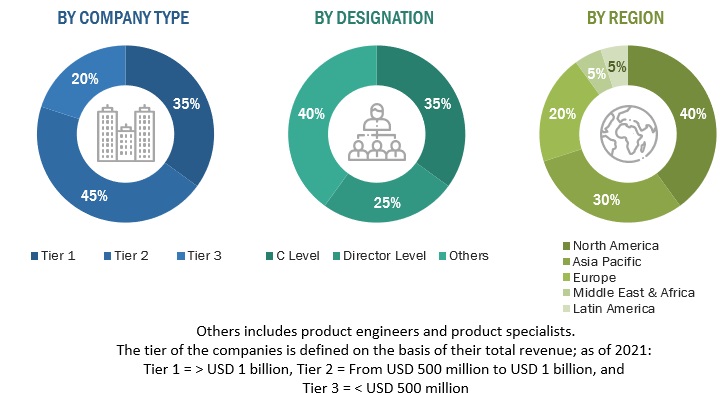

The study involved major activities in estimating the current size of the power grid market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the power grids market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The power grid market comprises several stakeholders such as power grid manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for power grid in, generation, transmission, and distribution application. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Power grid Market Size: Tow-Down Approach

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Defenition

The electric power grid is the physical system that delivers (transmits) electricity from where it is generated to the site where it is used (end-use, demand). The electricity leaving the generating station enters a substation with a step-up transformer that raises the voltage extremely high for long-distance transmission.

The growth of the market during the forecast period can be attributed to the planned rollout of green corridor programs across major countries in North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Key Stakeholders

- Analytics Vendors

- Communication Vendors

- Consulting Companies In The Energy And Power Sector

- DISCOMS

- Electric Utilities

- Energy & Power Sector Consulting Companies

- Energy Regulators

- Government & Research Organizations

- Government Utility Providers

- Independent Power Producers

Objectives of the Study

- To define, describe, segment, and forecast the power grid market based on component, power source, and application, in terms of value

- To describe and forecast the market for various segments with respect to five main regions (along with respective countries), namely, North America, South America, Europe, Asia Pacific, and the Middle East & Africa, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the market

- To provide a detailed overview of the supply chain, patent analysis, and Porter’s five forces in the market

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders by identifying high-growth segments and detailing the competitive landscape in the market

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies*

- To track and analyze competitive developments such as sales contracts, acquisitions, collaborations, partnerships, agreements, and expansions in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power Grid Market